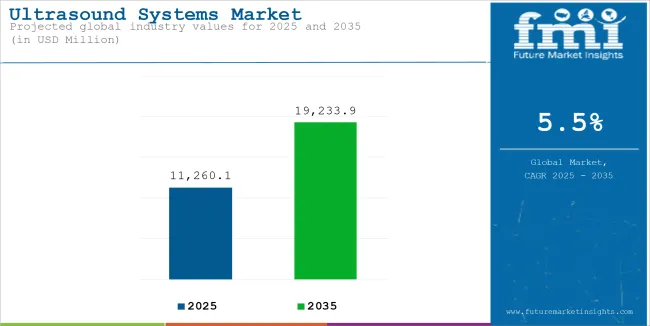

The ultrasound systems market is estimated to reach USD 11,260.1 million in 2025. It is estimated that revenue will increase at a CAGR of 5.5% between 2025 and 2035. The market is anticipated to reach USD 19,233.9 million by 2035.

The increasing prevalence of chronic diseases has increased the demand for ultrasound diagnosis. Which is contributing to the growth from demand side. The adoption of portable and handheld devices is growing rapidly due to their accessibility in critical care. Even though the adoption of portable device is increasing the cart/trolley based ultrasound still remain the dominating segment in the market.

The development of 3D/4D ultrasound systems has opened opportunities in various fields from obstetrics to cardiology. The market is growing but it also has certain challenges to overcome. High costs associated with advanced ultrasound systems remain a barrier for smaller healthcare providers mainly in developing regions.

Ultrasound Systems Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 10,673.1 million |

| Estimated Size, 2025 | USD 11,260.1 million |

| Projected Size, 2035 | USD 19,233.9 million |

| Value-based CAGR (2025 to 2035) | 5.5% |

The progress in portable and handheld ultrasound machines changed the nature of diagnostic imaging by allowing the use of ultrasound at the point of care, hence opening up new avenues for the underserved and areas which lacked traditional ultrasound machines. This means high-quality imaging is achievable without expensive large machines in an emergency room, in an ambulance, small rural clinic, or even at a patient's home.

Portable ultrasound devices have improved the speed and efficiency of diagnostics. In cases of critical care early diagnosis and timely treatment are a must. These devices offer speed, efficiency, and accessibility in emergency and remote care situations; this has been instrumental in overall progress in the ultrasound market.

Chronic diseases from cardiovascular diseases to cancer require constant monitoring and management. Hence, ultrasound has become one of the most preferred tools. Innovative advanced 3D/4D ultrasound systems provides opportunities for the market. These offer greater imaging capability for much more detailed views of the inner structures of the body.

However, the price of these advanced 3D/4D ultrasound systems is much higher, which is a significant entry barrier in terms of growth in the market. These systems prove to be price-intensive as it involves highly sophisticated technology coupled with enhanced capabilities. The relatively smaller healthcare facilities, mostly in the developing world, will hardly find it affordable to purchase and maintain these systems.

The below table presents the expected CAGR for the global ultrasound systems market over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.3%, followed by a slightly lower growth rate of 6.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.3% (2024 to 2034) |

| H2 | 6.0% (2024 to 2034) |

| H1 | 5.5% (2025 to 2035) |

| H2 | 5.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.5% in the first half and remain relatively moderate at 5.0% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS while in the second half (H2), the market witnessed a decrease of 100 BPS.

Development of Portable Ultrasound System has driven the Industry Growth

Ultrasound Systems are big, stationary machines, mostly used in hospitals and specialty clinics. The large size and fixed nature of these devices meant that their use was confined to certain settings, resulting in longer waiting times, increased costs, and more complicated logistics for patients. Compact and portable ultrasound devices have overcome many of these limitations, opening up new opportunities in various healthcare settings.

But, one of the main ways portable and handheld ultrasound devices are impacting the market right now is in their accessibility. With portable and handheld units, healthcare professionals can do point-of-care diagnostic imaging in environments which, up to this time, have been unserved or under-served by traditional ultrasound equipment.

These environments might also include high-tech, expensive imaging in ERs and ambulances, at small rural clinics, and in patient homes. Performing ultrasound examinations on-site, rather than having to send patients to specialized facilities, improves patient satisfaction and workflow in fast-paced medical environments.

Portability has also made diagnostics quicker and more efficient. In a handheld format, the clinicians may review a patient very fast and even make immediate life-or-death decisions in cases like trauma or cardiac events. Other key factors contributing much to the pervasiveness of their adoption even in the lowest-resource settings included more reasonable prices and the simplicity of operating portable ultrasound devices.

Therefore, besides traditional imaging, the ultrasound market has experienced increasing growth in more varied applications.

Growing Need for Real Time Diagnosis fuels Ultrasound Systems Industry Growth

Prevalence for chronic diseases from cardiovascular diseases to cancer is increasing due to aging populations. Lifestyle changes coupled with environmental factors are also contributing factor. These conditions require ongoing monitoring. The demand for cost-effective diagnostic tools has surged. Ultrasound technology is non-invasive in nature. It offers real-time imaging capabilities. Due to which is has emerged as an ideal solution to meet these growing diagnostic needs.

Demand for routine screening have further pushed the market demand. Chronic conditions require frequent check-ups to track disease progression. This approach also allows to detect complications and evaluate the effectiveness of treatment. Ultrasound is ideal for long-term monitoring since it provides repeatable, real-time imaging without any risks associated with radiation.

Such a modality would be especially applicable in the cardiac field to monitor heart conditions, including coronary artery disease, heart failure, and valvular heart disease. In oncology, too, ultrasound similarly has a very important role in tumor follow-up regarding its size and development in various cancers.

Development of 3D/4D Ultrasound Systems Offers an Untapped Opportunity for Market Growth

This 3D/4D ultrasound systems has opened up new opportunities in the medical imaging market. Obstetrics, cardiology, and musculoskeletal imaging are the main area to be benefitted. 3D and 4D ultrasound technologies provide improved image quality. Conventional 2D ultrasound systems capture two-dimensional images.

The 3D and 4D systems create multi-dimensional images that help clinicians make accurate diagnoses. This enables better visualization of organs, tissues, and even fetal development, and the modality is very helpful both in diagnosis and management.3D/4D ultrasound systems allow doctors to see a fetus in greater detail. Doctor can assess developmental stages and monitor the overall health of both the fetus and mother.

This development of 3D/4D ultrasound systems presents an opportunity that players can tap into. The design of the user interface can be further value-added by the manufacturers to make these systems more intuitive and easier for healthcare professionals, especially in settings where they may not be ultrasound specialists.

Additionally, such advanced systems could also be more widely marketed to other care providers-private clinics and even hospitals and outpatient centers-who could exploit 3D/4D ultrasound for diagnostic purposes in a much broader range of areas beyond conventional imaging.

High Cost of Advanced Ultrasound System Hinder the Market Growth

The advanced 3D/4D ultrasound systems have higher price. These advanced system have enhanced imaging capabilities. The initial investment required for purchasing a 3D/4D ultrasound system can be prohibitive for small healthcare facilities. Similar is the case of facilities operating in regions with limited budgets.

Hospitals in developing regions having constrained resources may find it challenging to upgrade to a 3D/4D system. While these advanced systems provide superior imaging quality and diagnostic precision. But many healthcare providers are reluctant to invest when the benefits are not immediately translate into higher revenue.

Additionally, the ongoing maintenance and repair costs for 3D/4D ultrasound machines can further strain financial resources. This is particularly true for smaller clinics or facilities without dedicated budgets for high-end equipment.

Advanced ultrasound procedures may not be covered by insurance reimbursement policies at the same level as the cost of obtaining these technologies. In case the reimbursement rates do not meet the operating costs of 3D/4D ultrasound systems, the adoption of these technologies will be limited among healthcare providers. Consequently, the overall growth of the market may be slowed down, especially in regions where the healthcare providers are sensitive to cost.

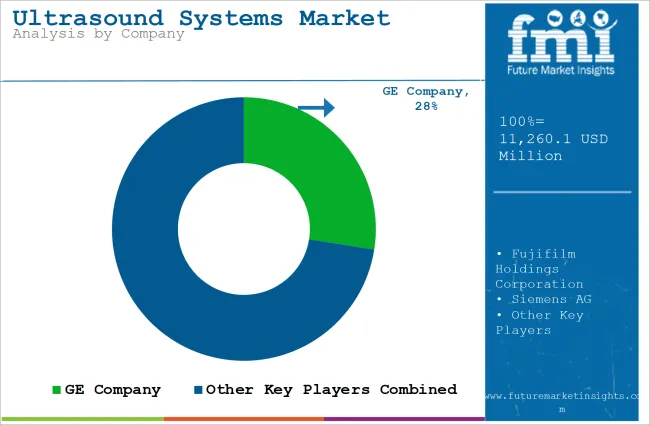

Companies in the Tier 1 sector account for 47.1% of the global market, ranking them as the dominant players in the industry. Tier 1 players’ offer a wide range of product and have established industry presence. Having financial resources enables them to enhance their research and development efforts and expand into new markets. A strong brand recognition and a loyal customer base provide them with a competitive advantage. Prominent companies within Tier 1 include GE Company, Siemens AG, Koninklijke Philips N.V., and others

Tier 2 players dominate the industry with a 31.5% market share. Tier 2 firms have a strong focus on a specific Product and a substantial presence in the industry, but they have less influence than Tier 1 firms. The players are more competitive when it comes to pricing and target niche markets. New Product and services will also be introduced into the industry by Tier 2 companies. Tier 2 companies include Fujifilm Holdings Corporation, Hitachi Medical Corp., Mindray Medical International Ltd, Toshiba Medical System Corp., and others.

Compared to Tiers 1 and 2, Tier 3 companies have smaller revenue spouts and less influence. Those in Tier 3 have smaller work force and limited presence across the globe. Prominent players in the tier 3 category are Esaote SpA, Samsung Medison Co., Ltd, and others.

The section below covers the industry analysis for the ultrasound systems for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided. The United States is anticipated to remain at the forefront in North America through 2035. India is projected to witness a CAGR of 6.7% from 2025 to 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.4% |

| Canada | 4.4% |

| Germany | 4.5% |

| France | 3.8% |

| Italy | 4.7% |

| UK | 6.6% |

| Spain | 4.5% |

| China | 5.5% |

United States has high prevalence of chronic diseases. In particular, heart disease, diabetes, and cancers continue their rapid growth so as to face unprecedented demand for its early detection and continued management. Ultrasound systems have proved helpful in their capability to show early detection against non-invasiveness and in real-time.

Ultrasound is attractive for patients and professionals alike because it can trace conditions such as heart disease, liver abnormalities, and tumors without the need to expose patients to radiation.

Besides, the nonstop development and upgrading of ultrasound systems have remarkably increased their diagnostic capabilities, therefore making them increasingly appealing to health professionals. Among such features are 3D and 4D imaging, auto-measurements, and integration of artificial intelligence that remarkably improve diagnosis precision while improving workflow.

These developments have furthered the value of ultrasound technology across medical fields such as cardiology, obstetrics, radiology, and emergency medicine.

German health care focuses on early detection and timely intervention to lessen the burden of a chronic disease. In view of the above facts, ultrasound forms one of the central investigation modalities for early, safe, and sensitive detection of diseases.

It is possible to satisfactorily keep under surveillance various common conditions like cardiovascular diseases, liver disorders, and cancers by the ultrasound systems so that early intervention can be made which is associated with better patient outcomes and at reduced costs.

Other factors contributing to the growth of the ultrasound systems market in Germany are its aging population. As the population of aged people starts to increase rapidly, the demand for monitoring age-related disorders such as heart disease, stroke, and cancer also increases. As ultrasound is a non-invasive diagnostic modality, and fairly reasonably priced, it becomes quite popular for regular monitoring of the aforementioned conditions and thus forms a vital part of geriatric care.

There is increasing demand for geriatric care in Japan. Above quarter of Japan population is aged 65 or older. As the population continues to age need for regular medical checkups will increase to manage chronic conditions. These condition ranges from cardiovascular diseases to cancer. Ultrasound systems provide a non-invasive accurate way to monitor these conditions.

Ultrasound systems offer the advantage of real-time imaging. It does not require contrast agents, hence it is well-suited for elderly patients. Because elder patient are more prone to side effects. The country is known for its high standards in medical research. Japanese manufacturers have been at the forefront of developing advanced ultrasound systems. Technological prowess and large geriatric population has led to the ultrasound market growth in Japan.

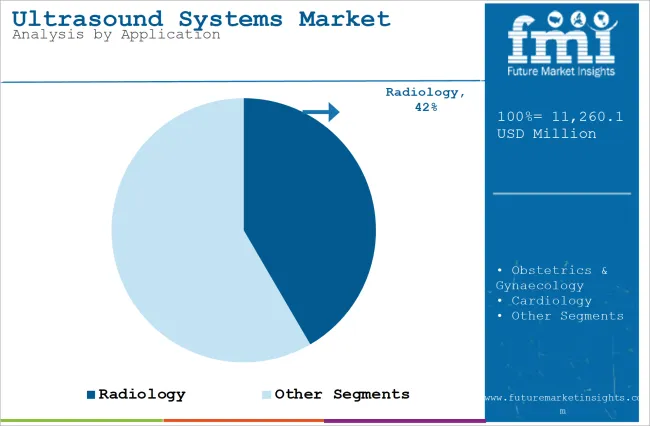

A description of the leading segments in the industry is provided in this section. The Cart/Trolley Based ultrasound system segment held 82.0% of the value share in 2025. Based on the application, radiology held 39.9% of the market in 2025.

| Modality | Cart/Trolley Based Ultrasound Systems |

|---|---|

| Value Share (2025) | 66.4% |

The Cart/Trolley-Based ultrasound systems are suitable for a wide range of clinical environments. Their design allows for easy mobility across different departments within hospitals. Cart based system are preferred choice in various applications, from radiology to obstetrics and cardiology. The ability to move the system from room to room without requiring permanent installation provides healthcare providers with greater efficiency.

Cart/Trolley-Based systems generally offer higher image resolution. They also have comprehensive software capabilities. Cart based system has the capacity for integrating additional components like 3D/4D imaging. Aforementioned capabilities make them attractive option for larger healthcare facilities. Large facilities need high-performance equipment to handle complex diagnostic tasks.

The durability of Cart/Trolley-Based ultrasound systems are another key factor in their dominance. These systems are designed to handle frequent use. Additionally, their ability to accommodate multiple probes and transducers provides greater diagnostic accuracy further enhancing their appeal to healthcare professionals.

| Application | Radiology |

|---|---|

| Value Share (2025) | 41.6% |

Radiology serves a central role in diagnostic imaging. Ultrasound system helps in delivering non-invasive, real-time pictures of body structures internally. Its ability to deliver quality pictures concerning tumors and abnormal conditions of body organs and everything related to the flow of blood enables it to remain indispensable in all radiology departments.

The increasing prevalence of chronic diseases has been a major contributor to the demand for radiological imaging. Ultrasound systems provide an efficient and relatively inexpensive modality for the continuous monitoring of such diseases, hence becoming an indispensable tool in both routine and specialized radiological examinations.

The non-invasive nature of ultrasound and the fact that it can provide immediate results further justify its wide application in emergency settings and critical care units where diagnosis needs to be done as quickly as possible. This has, especially, been enhanced with technological development in 3D and 4D ultrasound, making the modality increasingly more accurate and complex in the radiology department.

Key players in the ultrasound systems market are focusing on enhancing workflow efficiency. Companies are introducing next-generation ultrasound systems that integrate automated tools. These new system also have user-friendly interfaces with cross-compatibility with existing transducers.

This improves scanning efficiency making it easier to adopt across various healthcare settings. Some companies are developing handheld ultrasound devices. The handheld addresses the demand for portable solutions. The range of ultrasound applications is also being expanded. The ultrasound systems finds application in vascular access procedures and hemodynamic monitoring. Below are the few example of the recent development in the market

Recent Industry Developments in the Ultrasound Systems Market

In terms of modality, the industry is segmented into cart/trolley based and compact/hand held

In terms of application, the industry is bifurcated into radiology, obstetrics & gynaecology, cardiology, gastroenterology, and others

In terms of end user, the industry is bifurcated into hospitals & clinics, diagnostic imaging & surgical centers, ambulatory surgical centers (ASCs), and others

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East, and Africa have been covered in the report.

Ultrasound systems market is expected to increase at a CAGR of 5.5% between 2025 and 2035.

The cart/trolley based ultrasound systems segment is expected to occupy 82.0% market share in 2025.

The market for ultrasound systems is expected to reach USD 19,233.9 million by 2035.

The United States is forecast to see a CAGR of 3.4% during the assessment period.

The key players in the ultrasound systems industry include GE Company, Fujifilm Holdings Corporation, Siemens AG, Koninklijke Philips N.V., Toshiba Medical System Corp., Hitachi Medical Corp., Mindray Medical International Ltd, Samsung Medison Co., Ltd, Esaote SpA, and Others.

Table 01: North America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Country

Table 02: North America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 03: North America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Application

Table 04: North America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 05: Latin America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Country

Table 06: Latin America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 07: Latin America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Application

Table 08: Latin America Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 09: Western Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Country

Table 10: Western Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 11: Western Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Application

Table 12: Western Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 13: Eastern Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Country

Table 14: Eastern Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 15: Eastern Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 16: Eastern Europe Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 17: APEJ Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Country

Table 18: APEJ Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 19: APEJ Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 20: APEJ Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 21: Japan Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 22: Japan Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 23: Japan Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 24: MEA Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Country

Table 25: MEA Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 26: MEA Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 27: MEA Ultrasound Systems Market Size (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By End User

Table 28: Global Ultrasound Systems Market Size (US$ Mn) Forecast By Region, 2012–2021

Table 29: Global Ultrasound Systems Market Size Value (US$ Mn) Analysis-2012–2021 and Forecast 2022–2028, By Modality

Table 30: Global Ultrasound Systems Market Size (US$ Mn) Forecast By Application, 2012–2021

Table 31: Global Ultrasound Systems Market Size (US$ Mn) Forecast By End User, 2012–202

Figure 01: North America Ultrasound Systems Market Size Analysis, 2012–2021

Figure 02: North America Ultrasound Systems Market Forecast, 2022–2028

Figure 03: North America Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 04: North America Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 05: North America Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 06: North America Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 07: North America Radiology Market Size Analysis, 2012–2021

Figure 08: North America Radiology Market Forecast, 2022–2028

Figure 09: North America Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 10: North America Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 11: North America Cardiology Market Size Analysis, 2012–2021

Figure 12: North America Cardiology Market Forecast, 2022–2028

Figure 13: North America Gastroenterology Market Size Analysis, 2012–2021

Figure 14: North America Gastroenterology Market Size Forecast, 2022–2028

Figure 15: North America Others Market Size Analysis, 2012–2021

Figure 16: North America Others Market Forecast, 2022–2028

Figure 17: North America Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 18: North America Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 19: North America Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 20: North America Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 21: North America Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 22: North America Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 23: North America Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 24: North America Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 25: North America Ultrasound Systems Market Attractiveness Analysis by Country, 2022–2028

Figure 26: North America Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 27: North America Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 28: North America Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 29: Latin America Ultrasound Systems Market Size Analysis, 2012–2021

Figure 30: Latin America Ultrasound Systems Market Forecast, 2022–2028

Figure 31: Latin America Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 32: Latin America Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 33: Latin America Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 34: Latin America Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 35: Latin America Radiology Market Size Analysis, 2012–2021

Figure 36: Latin America Radiology Market Forecast, 2022–2028

Figure 37: Latin America Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 38: Latin America Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 39: Latin America Cardiology Market Size Analysis, 2012–2021

Figure 40: Latin America Cardiology Market Forecast, 2022–2028

Figure 41: Latin America Gastroenterology Market Size Analysis, 2012–2021

Figure 42: Latin America Gastroenterology Market Size Forecast, 2022–2028

Figure 43: Latin America Others Market Size Analysis, 2012–2021

Figure 44: Latin America Others Market Forecast, 2022–2028

Figure 45: Latin America Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 46: Latin America Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 47: Latin America Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 48: Latin America Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 49: Latin America Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 50: Latin America Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 51: Latin America Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 52: Latin America Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 53: Latin America Ultrasound Systems Market Attractiveness Analysis by Country, 2022–2028

Figure 54: Latin America Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 55: Latin America Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 56: Latin America Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 57: Western Europe Ultrasound Systems Market Size Analysis, 2012–2021

Figure 58: Western Europe Ultrasound Systems Market Forecast, 2022–2028

Figure 59: Western Europe Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 60: Western Europe Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 61: Western Europe Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 62: Western Europe Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 63: Western Europe Radiology Market Size Analysis, 2012–2021

Figure 64: Western Europe Radiology Market Forecast, 2022–2028

Figure 65: Western Europe Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 66: Western Europe Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 67: Western Europe Cardiology Market Size Analysis, 2012–2021

Figure 68: Western Europe Cardiology Market Forecast, 2022–2028

Figure 69: Western Europe Gastroenterology Market Size Analysis, 2012–2021

Figure 70: Western Europe Gastroenterology Market Size Forecast, 2022–2028

Figure 71: Western Europe Others Market Size Analysis, 2012–2021

Figure 72: Western Europe Others Market Forecast, 2022–2028

Figure 73: Western Europe Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 74: Western Europe Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 75: Western Europe Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 76: Western Europe Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 77: Western Europe Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 78: Western Europe Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 79: Western Europe Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 80: Western Europe Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 81: Western Europe Ultrasound Systems Market Attractiveness Analysis by Country, 2022–2028

Figure 82: Western Europe Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 83: Western Europe Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 84: Western Europe Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 85: Eastern Europe Ultrasound Systems Market Size Analysis, 2012–2021

Figure 86: Eastern Europe Ultrasound Systems Market Forecast, 2022–2028

Figure 87: Eastern Europe Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 88: Eastern Europe Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 89: Eastern Europe Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 90: Eastern Europe Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 91: Eastern Europe Radiology Market Size Analysis, 2012–2021

Figure 92: Eastern Europe Radiology Market Forecast, 2022–2028

Figure 93: Eastern Europe Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 94: Eastern Europe Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 95: Eastern Europe Cardiology Market Size Analysis, 2012–2021

Figure 96: Eastern Europe Cardiology Market Forecast, 2022–2028

Figure 97: Eastern Europe Gastroenterology Market Size Analysis, 2012–2021

Figure 98: Eastern Europe Gastroenterology Market Size Forecast, 2022–2028

Figure 99: Eastern Europe Others Market Size Analysis, 2012–2021

Figure 100: Eastern Europe Others Market Forecast, 2022–2028

Figure 101: Eastern Europe Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 102: Eastern Europe Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 103: Eastern Europe Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 104: Eastern Europe Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 105: Eastern Europe Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 106: Eastern Europe Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 107: Eastern Europe Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 108: Eastern Europe Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 109: Eastern Europe Ultrasound Systems Market Attractiveness Analysis by Country, 2022–2028

Figure 110: Eastern Europe Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 111: Eastern Europe Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 112: Eastern Europe Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 113: APEJ Ultrasound Systems Market Size Analysis, 2012–2021

Figure 114: APEJ Ultrasound Systems Market Forecast, 2022–2028

Figure 115: APEJ Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 116: APEJ Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 117: APEJ Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 118: APEJ Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 119: APEJ Radiology Market Size Analysis, 2012–2021

Figure 120: APEJ Radiology Market Forecast, 2022–2028

Figure 121: APEJ Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 122: APEJ Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 123: APEJ Cardiology Market Size Analysis, 2012–2021

Figure 124: APEJ Cardiology Market Forecast, 2022–2028

Figure 125: APEJ Gastroenterology Market Size Analysis, 2012–2021

Figure 126: APEJ Gastroenterology Market Size Forecast, 2022–2028

Figure 127: APEJ Others Market Size Analysis, 2012–2021

Figure 128: APEJ Others Market Forecast, 2022–2028

Figure 129: APEJ Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 130: APEJ Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 131: APEJ Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 132: APEJ Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 133: APEJ Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 134: APEJ Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 135: APEJ Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 136: APEJ Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 137: APEJ Ultrasound Systems Market Attractiveness Analysis by Country, 2022–2028

Figure 138: APEJ Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 139: APEJ Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 140: APEJ Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 141: Japan Ultrasound Systems Market Size Analysis, 2012–2021

Figure 142: Japan Ultrasound Systems Market Forecast, 2022–2028

Figure 143: Japan Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 144: Japan Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 145: Japan Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 146: Japan Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 147: Japan Radiology Market Size Analysis, 2012–2021

Figure 148: Japan Radiology Market Forecast, 2022–2028

Figure 149: Japan Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 150: Japan Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 151: Japan Cardiology Market Size Analysis, 2012–2021

Figure 152: Japan Cardiology Market Forecast, 2022–2028

Figure 153: Japan Gastroenterology Market Size Analysis, 2012–2021

Figure 154: Japan Gastroenterology Market Size Forecast, 2022–2028

Figure 155: Japan Others Market Size Analysis, 2012–2021

Figure 156: Japan Others Market Forecast, 2022–2028

Figure 157: Japan Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 158: Japan Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 159: Japan Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 160: Japan Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 161: Japan Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 162: Japan Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 163: Japan Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 164: Japan Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 165: Japan Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 166: Japan Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 167: Japan Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 168: MEA Ultrasound Systems Scanners Market Size Analysis, 2012–2021

Figure 169: MEA Ultrasound Systems Scanners Market Forecast, 2022–2028

Figure 170: MEA Cart/Trolley Based Ultrasound Systems Market Size Analysis, 2012–2021

Figure 171: MEA Cart/Trolley Based Ultrasound Systems Market Forecast, 2022–2028

Figure 172: MEA Compact/Handheld Ultrasound Systems Market Size Analysis, 2012–2021

Figure 173: MEA Compact/Handheld Ultrasound Systems Market Forecast, 2022–2028

Figure 174: MEA Radiology Market Size Analysis, 2012–2021

Figure 175: MEA Radiology Market Forecast, 2022–2028

Figure 176: MEA Obstetrics/Gynaecology Market Size Analysis, 2012–2021

Figure 177: MEA Obstetrics/Gynaecology Center Ultrasound Systems Market Forecast, 2022–2028

Figure 178: MEA Cardiology Market Size Analysis, 2012–2021

Figure 179: MEA Cardiology Market Forecast, 2022–2028

Figure 180: MEA Gastroenterology Market Size Analysis, 2012–2021

Figure 181: MEA Gastroenterology Market Size Forecast, 2022–2028

Figure 182: MEA Others Market Size Analysis, 2012–2021

Figure 183: MEA Others Market Forecast, 2022–2028

Figure 184: MEA Hospitals/Clinics Ultrasound Systems Market Size Analysis, 2012–2021

Figure 185: MEA Hospitals/Clinics Ultrasound Systems Market Forecast, 2022–2028

Figure 186: MEA Diagnostic Imaging/Surgical Center Ultrasound Systems Market Size Analysis, 2012–2021

Figure 187: MEA Diagnostic Imaging/Surgical Center Ultrasound Systems Market Forecast, 2022–2028

Figure 188: MEA Ambulatory Surgical Centers Ultrasound Systems Market Size Analysis, 2012–2021

Figure 189: MEA Ambulatory Surgical Centers Ultrasound Systems Market Forecast, 2022–2028

Figure 190: MEA Others Ultrasound Systems Market Size Analysis, 2012–2021

Figure 191: MEA Others Ultrasound Systems Market Size Forecast, 2022–2028

Figure 192: MEA Ultrasound Systems Market Attractiveness Analysis by Country, 2022–2028

Figure 193: MEA Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 194: MEA Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 195: MEA Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 196: Global Ultrasound Systems Scanners Market Size Analysis, 2012–2021

Figure 197: Global Ultrasound Systems Scanners Market Forecast, 2022–2028

Figure 198: Global Ultrasound Systems Market Attractiveness Analysis by Region, 2022–2028

Figure 199: Global Ultrasound Systems Market Attractiveness Analysis by Modality, 2022–2028

Figure 200: Global Ultrasound Systems Market Attractiveness Analysis by Application, 2022–2028

Figure 201: Global Ultrasound Systems Market Attractiveness Analysis by End User, 2022–2028

Figure 202: Global Ultrasound Systems Market Value Analysis and Forecast, 2022-2028 (US$ Mn)

Figure 203: Global Ultrasound Systems Market Absolute $ Opportunity (US$ Mn), 2022–2028

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Teleultrasound Systems Market

Micro-Ultrasound Systems Market

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Anesthesia Ultrasound Systems Market Analysis – Trends & Forecast 2025 to 2035

Preclinical Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Intravascular Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Ultrasound Systems Market

Automated Breast Ultrasound Systems Market Outlook - Share, Growth & Forecast 2025 to 2035

Portable Cardiology Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Global Ultrasound Conductivity Gels Market Insights – Size, Share & Industry Growth 2025–2035

Ultrasound Imaging Solution Market

Food Ultrasound Market Analysis – Applications & Innovations 2025 to 2035

Focused Ultrasound System Market Trends and Forecast 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Portable Ultrasound Bladder Scanner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA