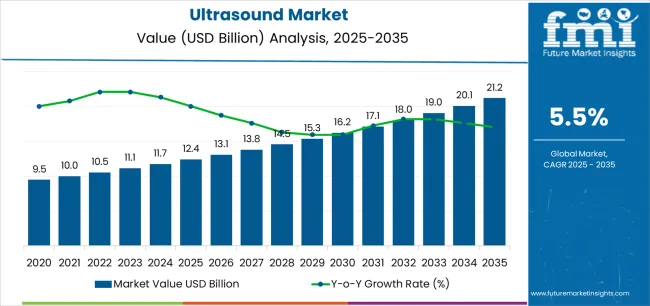

The Ultrasound Market is estimated to be valued at USD 12.4 billion in 2025 and is projected to reach USD 21.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The ultrasound market is witnessing sustained expansion, supported by increasing demand for non-invasive diagnostic procedures, advancements in imaging technology, and growing applications in preventive healthcare. Rising global healthcare expenditure, the proliferation of portable and point-of-care ultrasound devices, and improved access to diagnostic services have collectively strengthened market penetration.

Innovations such as AI-assisted image analysis, 3D/4D imaging, and miniaturized transducers are enhancing diagnostic accuracy while reducing procedure times. The market benefits from broad usage across cardiology, obstetrics, oncology, and musculoskeletal assessments.

As healthcare systems emphasize early diagnosis and cost-effective imaging solutions, ultrasound technology continues to evolve toward higher resolution and automation. With growing adoption in emerging economies and increasing replacement demand in developed markets, the ultrasound sector is poised for continued growth and diversification.

| Metric | Value |

|---|---|

| Ultrasound Market Estimated Value in (2025 E) | USD 12.4 billion |

| Ultrasound Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

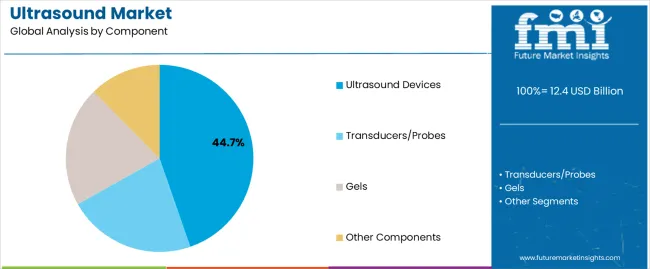

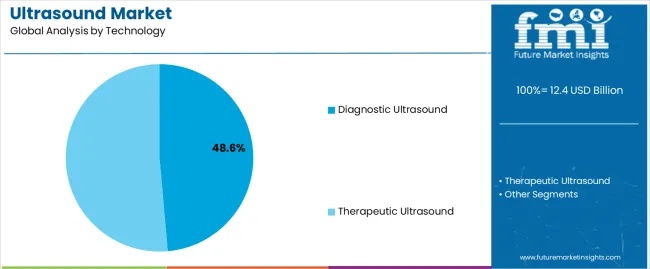

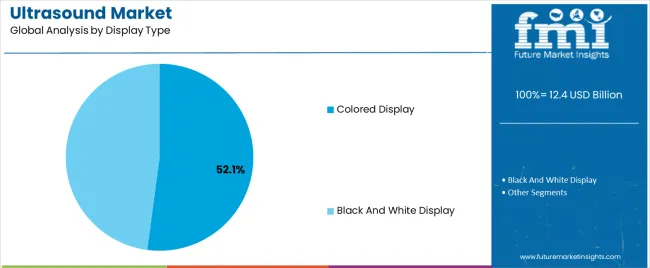

The market is segmented by Component, Technology, Display Type, and Portability and region. By Component, the market is divided into Ultrasound Devices, Transducers/Probes, Gels, and Other Components. In terms of Technology, the market is classified into Diagnostic Ultrasound and Therapeutic Ultrasound. Based on Display Type, the market is segmented into Colored Display and Black And White Display. By Portability, the market is divided into Handheld/Compact Ultrasound Systems, Cart/Trolly-Based Ultrasound Systems, and Point Of Care Ultrasound Systems. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ultrasound devices segment commands approximately 44.7% share in the component category, driven by continuous advancements in device design, imaging quality, and mobility. The increasing shift toward portable and handheld systems has expanded accessibility in outpatient and emergency care settings.

Hospitals and diagnostic centers are investing in upgraded systems with enhanced imaging capabilities and user-friendly interfaces to improve workflow efficiency. Demand for specialized devices catering to cardiovascular and obstetric imaging has reinforced this segment’s position.

Integration with artificial intelligence for automated measurements and improved accuracy has further enhanced clinical outcomes. As technology progresses, the ultrasound devices segment is expected to remain the primary revenue generator in the overall market.

The diagnostic ultrasound segment holds approximately 48.6% share in the technology category, attributed to its widespread use across medical specialties for real-time visualization and assessment. This segment benefits from its non-invasive nature, absence of ionizing radiation, and ability to deliver immediate diagnostic insights.

Growing utilization in early disease detection, maternal health monitoring, and cardiac imaging has cemented its importance in modern clinical practice. Continuous software innovation and image processing advancements have increased diagnostic precision and reduced examination time.

With increasing emphasis on preventive care and rapid diagnostics, the diagnostic ultrasound segment is expected to maintain its leadership throughout the forecast period.

The colored display segment dominates the display type category with approximately 52.1% share, driven by enhanced visual clarity, contrast, and depth perception it offers in medical imaging. Colored displays facilitate better tissue differentiation and accurate interpretation of diagnostic results, improving clinical confidence.

The segment’s adoption is supported by the availability of high-resolution, energy-efficient screens and demand for real-time, detailed visualization in complex examinations. Technological progress has also made colored displays more affordable, promoting their inclusion across portable and premium ultrasound systems alike.

As healthcare providers continue upgrading diagnostic equipment, colored displays are expected to remain standard in next-generation imaging systems.

The ultrasound industry is anticipated to surpass a valuation of USD 21.20 billion by 2035, registering a 5.80% CAGR. While the market is projected to experience remarkable growth, several restraining factors could adversely affect its progress:

Depending on the component, the ultrasound market branches into ultrasound devices, transducers, gels, and other components. The ultrasound devices segment is anticipated to develop at a CAGR of 4.20% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Component | Ultrasonic Devices |

| Forecasted CAGR (From 2025 to 2035) | 4.20% |

The ultrasound market is categorized by technology into 2D ultrasound, 3D and 4D ultrasound, color Doppler imaging, continuous Doppler imaging, etc. The 2D ultrasound technology segment dominates the market and is anticipated to flourish at a CAGR of 4.10% through 2035.

| Attributes | Details |

|---|---|

| Technology | 2D Ultrasounds |

| Forecasted CAGR (From 2025 to 2035) | 4.10% |

The section provides an analysis of the ultrasound market by country, including Japan, China, the United States, South Korea, and the United Kingdom. The table presents the CAGR for each country, indicating the expected market growth in that particular country through 2035.

| Countries | Forecasted CAGR (From 2025 to 2035) |

|---|---|

| South Korea | 6.80% |

| The United Kingdom | 6.60% |

| China | 6.40% |

| The United States | 5.90% |

| Japan | 5.00% |

South Korea is one of the leading countries in this market. The South Korea ultrasound market is anticipated to maintain its supremacy by progressing at an annual growth rate of 6.80% until 2035.

The United Kingdom also rules the ultrasound industry. The United Kingdom ultrasound market is anticipated to retain its ascendency by succeeding at an annual growth rate of 6.60% through 2035.

China, too, rules the ultrasound industry in the international marketplace. The Chinese ultrasound market is anticipated to exhibit an annual growth rate of 6.40% until 2035.

The United States tops the chart as the leading country when it comes to the ultrasound market, which is anticipated to register a CAGR of 5.90% through 2035.

Japan, too, plays a significant role in the ultrasound industry. Over the next ten years, the Japanese demand for ultrasounds is projected to rise at a 5.00% CAGR.

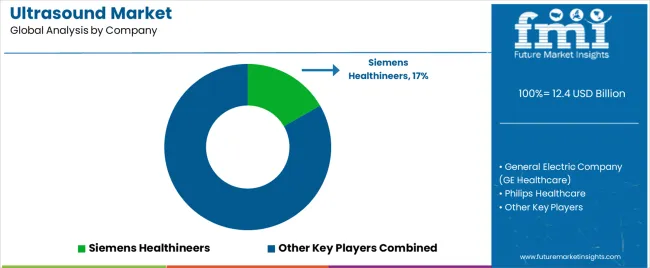

The ultrasound market consists of numerous players catering to both local and international consumers. Siemens Healthineers, General Electric Company, and Philips Healthcare are among the key players providing ultrasound components.

Hospitals, ambulatory surgical centers, specialty diagnostic centers, prenatal care clinics, etc., rely on these companies for their ultrasound devices. Apart from this, companies in the market are striving to make their products more cost-effective so that small clinics and hospitals can afford them.

This effort is intended to enable these companies not only to offer advanced facilities to patients but also to attract a substantial number of consumers to the market.

Recent Developments

The global ultrasound market is estimated to be valued at USD 12.4 billion in 2025.

The market size for the ultrasound market is projected to reach USD 21.2 billion by 2035.

The ultrasound market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in ultrasound market are ultrasound devices, transducers/probes, gels and other components.

In terms of technology, diagnostic ultrasound segment to command 48.6% share in the ultrasound market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

Global Ultrasound Conductivity Gels Market Insights – Size, Share & Industry Growth 2025–2035

Ultrasound Imaging Solution Market

Teleultrasound Systems Market

Food Ultrasound Market Analysis – Applications & Innovations 2025 to 2035

Micro-Ultrasound Systems Market

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Focused Ultrasound System Market Trends and Forecast 2025 to 2035

Portable Ultrasound Bladder Scanner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Analysis – Trends & Forecast 2024-2034

Wireless Ultrasound Scanner Market

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Endoscopic Ultrasound Needles Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Ultrasound Scanner Market Growth - Trends & Forecast 2025 to 2035

Anesthesia Ultrasound Systems Market Analysis – Trends & Forecast 2025 to 2035

Preclinical Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA