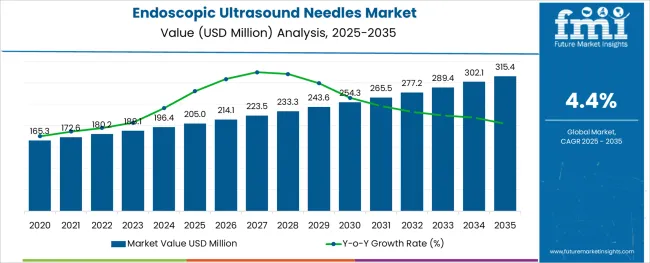

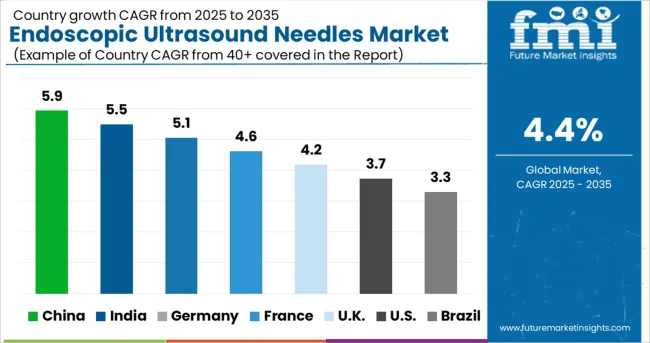

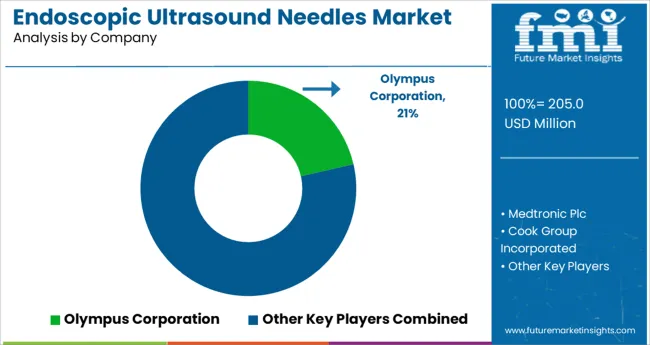

The Endoscopic Ultrasound Needles Market is estimated to be valued at USD 205.0 million in 2025 and is projected to reach USD 315.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The endoscopic ultrasound needles market is advancing steadily as healthcare systems prioritize early cancer detection, precision sampling, and minimally invasive diagnostic interventions. This growth is fueled by rising incidence of gastrointestinal and pulmonary malignancies, particularly in aging populations where timely and accurate tissue sampling is critical

Hospitals and specialty clinics are increasingly adopting EUS-guided procedures due to their real-time imaging advantages and ability to access deep-seated lesions with minimal patient trauma. Technological refinements in needle design - such as tip echogenicity, enhanced flexibility, and core tissue acquisition - have further expanded the clinical utility of these devices.

Concurrently, procedural demand is being driven by growing uptake of EUS for pancreatic, mediastinal, and submucosal assessments. Regulatory focus on diagnostic efficiency, paired with reimbursement enhancements for image-guided biopsy techniques, is expected to support long-term adoption. Future growth will likely emerge from wider application in bronchial diagnostics and expanded use across ambulatory and outpatient surgical centers.

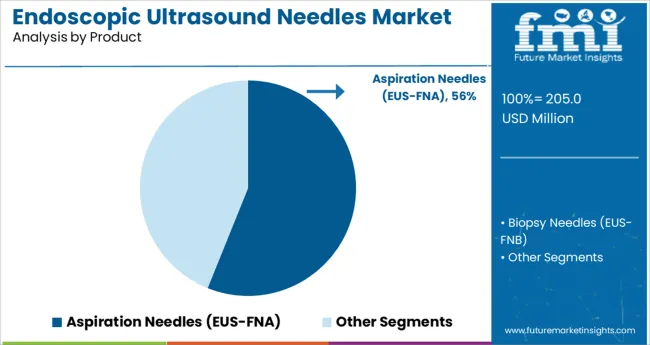

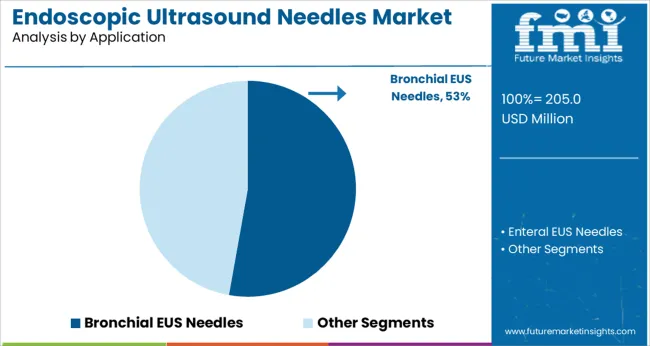

The market is segmented by Product, Application, and End User and region. By Product, the market is divided into Aspiration Needles (EUS-FNA) and Biopsy Needles (EUS-FNB). In terms of Application, the market is classified into Bronchial EUS Needles and Enteral EUS Needles.

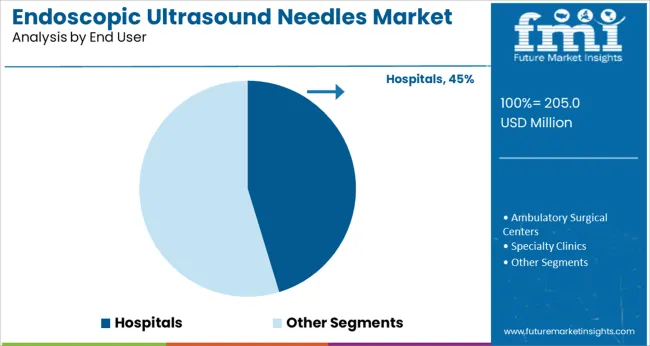

Based on End User, the market is segmented into Hospitals, Ambulatory Surgical Centers, and Specialty Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aspiration needles EUS FNA product segment is projected to account for 56.1% of total revenue in 2025, making it the leading product category. This position has been driven by their widespread use in fine needle aspiration of pancreatic, lymph node, and gastrointestinal lesions, where real-time cytological analysis is essential.

Their simplicity, cost-effectiveness, and proven diagnostic yield have led to routine adoption across hospital and specialty center procedures. Advancements in needle gauge options, ergonomic handle designs, and improved echogenicity have strengthened clinician preference.

Additionally, the lower risk profile and procedural familiarity associated with EUS FNA have contributed to its continued dominance over more complex core biopsy techniques in high-volume diagnostic settings.

The bronchial EUS needles application segment is expected to hold 52.8% of market revenue in 2025, positioning it as the top application area. This leadership is attributed to the rising number of endobronchial ultrasound procedures for lung cancer staging, mediastinal lymph node evaluation, and central airway lesions.

Clinical reliance on bronchial EUS for minimally invasive thoracic diagnostics has grown significantly with the rising global burden of pulmonary malignancies. Enhanced compatibility of EUS needles with linear echoendoscopes and bronchoscopes has improved precision in transbronchial sampling.

Additionally, widespread clinical guidelines now advocate bronchial EUS as a first-line diagnostic tool in lung cancer workups, contributing to its increased procedural volumes and leading market share.

The hospitals segment is projected to contribute 45.3% of overall market revenue in 2025, making it the largest end user category. This dominance is supported by hospitals’ infrastructure capabilities, access to advanced imaging systems, and availability of trained gastroenterologists and pulmonologists for EUS-guided procedures.

The integration of multidisciplinary care pathways in hospitals has enabled routine use of EUS needles in oncology diagnostics, infectious disease evaluation, and autoimmune disorder investigations. Further, hospitals are the primary sites for high-acuity cases and complex lesion assessments, where advanced EUS capabilities are necessary

Investments in image-guided surgical units and the inclusion of EUS in tertiary care protocols have also driven utilization. Institutional purchasing power and preference for premium-grade, high-accuracy diagnostic tools have reinforced hospitals’ leading position in the adoption of endoscopic ultrasound needle technologies.

| Particulars | Details |

|---|---|

| H1, 2024 | 4.64% |

| H1, 2025 Projected | 4.59% |

| H1, 2025 Outlook | 4.19% |

| BPS Change - H1, 2025 (O) – H1, 2025 (P) | (-) 40 ↓ |

| BPS Change – H1, 2025 (O) – H1, 2024 | (-) 45 ↓ |

The comparative analysis and market growth rate of global endoscopic ultrasound needles market as studied by Future Market Insights, will show a negative BPS growth in H1-2025 outlook as compared to H1-2025 projected period by 40 BPS, and, a negative BPS growth is expected in H1-2025 over H1- 2024 duration with 45 Basis Point Share (BPS).

The market observed a decline in the growth of the BPS values owed to the adverse events reported with endoscopic ultrasound needles, primarily for pain, infection, acute pancreatitis, and bleeding. This factor relates to the lowered product utilization rates, thus lowering the BPS values.

Conversely, with the introduction of the endoscopic ultrasound-guided fine-needle aspiration technique, the market for endoscopic ultrasound needles is set to witness a positive growth outlook over the forecast period. This technique is useful for the screening of diseases, and pathological diagnosis, which is an essential component of healthcare, especially after the recent advent of the global coronavirus pandemic.

The market is subject to changes as per the disease epidemiology, product adoption rate, and device regulatory dynamics, in accordance to the macro and industry factors.

Rising Advancements in Endoscopic Ultrasound Needle Technology to Accelerate Market Growth

Demand for endoscopic ultrasound needles rose at a CAGR of 4.4% from 2013 to 2024.

Endoscopic ultrasound (EUS) is a minimally invasive treatment that uses both visual and ultrasonic imaging to examine the thoracic and abdominal areas. The rising prevalence of gastrointestinal and stomach cancer around the world is expected to have a significant impact on the market. The market is predicted to see significant expansion due to the growing elderly population.

Physicians are focusing on using high-definition endoscopic ultrasound needle technology and endoscopic ultrasound biopsyneedles using better technology to get more accurate images of the gastrointestinal tract as compared to ultrasound and offer minimally invasive access to areas that are difficult to reach.

Manufacturers in the endoscopic ultrasound needles market are focusing on providing fine needle biopsy (FNB) technology to provide information on tissue architecture and a large amount of tissue for another ancillary testing.

Recently FNB devices have become commercially available and studies have also shown FNB needles to be more appropriate with greater accuracy than FNA needles. This is likely to drive demand for FNB needles in the endoscopic ultrasound needles market.

The market for endoscopic ultrasound needles is anticipated to rise at a CAGR of 4.4% over the forecast period of 2025 to 2035.

Rising Preference for Minimally-Invasive Surgeries to Boost Market Expansion

Owing to advanced robotic devices, healthcare providers are able to perform minimally invasive and safe surgical procedures. Endoscopic surgery is gaining traction as it uses advanced technology to reach internal organs with help of small incisions resulting in less pain, and quick recovery as compared to the traditional methods of surgery.

These factors are likely to drive the demand for endoscopic ultrasound needles in minimally invasive surgeries.

With the rise in digestive and lung diseases, endoscopic ultrasound is finding wide application as it is a minimally invasive procedure. Moreover, endoscopic ultrasound needles, including FNA, have emerged as a minimally-invasive alternative to exploratory surgery.

High Cost of Endoscopic Ultrasound Needles Restraining Market Growth

Market expansion is being hampered by lack of skilled professionals with expertise in operating with endoscopic ultrasound needles.

The market for endoscopic ultrasound needles will be hindered by high costs, the risk of infection, and stringent rules and regulations imposed by numerous government organizations.

Asia Pacific is expected to emerge as the lucrative region in the endoscopic ultrasound needles market, offering profit-making opportunities for key stakeholders in the endoscopic ultrasound needles market.

Increasing incidences of chronic diseases in the region is a key factor fueling the demand for bronchial EUS needles. Rising awareness about healthcare and increasing healthcare expenditure are likely to propel market growth in the region.

High Adoption of EUS Techniques for Gastrointestinal Disease Treatments

The market in the USA is developing due to the increasing use of advanced diagnostic methods in pulmonology, cancer, and gastroenterology, as well as the presence of keymarket players.

The USA leads the endoscopic ultrasound needles market owing to a rise in the number of diagnostic centers, the better healthcare infrastructure, growing adoption of EUS techniques for the treatment of gastrointestinal disorders.

Rising Investments by Government Organizations for Healthcare Development

Pharmaceutical and Biotechnology companies are focusing on establishing new production facilities in China due to the low cost of manufacturing. Moreover, the rise in investment by government organizations in the healthcare sector is also accelerating endoscopic ultrasound needles market growth.

The market in China is projected to rise attributed to the widespread adoption of endoscopy, growing awareness about early cancer diagnosis, and the rising demand for minimally invasive procedures.

High Prevalence of Gastrointestinal Tract-Related Cancers to Propel Demand for Aspiration Needles (EUS-FNA)

Aspiration needles (EUS-FNA) are expected to account for 53.7% share of the endoscopic ultrasound needles market in 2025. Endoscopic ultrasound-guided fine-needle aspiration (EUS-FNA) is widely used to diagnose both tumor and inflammatory lesions located in and adjacent to the gastrointestinal tract.

Aspiration needles (EUS-FNA) have become an integral part of the diagnosis. The rise in stomach cancer cases is driving the demand in the endoscopic ultrasound needles market including fine needle aspiration as the leading method to diagnosegastrointestinalcancer.

Growing usage of these needles in pulmonology & gastroenterology and continuous technological advancements are driving the demand for aspiration needles (EUS-FNA).

Ambulatory Surgical Centers Gaining Traction Owing to Safe Endoscopic Ultrasound Procedures & Expert Healthcare Teams

The market can be divided into three types of end users such as hospitals, ambulatory surgical centers, and specialty clinics. Ambulatory surgical centers are projected to expand at the quickest rate because of the rising number of these centers and the increasing number of endoscopic ultrasound procedures conducted in ambulatory surgical centers.

Ambulatory surgery centers are gaining pace in the market due to the minimally invasive and non-surgical treatment that may be performed through the colon or upper GI tract.

Leading manufacturers of endoscopic ultrasound needles are investing in advanced technologies and research & development activities for new product launches. Geographical expansion by collaborating with regional players is also a key focus area of endoscopic ultrasound needle suppliers.

For instance,

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | Value in million, Volume in Units |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Nordic, Spain, Japan, China, India, Malaysia, Thailand, Australia, GCC Countries, South Africa, Turkey |

| Key Market Segments Covered | Product, Application, End User, Region |

| Key Companies Profiled | ACE Medical Devices Pvt. Ltd.; Boston Scientific Corporation; CONMED Corporation; Cook Group Incorporated; Medi-Globe Corporation; Medtronic Plc; Micro-Tech Endoscopy; Olympus Corporation; Medline Industries, Inc.; CIVCO Medical Solutions; Protek Medical Products Inc.; Spectra Medical Devices, Inc.; Limaca-medical |

| Pricing | Available upon Request |

The global endoscopic ultrasound needles market is estimated to be valued at USD 205.0 million in 2025.

It is projected to reach USD 315.4 million by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are aspiration needles (eus-fna) and biopsy needles (eus-fnb).

bronchial eus needles segment is expected to dominate with a 52.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endoscopic Probe Disinfection Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Vessel Harvesting System Market Size, Share, and Forecast 2025 to 2035

Endoscopic Closure Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ERCP Devices Market Insights – Growth & Forecast 2024-2034

The Mobile Endoscopic Workstations Market is segmented by Colonoscopes, Enteroscopes, and Gastrointestinal endoscopes from 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

Ultrasound Imaging Solution Market

Teleultrasound Systems Market

Food Ultrasound Market Analysis – Applications & Innovations 2025 to 2035

Micro-Ultrasound Systems Market

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Focused Ultrasound System Market Trends and Forecast 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA