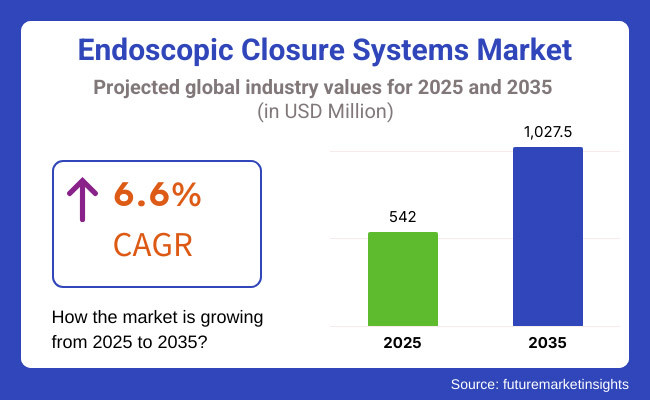

The global endoscopic closure systems market is projected to expand from USD 542.0 million in 2025 to USD 1,027.5 million by 2035, growing at a compound annual growth rate (CAGR) of 6.6%. This upward trajectory is driven by increasing demand for minimally invasive surgeries (MIS), rising prevalence of gastrointestinal (GI) disorders, and expanding use of endoscopic techniques across hospitals and ambulatory surgical centers (ASCs).

Endoscopic closure systems play a critical role in sealing perforations, managing internal bleeding, and closing incisions during or after procedures such as polypectomies, mucosal resections, and bariatric surgeries. These systems-comprising hemostatic clips, endoscopic suturing devices, and endoscopic staplers-minimize post-surgical complications, accelerate healing, and reduce hospitalization time. The global shift toward outpatient surgery and value-based healthcare further supports their adoption.

Ongoing technological innovation is transforming the field. Newer devices offer better precision, ergonomic handling, and are designed to reach challenging anatomical regions. Some systems integrate with real-time imaging and navigation technologies, improving accuracy in complex procedures. Leading manufacturers are also emphasizing reusability and ease of deployment, which support procedural efficiency and cost-effectiveness.

Rising incidences of colorectal cancer, gastric ulcers, and metabolic surgeries are propelling demand, especially in regions like North America and Asia Pacific. These markets benefit from robust healthcare infrastructure, favorable insurance reimbursements, and a strong clinical shift toward minimally invasive and endoluminal therapies.

In a 2023 interview with Gastroenterology & Endoscopy News, Dr. Steven Rothenberg, a prominent MIS specialist, stated: “Advanced closure systems are transforming the scope of what we can treat endoscopically. The ability to close even large defects reliably has opened doors to new procedures once thought too risky.”

As hospitals continue to prioritize surgical safety, faster recovery, and cost reduction, the endoscopic closure systems industry is set to play a pivotal role in the evolution of minimally invasive gastrointestinal care.

Endoscopic clips lead with a 63.2% share, while overstitch systems follow with 28.5%, driven by the increasing volume of gastrointestinal (GI) procedures and the growing adoption of minimally invasive surgery. Technological advancements and clinical demand for reliable closure post-endoscopic interventions are key growth accelerators.

Endoscopic clips, including over-the-scope clips (OTSC), are projected to hold a dominant 63.2% share in the endoscopic closure systems market in 2025. These devices are preferred for their fast deployment, non-invasive application, and strong closure efficacy across a range of GI procedures. Endoclips enable effective hemostasis, perforation repair, and mucosal defect closure without suturing-making them ideal for managing acute GI bleeding and post-polypectomy wounds.

Their ease of use and compatibility with standard endoscopes make them a cost-effective option for outpatient and emergency settings. Widely used in EMR, ESD, and polypectomy cases, endoscopic clips are now standard tools in gastroenterology suites globally. Companies such as Olympus Corporation, Cook Medical, and Boston Scientific are enhancing clip design with better rotational control, re-opening capability, and wider jaw spans to increase precision. As endoscopic procedures replace traditional surgeries, the demand for simple and effective closure methods like clips will continue to rise, especially in hospitals aiming for shorter patient stays and lower post-procedure complications.

Overstitch endoscopic suturing systems are expected to capture 28.5% of the market by 2025, gaining traction in more complex and high-risk GI procedures. Unlike clips, overstitch systems enable full-thickness suturing, providing a robust and durable closure-especially in cases involving perforations, fistulas, anastomotic leaks, and bariatric surgery. These systems replicate surgical suturing techniques via flexible endoscopes, enhancing closure strength in minimally invasive procedures.

Overstitch systems are particularly useful in bariatric revision surgeries, GERD management, and post-EMR resections where precision and tissue approximation are critical. Although they require more technical expertise, they deliver superior outcomes in complex closures. Medtronic, the market leader in endoscopic suturing, has developed modular overstitch platforms that integrate seamlessly into advanced endoscopy workflows. Training programs and simulation-based education are expanding surgeon proficiency, supporting broader adoption.

The demand for overstitch systems is further propelled by the rise in obesity-related surgeries and hospital policies favoring suture-based closure over metal implants. As surgical endoscopy becomes more advanced, overstitch technologies are expected to become integral to GI therapeutic procedures across tertiary care and specialized centers.

Challenges

Balancing Innovation and Affordability in Endoscopic Closure Systems

Most hospitals in cost-sensitive markets find the price of endoscopic closure devices, especially for robotic systems, too exorbitant and thus inaccessible. At the same time, they were also limited from using this advanced technology due to financial constraints.

Furthermore, new closure systems face lengthy and stringent regulatory approvals, affecting the business dimension of many smaller manufacturers because it is too time consuming and costly to pass through complex compliance requirements that hinder immediate access to new solutions. The availability of these procedures is also limited in some areas whose qualified endoscopic surgeons are lacking, thereby restricting market expansion.

Post procedural complications, including risk of infection and device migration, further strengthen the argument for stronger, more dependable closure systems. The increasing use of throwaway closure devices is raising medical waste concerns at the same time.

Efforts are being made by manufacturers towards more sustainable approaches, such as the introduction of biodegradable sutures and eco-friendly materials - destined to weigh the advantage of safety over environmental care.

Opportunities

Innovation and Developing Markets in Prospect of Endoscopy Closures

The endoscopic closure systems market is currently most vivid and growing rapidly with exciting technological advancements and better access to healthcare worldwide. There is a continued increase in telemedicine and remote patient monitoring systems which generate a further demand for these innovative closure systems enabling recovery and treatment in outpatient settings. The efforts by hospitals and surgery centers in reducing complications and readmissions are also compelling manufacturers to bring forth more resilient and infection-proof closure devices which guarantee patient safety.

While personalized medicine changes treatment paradigms, companies are developing specific closure solutions tailored to patients' needs to achieve better outcomes. Next-generation bioengineered closure materials are also being designed through collaborations between medical device companies and research organizations, which are likely to trigger innovations in this area.

This drives the demand for cheaper closure systems as poor governments introduce healthcare access into the low-income area. Complementary savings on making budgetary reductions by targeting local distribution are posed as the position to extend advanced endoscopic treatment to better global patient care

Changing Innovation and Policy Trends in Endoscopic Closure Systems

The endoscopic closure markets would not be left behind in the dynamic market that is changing fast and with new technologies making procedures safer and more effective. Robotic-assisted endoscopic closures are viewed as the greatest revolution in terms of surgery since robotic systems, powered by artificial intelligence, offer real-time imaging and automated suturing. These enable surgeons to carry out complex gastrointestinal repairs more accurately and with fewer complications while improving the recovery process for the patients.

On the other hand, scientists are inventing bioabsorbable closure devices that dissolve and disappear spontaneously once healing is accomplished. This feature prevents removal and the associated risks of infection. Bioabsorbable adhesives, sutures, and clips further improve outcomes for the patients, all while scientists continue their tweaking on biodegradable material for green replacements for the older generation.

Regulatory agencies like the FDA and EMA, and PMDA in Japan have also moved to demand a more significant contribution towards safety in which closure devices must be sterile and function properly. Even policymakers are looking into real-life clinical evidence for shaping reimbursement policy and accelerating new technology adoption. All these shifts will usher in an era full of opportunities for innovation and enhanced access to advanced treatments for patients.

In the United States, cutting-edge technologies for endoscopic closure account for widespread insurance acceptance that fosters high patient volume for GI and bariatric procedures. Therefore, surgical centers and hospitals invest significantly in advanced technologies that provide better patient outcomes with shorter recovery time.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

Germany is moving into minimally invasive endoscopic approaches supported by advanced hospitals and proficient endoscopists. Its focus on precision medicine and technical innovations will act as a catalyst for market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.4% |

Increased healthcare investments and better access to training in endoscopy are encouraging Indian hospitals and clinics to expand the use of some inexpensive closure methods. The uptrend in the demand for minimally invasive is pushing the growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.3% |

China's fast-growing healthcare infrastructure is driving the applicability of AI-enabled endoscopic procedures. As hospitals upgrade their facilities to meet rising patient demand, it is anticipated that obesity and GI-related ailments will increase.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Brazil is increasing access to advanced endoscopic procedures as health professionals respond to the rising burden of GI diseases. Public policies together with private investments ensure the dissemination of advanced closure technologies across the country.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.8% |

The market is very dynamic and fast growth is taking place in this sector for endoscopic closure systems, mostly on account of increased demand for minimally-invasive procedures and state-of-the-art advancements in the endoscopic field. More gastrointestinal and bariatric procedures are being performed that further accelerate the pace of innovations for suturing devices, clip-based closure systems, and bioabsorbable materials.

All incumbent players in the medical device sector who comprehend the endoscopy specialty, even the newcomers, are now compelled to compete with each other in bringing to market the most useful and user-friendly solutions. The scenario boosts ongoing developments in patient care, evolving procedures to be safer, more effective, and less invasive.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 542.0 million |

| Projected Market Size (2035) | USD 1,027.5 million |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Endoscopic Clips/Endoclips (Over-the-scope Clips), Overstitch Endoscopic Suturing System, Cardiac Septal Defect Occluders, Endoscopic Vacuum-Assisted Closure Systems, Others |

| Procedures Analyzed (Segment 2) | GI Bleeding Management, Post-Endoscopic Mucosal Resection (EMR) Closure, Closure of Perforations and Fistulas, Anastomotic Leak Repair, Bariatric Surgery, GERD Repair, Colon Diverticula Procedures, Stent Fixation, Pediatric GI Closure Procedures, Others |

| End Users Analyzed (Segment 3) | Hospitals, Ambulatory Surgical Centers, Specialty Clinics |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, China, Japan, South Korea, India, Brazil, Mexico, Australia, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Market | CooperSurgical Inc., USA Endoscopy, Life Partners Europe, Ovesco Endoscopy AG, Apollo Endosurgery, Inc., St. Jude Medical, Inc. (Abbott), Steris, Boston Scientific Corporation, Abbott, Medtronic, Olympus Corporation, Johnson & Johnson Services Inc., CONMED Corporation, ERBE Elektromedizin GmbH, Cook |

| Additional Attributes | Manufacturers of endoscopic closure systems would want to know dollar sales by product type, share across GI and bariatric procedures, hospital vs. ASC usage patterns, demand growth in pediatric and GERD closures, and regional adoption trends driven by reimbursement and tech innovation. |

Endoscopic clips/Endoclips (Over-the-scope Clips), Overstitch endoscopic suturing system, Cardiac septal defect occluders, Endoscopic vacuum-assisted closure systems and Others

Gastrointestinal (GI) Bleeding Management, Post-Endoscopic Mucosal Resection (EMR) Closure, Closure of Perforations and Fistulas, Anastomotic Leak Repair, Bariatric Surgery, Gastroesophageal Reflux Disease (GERD) Repair, Colon Diverticula Procedures, Stent Fixation, Pediatric GI Closure Procedures, Others Procedures

Hospitals, Ambulatory Surgical Centers and Specialty Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Endoscopic Closure Systems Market was USD 542.0 million in 2025.

The Endoscopic Closure Systems Market is expected to reach USD 1,027.5 million in 2035.

Rising awareness and growing demand for non-invasive procedure drive the growth of this market.

The top key players that drives the development of Drug Delivery Technology Market are, Medtronic plc, Johnson & Johnson, Services Inc., Boston Scientific Corporation and Olympus Corporation.

Endoscopic clips/Endoclips in product type of Endoscopic Closure Systems market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End-user, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End-user, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End-user, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End-user, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End-user, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End-user, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End-user, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End-user, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enclosure Support Arm Systems Market Size and Share Forecast Outlook 2025 to 2035

Abdominal Closure Systems Market Analysis – Trends & Forecast 2024-2034

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Probe Disinfection Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Vessel Harvesting System Market Size, Share, and Forecast 2025 to 2035

Endoscopic Ultrasound Needles Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

ERCP Devices Market Insights – Growth & Forecast 2024-2034

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Competitive Breakdown of Bag Closure Clip Providers

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA