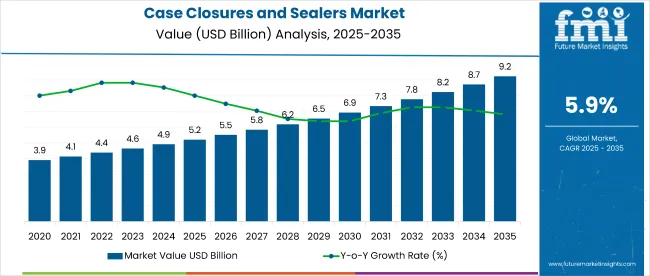

The global case closures and sealers market is projected to expand from USD 5.2 billion in 2025 to USD 9.3 billion by 2035, reflecting a CAGR of 5.9% during the forecast period.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 5.2 billion |

| Market Size (2035) | USD 9.3 billion |

| CAGR (2025 to 2035) | 5.9% |

Growth is primarily driven by increased demand for automation in end-of-line packaging, especially in sectors like food & beverage, e-commerce, and pharmaceuticals. In 2025, the broader packaging machinery market is estimated at USD 58.7 billion, positioning case closures and sealers at an 8.9% share within the segment.

Rising automation across packaging lines remains the primary driver, with fully automatic case sealers witnessing strong adoption-particularly in high-throughput sectors like food & beverage, which accounts for 33.6% of demand (FMI, 2025). Demand is further supported by growth in e-commerce, where rapid order fulfillment intensifies the need for efficient sealing systems.

However, high capital expenditure for advanced machines and integration costs-especially for small-to-mid manufacturers-act as a restraint. An opportunity lies in hybrid equipment with modular automation, enabling up to 30% lower upgrade costs over full system replacements. A key trend includes consolidation of end-of-line systems into integrated platforms, with OEMs offering combo machines driving 18% of equipment uptake.

The current market scenario is defined by rising demand volatility and customization pressures across packaging formats. Manufacturers are shifting from standalone machines to modular systems that can handle varying box sizes and product volumes with minimal downtime. In response, players are prioritizing compact designs, tool-less changeovers, and energy-efficient sealing mechanisms to meet operational cost targets.

Strategic moves include expanding regional assembly units, strengthening service networks, and integrating Industry 4.0 features such as sensor-based diagnostics and remote performance tracking. Several companies have ramped up R&D spending on multi-mode sealing systems to address demand from FMCG, pharma, and e-commerce warehouses operating under tight fulfillment cycles.

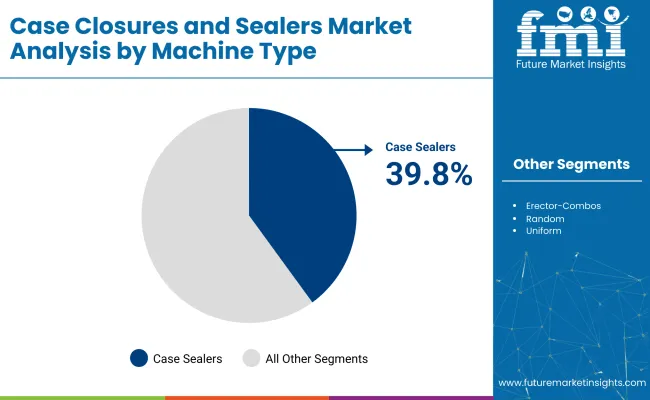

The case closures and sealers market has been segmented comprehensively to reflect evolving automation needs and application diversity. By machine type, the market includes case sealers; case closers; case erector-sealer combos; random case sealers; and uniform case sealers. By automation level, segmentation comprises manual case closures; semi-automatic case sealers; and fully automatic case sealers.

Based on end-use industry, key segments are food & beverage; pharmaceuticals; consumer electronics; e-commerce & retail; industrial goods; automotive components; and logistics & warehousing. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa, and Oceania.

Case sealers are projected to lead the machine type segment with a 39.8% share in 2025, owing to their widespread use in automated packaging lines that require speed, consistency, and minimal manual intervention. These machines have become standard in food, beverage, and retail distribution centers where throughput efficiency is prioritized.

Their ability to handle varying box sizes with minimal downtime makes them a preferred option in high-mix operations. Case closers, holding a 25% share, are more prevalent in heavy-duty or industrial environments where sealing often follows manual or semi-automatic processes.

Fully automatic case sealers are set to dominate the automation level segment by 2025, as manufacturers prioritize line efficiency, labor cost reduction, and error-free sealing. These systems are increasingly adopted in high-volume operations where downtime and manual intervention are seen as cost liabilities.

Semi-automatic machines retain relevance in mid-scale settings where flexibility and budget alignment matter, while manual closures continue to serve low-throughput or specialist production environments with irregular box sizes or fragile contents.

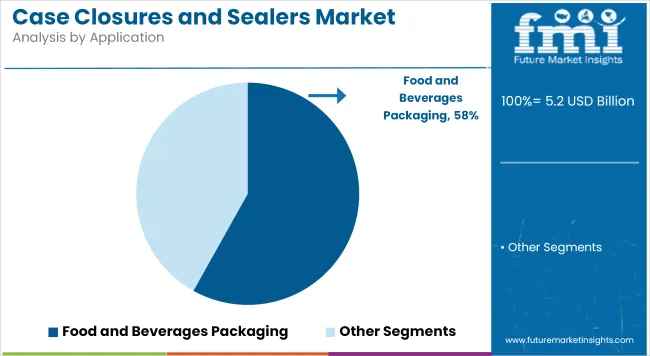

The food & beverage sector is projected to be the largest end-use segment, capturing 58% of the market in 2025. Consistent demand for shelf-ready packaging and cold-chain compatible sealing formats sustains equipment uptake in this category.

Pharmaceutical manufacturers follow, requiring tamper-evident and contamination-resistant sealing for regulated distribution. E-commerce and retail operators increasingly deploy automated sealers to meet fast-pick fulfillment and return-ready packaging requirements. Other contributors include consumer electronics, industrial goods, automotive components, and logistics hubs, each with distinct packaging throughput and security demands.

Country-wise momentum in the case closures and sealers market reflects a mix of automation maturity, packaging regulation, and industrial throughput. The United States leads in both value and installed base, with large-scale deployments in food, pharma, and retail warehousing. Germany and Japan show strong adoption of integrated systems, supported by engineering precision and high labor costs.

China’s market is scaling rapidly due to domestic manufacturing intensity and e-commerce fulfillment growth. India stands out with the highest CAGR, driven by automation catching up in FMCG, logistics, and retail sectors. These five markets are expected to account for a dominant share of global demand by 2035.

The USA market is valued at USD 1.6 billion in 2025 and expected to reach USD 2.8 billion by 2035, advancing at a CAGR of 6.8%. Growth is sustained by widespread automation in food packaging, pharmaceuticals, and large-scale e-commerce warehouses. Sealing systems integrated with barcode scanners and real-time diagnostics are becoming standard. However, equipment costs remain elevated due to domestic compliance and service-level mandates, limiting adoption among low-volume contract packers.

Germany’s market is projected to grow from USD 480 million in 2025 to USD 880 million by 2035, reflecting a CAGR of 6.4%. Packaging lines in automotive and food sectors drive sustained investment in high-precision sealing machinery. Energy-efficient machines with CE-certified safety modules are preferred. However, slower replacement cycles in legacy industries continue to moderate equipment turnover rates.

China’s market is valued at USD 510 million in 2025 and set to cross USD 1.0 billion by 2035, expanding at a CAGR of 6.9%. Growth is powered by scale-intensive FMCG and electronics sectors, where throughput exceeds 400 boxes/minute in peak logistics periods. Margins are competitive, but lower unit costs of domestic equipment encourage frequent machine upgrades. Demand for smart sensors and QR-code traceability in outbound packaging is rising sharply.

The Japanese market is expected to grow from USD 300 million in 2025 to USD 530 million by 2035, at a CAGR of 5.8%. Equipment adoption is led by compact and fully enclosed sealing systems suited for clean-room and controlled environments. Aging workforce pressures are accelerating transition from manual to semi-automatic machines. But stringent facility codes and lengthy procurement cycles continue to dampen speed of change.

India’s market is projected at USD 220 million in 2025 and expected to reach USD 440 million by 2035, advancing at the highest CAGR of 7.2%. Growth is fueled by rising automation in packaged foods, pharma logistics, and organized retail distribution. Demand is strongest for mid-range semi-automatic machines compatible with fluctuating carton sizes. Infrastructure gaps and fragmented warehousing remain a constraint for Tier-2 city expansion.

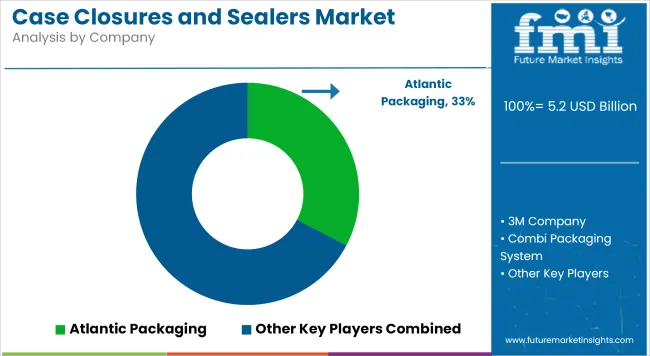

The players in the case closures and sealers market are focusing on modular automation and low-footprint integration to enhance throughput and minimize downtime in end-of-line packaging. Rising demand for sealing systems compatible with variable carton sizes and fluctuating order volumes has prompted investments in servo-driven mechanisms and sensor-activated sealing heads. Several manufacturers are also embedding diagnostics and remote monitoring capabilities, enabling predictive maintenance and reducing machine idle time.

In the near term, regional players are expected to increase share through service agility and retrofit solutions tailored to mid-scale operations. Meanwhile, global firms are scaling R&D to support multi-line combo machines that combine erection, filling, and sealing in one unit. High import duties and divergent safety standards continue to shape go-to-market strategies across Asia and Europe. Players that standardize interfaces, offer integration-ready modules, and localize service networks are likely to outperform laggards relying on monolithic designs or legacy tech stacks.

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 5.2 Billion |

| Market Size (2035) | USD 9.3 Billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Units | Revenue in USD Billion |

| Segments Covered | By Machine Type, Automation Level, End-Use Industry, Region, Country |

| Machine Types | Case Sealers, Case Closers, Erector-Sealer Combos, Random, Uniform |

| Automation Levels | Manual, Semi-Automatic, Fully Automatic |

| End-Use Industries | Food & Beverage, Pharmaceuticals, Consumer Electronics, E-commerce & Retail, Industrial Goods, Automotive Components, Logistics & Warehousing |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa, Oceania |

| Countries Covered | USA, Canada, Germany, France, UK, Italy, China, Japan, India, South Korea, Brazil, Mexico, Australia, GCC, and 40+ others |

| Key Companies Profiled | Schneider Packaging, Wexxar Bel, Loveshaw, Combi Systems, A-B-C Packaging, and more |

The case closures and sealers market is estimated to be worth USD 5.2 billion in 2025.

The case closures and sealers market is projected to reach USD 9.3 billion by 2035.

The case closures and sealers market is expected to grow at a CAGR of 5.9% during the forecast period.

Case sealers are forecast to dominate the case closures and sealers market with a 39.8% share in 2025.

The United States, Germany, China, Japan, and India are the top contributors to the case closures and sealers market.

The food & beverage sector leads the case closures and sealers market, accounting for 33.6% of demand in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Case Closures and Sealers in Japan Size and Share Forecast Outlook 2025 to 2035

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Case Coders Market Size and Share Forecast Outlook 2025 to 2035

Case Material Market Size and Share Forecast Outlook 2025 to 2035

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Case Packing Machines Market from 2025 to 2035

Case Erectors Market by Automation Type from 2025 to 2035

Casein Peptone Market Report – Growth & Industry Trends 2025 to 2035

Competitive Breakdown of Case Erectors Providers

Market Share Breakdown of Case Coders Industry

Leading Providers & Market Share in Case Material Industry

Casein Glycomacropeptide Market

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Slipcases Market Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Drop Sealers Market

Crank Case Ventilation Valve Market Size and Share Forecast Outlook 2025 to 2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA