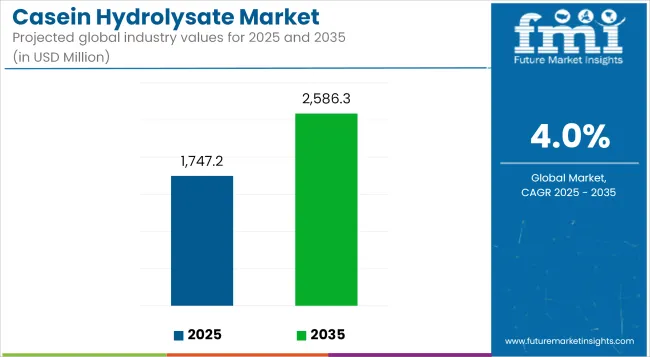

According to recent market analysis, casein hydrolysate industry revenues stood at USD 1,747.2 million in 2025 and are forecast to reach USD 2,586.3 million by 2035, reflecting a CAGR of 4.0%. The market is increasingly shaped by heightened interest in hypoallergenic and rapidly absorbable protein formats. Functional attributes of casein hydrolysates in nutritional formulations have gained critical importance among health-conscious consumers and specialized dietary segments.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,747.2 Million |

| Projected Market Size in 2035 | USD 2,586.3 Million |

| CAGR (2025 to 2035) | 4.0% |

Market expansion is being actively supported by consumer shifts toward medical-grade nutrition, especially in pediatric and geriatric segments. Nutritional advantages such as improved digestibility and reduced allergenicity are fostering product inclusion across clinical nutrition, sports recovery, and specialty infant food.

However, relatively high production costs and limited flavor masking capabilities remain key restraints. Industry players are prioritizing enzymatic optimization and encapsulation technologies to overcome sensory limitations. Notably, clean-label and non-GMO claims are gaining favor, aligning with broader consumer expectations across functional food categories.

By 2025, casein hydrolysates are expected to account for a growing share of the global protein hydrolysates sector. Adoption in sports and performance nutrition is being reinforced by clinical studies endorsing its efficacy in muscle repair and fast nutrient delivery.

Between 2025 and 2035, innovation is likely to concentrate on microencapsulation for flavor management, along with greater B2B customization for infant and elderly formulations. Advanced processing techniques and sustainable sourcing are anticipated to further differentiate premium suppliers. Product uptake in Asia-Pacific and North America is expected to be especially strong, driven by regulatory clarity and a rapidly growing population with specific nutritional requirements.

Accounting for an estimated 17.9% of market share in 2025, therapeutic nutrition applications are establishing themselves as a high-impact segment in the casein hydrolysate market. This growth is driven by the increasing demand for specialized medical nutrition to manage conditions such as protein malabsorption, gastrointestinal disorders, and metabolic syndromes.

Casein hydrolysate’s hypoallergenic and rapidly absorbable properties position it as an ideal protein source in clinical dietary formulations. In Europe, compliance with EU Regulation (EU) No 609/2013 on Food for Special Medical Purposes (FSMPs) has encouraged manufacturers to pursue evidence-backed formulations using hydrolyzed caseins.

For instance, Nestlé Health Science and Danone Nutricia are both actively marketing protein hydrolysate-based medical nutrition for pediatric and adult use. The focus is now shifting toward disease-specific product development, such as for inflammatory bowel disease or oncology nutrition. However, stringent safety substantiation and regulatory filings are essential, often lengthening commercialization timelines.

Manufacturers investing in R&D and clinical trials are better positioned to capture hospital, outpatient, and pharmacy distribution channels. The segment is expected to grow steadily through 2035, aided by improved hospital procurement budgets and rising chronic disease prevalence globally.

Pet nutrition represents a nascent yet increasingly relevant segment, capturing approximately 5.6% of the market share in 2025. This demand is fueled by the rise of premium functional pet foods targeting digestive health, immune support, and allergen-free diets. Casein hydrolysates, due to their bioactive peptides and low allergenicity, are being integrated into specialized canine and feline formulations.

In North America and Western Europe, regulatory clarity provided by entities such as the Association of American Feed Control Officials (AAFCO) has enabled safe incorporation of hydrolyzed proteins in companion animal diets. Brands like Royal Canin and Hill’s Pet Nutrition are leveraging hydrolyzed casein for sensitive digestion and stress-related indications in pets.

The segment's growth is further propelled by consumer willingness to invest in human-grade nutritional standards for pets. However, high ingredient costs and flavor masking challenges in meat-based formulations pose limitations. Strategic partnerships between ingredient suppliers and premium pet food manufacturers are emerging to develop tailored, high-performance recipes. This segment is poised to benefit from broader trends in pet humanization and functional animal nutrition across urbanized markets.

High Production Costs, Regulatory Compliance, and Allergen Concerns

The casein hydrolysate market is subject to a number of challenges, particularly the presence of high production costs arising from efforts such as enzymatic hydrolysis and protein purification processes. As casein hydrolysate is derived from dairy sources, its market stability is strongly affected by changing raw milk price and supply chain disruptions.

Moreover, there are high regulatory standards from FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and Codex Alimentarius for products like infant formula, clinical nutrition, and sports supplements, leading to strict quality control, labeling, and allergen testing. Other factors hindering market growth are rising consumer scrutiny of dairy allergens which restricts the uptake of casein-based hydrolysates in populations where lactose intolerance or milk protein allergies are a health issue and competition from plant-based protein alternatives.

Growth in Sports Nutrition, Infant Formula, and Medical Applications

Current trends and challenges facing the industry have also revealed new opportunities; the casein hydrolysate market is anticipated to grow over the next few years driven by the need for premium sources of protein in fields such as sports nutrition, infant formulas and medical nutrition. The fast absorption of hydrolyzed casein, muscle recovery and digestibility make it perfect for athletes, patients with metabolic disease and premature.

The rising usage of clinical nutrition solutions, specifically regarding the elderly, post-surgery recovery, and gastrointestinal health, is anticipated to push growth. Enzymatic hydrolysis also shows promising advances, improving bioavailability, taste, and functional properties, thus enhancing the market potential of casein hydrolysates as an ingredient in functional foods and beverages.

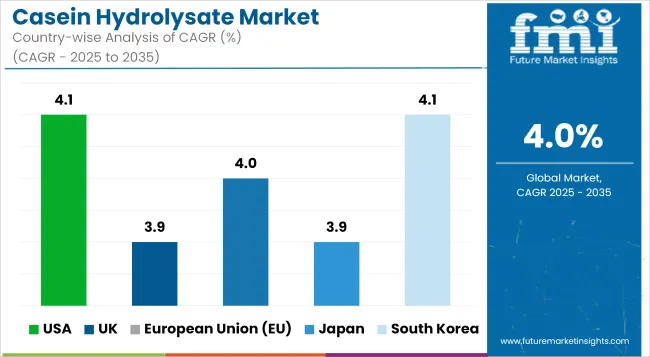

The USA casein hydrolysate market is growing steadily in the USA market, where growing demand in the segment of infant nutrition, sports nutrition and clinical nutrition is driving the growth. Increasing consumer awareness regarding protein-rich diets, along with an increase in the prevalence of lactose intolerance, is driving the adoption of casein hydrolysate as a functional ingredient. In addition to this, growing food preservation and enzyme hydrolysis processes are propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The United Kingdom casein hydrolysate market is anticipated to grow owing to high demand for hypoallergenic protein ingredients in infant formula and medical nutrition products. Increased use of sports nutrition supplements and sports protein beverages are also contributing to market growth. The movement toward clean-label and natural protein sources is also shaping product innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The casein hydrolysate market is flourishing across the European Union due to consumers' focus on nutrient-dense protein sources in functional food products and dietary supplements. The strong dairy sector in the region is boosting demand for the product along with regulatory support for protein-enhanced food products. The market expansion is also attributed to the studies done to assess the health benefits of bioactive peptides derived from casein hydrolysate.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

The Japan casein hydrolysate market is moderately growing due to growing need for protein-based nutritional products in aged populace. Growing focus on upholding functional food innovation and bioactive peptide incorporation in health supplements is expanding the market. Moreover, the country’s well-structured dairy processing industry is supporting the production of high-grade casein hydrolysate.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The South Korea casein hydrolysate market is growing as consumers shift towards increased protein supplementation for use in sports nutrition, infant formula, and clinical settings. Growing availability of hydrolyzed protein products across functional food and beverage segments is driving the market growth. Moreover, government initiatives for dairy innovation and nutritional research are helping the market to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

A casein hydrolysate is produced by the hydrolysis of casein, a family of related proteins found in mammal's milk. To increase bioavailability, digestibility, and nutritional benefits, companies are developing AI-led protein hydrolysis, enzyme-optimized digestion, and hypoallergenic formulations.

This market comprises dairy ingredient manufacturers, clinical nutrition companies, and functional food manufacturers; their development of technologies for protein hydrolysates, AI (artificial intelligence) process control, and sustainable dairy protein extraction is a technological consideration.

The overall market size for casein hydrolysate market was USD 1,747.2 Million in 2025.

Casein hydrolysate market is expected to reach USD 2,586.3 Million in 2035.

The demand for Casein Hydrolysate is expected to rise due to its increasing use in infant nutrition, sports supplements, and medical nutrition, along with growing consumer preference for easily digestible protein sources.

The top 5 countries which drives the development of casein hydrolysate market are USA, UK, Europe Union, Japan and South Korea.

Powder Form and Pharmaceuticals to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Casein Peptone Market Report – Growth & Industry Trends 2025 to 2035

Casein Glycomacropeptide Market

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Micellar Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Native Micellar Casein Market – Growth, Demand & Industry Innovations

Demand for Sodium Caseinates in EU Size and Share Forecast Outlook 2025 to 2035

Demand of Micellar Casein Isolate (MCI) for Medical Nutrition in EU Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Hydrolysates Market

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Whey Hydrolysates Market

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Gelatin Hydrolysates Market

Collagen Hydrolysates Market Analysis - Size, Share, and Forecast 2024 to 2034

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA