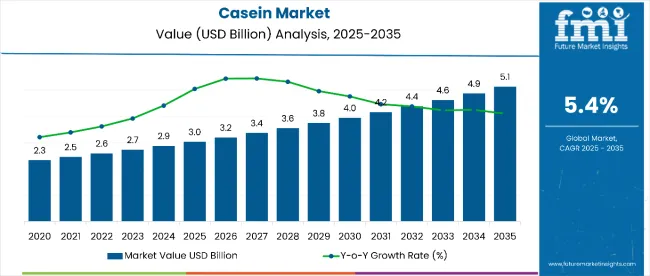

The global casein market is anticipated to expand from USD 3 billion in 2025 to nearly USD 5.1 billion by 2035, recording a CAGR of 6.4% throughout the forecast period. The market had recorded a CAGR of 5.4% between 2020 and 2025. The current growth trajectory is supported by increasing demand for functional proteins in the food & beverage, sports nutrition, and medical nutrition sectors.

Casein, a milk-based protein, is prized for its slow-digesting properties and high nutritional profile. Its application extends across diverse product categories including protein powders, functional beverages, meal replacements, and clinical nutrition products. Rising consumer awareness regarding sustained protein intake and growing demand for protein-enriched diets are key factors fueling market growth.

In April 2025, Arla Foods Ingredients expanded its micellar casein isolate (MCI) portfolio to address emerging needs in medical and functional nutrition. Highlighting the versatility of Lacprodan MicelPure, Mads Dyrvig, Head of Sales Development, Specialised Nutrition, stated: “Our Lacprodan MicelPure solutions are a great match for medical nutrition products that target protein malnutrition.

Meeting patient needs for high protein content and quality, great taste and texture, and a wider variety of formats can enhance compliance with medical nutrition, helping to improve recovery and quality of life. Lacprodan MicelPure offers great functionality and processing versatility, opening up exciting opportunities for product innovation in a fast-growing market.”

Sustainability trends are also reshaping the casein industry. Dairy processors are adopting eco-friendly production methods and implementing sustainable dairy sourcing to align with consumer expectations for ethical and environmental responsibility. Moreover, the emergence of hybrid protein products, which combine casein with plant-based proteins, is broadening the appeal of casein to flexitarian and health-conscious consumers.

Regionally, Europe and North America remain the largest markets due to their advanced dairy industries and high consumer awareness of functional nutrition. However, Asia Pacific is witnessing the fastest growth, supported by an expanding middle class and rising health and wellness trends in countries like China and India.

| Attributes | Description |

|---|---|

| Estimated Casein Market Size (2025E) | USD 3 Billion |

| Projected Casein Market Value (2035F) | USD 5.1 Billion |

| Value-based CAGR (2025 to 2035) | 6.40% |

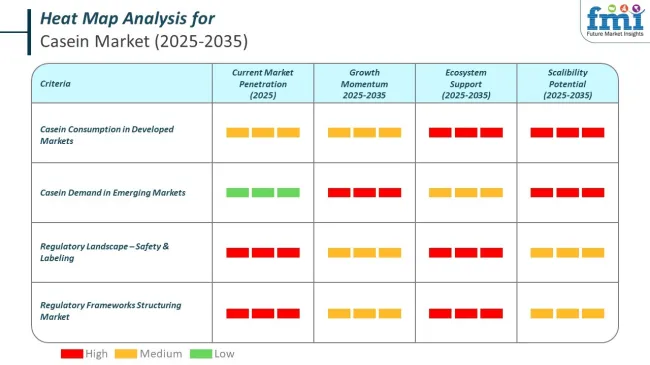

The casein market shows strong consumption concentration in North America and parts of Europe, driven by established dairy processing, health nutrition sectors, and protein-enriched product categories. The United States leads with 0.8 kg per capita, supported by demand across sports nutrition and food manufacturing channels.

Emerging economies such as China, India, and Brazil show comparatively low consumption but hold substantial growth headroom in the Casein Market. Lower base volumes reflect dietary patterns and evolving dairy infrastructure, with rising uptake driven by fitness, nutrition, and food modernization.

Regulatory bodies across the casein market’s top economies enforce specific controls around safety, labeling, and nutritional claims. The United States, China, and Japan operate through national food laws to standardize casein’s protein content, allergen disclosure, and manufacturing safety.

The casein market operates under well-defined regulatory frameworks that directly shape its safety, labeling, and product access parameters. These national rules influence how casein is processed, certified, and introduced across clinical nutrition, packaged foods, and performance-oriented product lines. In developed economies, compliance plays a central role in dictating formulation consistency and legal acceptability across retail and commercial channels.

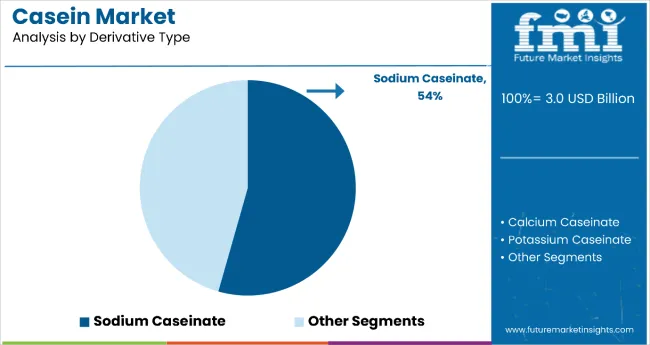

The casein market is driven by growth in sodium caseinate and nutritional powders & bars segments. In 2025, sodium caseinate is expected to dominate due to its functional properties in food and supplement applications. Nutritional powders and bars are gaining traction as consumer demand rises for protein-rich, on-the-go nutrition. These high-growth segments are projected to anchor market expansion through 2025.

The sodium caseinate segment is projected to hold approximately 54% of the market by 2025. This dominance is attributed to its strong emulsifying, stabilizing, and water-binding properties, making it essential for dairy, bakery, confectionery, and nutritional supplement applications. Sodium caseinate’s solubility and functionality in protein beverages and processed foods explain its widespread use.

Leading suppliers like FrieslandCampina Ingredients, Kerry Group, and Arla Foods Ingredients continue to expand production of sodium caseinate. Its use in high-protein drinks and clean-label formulations caters to increasing consumer interest in sports nutrition and health-enhancing foods. With manufacturers focusing on plant-based alternatives and clean-label formats, sodium caseinate remains the preferred casein derivative, sustaining market dominance through 2025

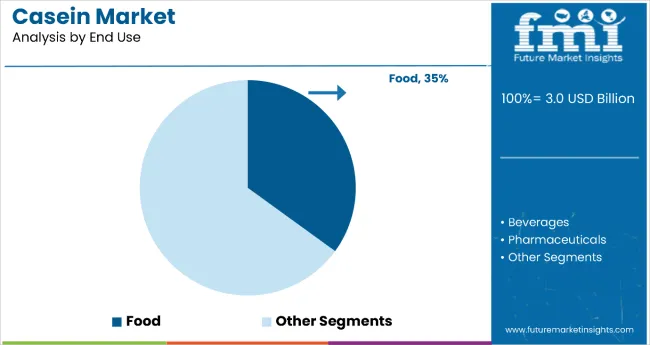

The food segment accounts for 35% share. The growing food processing industry is playing a major role in boosting casein sales globally.

As manufacturers expand their portfolios with high-protein, functional, and clean-label food products, casein has become a preferred ingredient due to its excellent emulsifying, binding, and nutritional qualities. In protein-enriched snacks, bakery goods, dairy-based items, and ready-to-eat meals, casein contributes to improved texture, stability, and extended shelf life.

The rise of health-conscious consumers seeking sustained energy and muscle recovery has also increased the demand for casein in sports and medical nutrition. Additionally, advances in casein extraction and formulation technologies have enhanced its solubility and versatility, making it more appealing for large-scale food production

The general public’s growing awareness of health and wellness is one of the main factors driving market expansion. Furthermore, the market is expanding due to peoples growing preferences for diets high in protein to promote weight management muscle growth and general well-being.

The demand for casein is also being driven by peoples increased involvement in sports and fitness activities because it offers sustained protein release. To capitalize on its bioactive qualities casein is being incorporated into nutraceuticals and functional foods. It is a component of products designed to address particular health issues like improving digestion or encouraging better sleep.

Additionally, a number of functional food producers are always looking into new culinary techniques that use casein. Cheese yogurt ice cream and baked goods are just a few of the many products that use it for its functional qualities which include emulsification gelling and texture enhancement. Additionally, the market is expanding as a result of the snack food industry’s introduction of protein-enriched snacks.

The markets growth is being reinforced by the growing demand for foods and beverages made with natural and sustainable ingredients. Furthermore, businesses are paying more attention to obtaining milk for casein production from ethical and sustainable sources. This entails upholding standards for animal welfare and assisting dairy farms that use environmentally friendly methods.

In addition, continuous advancements in casein production methods are meant to lessen carbon emissions in order to improve environmental health. This includes initiatives to reduce manufacturing waste and energy usage. Accordingly, a number of businesses are concentrating on environmentally friendly packaging options for casein-based goods minimizing the use of plastic and encouraging biodegradable alternatives.

Furthermore, more stringent environmental laws and standards are being implemented by the regulatory agencies and governing bodies of numerous nations. As a result, businesses are encouraged to implement sustainable practices in order to meet legal requirements. In order to improve environmental health and draw in a larger customer base numerous business are also actively developing sustainable packaging options for casein-based products.

The markets expansion is being reinforced by the increasing use of casein in the production of different foods and drinks. Food producers are always experimenting with new casein-based culinary techniques. Due to its useful qualities which include emulsification gelling and texture enhancement it is utilized in a variety of products such as cheese yogurt ice cream and baked goods.

Additionally, the use of casein in food formulations is being encouraged by the growing demand for natural clean label products. Consumer preferences for clear uncluttered labeling are met and it helps enhance texture and stability without the need for artificial additives.

Accordingly, there are growing prospects for casein incorporation due to the steady growth of functional dairy products like protein shakes and probiotic-rich water. It adds to the beverages creamy texture and flavor while also boosting their nutritional value. A further factor driving the demand for casein in a variety of international cuisines and products is the quick globalization of food trends.

During the period 2020 to 2024, the sales grew at a CAGR of 5.4%, and it is predicted to continue to grow at a CAGR of 6.4% during the forecast period of 2025 to 2035.

Before 2024 the market for casein and caseinate grew steadily due to the growing demand for foods and drinks high in protein particularly in the sports supplement and nutrition sectors. The slow-digesting qualities of caseinates which are derived from the casein protein in milk make them a popular ingredient in protein bars infant formulas and meal replacements.

Demand was also increased by consumers growing health consciousness and their growing understanding of the advantages of casein protein for weight management and muscle recovery. The development of the casein market was aided by the dairy industry’s emphasis on product innovation such as lactose-free and fortified dairy products. Several factors will probably cause the casein and caseinate industry to grow more quickly after 2024. The growing need for fortified and functional foods especially in developing nations will be a major factor in growth.

Although the widespread use of plant-based and alternative protein sources may pose some difficulties dairy-based caseinates are probably going to continue to be widely used because of their superior functional qualities. New applications in food medicine and cosmetics as well as advancements in dairy processing technologies should open up new avenues for expansion. A strong CAGR is predicted by analysts suggesting continued momentum in the years after 2025.

Tier 1 companies includes industry leaders acquiring a 30% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 10%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies includes mostly of small-scale businesses serving niche economies and operating at the local presence having a market share of 60%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

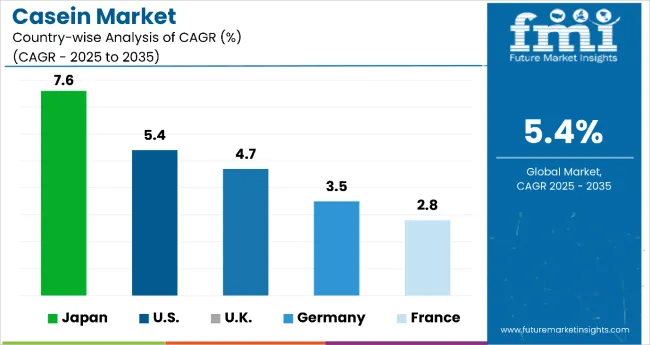

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and Japan come under the exhibit of high consumption, recording CAGRs of 5.4%, 3.5% and 7.6%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.4% |

| Germany | 3.5% |

| Japan | 7.6% |

There is an increasing need for casein in North America with the USA playing a major role. The market is expanding as a result of the growing demand for diets high in protein and the existence of numerous food and beverage producers. A sizable market exists in North America for casein-containing sports nutrition products.

The growing middle class and shifting dietary habits in Asia are making the region a promising casein market. Dairy products including those containing casein are becoming more and more popular in countries like Japan. The demand for casein is also being fueled by the growth of the food processing sector in Asia.

Europe has a sizable casein market mostly because of the prosperous dairy sector in nations like Germany. The demand for casein is high in these countries because of their reputation for producing high-quality dairy products. Due to caseins high protein content the market is also driven by health-conscious European consumers.

Leading businesses in the sector are investing a lot of R&D to diversify their product lines which will encourage the market for casein and casein derivatives to grow even more. Additionally, market players are taking a number of calculated steps to broaden their global reach. The introduction of new products contracts, higher investments, mergers and acquisitions and cooperation with other organizations are examples of significant market developments.

The casein and casein derivatives industry must offer reasonably priced goods in order to develop and prosper in a more ruthless and competitive market environment. Local manufacturing to cut operating costs is one of the primary business strategies used by manufacturers in the global casein and casein derivatives industry to benefit consumers and grow the market sector. Recent years have seen some of the most significant medical benefits from the casein and casein derivatives industry.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3 Billion |

| Projected Market Size (2035) | USD 5.1 Billion |

| CAGR (2025 to 2035) | 6.40% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Derivative Types Analyzed (Segment 1) | Sodium Caseinate, Calcium Caseinate, Potassium Caseinate |

| End Uses Analyzed (Segment 2) | Food, Yogurt, Cheese Processing, Ready-to-eat Meals, Dairy Products, Coffee Whiteners, Confectionary, Sauce & Seasoning, Meat Processing (Sausage), Meat Products, Beverage, Pharmaceuticals, Infant Nutrition, Clinical Nutrition, Sports Nutrition, Personal Care, Skin Care, Hair Care, Cosmetics, Agriculture / Poultry / Animal Feed |

| Function Types Analyzed (Segment 3) | Texturizing Agent, Flavoring Agent, Coating Agent, Binding Agent, Emulsifying Agent, Heat Stabilizing Agent |

| Regions Covered | North America; Europe; Middle East; Africa; ASEAN; South Asia; Asia; New Zealand; Australia |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the Casein Market | Fonterra Co‑operative Group Limited, Groupe Lactalis S.A., Arla Foods amba, Kerry Group plc, Royal FrieslandCampina N.V., Nestlé S.A., Danone S.A., Westland Milk Products, Saputo Inc., Dairygold Co‑Operative |

| Additional Attributes | Dollar sales by derivative type, Demand trends in functional foods and nutrition, Application diversity across end-use industries, Regional dietary trends, Sustainability and traceability initiatives, Innovations in casein-based formulations |

By derivative type, industry has been categorized into Sodium Caseinate, Calcium Caseinate and Potassium Caseinate.

By end-use industry has been categorized into Nutritional Powders & Bars, Food, Yogurt, Cheese Processing, Ready-to-eat Meals, Dairy Products, Coffee Whiteners, Confectionary, Sauce & Seasoning, Meat Processing (Sausage), Meat Products, Beverage, Pharmaceuticals, Infant Nutrition, Clinical Nutrition, Sports Nutrition, Personal Care, Skin Care, Hair Care, Cosmetics, Agriculture / Poultry / Animal Feed.

By function type industry has been categorized into Texturizing Agent, Flavoring Agent, Coating Agent, Binding Agent, Emulsifying Agent and Heat Stabilizing Agent.

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia.

The market is expected to grow at a CAGR of 6.4% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 5.1 Billion.

Growing awareness of health is increasing demand for casein.

Europe is expected to dominate the global consumption.

Some of the key players include Lactalis Group, Royal Fries Campina N.V., Fonterra Co-operative Group, Savencia Fromage and more.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 4: Global Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 8: Global Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 12: North America Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 14: North America Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 16: North America Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 30: Europe Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: East Asia Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 36: East Asia Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: South Asia Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 44: South Asia Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 46: South Asia Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 48: South Asia Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Oceania Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 52: Oceania Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 54: Oceania Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 56: Oceania Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: MEA Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Derivatives Type, 2017 to 2033

Table 60: MEA Market Volume (Tons) Forecast by Derivatives Type, 2017 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 62: MEA Market Volume (Tons) Forecast by End-Use, 2017 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Function Type, 2017 to 2033

Table 64: MEA Market Volume (Tons) Forecast by Function Type, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 14: Global Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 23: Global Market Attractiveness by Function Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 38: North America Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 47: North America Market Attractiveness by Function Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Function Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 93: Europe Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 95: Europe Market Attractiveness by Function Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: East Asia Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 106: East Asia Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 110: East Asia Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 114: East Asia Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Function Type, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: South Asia Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 130: South Asia Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 134: South Asia Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 138: South Asia Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Function Type, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Oceania Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 154: Oceania Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 158: Oceania Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 162: Oceania Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by End-Use, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Function Type, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Derivatives Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 174: MEA Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Derivatives Type, 2017 to 2033

Figure 178: MEA Market Volume (Tons) Analysis by Derivatives Type, 2017 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Derivatives Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Derivatives Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 182: MEA Market Volume (Tons) Analysis by End-Use, 2017 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Function Type, 2017 to 2033

Figure 186: MEA Market Volume (Tons) Analysis by Function Type, 2017 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 189: MEA Market Attractiveness by Derivatives Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 191: MEA Market Attractiveness by Function Type, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Casein Peptone Market Report – Growth & Industry Trends 2025 to 2035

Casein Glycomacropeptide Market

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Micellar Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Native Micellar Casein Market – Growth, Demand & Industry Innovations

Demand for Sodium Caseinates in EU Size and Share Forecast Outlook 2025 to 2035

Demand of Micellar Casein Isolate (MCI) for Medical Nutrition in EU Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA