Casein peptone, derived from milk protein, is a vital component that plays a significant role in various microbial culture media formulations. However, casein peptone is obtained from proteolysis of casein protein. Its uniform composition, its balanced amino acid spectrum and its ease of use, it is an ideal candidate for the use in laboratories and industrial production.

Furthermore, the growing biotechnology sector and rising R&D activities for developing biologics, vaccines, and probiotics are driving the need for consistent peptone sources.

Manufacturers are increasingly focusing on traceability, sustainability, along with high purity standards of ingredients, which is set to boost growth of casein peptone market until 2035.

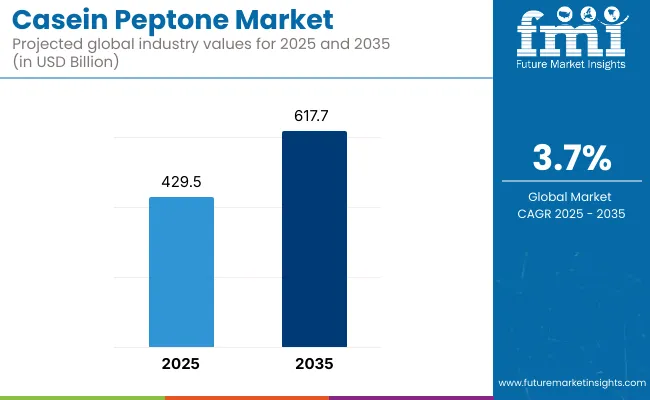

The global casein peptone market was valued over USD 429.5 Million in 2025. The market is anticipated to reach approximately USD 617.7 Million by 2035, at a CAGR of 3.7% during the forecast period. Market growth reminds us how much peptone high-purity products are needed and that advanced fermentation technology is more widely used in different fields.

The North America market for casein peptone is driven by a robust pharmaceutical and biotechnology industry. By research and development demand, and also the increasing biologics and cell-based therapies production, the demand is driven by the United States and Canada majorly. Presence of large biotech companies and strict quality standards, supported by several regulations contribute to the growth of North America casein peptone market.

The second significant market for casein peptone is Europe, due to its strong focus on pharmaceutical and microbiological research, experiences in high-quality production and scientific research, casein peptone is a crucial factor in culture media and fermentation of countries such as German, France and the United Kingdom.

Furthermore, stringent sourcing and production protocols adopted by manufacturers in response to Europe’s emphasis on sustainability and traceability have also strengthened the market attractiveness in this region.

Due to rapid industrialization, increasing healthcare expenditure, and growing biopharmaceutical production, the Asia-Pacific region is the fastest-growing region for the casein peptone market. Countries like China, India, and Japan are experiencing large investments in the fields of biotechnology, vaccine production, and industrial fermentation, many of which are crucially dependent on high-quality peptone products.

With the growing scientific infrastructure in the region and the improving capabilities of the local manufacturers, the Asia-Pacific market is projected to witness significant growth in the coming years.

Challenges

High Production Costs, Regulatory Compliance, and Alternative Growth Media Competition

Some of the key challenges faced by this market are the high production costs involved in enzymatic hydrolysis, purification, and quality control methods. Casein protein peptone expensive due to the advanced filtration and biotechnology techniques for its extraction and processing of casein peptone; however, the surface-activated peptones either soy peptone or yeast extract peptone are very low-cost peptones than the casein peptone.

Moreover, strict regulatory requirements from FDA (Food and Drug Administration), EFSA (European Food Safety Authority) and ISO (International Organization for Standardization) in microbiology, pharmaceuticals and food testing impose rigorous quality assurance and traceability requirements. A further difficulty arises from the increasing demand for plant-based peptones, as industries search for vegan, allergen-free, and non-animal-derived alternatives to casein-based peptones for use in microbial culture media.

Opportunities

Growth in Biotechnology, Pharmaceuticals, and Diagnostic Applications

Nevertheless,the casein peptone market is also witnessing growth opportunities on account of rising demand in microbiological research, vaccine production, and fermentation in the pharmaceutical industry. Peptones have high nitrogen content, enabling them to be used in growth media, cell culture, and as nutrients for antibiotic production.

Biopharmaceutical, probiotics, and precision medicine are some of the demanding laboratory applications requiring high purity peptones, which are progressively becoming the fermentative media of the future. Moreover, with the ongoing improvement of solubility, bioavailability and performance of casein peptones through the production process (enzyme-optimized hydrolysis technology), casein peptones are increasingly becoming a suitable component of specialized culture media formulations.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with GMP (Good Manufacturing Practices), food safety, and pharmaceutical-grade peptone standards. |

| Consumer Trends | High demand for microbial growth media, antibiotic production, and vaccine development. |

| Industry Adoption | Adoption in food microbiology, biotech research, and fermentation-based drug development. |

| Supply Chain and Sourcing | Dependence on dairy-based raw materials with moderate price volatility. |

| Market Competition | Dominated by biotech firms, culture media manufacturers, and pharmaceutical ingredient suppliers. |

| Market Growth Drivers | Growth fueled by biopharmaceutical advancements, food safety testing, and microbial culture innovations. |

| Sustainability and Environmental Impact | Moderate efforts toward reducing carbon footprint in dairy-based peptone production. |

| Integration of Smart Technologies | Early adoption of enzyme-based hydrolysis techniques for enhanced bioavailability. |

| Advancements in Biotech Applications | Use in antibiotic production, cell culture, and probiotics development. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter traceability regulations, sustainability-driven sourcing policies, and non-animal-derived certification requirements. |

| Consumer Trends | Growth in customized cell culture formulations, AI-optimized peptone selection, and synthetic biology applications. |

| Industry Adoption | Expansion into precision probiotics, AI-driven bioprocess optimization, and next-gen protein-based therapeutics. |

| Supply Chain and Sourcing | Shift toward sustainable dairy farming, alternative protein sourcing, and plant-based peptone innovations. |

| Market Competition | Entry of synthetic biology firms, alternative peptone producers, and AI-driven lab automation companies. |

| Market Growth Drivers | Accelerated by automated bioprocessing, cell-based meat production, and AI-powered microbial research tools. |

| Sustainability and Environmental Impact | Large-scale adoption of eco-friendly, low-emission peptone extraction processes and alternative protein sources. |

| Integration of Smart Technologies | Expansion into AI-assisted bioprocessing, machine learning-driven culture media formulation, and smart fermentation analytics. |

| Advancements in Biotech Applications | Evolution toward next-gen bacterial culture media, regenerative medicine applications, and engineered microbial ecosystems. |

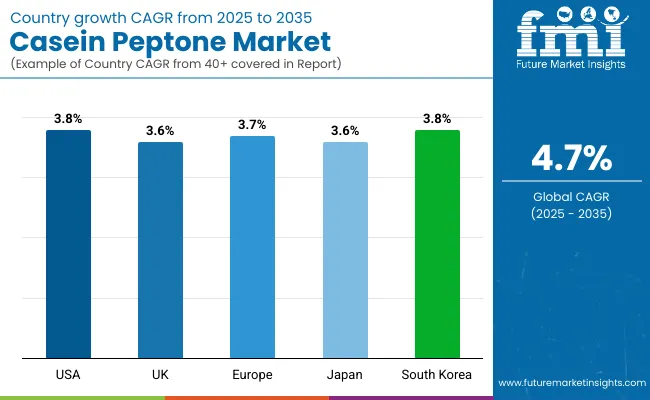

The USA casein peptone market is poised to expand as it is being used increasingly in the biotechnology, microbiology and pharmaceutical segments. The market is being supported by the rising demand for quality peptones and their use in culture media in microbial fermentation and diagnostic fields. The growing adoption of casein peptone are also complemented by the prospects of bioprocessing and biopharmaceutical production.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

In the United Kingdom, the casein peptone market is experiencing several new advances due to the increasing demand in pharmaceutical research and laboratory applications. Biotechnology expansion and extensive application of casein derived peptones in the microbial culture media are boosting the market. Investments in research-enduring and innovation-encouraging regulatory support for biosciences also facilitate the biosciences sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

Casein peptone market is growing in Europe and in the overall world as there is increased biopharmaceutical research and food microbiology applications. High demand in bacterial culture media and enzyme production owing to robust pharmaceutical and life sciences industry is boosting the market for casein peptones. Market dynamics are also shaped by strict quality standards and regulatory compliance.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan Casein Peptone market is showing steady growth owing to the growing scope of biotechnology, pharmaceutical research, and industrial microbiology over the recent years. Growing usage of casein peptones in vaccine production and enzyme manufacturing is fueling demand. The focus on precision fermentation and bioprocessing innovations to realize greater efficiency by Japan is also contributing to the expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

The casein peptone market in South Korea is expanding owing to high-investment activities in biopharmaceuticals, diagnostics, and fermentation technology. This is supporting market expansion of high-purity peptones in cell culture applications and laboratory research. Moreover, the market is being boosted by the continuous support of government initiatives for the advancement of the biotech and pharmaceutical sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The casein peptone market is anticipated to establish a firm foothold due to the high demand in applications such as pharmaceuticals, biotechnology, and microbiological research. Casein peptone from hydrolyzed casein is commonly used as a rich amino acid, a peptide, and a growth factor source for a variety of biological processes.

It plays a vital role in both scientific research and industrial processes through its involvement in microbial culture media, vaccine development, enzyme production, and industrial fermentation. The market is segmented by Application (Diagnostic Media Production, Industrial Fermentation, Biomass Production, Enzyme Production, Vaccine Production, Others)

Diagnostic media production is the largest market, which casein peptone is an essential solution media for growth, isolation and identification of microorganisms. It contains the necessary nitrogen, peptides, and vitamins required for growth in medical labs, research facilities, and industrial quality control for growing bacteria, fungi and other microorganisms.

With the growing need for rapid and accurate diagnostic testing in clinical microbiology and food safety testing, manufacturers of agar-based, liquid, and synthetic culture media are becoming increasingly dependent upon the use of high-quality casein peptones in order to provide an optimal environment for growth of the target microbes. This growth in the segment is also supported by an increasing prevalence of infectious diseases and the demand for antimicrobial resistance studies and pharmaceutical research.

With global investments in biopharmaceuticals and their immunization programs on the rise, along with growing concerns for pandemic preparedness, the vaccine production segment is seeing strong growth in recent years. In vaccine manufacturing, casein peptone acts as a nitrogen source, supplying necessary amino acids and peptides to the culture, thereby increasing the yield of both cells and viruses in bioreactor systems.

Increased demand for high-purity, pharmaceutical-grade casein peptones is anticipated, as the focus remains on COVID-19 vaccines, mRNA technology and next-generation biologics. Moreover, the growth of enterprises specializing in biotechnology as well as government healthcare programs and research institutions also propel market advancement in such markets.

The growing demand for microbiological culture media and biopharmaceutical research and fermentation-based applications is driving the growth of the casein peptone market. The growing interests of the companies include AI-based enzymatic hydrolysis processes, high purity peptone manufacturing, eco-friendly dairy protein extraction, all of which are intended to improve microbial growth kinetics, pharmaceutical utility, and biotechnological advancements.

Based on source, the market is segmented into biopharmaceutical ingredient suppliers, microbiology media manufacturers, and research-grade peptone providers, each of these segments contributing to technological advancements such as casein peptone formulation, AI-powered process control, and quality optimization.

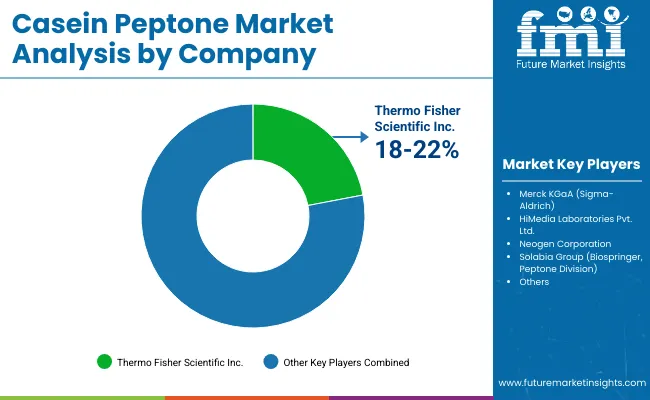

Market Share Analysis by Key Players & Casein Peptone Suppliers

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific Inc. | 18-22% |

| Merck KGaA (Sigma-Aldrich) | 12-16% |

| HiMedia Laboratories Pvt. Ltd. | 10-14% |

| Neogen Corporation | 8-12% |

| Solabia Group (Biospringer, Peptone Division) | 5-9% |

| Other Biopharmaceutical & Microbial Media Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific Inc. | Develops high-purity casein peptone for microbial culture media, biopharmaceutical production, and industrial fermentation. |

| Merck KGaA (Sigma-Aldrich) | Specializes in AI-optimized enzymatic hydrolysis for pharmaceutical-grade casein peptones used in vaccine production and diagnostics. |

| HiMedia Laboratories Pvt. Ltd. | Provides biotech-grade casein peptones for microbiology, tissue culture media, and AI-assisted bioprocessing applications. |

| Neogen Corporation | Focuses on rapid-dissolving casein peptones for microbial diagnostics, food safety testing, and fermentation applications. |

| Solabia Group (Biospringer, Peptone Division) | Offers casein-derived peptones for biopharmaceutical production, bio-fermentation, and AI-powered quality control enhancements. |

Key Market Insights

Thermo Fisher Scientific Inc. (18-22%)

Thermo Fisher is one of the key players in the casein peptone market, engaged in the manufacture of high purity, pharmaceutical & food-grade peptones, used in microbial culture, biopharmaceutical analyses, and fermentation processes

Merck KGaA (Sigma-Aldrich) (12-16%)

Making innovative vaccines and pharmaceuticals requires high-quality solutions and ingredients, including casein peptone, which is often used as a nutrient medium for cell culture or fermentation; these products meet exacting AI-driven quality-testing and sustainability standards.

HiMedia Laboratories Pvt. Ltd. (10-14%)

Being a biotechnology and microbiology-grade solution provider, HiMedia has formulated these casein peptones through the optimization of AI-assisted protein hydrolysis to enhance the performance of microbial media.

Neogen Corporation (8-12%)

Neogen manufactures rapid-dissolving casein peptones for food safety diagnostics, fermentation processes, and microbiology laboratories.

Solabia Group (5-9%)

AI-optimized production of peptones enabled through functional casein peptone range for biopharmaceutical and fermentation-based solutions from Solabia.

Other Key Players (30-40% Combined)

Several biotechnology firms, microbiology media producers, and peptone processing companies contribute to next-generation casein peptone innovations, AI-powered enzymatic hydrolysis, and pharmaceutical-grade formulations. These include:

The overall market size for casein peptone market was USD 429.5 Million in 2025.

Casein peptone market is expected to reach USD 617.7 Million in 2035.

The demand for Casein Peptone is expected to rise due to its growing applications in microbiological media, pharmaceutical formulations, and biotechnology research, along with increasing demand for high-quality culture media in diagnostics.

The top 5 countries which drives the development of casein peptone market are USA, UK, Europe Union, Japan and South Korea.

Diagnostic Media Production and Vaccine Production to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Casein Glycomacropeptide Market

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Micellar Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Native Micellar Casein Market – Growth, Demand & Industry Innovations

Demand for Sodium Caseinates in EU Size and Share Forecast Outlook 2025 to 2035

Demand of Micellar Casein Isolate (MCI) for Medical Nutrition in EU Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peptone Market Growth – Trends & Forecast 2024-2034

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Proteose Peptone Market Insights - Industry Growth & Applications 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA