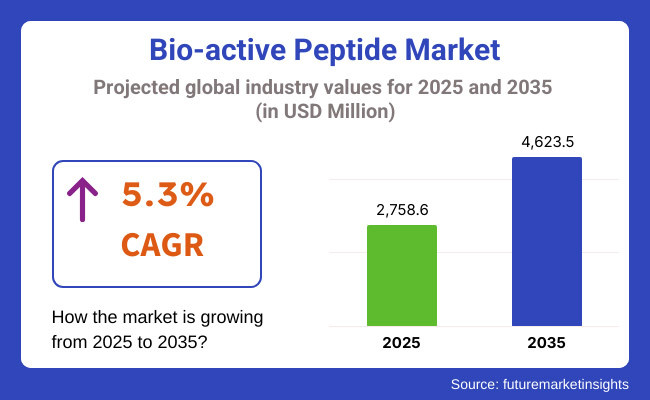

USD 2,508.3 million world bio-active peptide market in 2023. Annually, global sales revenue of the global bio-active peptides increased with a compound annual growth rate of 5.3% in 2024 and estimated the global bio-active peptide market to be USD 2,758.6 million in 2025. International revenue from 2025 to 2035 would increase at a CAGR of 5.3%, and sales value in 2035 would be USD 4,623.5 million.

The market for the bio-active peptides is dominated to a large scale by the increased demand for nutritious food ingredients having positive impacts on health, particularly on nutrition, skin, and disease prevention.

Bio-active peptides of natural milk raw materials, soybeans, and fish are universally accepted wherever it is employed due to its therapeutic effect caused by their antioxidant, anti-inflammatory, and antimicrobial activities. As more and more people are turning towards nature-based treatments through food supplements and cosmetics, bio-active peptides are rapidly making their presence felt in the market space.

Bio-active peptides are applied in the pharma and food industry to create medicines for immune system wellness and cardiovascular wellness and aging well. Peptides are included as one of the ingredients along with others in food and beverage food supplements and food and beverage protein supplements. Cosmetics also apply the use of bio-active peptides for repair and anti-aging.

Bio-active peptides are motivated by international trends in health and well-being, and their market is greatly driven by expanding consumer desire for healthy ageing, immunity, and body function. Bio-active peptides are added more and more to functional food and beverages in order to fulfill a demand.

They are requested more in the sports nutrition arena since sportswomen and sportsmen utilize peptide supplements as performance agents, agents for muscle recovery, and for overall well-being. Another common industry driver is cosmetics where the use of bio-active peptides is employed since they are regenerating and anti-aging in nature. Cosmetics face masks, creams, and serums now use peptides since such peptides stimulate the release of collagen, smooth wrinkles, and lead to healthy and young skin.

Following is the table representing comparative study of six-month lag in CAGR in base year (2024) and current year (2025) in world market of bio-active peptides. It showcases excess volatility in performance and presents revenue realization trend, thus helping the stakeholders realize self-explanatory vision in growth curve of the year. H1 refers to January to June and H2 to July to December.

| Particular | Value CAGR (2025 to 2035) |

|---|---|

| H1 (2024 to 2034) | 4.8% |

| H2 (2024 to 2034) | 4.9% |

| H1 (2025 to 2035) | 5.0% |

| H2 (2025 to 2035) | 5.3% |

The market expands in the first half (H1) of 2025 to 2035 years at a rate of 5.0% and again afterwards at 5.3% growth for the second half (H2) of years. The rate of growth accelerates marginally in the subsequent half of years because of the growing demand of bio-active peptides from various industries.

The industry registered 20 BPS growth in the first half (H1) but would be witnessing much higher 30 BPS growth in the second half (H2) as the company would be witnessing momentum of growth. Such bio-cyclic utilization of health-centric, wellbeing-creation and growth activities of bio-active peptides in industry after industry keeps the market keep on fuel for the future gains over the next couple of years.

There are organized and unorganized players across the globe with differing market concentration in different regions. Multinational corporations and well-established biotech firms with state-of-the-art research and development centers, strong regulatory compliance, and extensive distribution networks constitute the organized sector.

They command the market monopoly with proprietary peptide products, large-scale mass production, and affiliation with pharma, nutraceutical, and food industries. They are particularly keen on functional food ingredients, drugs, and supplements and have a good-quality and efficient product to offer.

The disorganized segment comprises small- and medium-sized enterprises with limited research capabilities and production capacity operating at the local level. The companies primarily deal in domestic markets with uncomplicated extraction and synthesis processes of relatively low-value products.

Lack of strict regulation and quality control measures means that the majority of the local businesses are not well placed to ship their products out of regional markets. The unorganized sector commands a larger presence in more developing countries where the demand for bio-active peptides for use in traditional medicine, cosmetics, and food supplements is rising.

The strongest local industry players in the market for bio-active peptides are found in the Asia-Pacific region, where South Korea, India, and China are some of the countries that are leading the region with market demand for functional food as well as nutraceuticals growing.

The same is the trend of local production rising in Latin America where bio-active peptides are on offer for use in pharmacy and animal nutrition. North America and Europe, however, are characterized by highly regulated markets where proprietary-technology firms have pioneered and are consolidating towards an even more concentrated market.

Growing consumer demand for the health impacts of bio-active peptides is driving demand and dictating the market to be defined. Strict regulation, production cost, and need for advanced research and clinical validation are concerns for small, unstructured players.

Food & Beverage Rising Demand for Bio-active Peptides

Shift: They are looking for natural, functional ingredients with cardiovascular health, muscle recovery, and immune system benefits. Bio-active peptides from dairy, plant, and sea sources are preferred because of higher bioavailability and specific health benefits. Double-digit growth of global functional food market is underway with firms aiming at protein-rich beverages, dairy-free products, and body-building sports nutrition using bio-active peptides for improved health benefits.

Strategic Response: Companies such as Nestlé Health Science and Danone have introduced bio-active peptide-enriched milk and vegetable drinks with solutions for blood pressure, digestive health, and muscle recovery. Rousselot's Peptan developed marine collagen peptides for functional beverages with a 17% boost in consumer acceptability.

Meiji Japan in Asia incorporated peptides in ready-to-drink (RTD) protein beverages, and sales of functional beverages grew by 14%. This growth welcomes bio-active peptides as a flagship of the future functional nutrition market.

Booming Demand for Peptides in Anti-Aging & Beauty-From-Within Food Supplements

Shift: People are shifting from external to oral beauty dietary supplements, wherein they want collagen peptides and elastin-sparing peptides to enhance skin elasticity, moisturization, and wrinkle smoothness. Nutricosmetics is growing at a very rapid pace, with 20% anticipated growth in peptide-enriched beauty products.

Strategic Response: International cosmetics firms such as Shiseido, AmorePacific, and L'Oréal are launching collagen peptide beverages and capsules, propelling ingestible skincare trends by 19%. Nestlé Vital Proteins launched ocean-derived marine collagen peptides that are part of a line of skin-hydrating products which recorded customer demand for their 23% growth.

DSM launched bio-active peptides that trigger the production of keratin throughout Europe, driving consumption of peptide hair and nail supplements. All these beauty sales promotions are reinforcing the position of bio-active peptides in the movement of beauty-from-within.

Growing Use of Peptides in Sports Nutrition & Muscle Repair

Shift: Bodybuilding competitors and sports experts alike no longer opt for traditional protein powders but now switch to bio-active peptides that are rapidly absorbed and have the capability to heal muscles. Whey, soy, and sea collagen-type peptides are becoming increasingly popular because they have the ability to speed up muscle repair, reduce inflammation, and enhance stamina.

Strategic Response: Optimum Nutrition and MuscleTech are only two of the firms which have redesigned their sports recovery beverages with hydrolyzed protein peptides with 32% greater absorption than regular protein powders.

Arla Foods Ingredients launched Lacprodan Hydro.Power, a whey peptide that advances muscle repair, and post-exercise supplement absorption improved by 15%. Meiji Protein in Japan launched peptide-containing RTD shakes and its portion of the sports nutrition market expanded 22%. These breakthroughs bring bio-active peptides into the limelight as the wave of the future of high-performance sport recovery food.

Peptide Growth in Cognitive & Mental Well-being Supplements

Shift: Increasing needs for brain health, stress alleviation, and mental improvement have driven a market for neuroprotective peptides. People crave natural foods that replace nootropics, and milk bio-active peptides (casein-derived peptides), fish bio-active peptides, and soy bio-active peptides are likely to enhance concentration, reduce anxiety, and enhance memory.

Strategic Response: Lactium®, clinically proven casein peptide for stress reduction and improved quality of sleep, accounted for 16% augmented uptake by FrieslandCampina Ingredients-produced mental wellbeing products.

NeuroScience Supplements launched peptide-based cognitive enhancers with 20% market share in North America. GNC launched fish-based neuropeptides in their nootropic and boosted their investment in the brain wellness supplement business. This is a healthy pull towards the application of bio-active peptides in mental wellbeing products.

Increasing Application of Peptides in Pharmaceutical & Medical Nutrition Sector

Shift: Peptides are used more and more in medical nutrition, the management of chronic diseases, and pharma applications as they possess antimicrobial, antihypertensive, and anti-inflammatory activity. The pharmaceutical sector is investing a lot in bio-active peptide drug-based therapy with an eye on combating diabetes, cardiovascular disease, and metabolic disorder.

Strategic Response: Firms such as Novo Nordisk and Amgen have developed peptide-based medicines, in which diabetes and cardiovascular disease were targeted, and were 30% more effective than conventional treatment in clinical trials.

Abbott Nutrition has launched bio-active peptide nutritional supplements for elderly patients, and there has been a 12% boost in medical nutrition. Tetra Bio-Pharma has also made investments in anti-inflammatory peptide-based treatments, and bio-active peptides are becoming the trendsetter in new drugs.

On the Rise: Bio-active Peptides for Gut Health & Microbiome Support

Shift: The consumer is rapidly becoming interested in gut health because it is linked to immunity, digestion, and overall health. The research has pointed to the function of bio-active peptides to maintain a healthy gut microbiome, decrease intestinal inflammation, and activate probiotics. Dairy peptides (such as casein hydrolysates), plant peptides, and sea peptides are gaining use in probiotic supplements, functional foods, and gut health products. Gut health will experience double-digit growth globally, which will fuel peptide-supplemented gut health product demand.

Strategic Response: Kerry Group created probiotic and peptide-based digestive solutions, leading to a 22% sales increase in gut health. Yakult Japan introduced fermented milk beverages with bio-active peptides that saw a 17% increase in digestive supplement consumption on the Asia continent.

FrieslandCampina introduced Biotis® Gut Health range now with peptide-harvested mixtures of prebiotics, contributing to 19% greater consumer interaction. Nestlé Health Science also created gut health powders supplemented with peptides and cemented its leadership position in digestive health. The developments reflect accelerating convergence between health-solutions that are microbiome-targeted and bio-active peptides.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of bio-active peptides through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.2% |

| Germany | 7.6% |

| China | 4.9% |

| Japan | 4.2% |

| India | 9.4% |

The bio-active peptide market of the USA is steadily growing owing to factors such as the increasing demand for functional foods, nutraceuticals, and pharmaceutical-grade bio peptides. Bio-active peptides for muscle recovery, anti-aging & cardiovascular health are increasingly being sought by consumers.

Moreover, growing focus on targeted drug delivery and regenerative medicine using therapeutic peptides directly attributes to growth of biopharmaceutical research which in turn drives the demand for market growth.

In Germany, the bio-active peptide market reports steady growth driven by stringent EU regulations regarding health supplements, sustainable protein sourcing, and clean-label formulations. Fermented, vegan, and enzymatically derived peptides are gaining popularity in sports nutrition, anti-inflammatory formulations and functional skincare. Germany (A focus on biotechnological innovations)German manufacturers have invested in precision fermentation and peptide-based bioactive for clinical applications

China's bio-active peptide market has been growing rapidly due to the increasing demand for protein-rich functional food, peptide-based pharmaceutical, and dietary supplements. Fueled by government-backed biotechnology and pharmaceutical innovation, local manufacturers are ramping up their production of collagen, whey, and soy-based peptides.

As more is revealed of the importance of gut health, for skin rejuvenation and for metabolic disorders, so marine-sourced and milk-derived bio peptides are soaring in demand.

Japan's bio-active peptide market is also bolstered by a focus on high-purity skincare, anti-aging solutions and pharmaceutical-grade peptides in the country. Kappa casein hydrolysate provides a nifty way to stay ahead of those needs as Japanese consumers are very much inclined for bioactive collagen peptides with respect to beauty supplements and functional cosmetics. Peptide-based nutraceuticals and therapeutic options are also being developed through advancements in peptide synthesis and enzymatic hydrolysis technologies providing highly bioavailable solutions.

Increasing consumer interest in plant-based nutrition, alternative proteins, and therapeutic nutraceuticals is driving the growth of India’s bio-active peptide market. The growing demand for low-allergen, gluten-free, and vegan peptide formulations is also contributing to market growth. Now, India has emerged as a major player in the nutraceuticals and functional food space, with startup-led innovations in sustainable bio peptide extraction and plant-derived bioactive.

| Segment | Value Share (2025) |

|---|---|

| Nutraceuticals & Functional Foods (By Application) | 63.8% |

Because of their widespread application as sports nutrition supplements; anti-aging supplements; and digestive health aids, the nutraceutical and functional food category has the lion's share of the market in bio-active peptides. These bio-active peptides occur highly concentrated in protein powders, meal replacements, and functional drinks from collagen, whey, casein, and sea-derived proteins, and are of most value in high-performance and well-being nutrition.

With continued scientific evidence proving the benefits of bio-active peptides, they are now a focal point area of interest most especially for muscle reparation, immune system support, and heart health. This has led to the creation of organic, sustainably sourced, and highly bioavailable peptide products for clean-label and plant-based diets.

The increasing requirement for gut-health-promoting bio peptides and plant-based bio actives is also driving the innovation for such peptide products. The requirement for functional foods to address particular health requirements has prompted manufacturers to create low-allergenic, non-GMO, and enzymatically hydrolysed peptide products to enhance nutrient intake, digestibility, and metabolic effectiveness in consumers, which is likely to propel market growth in the long run.

| Segment | Value Share (2025) |

|---|---|

| Pharmaceuticals & Cosmeceuticals (By Application) | 36.2% |

Genome sequencing has increased research in the area of bio-active peptides for wound healing and metabolic disorder treatment as well as drug formulation development for anti-inflammatory diseases. Increased development of peptide-based biopharmaceuticals for targeted drug delivery and precision medicine is another driver of demand.

Being vital in cell regeneration, immune modulation, and tissue repair, these peptides have been used in therapeutic and regenerative medicine, potentially soon through more targeted systems. Collagen, keratin and elastin bio peptides are utilized in anti-aging skin creams, hair strengthening treatments, and ultraviolet (UV) protection skin care in the cosmeceutical market. These bioactive enhance elasticity, smooth out wrinkles, induce mindfulness in hair care and stamina for effortless detangling, due to an increased consumer demand for functional beauty.

Hydrolysed peptides and nano-encapsulated bio actives are also very much in demand since they offer improved skin penetration and improved efficacy. As science continues to progress, the future of bio-active peptides looks bright since they are likely to be game-changers in the pharmaceutical industry, dermal products and more individualized medicine.

Key players are engaged in sustainable sourcing, bioengineering innovations, and expanding therapeutic applications, making the bio-active peptide market highly competitive. This has led to investments in precision fermentation, enzymatic hydrolysis and recombinant peptide synthesis.

The industry is represented by key players including Glanbia Nutritionals, Rousselot, Gelita, FrieslandCampina and Arla Foods Ingredients who incorporate functional bio peptides, sports nutrition formulations, and clinical peptide applications into their business. diversos companies expand their North American and Asia-Pacific business units, in response to growing demand for nutraceuticals and cosmeceuticals.

Commercial strategies have included collaborations with pharmaceutical and food manufacturers, investments in precision peptide extraction, and the development of synthetic biopeptide analogs. Moreover, manufacturers are increasingly focused on low-carbon peptide production and plant-based peptide formulations.

For instance

The market includes various peptide types, such as Milk Peptides, Egg Peptides, Soy Peptides, Marine Peptides, Meat Peptides, and others, catering to diverse consumer and industrial needs.

Peptides are derived from different sources, including Plant, Animal, and Marine, ensuring a wide range of options for various applications.

These peptides are used across multiple industries, including Functional Food, Dietary Supplements, Pharmaceuticals, and Animal Feed, with additional applications in other specialized sectors.

Peptides are available in different forms, such as Liquid, Powder, and Capsule, allowing for flexibility in product formulation and consumption.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global bio-active peptide industry is projected to reach USD 2,758.6 million in 2025.

Key players include Angel Yeast Co., Ltd.; BASF SE; Seagarden AS; Archer Daniels Midland Company; Ingredia SA; Rousselot S.A.S.; FrieslandCampina Ingredients.

Asia-Pacific is expected to dominate due to high demand for biopeptides in functional foods, pharmaceuticals, and cosmeceuticals.

The industry is forecasted to grow at a CAGR of 5.3% from 2025 to 2035.

Key drivers include rising demand for functional proteins, increasing adoption of biopeptides in pharmaceutical applications, and advancements in sustainable peptide production technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 74: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 189: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 222: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 225: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 227: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 231: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 233: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 234: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 235: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 236: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 237: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 238: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 239: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 233: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: MEA Market Attractiveness by Source, 2023 to 2033

Figure 237: MEA Market Attractiveness by Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Form, 2023 to 2033

Figure 239: MEA Market Attractiveness by Application, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Based Nanomaterials Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Peptide-based Sweetener Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peptide Receptor Radionuclide Therapy (PRRT) Market Trends and Forecast 2025 to 2035

Peptide Synthesis Market Analysis – Trends, Share & Growth 2025 to 2035

Key Players & Market Share in the Peptide Microarray Sector

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Peptide Antibiotics Market

Peptide Microarrays Market

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Tetra-Peptide Anti-Wrinkle Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Marine Peptide Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA