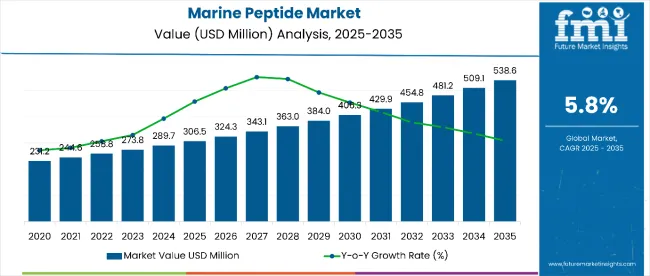

The marine peptide market is estimated to be valued at USD 306.5 million in 2025 and is projected to reach USD 538.6 million by 2035, registering a CAGR of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 306.5 million |

| Market Forecast Value in (2035F) | USD 538.6 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The market is expected to add an absolute dollar opportunity of USD 232.1 million during this period, reflecting a 1.76 times growth. Growth is set to be driven by increasing demand for functional food ingredients, nutraceutical applications, and bioactive compounds in pharmaceuticals and cosmetics.

By 2030, the market is likely to reach approximately USD 406.3 million, accounting for around USD 99.8 million in incremental value during the first half of the period. The remaining USD 132.3 million is expected to be added in the second half, indicating a balanced growth trajectory. Product adoption is accelerating due to marine peptides’ proven health benefits, including antioxidant, anti-inflammatory, and skin-rejuvenating properties.

Companies such as Rousselot (Darling Ingredients Inc.), Gelita AG, Nitta Gelatin Inc., Weishardt Group, and Amicogen Inc. are strengthening their positions through investments in eco-friendly marine sourcing, advanced extraction technologies, and the development of high-value peptide formulations. Rising consumer preference for natural, eco-friendly, and functional ingredients is supporting expansion into pharmaceuticals, nutraceuticals, cosmetics, and biotechnology.

The market holds approximately 42% of the global marine-derived bioactive compounds market, driven by their scientifically proven antioxidant, anti-inflammatory, and skin-rejuvenating properties, making them highly attractive for health-conscious consumers and premium product manufacturers. It accounts for around 38% of the marine nutraceutical ingredients market, supported by applications in animal feed, pharmaceuticals, cosmetics, and functional food products. The market contributes nearly 34% to the bioactive marine protein market, particularly in value-added formats like powders, capsules, and liquid concentrates. It holds close to 29% of the natural marine-based functional ingredient market, where peptides are valued for their amino acid profile and bioactivity. The share in the clean-label marine supplement market reaches about 31%, reflecting consumer preference for natural, sustainably sourced alternatives.

The market is undergoing structural change driven by rising demand for natural, marine-derived functional ingredients. Advanced extraction methods such as enzymatic hydrolysis and membrane filtration have enhanced purity, bioavailability, and stability of marine peptides. Manufacturers are introducing specialized peptide formulations for targeted health benefits, including cardiovascular support, joint health, and anti-aging, expanding their role beyond traditional nutraceutical applications.

Marine peptides’ proven bioactivity, including antioxidant, anti-inflammatory, antimicrobial, and skin-rejuvenating properties, makes them a highly attractive natural ingredient for pharmaceuticals, nutraceuticals, cosmetics, and functional food formulations.

Growing awareness of natural, marine-derived functional ingredients is further propelling adoption, especially in anti-aging skincare, cardiovascular health supplements, joint health products, and sports nutrition. Consumer demand for clean-label and sustainably sourced products, along with innovations in enzymatic hydrolysis, fermentation, and advanced purification technologies, are enhancing purity, bioavailability, and application versatility.

As the global nutraceutical, pharmaceutical, and cosmetic industries increasingly prioritize bioactive, high-efficacy ingredients, the market outlook remains highly favorable. With manufacturers and consumers valuing natural origin, potency, and sustainability, marine peptides are well-positioned to expand across diverse health and wellness applications.

The market is segmented by product type, end-use application, and region. By product type, the market is divided into fish peptides, shellfish peptides, seaweed peptides, sponge peptides, squid peptides. Based on end-use application, the market is divided into food and beverages, cosmetics, pharmaceuticals, nutraceuticals, animal feed, biotechnology. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

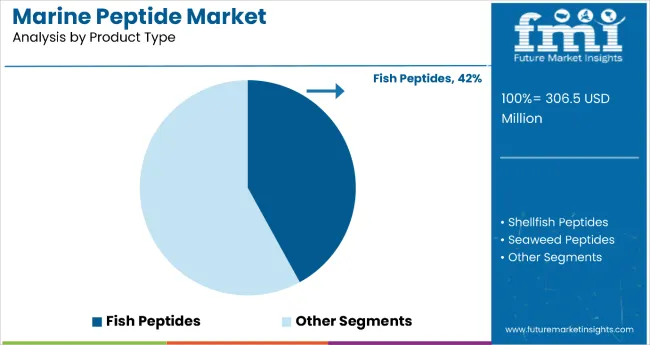

Fish peptides stand out as the most lucrative product type, holding a commanding 42% market share in 2025. This dominance is driven by their high bioavailability, rich amino acid profile, and wide-ranging health benefits, including antioxidant, antihypertensive, antimicrobial, and collagen-boosting properties. Fish peptides are extensively used in nutraceuticals, functional foods, pharmaceuticals, and cosmetics, owing to their proven ability to support cardiovascular health, enhance skin elasticity, and promote muscle recovery.

The growing global shift toward natural, protein-rich, and bioactive ingredients has amplified their appeal, particularly in the sports nutrition and anti-aging skincare markets. Technological advancements in enzymatic hydrolysis and eco-friendly fishery by-product utilization are further improving purity, potency, and cost-efficiency. With expanding R&D into targeted health formulations, and rising consumer preference for marine-derived wellness products, fish peptides are expected to maintain strong demand growth from 2025 to 2035, outpacing several other marine-derived bioactive segments.

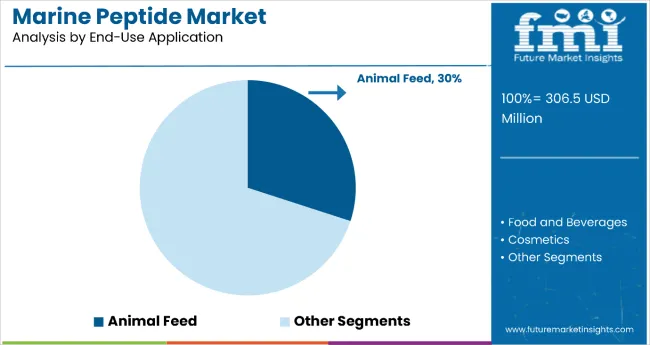

Animal feed is the most lucrative end-use application, accounting for 30% market share in 2025. Marine peptides in animal feed are highly valued for their exceptional nutritional profile, bioactive properties, and digestibility, which improve growth performance, immunity, and overall health in livestock, aquaculture species, and companion animals. Their natural antimicrobial and antioxidant functions reduce reliance on synthetic growth promoters and antibiotics, aligning with the global push toward antibiotic-free animal nutrition.

The aquaculture industry, in particular, is a major growth driver, as marine peptides derived from fish and shellfish processing by-products provide an eco-friendly protein source while minimizing waste. Technological advances in peptide extraction and formulation have enhanced stability and nutrient absorption, making these ingredients more cost-effective and commercially viable. With rising demand for high-quality protein in feed and stricter feed safety regulations, marine peptides are positioned for strong, long-term growth in this segment.

From 2025 to 2035, health-conscious consumers and industries adopt marine peptide-based products to leverage their proven antioxidant, anti-inflammatory, and skin-rejuvenating properties, driving demand across nutraceuticals, pharmaceuticals, cosmetics, and functional food applications. This shift positions marine peptide producers focusing on eco-friendly marine sourcing and high-purity extraction as key beneficiaries of the growing demand for natural bioactive ingredients.

Proven Bioactivity Drives Marine Peptide Market Growth

The scientifically validated bioactivity of marine peptides, supported by research demonstrating benefits in cardiovascular health, skin regeneration, and immune modulation, is identified as the primary growth driver. In 2024, clinical studies highlighting their role in collagen synthesis, antioxidant defense, and anti-aging applications prompted nutraceutical, cosmetic, and pharmaceutical manufacturers to integrate marine peptides into formulations. By 2025, functional product developers increasingly utilized fish peptides in sports nutrition, anti-aging skincare, and cardiovascular support products. These developments show that clinically proven efficacy, rather than marketing alone, fuels market expansion. Producers offering standardized, high-purity marine peptide products are best positioned to capture growing demand from premium health and beauty markets.

Value-Added Product Development Creates Market Opportunities

In 2024, marine peptide processors began adopting enzymatic hydrolysis, membrane filtration, and fermentation technologies to enhance bioavailability and product stability while diversifying application potential. By 2025, advanced product formats such as microencapsulated peptides, high-concentration powders, ready-to-mix blends, and peptide-enriched beverages were introduced, expanding their market beyond traditional capsule and powder formats. These advancements demonstrate that when innovative processing is combined with high bioactivity retention, both consumer acceptance and industry adoption are significantly enhanced. Manufacturers investing in cutting-edge extraction technology and targeted health formulations are poised to capture expanding opportunities across pharmaceuticals, nutraceuticals, cosmetics, and biotechnology sectors.

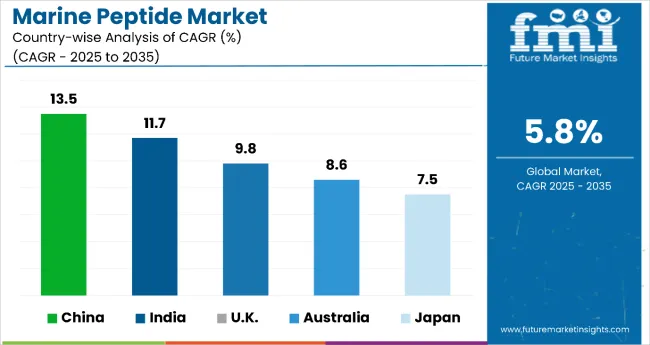

| Countries | CAGR |

|---|---|

| China | 13.5% |

| India | 11.7% |

| UK | 9.8% |

| Australia | 8.6% |

| Japan | 7.5% |

China is set to lead the market with the highest CAGR of 13.5%, fueled by large-scale R&D investments, strong government backing, and expanding export capabilities. India follows closely at 11.7%, leveraging its cost-effective manufacturing base, expanding aquaculture infrastructure, and growing nutraceutical adoption. The UK, with a 9.8% CAGR, stands out for its stringent eco-friendly standards, advanced biotechnology research, and premium product positioning. Australia is projected to grow at 8.6%, capitalizing on pristine marine resources, eco-friendly harvesting methods, and strong demand in sports nutrition and anti-aging segments. Japan, while posting the lowest CAGR of 7.5%, maintains high market value through premium formulations, advanced peptide bioactivity research, and strong domestic demand from an aging population.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Demand for marine peptide in China is projected to grow at an impressive CAGR of 13.5% from 2025 to 2035, driven by surging demand for natural bioactive compounds in functional foods, pharmaceuticals, and cosmetics. Expanding R&D activities, coupled with advanced marine biotechnology capabilities, are enabling large-scale extraction and purification processes. Coastal provinces are investing heavily in eco-friendly fishing and marine biomass utilization.

The government’s focus on marine economy development aligns with consumer demand for functional ingredients. Partnerships between biotech firms and universities are fostering innovation in peptide formulations. E-commerce platforms are enhancing direct-to-consumer distribution channels. The rising middle-class population is also fueling premium product purchases. Export potential remains high due to global demand for cost-effective, high-quality peptides.

The marine peptide market in India is forecast to expand at a robust CAGR of 11.7% between 2025 and 2035, driven by a thriving seafood processing industry and government-backed marine resource development programs. India’s marine peptide sector is expanding due to increasing nutraceutical adoption, especially in joint health, anti-aging, and cardiovascular wellness.

Coastal states such as Kerala, Tamil Nadu, and Andhra Pradesh are boosting marine biomass supply chains. Low-cost manufacturing advantages are attracting global buyers and fostering export growth. Government initiatives to promote the blue economy and eco-friendly aquaculture are creating favorable conditions. Academic institutions are actively engaging in peptide research and technology transfer. Local companies are exploring value-added marine products for both domestic and international markets.

Revenue from marine peptides in the UK is anticipated to grow at a healthy CAGR of 9.8% from 2025 to 2035, fueled by advancements in marine biotechnology research and the increasing use of eco-friendly marine resources. Strict quality and eco-focused regulations are driving companies to source eco-friendly and traceable raw materials. Consumer interest in anti-aging and wellness products is fueling demand for peptide-based solutions.

Leading biotech firms are investing in advanced peptide synthesis and encapsulation technologies. Academic research hubs in Scotland and Wales are pioneering marine bioactive applications. E-commerce platforms are offering premium peptide supplements targeted toward health-conscious consumers. The country’s innovation-driven ecosystem supports the development of novel formulations for global markets. Export-oriented strategies are enabling British firms to compete internationally.

Sales of marine peptides in Australia are projected to expand at a CAGR of 8.6% from 2025 to 2035, driven by its pristine marine ecosystems and strong focus on eco-friendly resource management. The country’s biotech companies are investing in eco-conscious extraction methods and high-purity peptide processing. Nutraceutical and pharmaceutical companies are incorporating marine peptides into joint health, sports recovery, and skin health products.

Strong government support for blue economy projects is boosting sector competitiveness. Collaboration between fisheries, research institutions, and industry players is enabling advanced product innovations. Increasing health awareness among Australians is driving domestic consumption. Export potential remains strong, particularly to Asia-Pacific markets. Premium branding based on purity and eco-conscious practices is giving Australian peptides a global edge.

Demand for marine peptides in Japan is set to grow at a CAGR of 7.5% between 2025 and 2035, supported by a deep cultural connection to seafood-based nutrition and strong consumer interest in functional health products. The country’s marine research institutes are pioneering peptide bioactivity studies, supporting product innovation in skincare, cardiovascular health, and sports recovery.

Japan’s aging population is increasingly seeking anti-aging and joint health solutions, boosting market demand. Domestic manufacturers are focusing on premium formulations, often combined with other bioactives for enhanced functionality. Government policies on marine sustainability are reinforcing responsible sourcing practices. The local market is also benefiting from strong distribution through pharmacies, specialty stores, and e-commerce. Japanese marine peptide exports are gaining traction in Asian and Western markets.

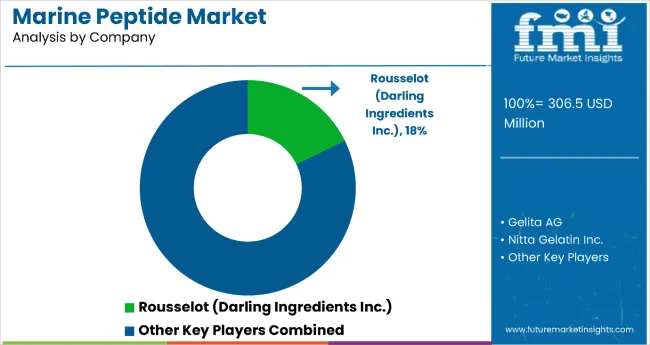

The market is moderately consolidated, with a mix of global ingredient leaders and specialized marine biotechnology firms. Rousselot (Darling Ingredients Inc.) leads the market with a 18% share, leveraging advanced hydrolysis technologies, strong regulatory compliance, and a diversified marine-based ingredient portfolio serving pharmaceuticals, nutraceuticals, and cosmetics.

Gelita AG and Nitta Gelatin Inc. focus on high-quality peptide extraction from eco-friendly marine resources, supported by robust R&D capabilities to enhance bioactivity and application versatility in functional foods and anti-aging products. Weishardt Group specializes in premium-grade peptides, particularly for beauty-from-within formulations, while Amicogen Inc. emphasizes biotechnology-driven production and targeted peptide applications for health supplements and pharmaceuticals.

Regional players and niche biotechnology firms are increasingly adopting eco-friendly sourcing and eco-friendly extraction methods to cater to rising consumer demand for clean-label, traceable marine peptides. Entry barriers remain high due to the complexity of peptide isolation, bioactivity preservation, and strict compliance with pharmaceutical and food-grade quality standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 306.5 Million |

| Product Type | Fish Peptides, Shellfish Peptides, Seaweed Peptides, Sponge Peptides, and Squid Peptides |

| End-Use Application | Animal Feed, Food & Beverages, Cosmetics, Pharmaceuticals, Nutraceuticals, and Biotechnology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Top Companies Profiled | Amicogen Inc., Cargill Inc., China Peptides, Darling Ingredients, Gelita AG, Guangzhou Honsea Sunshine Bio Science & Technology, Lapi Gelatine, Nippi Collagen, Nitta Gelatin, PB Gelatins /PB Leiner, Rousselot (Peptan), Trobas Gelatine B.V., Vital Proteins LLC., Weishardt Gélatines, Wellnex |

| Additional Attributes | Increasing use in nutraceuticals and functional foods, rising demand for marine-derived bioactives, advancements in peptide extraction and purification, growing applications in cosmetics and pharmaceuticals, emphasis on eco-friendly marine sourcing |

The global marine peptide market is estimated to be valued at USD 343.1 million in 2025.

The market size for the marine peptide market is projected to reach USD 602.9 million by 2035.

The marine peptide market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in marine peptide market are fish peptides, shellfish peptides, seaweed peptides, sponge peptides, squid peptides and other product types.

In terms of end-use applications, food and bEVerages segment to command 29.4% share in the marine peptide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peptide-Based Formulas Market Size and Share Forecast Outlook 2025 to 2035

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA