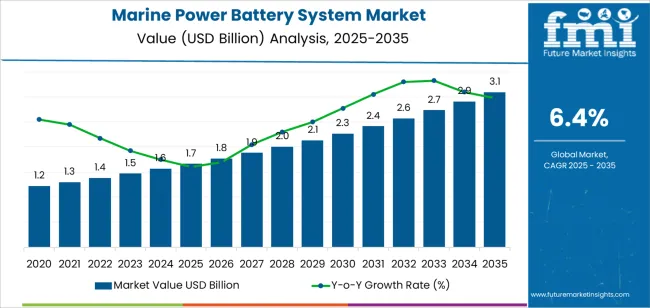

The marine power battery system market is likely to grow from USD 1,664.2 million in 2025 to USD 3,094.8 million by 2035, representing substantial growth, demonstrating the accelerating adoption of advanced battery formulations and premium electrification technology across hybrid vessel operations, pure electric ship propulsion, and specialty marine sectors.

The first half of the decade (2025-2030) will witness the marine power battery system market climbing from USD 1,664.2 million to approximately USD 2,269.5 million, adding USD 605.3 million in value, which constitutes 42% of the total forecast growth period. This phase will be characterized by the rapid adoption of lithium-ion battery systems, driven by increasing maritime decarbonization mandates and the growing need for emission reduction requirements worldwide. Advanced energy density capabilities and flexible integration systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness sustained growth from USD 2,269.5 million to USD 3,094.8 million, representing an addition of USD 825.3 million or 58% of the decade's expansion. This period will be defined by mass market penetration of specialized battery designs, integration with comprehensive vessel electrification platforms, and seamless compatibility with existing marine propulsion infrastructure. The marine power battery system market trajectory signals fundamental shifts in how shipbuilders approach vessel electrification and environmental compliance management, with participants positioned to benefit from sustained demand across multiple power source types and application segments.

The Marine Power Battery System market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the marine power battery system market progresses through its electrification adoption phase, expanding from USD 1,664.2 million to USD 2,269.5 million with steady annual increments averaging 6.4% growth. This period showcases the transition from basic marine battery systems to advanced lithium-ion designs with enhanced energy density capabilities and integrated power management systems becoming mainstream features.

The 2025-2030 phase adds USD 605.3 million to market value, representing 42% of total decade expansion. Market maturation factors include standardization of marine electrification and vessel power protocols, declining component costs for specialized battery systems, and increasing industry awareness of emission reduction benefits reaching optimal environmental compliance effectiveness in hybrid and pure electric vessel applications. Competitive landscape evolution during this period features established marine battery manufacturers like WhisperPower and Saft expanding their marine power battery portfolios while specialty manufacturers focus on advanced energy storage development and enhanced safety capabilities.

From 2030 to 2035, market dynamics shift toward advanced battery integration and global maritime electrification expansion, with growth continuing from USD 2,269.5 million to USD 3,094.8 million, adding USD 825.3 million or 58% of total expansion. This phase transition centers on specialized marine battery systems, integration with autonomous vessel networks, and deployment across diverse commercial shipping and recreational marine scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic energy storage capability to comprehensive vessel electrification systems and integration with ship management monitoring platforms.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,664.2 million |

| Market Forecast (2035) | USD 3,094.8 million |

| Growth Rate | 6.4% CAGR |

| Leading Technology | Lithium-ion Battery Power Source Type |

| Primary Application → | Hybrid Powered Ships Segment |

The marine power battery system market demonstrates strong fundamentals with lithium-ion battery systems capturing a dominant share through advanced energy density and cycle life optimization capabilities. Hybrid powered ships applications drive primary demand, supported by increasing maritime emission regulations and vessel electrification technology requirements. Geographic expansion remains concentrated in developed markets with established maritime infrastructure, while emerging economies show accelerating adoption rates driven by green shipping expansion and rising environmental standards.

Market expansion rests on three fundamental shifts driving adoption across the hybrid vessels, pure electric ships, and commercial marine sectors. First, environmental regulation demand creates compelling operational advantages through marine power battery systems that provide immediate emission reduction and fuel efficiency enhancement without compromising vessel performance goals, enabling shipowners to meet stringent IMO standards while maintaining operational productivity and reducing fuel costs. Second, maritime decarbonization modernization accelerates as shipping companies worldwide seek advanced battery systems that complement traditional propulsion, enabling precise power management and emission control that align with industry standards and environmental regulations.

Third, operational cost enhancement drives adoption from ferry operators and commercial vessel owners requiring effective energy storage solutions that maximize fuel savings while maintaining operational productivity during voyage and port operations. However, growth faces headwinds from capital investment challenges that vary across shipowners regarding the acquisition of battery systems and vessel retrofitting costs, which may limit adoption in cost-sensitive maritime operations. Technical limitations also persist regarding energy density constraints and safety concerns that may reduce effectiveness in long-distance voyages and heavy-weather conditions, which affect vessel range and operational requirements.

The marine power battery system market represents a transformative yet critical maritime opportunity driven by expanding global shipping electrification, environmental regulation compliance, and the need for superior emission reduction in diverse vessel applications. As shipowners worldwide seek to achieve optimal fuel efficiency, eliminate emissions, and integrate advanced battery systems with hybrid platforms, marine power battery systems are evolving from auxiliary power sources to primary propulsion solutions ensuring environmental excellence and operational efficiency leadership.

The marine power battery system market's growth trajectory from USD 1,664.2 million in 2025 to USD 3,094.8 million by 2035 at a 6.4% CAGR reflects fundamental shifts in maritime industry environmental requirements and vessel electrification optimization. Geographic expansion opportunities are particularly pronounced in Asia Pacific markets, while the dominance of lithium-ion battery systems and hybrid powered ships applications provides clear strategic focus areas.

Strengthening the dominant lithium-ion segment through enhanced energy density formulations, superior cycle life performance, and integrated battery management systems. This pathway focuses on optimizing battery chemistry, improving safety features, extending operational effectiveness to optimal energy storage rates, and developing specialized formulations for diverse applications. Market leadership consolidation through advanced battery engineering and safety system integration enables premium positioning while defending competitive advantages against fuel cell alternatives. Expected revenue pool: USD 120-165 million

Rapid shipbuilding and green shipping growth across Asia Pacific creates substantial expansion opportunities through local battery production capabilities and technology transfer partnerships. Growing vessel electrification mandates and environmental compliance initiatives drive sustained demand for advanced marine battery systems. Localization strategies reduce import costs, enable faster technical support, and position companies advantageously for procurement programs while accessing growing domestic markets. Expected revenue pool: USD 95-135 million

Expansion within the dominant hybrid powered ships segment through specialized battery designs addressing dual propulsion standards and high-power requirements. This pathway encompasses diesel-electric hybrid systems, power management integration, and compatibility with diverse vessel operations. Premium positioning reflects superior fuel savings and comprehensive emission reduction supporting modern maritime operations. Expected revenue pool: USD 80-115 million

Strategic expansion into pure battery powered ships applications requires enhanced energy capacity and specialized battery systems addressing all-electric vessel operational requirements. This pathway addresses zero-emission propulsion, fast-charging infrastructure integration, and route-optimized systems with advanced energy management for demanding ferry and short-sea shipping standards. Premium pricing reflects specialized energy requirements and environmental benefits. Expected revenue pool: USD 65-95 million

Development of specialized fuel cell systems and other power source technologies, addressing specific range requirements and hydrogen infrastructure demands. This pathway encompasses hybrid fuel cell-battery designs, long-range capability optimization, and versatile alternatives for diverse maritime segments. Technology differentiation through complementary systems enables diversified revenue streams while reducing dependency on single battery platforms. Expected revenue pool: USD 50-75 million

Expansion across commercial shipping and ferry applications through enhanced operational reliability, superior charging infrastructure compatibility, and specialized maritime requirements. This pathway encompasses passenger ferry operations, cargo vessel applications, and specialty maritime services requiring proven battery performance. Market development through maritime sector partnerships enables differentiated positioning while accessing high-utilization marine markets requiring reliable energy storage solutions. Expected revenue pool: USD 40-60 million

Development of recreational marine applications addressing yacht electrification and leisure craft requirements across luxury vessel and small boat scenarios. This pathway encompasses silent propulsion systems, extended cruising range, and comprehensive environmental compliance. Market positioning reflects premium positioning and lifestyle benefits while enabling access to high-value marine segments and eco-conscious vessel owner partnerships. Expected revenue pool: USD 30-50 million

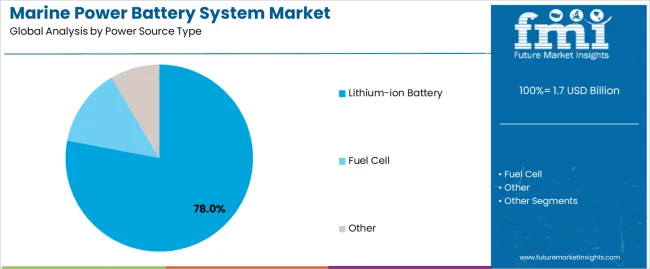

Primary Classification: The market segments by power source type into Lithium-ion Battery, Fuel Cell, and Other categories, representing the evolution from basic energy storage to advanced power generation solutions for comprehensive vessel electrification optimization.

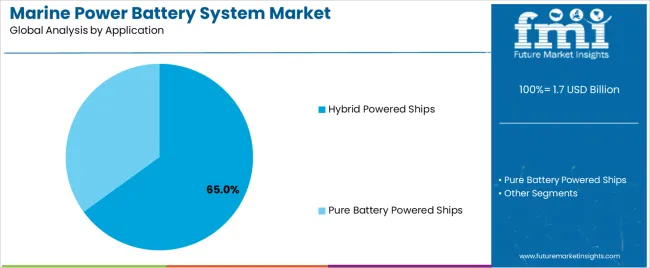

Secondary Classification: Application segmentation divides the marine power battery system market into Hybrid Powered Ships and Pure Battery Powered Ships sectors, reflecting distinct requirements for power capacity, energy density, and propulsion architecture.

Regional Classification: Geographic distribution covers Asia Pacific, Europe, North America, and other regions, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by maritime manufacturing expansion programs.

The segmentation structure reveals technology progression from conventional marine battery systems toward advanced lithium-ion designs with enhanced energy density and safety capabilities, while application diversity spans from hybrid propulsion to specialized pure electric vessels requiring comprehensive marine power solutions.

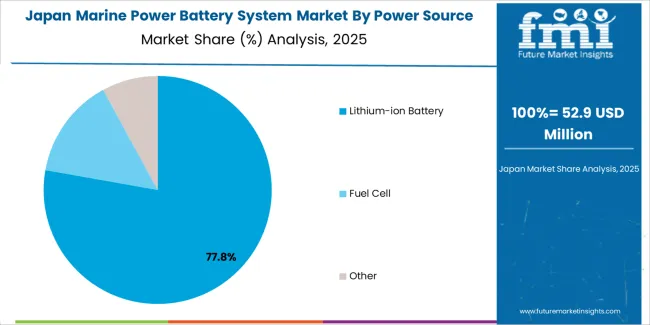

Market Position: Lithium-ion battery systems command the leading position in the Marine Power Battery System market with approximately 78% market share through superior energy properties, including high energy density capability, extended cycle life characteristics, and compact design that enable shipbuilders to achieve optimal vessel electrification across diverse commercial and recreational marine environments.

Value Drivers: The segment benefits from shipowner preference for proven battery technology that provides reliable power performance, established safety records, and operational flexibility without requiring hydrogen infrastructure. Advanced battery features enable fast charging capabilities, power management integration, and compatibility with existing vessel electrical systems, where energy density and safety reliability represent critical operational requirements.

Competitive Advantages: Lithium-ion marine battery systems differentiate through proven reliability effectiveness, mature supply chain infrastructure, and integration with hybrid propulsion systems that enhance operational efficiency while maintaining optimal power delivery suitable for diverse ferry operations, cargo vessels, and yacht applications. The segment's dominance is reinforced by comprehensive industry validation across major shipbuilders and vessel operators, established safety certification supporting marine classification societies, and continuous innovation in battery chemistry that addresses evolving maritime requirements and IMO regulations.

Key market characteristics:

Fuel cell systems maintain emerging market positioning in the Marine Power Battery System market with approximately 15.0% market share due to their long-range capabilities and hydrogen power advantages. These systems appeal to operators requiring extended voyage capabilities with zero emissions for specialized applications. Market adoption is driven by hydrogen infrastructure development, highlighting clean energy solutions and operational range through fuel cell-battery hybrid systems while addressing long-distance maritime requirements.

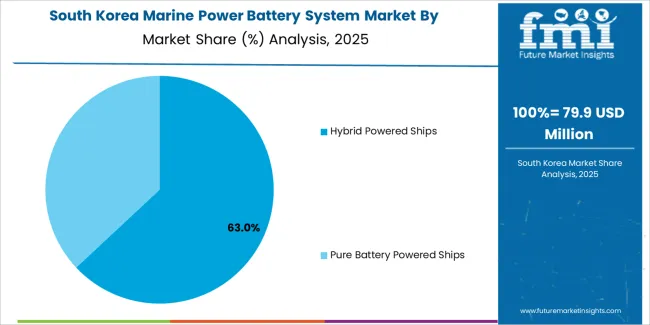

Market Context: Hybrid powered ships applications dominate the Marine Power Battery System market with approximately 65% market share due to widespread adoption of dual propulsion technology and increasing focus on fuel efficiency, emission reduction, and operational flexibility applications that minimize environmental impact while maintaining maritime industry standards.

Appeal Factors: Ship operators prioritize fuel savings, emission compliance, and integration with existing diesel propulsion infrastructure that enables coordinated power management across multiple operational modes. The segment benefits from substantial maritime investment and environmental programs that emphasize the acquisition of battery systems for emission reduction and operational cost optimization applications.

Growth Drivers: Ferry fleet modernization programs incorporate hybrid battery systems as standard propulsion components for coastal shipping operations, while environmental regulation growth increases demand for emission reduction capabilities that comply with IMO 2030 targets and optimize fuel consumption. The growing emphasis on port emission control is driving demand for advanced marine battery systems that enable zero-emission port operations across diverse vessel types, while increasing fuel price volatility requires operators to implement hybrid propulsion to support operational cost reduction and economic sustainability maintenance throughout vessel lifecycles.

Market Challenges: Varying vessel designs and operational profiles may limit battery system standardization across different ship types or route configurations.

Application dynamics include:

Pure battery powered ships applications capture approximately 35.0% market share through zero-emission requirements in short-route ferry operations, harbor vessels, and electric boat scenarios demanding complete electrification systems capable of eliminating fossil fuels entirely while providing sufficient energy capacity for defined route operations and frequent charging access.

Growth Accelerators: Maritime decarbonization drives primary adoption as marine power battery systems provide emission elimination capabilities that enable shipowners to meet environmental standards without excessive operational compromises, supporting sustainability goals and regulatory missions that require optimal emission reduction applications. IMO regulation compliance demand accelerates market expansion as operators seek effective battery systems that reduce emissions while maintaining operational effectiveness during voyage and port scenarios. Maritime industry investment increases worldwide, creating sustained demand for advanced marine battery systems that complement modern vessel designs and provide competitive advantages in environmentally-focused markets.

Growth Inhibitors: Capital cost challenges vary across ship operators regarding the acquisition of battery systems and vessel modification expenses, which may limit operational flexibility and market penetration in regions with limited financing or traditional shipping operations. Technical performance limitations persist regarding energy density constraints and charging infrastructure availability that may reduce effectiveness in long-distance routes, heavy cargo operations, or remote operational conditions, affecting vessel range and operational requirements. Market fragmentation across multiple vessel types and maritime regulations creates system integration concerns between different battery suppliers and existing ship infrastructure.

Market Evolution Patterns: Adoption accelerates in ferry operations and coastal shipping sectors where route characteristics justify battery investment costs, with geographic concentration in European and Asian markets transitioning toward broader adoption in global shipping driven by environmental regulation expansion and battery technology advancement. Technology development focuses on enhanced energy density, improved fast-charging systems, and compatibility with hydrogen fuel cells that optimize vessel electrification and operational flexibility. The marine power battery system market could face disruption if alternative maritime propulsion technologies or synthetic fuel innovations significantly limit the deployment of battery systems, though marine batteries' unique combination of emission elimination, operational cost savings, and regulatory compliance continues to make them essential in maritime decarbonization efforts.

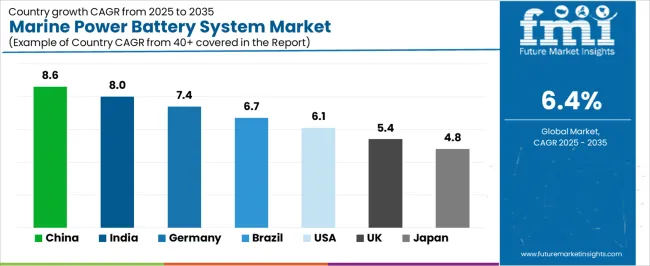

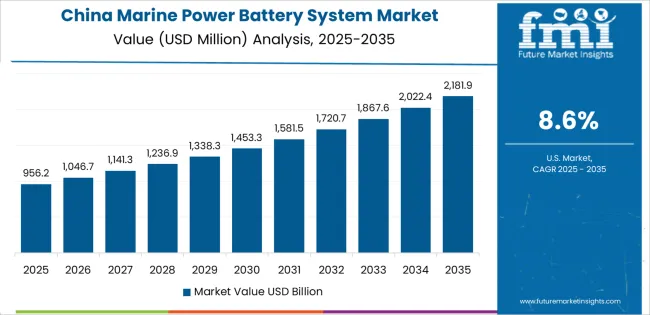

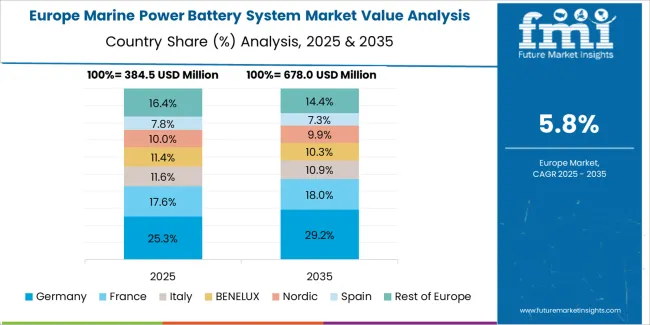

The Marine Power Battery System market demonstrates varied regional dynamics with Growth Leaders including China (8.6% CAGR) and India (8.0% CAGR) driving expansion through shipbuilding capacity additions and green shipping programs. Steady Performers encompass Germany (7.4% CAGR), Brazil (6.7% CAGR), and United States (6.1% CAGR), benefiting from established maritime industries and advanced vessel electrification adoption. Mature Markets feature United Kingdom (5.4% CAGR) and Japan (4.8% CAGR), where specialized ferry applications and premium battery integration support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.6 |

| India | 8.0 |

| Germany | 7.4 |

| Brazil | 6.7 |

| United States | 6.1 |

| United Kingdom | 5.4 |

| Japan | 4.8 |

Regional synthesis reveals Asia Pacific markets leading adoption through shipbuilding expansion and electric vessel infrastructure development, while European countries maintain strong expansion supported by advanced maritime environmental regulations and ferry electrification requirements. North American markets show moderate growth driven by coastal shipping applications and green maritime integration trends.

The Chinese market emphasizes advanced maritime electrification features, including high-capacity battery designs and integration with comprehensive shipbuilding platforms that manage power systems, emission control, and efficiency applications through unified vessel management systems. The country demonstrates strong growth at 8.6% CAGR, driven by shipbuilding industry expansion, green shipping initiatives, and emerging electric ferry development that support marine battery integration. Chinese shipbuilders prioritize operational effectiveness with marine power battery systems delivering consistent propulsion performance through advanced energy density capabilities and vessel adaptation features.

Technology deployment channels include major shipyards, ferry operators, and maritime equipment procurement programs that support professional applications for complex vessel electrification and hybrid propulsion operations. Vessel platform integration capabilities with established marine systems expand market appeal across diverse operational requirements seeking emission reduction and efficiency benefits. The expanding coastal shipping sector and accelerating electric vessel market create sustained demand, while innovative applications in inland waterway transportation and port harbor craft open new growth avenues.

Performance Metrics:

Germany's advanced maritime market demonstrates sophisticated marine battery deployment with documented operational effectiveness in ferry applications and hybrid vessel facilities through integration with existing ship propulsion systems and maritime infrastructure. The country leverages engineering expertise in vessel electrification and marine systems integration to maintain strong growth at 7.4% CAGR. Maritime centers, including Hamburg, Bremen, and Kiel, showcase premium installations where marine battery systems integrate with comprehensive vessel platforms and power management systems to optimize propulsion performance and environmental effectiveness.

German shipowners prioritize system reliability and EU maritime compliance in battery selection, creating demand for premium marine battery systems with superior features, including advanced battery management systems and comprehensive safety certification. The marine power battery system market benefits from established ferry operations infrastructure and a willingness to invest in vessel electrification technologies that provide long-term environmental benefits and compliance with international maritime and emission standards.

Market Intelligence Brief:

The USA marine power battery system market demonstrates sophisticated deployment across ferry and coastal vessel applications with documented effectiveness in passenger transportation and harbor operations through integration with comprehensive hybrid propulsion systems and environmental compliance infrastructure. The country leverages advanced maritime capabilities in battery innovation and vessel electrification technologies to maintain moderate growth at 6.1% CAGR. Maritime centers, including Seattle, San Francisco, and New York, showcase installations where marine battery systems integrate with comprehensive ferry platforms and port emission control networks to optimize environmental effectiveness and operational efficiency.

American ferry operators prioritize emission reduction and operational cost savings in battery selection, creating demand for innovative marine battery systems with advanced features, including shore power integration and comprehensive energy management. The marine power battery system market benefits from established ferry operations infrastructure and willingness to invest in vessel electrification technologies that provide long-term environmental benefits and compliance with EPA and maritime emission standards.

Market Intelligence Brief:

The UK marine power battery system market demonstrates advanced environmental deployment with documented operational effectiveness in ferry applications and coastal shipping through integration with existing maritime compliance systems and vessel infrastructure. The country leverages regulatory expertise in vessel electrification and marine systems integration to maintain steady growth at 5.4% CAGR. Maritime centers, including London, Southampton, and Glasgow, showcase installations where marine battery systems integrate with comprehensive environmental platforms and emission management systems to optimize regulatory compliance and propulsion effectiveness.

British ferry operators prioritize system efficiency and regulatory compliance in battery selection, creating demand for certified marine battery systems with advanced features, including port emission control compatibility and comprehensive safety documentation. The marine power battery system market benefits from established ferry operations infrastructure and commitment to invest in vessel electrification technologies that provide long-term environmental benefits and compliance with UK and EU maritime emission standards. Ferry applications, coastal shipping systems, and harbor vessel programs drive diversified demand across multiple maritime segments.

Strategic Market Indicators:

India's marine power battery system market demonstrates rapid expansion deployment with documented operational effectiveness in ferry applications and coastal shipping through integration with emerging vessel electrification systems and maritime infrastructure. The country leverages growing shipbuilding capabilities in maritime battery technology and vessel systems integration to achieve high growth at 8.0% CAGR. Maritime centers, including Mumbai, Kochi, and Visakhapatnam, showcase expanding installations where marine battery systems integrate with comprehensive ferry platforms and coastal shipping networks to optimize market penetration and environmental effectiveness.

Indian ferry operators prioritize cost-effectiveness and operational reliability in battery selection, creating demand for accessible marine battery systems with competitive features, including proven performance and local support. The marine power battery system market benefits from expanding coastal transportation infrastructure and willingness to invest in vessel electrification that provides environmental benefits and compliance with emerging maritime standards.

Market Intelligence Brief:

Brazil's marine power battery system market demonstrates growth deployment with documented operational effectiveness in coastal vessel applications and offshore support operations through integration with established maritime systems and environmental compliance infrastructure. The country leverages maritime industry capabilities in vessel electrification and coastal shipping operations to achieve growth at 6.7% CAGR. Maritime centers, including Rio de Janeiro, Santos, and Salvador, showcase installations where marine battery systems integrate with offshore support platforms and coastal ferry operations to optimize emission control and operational effectiveness.

Brazilian vessel operators prioritize operational reliability and environmental compliance in battery selection, creating demand for robust marine battery systems with proven performance and comprehensive support. The marine power battery system market benefits from established offshore industry infrastructure and growing environmental awareness that provides sustained demand for vessel electrification technology.

Market Intelligence Brief:

Japan's marine power battery system market demonstrates precision deployment with documented operational effectiveness in ferry applications and coastal shipping through integration with advanced vessel systems and quality control infrastructure. The country leverages engineering excellence in precision maritime technology and vessel systems integration to maintain steady growth at 4.8% CAGR. Maritime centers, including Tokyo, Osaka, and Yokohama, showcase premium installations where marine battery systems integrate with comprehensive quality platforms and vessel monitoring systems to optimize operational excellence and environmental effectiveness.

Japanese ferry operators prioritize system precision and operational reliability in battery selection, creating demand for premium marine battery systems with advanced features, including sophisticated battery management and comprehensive safety systems. The marine power battery system market benefits from established ferry operations infrastructure and commitment to invest in highest-quality vessel electrification equipment that provides superior environmental performance and compliance with stringent Japanese maritime standards.

Strategic Market Indicators:

The Marine Power Battery System market in Europe is projected to grow substantially over the forecast period, with Germany expected to maintain its leadership position with a significant market share supported by its advanced maritime infrastructure and major ferry operations in Hamburg and Bremen. Norway follows with strong market presence, driven by comprehensive electric ferry programs and coastal shipping electrification initiatives. The United Kingdom holds substantial market share through specialized ferry electrification activities, coastal vessel applications, and harbor craft operations. The Netherlands commands notable market presence through strong inland waterway and ferry projects. France accounts for growing market share aided by ferry modernization expansion and maritime electrification adoption. Denmark maintains steady share driven by specialty ferry applications and maritime environmental demand. The Rest of Europe region is anticipated to show steady adoption, reflecting consistent growth in Nordic countries, coastal shipping expansion in Mediterranean markets, and vessel electrification upgrades across Eastern European maritime facilities.

In Japan, the Marine Power Battery System market prioritizes lithium-ion battery systems, which capture the dominant share of ferry and coastal vessel installations due to their advanced features, including high energy density optimization and seamless integration with existing vessel electrical infrastructure. Japanese ferry operators emphasize reliability, safety, and long-term operational excellence, creating demand for lithium-ion marine battery systems that provide consistent power delivery capabilities and superior cycle life performance based on operational requirements and maritime standards. Fuel cell options maintain secondary positions primarily in long-range vessel applications and experimental installations where hydrogen infrastructure meets operational requirements without compromising emission goals.

Market Characteristics:

In South Korea, the marine power battery system market structure favors international marine battery manufacturers, including WhisperPower, Saft, and Corvus Energy, which maintain dominant positions through comprehensive product portfolios and established shipbuilding networks supporting both commercial vessel and ferry installations. These providers offer integrated solutions combining advanced marine battery systems with professional engineering services and ongoing technical support that appeal to Korean shipbuilders seeking reliable vessel electrification technology. Local battery manufacturers and marine equipment suppliers capture moderate market share by providing localized support capabilities and competitive pricing for standard marine battery installations, while domestic shipbuilding companies focus on specialized applications and cost-effective solutions tailored to Korean maritime market characteristics.

Channel Insights:

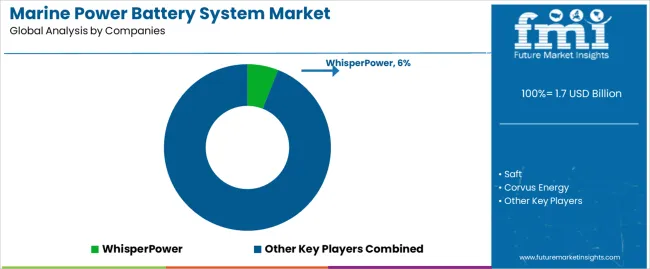

The Marine Power Battery System market operates with moderate concentration, featuring approximately 15-20 meaningful participants, where leading companies control roughly 45-50% of the global market share through established maritime relationships and comprehensive battery system portfolios. Competition emphasizes energy density performance, safety certification, and technical support strength rather than price-based rivalry. Leading companies maintain market presence through extensive marine battery product lines and global shipbuilding industry integration.

Market Leaders encompass WhisperPower, Saft, and Corvus Energy, which maintain competitive advantages through extensive marine battery expertise, global technical support networks, and comprehensive vessel integration capabilities that create customer loyalty and support premium pricing. These companies leverage decades of maritime battery experience and ongoing innovation investments to develop advanced marine power battery systems with safety optimization and energy density features. Technology Innovators include Navico Group and MG Energy Systems, which compete through specialized battery technology focus and innovative energy management capabilities that appeal to shipbuilders seeking advanced vessel electrification solutions and emission reduction.

These companies differentiate through rapid certification development cycles and specialized maritime application focus. Regional Specialists feature marine battery manufacturers focusing on specific geographic markets and specialized applications, including ferry-optimized systems and integrated propulsion solutions. Market dynamics favor participants that combine proven marine safety performance with advanced energy density capabilities, including comprehensive battery management support and automatic thermal control optimization features. Competitive pressure intensifies as traditional battery suppliers expand into marine applications, while maritime technology companies challenge established players through innovative energy storage solutions and hybrid propulsion platforms targeting ferry and commercial vessel segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,664.2 million |

| Power Source Type | Lithium-ion Battery, Fuel Cell, Other |

| Application | Hybrid Powered Ships, Pure Battery Powered Ships |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 20+ additional countries |

| Key Companies Profiled | WhisperPower, Saft, Corvus Energy, Navico Group, MG Energy Systems, RELiON Batteries, Lehmann Marine GmbH, Leclanché, Super B, BigBattery, Eco Marine Power, JSE Marine, Anhui Field New Energy Technology Co. Ltd., ePropulsion, EVE Battery, Shuangdeng Group |

| Additional Attributes | Dollar sales by power source type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with marine battery manufacturers and vessel electrification suppliers, shipowner preferences for energy density and safety certification, integration with vessel propulsion platforms and battery management systems, innovations in lithium-ion battery technology and maritime excellence, and development of fast-charging solutions with enhanced safety performance and operational optimization capabilities. |

The global marine power battery system market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the marine power battery system market is projected to reach USD 3.1 billion by 2035.

The marine power battery system market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in marine power battery system market are lithium-ion battery, fuel cell and other.

In terms of application, hybrid powered ships segment to command 65.0% share in the marine power battery system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine Winch Motors Market Size and Share Forecast Outlook 2025 to 2035

Marine Biotech Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Marine Plankton Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA