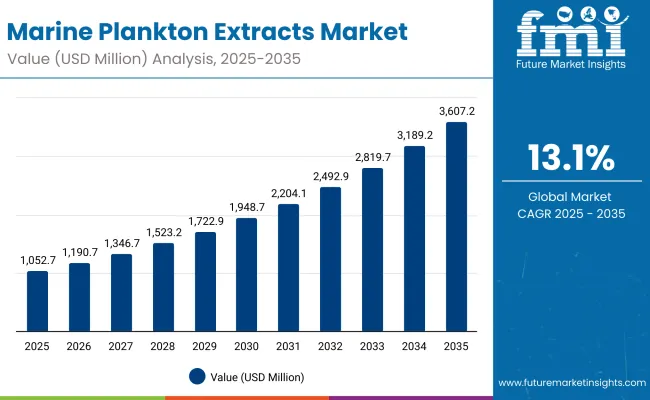

A valuation of USD 1,052.7 million has been projected for the marine plankton extracts market in 2025, while by 2035, the market is anticipated to reach USD 3,607.2 million. This translates into an absolute increase of USD 2,554.5 million over the decade, reflecting a robust expansion trajectory. The overall growth corresponds to a CAGR of 13.1%, signaling a market size that is expected to more than triple within ten years.

Marine Plankton Extracts Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,052.7 million |

| Market Forecast Value in (2035F) | USD 3,607.2 million |

| Forecast CAGR (2025 to 2035) | 13.10% |

During the first five-year horizon from 2025 to 2030, the market is forecast to increase from USD 1,052.7 million to USD 1,948.7 million. This incremental gain of USD 896 million will account for more than one-third of total decade growth. This period is likely to be marked by steady adoption across cosmetics, personal care, and wellness-driven formulations, particularly supported by early consumer preference for natural anti-aging and hydration actives.

In the subsequent phase between 2030 and 2035, expansion is expected to accelerate as the market climbs from USD 1,948.7 million to USD 3,607.2 million. This leap of USD 1,658.5 million will represent nearly two-thirds of the decade’s incremental value. Growth during this stage is projected to be powered by greater penetration of marine biotechnology, scale-up in nutraceutical applications, and premium skincare adoption in emerging economies. The forecast highlights a decisive shift toward sustainable sourcing and high-efficacy marine extracts, which will reinforce market leadership for innovators able to combine scientific validation with transparent supply chains.

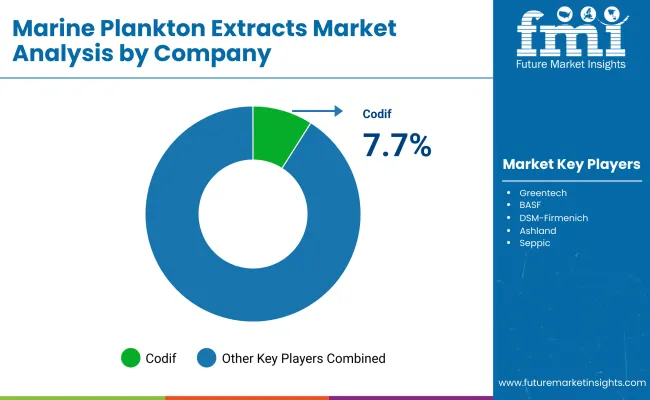

From 2020 to 2024, the Marine Plankton Extracts Market steadily expanded, reflecting early adoption of marine-derived actives in premium skincare and nutraceuticals. By 2025, the market is projected to surpass USD 1,052.7 million, fueled by innovation in bioactive extraction and sustainability-led consumer preferences. Historically, leadership has been concentrated among specialized marine biotechnology firms, with Codif maintaining the largest identified share at 7.7% in 2025. Competitive differentiation has been reliant on scientific validation, sustainable sourcing, and transparent supply chains rather than scale alone.

Between 2025 and 2035, revenue distribution is expected to shift as multifunctional applications in personal care and wellness strengthen demand. Leading players are anticipated to integrate biotechnology, clinical substantiation, and premium positioning to sustain competitiveness, while mid-sized innovators will focus on agility, customization, and brand partnerships to secure growth.

growth in the marine plankton extracts market is being driven by rising demand for bio-based and sustainable ingredients, supported by increasing consumer awareness of natural skincare and wellness solutions. Strong interest in anti-aging and hydration benefits has positioned marine extracts as premium actives in cosmetics and nutraceuticals. Advances in marine biotechnology have enabled higher-yield extraction and improved stability of bioactive compounds, strengthening product efficacy and market confidence.

Adoption has been further encouraged by the clean-label movement, where brands are aligning with consumer expectations for transparency and traceability. Expanding applications across serums, creams, and functional supplements are expected to diversify revenue streams. Favorable regulatory support for natural ingredients and growing investment in research collaborations are projected to accelerate innovation pipelines. Emerging economies are anticipated to play a critical role, where rising disposable incomes and rapid urbanization are set to amplify premium product consumption. The combined influence of sustainability, science-led innovation, and consumer-driven demand is expected to secure long-term growth momentum.

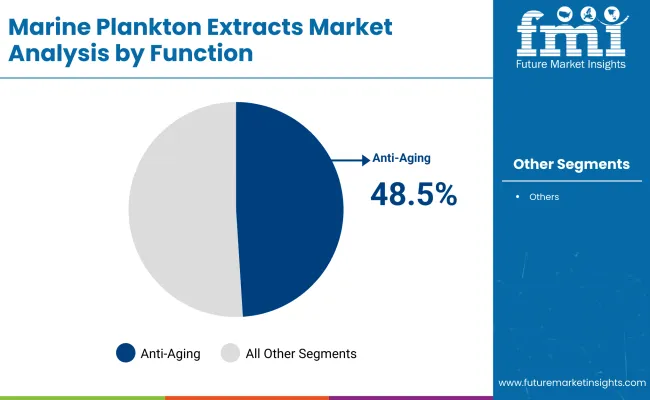

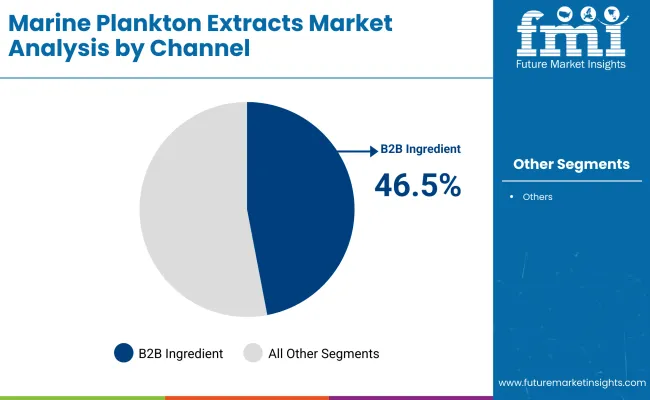

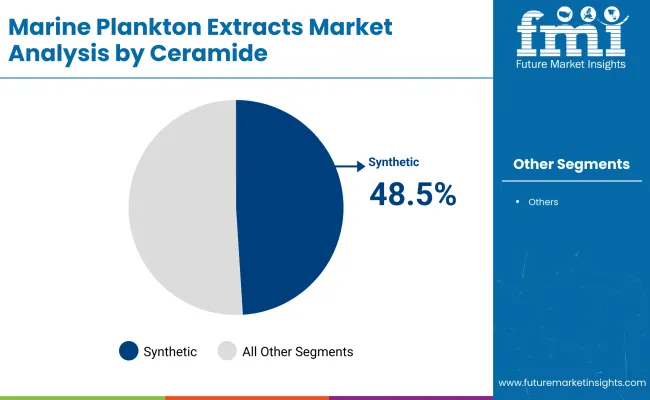

The marine plankton extracts market has been segmented across multiple dimensions to provide a clear perspective on growth dynamics. Segmentation is based on function, channel, and ceramide type, highlighting the primary areas shaping demand patterns. Functional benefits such as anti-aging and hydration are driving consumer alignment toward premium skincare, while distribution channels distinguish between B2B ingredient integration and consumer-facing retail. Additionally, ceramide types highlight innovation pathways where synthetic and other formulations compete for market relevance. Each segment demonstrates a distinct trajectory, offering insights into value capture opportunities and competitive positioning over the forecast period.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 48.5% |

| Others | 51.5% |

Anti-aging is expected to capture 48.5% of the functional segment in 2025, equivalent to USD 509.9 million, while other applications account for 51.5%. This near-equal distribution highlights a balanced yet competitive landscape. Anti-aging demand is being fueled by growing consumer investment in natural actives that combat early signs of aging, supported by plankton-derived peptides and antioxidants.

Preventive skincare adoption among younger populations has strengthened the category, while older demographics continue to anchor growth through anti-wrinkle and skin-firming needs. Scientific validation and increasing clinical trials are reinforcing efficacy claims, enabling stronger brand positioning. Over the forecast horizon, anti-aging is projected to remain the defining growth axis of the marine plankton extracts market, consolidating its position as a high-value functional category.

| Segment | Market Value Share, 2025 |

|---|---|

| B2B ingredients | 46.5% |

| Others | 53.5% |

B2B ingredients are forecast to hold 46.5% of channel sales in 2025, valued at USD 489.1 million, while others contribute 53.5%. This split underscores the vital role of ingredient integration in driving demand for marine plankton extracts. The B2B channel is being strengthened by collaborations between suppliers and global cosmetics and nutraceutical brands, enabling standardized adoption of high-performance marine actives. Sustainable sourcing, ingredient traceability, and certification requirements are further elevating B2B’s strategic importance. Strong partnerships are expected to ensure recurring demand pipelines, particularly as personalization and premiumization trends intensify. Over the forecast period, B2B ingredients are projected to maintain their role as a stable growth driver, anchoring market expansion across multiple product categories worldwide.

| Segment | Market Value Share, 2025 |

|---|---|

| Synthetic | 48.5% |

| Others | 51.5% |

Synthetic ceramides are projected to represent 48.5% of the ceramide type segment in 2025, amounting to USD 1,406.8 million, while other types account for 51.5%. This robust share demonstrates strong reliance on synthetic formulations within marine plankton extracts. Their advantages lie in scalability, stability, and proven reliability across diverse cosmetic and personal care applications. Advanced bioengineering has enabled synthetic ceramides to closely replicate natural lipid functions, strengthening their role in hydration and skin barrier repair. These attributes are encouraging wider industry adoption, particularly among global manufacturers seeking uniform quality and regulatory compliance. Looking forward, synthetic ceramides are anticipated to maintain resilience against natural alternatives, establishing themselves as a key pillar in marine plankton-based innovation.

While scalability challenges and formulation complexities persist, opportunities are being reshaped by biotechnology breakthroughs, premium skincare adoption, and sustainability commitments, which are redefining the global marine plankton extracts market across cosmetic, nutraceutical, and wellness-driven industries.

Advancements in Marine Biotechnology

Expansion in the marine plankton extracts market is being catalyzed by innovations in biotechnology, where enhanced photobioreactor systems and precision fermentation are enabling cost-efficient and high-yield extraction of bioactive compounds. These advances have improved consistency, stability, and concentration of functional molecules, strengthening the scientific credibility of marine actives. As biotechnology platforms integrate with AI-enabled bioinformatics, more precise screening of plankton strains is being conducted to identify peptides and lipids with superior anti-aging and hydration performance. Over the forecast horizon, such advances are expected to create a pipeline of novel extracts with verifiable efficacy, which will help manufacturers differentiate in crowded skincare and nutraceutical markets.

Supply Chain Vulnerabilities Linked to Ocean Ecology

Growth prospects are constrained by ecological and supply chain vulnerabilities, as ocean biodiversity and plankton biomass remain sensitive to climate change, rising ocean temperatures, and microplastic pollution. These environmental pressures are introducing volatility in raw material sourcing, which can destabilize long-term supply security. Dependence on marine ecosystems without sufficient synthetic or lab-cultivated alternatives exposes manufacturers to reputational and regulatory risks.

Stricter environmental governance and marine conservation policies are expected to intensify compliance burdens, requiring significant investment in sustainable harvesting or bioengineered substitutes. Unless mitigated by closed-loop cultivation systems and traceable sourcing models, these vulnerabilities may limit scalability and restrain broader adoption in mainstream product categories.

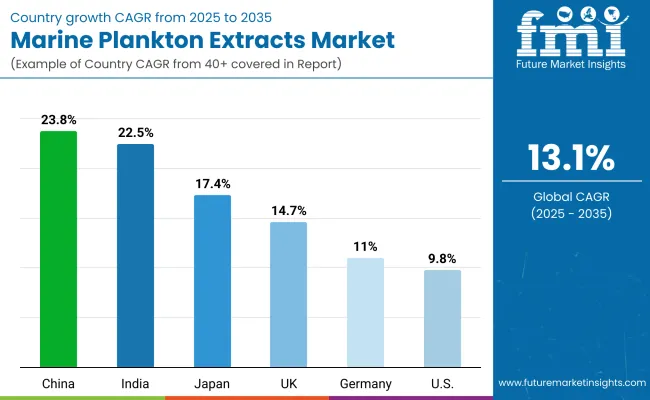

| Countries | CAGR |

|---|---|

| China | 23.8% |

| USA | 9.8% |

| India | 22.5% |

| UK | 14.7% |

| Germany | 11.0% |

| Japan | 17.4% |

The global marine plankton extracts market is expected to advance unevenly across countries, with adoption shaped by biotechnology investments, sustainability policies, and consumer alignment with natural actives. Asia is projected to emerge as the fastest-growing hub, led by China at a CAGR of 23.8% and India at 22.5%. China’s rapid growth will be underpinned by strong government backing for marine biotechnology, expanding cosmetic manufacturing bases, and consumer preference for premium natural formulations. India’s trajectory is likely to reflect a combination of rising urban incomes, large-scale personal care manufacturing, and fast-moving nutraceutical adoption.

Japan is projected to achieve 17.4% CAGR, supported by advanced skincare markets and high receptivity to scientifically validated marine actives. The UK, at 14.7% CAGR, is anticipated to strengthen through regulatory alignment with sustainable cosmetics and innovation in premium wellness segments. Germany, with an 11.0% CAGR, is expected to maintain momentum through its strong dermocosmetic and pharmaceutical industries, though growth will remain comparatively moderate. In contrast, the USA market is forecast to expand at 9.8%, reflecting a mature landscape where growth will be primarily driven by wellness-focused formulations and clean-label preferences. Overall, Asia-Pacific is positioned to define future global leadership, while Europe and North America sustain complementary roles.

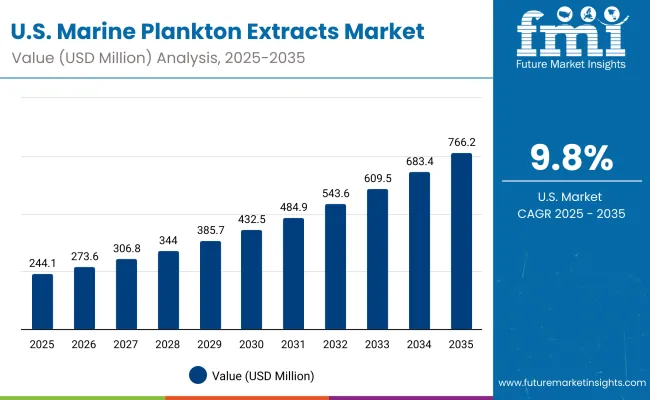

| Year | USA Marine Plankton Extracts Market (USD Million) |

|---|---|

| 2025 | 244.11 |

| 2026 | 273.69 |

| 2027 | 306.86 |

| 2028 | 344.05 |

| 2029 | 385.75 |

| 2030 | 432.5 |

| 2031 | 484.92 |

| 2032 | 543.68 |

| 2033 | 609.57 |

| 2034 | 683.45 |

| 2035 | 766.28 |

The marine plankton extracts market in the United States is projected to expand at a CAGR of 9.8% from 2025 to 2035, increasing from USD 244.11 million in 2025 to USD 766.28 million by 2035. Growth is expected to be guided by rising consumer alignment with sustainable skincare, the adoption of natural nutraceuticals, and the integration of marine bioactives into premium product portfolios. Early adoption of anti-aging and hydration applications has positioned the USA as a key innovation hub, with formulators prioritizing clinically validated extracts. Strategic opportunities are anticipated in wellness-driven categories, where consumers are increasingly seeking multifunctional solutions that combine health and beauty benefits. Regulatory emphasis on clean-label compliance is projected to reinforce market credibility, while collaborations between biotechnology companies and cosmetic brands are expected to drive product differentiation.

The marine plankton extracts market in the United Kingdom is projected to grow at a CAGR of 14.7% between 2025 and 2035, reflecting steady advancement supported by sustainability commitments and premium product adoption. Expansion is expected to be shaped by the integration of marine actives into high-end skincare and wellness formulations, with consumers demonstrating strong loyalty to clean-label and eco-certified products. Innovation is anticipated to be supported by the UK’s advanced R&D ecosystem and regulatory frameworks favoring natural cosmetics. Growth momentum will also be reinforced by retail channels, particularly e-commerce, where premium cosmetic lines are achieving broader reach.

The marine plankton extracts market in India is forecast to expand at a CAGR of 22.5% from 2025 to 2035, making it one of the fastest-growing global markets. Expansion is being driven by rapid growth in personal care manufacturing, an emerging nutraceutical ecosystem, and rising urban consumer incomes. Strong opportunities are anticipated as international brands expand local sourcing partnerships and domestic players incorporate marine actives into value-added formulations. Government initiatives supporting biotechnology innovation are expected to further accelerate adoption, while evolving consumer preference for natural anti-aging and hydration solutions will strengthen product uptake.

The marine plankton extracts market in China is projected to record a CAGR of 23.8% between 2025 and 2035, the highest among key markets. Growth is expected to be anchored by government-backed marine biotechnology programs, consumer readiness for premium skincare, and large-scale cosmetics production ecosystems. Strong opportunities are anticipated as domestic brands scale up marine-derived actives, while international companies invest in partnerships to strengthen supply security and innovation pipelines. Rapid adoption in anti-aging and brightening segments is forecast to support revenue leadership, while the nutraceutical sector provides additional avenues for product integration.

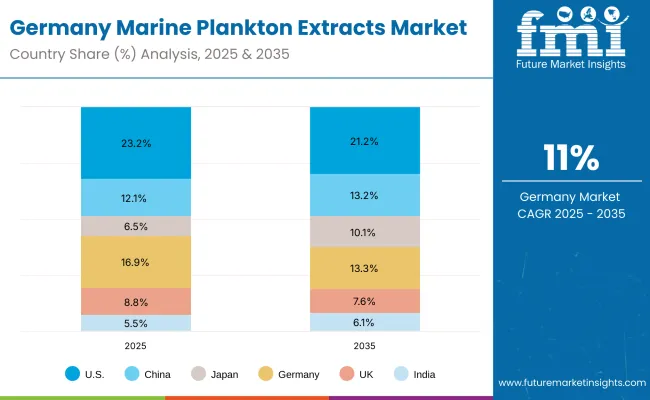

| Countries | 2025 |

|---|---|

| USA | 23.2% |

| China | 12.1% |

| Japan | 6.5% |

| Germany | 16.9% |

| UK | 8.8% |

| India | 5.5% |

| Countries | 2035 |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.3% |

| UK | 7.6% |

| India | 6.1% |

The marine plankton extracts market in Germany is expected to expand at a CAGR of 11.0% from 2025 to 2035, supported by strong dermocosmetic and pharmaceutical industries. Growth is anticipated to be reinforced by demand for clinically validated marine actives, which align with Germany’s tradition of science-driven product innovation. Pharmaceutical-grade formulations are likely to emerge as a competitive differentiator, particularly within anti-aging and hydration categories. Demand is also projected to be shaped by consumer prioritization of sustainability and traceable sourcing. Distribution through specialty pharmacies and retail chains is expected to maintain momentum, while e-commerce platforms expand visibility for premium marine-based brands.

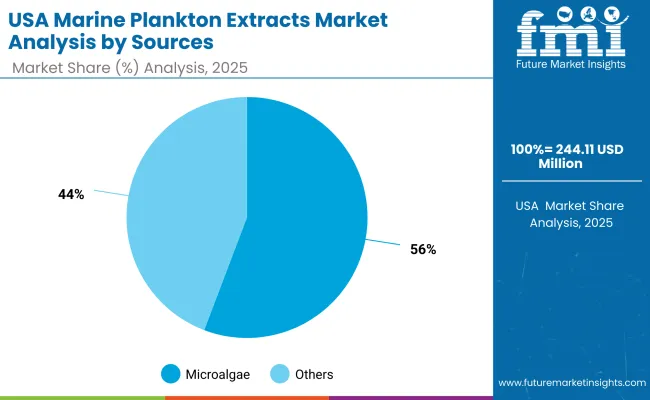

| Segment | Market Value Share, 2025 |

|---|---|

| Microalgae | 55.8% |

| Others | 44.2% |

The Marine Plankton Extracts Market in the United States is projected at USD 244.11 million in 2025. Microalgae contribute 55.8% of the value, while other sources hold 44.2%, signaling a strong preference for controlled, high-purity bioactive ingredients. This microalgae dominance is expected to be reinforced as closed photobioreactor cultivation becomes more cost-efficient and as brands increasingly favor traceable and sustainable ingredient supply chains. The value shift toward microalgae is also anticipated to be accelerated by the growing demand for reproducible bioactivity profiles, which are critical for efficacy claims in anti-aging and hydration formulations.

The market outlook indicates that microalgae-based extracts will continue to benefit from their superior yield consistency and lower contamination risk, positioning them as the preferred input for premium dermocosmetic and cosmeceutical products. Others, while still significant, are expected to serve niche applications and cost-driven formulations but may lose share over time as innovation pipelines increasingly favor microalgae strains with novel functional properties.

Rising adoption of clinical validation, digital consumer engagement, and science-backed claims is expected to support higher price realizations, especially for microalgae-derived actives. Increasing collaborations between USA personal care brands and biotech companies are projected to create differentiated ingredient systems with exclusive intellectual property rights, further elevating the segment’s value contribution. As sustainability disclosures become a prerequisite for retail listings, producers with verifiable carbon and biodiversity footprints are expected to command premium positioning.

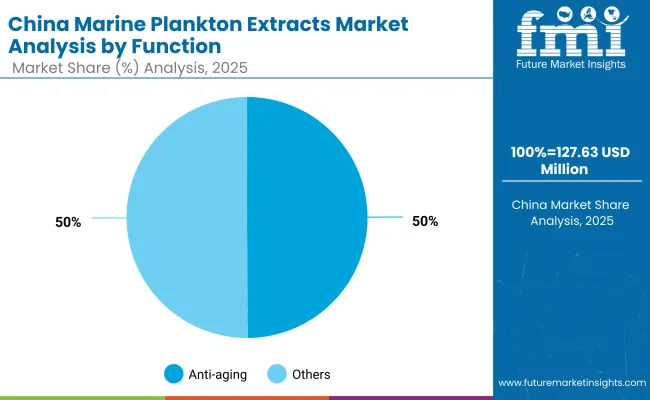

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 49.9% |

| Others | 50.1% |

The Marine Plankton Extracts Market in China is projected at USD 127.63 million in 2025. Anti-aging applications contribute 49.9% (USD 63.7 million), while other functional uses account for 50.1% (USD 63.94 million), showing a nearly balanced demand pattern but signaling an imminent tilt toward anti-aging-driven growth. This slight edge toward anti-aging is expected to widen as premium skincare categories accelerate adoption of clinically proven marine bioactives to meet rising consumer expectations for performance, safety, and visible results.

The projected dominance of anti-aging functionality is being driven by a surge in dermocosmetic innovation and the increasing purchasing power of China’s aging but beauty-conscious population. The “skin health and longevity” narrative is expected to further boost demand, with marine plankton extracts positioned as potent natural sources of antioxidants, peptides, and essential micronutrients. This trend is likely to be amplified by a rapidly maturing regulatory framework that favors ingredients with robust safety and efficacy dossiers, providing a competitive advantage to suppliers investing in standardized and traceable production.

Consumer preference for premium anti-aging formulations is projected to support higher inclusion rates of marine plankton actives in serums, creams, and dermocosmetic supplements. Digital engagement and influencer-driven education are expected to accelerate awareness of marine-derived actives, pushing formulators to integrate these ingredients in high-efficacy product lines.

Rising investments in closed-system cultivation and local biotech collaborations are anticipated to reduce dependency on imports and improve cost efficiency, further stimulating domestic adoption. As China’s beauty and personal care market continues to premiumize, anti-aging formulations leveraging marine plankton extracts are expected to emerge as a critical differentiator for both domestic and global brands operating in the region.

The marine plankton extracts market is moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across cosmetic, nutraceutical, and wellness applications. Global ingredient majors such as BASF, DSM-Firmenich, and Croda are positioned with broad portfolios, clinical substantiation programs, and ESG-led sourcing. Strategies are being steered toward traceable supply chains, photobioreactor scale-up, and co-development with multinational beauty brands to secure premium shelf space and regulatory confidence.

Established mid-sized players including Codif, Greentech, Seppic, and Ashland are anchoring growth through fast iteration, evidence-backed claims in anti-aging/hydration, and white-label partnerships with leading skincare houses. Strong emphasis is being placed on life-cycle assessments, INCI transparency, and data-rich dossiers to reduce brand risk and speed approvals.

Specialists such as Solabia, Algatech, and Biotech Marine are competing through microalgae expertise and application-specific actives, leveraging sustainability credentials and high-purity extraction to win in premium segments. Differentiation is expected to shift from ingredient lists to integrated ecosystems: authenticated sourcing, standardized bioactive titers, and post-launch surveillance linking efficacy to consumer outcomes.

Company relevance check: the listed firms (Codif, Greentech, BASF, DSM-Firmenich, Ashland, Seppic, Solabia, Algatech, BiotechMarine, Croda) are appropriate competitors for marine plankton-based actives.

Key Developments in Marine Plankton Extracts Market

| Item | Value |

|---|---|

| Market size (2025) | USD 1,052.7 million |

| Market size (2035) | USD 3,607.2 million |

| CAGR (2025-2035) | 13.10% |

| Incremental growth (2025-2035) | USD 2,554.5 million |

| Sources covered | Microalgae; Cyanobacteria; Phytoplankton |

| Function split (2025) | Anti-aging 48.5% (USD 509.9 million); Others 51.5% (USD 542.04 million) |

| Product formats | Serums; Creams; Masks; Powders |

| Channel split (2025) | B2B ingredients 46.5% (USD 489.1 million); Others 53.5% (USD 562.88 million) |

| Ceramide type (2025) | Synthetic 48.5%; Others 51.5% |

| Regions covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries covered | United States; China; Japan; India; Germany; United Kingdom |

| High-growth countries (CAGR 2025-2035) | China 23.8%; India 22.5%; Japan 17.4%; UK 14.7%; Germany 11.0%; USA 9.8% |

| Competitive landscape (2025) | Codif 7.7% global value share; Others 92.3% |

| Key companies profiled | Codif; Greentech; BASF; DSM-Firmenich; Ashland; Seppic; Solabia; Algatech; BiotechMarine; Croda |

| Additional scope notes | Sustainability and traceability prioritized; photobioreactor/biotech scale-up expected; clinical validation and clean-label dossiers emphasized; premiumization across e-commerce and specialty retail anticipated; use cases anchored in anti-aging, hydration, brightening, and detox across personal care and nutraceuticals. |

The global Marine Plankton Extracts Market is estimated to be valued at USD 1,052.7 million in 2025.

The market size for the Marine Plankton Extracts Market is projected to reach USD 3,607.2 million by 2035.

The Marine Plankton Extracts Market is expected to grow at a CAGR of 13.1% between 2025 and 2035.

The key product formats in the Marine Plankton Extracts Market are serums, creams, masks, and powders.

In terms of functionality, the anti-aging segment is projected to command 48.5% share in the Marine Plankton Extracts Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA