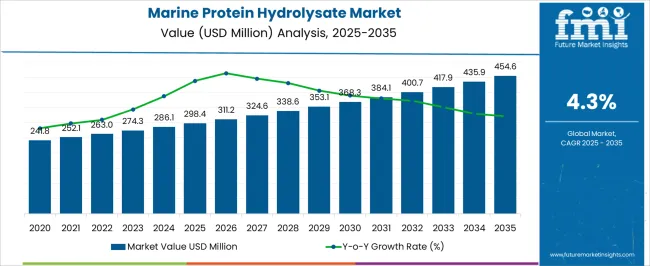

The marine protein hydrolysate market is expected to expand from USD 298.4 million in 2025 to USD 454.6 million by 2035, advancing at a CAGR of 4.3%. This creates an absolute dollar opportunity of USD 156.2 million and a multiplication factor of 1.5x over the ten-year period. Demand is supported by applications in dietary supplements, functional foods, animal feed, and cosmetics, where marine-derived proteins provide bioactive peptides with high digestibility and nutritional benefits.

A 5-year growth block analysis shows how expansion is distributed across the forecast horizon. Between 2025 and 2030, the market adds around USD 65 million, with adoption driven by nutraceuticals in Europe and North America and growing use in aquaculture feed across Asia Pacific. From 2030 to 2035, the market contributes an additional USD 91 million, reflecting stronger growth momentum as innovations in enzymatic hydrolysis and sustainability certifications broaden acceptance in food and personal care sectors. The second block also benefits from expanding consumer awareness of marine-based proteins and their health applications, particularly in Asia Pacific and Latin America. This two-phase pattern demonstrates steady yet regionally diversified growth, where the later half of the decade contributes more significantly to overall market value than the early years.

| Metric | Value |

|---|---|

| Marine Protein Hydrolysate Market Estimated Value in (2025 E) | USD 298.4 million |

| Marine Protein Hydrolysate Market Forecast Value in (2035 F) | USD 454.6 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The marine protein hydrolysate market is primarily shaped by the dietary supplements and nutraceuticals sector, which contributes around 38% of the market share, as these products are widely used for muscle recovery, joint health, and overall nutrition. The animal feed and aquaculture segment accounts for about 30%, utilizing protein hydrolysates to improve digestibility and promote faster growth in livestock and fish. The food and beverage industry represents close to 18%, where marine-derived proteins are incorporated into fortified products. Pharmaceuticals make up roughly 9%, using hydrolysates in formulations for specialized health applications. The remaining 5% comes from cosmetics and personal care products, leveraging bioactive peptides for skin and hair health. The marine protein hydrolysate market is advancing with innovations in extraction processes, product formulations, and applications.

Enzymatic hydrolysis techniques are being refined to produce high-quality, bioactive peptides with targeted health benefits. Clean-label and allergen-free formulations are gaining attention in dietary supplements and functional foods. Marine by-products, such as fish skins and shells, are increasingly being repurposed, supporting efficient resource utilization. Customized blends for sports nutrition and clinical nutrition are becoming more prominent. In cosmetics, hydrolysates are being integrated into anti-aging and moisturizing products.

The Marine Protein Hydrolysate market is witnessing steady growth, driven by rising demand for high-quality protein sources in animal nutrition and specialized food formulations. Increasing awareness regarding sustainable and functional protein sources has amplified the adoption of marine-derived hydrolysates. Fish-based protein hydrolysates are being preferred due to their superior amino acid profile and bioactive peptides, which support enhanced growth performance, immunity, and digestibility in target applications.

In addition, the versatility of protein hydrolysates in different product forms enables incorporation into animal feed, aquaculture diets, and nutritional supplements, expanding their applicability. Growing focus on sustainable marine sourcing practices, coupled with technological advances in enzymatic hydrolysis, has enhanced product consistency, solubility, and flavor profile, further driving market acceptance.

Future opportunities are expected in the development of high-purity hydrolysates tailored for specific animal species and the integration of marine protein hydrolysates into functional foods, supporting both health benefits and environmental sustainability As global protein demand increases and regulatory frameworks encourage natural and functional ingredients, the market is anticipated to maintain robust growth.

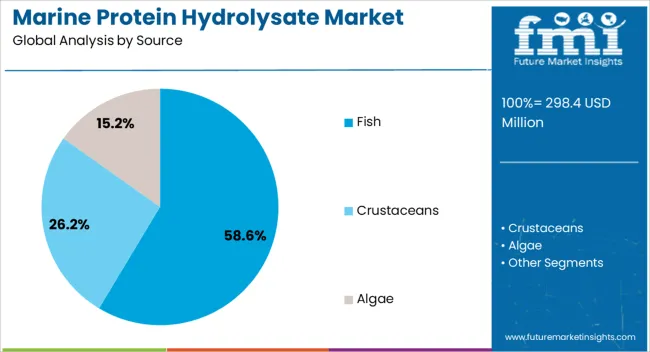

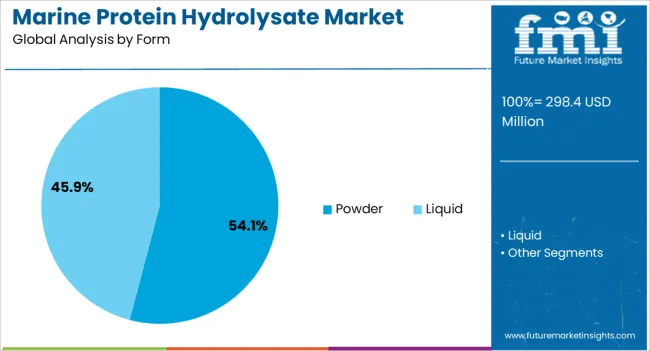

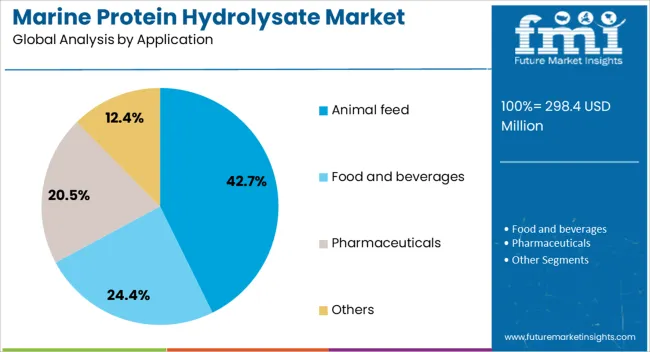

The marine protein hydrolysate market is segmented by source, form, application, and geographic regions. By source, marine protein hydrolysate market is divided into Fish, Crustaceans, and Algae. In terms of form, marine protein hydrolysate market is classified into Powder and Liquid. Based on application, marine protein hydrolysate market is segmented into Animal feed, Food and beverages, Pharmaceuticals, and Others. Regionally, the marine protein hydrolysate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fish source segment is projected to hold 58.6% of the Marine Protein Hydrolysate market revenue share in 2025, establishing it as the leading source category. This dominance is being attributed to the high nutritional value and bioactive content of fish protein hydrolysates, which support enhanced growth, immunity, and digestibility in animal feed and aquaculture applications.

Adoption has been accelerated by advances in enzymatic hydrolysis processes that preserve protein integrity while producing a soluble, palatable product suitable for diverse feed formulations. Additionally, the wide availability of sustainable fish resources, along with optimized processing technologies, has made fish-derived hydrolysates more cost-effective compared to alternative marine or plant-based sources.

The preference for fish as a protein source is further reinforced by regulatory support for natural protein ingredients and increasing demand from commercial aquaculture and livestock sectors seeking functional feed additives As innovation continues in formulation and extraction techniques, fish-derived hydrolysates are expected to maintain their market leadership.

The powder form segment is expected to account for 54.1% of the Marine Protein Hydrolysate market revenue share in 2025, positioning it as the leading form. This leadership is being driven by the ease of handling, storage, and incorporation of powder hydrolysates into feed, aquaculture, and nutritional products.

Powdered formulations provide uniform dispersion, controlled dosing, and extended shelf life, making them highly suitable for industrial and commercial applications. The growth of this segment has also been reinforced by the rising demand for cost-effective and scalable production methods that retain bioactive peptides while minimizing moisture content and microbial contamination.

Additionally, powder forms allow for flexible formulation across various animal species and feed types, enhancing adoption among commercial producers With ongoing technological improvements in spray drying and granulation, the powder form is expected to remain the preferred option in the Marine Protein Hydrolysate market, supporting both performance and operational efficiency.

The animal feed application segment is projected to hold 42.7% of the Marine Protein Hydrolysate market revenue share in 2025, making it the largest application segment. This predominance is being attributed to the high nutritional and functional benefits that hydrolysates provide in livestock and aquaculture diets.

The segment has experienced significant growth due to the increasing demand for protein-rich, digestible, and bioactive-enriched feed ingredients that improve growth performance, immune response, and overall animal health. Regulatory encouragement for natural and sustainable feed additives has also accelerated adoption in commercial farming operations.

Furthermore, the versatility of protein hydrolysates in improving palatability, reducing anti-nutritional factors, and supporting early weaning or stress conditions has strengthened their integration into animal feed formulations. As global protein demand grows and aquaculture and livestock sectors expand, the animal feed application segment is expected to continue driving revenue growth in the Marine Protein Hydrolysate market.

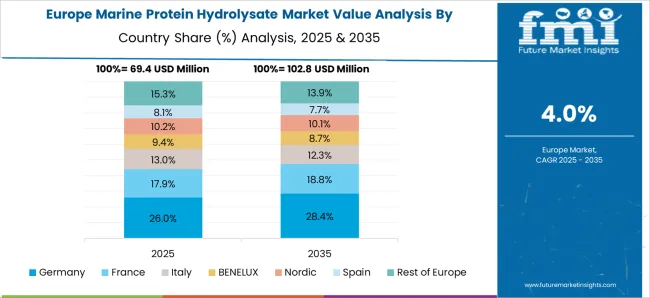

The marine protein hydrolysate market is growing due to increasing use in nutraceuticals, aquaculture feed, functional foods, and pet nutrition. Asia Pacific leads with 37% adoption, driven by China (18%), Japan (12%), and India (7%). Europe holds 32%, led by Germany (11%), France (10%), and UK (11%), while North America contributes 24%, primarily the USA Fish-derived hydrolysates constitute 65% of supply, crustacean 20%, and mollusk 15%. Dietary supplements account for 30% of applications, aquaculture feed 28%, clinical nutrition 15%, and pet nutrition 10%, showing consistent adoption across multiple segments worldwide.

The market growth is supported by increasing demand in dietary supplements, aquaculture feed, and clinical nutrition. Sports nutrition and elderly health supplements contribute 18% of dietary supplement adoption. Aquaculture feed adoption is highest in Asia Pacific, improving growth in salmon, shrimp, and tilapia by 15–20%. North America focuses on functional nutrition and wellness, while Europe emphasizes clinical applications. Pet nutrition accounts for 10% of adoption, driven by consumer preference for hypoallergenic proteins. Advancements in enzymatic hydrolysis enhance digestibility and peptide quality. Growing interest in functional foods, aquaculture, and pet health continues to fuel global expansion across multiple regions and sectors.

Key trends include enzymatic hydrolysis, sustainable raw material sourcing, and diversified product formats. Enzymatic extraction improves peptide quality, while fish by-product utilization reduces waste by 25%. Pet food applications account for 10% of market use, while Europe emphasizes traceable sourcing certifications. Asia Pacific focuses on high-volume, cost-efficient production, and North America invests in marine-derived peptides for pharmaceutical and cosmetic applications. Ready-to-drink protein beverages and powdered blends contribute 12–15% of applications. Expansion in functional foods, clinical nutrition, and pet health products drives innovation and broader adoption across all major markets worldwide.

Market opportunities exist in aquaculture feed, clinical nutrition, and dietary supplements. Aquaculture feed accounts for 28% of adoption, improving growth in farmed fish and shrimp by 15–20%. Dietary supplements represent 30%, clinical nutrition 15%, and pet nutrition 10% of applications. Europe focuses on premium-grade hydrolysates, Asia Pacific leverages abundant fishery by-products, and North America targets functional beverages and peptide-enriched formulations. Ready-to-drink and powdered products are gaining adoption. Bulk procurement by aquaculture operators and nutraceutical manufacturers supports steady demand. Rising consumer interest in high-quality protein sources drives growth in pet nutrition, functional foods, and clinical nutrition segments globally.

Challenges include raw material variability, production costs, and regulatory compliance. Seasonal fluctuations in fish and crustacean supply lead to 8–12% price variations. Enzymatic hydrolysis requires specialized equipment and enzymes, increasing production costs by 15–20%. Safety, labeling, and certification standards in Europe and North America add further costs. Cold chain logistics for peptide-based formulations increase handling expenses. Price sensitivity limits adoption in South and Southeast Asia. Shelf-life, digestibility, and perceived efficacy influence uptake in nutraceutical, aquaculture, and pet nutrition segments. Limited local processing capacity in certain regions constrains near-term market growth despite strong global demand.

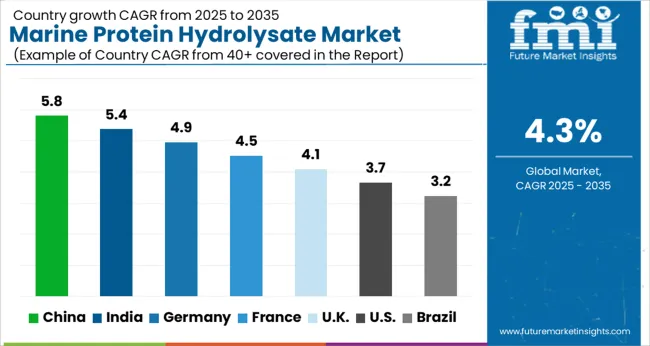

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The marine protein hydrolysate market is projected to advance at a global CAGR of 4.3% through 2035, with regional demand varying across BRICS, OECD, and other economies. China leads with 5.8%, a 1.35× multiple of the global benchmark, supported by large-scale aquaculture production, dietary supplement demand, and functional food applications. India follows at 5.4%, 1.26× the global rate, where usage in animal feed, sports nutrition, and pet food segments is expanding. Germany records 4.9%, about 1.14× the benchmark, underpinned by OECD-driven product innovation, regulatory alignment in nutraceuticals, and health-conscious consumption. The United Kingdom posts 4.1%, or 0.95× the global pace, with moderate uptake in clinical nutrition and specialized food processing. The United States stands at 3.7%, a 0.86× multiple, reflecting applications in dietary supplements and pharmaceutical formulations but with more mature consumption levels. BRICS economies are driving volume growth, OECD nations focus on high-quality formulations, while ASEAN markets are steadily increasing demand for fish-based protein hydrolysates in feed and functional food industries.

The marine protein hydrolysate market in China is projected to grow at a CAGR of 5.8%, driven by rising demand in aquaculture, animal feed, and functional food applications. Domestic producers such as Shandong Longda Bioengineering and Fujian Marine Biotechnology supply high-quality hydrolysates for livestock and poultry feed, as well as nutraceuticals. Technological focus includes enhanced amino acid profiles, enzymatic hydrolysis methods, and improved digestibility. Demand is also influenced by government support for sustainable aquaculture and nutritional enhancement programs for livestock and fish.

The marine protein hydrolysate market in India is expected to grow at a CAGR of 5.4%, supported by expanding aquaculture, livestock feed, and dietary supplement sectors. Key domestic players such as Sea6 Energy and Blue Ocean Biotech supply enzymatically hydrolyzed marine proteins for poultry, fish, and pet nutrition. Technological innovation emphasizes protein bioavailability, amino acid concentration, and odor-neutralization techniques. Growth is driven by increasing consumer awareness of protein-enriched products and adoption of nutritionally fortified feeds. Export potential to Southeast Asian countries also supports market expansion.

Germany’s marine protein hydrolysate market is projected to grow at a CAGR of 4.9%, influenced by demand for functional foods, animal feed supplementation, and nutraceutical products. Companies such as Evonik Industries and Ocean Nutrition provide high-quality enzymatically hydrolyzed protein powders. Regulatory standards on feed quality and human consumption drive technological improvements, including enhanced amino acid retention, low allergenicity, and solubility. Demand is mainly concentrated in aquaculture, pet food, and functional nutrition sectors, with exports to neighboring European countries further supporting market growth.

The marine protein hydrolysate market in the United Kingdom is expected to grow at a CAGR of 4.1%, driven by demand in aquaculture, functional foods, and dietary supplements. Suppliers provide enzymatically hydrolyzed proteins optimized for digestibility, bioactive peptides, and minimal odor. Consumer awareness of high-protein nutrition and the rise of health-focused pet food products contribute to market expansion. Sustainable sourcing and eco-friendly processing are increasingly influencing purchasing decisions.

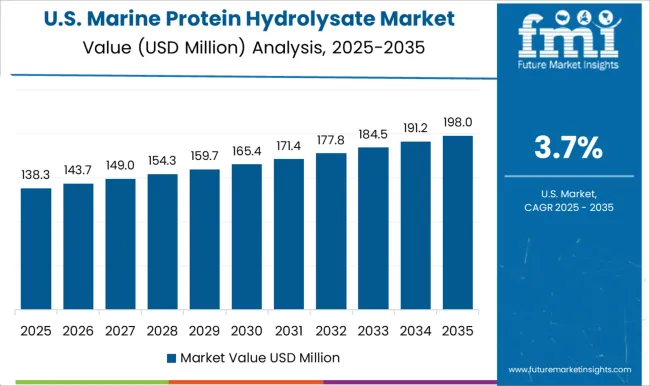

The marine protein hydrolysate market in the United States is projected to grow at a CAGR of 3.7%, supported by demand for animal feed, aquaculture, and dietary supplements. Major suppliers such as Archer Daniels Midland and Omega Protein provide high-quality enzymatically hydrolyzed products. Technological innovation focuses on improved protein digestibility, amino acid retention, and odor-neutralization. Growth is also influenced by increasing awareness of functional nutrition in pet food and human supplements.

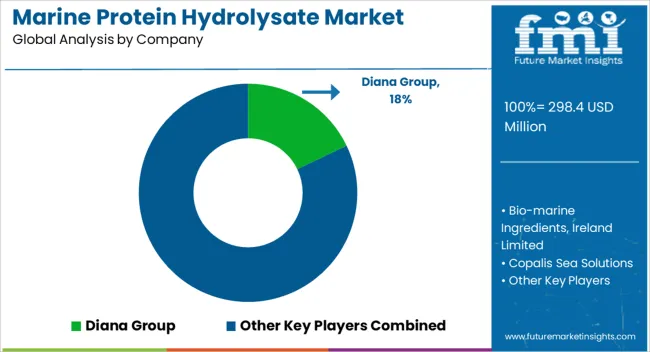

Competition in the marine protein hydrolysate market is being shaped by product purity, bioavailability, and application versatility for aquaculture, animal feed, and nutraceutical sectors. Market positions are being reinforced through advanced hydrolysis technologies, quality assurance, and global supply networks that ensure consistent production and compliance with safety standards. Diana Group and Bio-marine Ingredients, Ireland Limited are being represented with high-quality protein hydrolysates engineered for optimal digestibility and amino acid retention. Copalis Sea Solutions and CR Brown Enterprises are being promoted with marine-derived solutions structured for aquaculture growth and feed efficiency. Hofseth BioCare ASA and Janatha Fish Meal & Oil Products are being applied with hydrolysates optimized for stability, nutritional content, and sustainability in fish and livestock diets.

Marutham Bio Ages Innovations and SAMPI are supplying products designed for functional feed additives and performance enhancement. Scanbio Marine Group AS and Sopropêche are being advanced with solutions focused on bioactive peptides and balanced nutritional profiles. Vinh Hoan Seafood JSC, Enviro Tech International Ltd., Amano Enzyme Inc., Bio-Cat, Inc., and Biomax Ltd. are being utilized with specialized hydrolysates structured for aquafeed, animal nutrition, and industrial applications. Strategies in the market are being centered on enhancing protein quality, expanding application ranges, and ensuring regulatory compliance. Research and development are being allocated to improve enzymatic hydrolysis methods, peptide bioactivity, and stability under processing conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 298.4 Million |

| Source | Fish, Crustaceans, and Algae |

| Form | Powder and Liquid |

| Application | Animal feed, Food and beverages, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Diana Group, Bio-marine Ingredients, Ireland Limited, Copalis Sea Solutions, CR Brown Enterprises, Hofseth BioCare ASA, Janatha Fish Meal & Oil Products, Marutham Bio Ages Innovations (P) Ltd, SAMPI, Scanbio Marine Group AS, Sopropêche, Vinh Hoan Seafood JSC, Enviro Tech International Ltd., Amano Enzyme Inc., Bio-Cat, Inc., and Biomax Ltd. |

| Additional Attributes | Dollar sales by product type and end use, demand dynamics across animal feed, aquaculture, and nutraceuticals, regional trends in protein ingredient adoption, innovation in enzymatic processing and bioavailability, environmental impact of marine sourcing and waste, and emerging use cases in functional foods, supplements, and sustainable aquafeed. |

The global marine protein hydrolysate market is estimated to be valued at USD 298.4 million in 2025.

The market size for the marine protein hydrolysate market is projected to reach USD 454.6 million by 2035.

The marine protein hydrolysate market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in marine protein hydrolysate market are fish, crustaceans and algae.

In terms of form, powder segment to command 54.1% share in the marine protein hydrolysate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA