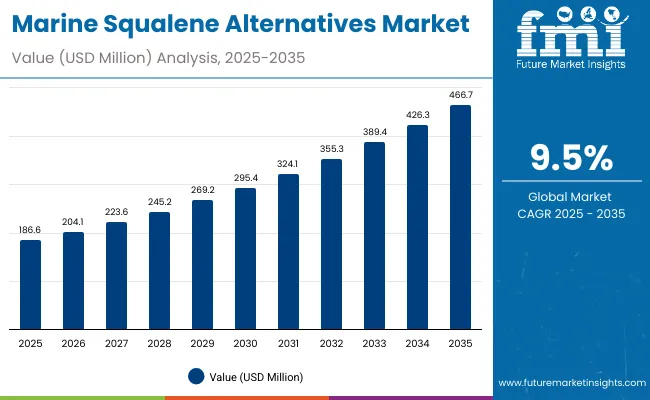

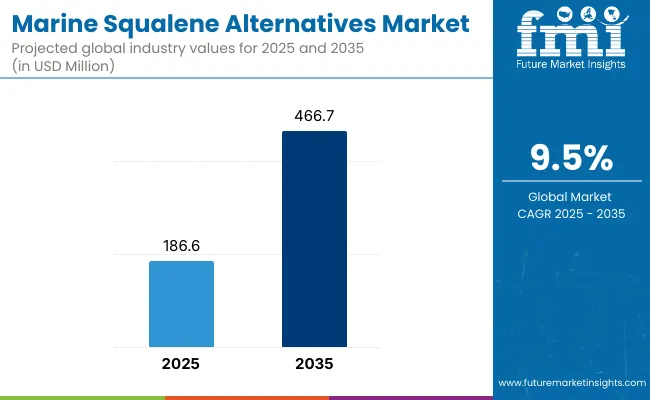

The Marine Squalene Alternatives Market is projected to record a valuation of USD 186.6 million in 2025 and reach USD 466.7 million in 2035, representing an absolute increase of over USD 280.1 million during the period. The overall expansion reflects a CAGR of 9.5%, underscoring strong momentum driven by sustainability imperatives, ethical sourcing, and innovation in biotechnology.

Marine Squalene Alternatives Market Key Takeaways

| Metric | Value |

|---|---|

| Marine Squalene Alternatives Estimated Value in (2025E) | USD 186.6 million |

| Marine Squalene Alternatives Forecast Value in (2035F) | USD 466.7 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

During the first half of the decade (2025-2030), the market is expected to expand from USD 186.6 million to nearly USD 295.4 million, adding approximately USD 108.8 million, which accounts for nearly 39% of total decade growth. This early phase is anticipated to be characterized by steady adoption across cosmetics and nutraceuticals, supported by rising consumer preference for cruelty-free and traceable ingredients. Demand is further reinforced by advancements in microbial fermentation and yeast-based pathways, which are projected to enhance cost competitiveness and supply resilience.

The second half of the forecast horizon (2030-2035) is projected to accelerate more strongly, contributing nearly USD 171.3 million around 61% of total growth as the market scales from USD 295.4 million to USD 466.7 million. This acceleration is expected to be underpinned by broader pharmaceutical integration, improved industrial refining of squalane, and greater penetration into functional food applications. Partnerships between biotechnology firms and global consumer goods companies are anticipated to deepen, ensuring both secure supply and innovation leadership.

By 2035, marine squalene alternatives are expected to evolve from niche sustainability substitutes into mainstream bio-based lipid solutions, redefining competitive standards across cosmetic, pharmaceutical, and nutraceutical industries.

From 2020 to 2024, the Marine Squalene Alternatives Market expanded steadily, driven by the growing replacement of shark-derived squalene with bio-based and fermentation-derived alternatives. During this period, cosmetics and personal care applications commanded the majority of demand, supported by consumer advocacy for ethical sourcing and regulatory pressure on marine-derived ingredients. Competitive differentiation was based on purity, traceability, and alignment with sustainability certifications.

By 2025, market value is projected at USD 186.6 million, with momentum shifting toward biotechnology-driven solutions such as synthetic biology and microbial fermentation. By 2035, as the market approaches USD 466.7 million, digital bio-manufacturing, supply chain traceability, and eco-certification are expected to drive adoption. Industry leaders are anticipated to evolve toward hybrid models, combining traditional plant-based oils with scalable biotech platforms, while new entrants specializing in fermentation efficiency and synthetic biology pathways are forecasted to capture rising shares. Competitive advantage is projected to move from raw material access to innovation ecosystems, intellectual property, and sustainability-driven branding.

The growth of the Marine Squalene Alternatives Market is being driven by a confluence of sustainability imperatives, ethical sourcing requirements, and evolving consumer expectations. Increasing restrictions on shark-derived squalene have reinforced the urgency for sustainable substitutes, with regulatory pressures aligning closely with consumer advocacy for cruelty-free and traceable ingredients. Strong policy backing in Europe and East Asia is expected to further accelerate adoption across industries.

Advances in biotechnology, particularly microbial and yeast-based fermentation, are being leveraged to enhance scalability and cost efficiency. Synthetic biology is anticipated to play a transformative role by enabling consistent, high-purity outputs that reduce dependency on natural variability. These innovations are allowing manufacturers to secure competitive advantages by aligning environmental stewardship with economic viability.

End-use demand is being amplified by cosmetics and personal care manufacturers, who are under increasing scrutiny to demonstrate clean-label and ethical sourcing practices. Pharmaceutical and nutraceutical sectors are also expected to expand usage, owing to the functional health benefits and high stability of squalane derivatives. Collaborative partnerships between biotech firms and global consumer goods companies are reinforcing supply security while accelerating commercial-scale adoption.

As sustainability commitments deepen and biotechnology advances mature, market growth is projected to strengthen further, positioning marine squalene alternatives as a mainstream bio-based lipid solution in the decade ahead.

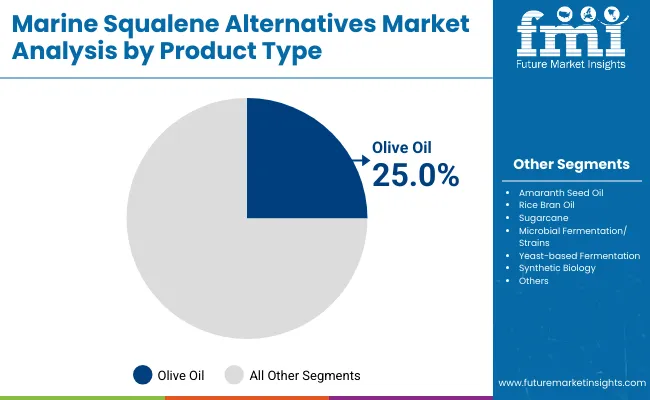

The Marine Squalene Alternatives Market has been segmented across product type, end-use application, and purity grade, reflecting the structural dynamics shaping its growth trajectory. By product type, diversification across plant oils, microbial fermentation, yeast-based pathways, and synthetic biology underscores the transition from traditional to next-generation sustainable sources. Each pathway offers distinct cost, scalability, and purity advantages, making the competitive landscape highly innovation-driven. In terms of end-use application, adoption is being accelerated by cosmetics and personal care, pharmaceuticals, nutraceuticals, food and beverages, and industrial sectors. Each vertical demonstrates unique demand patterns, with sustainability, traceability, and performance emerging as unifying growth drivers. Purity grades further define the market’s evolution, with cosmetic, pharmaceutical/GMP, and food/nutraceutical grades aligning with regulatory requirements and consumer trust. The interplay of these segments indicates that innovation in biotechnology and rising ethical standards are projected to redefine adoption curves across all categories over the forecast period.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Olive oil | 25.0% |

| Amaranth seed oil | 15.0% |

Olive oil-derived squalene alternatives are projected to command the largest share at 25% in 2025, underpinned by established supply chains and consumer familiarity with plant-derived ingredients. While traditional oils retain dominance, the fastest growth is expected from synthetic biology and yeast-based fermentation, driven by precision scalability and reduced agricultural dependency. Microbial strains are anticipated to strengthen mid-term competitiveness by offering stable yields under controlled environments. Collectively, the product type landscape is forecasted to evolve from reliance on agricultural crops toward biotechnology-led solutions. Strategic integration of plant oils with fermentation-based pathways is expected to create hybrid models, ensuring both cost efficiency and supply security. As regulatory scrutiny heightens, product differentiation based on sustainability credentials and traceability is likely to emerge as a defining advantage across all product categories.

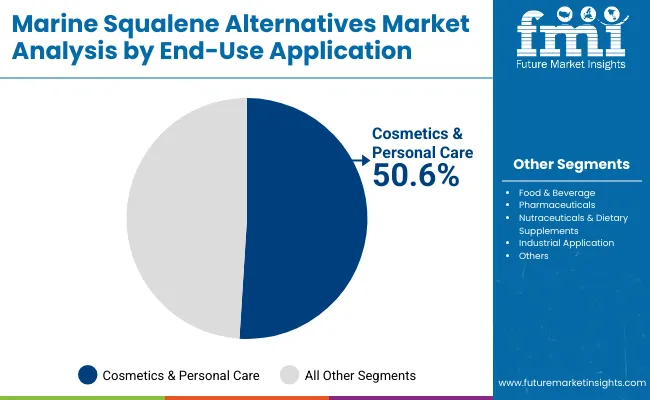

| End-Use Application | 2025 Share% |

|---|---|

| Cosmetics & Personal Care | 50.6% |

| Food & beverage | 14.5% |

| Pharmaceuticals | 12.0% |

Cosmetics and personal care are projected to dominate demand with a 50.6% market share in 2025, driven by the global transition toward cruelty-free, ethical, and sustainable formulations. Brands are increasingly adopting marine squalene alternatives to align with clean-label standards and consumer transparency expectations. The pharmaceutical and nutraceutical sectors are expected to expand adoption at higher CAGRs, supported by bioactive properties and GMP-grade innovations. Food and beverage applications are anticipated to grow steadily as lipid-based fortification gains relevance. Industrial use, though smaller, is projected to rise at the fastest pace due to the demand for bio-based lubricants and specialty applications. This multi-sector integration highlights the versatility of squalene alternatives. By 2035, cosmetics are expected to retain leadership, but pharmaceuticals and industrial applications are anticipated to drive incremental volume growth, diversifying the end-use footprint of the market.

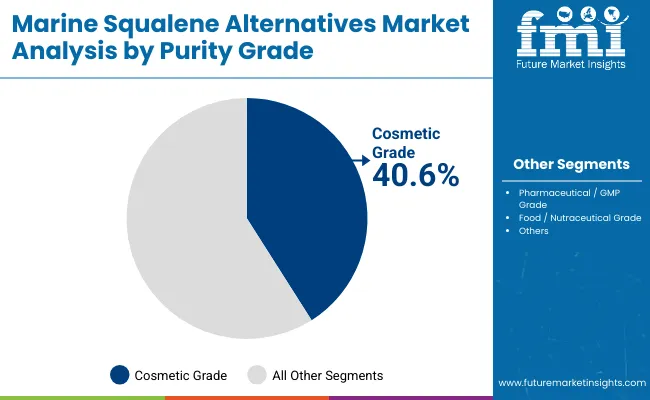

| Purity Grade | 2025 Share% |

|---|---|

| Cosmetic Grade | 40.6% |

| Pharmaceutical / GMP Grade | 34.2% |

| Food / Nutraceutical Grade | 25.2% |

Cosmetic-grade squalene alternatives are expected to remain the dominant category with a 40.6% share in 2025, reflecting their widespread adoption in skincare, haircare, and personal care formulations. This dominance is supported by performance attributes such as emolliency, stability, and consumer preference for natural alternatives. Pharmaceutical/GMP-grade products are anticipated to post strong growth, fueled by clinical validation, stringent quality requirements, and expansion into high-value therapeutic formulations. Food and nutraceutical-grade squalene is projected to grow steadily, with demand driven by dietary supplements and functional foods. The interplay of grades demonstrates how regulatory compliance and quality assurance will remain central to market expansion. As manufacturing capabilities advance, higher-purity formulations are expected to gain traction, reshaping competitive differentiation. Cosmetic grade will continue to hold leadership, yet pharmaceutical and nutraceutical adoption will be pivotal in diversifying long-term growth avenues.

The Marine Squalene Alternatives Market is being shaped by sustainability imperatives, biotechnology innovations, and rising ethical sourcing demands. While opportunities are expanding across cosmetics, pharmaceuticals, and nutraceuticals, challenges remain in scaling production and achieving cost parity. Regulatory support and consumer-driven sustainability goals are projected to reinforce long-term adoption, positioning the market as a transformative bio-based lipid segment.

Ethical Sourcing and Sustainability Imperatives

Market growth is being propelled by escalating demand for ethical and sustainable ingredients. Heightened restrictions on shark-derived squalene, combined with consumer advocacy for cruelty-free sourcing, are expected to accelerate the adoption of plant, microbial, and synthetic biology-derived alternatives. Companies are projected to leverage sustainability certifications and traceability mechanisms to strengthen brand value. This shift is anticipated to transform marine squalene alternatives from niche substitutes into mainstream bio-based lipid solutions, creating lasting demand across personal care, pharmaceutical, and nutraceutical applications. Regulatory reinforcement and industry sustainability commitments are likely to amplify this driver over the forecast horizon, ensuring long-term market expansion.

Biotechnology-led Transformation through Fermentation Pathways

A major trend reshaping the market is the integration of microbial and yeast-based fermentation as scalable production models. Synthetic biology innovations are being deployed to deliver higher-purity squalane with predictable yields, reducing dependency on agricultural variability. This trend is expected to diversify the supply chain while lowering long-term costs, strengthening competitiveness against conventional oils. Strategic alliances between biotechnology firms and downstream manufacturers are projected to accelerate commercialization, embedding these alternatives into global cosmetic and pharmaceutical formulations. As fermentation efficiency improves, marine squalene alternatives are anticipated to evolve into a benchmark for innovation-driven sustainability within the global bio-ingredients industry.

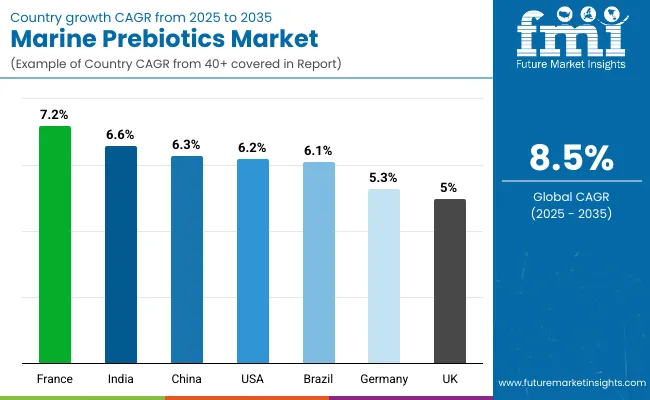

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

| India | 6.6% |

| Germany | 5.3% |

| France | 7.2% |

| UK | 5.0% |

| USA | 6.2% |

| Brazil | 6.1% |

The Marine Squalene Alternatives Market demonstrates varied growth trajectories across key countries, shaped by regulatory frameworks, biotechnology investments, and consumer-driven sustainability expectations. In Asia, China is projected to grow at a 6.3% CAGR, supported by strong cosmetics and nutraceutical demand, alongside rapid advances in fermentation-based production. India, with a 6.6% CAGR, is expected to accelerate adoption due to expanding pharmaceutical manufacturing and growing investments in plant-based and synthetic biology platforms.

Europe remains a strategic growth hub, reinforced by stringent sustainability mandates and ethical sourcing regulations. France leads regional momentum with a 7.2% CAGR, driven by its strong cosmetics sector and proactive policies on green chemistry. Germany, advancing at 5.3% CAGR, is expected to integrate alternatives more gradually, with adoption tied to industrial applications and pharmaceutical-grade formulations. The UK, at 5.0% CAGR, reflects steady but conservative uptake, largely influenced by personal care innovations and supply chain shifts post-Brexit.

North America shows a moderate but steady profile, with the USA expanding at 6.2% CAGR, underpinned by biotechnology R&D, dietary supplement growth, and alignment with FDA quality standards. In Latin America, Brazil, at 6.1% CAGR, is projected to emerge as a regional growth engine, supported by expanding cosmetics and food supplement industries and an increasing focus on bio-based ingredients.

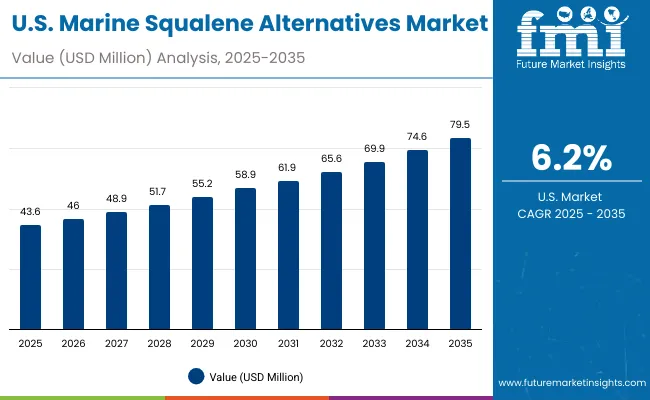

| Year | USA Marine Squalene Alternatives Market (USD Million) |

|---|---|

| 2025 | 43.6 |

| 2026 | 46.0 |

| 2027 | 48.9 |

| 2028 | 51.7 |

| 2029 | 55.2 |

| 2030 | 58.9 |

| 2031 | 61.9 |

| 2032 | 65.6 |

| 2033 | 69.9 |

| 2034 | 74.6 |

| 2035 | 79.5 |

The Marine Squalene Alternatives Market in the United States is projected to expand at a 6.1% CAGR between 2025 and 2035, reflecting a steady transition toward sustainable and traceable lipid solutions. Growth is being reinforced by strong consumer demand for cruelty-free cosmetics, FDA-compliant pharmaceutical innovations, and the rising popularity of nutraceutical formulations.

Personal care brands are expected to remain key adopters, with bio-based squalane increasingly integrated into skincare and haircare product lines. Pharmaceutical manufacturers are anticipated to accelerate uptake of GMP-grade squalene for therapeutic applications, ensuring alignment with stringent quality standards. Nutraceuticals and functional foods are also projected to expand their share, driven by consumer preference for natural bioactives.

Partnerships between biotechnology innovators and USA-based consumer goods companies are likely to strengthen supply chain security and drive early commercialization of synthetic biology-derived alternatives. Industrial applications, though smaller in scale, are projected to gain momentum through the adoption of bio-based lubricants and specialty formulations.

The Marine Squalene Alternatives Market in the UK is projected to grow at a 5.0% CAGR from 2025 to 2035, reflecting steady but measured adoption. Growth is being driven by increasing demand for sustainable cosmetics and the premiumization of personal care brands. Pharmaceutical applications are expanding more slowly but remain supported by regulatory alignment with EU-derived standards. Nutraceutical usage is expected to benefit from heightened consumer health awareness, while industrial adoption remains limited. As supply chain resilience becomes a focus post-Brexit, domestic partnerships with biotechnology innovators are anticipated to gain momentum.

The Marine Squalene Alternatives Market in China is expected to grow at a 6.3% CAGR, driven by the strong presence of domestic cosmetics and nutraceutical manufacturers. Rapid regulatory alignment with sustainability and green chemistry initiatives is reinforcing adoption. Pharmaceutical uptake is anticipated to increase as domestic companies scale GMP-grade production for both local and export markets. Biotechnology-led production, particularly fermentation and synthetic biology, is projected to expand as government-backed investments strengthen the innovation ecosystem. Rising consumer emphasis on traceability and safety is likely to boost demand across premium product categories.

The Marine Squalene Alternatives Market in India is forecasted to expand at a 6.6% CAGR, supported by a rapidly growing pharmaceutical manufacturing sector and rising consumer awareness of plant-based and cruelty-free products. Nutraceutical adoption is expected to accelerate as urban populations prioritize preventive health. Cosmetics and personal care adoption remains concentrated in premium categories but is projected to expand with the growth of e-commerce distribution. Biotechnology-driven production models are likely to gain traction as domestic players invest in fermentation-based and synthetic biology pathways. India’s role as an export hub is also anticipated to strengthen adoption of GMP-grade squalene alternatives.

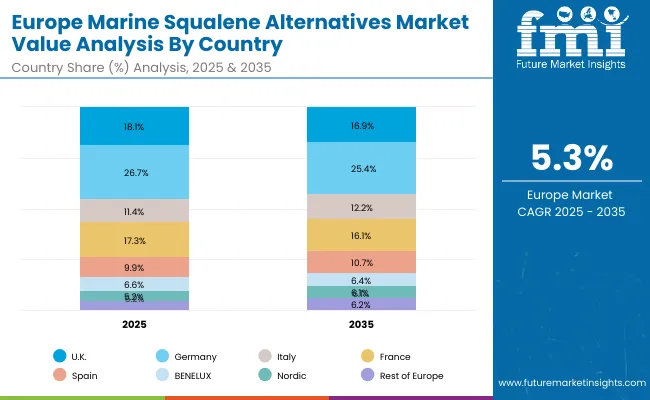

| Country | 2025 |

|---|---|

| UK | 18.1% |

| Germany | 26.7% |

| Italy | 11.4% |

| France | 17.3% |

| Spain | 9.9% |

| BENELUX | 6.6% |

| Nordic | 5.2% |

| Rest of Europe | 4.8% |

| Country | 2035 |

|---|---|

| UK | 16.9% |

| Germany | 25.4% |

| Italy | 12.2% |

| France | 16.1% |

| Spain | 10.7% |

| BENELUX | 6.4% |

| Nordic | 6.1% |

| Rest of Europe | 6.2% |

The Marine Squalene Alternatives Market in Germany is projected to grow at a 5.3% CAGR, reflecting steady uptake across cosmetics, pharmaceuticals, and industrial applications. Stringent sustainability regulations and strong consumer preference for eco-certified products are driving cosmetics adoption. Pharmaceutical usage is expanding, supported by Germany’s leadership in clinical research and compliance with GMP standards. Industrial applications, though smaller in value, are projected to benefit from the country’s strong bioeconomy agenda. Partnerships between domestic biotech startups and European consumer goods majors are expected to secure innovation-led adoption. By 2035, Germany is anticipated to remain a key European anchor market for high-quality squalene alternatives.

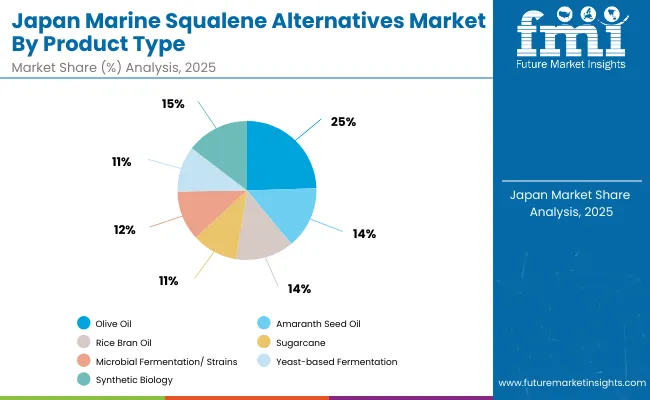

| Product Type | Market Value Share, 2025 |

|---|---|

| Olive oil | 24.5% |

| Amaranth seed oil | 14.5% |

| Rice bran oil | 13.5% |

| Sugarcane | 10.7% |

| Microbial fermentation/ Strains | 11.6% |

| Yeast-based fermentation | 10.6% |

| Synthetic biology | 14.6% |

The Marine Squalene Alternatives Market in Japan is projected to achieve a significant share in 2025, reflecting a strong domestic emphasis on sustainable innovation. Olive oil remains the leading category at 24.5%, supported by established sourcing channels and consumer trust in plant-derived ingredients. However, synthetic biology, at 14.6%, is emerging as the most dynamic pathway, reflecting Japan’s deep investment in precision fermentation and advanced biotechnology platforms.

Microbial and yeast-based solutions, collectively accounting for more than 22%, demonstrate rising acceptance as scalable and reliable sources that align with the nation’s focus on high-purity, traceable ingredients for cosmetics and pharmaceuticals. Amaranth and rice bran oils provide continuity from traditional supply chains but are gradually being complemented by biotech-led innovations. This blend of traditional and advanced approaches is anticipated to define Japan’s growth outlook.

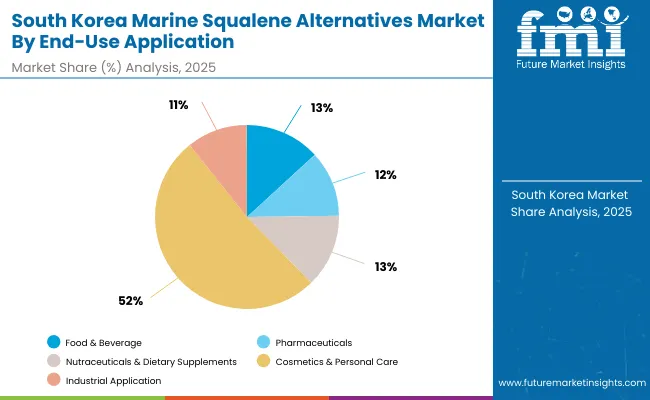

| End-Use Application | Market Value Share, 2025 |

|---|---|

| Food & beverage | 13.2% |

| Pharmaceuticals | 11.6% |

| Nutraceuticals & Dietary Supplements | 12.9% |

| Cosmetics & Personal Care | 51.6% |

| Industrial Application | 10.7% |

The Marine Squalene Alternatives Market in South Korea is projected to achieve strong growth, anchored by the dominance of cosmetics and personal care, which account for 51.6% of market share in 2025. This leadership is being reinforced by South Korea’s global reputation as a hub for skincare and K-beauty innovation, where bio-based and cruelty-free formulations are becoming essential to competitiveness.

Pharmaceutical and nutraceutical applications are expected to expand steadily, with market shares of 11.6% and 12.9%, supported by the nation’s advanced healthcare infrastructure and rising consumer awareness of preventive wellness. Food and beverage usage, while smaller in scale, reflects opportunities in functional fortification and clean-label ingredients. Industrial applications, projected at the fastest CAGR of 8.5%, are anticipated to grow through bio-based lubricants and specialty chemical innovations.

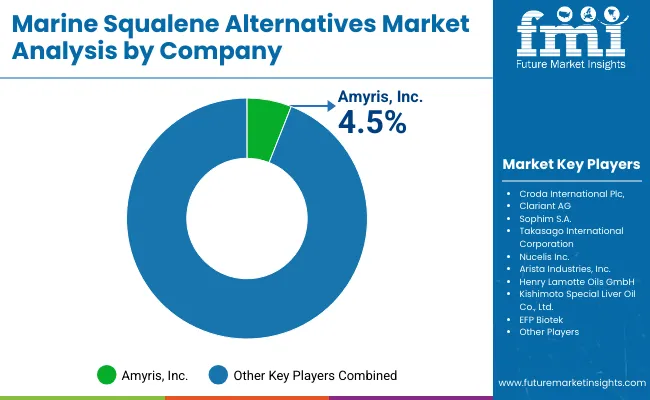

| Company | Global Value Share 2025 |

|---|---|

| Amyris, Inc. | 4 .5% |

| Others | 95 .5% |

The Marine Squalene Alternatives Market is moderately fragmented, with global leaders, biotechnology innovators, and niche-focused suppliers competing across diverse applications. Established players such as Croda International Plc, Clariant AG, and Takasago International Corporation are positioned as global leaders, leveraging extensive portfolios in specialty chemicals and sustainable ingredients. Their strategies are being directed toward biotechnology integration, high-purity squalane formulations, and partnerships with multinational cosmetics and pharmaceutical brands.

Mid-sized innovators, including Amyris, Inc., Sophim S.A., and Nucelis Inc., are advancing through synthetic biology, yeast-based fermentation, and precision biotechnology platforms. These companies are increasingly differentiating themselves by offering scalable, traceable, and ethically sourced alternatives that directly address the limitations of shark-derived squalene. Their focus on intellectual property and collaborative commercialization is expected to strengthen competitive positioning.

Niche suppliers such as Kishimoto Special Liver Oil Co., Arista Industries, Henry Lamotte Oils GmbH, and EFP Biotek are contributing through specialized sourcing, tailored formulations, and region-specific distribution networks. Their strength lies in supplying cost-effective, application-focused solutions for smaller cosmetics, nutraceutical, and food manufacturers.

Competitive differentiation is projected to shift from raw material substitution toward integrated solutions emphasizing biotechnology innovation, regulatory compliance, and sustainability certifications. The long-term competitive edge is expected to be defined by supply security, purity standards, and alignment with ethical sourcing mandates.

Key Developments in Marine Squalene Alternatives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 186.6 million |

| Product Type | Olive oil, Amaranth seed oil, Rice bran oil, Sugarcane, Microbial fermentation/Strains, Yeast-based fermentation, Synthetic biology |

| Form | Squalene (pure compound), Squalane (hydrogenated, stabilized form) |

| Purity Grade | Cosmetic Grade, Pharmaceutical/GMP Grade, Food/Nutraceutical Grade |

| End-Use Application | Food & Beverage, Pharmaceuticals, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care, Industrial Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amyris, Inc., Croda International Plc, Clariant AG, Sophim S.A., Takasago International Corporation, Nucelis Inc., Arista Industries, Inc., Henry Lamotte Oils GmbH, Kishimoto Special Liver Oil Co., Ltd., EFP Biotek |

| Additional Attributes | Market dollar sales by product type, form, and end-use application; adoption trends in cosmetics, nutraceuticals, and pharmaceuticals; rising demand for synthetic biology and microbial fermentation; regulatory and sustainability drivers across Europe and East Asia; strategic collaborations between biotech innovators and consumer goods companies; increasing competitiveness based on purity, traceability, and eco-certification; regional variations in adoption driven by ethical sourcing and consumer awareness. |

The Marine Squalene Alternatives is estimated to be valued at USD 186.6 million in 2025.

The market size for the Marine Squalene Alternatives is projected to reach USD 466.7 million by 2035.

The Marine Squalene Alternatives is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in the Marine Squalene Alternatives Market are olive oil, amaranth seed oil, rice bran oil, sugarcane, microbial fermentation/strains, yeast-based fermentation, and synthetic biology-based production.

In terms of end-use application, the cosmetics and personal care segment is projected to command the largest share, accounting for 50.6% of the Marine Squalene Alternatives Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA