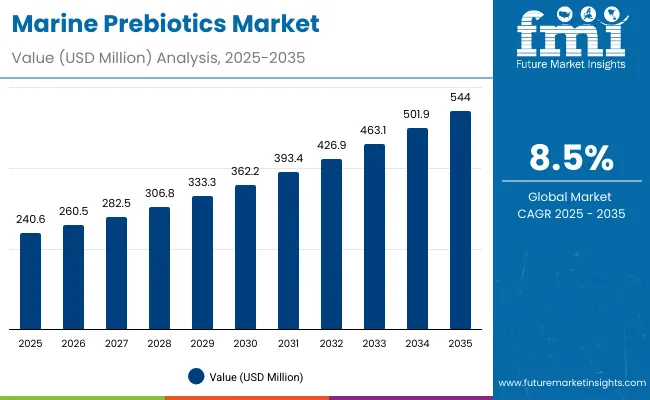

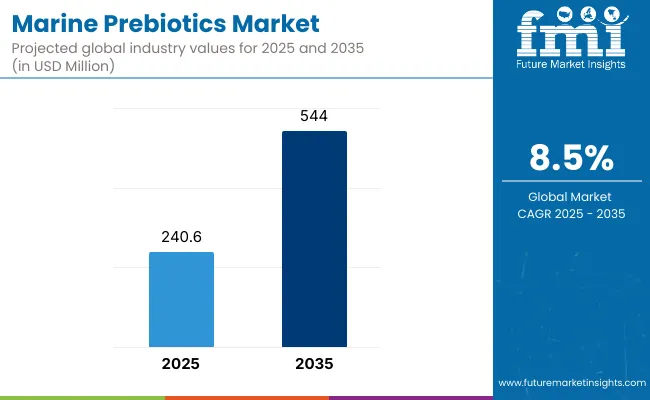

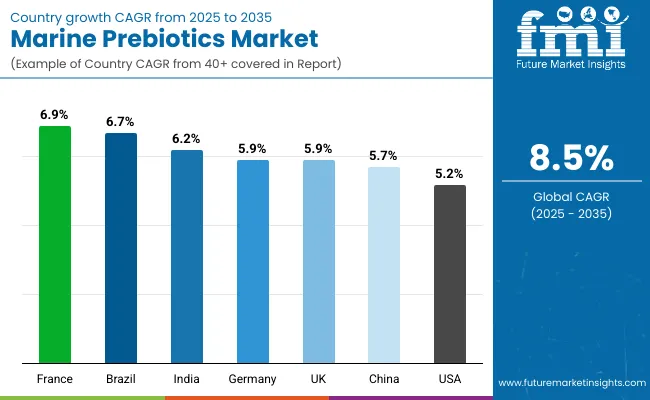

The global Marine Prebiotics Market has been projected to be valued at USD 240.6 million in 2025 and is anticipated to reach approximately USD 544.0 million by 2035. A cumulative gain of USD 264.9 million is expected over the forecast decade, signaling a 8.5% CAGR positioning marine-derived prebiotics as one of the most dynamic categories within functional health and nutrition.

Marine Prebiotics Market Key Takeaways

| Metric | Value |

|---|---|

| Marine Prebiotics Estimated Value in (2025E) | USD 240.6 million |

| Marine Prebiotics Forecast Value in (2035F) | USD 544.0 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

Future adoption is likely to be reinforced by innovation in extraction technologies, clinical research, and targeted formulation strategies, allowing suppliers to enhance bioavailability and substantiate health claims. With the convergence of nutraceuticals, functional foods, and medical nutrition, marine prebiotics are expected to be absorbed into diversified end-use sectors, including infant and clinical nutrition, animal feed, pharmaceuticals, and cosmetics.

During the initial phase from 2025 to 2030, the market is anticipated to rise from USD 240.6 million to approximately USD 362.2 million, accounting for nearly 40% of the total decade expansion. This stage of growth is expected to be shaped by rising adoption across dietary supplements and functional foods, with early traction emerging in infant nutrition and medical formulations. The narrative during this phase will be centered on proof-of-concept validation, clinical research support, and heightened consumer awareness regarding the unique benefits of marine bioactives.

The subsequent phase from 2030 to 2035 is forecasted to accelerate further, with the market advancing from USD 362.2 million to USD 544.0 million. This period is expected to contribute about 60% of the decade’s growth, supported by regulatory clarity, expanding application in pharmaceuticals and cosmetics, and a broader push for sustainability in sourcing. By the end of the forecast horizon, marine prebiotics are anticipated to transition from niche adoption to mainstream incorporation, underscoring their role in the evolving microbiome economy.

From 2020 to 2024, the Marine Prebiotics Market was propelled by early adoption of seaweed- and algae-based bioactives in nutraceuticals and functional foods, with marine polysaccharides gaining significant traction. During this period, global ingredient leaders and marine biotechnology firms consolidated their presence by scaling extraction and fermentation technologies, enabling cost efficiency and broader application integration. Competitive differentiation relied on sustainability, traceability, and clinical validation, with supplements serving as the entry point for consumer adoption.

By 2025, the market is projected to reach USD 240.6 million, and by 2035, revenues are expected to cross USD 544.0 million. The revenue mix will shift as pharmaceuticals, cosmetics, and aquaculture applications expand their share. Established leaders are expected to pivot toward hybrid business models, combining B2B ingredient supply with partnerships in functional food and cosmeceutical innovation. Competitive advantage is anticipated to move from raw material supply alone to ecosystem strength, regulatory alignment, and consumer trust.

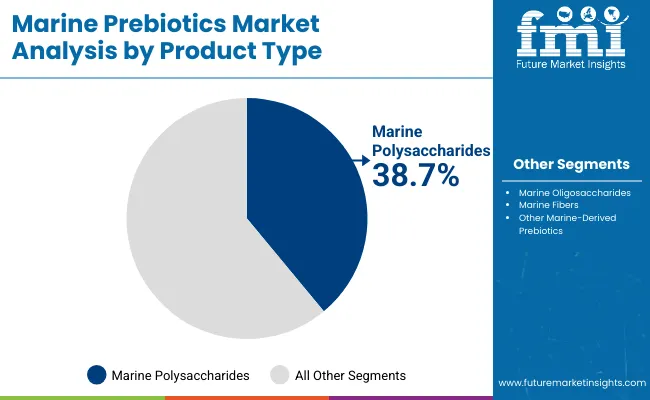

Growth of the Marine Prebiotics Market is being shaped by clear differentiation across product type, application, and end-user segments. Among product types, marine polysaccharides are expected to retain the leading share at 38.7% in 2025, supported by their established clinical validation and versatile functionality. However, higher growth momentum is projected within marine fibers and other marine-derived prebiotics, expanding at 7.2% and 7.5% CAGR, respectively, as innovation in extraction and functional integration accelerates. Marine oligosaccharides are also expected to record sustained demand, particularly in functional nutrition applications.

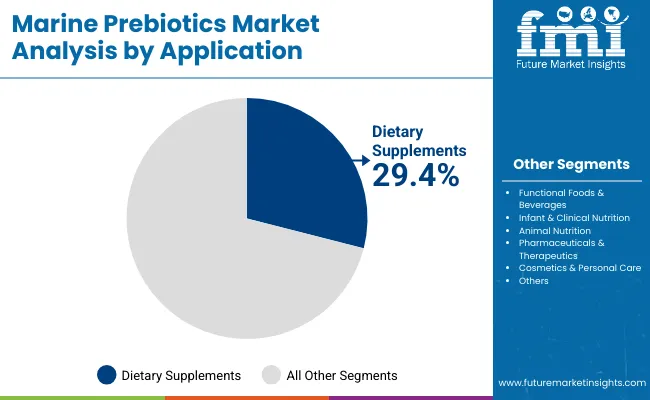

On the application front, dietary supplements are projected to remain dominant with 29.4% share in 2025, driven by consumer reliance on microbiome-supporting products. Yet, faster expansion is anticipated in pharmaceuticals and therapeutics (8.2% CAGR) and cosmetics and personal care (8.6% CAGR), reflecting rising adoption in specialized health and cosmeceutical markets. Functional foods and beverages will also grow steadily, enabling marine prebiotics to transition from niche adoption toward everyday consumption formats.

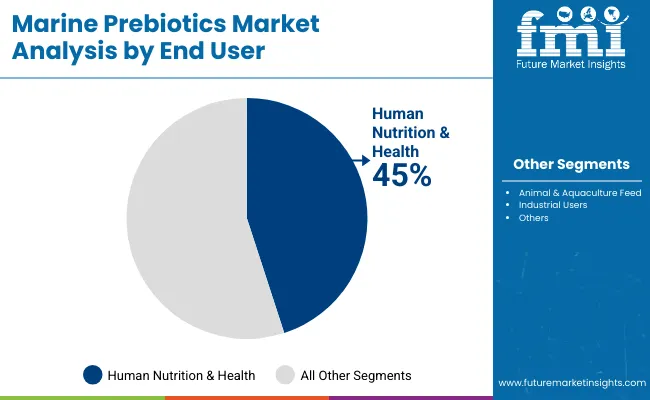

In terms of end users, human nutrition and health are expected to account for 45% of the market in 2025, reinforcing the consumer-driven demand base. Growth, however, will also be reinforced by industrial users at 7.6% CAGR, supported by pharmaceutical and cosmeceutical adoption, and by animal feed applications at 6.9% CAGR, where aquaculture innovations are enhancing sustainability.

By 2035, the market is forecasted to display both scale and diversity, with broader adoption beyond supplements into medical, industrial, and personal care ecosystems, positioning marine prebiotics as an integrated pillar of global health solutions.

The Marine Prebiotics Market has been segmented across product type, application, end-user, source, distribution channel, and region, reflecting the multifaceted drivers of adoption. Product type segmentation highlights polysaccharides, oligosaccharides, fibers, and other marine-derived compounds, each contributing uniquely to functional efficacy. Applications span dietary supplements, functional foods, pharmaceuticals, cosmetics, and animal nutrition, illustrating the broad commercial relevance of marine-based prebiotics. End-user segmentation includes human nutrition and health, animal and aquaculture feed, and industrial users, aligning demand with distinct consumption pathways. Source-based segmentation emphasizes seaweed, microalgae, marine crustaceans, and marine bacteria, showcasing the depth of resource utilization. Distribution channels are split into direct supply, retail, online platforms, and specialty stores, reflecting evolving consumer access points. Regionally, the scope covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, where market potential is expected to differ based on dietary preferences, regulatory frameworks, and marine biotechnology investments.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Marine Polysaccharides (fucoidan, laminarin, alginate) | 38.7% |

| Marine Oligosaccharides (galacto-oligosaccharides, xylo-oligosaccharides) | 34.1% |

Marine polysaccharides are expected to dominate with 38.7% share in 2025, reflecting their strong clinical validation and wide functional range. Their application in gut health, immunity, and anti-inflammatory benefits has been widely supported by research, positioning them as trusted bioactive compounds. Growth is anticipated to be supported by regulatory acceptance and increased availability of scalable extraction methods from seaweed. Meanwhile, innovation in marine oligosaccharides and fibers is being accelerated, enhancing their positioning in premium formulations. Polysaccharides are projected to retain leadership as advancements in biotechnology improve cost efficiency and bioactivity, ensuring their sustained prominence.

| Application | 2025 Share% |

|---|---|

| Dietary Supplements | 29.4% |

| Functional Foods & Beverages | 21.7% |

| Infant & Clinical Nutrition | 14.3% |

Dietary supplements are forecasted to hold the leading share of 29.4% in 2025, with consumer demand for microbiome-supporting products serving as a primary growth catalyst. Marine prebiotics are being increasingly formulated into capsules, powders, and blends, enhancing accessibility for health-conscious consumers. This segment is being reinforced by clinical research linking marine-derived bioactives with gut health, immunity, and metabolic wellness. Growth is further supported by consumer willingness to pay for natural and sustainable alternatives to synthetic ingredients. Over the decade, pharmaceutical and cosmetic applications are projected to accelerate faster, but dietary supplements will remain the core entry point for widespread adoption.

| End-User | 2025 Share% |

|---|---|

| Human Nutrition & Health | 45% |

| Animal & Aquaculture Feed | 35% |

| Industrial Users (cosmeceutical & pharmaceutical companies) | 20% |

Human nutrition and health are expected to command 45% of the market in 2025, supported by strong integration into nutraceuticals, functional foods, and medical nutrition. Consumer demand for natural gut health enhancers and immune-supporting ingredients is being amplified by rising awareness of microbiome wellness. Expansion in this segment is being driven by lifestyle-driven health concerns and preventive healthcare trends. Animal and aquaculture feed is projected to remain critical, particularly in sustainable aquaculture systems where marine prebiotics enhance growth performance and immunity in aquatic species. Industrial users, though smaller in share, are forecasted to expand faster due to rising adoption in cosmeceuticals and pharmaceutical formulations, reinforcing the market’s diversification potential.

Rising health awareness and demand for natural gut-supporting ingredients are being recognized as primary growth drivers for the Marine Prebiotics Market. However, challenges linked to high extraction costs and limited regulatory clarity are being observed as restraints. Simultaneously, expanding applications in pharmaceuticals, cosmetics, and aquaculture are being positioned as transformative trends shaping future opportunities.

Rising Demand for Gut Health and Immunity Solutions

Global consumer focus on gut health and immunity is being reinforced by scientific evidence, positioning marine prebiotics as valuable bioactive ingredients. The market is being driven by their ability to support microbiome balance, enhance metabolic health, and deliver anti-inflammatory benefits. Nutraceutical brands are expected to integrate these prebiotics into mainstream supplements and functional foods, ensuring wider adoption across human health applications. This driver is expected to remain fundamental to long-term market expansion.

Expansion into Pharmaceuticals and Cosmeceuticals

A notable trend is being observed in the adoption of marine prebiotics within pharmaceuticals and personal care products. Their potential for anti-inflammatory, antimicrobial, and skin barrier-enhancing effects is being validated through clinical and biotechnological studies. This expansion is expected to diversify revenue streams and position marine prebiotics as more than nutritional additives. Future growth will be strengthened by partnerships between biotech firms and cosmetic innovators, establishing marine prebiotics as premium multifunctional ingredients.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.7% |

| India | 6.2% |

| Germany | 5.9% |

| France | 6.9% |

| UK | 5.9% |

| USA | 5.2% |

| Brazil | 6.7% |

The global Marine Prebiotics Market is expected to expand unevenly across countries, reflecting differences in dietary patterns, regulatory ecosystems, and levels of investment in marine biotechnology. Growth momentum is projected to be strongest in Asia-Pacific, with India (6.2% CAGR) and China (5.7% CAGR) emerging as critical demand centers. Expansion in these markets is being reinforced by government-backed initiatives in functional food innovation and aquaculture sustainability, enabling marine prebiotics to be integrated into mainstream nutrition and feed systems. India’s trajectory is expected to be supported by rapid urban health awareness and rising nutraceutical consumption, while China is projected to leverage its large-scale seaweed industry to strengthen domestic production capacity.

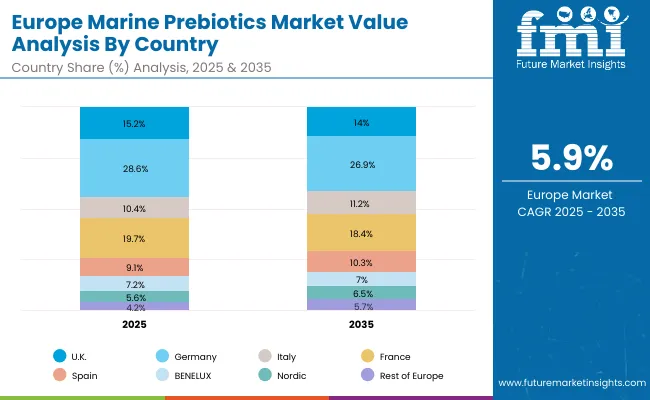

In Europe, steady adoption is anticipated, led by France (6.9% CAGR), Germany (5.9% CAGR), and the UK (5.9% CAGR). Strong regulatory frameworks on food safety and consumer inclination toward natural functional ingredients are driving incorporation into supplements and cosmeceuticals. France is expected to stand out due to its innovation-driven marine bioeconomy, while Germany and the UK are projected to remain central to clinical validation and premium product launches.

In the Americas, Brazil (6.7% CAGR) is forecasted to outpace the USA (5.2% CAGR), as adoption in Latin America is being stimulated by aquaculture growth and functional food demand, while the USA market reflects maturity and slower expansion in traditional supplement categories.

| Year | USA Marine Prebiotics Market (USD Million) |

|---|---|

| 2025 | 43.1 |

| 2026 | 45.5 |

| 2027 | 48.0 |

| 2028 | 51.2 |

| 2029 | 54.4 |

| 2030 | 57.6 |

| 2031 | 61.1 |

| 2032 | 64.5 |

| 2033 | 69.0 |

| 2034 | 73.4 |

| 2035 | 77.8 |

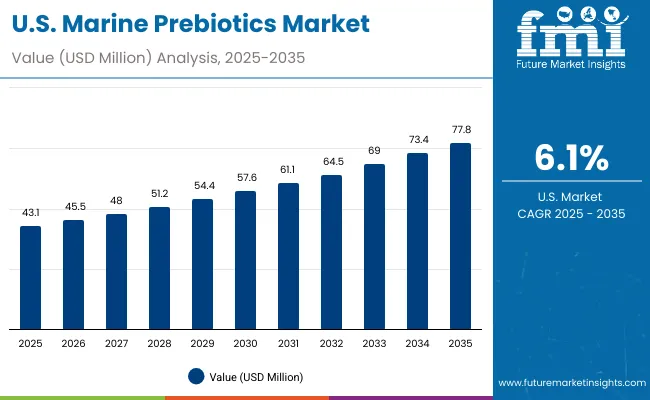

The Marine Prebiotics Market in the United States is projected to grow from USD 43.1 million in 2025 to USD 77.8 million by 2035, advancing at a CAGR of approximately 5.2%. Expansion is being supported by consumer demand for microbiome-targeted nutrition, growing integration of marine-derived ingredients in dietary supplements, and rising acceptance of natural solutions in functional foods and beverages.

The Marine Prebiotics Market in the UK is expected to expand steadily, advancing at a CAGR of 5.9% between 2025 and 2035. Demand is being reinforced by consumer preference for sustainable and clinically validated functional ingredients. Strong alignment with regulatory frameworks on food safety and nutrition labeling is anticipated to strengthen trust and adoption. Growth is expected to be centered on premium dietary supplements and cosmeceutical applications, with marine-derived fibers and polysaccharides gaining prominence.

The Marine Prebiotics Market in India is projected to grow at a CAGR of 6.2%, the highest among key markets, driven by rapid urbanization, rising health awareness, and expansion of nutraceutical consumption. Increasing penetration of dietary supplements and functional beverages is being supported by younger demographics and shifting preventive healthcare preferences. Domestic marine resources and biotechnology investments are expected to enhance scalability and reduce dependence on imports.

The Marine Prebiotics Market in China is forecasted to expand at a CAGR of 5.7%, supported by its strong seaweed industry and biotechnology advancements. Demand is being shaped by rising consumer preference for natural, science-backed gut health solutions and government focus on marine resource utilization. Functional food integration is expected to gain significant momentum, particularly in fortified beverages and infant nutrition products. Pharmaceutical and cosmeceutical applications are also anticipated to create high-value opportunities.

| Countries | 2025 |

|---|---|

| UK | 15.2% |

| Germany | 28.6% |

| Italy | 10.4% |

| France | 19.7% |

| Spain | 9.1% |

| BENELUX | 7.2% |

| Nordic | 5.6% |

| Rest of Europe | 4.2% |

| Countries | 2035 |

|---|---|

| UK | 14.0% |

| Germany | 26.9% |

| Italy | 11.2% |

| France | 18.4% |

| Spain | 10.3% |

| BENELUX | 7.0% |

| Nordic | 6.5% |

| Rest of Europe | 5.7% |

The Marine Prebiotics Market in Germany is projected to record a CAGR of 5.9%, with growth underpinned by stringent regulatory standards, consumer demand for natural health solutions, and strong innovation pipelines. Functional foods and dietary supplements are expected to remain central to adoption, while pharmaceuticals and cosmeceuticals are anticipated to accelerate steadily. Market penetration is being reinforced by clinical validation, which remains a key purchasing factor among German consumers.

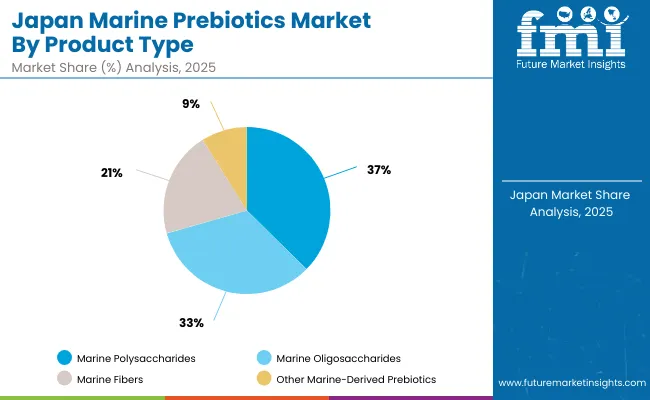

| Product Type | Market Value Share, 2025 |

|---|---|

| Marine Polysaccharides (fucoidan, laminarin, alginate) | 37.4% |

| Marine Oligosaccharides (galacto-oligosaccharides, xylo-oligosaccharides) | 33.2% |

| Marine Fibers (chitosan, chitin, seaweed fiber) | 20.5% |

| Other Marine-Derived Prebiotics | 8.9% |

The Marine Prebiotics Market in Japan is projected to display steady expansion, underpinned by strong consumer orientation toward scientifically validated and naturally derived health ingredients. In 2025, marine polysaccharides are expected to contribute the highest share at 37.4%, while marine oligosaccharides follow with 33.2%, highlighting their significant role in gut health and immunity support. Marine fibers and other marine-derived prebiotics, although smaller in share, are forecasted to record higher CAGRs (7.1% and 7.4%, respectively), reflecting innovation-driven adoption and growing functional versatility.

This distribution reflects Japan’s focus on preventive healthcare, aging population needs, and demand for evidence-based nutritional solutions. Marine polysaccharides are likely to maintain dominance due to established clinical relevance, while fibers are projected to gain traction in cosmeceuticals and functional food applications. Rising integration into premium supplements and fortified foods will define the competitive outlook. Partnerships between Japanese nutraceutical firms and global marine biotechnology companies are expected to accelerate product innovation and ensure differentiation.

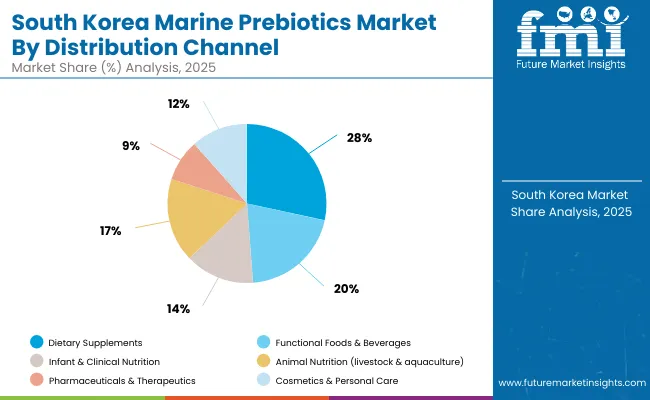

| Application | Market Value Share, 2025 |

|---|---|

| Dietary Supplements | 28.4% |

| Functional Foods & Beverages | 20.4% |

| Infant & Clinical Nutrition | 14.1% |

| Animal Nutrition (livestock & aquaculture) | 17.1% |

| Pharmaceuticals & Therapeutics | 8.5% |

| Cosmetics & Personal Care | 11.5% |

The Marine Prebiotics Market in South Korea is projected to expand steadily, supported by advanced functional food innovation and a strong domestic culture of preventive healthcare. In 2025, dietary supplements are expected to lead with 28.4% share, reflecting widespread consumer reliance on microbiome-supporting solutions. Functional foods and beverages, at 20.4%, are anticipated to benefit from South Korea’s position as a trendsetter in health-oriented food and drink formulations.

Higher growth momentum is forecasted in pharmaceuticals (8.2% CAGR) and cosmetics (8.5% CAGR), where marine prebiotics are increasingly recognized for their therapeutic and skin wellness benefits. Infant and clinical nutrition is also anticipated to grow steadily at 7.6% CAGR, reflecting strong emphasis on maternal and child health. Animal nutrition is projected to gain relevance through aquaculture, given South Korea’s investments in marine sustainability.

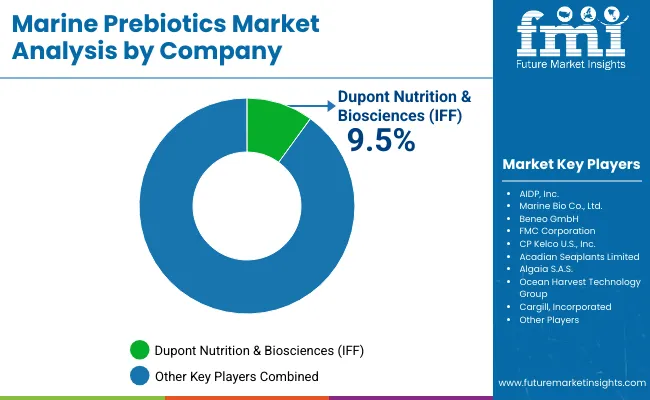

| Company | Global Value Share 2025 |

|---|---|

| Dupont Nutrition & Biosciences (IFF) | 9.5% |

| Others | 90 .5% |

The Marine Prebiotics Market is moderately fragmented, with global leaders, mid-sized innovators, and specialized firms competing across diverse application areas. Multinational ingredient leaders such as Dupont Nutrition & Biosciences (IFF), Beneo GmbH, and Cargill, Incorporated are expected to maintain significant market positions, supported by advanced R&D capabilities, extensive distribution networks, and integration into global food, pharmaceutical, and nutraceutical value chains. Their strategies are being increasingly aligned with sustainability commitments, clinical validation, and cross-category innovation.

Established marine-focused specialists such as FMC Corporation, CP Kelco USA, Inc., and Acadian Seaplants Limited are reinforcing competitiveness by leveraging expertise in seaweed-derived bioactives, scalable extraction technologies, and partnerships with global nutraceutical and cosmetic brands. Their ability to deliver traceable, natural, and eco-certified solutions is expected to remain a critical differentiator in high-value markets.

Niche players including Marine Bio Co., Ltd., Algaia S.A.S., AIDP, Inc., and Ocean Harvest Technology Group are positioning themselves through innovation-driven approaches, catering to specific product applications such as dietary supplements, infant nutrition, and animal feed. These firms are expected to benefit from targeted regional demand and customized solutions.

Competitive differentiation is shifting toward end-to-end ecosystems, where clinical substantiation, digital supply chain integration, and sustainability-driven narratives are projected to define future success.

Key Developments in Marine Prebiotics Market

| Item | Value |

|---|---|

| Quantitative Units | USD 240.6 million |

| Product Type | Marine Polysaccharides (fucoidan, laminarin, alginate); Marine Oligosaccharides (GOS, XOS); Marine Fibers (chitosan, chitin, seaweed fiber); Other Marine-Derived Prebiotics |

| Source | Seaweed (brown, red, green); Microalgae (spirulina, chlorella, nannochloropsis); Marine Crustaceans (chitin/chitosan from shell waste); Marine Bacteria & Fungi (fermentation-derived prebiotics) |

| Application | Dietary Supplements; Functional Foods & Beverages; Infant & Clinical Nutrition; Animal Nutrition (livestock & aquaculture); Pharmaceuticals & Therapeutics; Cosmetics & Personal Care |

| End-User | Human Nutrition & Health; Animal & Aquaculture Feed; Industrial Users (cosmeceutical & pharmaceutical companies) |

| Distribution Channel | Direct (B2B ingredient supply); Retail (supermarkets & pharmacies); Online Sales (nutraceuticals & functional platforms); Specialty & Health Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AIDP, Inc.; Marine Bio Co., Ltd.; Beneo GmbH; Dupont Nutrition & Biosciences (IFF); FMC Corporation; CP Kelco USA, Inc.; Acadian Seaplants Limited; Algaia S.A.S.; Ocean Harvest Technology Group; Cargill, Incorporated |

| Additional Attributes | Dollar sales by product type and application; adoption trends in functional foods, supplements, and animal feed; rising use in pharmaceuticals and cosmetics; sustainability-driven sourcing from seaweed and algae; regional shifts in marine biotechnology investment; regulatory support for health claims; and innovation in bioavailability and fermentation processes. |

The global Marine Prebiotics is estimated to be valued at USD 240.6 million in 2025.

The market size for the Marine Prebiotics is projected to reach USD 544.0 million by 2035.

The Marine Prebiotics is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in the Marine Prebiotics Market are marine polysaccharides, marine oligosaccharides, marine fibers, and other marine-derived prebiotics.

In terms of application, , the dietary supplements segment is expected to command the largest share of 29.4% in 2025, followed by functional foods & beverages and animal nutrition.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA