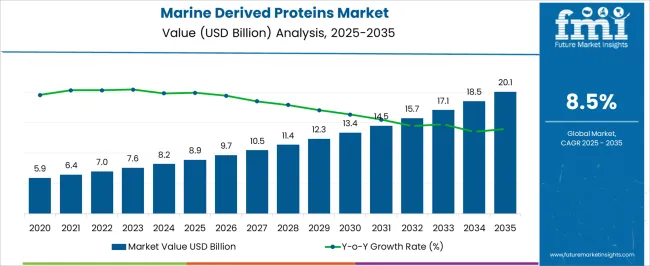

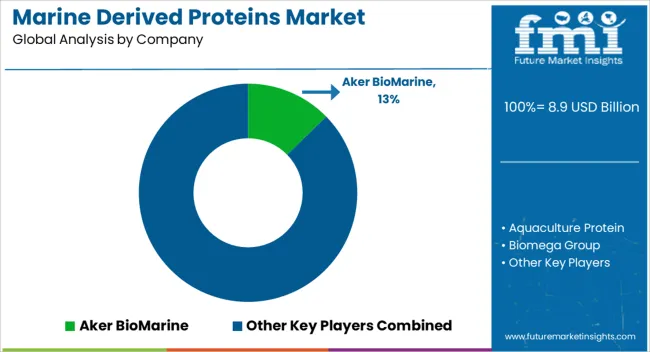

The marine derived proteins market, valued at USD 8.9 billion in 2025 and expected to reach USD 20.1 billion by 2035 at a CAGR of 8.5%, is strongly influenced by regulatory frameworks governing seafood sourcing, protein extraction, and product labeling. Regulatory compliance impacts all stages of the value chain, beginning with raw material procurement from sustainable fisheries or aquaculture operations. Guidelines concerning catch limits, traceability, and environmental impact dictate sourcing practices, affecting both the availability and cost of marine protein feedstocks.

Processing and extraction operations are subjected to food safety and hygiene standards imposed by agencies such as the FDA, EFSA, and regional authorities. These regulations determine allowable processing methods, residual limits, and permissible additives, which in turn shape production practices and operational expenditures. Moreover, certifications such as MSC, ASC, and ISO standards influence market credibility and market access, particularly for products targeting health-conscious consumers or international trade. Downstream, labeling, claims regarding nutritional content, allergen warnings, and compliance with dietary regulations further dictate product design and marketing strategies.

Regulatory changes or delays can directly affect commercialization timelines, pricing, and investment planning, making compliance a critical factor in market expansion. The market exhibits a high degree of regulatory interdependence, where adherence to environmental, safety, and labeling standards influences cost structures, market access, and growth potential, reinforcing the strategic importance of regulatory alignment for sustainable market development between 2025 and 2035.

| Metric | Value |

|---|---|

| Marine Derived Proteins Market Estimated Value in (2025 E) | USD 8.9 billion |

| Marine Derived Proteins Market Forecast Value in (2035 F) | USD 20.1 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The marine derived proteins market represents a specialized segment within the global animal and human nutrition industry, emphasizing high-quality protein sources from fish, shellfish, and algae. Within the broader protein ingredients market, it accounts for about 4.9%, driven by demand in dietary supplements, functional foods, and feed applications. In the aquaculture and animal feed sector, it holds nearly 5.3%, reflecting use in growth promotion, immunity support, and enhanced digestibility.

Across the human nutrition and nutraceutical ingredients segment, the market captures 4.1%, supporting protein bars, powders, and fortified beverages. Within the specialty bioactive and peptide derivatives category, it represents 3.7%, highlighting applications in health, wellness, and functional formulation. In the pharmaceutical and cosmetic applications sector, it secures 3.2%, emphasizing collagen, bioactive peptides, and skin health solutions. Recent developments in this market have focused on extraction efficiency, purity, and sustainability. Innovations include enzymatic hydrolysis, membrane filtration, and spray drying technologies to improve bioavailability and functional performance. Key players are collaborating with aquaculture companies, nutraceutical brands, and research institutions to expand high-value marine protein applications.

Efforts in sustainable sourcing, byproduct utilization, and traceable supply chains are gaining traction to address environmental and regulatory concerns. The marine proteins are being integrated into multi-protein formulations, functional foods, and cosmetic solutions.

The marine derived proteins market is expanding steadily, driven by the growing recognition of marine-sourced proteins as high-quality, bioavailable nutritional ingredients. Industry publications and nutrition science journals have emphasized their rich amino acid profile, high digestibility, and functional benefits across dietary supplements, sports nutrition, and functional food products. Increasing consumer preference for natural and sustainable protein sources has strengthened demand, particularly as overfishing concerns and traceability requirements push the industry toward responsibly sourced marine ingredients.

Technological advancements in hydrolysis, concentration, and purification processes have improved product quality, enabling diverse applications in nutraceuticals, pharmaceuticals, and animal nutrition. Additionally, strategic partnerships between fisheries, processing plants, and nutrition companies are enhancing supply chain integration and ensuring consistent quality standards.

With the rise of protein-enriched diets and health-focused consumption, the market is expected to see sustained growth, led by fish-based sourcing, concentrate formulations, and direct sales channels that cater to both B2B and B2C customer segments.

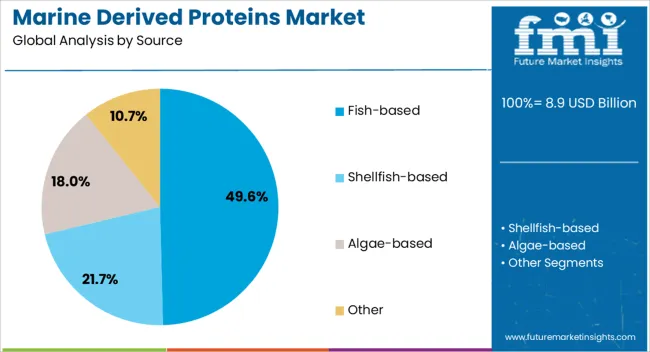

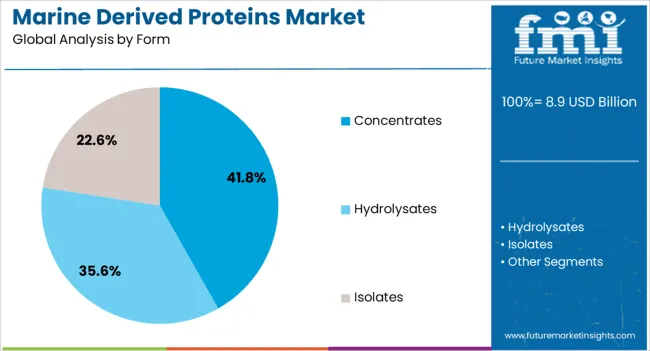

The marine derived proteins market is segmented by source, form, distribution channel, and geographic regions. By source, marine derived proteins market is divided into Fish-based, Shellfish-based, Algae-based, and Other. In terms of form, marine derived proteins market is classified into Concentrates, Hydrolysates, and Isolates.

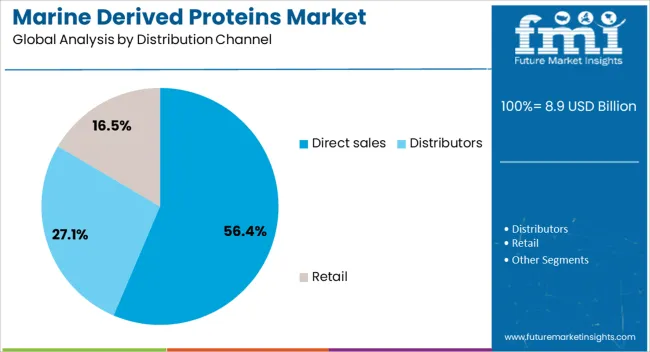

Based on distribution channel, marine derived proteins market is segmented into Direct sales, Distributors, and Retail. Regionally, the marine derived proteins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fish-based segment is projected to hold 49.6% of the marine derived proteins market revenue in 2025, maintaining its leadership due to its superior protein content, amino acid composition, and global availability. This segment’s strength has been supported by well-established fishing and processing industries, particularly in regions with abundant marine resources.

Advances in enzymatic hydrolysis have enhanced the nutritional value and functional properties of fish proteins, increasing their appeal in health supplements, clinical nutrition, and fortified food applications. Sustainability certifications and traceability programs have also boosted consumer confidence in fish-based protein products, especially in export markets.

Additionally, fish processing by-products have been increasingly utilized for protein extraction, reducing waste and improving cost efficiency. These factors, combined with consistent supply and proven nutritional benefits, have reinforced the dominant position of the fish-based segment.

The concentrates segment is projected to account for 41.8% of the marine-derived proteins market revenue in 2025, due to its high protein content and versatility in various applications. Concentrates offer a balance between purity, functional properties, and cost-effectiveness, making them suitable for sports nutrition, medical foods, and functional beverages.

Food technology developments have enabled the production of concentrates with improved solubility, neutral taste, and enhanced bioavailability, broadening their use in consumer products. Manufacturers have favored concentrates for their adaptability in both dry and liquid formulations, as well as their compatibility with other nutrient fortifications.

In addition, concentrates provide a cost advantage over isolates while still delivering significant nutritional benefits, appealing to manufacturers targeting mid- to premium-range product lines. This combination of performance, application flexibility, and affordability has secured the segment’s leading market share.

The direct sales segment is projected to contribute 56.4% of the marine derived proteins market revenue in 2025, retaining its dominant position as the primary distribution channel. Its growth has been driven by the ability to establish strong relationships between producers and end-users, ensuring consistent supply and product customization.

Direct sales channels allow suppliers to cater to specific technical and quality requirements, particularly in industries such as nutraceuticals, pharmaceuticals, and sports nutrition, where ingredient specifications are critical. This model also enables better pricing control, faster feedback loops, and opportunities for joint product development with clients.

In addition, direct engagement supports transparent communication regarding sourcing, processing methods, and sustainability certifications, which are increasingly valued by buyers. As market competition intensifies, direct sales are expected to remain the preferred channel for high-value marine protein transactions, sustaining their leadership in the distribution landscape.

The market has expanded as demand for high-quality, functional, and sustainable protein sources rises across food, nutraceutical, and pharmaceutical sectors. Proteins extracted from fish, shellfish, and algae are utilized in dietary supplements, functional foods, infant formulas, and clinical nutrition products. Growing awareness of health benefits, including joint support, cardiovascular health, and muscle maintenance, has increased consumer adoption. Sustainable sourcing practices, coupled with regulatory support for marine-based ingredients, have strengthened market credibility. Technological advancements in extraction, purification, and formulation have improved protein quality, bioavailability, and stability.

Functional foods and nutraceutical products have been primary drivers for marine derived proteins due to their high bioactive content and health benefits. Fish collagen, hydrolyzed protein, and marine peptides are widely incorporated into protein bars, beverages, supplements, and dietary powders to support joint health, skin elasticity, and cardiovascular wellness. Consumer preference for natural, sustainable ingredients has reinforced adoption in both developed and emerging markets. Manufacturers focus on integrating marine proteins with vitamins, minerals, and probiotics to create multifunctional products. Packaging innovations, product diversification, and flavor masking technologies have enhanced acceptance and convenience. Regulatory approvals and safety certifications further facilitate inclusion in global functional food products. This sector continues to expand as awareness of preventive healthcare and performance nutrition grows among health-conscious populations.

Marine derived proteins are increasingly utilized in pharmaceutical and clinical nutrition applications to provide essential amino acids, collagen, and peptides for therapeutic formulations. Hospitals and healthcare providers incorporate fish-based proteins into medical nutrition, wound healing solutions, and recovery products. Research indicates benefits for bone health, muscle regeneration, and chronic disease management, making marine proteins a preferred ingredient in specialized diets. Pharmaceutical companies leverage purification technologies to meet stringent safety, allergen, and quality standards. Growing prevalence of age-related conditions, metabolic disorders, and chronic diseases has increased demand for clinically validated protein supplements. This sector emphasizes consistency, bioavailability, and regulatory compliance, ensuring that marine derived proteins remain a critical component of medical nutrition and therapeutic formulations worldwide.

Advancements in extraction and processing technologies have enhanced the efficiency, purity, and functional properties of marine derived proteins. Enzymatic hydrolysis, membrane filtration, and spray-drying techniques allow production of high-quality peptides and collagen with improved solubility and bioavailability. Innovations in flavor masking, odor reduction, and microencapsulation have enabled wider incorporation into diverse food, beverage, and supplement products. Cold-chain logistics, storage optimization, and formulation expertise ensure protein stability during distribution. Analytical methods, such as chromatography and mass spectrometry, ensure consistency and quality control. These technological improvements make marine proteins more suitable for mass-market applications while maintaining nutritional and functional efficacy, increasing their adoption across food, nutraceutical, and clinical nutrition sectors.

Despite market growth, marine derived proteins face challenges related to sustainable sourcing, seasonal availability, and supply chain logistics. Overfishing concerns, environmental regulations, and certification requirements impact raw material procurement. Supply fluctuations due to climate, species availability, and regional fishing policies can affect production consistency. Extraction costs, regulatory compliance, and quality assurance requirements contribute to higher operational expenses. Companies are increasingly adopting traceable sourcing, responsible aquaculture, and by-product utilization to mitigate environmental impact and ensure a steady supply. Investment in infrastructure, cold-chain management, and supplier partnerships is crucial to maintain production efficiency. Addressing these challenges enables sustainable market growth while meeting rising consumer and industrial demand for marine-derived protein solutions.

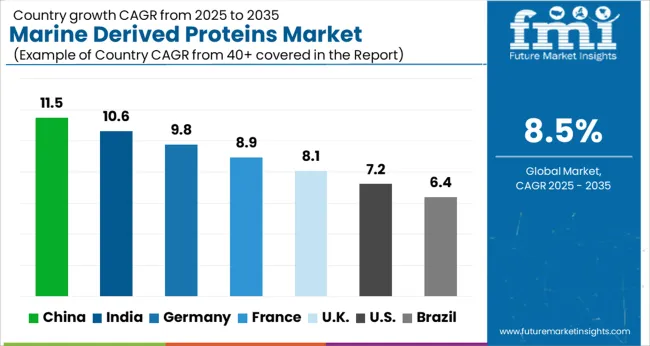

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

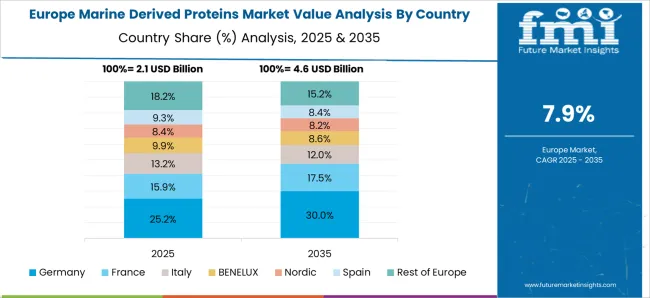

The market is experiencing robust expansion, with India achieving 10.6% growth due to rising incorporation in functional foods and nutraceuticals. China follows with 11.5%, propelled by strong demand in food, feed, and pharmaceutical applications. Germany recorded 9.8%, reflecting increased integration of marine proteins in health-focused consumer products. The United Kingdom reached 8.1%, supported by research and development in bioactive protein extraction. The United States posted 7.2%, driven by adoption in dietary supplements and sports nutrition. Together, these countries highlight a landscape of production, technological innovation, and scaling that is shaping the global marine derived proteins market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 11.5%, driven by increasing utilization of high-quality protein sources in food, feed, and nutraceutical applications. Rising consumer awareness about protein-rich diets, along with the expanding aquaculture and seafood processing industries, is fueling market adoption. Technological advancements in protein extraction, purification, and functional enhancement are contributing to higher market penetration. Additionally, industrial investments and government support for sustainable marine resource utilization are encouraging the development of protein-based products for human nutrition and animal feed. The growing demand for specialty proteins in dietary supplements, fortified foods, and functional nutrition is positioning China as a key market for marine-derived proteins.

India’s market is projected to grow at a CAGR of 10.6%, driven by rising health-conscious consumer segments and increasing adoption of protein-enriched food products. Expanding aquaculture operations and seafood processing facilities are contributing to higher availability of marine proteins. Advanced extraction techniques improving bioavailability and functional properties are enabling new applications in functional foods, nutraceuticals, and animal feed. Government policies supporting sustainable fishing and marine resource utilization are further encouraging the market. Industrial and retail sectors are increasingly investing in marine protein-based products for dietary supplements, fortified foods, and specialty formulations, which is positioning India as a growing hub for marine protein adoption.

Germany is expected to expand at a CAGR of 9.8%, fueled by demand for high-quality, sustainable protein sources in food and nutraceutical industries. Consumers are increasingly seeking functional and fortified foods, which drives the use of marine-derived proteins. Technological improvements in protein isolation, purification, and functionality enhance their application in dietary supplements, food enrichment, and specialty animal feed. Strict regulatory standards and sustainability-focused policies are encouraging responsible sourcing of marine proteins. Growing awareness among industries and end-users regarding health benefits and environmental impact is further supporting the adoption of marine-derived proteins across food, nutraceutical, and animal feed segments.

The United Kingdom’s market is projected to grow at a CAGR of 8.1%, supported by rising demand for health-oriented and protein-enriched products. Marine proteins are increasingly incorporated into functional foods, dietary supplements, and fortified beverages due to their high bioactivity and nutritional profile. Investments in aquaculture and seafood processing, along with technological advances in extraction and purification, are expanding applications. Sustainability concerns and government policies promoting responsible utilization of marine resources are further encouraging the adoption of marine proteins. The growing focus on health-conscious consumers, fitness, and wellness products is positioning the United Kingdom as a significant market for marine-derived proteins.

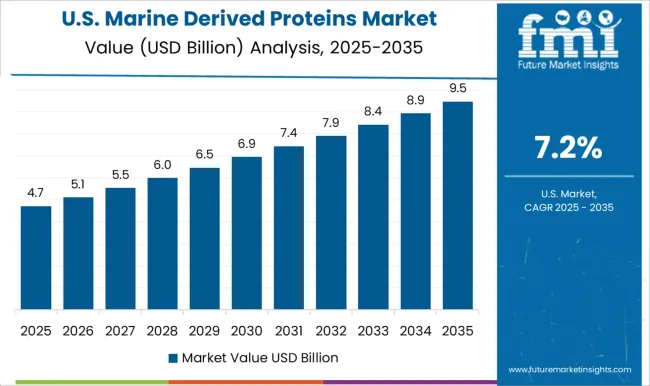

The United States is anticipated to expand at a CAGR of 7.2%, driven by high consumer awareness about protein-rich diets and growing interest in functional foods. Marine proteins are widely used in nutraceuticals, fortified food products, and specialty animal feed to improve nutritional profiles and support wellness trends. Investments in research, aquaculture, and seafood processing facilities are enhancing protein quality and availability. Technological developments in protein bioactivity, purification, and functional applications are enabling diversification into innovative food and health products. Sustainability concerns and corporate initiatives promoting responsible sourcing of marine proteins are also positively influencing market growth, positioning the United States as a key market for marine-derived proteins.

The market is dominated by key players offering specialized proteins sourced from marine organisms to meet growing demand in nutraceuticals, animal feed, and functional food applications. Aker BioMarine leads with sustainable krill-based proteins, emphasizing high bioavailability and eco-friendly harvesting practices. Aquaculture Protein and Biomega Group focus on providing marine proteins tailored for aquafeed, enhancing growth performance and overall health in farmed species. Cargill, DSM, and Corbion supply marine-derived protein concentrates and hydrolysates for human and animal nutrition, integrating advanced processing technologies to preserve nutritional quality. Cellulac and Epax provide high-purity omega-3 protein isolates, supporting the functional food and dietary supplement industries with consistent quality and efficacy.

FMC Corporation and Kerry Group extend their offerings to include marine protein ingredients formulated for flavor, texture, and nutritional enhancement in food applications. These companies are investing in sustainable sourcing, process innovation, and product development, ensuring the Marine Derived Proteins Market grows in line with global health trends, environmental standards, and industrial application requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Source | Fish-based, Shellfish-based, Algae-based, and Other |

| Form | Concentrates, Hydrolysates, and Isolates |

| Distribution Channel | Direct sales, Distributors, and Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aker BioMarine, Aquaculture Protein, Biomega Group, Cargill, Cellulac, Corbion, DSM, Epax, FMC Corporation, and Kerry Group |

| Additional Attributes | Dollar sales by protein type and application, demand dynamics across food, nutraceutical, and aquaculture sectors, regional trends in marine-sourced ingredient adoption, innovation in extraction methods, bioavailability, and functional properties, environmental impact of sustainable sourcing and processing, and emerging use cases in functional foods, dietary supplements, and specialty nutrition products. |

The global marine derived proteins market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the marine derived proteins market is projected to reach USD 20.1 billion by 2035.

The marine derived proteins market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in marine derived proteins market are fish-based, shellfish-based, algae-based and other.

In terms of form, concentrates segment to command 41.8% share in the marine derived proteins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA