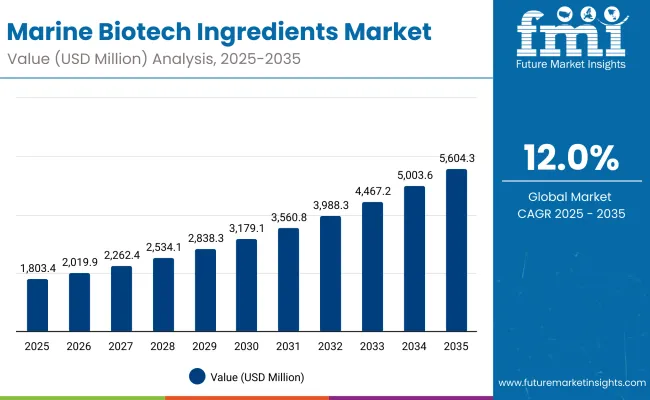

The Marine Biotech Ingredients Market is anticipated to register sales worth USD 1,803.4 million in 2025 and is forecasted to reach USD 5,604.3 million by 2035. This projected expansion signifies an additional USD 3,800.9 million over the ten-year span, resulting in more than a threefold increase. The compound annual growth rate is estimated at 12.0% during this period, underlining the strong momentum being built within the sector.

Marine Biotech Ingredients Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value In (2025E) | USD 1,803.4 Million |

| Market Forecast Value In (2035F) | USD 5,604.3 Million |

| Forecast CAGR (2025 to 2035) | 12.00% |

In the first half of the forecast, from 2025 to 2030, the market is expected to rise from USD 1,803.4 million to USD 3,179.1 million, adding nearly USD 1,375.7 million. This growth will represent around 36% of the total decade’s incremental gains, reflecting early adoption trends across nutraceutical, cosmetics, and personal care formulations. The period will be characterized by consistent scaling, with scientific validation of bioactive marine components acting as a catalyst for wider utilization.

During the second phase, between 2030 and 2035, the value is projected to surge further from USD 3,179.1 million to USD 5,604.3 million, capturing about 64% of overall growth. This acceleration will be fueled by broader commercialization, supported by advanced fermentation, enzyme engineering, and sustainable aquaculture-derived sourcing models. Demand for marine-derived peptides, polysaccharides, and bio-actives will likely intensify, with blue-biotech claims anticipated to consolidate dominance across applications such as anti-aging, hydration, and UV protection.

The outlook indicates that momentum in serums and scientifically substantiated claims will sustain leadership, while increasing investment in sustainable biotech solutions is expected to secure competitive advantages throughout the forecast horizon.

From 2020 to 2024, the Marine Biotech Ingredients Market transitioned from niche applications toward mainstream adoption, driven by skincare and nutraceutical integration. Blue-biotech players expanded value share through clinically validated peptides and polysaccharides, while multinationals strengthened distribution and regulatory compliance capabilities. Between 2025 and 2035, the revenue mix is expected to shift as demand for anti-aging and hydration solutions accelerates, supported by sustainability-driven sourcing and COSMOS-certified innovation. Competitive advantage will move beyond extraction capabilities toward ecosystem strength, IP-backed strain development, and fermentation-based scalability.

The growth of the marine biotech ingredients market is being fueled by rapid advancements in blue-biotechnology platforms and increased consumer demand for sustainable, high-performance actives. The sector is being propelled by rising adoption of algae- and bacteria-derived compounds, which are perceived as clean, traceable, and eco-efficient. Demand has been strengthened by the surge in clinical validation linking marine bioactives to anti-aging, hydration, and skin-brightening outcomes, encouraging brand investment in science-backed claims.

Premiumization is being driven by regulatory support for COSMOS-certified and vegan-friendly inputs, creating a pathway for higher pricing power. Expanding serum-led product launches have amplified market visibility, while innovation in fermentation and purification has reduced cost volatility, enabling scalable production. Growth is expected to accelerate across Asia particularly China and India where skincare and wellness adoption is expanding rapidly. Over the next decade, value creation is projected to favor companies that combine strain innovation, supply chain control, and robust claim substantiation.

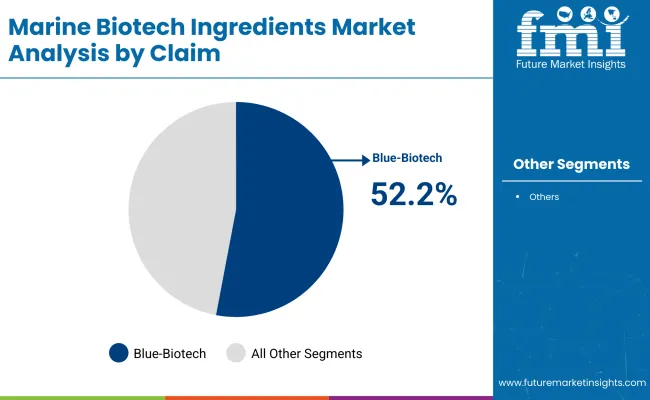

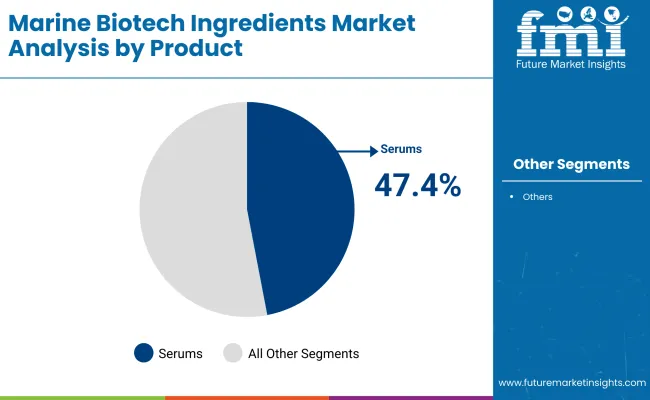

The Marine Biotech Ingredients Market has been segmented into claims, product formats, and applications, each shaping demand in unique ways. Segmentation by claims highlights the growing influence of science-backed narratives, with blue-biotech ingredients gaining strong traction due to their evidence-driven appeal. In product formats, consumer preferences are being shaped by ease of application and efficacy delivery, with serums emerging as a preferred choice in premium personal care.

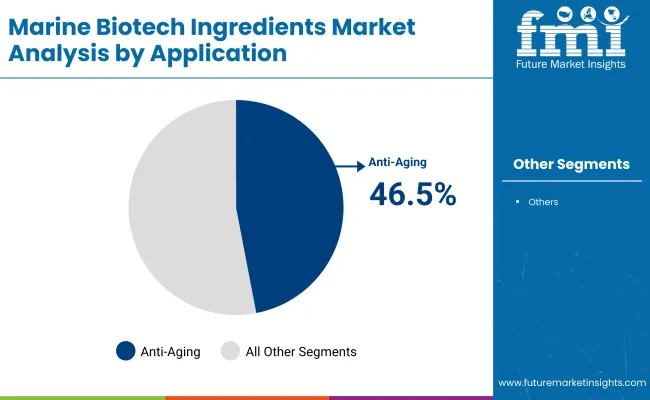

Application segmentation reflects the rising importance of anti-aging solutions, where bioactive marine components are being positioned to meet long-term consumer needs. Together, these three segments define how value is being distributed across the market, while signaling where future innovation and investment are most likely to consolidate competitive advantage.

| Segment | Market Value Share, 2025 |

|---|---|

| Blue-biotech | 52.20% |

| Others | 47.80% |

The blue-biotech segment is projected to command 52.2% of the Marine Biotech Ingredients Market in 2025, equivalent to USD 926.6 million. This dominance is being reinforced by evidence-based claims that resonate with consumers seeking scientifically validated results. The segment’s strength lies in its ability to combine sustainability with efficacy, offering brands a platform to build premium positioning. Growing regulatory support for natural-origin and traceable marine ingredients is expected to accelerate momentum further. As biotechnology advances enable better extraction and stabilization of marine actives, the blue-biotech segment is anticipated to maintain its lead, making it a central growth driver throughout the forecast horizon..

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 47.40% |

| Others | 52.60% |

The serum segment is expected to account for 47.4% of market value in 2025, translating to USD 837.5 million. Serums are being favored due to their ability to deliver concentrated actives with rapid absorption, aligning with consumer expectations for performance and convenience. Their lightweight texture and targeted functionality make them particularly suitable for anti-aging and hydration applications, enhancing their role in premium skincare lines. The segment’s growth is being supported by innovation in formulation science, which allows marine-derived peptides and enzymes to remain stable and effective in serum bases. As consumers continue to seek high-efficacy solutions, serums are anticipated to sustain their leadership position, reinforcing their role as the preferred product format.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 46.50% |

| Others | 53.50% |

The anti-aging segment is projected to capture 46.5% of the Marine Biotech Ingredients Market in 2025, equating to USD 819.7 million. Demand has been driven by the proven benefits of marine-derived bioactives in reducing oxidative stress, enhancing collagen production, and supporting skin renewal. Consumers are increasingly prioritizing preventative and restorative solutions, making anti-aging a cornerstone of product development strategies. The segment’s growth is being reinforced by heightened awareness of environmental stressors such as UV exposure and pollution, where marine peptides and polysaccharides offer protective properties. As R&D investment in marine biotechnology intensifies, anti-aging applications are expected to gain further traction, solidifying their role as a consistent driver of market expansion.

The Marine Biotech Ingredients Market is advancing through a mix of enabling forces and structural challenges. While scientific progress and sustainability imperatives provide momentum, certain barriers in regulation and scale remain influential in shaping the industry’s future growth trajectory.

Bioprocess Innovations Enhancing Yield Efficiency

Significant growth is being supported by advances in bioprocessing methods, particularly enzyme engineering and precision fermentation, which have enhanced yields and improved the scalability of marine-derived actives. These innovations have enabled consistent production of bioactive peptides, polysaccharides, and enzymes, reducing dependence on volatile biomass sourcing. By offering stable supply and controlled quality, bioprocess technologies are expected to strengthen the commercial viability of marine biotech solutions. Additionally, alignment with circular economy principles has positioned such processes as central to achieving regulatory acceptance, premium pricing, and global expansion across nutraceuticals, pharmaceuticals, and personal care.

Regulatory Complexity in Global Compliance

Expansion is being constrained by complex and fragmented regulatory requirements across major markets. Divergent standards for safety validation, claims substantiation, and eco-certifications have increased compliance costs and prolonged approval timelines. This complexity has particularly affected smaller innovators that lack extensive regulatory infrastructure. As authorities tighten oversight of marine resource utilization and bio-based claims, challenges in harmonizing global compliance will likely persist. This barrier may slow market entry and discourage investment in niche applications, unless collaborative frameworks and pre-competitive consortia are leveraged to streamline compliance pathways. Such hurdles are expected to shape the competitive landscape by favoring well-capitalized players with robust regulatory expertise.

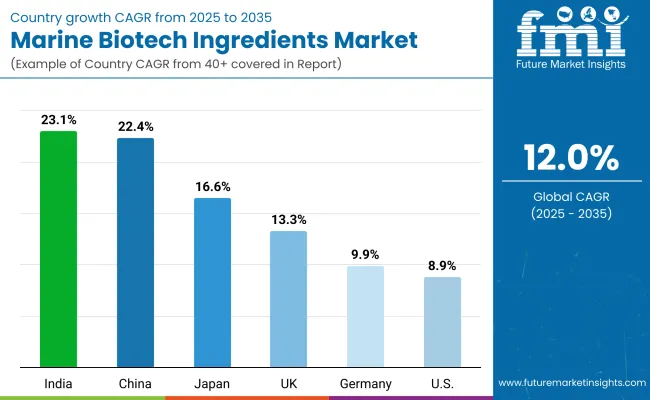

| Countries | CAGR |

|---|---|

| China | 22.4% |

| USA | 8.9% |

| India | 23.1% |

| UK | 13.3% |

| Germany | 9.9% |

| Japan | 16.6% |

shaped by scientific investment, regulatory frameworks, and consumer adoption dynamics. Asia is emerging as the fastest-expanding hub, with China and India leading at CAGRs of 22.4% and 23.1% respectively. In China, expansion is being propelled by large-scale R&D programs, supportive government policies around sustainable biotechnology, and the commercialization of marine-derived actives for cosmetics and nutraceuticals. India is demonstrating even stronger momentum, as domestic demand for natural and functional wellness products is rising in tandem with increasing export opportunities to Europe and North America. Both countries are likely to establish themselves as dominant producers and innovators, securing global influence in marine biotech applications.

Japan, with an estimated CAGR of 16.6%, is expected to benefit from advanced biotechnology capabilities and established personal care industries, where demand for anti-aging and cosmeceutical solutions remains strong. Europe’s trajectory is anchored by the UK at 13.3% and Germany at 9.9%, supported by strict sustainability compliance and ongoing integration of bio-based actives in regulated sectors. The USA is projected to grow more moderately at 8.9%, reflecting a mature but innovation-driven market where focus is shifting to premium, clinically validated marine-derived ingredients. Collectively, these disparities emphasize how Asia will lead global acceleration, while Europe and North America will rely on regulatory-driven adoption and premiumization strategies.

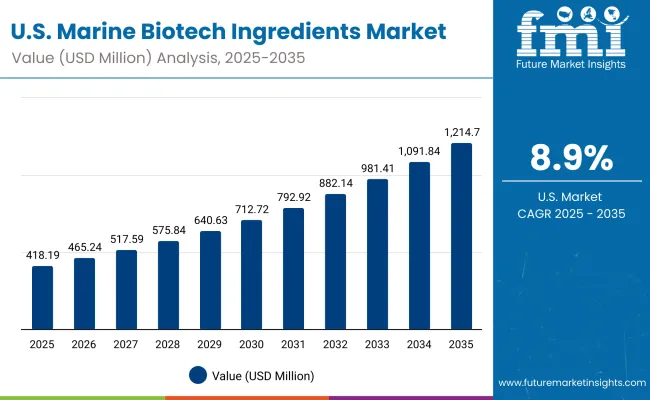

| Year | USA Marine Biotech Ingredients Market (USD Million) |

|---|---|

| 2025 | 418.19 |

| 2026 | 465.24 |

| 2027 | 517.59 |

| 2028 | 575.84 |

| 2029 | 640.63 |

| 2030 | 712.72 |

| 2031 | 792.92 |

| 2032 | 882.14 |

| 2033 | 981.41 |

| 2034 | 1,091.84 |

| 2035 | 1,214.70 |

The Marine Biotech Ingredients Market in the United States is projected to grow at a CAGR of 11.3%, expanding from USD 418.19 million in 2025 to USD 1,214.70 million by 2035, marking a threefold increase over the forecast horizon.

The initial five years from 2025 to 2030 are expected to add nearly USD 294.53 million, as the market value rises from USD 418.19 million to USD 712.72 million. This phase will likely be defined by increased demand for marine-derived actives in skincare, nutraceuticals, and dietary supplements, supported by strong consumer interest in natural and sustainable formulations.

From 2030 to 2035, acceleration is projected as value climbs further to USD 1,214.70 million, contributing nearly USD 502 million in just five years. This stage is anticipated to be shaped by broader integration of marine peptides, polysaccharides, and enzymes in premium personal care and pharmaceutical applications, with evidence-based claims consolidating brand positioning.

The Marine Biotech Ingredients Market in the UK is projected to grow at a CAGR of 13.3% from 2025 to 2035, reflecting steady adoption across personal care, nutraceuticals, and pharmaceutical industries. Growth will be anchored by regulatory frameworks that emphasize sustainability and natural sourcing. By 2030, market expansion is expected to be supported by premiumization trends in skincare and functional supplements, with marine-derived peptides and polysaccharides positioned as high-value ingredients.

Between 2030 and 2035, further acceleration is anticipated as innovation in biotech processes improves cost efficiency, enabling wider product integration across mid-tier consumer brands. Collaborations with academic institutions and biotech start-ups are expected to enhance R&D pipelines, further supporting clinical validation of marine actives.

The Marine Biotech Ingredients Market in India is projected to record a CAGR of 23.1%, making it the fastest-growing among major countries. Expansion will be underpinned by rising consumer demand for natural wellness solutions and export-led opportunities in nutraceuticals and personal care.

By 2030, growth will be shaped by strong domestic uptake of marine bioactives in dietary supplements, supported by a rapidly expanding middle-class consumer base. Additionally, India’s cost-competitive manufacturing capabilities are expected to position it as a global supply hub, catering to demand in Europe and North America.

Between 2030 and 2035, innovation in fermentation and enzyme engineering is projected to improve supply stability, while regulatory reforms are likely to enhance global competitiveness. Broader adoption across pharmaceuticals and functional foods will further elevate India’s role in the global landscape.

The Marine Biotech Ingredients Market in China is forecast to expand at a CAGR of 22.4% from 2025 to 2035, fueled by large-scale R&D investments and strong government support for blue-biotechnology initiatives. Market growth will be driven by rapid consumer adoption of marine-derived actives in skincare and nutrition products.

By 2030, China’s ecosystem of biotech start-ups, supported by favorable policy frameworks, is expected to deliver advancements in marine peptides and polysaccharides, reinforcing domestic supply chains and reducing reliance on imports. The period will also see rising integration of marine ingredients into cosmeceuticals, functional beverages, and wellness formulations.

From 2030 to 2035, commercial scale-up is projected to accelerate, with leading multinational companies forming joint ventures to tap into the country’s expanding consumer base. Global positioning is expected to be strengthened by large-scale production and export growth.

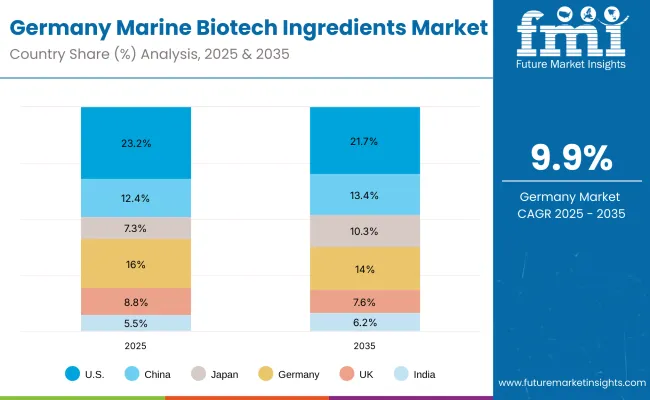

| Countries | 2025 |

|---|---|

| USA | 23.2% |

| China | 12.4% |

| Japan | 7.3% |

| Germany | 16.0% |

| UK | 8.8% |

| India | 5.5% |

| Countries | 2035 |

|---|---|

| USA | 21.7% |

| China | 13.4% |

| Japan | 10.3% |

| Germany | 14.0% |

| UK | 7.6% |

| India | 6.2% |

The Marine Biotech Ingredients Market in Germany is anticipated to grow at a CAGR of 9.9%, reflecting a mature but steadily expanding market environment. The growth outlook will be shaped by strict regulatory compliance and consumer preference for certified, sustainable ingredients.

By 2030, Germany is expected to strengthen its leadership in high-quality marine bioactives for pharmaceutical and cosmeceutical applications, supported by its advanced R&D infrastructure and robust testing frameworks. This period will likely emphasize clinical validation, safety, and efficacy, aligning with EU regulatory requirements.

From 2030 to 2035, wider integration of marine-derived actives into mainstream personal care and dietary supplements is projected, with premiumization trends sustaining higher value growth. Sustainability certifications, including COSMOS and vegan-friendly claims, are expected to remain strong demand drivers.

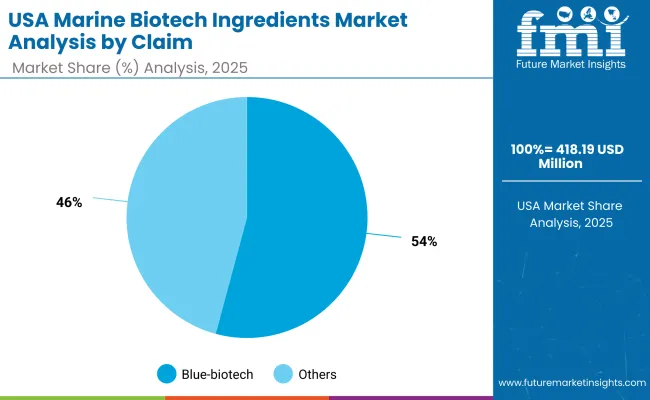

| Segment | Market Value Share, 2025 |

|---|---|

| Blue-biotech | 54.2% |

| Others | 45.8% |

The Marine Biotech Ingredients Market in the USA is projected at USD 418.19 Million in 2025 and is expected to expand steadily through 2035. Blue-biotech contributes the majority share at 54.2%, indicating strong adoption of advanced marine-derived bioactives, while others account for 45.8%. This slight dominance of blue-biotech highlights the sector’s transition toward fermentation-based and highly standardized bio-ingredients, reflecting growing demand for reproducible quality, clinical validation, and scalable sustainability. Growth is expected to be driven by heightened consumer preference for traceable and eco-certified ingredients, with COSMOS and vegan certifications serving as trust-building levers. The market is likely to benefit from rising investments by USA brands in claims-backed anti-aging and hydration solutions that command premium pricing. As competition intensifies, differentiation will increasingly rely on clinical data packages, IP-protected strains, and co-creation partnerships that enable faster innovation cycles and higher entry barriers.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 47.4% |

| Others | 52.6% |

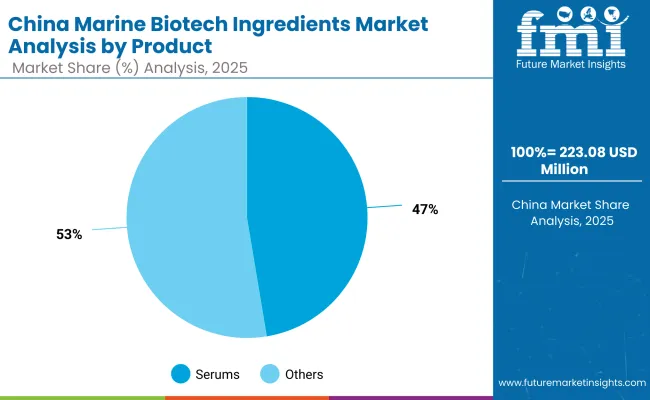

The Marine Biotech Ingredients Market in China is projected at USD 223.08 Million in 2025 and is expected to post one of the fastest growth rates globally through 2035. Serums represent 47.4% of market value, underscoring the format’s position as the preferred vehicle for high-efficacy, concentrated actives. The remaining 52.6% share is held by creams, masks, and other formats, reflecting a balanced portfolio that supports routine integration across multiple product categories. Market expansion is anticipated to be driven by the surge in demand for premium skincare, fueled by rising disposable incomes, growing middle-class adoption, and strong e-commerce penetration. Blue-biotech innovation is projected to resonate strongly with China’s clean beauty movement, where transparency, safety, and clinical validation are critical purchase drivers. Over the next decade, growth is expected to accelerate as domestic and international brands expand serum-based launches, supported by localized R&D and government initiatives promoting biotech innovation.

| Global Value Share 2025 | |

| Algatech | 7.40% |

| Others | 92.60% |

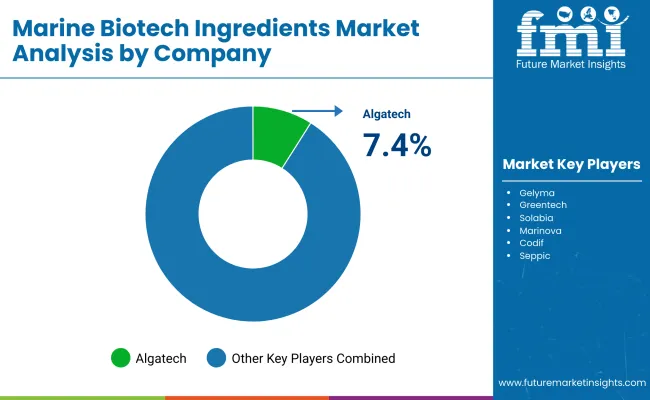

Competitive dynamics in the Marine Biotech Ingredients Market are being shaped by a mix of global multinationals, mid-sized innovators, and niche specialists. Scale players such as BASF, Croda, Ashland, and Seppic are being positioned to leverage broad portfolios, regulatory infrastructure, and global distribution to win large brand programs requiring COSMOS/vegan compliance and validated safety dossiers. Mid-sized leaders including Algatech, Marinova, Greentech, Solabia, Codif, and Gelyma are being differentiated through proprietary strains, fucoidan and microalgae expertise, and evidence-rich claims that support premium pricing in anti-aging, hydration, and UV-protection. Application-focused specialists are being favored in co-development models where fermentation yield, traceability, and clinical substantiation are mission-critical.

Competitive advantage is expected to migrate from commodity extracts toward protected IP (strain libraries, enzymatic processes), reproducible clinical outcomes, and supply optionality (wild harvest plus fermentation). Partnerships with blue-biotech start-ups and universities are likely to be intensified to accelerate dossier generation and speed regulatory clearance. Pricing power is anticipated to concentrate with vendors that can supply audited sustainability data and scale bioprocess capacity.

Company relevance check: Algatech, Gelyma, Greentech, Solabia, Marinova, Codif, Seppic, Ashland, BASF, and Croda are all appropriate participants in marine biotech ingredients.

Market share snapshot (global): Algatech is indicated as the leading identifiable player with a 7.4% value share in 2025; others collectively account for 92.6%. As 2024 splits were not provided, Algatech’s 2024 share is conservatively proxied at about 7.3% based on stable concentration assumptions.

Key Developments in Marine Biotech Ingredients Market

| Item | Value |

|---|---|

| Market Size 2025 | USD 1,803.4 Million |

| Market Size 2035 | USD 5,604.3 Million |

| CAGR (2025-2035) | 12.00% |

| Component | Marine algae (red, brown, green), Marine bacteria, Marine peptides, Marine enzymes |

| Claim Segmentation | Blue-biotech - 52.2% (USD 926.6 Million), Others - 47.8% (USD 862.03 Million) |

| Product Format | Serums - 47.4% (USD 837.5 Million), Others - 52.6% (USD 948.59 Million) |

| Application | Anti-aging - 46.5% (USD 819.7 Million), Others - 53.5% (USD 964.82 Million) |

| End-use Industries | Cosmetics & Personal Care, Nutraceuticals, Pharmaceuticals, Functional Foods, Biotechnology R&D |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Algatech, Gelyma, Greentech, Solabia, Marinova, Codif, Seppic, Ashland, BASF, Croda |

| Additional Attributes | Dollar sales by claim type and format, adoption in anti-aging skincare, COSMOS-certified and vegan-friendly demand, fermentation and enzyme technology expansion, export opportunities from Asia, premiumization in cosmeceuticals and nutraceuticals |

The global Marine Biotech Ingredients Market is estimated to be valued at USD 1,803.4 million in 2025.

The market size for the Marine Biotech Ingredients Market is projected to reach USD 5,604.3 million by 2035.

The Marine Biotech Ingredients Market is expected to grow at a CAGR of 12.0% between 2025 and 2035.

The key product formats in the Marine Biotech Ingredients Market include serums and other categories such as creams, masks, and capsules/powders.

In terms of applications, the anti-aging segment is projected to command 46.5% share in the Marine Biotech Ingredients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA