The UK collagen peptide market is on track to reach USD 50.5 million by 2025, with consistent growth projected to elevate its value to USD 81.9 million by 2035. This expansion corresponds to a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The rising demand for nutritional supplements, functional food & beverages, and cosmetics is fueling this growth, alongside innovations in marine and plant-based collagen alternatives catering to a broader consumer base, including the vegan population.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 50.5 million |

| Industry Value (2035F) | USD 81.9 million |

| CAGR (2025 to 2035) | 5.0% |

The steady growth in focus on health, beauty, and functional nutrition is causing the UK collagen peptide market to grow. There is increased demand across nutritional products and food and beverage services as marine and plant based collagen peptides become more popular in sustainable options.

The growth in sports nutrition with collagen peptide user integration, construction of collagen enhanced beauty supplement capsules, bioactive and hydrolyzed formulations are some key trends of the industry. There are leading companies in the region such as Gelita AG, Peptan UK, and Rousselot who are adopting new advanced technologies in processing, product new formulations, and providing clean label products to stand out in the competitively growing market.

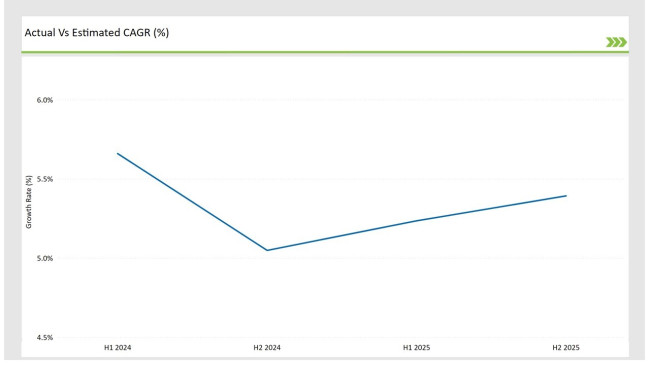

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Collagen Peptide market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate(%) | 5.7% |

| H2 Growth Rate(%) | 5.0% |

| Year | 2025 |

|---|---|

| H1 Growth Rate(%) | 5.2% |

| H2 Growth Rate(%) | 5.4% |

For the UK market, the Collagen Peptide sector is projected to grow at a CAGR of 5.7% during the first half of 2024, with an increase to 5.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 5.2% in H1 and reach 5.4% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Marine Collagen UK launched a new range of fish-derived collagen peptides with proven bioavailability. The product is sourced exclusively from sustainable Scottish fisheries and processed using enzymatic hydrolysis. |

| Oct-2024 | Rousselot opened a new collagen peptide production facility in Wales with £30M investment. The facility specializes in bovine-derived collagen peptides for the sports nutrition market. |

| Aug-2024 | PB Leiner acquired British collagen manufacturer NaturePep in a £45M deal. The acquisition strengthens PB Leiner's position in the UK's growing collagen supplements market. |

| June-2024 | Yorkshire-based Collagen Solutions launched a new range of bioactive collagen peptides for joint health. The products feature enhanced bioavailability through a proprietary enzymatic process. |

| Mar-2024 | Peptan UK introduced a new line of grass-fed bovine collagen peptides for premium supplements. The product targets the high-end sports nutrition and beauty-from-within markets. |

Expansion of Collagen Peptides in Sports Nutrition and Functional Beverages

Collagen peptides are experiencing rapid growth in the sports nutrition and functional beverage sectors because the targets of joint health are becoming a higher priority. In the UK, brands are introducing collagen infused beverages and protein powders designed for drinkable consumption for athletes and other fitness enthusiasts.

Along with Protein Works other brands such as Peptan UK are at the forefront of the industry by producing easily accessible bioactive collagen powders, while other uses are switching to using marine collagen peptides in order to appeal to sustainability focused consumers.

Marine Collagen Peptides Gaining Traction as a Sustainable Alternative

An increase in the preference for vegan and pescatarian diets has accelerated interest in marine collagen peptides in the UK. With a focus on sustainability, companies attempt to mitigate waste in the seafood industry by harvesting collagen from fish skin and scales.

Rousselot and Collagen Solutions took a lead in innovative marine collagen as they produced the hydrolyzed collagen with improved absorption rates. The beauty and cosmetics industry has also capitalized on the opportunities being presented by the marine collagen with its anti-aging and hydrating properties in the skin.

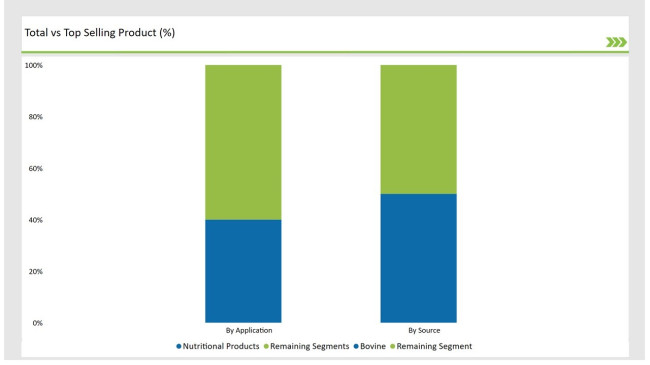

| Application | Market Share |

|---|---|

| Nutritional Products | 40% |

| Remaining Segments | 60% |

Nutrition product, especially supplement, functional foods, and powder, remains in the lead as the UK's collagen peptide market. This development is driven by the growing requirements of the matured population coupled with health-aware consumers seeking health solutions for joint and skin. However, in the pharmaceutical sector, adoption has been slower. Collagen-based medical applications are still largely niche, concentrating on wound care and regenerative medicine, which stops more widespread commercial growth.

| Source | Market Share |

|---|---|

| Bovine Collagen | 50% |

| Remaining Segments | 50% |

Abundant availability, cost efficiency and structural advantages of bovine collagen keeps it to be the most dominant collagen peptide type in the UK market. Nonetheless, marine collagen peptides are growing more sharply as consumers become more environmentally sensitive and look for sustainable as well as pescatarian friendly alternatives. This trend is supporting diversification among companies collagens sources in response to changing environmental manners and new technologies in fish collagen processing.

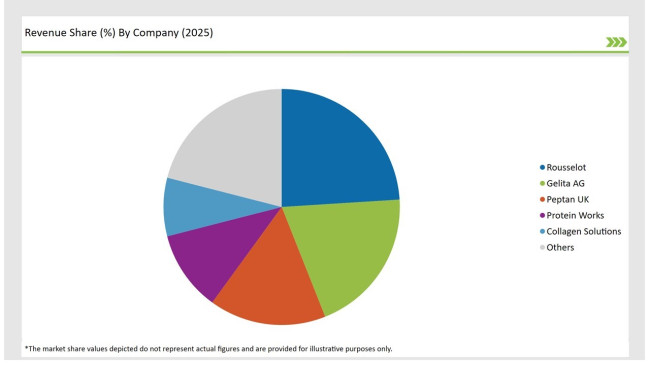

The UK collagen peptide market is highly concentrated with a handful of multi-national companies dominating the market. The Collagen peptide industry is unexpectedly growing in regions due to global players such as Collagen Solutions, Proteinworks, Rousselot, Gelita AG and Peptan UK which capture significant market portions with their technological prowess, strong supply chains and wide catalogs.

Although these regional players are advancing with innovative and niche offerings such as Marine and vegan collagen blends, the industry still relies on collates direct raw material sourcing. The end result is lower maintained product cost but the much higher advanced processing output per unit time.

| Company | Market Share(%) |

|---|---|

| Rousselot | 24% |

| Gelita AG | 20% |

| Peptan UK | 16% |

| Protein Works | 11% |

| Collagen Solutions | 8% |

| Other Players | 21% |

The primary companies for the collagen peptide market in the UK have their plants in England and Scotland and are specialized in the latest hydrolyzed and bioactive collagen peptides innovations. Rousselot and Gelita AG are actively investing in superior collagen extraction processes, and Peptan UK is moving into marine collagen peptides to support sustainability.

Protein Works and Collagen Solutions are capitalizing on the direct sales to customers and collaborative agreements with dietary supplement companies to expand their market share. The company uses a variety of sources for collagen raw material, which include bovine and porcine got collagen as well as fish and vegetarian collagen, with local and international distributors guaranteeing effective market access.

Nutritional Products, Food & Beverages, Cosmetics & Personal Care Products, Pharmaceuticals

Bovine, Porcine, Marine & Poultry

Dry, Liquid

By 2025, the UK collagen peptide market is projected to expand at a CAGR of 5.0%, fueled by increasing demand for functional foods, beauty supplements, and high-protein nutritional formulations.

By 2035, the UK collagen peptide industry is expected to reach a total value of USD 81.9 million, driven by rising health awareness and advancements in collagen processing technologies.

The UK collagen peptide market is growing due to the surge in sports nutrition products, increased demand for anti-aging skincare, consumer preference for clean-label formulations, and rising adoption of marine-based collagen alternatives.

The South East and London lead collagen peptide consumption in the UK, with strong demand in premium wellness and beauty markets. Scotland also sees rising adoption due to its focus on functional food innovations.

Key players in the UK market include Rousselot, Gelita AG, Peptan UK, Protein Works, and Collagen Solutions, alongside international manufacturers such as Weishardt Group and Nitta Gelatin.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Collagen Casings Market Insights – Demand, Size & Industry Trends 2025–2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Insights for Collagen Peptide Providers

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Collagen Peptide Market Growth – Trends, Demand & Innovations 2025–2035

Europe Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Australia Collagen Peptide Market Insights – Size, Share & Industry Trends 2025-2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Peptide-Based Formulas Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Collagen Supplement Market Size and Share Forecast Outlook 2025 to 2035

Collagen Water Market Forecast and Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Based Nanomaterials Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA