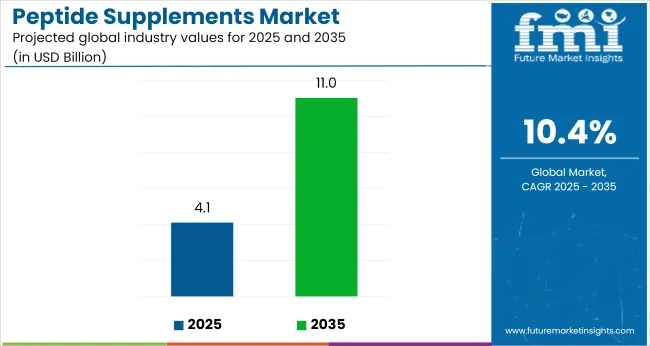

The global peptide supplements market is projected to grow from USD 4.1 billion in 2025 to USD 11.2 billion by 2035, registering a robust CAGR of 10.4%. Market expansion is driven by rising consumer focus on preventive health, fitness, and anti-aging solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.1 billion |

| Industry Value (2035F) | USD 11.2 billion |

| CAGR (2025 to 2035) | 10.4% |

Increasing demand for functional ingredients that support muscle recovery, immune health, and skin vitality is prompting supplement manufacturers to incorporate bioactive peptides across sports nutrition, beauty, and wellness formulations.

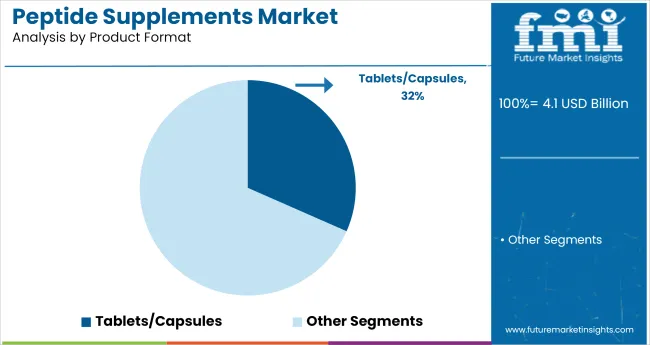

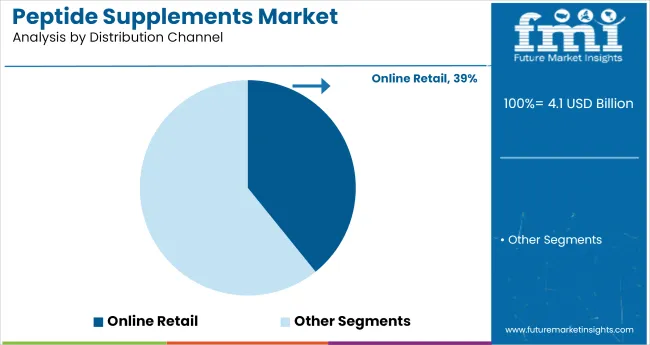

The market holds an approximately 31.6% share of tablets and capsules, driven by their ease of consumption, precise dosing, and extended shelf life. Within the distribution channel, online retail accounts for approximately 39.2% share, reflecting rising consumer preference for convenience, subscription-based wellness, and direct-to-consumer supplement brands. The market also contributes to the broader nutraceuticals industry, supporting innovation in functional health products and performance nutrition.

Government regulations impacting the market focus on ingredient safety, health claims, labeling accuracy, and dosage limits. Regulatory bodies such as the USA FDA and EFSA play a key role in approving bioactive peptides and enforcing standards under frameworks like GRAS (Generally Recognized as Safe) and Novel Food Regulation.

These regulations ensure that peptides used in supplements are safe, well-researched, and clearly communicated to consumers. Additionally, global standards on nutritional claims and product transparency are promoting the adoption of clinically backed peptide formulations. This regulatory oversight strengthens consumer trust and encourages responsible innovation across regions.

The USA is projected to be the fastest-growing market, expanding at a CAGR of 11.3% from 2025 to 2035. Tablets and capsules will lead the product format segment with a 31.6% share, while online retail will dominate the distribution channel with a 39.2% share in 2025. The Germany and Japan markets are also expected to grow steadily at CAGRs of 7.8% and 9.2%, respectively.

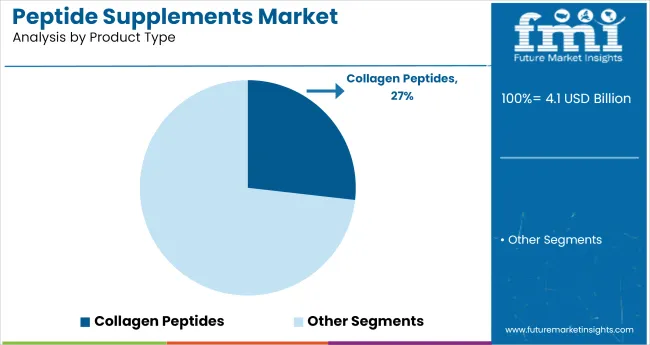

The market is segmented by product type, source type, functionality, product format, distribution channel, and region. By product type, the market is categorized into bioactive peptides, collagen peptides, whey protein peptides, muscle-building peptides, anti-aging peptides, and immune-enhancing peptides.

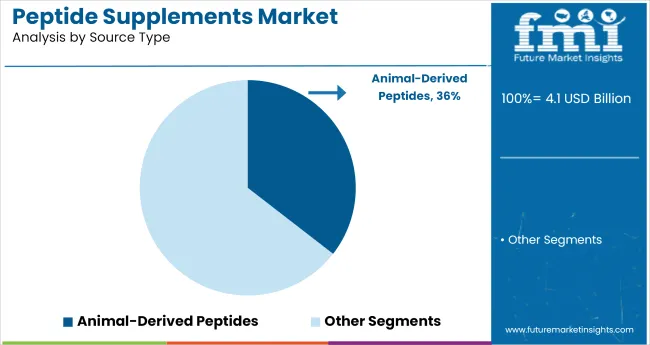

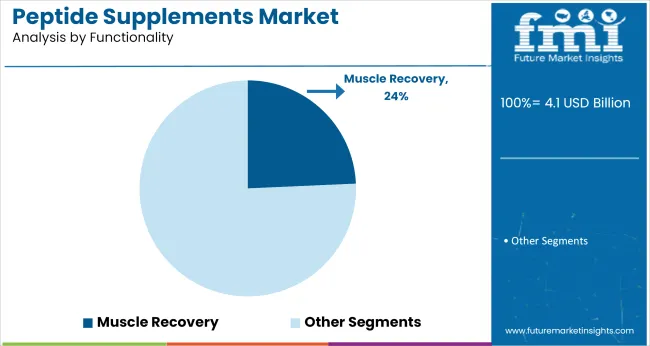

Based on source type, the market is divided into animal-derived, plant-derived, and synthetic peptides. By functionality, the market includes muscle recovery, weight management, skin health, immune support, cognitive function, anti-inflammatory, and cardiovascular health. By product format, the market is segmented into powder, tablets/capsules, chews/soft gels, liquid, and oral strips.

Based on distribution channel, the market is categorized into online retail, pharmacies, specialty nutrition stores, supermarkets, direct sales, and healthcare institutions. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Collagen peptides are projected to lead the product type segment, accounting for 26.8% of the global market share in 2025. Their benefits for skin health, joint strength, and bone density make them a leading choice among aging and beauty-focused consumers.

Animal-derived peptides are expected to dominate the source type segment, accounting for 35.5% of the market share in 2025. These include collagen and whey peptides known for superior bioavailability and muscle recovery benefits.

Muscle recovery is anticipated to lead the functionality segment, accounting for 24.3% of the global market share in 2025. Peptides in this category support post-workout recovery, muscle synthesis, and fatigue reduction.

Tablets and capsules are expected to dominate the product format segment, accounting for approximately 31.6% of the global peptide supplements market by 2025. Their convenience, precise dosing, and portability make them highly popular among fitness enthusiasts and aging populations.

Online retail is expected to lead the distribution channel segment, capturing 39.2% of the global market share in 2025. E-commerce platforms offer broad accessibility, product variety, and discounts that appeal to a tech-savvy and health-conscious consumer base.

The global peptide supplements market has been experiencing steady growth, driven by rising consumer focus on fitness, anti-aging solutions, and personalized nutrition. Peptides are gaining popularity for their targeted functionality in muscle recovery, immune support, and skin health aligning with preventive healthcare and performance wellness trends.

Recent Trends in the Peptide Supplements Market

Challenges in the Peptide Supplements Market

The USA leads the peptide supplements market due to regulatory compliance, wellness trends, and advancements in functional nutrition. In Germany and France, growth rates of 7.8% and 8.1%, respectively, are being recorded, with market expansion supported by cognitive and weight management formulations. While, UK market is projected to grow at 8.7% CAGR and Japan, at a CAGR of 9.2%.

Japan is witnessing strong growth in peptide supplement demand, especially for collagen-based products favored by its aging population and preference for minimalist wellness solutions. The UK is also gaining momentum, with rising interest in clean-label, vegan, and performance-oriented peptides.

Meanwhile, Germany and France are experiencing steady growth, fueled by innovation in cognitive and weight management applications. These countries benefit from supportive regulatory frameworks, growing consumer awareness, and a shift toward holistic health and targeted nutritional supplementation.

The report includes detailed analysis of 40+ countries, with the five top-performing OECD nations highlighted here.

The USA peptide supplements revenue is poised to grow at a CAGR of 11.3% from 2025 to 2035. Growth is driven by strong consumer demand for sports nutrition, anti-aging, and immune-enhancing supplements.

The sales of peptide supplements in Germany are poised to expand at a CAGR of 7.8% during the forecast period. Growth is driven by increased awareness of preventive healthcare and beauty-from-within nutrition trends.

The demand for peptide supplements market in France is projected to grow at a CAGR of 8.1% from 2025 to 2035. Demand is driven by supported by increasing demand for weight management, skin health, and muscle support formulations.

The Japan peptide supplements market is projected to grow at a CAGR of 9.2% from 2025 to 2035.The growth is driven by aging population concerns and rising interest in collagen and cognitive health peptides.

The UK peptide supplements revenue is expected to grow at a CAGR of 8.7% between 2025 and 2035. Growth is supported by rising fitness culture, growing acceptance of protein supplementation, and demand for vegan peptides are key growth drivers.

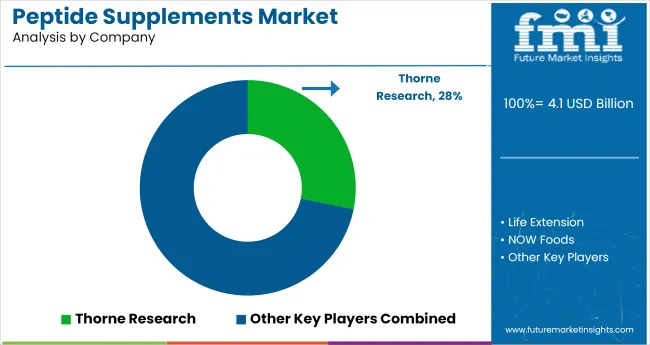

The peptide supplements market is moderately consolidated, with prominent players such as Thorne Research, Life Extension, NOW Foods, Designs for Health, and Nootropics Depot actively shaping the industry. These companies are known for delivering high-purity, science-backed peptide formulations that support muscle growth, anti-aging, cognitive enhancement, and immune function.

Thorne Research is recognized for its clinical-grade peptide blends and sports nutrition offerings, with a strong focus on third-party testing and clean-label compliance.

Leading players in the peptide supplements market, such as Thorne Research, Life Extension, NOW Foods, Designs for Health, and Nootropics Depot, are shaping industry standards through innovation, quality, and science-backed formulations. These companies offer a wide range of peptide-based products targeting muscle recovery, cognitive function, anti-aging, and immune health.

Known for their commitment to purity and efficacy, they invest in third-party testing, clean-label compliance, and advanced delivery systems. Their focus on research-driven development and consumer wellness has positioned them as trusted names in both practitioner and direct-to-consumer segments of the markets.

Recent Peptide Supplements Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.1 billion |

| Projected Market Size (2035) | USD 11.2 billion |

| CAGR (2025 to 2035) | 10.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/Volume in metric tons |

| By Product Type | Bioactive Peptides, Collagen Peptides, and Whey Protein Peptides, Muscle-Building Peptides, Anti-Aging Peptides, and Immune-Enhancing Peptides |

| By Source Type | Animal-Derived, Plant-Derived, and Synthetic Peptides |

| By Functionality | Muscle Recovery, Weight Management, Skin Health, Immune Support, Cognitive Function, Anti-Inflammatory, and Cardiovascular Health |

| By Product Format | Powder, Tablets/Capsules, Chews/Soft Gels, Liquid, and Oral Strips |

| By Distribution Channel | Online Retail, Pharmacies, Specialty Nutrition Stores, Supermarkets, Direct Sales, and Healthcare Institutions |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Thorne Research, Life Extension, NOW Foods, Designs for Health, Nootropics Depot, Peptides Sciences, American Peptide Company, Pure Encapsulations, BioMed Nutrition, Vitamin Research Products, Hammer Nutrition, Source Naturals |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

As per Product Type, the industry has been categorized into Bioactive peptides, Collagen peptides, Whey protein peptides, Muscle-building peptides, Anti-aging peptides and Immune-enhancing peptides.

As per Source, the industry has been categorized into Animal-derived, Plant-derived and Synthetic peptides.

As per Functionality, the industry has been categorized into Muscle recovery, Weight management, Skin health, Immune support, Cognitive function, Anti-inflammatory and Cardiovascular health.

As per Product Format, the industry has been categorized into Powder, Tablets/Capsules, Chews/Soft Gels, Liquid and Oral Strips.

As per Distribution Channel, the industry has been categorized into Online retail, Pharmacies, Specialty nutrition stores, Supermarkets, Direct sales and Healthcare institutions.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific and Middle East & Africa.

The market is valued at USD 4.1 billion in 2025.

The market is forecasted to reach USD 11.2 billion by 2035, reflecting a CAGR of 10.4%.

Tablets and capsules will lead the product format segment, accounting for 31.6% of the global market share in 2025.

Online retail will dominate the distribution channel segment with a 39.2% share in 2025.

The USA is projected to grow at the fastest rate, with a CAGR of 11.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Based Nanomaterials Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Peptide-based Sweetener Size and Share Forecast Outlook 2025 to 2035

Peptide Receptor Radionuclide Therapy (PRRT) Market Trends and Forecast 2025 to 2035

Peptide Synthesis Market Analysis – Trends, Share & Growth 2025 to 2035

Key Players & Market Share in the Peptide Microarray Sector

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Peptide Antibiotics Market

Peptide Microarrays Market

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Tetra-Peptide Anti-Wrinkle Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Marine Peptide Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA