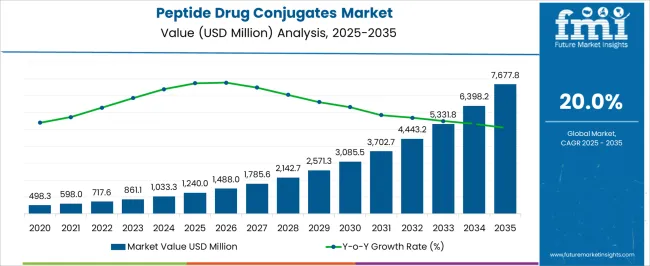

The Peptide Drug Conjugates Market is estimated to be valued at USD 1240.0 million in 2025 and is projected to reach USD 7677.8 million by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

| Metric | Value |

|---|---|

| Peptide Drug Conjugates Market Estimated Value in (2025 E) | USD 1240.0 million |

| Peptide Drug Conjugates Market Forecast Value in (2035 F) | USD 7677.8 million |

| Forecast CAGR (2025 to 2035) | 20.0% |

The peptide drug conjugates market is advancing steadily, fueled by the growing demand for targeted therapeutics that offer precision with minimal systemic toxicity. Advances in peptide engineering, linker technology, and payload optimization have positioned these conjugates as a promising approach for treating various chronic and oncological conditions.

Their ability to combine the selectivity of peptides with the potency of small molecule drugs is attracting significant investment from pharmaceutical and biotech firms. Additionally, the increasing incidence of cancer and the limitations of traditional chemotherapy have driven interest in novel delivery systems that enhance therapeutic index and reduce off target effects.

Favorable regulatory support and expanding clinical pipelines are also contributing to market acceleration. The outlook for the sector remains strong, with innovations in delivery technologies and strategic collaborations expected to further elevate the clinical and commercial potential of peptide drug conjugates.

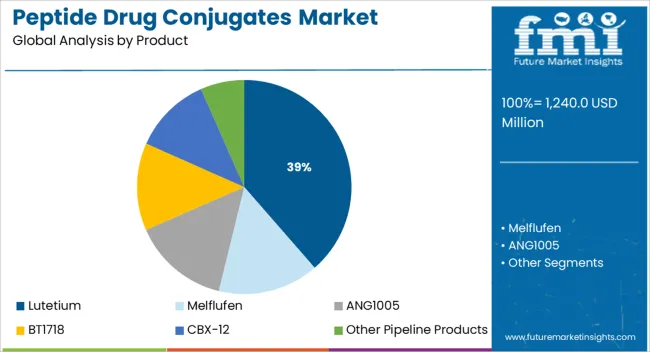

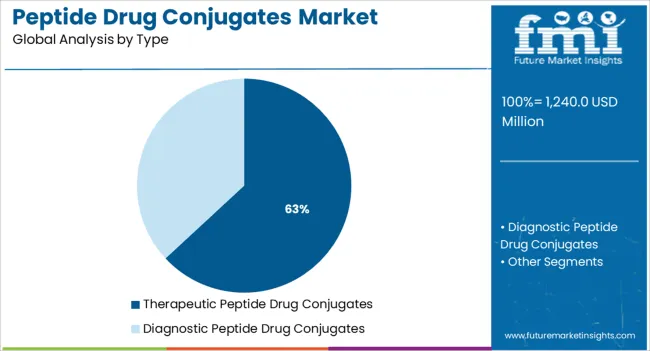

The market is segmented by Product and Type and region. By Product, the market is divided into Lutetium, Melflufen, ANG1005, BT1718, CBX-12, and Other Pipeline Products. In terms of Type, the market is classified into Therapeutic Peptide Drug Conjugates and Diagnostic Peptide Drug Conjugates. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lutetium segment is projected to account for 38.60% of the overall market revenue by 2025 within the product category, establishing it as the leading contributor. This dominance is driven by lutetium’s strong therapeutic performance in radiopharmaceutical applications, particularly in targeting specific cancer cells with minimal impact on surrounding healthy tissues.

The isotope’s favorable decay characteristics, including its emission profile and half life, support its growing use in targeted radiotherapy. Furthermore, increasing clinical evidence demonstrating its efficacy in managing advanced neuroendocrine tumors and prostate cancer has propelled its adoption.

Investment in radiolabeled peptide technologies and expanding production capabilities are reinforcing the uptake of lutetium based peptide drug conjugates, positioning it as a key product segment in the evolving oncology landscape.

The therapeutic peptide drug conjugates segment is expected to hold 63.10% of total market revenue by 2025 within the type category, making it the most dominant segment. This leadership is attributed to their role in delivering targeted cytotoxic agents directly to diseased cells, significantly improving treatment outcomes while minimizing side effects.

Therapeutic peptide conjugates have demonstrated strong applicability in oncology, endocrinology, and autoimmune diseases due to their high specificity and biodegradability. The segment’s growth is further supported by increasing research and development activity, a rising number of clinical trials, and expanding strategic partnerships between biotech startups and large pharmaceutical firms.

As the need for precise and effective treatment modalities intensifies, therapeutic peptide drug conjugates continue to lead the market based on their safety, efficacy, and commercial viability.

The global peptide drug conjugates market garnered USD 1240 Million in 2025, expanding at a historical CAGR of 16%. Pharmaceutical companies are developing PDCs for metabolic diseases and coronavirus diseases and cancer among others.

Currently, the market has two FDA-approved drugs Pepaxto (Melflufen) and Lutathera (Lu 177 dotatate) for cancer treatment. Therefore, the rising prevalence of such diseases is driving the peptide drug conjugates market. According to the National Cancer Institute, in 2024, more than 1.8 million new cancer cases and more than 600,000 deaths occurred in the USA due to cancer.

Due to the increased number of cancer cases, the pharmaceutical industry has been pushed to investigate additional drug conjugates, resulting in the development and popularity of PDCs. The estimation reveals that the PDCs market is projected to secure a market value of USD 5,331.83 Million by 2035.

Growing Technological Advancements and Financial Investments to Aid Market Growth

The strong product pipeline and increasing financial investments in research and development are offering lucrative opportunities for the peptide drug conjugates market growth. For instance, AngioChem, Inc.’s product candidate- ANG1005 indicated for brain tumors is undergoing phase 3 clinical studies, and Bicycle Therapeutics pipeline products- BT5528&BT1718 indicated for non-small cell carcinoma, are under phase 2 clinical trials. Hence, the expected new PDC approval for the treatment of multiple types of cancer will boost the market growth in the near future.

According to the national cancer institute, there are more than 250 FDA-approved chemotherapeutic drugs used in the treatment of malignant tumors. However, the major drawback associated with such small molecules is uncontrolled toxicity resulting in severe side effects. Moreover, increasing drug resistance of tumor cells to such agents has led to demand for a better treatment approach like targeted PDCs and thereby, driving the peptide drug conjugates space.

Increasing Costs to Hinder Market Growth

Low bioactivity, poor stability, long research and development time, and slow clinical development process as therapeutic agents of PDC are expected to restrain the segment, leading to an increase in overall time and cost incurred for the development.

Presence of Key Players in the Region to Increase Consumer Demand

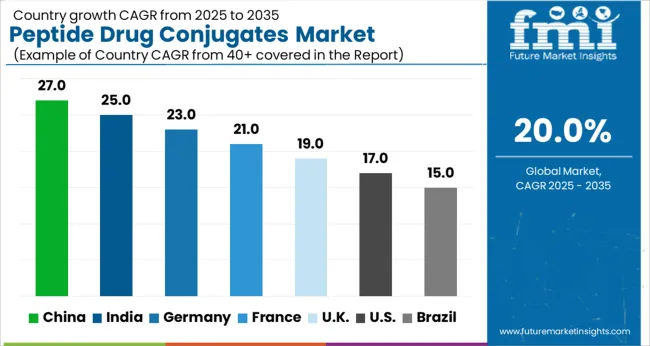

North America dominated the overall peptide drug conjugates (PDCs) market in terms of the revenue share of 45.6% in 2025, owing to the launch of Melflufen and the rapid uptake of PDC drugs in cancer therapy.

Increasing awareness about current treatment options, favorable reimbursement policies, and improved patient affordability are the factors expected to drive market growth. Furthermore, rising cases of cancer and related mortality are fueling the market growth in the region. For instance, NCI reported approximately 1,806,590 new cancer cases and 606,520 disease-related deaths in 2024.

Increasing Investments to Develop PDCs to Boost Regional Market

Asia Pacific is expected to witness a growth rate of 27.4% during the forecast period. The growth of the region is attributed to the upsurge in the number of cancer cases and strategic initiatives undertaken by the market players for regional expansion in such regions. Furthermore, rising research and development along with increasing investments to develop and commercialize such novel delivery systems is anticipated to boost the market growth in the region.

Lutathera Product Segment to Dominate the Category

The Lutathera product segment dominated the peptide drug conjugates market with a revenue share of 80.5% in 2025. The first FDA-approved PDC is Novartis’s Lutathera (lutetium Lu 177), a radiolabeled somatostatin analog which is an advanced accelerator injection. The expected patent expiry date is 25th July 2038. It is indicated for the treatment of somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors including foregut, midgut, and hindgut neuroendocrine tumors in adults. Lutathera consists of an amide linkage between homing peptide somatostatin and cytotoxic radiotherapeutic agent 177Lu.

Oncopeptides AB received FDA approval for its first-in-class peptide-conjugated alkylator, Pepaxto (melflufen), in February 2024. The combination of Pepaxto (Melphalan flufenamide) with dexamethasone is indicated for multiple myeloma in adult patients. The drug has demonstrated anti-myeloma activity in myeloma tumor cells resistant to bortezomib and the alkylator melphalan. Melflufen patents cover major markets in the USA, Japan, Canada, and Europe. However, the drug has been withdrawn from the USA market in October 2024, based on overall survival data from its phase 3 study.

Therapeutic Segment Leads the Type Segment and is Projected to Dominate the Market

Therapeutic agents of PDC dominated the peptide drug conjugates market with a revenue share of 82.3% in 2025 and are anticipated to witness the fastest growth. The factors attributing to dominance is the presence of both approved PDCs, Lutathera and Pepaxtoas therapeutic agents targeting tumor cells. Moreover, the presence of targeting therapeutic drugs such as ANG1005,

BT5528 and BT1718 under clinical trials are expected to boost the market during the forecast period. Along with cancer, pharmaceutical companies are developing targeting therapeutic PDCs for metabolic diseases and coronavirus diseases due to the significant benefits of PDCs in the therapeutic segment.

PDCs coupled with radionuclides can also act as diagnostic agents. For example, Mallinckrodt Pharmaceuticals’ In-DTPA-octreotide (octreoscan) which contains radioactive nucleotides, is primarily used in the localization of neuroendocrine tumors. Furthermore, the development and applications of PDCs in diagnosis are anticipated to offer remunerative opportunities for segment growth.

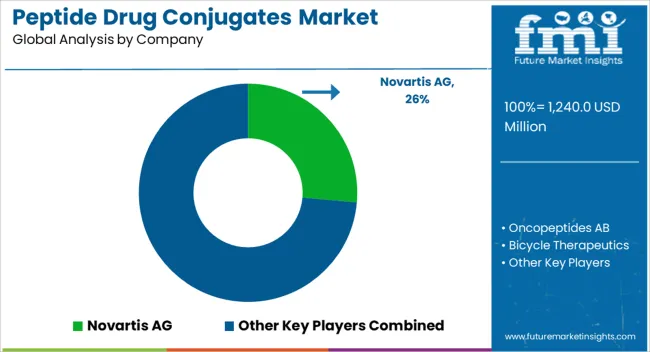

The players in the market are focusing to increase their global influence and adopt strategies such as; acquisition, collaboration, and partnerships. Key players in the market include Novartis AG; Bicycle Therapeutics; AstraZeneca; Cybrexa Therapeutics; Oncopeptides AB; Angiochem Inc.; Innovasium Soricimed Biopharma; and Theratechnologies. Some of the recent key developments among key players are:

| Report Attributes | Details |

|---|---|

| Market Value in 2025 | USD 1240.0 million |

| Market Value in 2035 | USD 7677.8 million |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2025 |

| Quantitative Units | USD Million for Value and CAGR from 2025 to 2035 |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Segments Covered | Type, Product, Region |

| Key Companies Profiled | Novartis AG; Oncopeptides AB; Bicycle Therapeutics; AstraZeneca; Cybrexa Therapeutics; Angiochem Inc.; Innovasium Soricimed Biopharma; Theratechnologies; Coherent Biopharma; WuXI STA |

| Pricing | Available upon Request |

The global peptide drug conjugates market is estimated to be valued at USD 1,240.0 million in 2025.

The market size for the peptide drug conjugates market is projected to reach USD 7,677.8 million by 2035.

The peptide drug conjugates market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in peptide drug conjugates market are lutetium, melflufen, ang1005, bt1718, cbx-12 and other pipeline products.

In terms of type, therapeutic peptide drug conjugates segment to command 63.1% share in the peptide drug conjugates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Based Nanomaterials Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide-based Sweetener Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peptide Receptor Radionuclide Therapy (PRRT) Market Trends and Forecast 2025 to 2035

Peptide Synthesis Market Analysis – Trends, Share & Growth 2025 to 2035

Key Players & Market Share in the Peptide Microarray Sector

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Peptide Antibiotics Market

Peptide Microarrays Market

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Tetra-Peptide Anti-Wrinkle Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Marine Peptide Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA