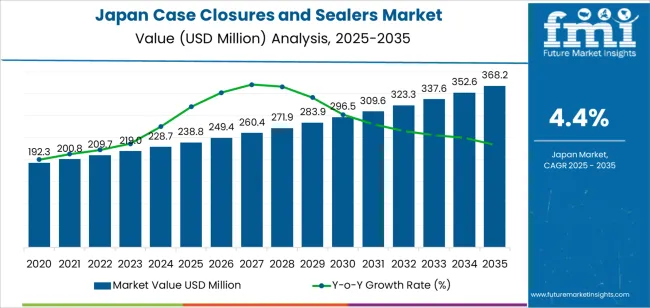

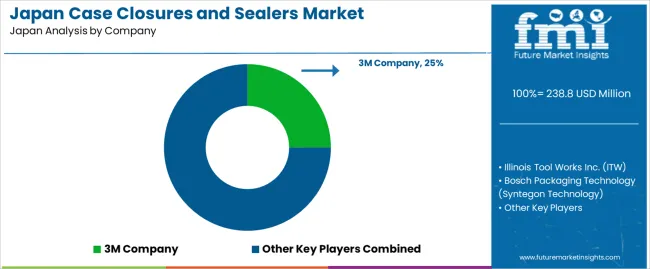

The demand for case closures and sealers in Japan is valued at USD 238.8 million in 2025 and is projected to reach USD 368.2 million by 2035, reflecting a CAGR of 4.4%. Between 2025 and 2030, the market will grow steadily, increasing from USD 238.8 million to approximately USD 296.5 million by 2030. This period of growth is driven by the expanding demand for packaging solutions in food and beverage, pharmaceuticals, and consumer goods industries. The steady increase reflects the ongoing need for secure, reliable, and efficient sealing technologies to ensure product safety, quality, and compliance with regulatory standards.

From 2030 to 2035, the demand for case closures and sealers continues to rise, reaching USD 368.2 million by 2035. The later years of the forecast will experience a slightly higher growth rate, driven by innovations in packaging technologies, including automation and eco-friendly materials. As industries seek more sustainable and cost-effective solutions, the adoption of advanced closure and sealing technologies will become more widespread. The growing emphasis on sustainability in packaging will support this demand, particularly in the food and beverage sector, where sealing plays a crucial role in product freshness and shelf-life.

Between 2025 and 2030, the demand for Case Closures and Sealers in Japan is expected to grow from USD 238.8 million to USD 249.4 million, representing an increase of USD 10.6 million. This phase will experience a moderate growth rate, driven by the continued importance of effective sealing and packaging solutions in industries such as food and beverages, pharmaceuticals, and chemicals. As regulatory standards tighten and the focus on product integrity intensifies, the demand for reliable and advanced case closures and sealers will rise. The sector will likely see innovations in materials and technologies that enhance packaging safety and consumer convenience, boosting the market during this period.

From 2030 to 2035, the market is forecast to grow more robustly, rising from USD 249.4 million to USD 368.2 million, reflecting an increase of USD 118.8 million. The accelerated growth in this period can be attributed to the ongoing demand for high-quality packaging solutions across a broader range of industries. Case closures and sealers are essential to meet consumer expectations for convenience, safety, and quality. With increasing product diversification and packaging automation, manufacturers are likely to invest in more advanced technologies that improve sealing efficiency, reduce costs, and meet sustainability goals, further propelling market growth in the latter half of the forecast period.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 238.8 million |

| Forecast Value (2035) | USD 368.2 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The current market expansion in Japan is largely driven by increased automation in manufacturing, heightened labour cost pressures, and rising standards of packaging quality in industries such as food & beverage, pharmaceuticals and electronics. Historically, Japan’s packaging machinery adoption was slower because of long procurement cycles and legacy manual systems. Over the past decade, however, companies have begun replacing tape and hand sealing operations with semi automatic and automatic case sealers to meet stricter efficiency and hygiene requirements in export oriented production. The move from manual to mechanised case sealing is a key factor supporting demand growth.

Looking ahead, future growth will be shaped by the convergence of ageing workforce concerns, growth in e commerce fulfilment and stricter traceability and clean room requirements. As manufacturers in Japan face fewer available operators, adoption of automated case closures and sealers will accelerate. Simultaneously, the growth of online retail and direct to consumer distribution will increase demand for sealed cartons and consistent packaging integrity. In addition, clean room production in pharmaceuticals and electronics will require fully enclosed sealing systems, further driving uptake. These factors will sustain steady demand growth in the coming years.

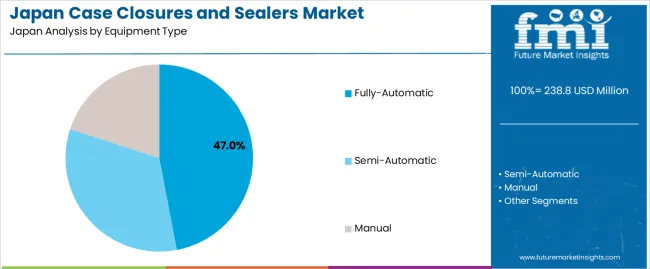

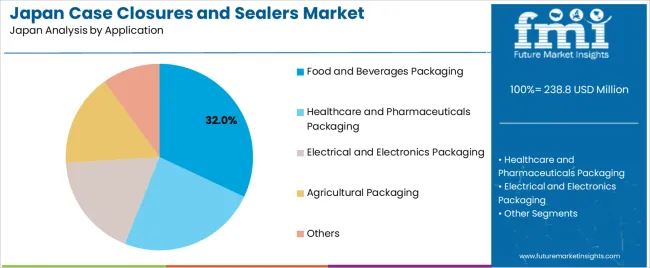

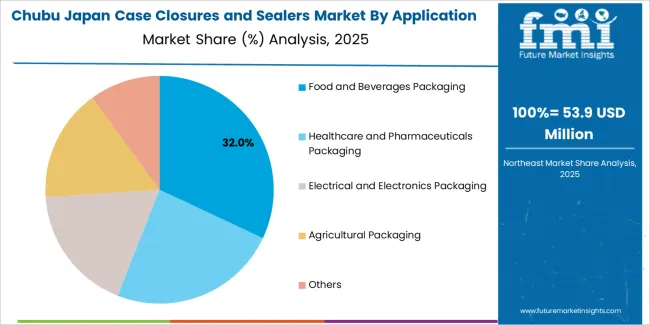

The demand for case closures and sealers in Japan is segmented by equipment type and application. In terms of equipment type, fully-automatic systems account for 47% of the market, followed by semi-automatic and manual systems. Fully-automatic systems are preferred for their high efficiency and ability to handle large-scale operations. In terms of application, case closures and sealers are used across various industries, including food and beverages packaging, healthcare and pharmaceuticals, electrical and electronics, agricultural packaging, and others. Food and beverages packaging leads the demand, accounting for 32% of the total market, driven by the high volume of packaged goods in the sector.

Fully-automatic case closures and sealers dominate the demand in Japan, representing 47% of the market. These systems are highly sought after for their efficiency, speed, and precision, making them ideal for large-scale packaging operations across various industries. The automation reduces labor costs, minimizes human error, and ensures consistent packaging quality, all crucial for maintaining production efficiency in high-volume environments. The demand for fully-automatic systems is particularly strong in sectors such as food and beverages, healthcare, and pharmaceuticals, where high throughput and strict quality control are essential.

The growing trend toward automation in packaging is driven by the need to meet increasing consumer demand, regulatory standards, and cost-saving objectives. In Japan, fully-automatic closures and sealers allow manufacturers to keep pace with the rapid expansion of industries such as food packaging, where fast, reliable, and hygienic sealing solutions are critical. As Japan continues to prioritize operational efficiency and product safety, the demand for fully-automatic systems is expected to remain strong, supporting the need for scalable and high-performance packaging equipment.

Food and beverages packaging accounts for 32% of the total demand for case closures and sealers in Japan. This segment is driven by the increasing consumption of packaged food and beverages, fueled by Japan’s busy lifestyle and demand for convenience. Case closures and sealers ensure that products such as snacks, beverages, and ready-to-eat meals are securely sealed, maintaining freshness, quality, and safety. The food and beverage industry in Japan is highly regulated, requiring reliable packaging systems to prevent contamination and extend shelf life, further increasing the demand for advanced sealing equipment.

The growing trend toward packaged food, especially ready-to-eat meals and beverages, contributes to the rising demand for case closures and sealers. Additionally, the shift toward sustainable packaging solutions and consumer demand for hygiene and convenience drive the adoption of automated and semi-automated systems. As the food and beverages sector continues to expand in Japan, the need for packaging solutions that ensure quality, compliance, and operational efficiency remains critical, sustaining the demand for high-performance case closures and sealers.

The demand for case closures and sealers in Japan is influenced by factors including automation in manufacturing, increasing packaging needs across various sectors, and evolving consumer preferences. High demand for secure and efficient packaging in industries such as food & beverage and pharmaceuticals drives this market. However, constraints such as high machinery costs and the slow pace of procurement processes in regulated sectors limit growth. Trends such as the shift toward compact, high-speed sealing solutions and a growing focus on sustainability in packaging are key to shaping the demand for case closures and sealers in Japan.

Manufacturers in Japan are under increasing pressure to improve efficiency and reduce labor costs. Automated packaging lines, including case closures and sealers, have become essential to meet these demands. Additionally, industries such as food & beverage, e-commerce, and pharmaceuticals require robust sealing solutions to handle high volumes of products, particularly for safe and secure shipping. The growing trend of e-commerce and increased product packaging in the food sector is driving the need for more advanced, reliable case closures and sealers. Japanese manufacturers are focusing on investing in machinery that ensures faster turnaround times and increased operational efficiency.

Despite the growing demand, high initial costs associated with purchasing and installing advanced sealing equipment are limiting widespread adoption in Japan. For many companies, particularly small and medium-sized enterprises, the financial barrier to upgrading existing equipment is significant. Additionally, the slow procurement processes in regulated industries, like pharmaceuticals, create delays in equipment upgrades. Japan’s stringent regulatory environment for packaging materials adds further complexity, as manufacturers must ensure that case closures meet high standards for safety, hygiene, and quality. These constraints act as key barriers to expanding the case closures and sealers market in Japan.

One of the main trends in Japan’s case closures and sealers market is the increasing demand for equipment that can accommodate varied packaging sizes and faster changeovers. The shift toward more flexible and versatile packaging systems is being driven by evolving consumer preferences and the rise of e-commerce, where smaller and more frequent deliveries are common. Additionally, there is a growing focus on reducing environmental impact, leading to the adoption of more sustainable sealing materials and methods. These trends suggest a shift toward machinery that supports quicker, more efficient, and environmentally conscious packaging solutions in Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.5% |

| Kanto | 5.1% |

| Kinki | 4.5% |

| Chubu | 3.9% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

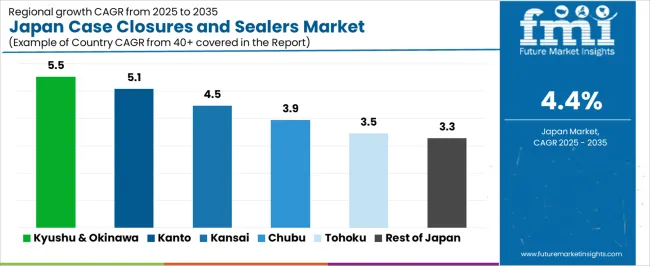

The demand for case closures and sealers in Japan is projected to grow at different rates across regions. Kyushu & Okinawa lead with a 5.5% CAGR, supported by local manufacturing of packaging machinery and rising automation in logistics operations. The Kanto region follows at 5.1%, driven by its large concentration of food, beverage and pharmaceutical packaging facilities investing in end of line automation. The Kinki region achieves 4.5% growth as regional manufacturers upgrade ageing equipment. In Chubu the 3.9% CAGR reflects moderate adoption in manufacturing hubs. Tohoku at 3.5% and the Rest of Japan at 3.3% show slower uptake, reflecting lower industrial density and slower capital investment in packaging automation.

In Kyushu & Okinawa, the demand for case closures and sealers is growing at a CAGR of 5.5% through 2035. The region's food, beverage, and pharmaceutical industries are key drivers of this growth. With increasing demand for efficient packaging solutions, the adoption of automated and semi-automated sealing equipment is on the rise. The expanding manufacturing capabilities in both regions, especially in food production and pharmaceuticals, are contributing to the growing use of case closures and sealers. Additionally, the local focus on improving packaging efficiency and sustainability is boosting market growth in Kyushu & Okinawa.

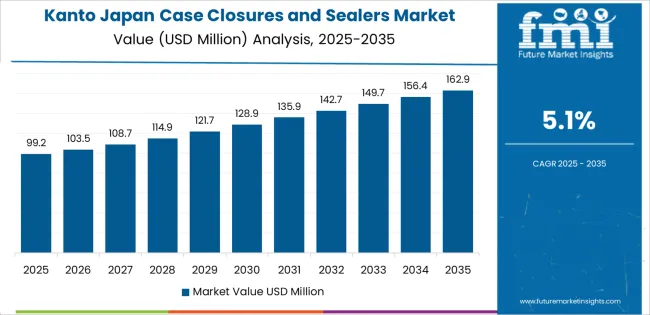

In Kanto, the demand for case closures and sealers is projected to grow at a CAGR of 5.1% through 2035. As Japan's largest economic region, Kanto has a well-developed food, beverage, healthcare, and pharmaceutical industry, all of which are driving the demand for packaging equipment. The rapid growth in the retail sector and increasing e-commerce activities are also contributing to higher packaging needs, which in turn increases the demand for case closures and sealers. The region’s high level of automation in packaging operations ensures that these systems continue to see widespread use in various industries.

In Kinki, the demand for case closures and sealers is expected to grow at a CAGR of 4.5% through 2035. Kinki's strong industrial base, especially in food processing and pharmaceuticals, is driving the demand for advanced sealing equipment. As more manufacturers focus on improving production efficiency, the need for reliable and efficient sealing systems is increasing. The region’s retail and foodservice sectors are also adopting automated sealing solutions to meet consumer demand for high-quality, well-packaged products. The trend towards sustainable packaging is further supporting the use of case closures and sealers in Kinki.

In Chubu, the demand for case closures and sealers is projected to grow at a CAGR of 3.9% through 2035. The region’s food and beverage industries are the primary drivers of packaging equipment demand, with increasing adoption of automated and semi-automated case closures and sealers. As Chubu's manufacturing sector expands and more companies focus on optimizing production efficiency, the need for reliable sealing systems grows. Additionally, the region’s growing focus on sustainability is pushing for eco-friendly packaging solutions, which is boosting the adoption of case closures and sealers in various industries.

In Tohoku, the demand for case closures and sealers is expected to grow at a CAGR of 3.5% through 2035. While the market in Tohoku is smaller compared to other regions, the increasing adoption of automated packaging systems in food and agricultural sectors is contributing to steady growth. The region’s growing interest in sustainable and efficient packaging solutions is also boosting demand for case closures and sealers. As local manufacturers invest in better packaging technology, the need for advanced sealing solutions continues to rise in Tohoku.

In the rest of Japan, the demand for case closures and sealers is projected to grow at a CAGR of 3.3% through 2035. As regional markets develop and packaging standards improve, the demand for packaging equipment continues to rise. Local industries in sectors such as food, agriculture, and pharmaceuticals are adopting case closures and sealers to improve production efficiency and packaging quality. The increasing focus on eco-friendly packaging options is contributing to the growing adoption of sustainable sealing systems in these regions.

The demand for case closures and sealers in Japan is largely influenced by the country’s advanced manufacturing landscape, which relies on efficient and reliable packaging solutions. As industries such as food and beverage, pharmaceuticals, and electronics expand, the need for high-quality sealing technologies increases. The aging workforce in Japan, combined with rising labor costs, is prompting companies to adopt automated and semi-automated packaging systems to improve efficiency and reduce reliance on manual labor. Additionally, increasing consumer preference for well-packaged, secure products is driving the demand for innovative case closures and sealers.

Key players in Japan’s case closures and sealers market include 3M Company, Illinois Tool Works Inc. (ITW), Syntegon Technology, ProMach (via Wexxar Bel), and Lantech Inc. These companies offer a range of sealing systems and case-erecting machines tailored to meet the needs of Japan’s diverse industries. 3M is known for its adhesive and sealing technologies, while ITW provides specialized solutions for packaging in the food and beverage sectors. Syntegon Technology and Wexxar Bel offer high-speed, precise sealing machinery, and Lantech focuses on durable case sealing and stretch wrapping systems. These companies continue to innovate and refine their offerings to meet the evolving demands of the Japanese market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Equipment Type | Fully-Automatic, Semi-Automatic, Manual |

| Application | Food and Beverages Packaging, Healthcare and Pharmaceuticals Packaging, Electrical and Electronics Packaging, Agricultural Packaging, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | 3M Company, Illinois Tool Works Inc. (ITW), Syntegon Technology, Wexxar Bel (a brand under ProMach), Lantech Inc. |

| Additional Attributes | Dollar by sales by type, application, and region; regional CAGR and adoption trends; volume and value growth projections; regulations surrounding packaging machinery for various industries; advancements in automation, traceability, and compliance features; demand for eco-friendly packaging solutions; focus on speed, efficiency, and product integrity; innovations in sealing technologies; growing demand for automated systems due to labor cost pressures; role of sealing in food safety, healthcare, and electronics. |

The demand for case closures and sealers in Japan is estimated to be valued at USD 238.8 million in 2025.

The market size for the case closures and sealers in Japan is projected to reach USD 368.2 million by 2035.

The demand for case closures and sealers in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in case closures and sealers in Japan are fully-automatic, semi-automatic and manual.

In terms of application, food and beverages packaging segment is expected to command 32.0% share in the case closures and sealers in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Casein Peptone in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Casein Hydrolysate in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Case Coders Market Size and Share Forecast Outlook 2025 to 2035

Case Material Market Size and Share Forecast Outlook 2025 to 2035

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA