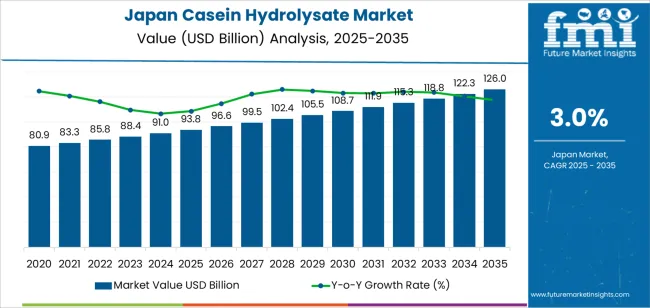

The demand for casein hydrolysate in Japan is expected to reach USD 93.8 billion in 2025, growing steadily to USD 126.0 billion by 2035, with a CAGR of 3.0%. Between 2025 and 2030, the market will experience gradual growth, rising from USD 93.8 billion to approximately USD 108.7 billion. The steady increase during this period reflects the growing use of casein hydrolysate in sectors such as food and beverages, pharmaceuticals, and health supplements. Its application in infant formula and specialized nutritional products continues to be a significant driver, fueled by rising consumer interest in health-conscious and personalized nutrition solutions.

From 2030 to 2035, the demand will continue its consistent upward trajectory, reaching USD 126.0 billion by 2035. This period will be marked by increased research into casein hydrolysate's functional properties and broader adoption in nutraceuticals and protein-based supplements. As the demand for high-quality protein sources grows, particularly in the wellness and fitness sectors, the adoption of casein hydrolysate is expected to expand further. By 2035, the market will have matured, but its steady growth will be sustained by ongoing product innovations and the growing focus on personalized healthcare and nutrition.

Between 2025 and 2030, the demand for Casein Hydrolysate in Japan is expected to grow from USD 93.8 billion to USD 96.6 billion, representing an increase of USD 2.8 billion. This period will reflect a compound annual growth rate (CAGR) of 3.0%, driven by the growing demand for protein hydrolysates in sectors such as nutrition, food, and pharmaceuticals. Casein hydrolysate is increasingly used in infant formula, medical nutrition, and dietary supplements due to its bioavailability and health benefits. As consumer awareness of its nutritional advantages rises, the demand for casein hydrolysate will continue to expand, further supported by the increasing focus on high-quality, easily digestible protein sources in health and wellness products.

From 2030 to 2035, the demand for Casein Hydrolysate is forecast to grow from USD 96.6 billion to USD 126.0 billion, marking a substantial increase of USD 29.4 billion. This accelerated growth will be driven by the ongoing trend towards premium nutrition products, as well as increasing consumer preference for functional foods and dietary supplements. The expansion of the healthcare and wellness sectors, coupled with the rise in demand for specialized nutrition solutions, will support this trend. Companies are expected to focus on innovations in casein hydrolysate formulations to meet evolving consumer needs, further boosting market growth and solidifying its position in the Japanese market.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 93.8 billion |

| Forecast Value (2035) | USD 126.0 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

Historically, the demand for casein hydrolysate in Japan has been shaped by the country’s ageing population and mature nutrition markets. The ingredient’s use in medical nutrition for post surgery recovery, gastrointestinal disorders and older adult dietary support has grown steadily. At the same time, infant nutrition for formulae addressing cow’s milk protein allergy (CMPA) has supported adoption of hydrolysed dairy proteins, including casein hydrolysate. The established dairy processing infrastructure in Japan has also enabled local supply of high grade hydrolysates. Production upgrades in enzymatic hydrolysis improved digestibility and bioavailability, helping boost usage in specialist food and beverage applications.

Looking ahead, future growth in Japan will be driven by several evolving factors. The increasing interest in sports and active lifestyle nutrition will expand use of rapidly absorbed, premium proteins like casein hydrolysate. The growth of functional foods and beverages targeted at digestive health and older adult wellness will further support demand. Advances in manufacturing to deliver flavour masked, clean label hydrolysates will improve market acceptance. While competition from plant based protein hydrolysates and rising raw material costs present constraints, the convergence of health driven consumption and product innovation will ensure sustained growth in the Japanese casein hydrolysate market.

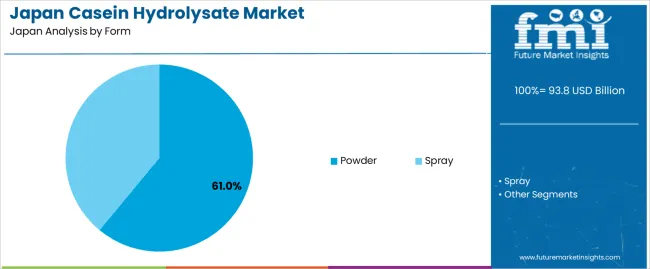

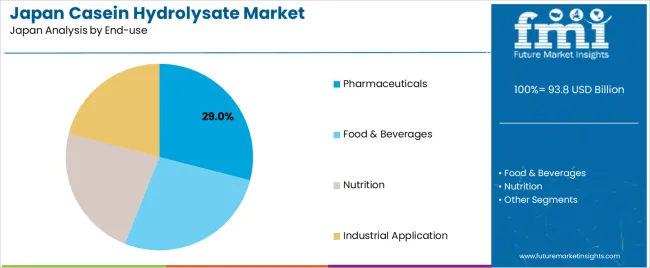

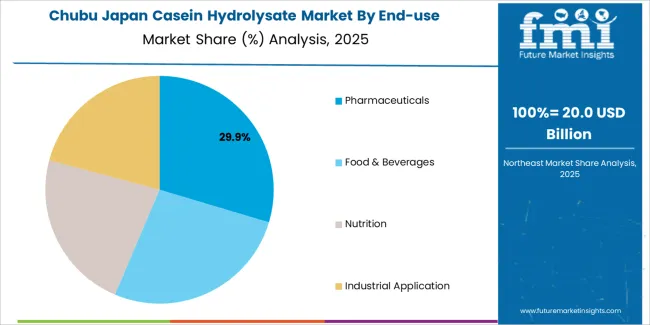

The demand for casein hydrolysate in Japan is influenced by both form and end-use. The two primary forms are powder and spray, with powder form leading the demand at 61%. In terms of end-use, the key industries include pharmaceuticals (29%), food and beverages, nutrition, and industrial applications. Powdered casein hydrolysate is preferred for its versatility and ease of incorporation into various products, while spray form is used for applications requiring quick dissolution or specific texture. These segments reflect the broad usage of casein hydrolysate across different sectors, driven by its nutritional and functional benefits.

Powdered casein hydrolysate represents 61% of the total demand in Japan. This form is highly favored due to its convenience, stability, and versatility, which makes it ideal for various applications. Powdered casein hydrolysate is widely used in the pharmaceutical and food industries due to its easy handling, storage, and incorporation into both solid and liquid formulations. Its ability to provide high-quality protein with enhanced digestibility makes it an essential ingredient in nutritional products, especially for infant formulas and sports nutrition. Furthermore, powdered form offers longer shelf life compared to spray, driving its demand across diverse sectors.

The preference for powdered casein hydrolysate is also supported by its role in enhancing the nutritional profile of a range of food and beverage products. In addition, the powder form can be efficiently scaled for mass production, making it suitable for large manufacturers. Its use in the pharmaceutical sector, particularly in protein supplements and medicinal formulations, contributes significantly to its demand. With the growing interest in protein-based nutrition and functional foods in Japan, the demand for powdered casein hydrolysate is expected to continue to increase, driven by its wide applicability and benefits in health-focused products.

Pharmaceuticals represent 29% of the total demand for casein hydrolysate in Japan. This demand is primarily driven by the growing use of casein hydrolysate as a protein supplement in various therapeutic and medical applications. Its high digestibility and amino acid profile make it an ideal ingredient in supplements aimed at patients with specific dietary requirements, including those recovering from illness or surgery. Casein hydrolysate is also used in infant nutrition products, where easily absorbed proteins are critical for infant growth and development.

The demand for casein hydrolysate in pharmaceuticals is supported by Japan's aging population, which has increased the need for medical nutrition products targeting elderly health. Casein hydrolysate’s role in boosting immune function and supporting muscle recovery has also led to its growing inclusion in nutritional products designed for senior care. As Japan continues to invest in healthcare and wellness products, the demand for casein hydrolysate in pharmaceuticals is expected to remain strong, driven by the increasing focus on functional foods and dietary supplements in the healthcare sector.

Demand for casein hydrolysate in Japan is driven by a mature healthcare system, an ageing population and strong demand for easily digestible, high quality proteins. Growth is especially visible in the clinical nutrition, sports nutrition and infant formula sectors. At the same time, cost pressures related to dairy raw materials, stringent regulatory requirements and competition from plant based alternatives act as restraints. Trends include tailored hydrolysate formulations (e.g., low allergenic, fast absorbing), increased use in wellness and lifestyle products and integration into digital retail channels. These dynamics are shaping how the casein hydrolysate market in Japan evolves.

Japan’s population includes a large segment of elderly consumers who require protein sources that aid muscle maintenance, recovery and general wellness. Casein hydrolysate offers high quality amino acids with easier absorption and is appearing in medical nutrition, meal replacement and supplement products targeted at seniors. At the same time, Japanese consumers increasingly seek functional foods and beverages that support preventive health. These demographic and nutritional health trends therefore underpin rising uptake of casein hydrolysate in Japan.

Manufacturers in Japan face higher cost structures for dairy derived ingredients such as casein hydrolysate due to dairy price volatility and processing complexity. Regulatory approval and stringent food safety standards impose additional costs and time for specialized hydrolysate formulations. Meanwhile, plant based protein hydrolysates and simpler dairy derived proteins compete aggressively, limiting pricing power and share expansion. These cost, raw material and competitive factors restrain faster growth of the casein hydrolysate segment in Japan.

In Japan the casein hydrolysate market is shifting from basic nutrition to more specialised applications such as hypoallergenic infant formulas, sports nutrition blends and clinical nutrition meal systems. Formulators are offering hydrolysates with lower allergenicity, enhanced solubility and tailored amino acid profiles. Online retail and e commerce channels are enabling niche products and functional ingredient claims. Clean label and transparent sourcing are also gaining importance among Japanese consumers. These trends indicate that casein hydrolysate demand in Japan is evolving toward premium, differentiated formulations and diverse channels.

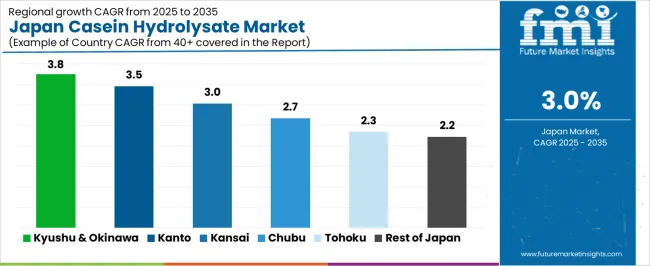

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8% |

| Kanto | 3.5% |

| Kinki | 3.0% |

| Chubu | 2.7% |

| Tohoku | 2.3% |

| Rest of Japan | 2.2% |

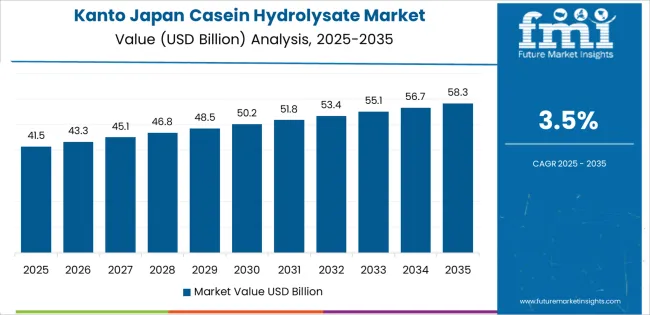

The demand for casein hydrolysate in Japan is projected to grow regionally with Kyushu & Okinawa at the highest rate of 3.8 %. This region benefits from expanding nutritional product manufacturing and regional dairy industry linkages supporting hydrolysate production. The Kanto region follows at 3.5 %, backed by strong biotech and clinical nutrition sectors that incorporate hydrolysed proteins. In the Kinki region the growth rate is 3.0 %, driven by food formulation activity and mid tier nutrition manufacturing. The Chubu region at 2.7 % reflects moderate demand tied to local ingredient sourcing and processing facilities. Tohoku at 2.3 % and the Rest of Japan at 2.2 % show slower rates due to smaller scale of high end nutrition manufacturing and less concentrated demand clusters.

In Kyushu & Okinawa, the demand for casein hydrolysate is growing at a CAGR of 3.8% through 2035. This growth is primarily driven by the increasing demand for functional food and beverage products, where casein hydrolysate is valued for its high bioavailability and protein content. The expanding healthcare and nutrition sectors in both regions are contributing to the rise in demand for casein hydrolysate. Additionally, the growing focus on health-conscious consumers and the development of new dietary supplements is further driving the market in Kyushu & Okinawa.

In Kanto, the demand for casein hydrolysate is projected to grow at a CAGR of 3.5% through 2035. As Japan's largest economic and industrial hub, Kanto has a well-established food and beverage industry that continues to drive the demand for high-quality ingredients like casein hydrolysate. The region’s growing focus on functional and nutraceutical products is fueling the demand for this ingredient. Additionally, Kanto’s large population and increasing awareness of health and wellness are further supporting the market for casein hydrolysate in food and supplements.

In Kinki, the demand for casein hydrolysate is expected to grow at a CAGR of 3.0% through 2035. The region’s strong presence in food manufacturing, particularly in processed foods and dairy products, is supporting the increasing use of casein hydrolysate. As consumer demand for high-quality protein sources and functional ingredients rises, manufacturers in Kinki are increasingly adopting casein hydrolysate for use in food and beverage products. The growing interest in personalized nutrition and wellness products is also contributing to the market’s expansion in this region.

In Chubu, the demand for casein hydrolysate is projected to grow at a CAGR of 2.7% through 2035. The region’s food and beverage industry, including dairy and nutritional products, is a significant driver of demand for casein hydrolysate. As more consumers in Chubu seek protein-enriched and functional foods, the adoption of casein hydrolysate is rising. The increasing popularity of sports nutrition and dietary supplements is also contributing to market growth. The regional focus on sustainable food production and healthy ingredients is supporting the increasing use of casein hydrolysate in various food products.

In Tohoku, the demand for casein hydrolysate is expected to grow at a CAGR of 2.3% through 2035. The demand is being driven by the increasing focus on functional foods and dietary supplements in the region. As consumer awareness of health and wellness grows, Tohoku’s food manufacturers are increasingly adopting casein hydrolysate as an ingredient in protein-rich products. Additionally, the region’s growing interest in sustainable food production is contributing to the use of natural ingredients like casein hydrolysate, which is supporting the growth of the market.

In the rest of Japan, the demand for casein hydrolysate is projected to grow at a CAGR of 2.2% through 2035. As regional food manufacturers look for functional ingredients to meet growing consumer demand for healthier products, casein hydrolysate is becoming increasingly popular. The rise in health-conscious consumers across smaller markets is fueling the demand for high-quality protein ingredients. Additionally, the growing interest in personalized nutrition and wellness is further supporting the use of casein hydrolysate in food and supplement products in these regions.

The demand for casein hydrolysate in Japan is expanding as the country adapts to demographic and nutritional shifts. The market in Japan is expected to grow at a CAGR of approximately 3.9 % between 2025 and 2035. This growth is underpinned by a rising elderly population requiring easily digestible, high quality protein sources for clinical nutrition and muscle maintenance. The infant nutrition segment also contributes as formula developers seek hypoallergenic, bio available proteins. Sports nutrition and functional food applications further drive uptake as Japanese consumers increasingly pursue health driven diets. The domestic dairy protein supply chain supports innovation in hydrolysed casein formulations.

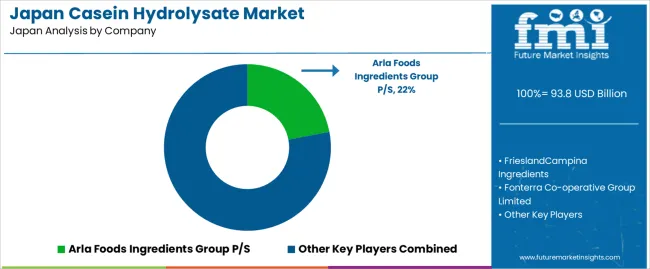

Key industry players include Arla Foods Ingredients Group P/S, FrieslandCampina Ingredients, Fonterra Co operative Group Limited, AMCO Proteins and Glanbia plc. Arla Foods delivers tailored hydrolysed casein products suited for mature nutrition and infant segments. FrieslandCampina and Fonterra leverage extensive dairy networks and ingredient expertise to service Japanese formulators. AMCO Proteins specialises in high purity and custom hydrolysates. Glanbia supports a broad range of applications from sports nutrition to clinical formulations. Together these companies steer the market through product development, formulation support and regional distribution.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Form | Powder, Spray |

| End-Use Industry | Pharmaceuticals, Food & Beverages, Nutrition, Industrial Application |

| Distribution Channels | Supermarkets in Japan, E-Commerce, Specialty Stores |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Arla Foods Ingredients Group P/S, FrieslandCampina Ingredients, Fonterra Co-operative Group Limited, AMCO Proteins, Glanbia plc |

| Additional Attributes | Dollar by sales by form, end-use industry, and region; regional CAGR and adoption trends; volume and value growth projections; innovations in casein hydrolysate formulations for clinical nutrition, sports supplements, and infant formula; market share and competitive dynamics of major players in the Japanese market; market trends towards hypoallergenic and fast-absorbing casein hydrolysates; rising demand for personalized nutrition solutions. |

The demand for casein hydrolysate in Japan is estimated to be valued at USD 93.8 billion in 2025.

The market size for the casein hydrolysate in Japan is projected to reach USD 126.0 billion by 2035.

The demand for casein hydrolysate in Japan is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in casein hydrolysate in Japan are powder and spray.

In terms of end-use, pharmaceuticals segment is expected to command 29.0% share in the casein hydrolysate in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Demand for Casein Peptone in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA