The Case Material Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The case material market is evolving steadily as industries seek durable, lightweight, and sustainable materials to meet growing functional and regulatory demands. Rising expectations for product longevity, hygienic standards, and aesthetic appeal have been driving manufacturers to innovate in material selection and design.

Increasing demand from healthcare, electronics, and logistics sectors has propelled investments in advanced metals, composites, and recyclable materials, aligning with both operational requirements and environmental goals.

Future growth is expected to be supported by advancements in material engineering, customization capabilities, and an expanding online retail ecosystem that facilitates broader market reach. Regulatory pressures to reduce waste, coupled with a shift toward premium and specialized applications, are creating new opportunities for suppliers to differentiate through performance and compliance. These factors are collectively paving the way for sustainable and profitable expansion across diverse end-use industries.

The market is segmented by Sales Channel, End-user, and Material Type and region. By Sales Channel, the market is divided into Online Sales, Super Market/ Hyper Market, Brands Stores, and Retail Stores. In terms of End-user, the market is classified into Healthcare & Hospitals, Food and Beverage Industry, Chemical Industry, Automotive Industry, Defence, and Others.

Based on Material Type, the market is segmented into Metal, Steel, Aluminum, Plastic, Polyethylene, PET, Polypropylene, Polystyrene, Polyamine, Others, Leather, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

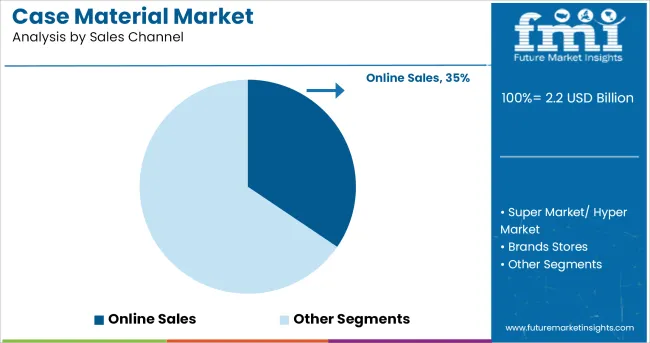

When segmented by sales channel, online sales are expected to account for 34.5% of the total market revenue in 2025, emerging as the leading channel. This prominence has been driven by a marked shift in buyer behavior toward digital platforms, where convenience, variety, and competitive pricing have attracted a wider customer base.

Businesses and consumers alike have increasingly preferred online procurement due to ease of comparing specifications, accessing niche or customized options, and benefiting from transparent reviews and support.

The online channel has also enabled suppliers to directly engage end-users, bypassing intermediaries and reducing distribution costs, which has strengthened margins and enhanced responsiveness to market trends. Broader internet penetration, improved logistics networks, and the rise of business-to-business e-commerce platforms have further entrenched the online sales channel’s leadership in the case material market.

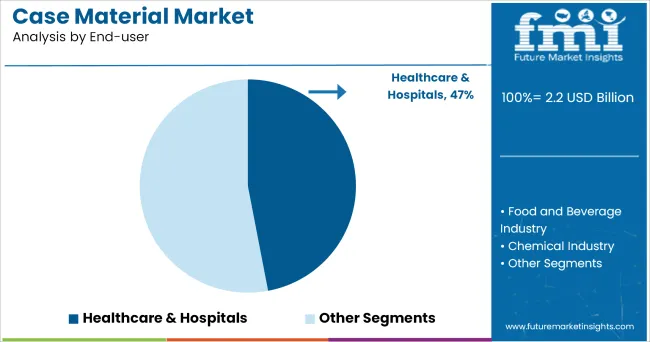

Segmenting by end-user shows that healthcare and hospitals are projected to hold 47.0% of the market revenue in 2025, maintaining their leading position. This dominance has been sustained by the healthcare sector’s critical need for sterile, durable, and reliable materials to safeguard medical instruments, devices, and supplies.

Stringent hygiene standards, coupled with the high frequency of handling and transportation in clinical settings, have necessitated the use of robust case materials that can withstand repeated sterilization and minimize contamination risks.

Increased investments in healthcare infrastructure and a rising focus on patient safety have amplified demand for specialized materials with proven performance under demanding conditions. The sector’s prioritization of compliance with health regulations and its preference for high quality, long lasting solutions have positioned healthcare and hospitals as the most significant consumers within the market.

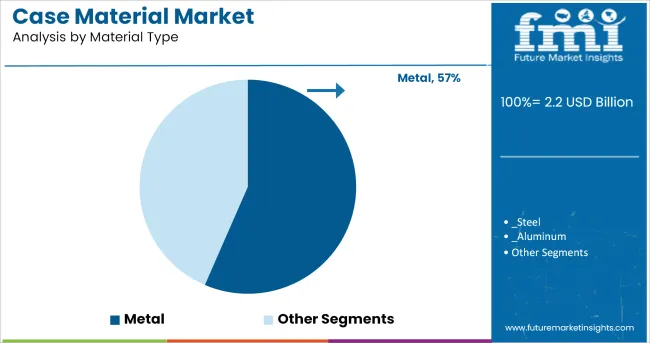

When segmented by material type, metal is anticipated to contribute 56.5% of the total market revenue in 2025, securing its position as the foremost material category. This leadership has been underpinned by metal’s inherent strength, durability, and resistance to external stresses, which have made it indispensable in applications requiring superior protection.

The ability of metals to endure harsh environments, provide structural integrity, and support precise fabrication has reinforced their appeal in industries demanding reliability and longevity.

Furthermore, the recyclability and perceived premium quality of metal materials have aligned with sustainability objectives and customer expectations for robust solutions. Advances in lightweight alloys and surface treatments have further enhanced the functional and aesthetic attributes of metal, consolidating its dominance as the preferred material in the case material market.

Packaging industries are the prime utilizers of case material due to recent development on online shopping patterns. The packaging industry continues to emphasize the importance of shipments during inclement weather.

Due to better physical and chemical properties plastic will outshine metals as raw material despite of strict environmental regulations. On the other hand, players in the case material industry may face problems as a result of the growing popularity of 'custom-designed' paper-based protective cases, which offer cost savings.

But with increasing regulation by various government bodies for environment protection to control global warming has created clouds of worry for the manufacturers. Increasing the variety of a diverse range of materials - including plastic, metal, and leather - to experiment with and stimulate creativity, manufacturers have a lot of options to choose from.

Furthermore, the adaptability of plastic materials for the production of cases of any shape or size, as well as their lightness and strength, is expected to remain a crucial lever for their widespread acceptance. In turn, as consolidation-seeking manufacturers become more concerned about environmental sustainability, metal's importance in the development of protective casings will expand at an exponential rate.

The prominent regions included in the FMI on “Global case material market” are North America, Latin America, Europe, East Asia, South Asia & Oceania and Middle East and Asia.

Asia Pacific is prominent region holding major revenue share of case material market. As China is the largest producer and exporter of plastic goods. India and Japan are following the footprints of China due to high demand of product from all over the globe.

During the evaluation period, the regional market is expected to be driven by changing lifestyles and rising disposable income. Rapid development and an increase in the number of households due to population expansion are two other major drivers propelling market growth in the region.

Succeeding Asia Pacific followed by Europe in which Germany accounts for the majority of the market share in Europe market and is predicted to grow at a CAGR of 3.4% over the forecast period. The market in the region is being driven by the high use of various types of cookware which need to transported and packed for safe delivery.

Whereas, North America and Latin America are anticipated to capture a significant portion of the market share. On the other hand MEA, is showing the stagnant growth throughout the projection period.

Plastic is preferred by manufacturers for protective cases. During the projected period, polypropylene is expected to lead the market in terms of market share. These cases are used to safeguard components and consumer products from harm, such as electronic components, military equipment, and delicate items that must be protected from environmental changes.

Polypropylene's high heat coefficient, combined with its excellent impact resistance, gives great value to protective case qualities. Leading players are opting for aluminum over steel in metal protective cases, which is predicted to rise at a significant rate over the projection period.

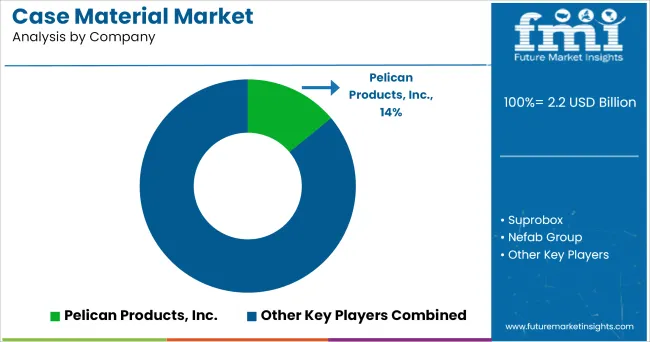

The major players in the case material market

The capacity of market participants to adapt to the changing nature of the cases material market is critical to their success. Manufacturers requires to go beyond their traditional production capabilities to fulfil the latent potential of custom development, ensuring their clients' loyalty.

Expanding the value-added product portfolio might provide improved exposure prospects for market participants in this concentrated context, where there are a few, yet well-established market leaders.

Players are aggressively pursuing a substantial portion of the market, utilizing both organic and inorganic expansion strategies. Alliances, acquisitions, and a steady expansion of their global internet sales and distribution network were the main goals.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global case material market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the case material market is projected to reach USD 3.1 billion by 2035.

The case material market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in case material market are online sales, super market/ hyper market, brands stores and retail stores.

In terms of end-user, healthcare & hospitals segment to command 47.0% share in the case material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Case Material Industry

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Case Coders Market Size and Share Forecast Outlook 2025 to 2035

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Case Erectors Market by Automation Type from 2025 to 2035

Case Packing Machines Market from 2025 to 2035

Casein Peptone Market Report – Growth & Industry Trends 2025 to 2035

Competitive Breakdown of Case Erectors Providers

Market Share Breakdown of Case Coders Industry

Casein Glycomacropeptide Market

Slipcases Market Size and Share Forecast Outlook 2025 to 2035

Crank Case Ventilation Valve Market Size and Share Forecast Outlook 2025 to 2035

Watch Case Market Trends & Growth Forecast 2024-2034

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Mobile cases and covers market Size, Share & Forecast 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Pillow Cases Market Analysis - Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA