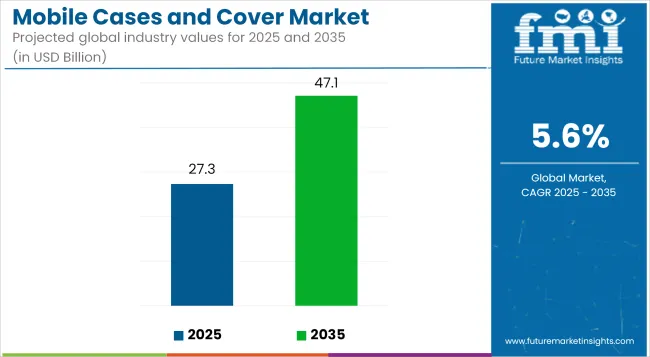

The mobile cases and covers market is projected to grow from USD 27.3 billion in 2025 to USD 47.1 billion by 2035, registering a CAGR of 5.6% during the forecast period. Reflecting stable and consistent demand.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 27.3 billion |

| Projected Market Size in 2035 | USD 47.1 billion |

| CAGR (2025 to 2035) | 5.6% |

This growth has been attributed to the rapid penetration of smartphones, rising demand for device personalization, and the need for protective solutions. Increasing consumer inclination toward stylish and functional accessories has fueled product diversification across back covers, flip cases, wallets, and pouches.

The availability of innovative materials such as biodegradable polymers, silicon blends, and hybrid shock-absorbing composites has reshaped the product landscape to align with evolving performance and aesthetic expectations.

The mobile cases and covers market has been significantly influenced by rising smartphone adoption, the need for device longevity, and growing consumer interest in personalized, multifunctional accessories.

Technological enhancements such as MagSafe compatibility, antimicrobial coatings, and wireless charging support have contributed to the growing utility and consumer appeal of modern mobile cases. Simultaneously, shifts in materials and formats have enabled the production of lightweight, shock-absorbing, and eco-friendly products that cater to both mainstream and premium customer segments. Increasing demand for stylish and durable phone protection continues to reshape design and production priorities.

The mobile cases and covers market is poised for steady expansion, supported by global smartphone shipments and evolving consumer lifestyle trends. The market’s trajectory indicates continued demand for high-performance, aesthetically appealing, and sustainably manufactured accessories.

Companies investing in research, ergonomic design, and biodegradable or recycled materials are expected to gain a competitive edge. The rise of e-commerce and demand for custom-designed cases will drive future growth. Strategic partnerships with device manufacturers and tech-driven innovation in smart features are likely to further shape the market’s direction in the coming decade.

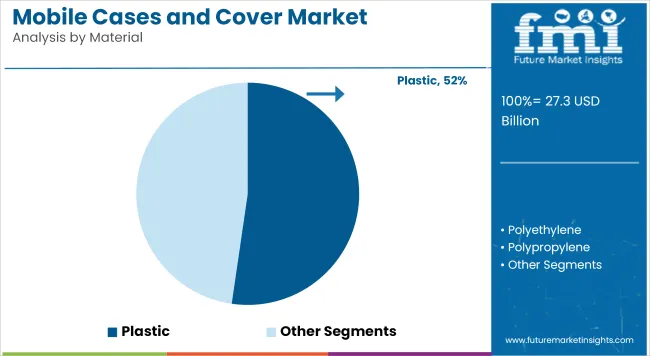

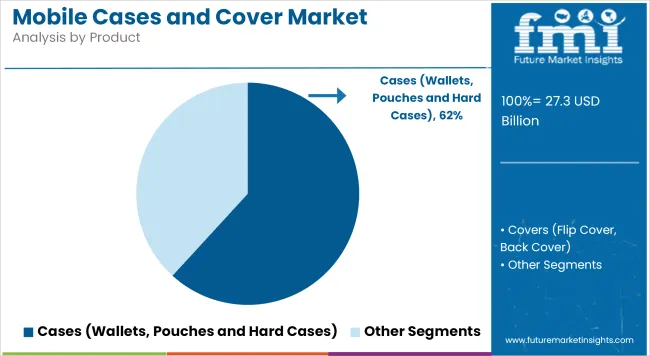

The market is segmented based on material type, product type, and print type. By material, the market includes plastic variants such as polyethylene, polypropylene, polyvinyl chloride, polyurethane, and others, alongside leather, silicon, rubber, biodegradable materials, paper & paperboard, fabric, and even food-based materials. In terms of product type, the market comprises cases, wallets, pouches, hard cases, covers, flip covers, and back covers. By print type, the market is divided into printed and non-printed categories.

Plastic materials are projected to account for 52.3% of the mobile cases and covers market by 2025, driven by their affordability, ease of molding, and mass customization potential. Within this segment, polyethylene (PE) and polypropylene (PP) are widely used for lightweight, impact-resistant back covers and pouches.

Polyvinyl chloride (PVC) cases, though less favoured due to environmental concerns, continue to see limited use in ruggedized phone cases with waterproof or shock-absorbent properties. Meanwhile, polyurethane (PU) remains a go-to choice for imitation leather finishes and flip covers that balance durability with aesthetics.

Manufacturers have leveraged injection molding and thermoforming to create ultra-slim profiles with vibrant printed designs, clear windows, and embossed logos. The popularity of transparent hard-shell cases and dual-layer hybrid plastic formats has driven innovation in anti-yellowing coatings and antimicrobial finishes. As sustainability pressures increase, plastic cases with recycled content or bioplastic blends are entering the mainstream, particularly in Europe and North America.

Flip covers are projected to hold 61.8% of the mobile cases and covers market by 2025, driven by consumer demand for both comprehensive device protection and personalized aesthetics. Their ability to shield both the screen and the back of smartphones makes them especially attractive for users prioritizing durability.

Often favored in executive and premium device segments, flip covers combine function and form commonly featuring PU leather, stitched fabric, or hybrid faux leather designs. Integrated features like card slots, stand support, and magnetic closures cater to professionals and multitaskers.

The rise of wallet-style flip covers in offline retail markets across Asia-Pacific and Latin America signals a strong regional preference for multifunctional accessories. Flip covers are also increasingly compatible, and some brands are adding anti-microbial linings or scratch-resistant interiors to boost hygiene and longevity. Fashion collaborations and co-branded editions have turned flip covers into lifestyle statements, positioning them as both utility products and style extensions for modern users.

Intense Market Competition and Price Wars

The Mobile cases and covers market has been under pressure due to competition from domestic as well as international manufacturers. The low entry barriers result in a flooded market with unbranded and counterfeit products, which leads to price wars and reduced profit margins for the established players.

The danger for premium brands is that consumers will gravitate to cheaper options. To ensure they can weather this market turbulence, companies will need to stand apart by incorporating differentiated designs, sustainable materials, and partnerships with brands that call to specific consumer segments.

Rapid Technological Advancements in Smartphones

The frequent launches of new smartphone models and rapid technological advancements make it challenging for manufacturers to keep pace with evolving designs and models. The short cycles of product also create stockouts that leave inventory for case manufacturers a lot and increase production cost.

Moreover, new trends such as foldable smartphones and built-in protective characteristics reduce the importance of additional protective accessories. To overcome this, companies must adopt agile production methods, predictive models, and more flexible manufacturing processes to achieve long-term growth.

Growing Consumer Demand for Customization and Personalization

Furthermore, consumers are never stopping in pursuit of customized mobile accessories designed according to their desired style and goals. As a result, there is an increasing demand for customized cases featuring unique prints, engravings, or personalized messages.

This trend is evident for brands that streamline their operations via AI-powered design platforms, online customization tools, or DTC sales channels. Limited-edition collaborations and influencer-designed collections are additional ways to enhance brand appeal and foster customer loyalty.

Rising Adoption of Sustainable and Eco-Friendly Materials

With rising awareness of environmental sustainability, consumers are now demanding eco-friendly and biodegradable mobile cases. Consumers are proactively selecting products made with recycled plastics, plant-based materials and compostable materials.

Rands that prioritize sustainable production techniques, carbon-neutral shipping, and ethical sourcing practices will be ahead of the game. Organizations that meet global sustainability guidelines and offer green packaging solutions will gain the focus of buyers seeking eco-friendly products.

A summary of mobile cases and covers macro and micro economic factors shifts in the mobile cases and covers market, 2020 to 2024, and future trends 2025 to 2035 The mobile cases and covers market has been characterized by strong growth between 2020 and 2024, driven by the increasing adoption of smartphones across emerging economies, growing smartphone usage on social media, and rising consumer interest towards premium protective offers.

Nonetheless, challenges, including market saturation, supply chain disruptions, and the proliferation of counterfeit products, took a toll on profit margins. Companies countered with new materials, enhanced online retail and sustainable packaging solutions.

Between 2025 and 2035, advancements such as smart cases, wireless charging compatibility, and modular protective solutions are expected to redefine the industry. Custom design options, including AI-generated 3D-printed cases and ultra-thin covers made of graphene, will also dominate.

Furthermore, initiatives within the circular economy that encourage case recycling and take-back programs will reshape industry standards. The evolving market ecosystem will be dominated by companies focused on sustainable innovations, digital transformation, and next-generation protective technologies.

The United States is a significant market for mobile cases and covers, driven by the high penetration of smartphones and a growing consumer inclination towards customized accessories. Also contributing to market growth is the increasing popularity of rugged, shockproof, and waterproof cases

As such, eco-friendly and biodegradable cases are gaining popularity as consumers become increasingly conscious of their environmental impact. The growth of the market is also compounded by the readily available designer and customized cases by major brands and e-commerce channels. Social media trends and endorsements by key influencers have a significant impact on sales. Technology upgrades, such as antimicrobial coatings and MagSafe compatibility, also enhance product appeal.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

While the growth of the mobile cases and covers market in the United Kingdom is steady, the rise in penetration rate of smartphones in the region, combined with the growing inclination of consumers toward protective accessories, is responsible for driving the market.

High-demand, premium, and luxury cases are crafted from leather and other high-quality materials. Another trend is the growing popularity of slim, lightweight, and transparent cases that capitalize on the aesthetic of smartphones. The rising integration of advanced features, such as built-in cardholders and kickstands, as well as advanced battery packs, is expected to fuel market growth. Folders and online channels, such as mobile phone accessory stores, are the primary sales drivers, and consumers have been found to respond to discounts and promotional offers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

Germany, France and Italy are the most significant contributors to the European Union mobile cases and covers market. The increased demand for long-lasting and versatile phone cases is contributing to the market's growth.

With the number growing, consumers are seeking more from a case, including military-grade protection, increased grip, and compatibility with wireless charging. Sustainable materials, including bamboo, recycled plastics, and plant-based leather, are on the rise as people’s concern for the environment grows. The rise of e-commerce platforms and direct-to-consumer brands is making it easier to access a variety of cases. Moreover, companies are introducing high-quality products with unique designs by partnering with accessory brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.6% |

The Japanese mobile cases and covers market is driven by a strong demand for innovative and stylish designs among consumers. The market is leaning toward minimalist, practical accessories, like ultra-thin cases with interlaced grip technology.

As consumers fully embrace the potential of 5G devices, there will also be an increased demand for 5G support and cooling solutions. The market also has a healthy appetite for anime-themed and pop culture-inspired cases, a nod to Japan’s influence on the entertainment industry. Smart cases with LED notifications, temperature control, and self-cleaning capabilities are also growing in popularity. Powerful retail networks and exclusive brand partnerships further drive market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

South Korea has a tech-savvy population and high smartphone penetration, which is contributing to growth in the mobile cases and covers market. Market growth is driven by high consumer spending on mobile accessories and increased demand for premium and aesthetically pleasing cases.

Brands are investing heavily in developing smart functionalities, such as NFC-based cases, for one-tap payment access. There is a growing trend for eco-friendly materials such as biodegradable TPU and vegan leather. Moreover, exclusive and K-pop-themed cases are very well-received by the younger generation. Additionally, the presence of key smartphone manufacturers in the country, along with a well-established e-commerce ecosystem, drives the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

With smartphone penetration increasing, customers seeking stylish and durable accessories, and the need for device protection, the mobile cases and covers market is growing rapidly. Companies are responding to changing consumer preferences with innovative materials, shock-absorbing designs, eco-friendly options, and custom features.

Some of these trends are biodegradable phone covers, impact-resistant phone cases, wireless charging-enabled models, and personalization through 3D printing and laser engraving technologies. Similar to the evolving market trends, external driving force includes the rise of fashion trends and innovative collaborations.

Other Key Players

The overall market size for mobile cases and covers market was USD 27.3 billion in 2025.

The mobile cases and covers market expected to reach USD 47.1 billion in 2035.

The demand for the mobile cases and covers market will be driven by increasing smartphone adoption, rising consumer preference for device protection, growing demand for stylish and customized designs, expanding e-commerce sales, and advancements in durable, eco-friendly, and shock-resistant materials.

The top 5 countries which drives the development of mobile cases and covers market are USA, UK, Europe Union, Japan and South Korea.

Material innovations driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Phone Cases and Covers Market

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA