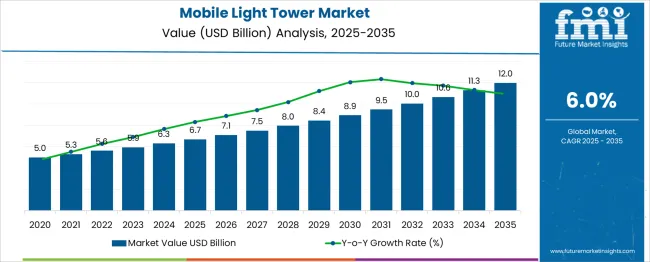

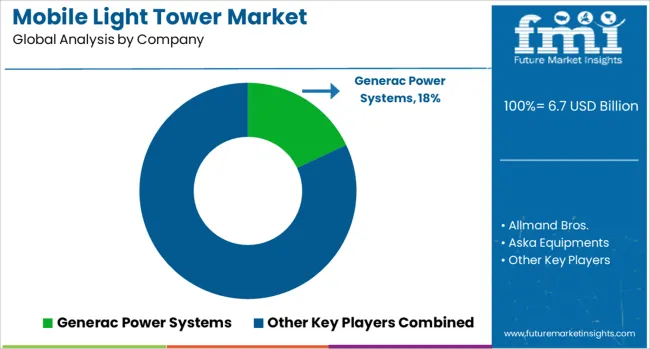

The Mobile Light Tower Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A rolling CAGR analysis across sub-periods highlights how growth momentum evolves decade-wide. From 2025 to 2030, the market expands from USD 6.7 billion to USD 8.9 billion, reflecting a 5.8% CAGR over these five years. This phase benefits from increased infrastructure activity, mining expansion, and event lighting demand, particularly across Asia and the Middle East. Between 2030 and 2035, the market grows from USD 8.9 billion to USD 12.0 billion, translating to a rolling CAGR of 6.2%, slightly stronger than the earlier half.

This higher momentum reflects technological improvements in LED efficiency, hybrid energy systems, and broader adoption in remote construction and disaster relief operations. Rolling CAGR trends indicate that the growth pace accelerates in the second half of the decade due to wider deployment of smart control systems and solar-powered units. The compounded nature of gains, combined with minimal volatility in annual additions, suggests a structurally resilient market. Stakeholders can anticipate stable returns with potential upside from electrification trends and smart grid-integrated lighting solutions.

| Metric | Value |

|---|---|

| Mobile Light Tower Market Estimated Value in (2025 E) | USD 6.7 billion |

| Mobile Light Tower Market Forecast Value in (2035 F) | USD 12.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The mobile light tower market contributes approximately 18–20% to the broader Temporary Lighting Equipment Market, driven by requirements for flexible, portable lighting across industrial and infrastructure projects. Within the Construction Equipment Market, mobile light towers represent 6–8%, supporting site visibility, extended work hours, and safety compliance in non-daylight operations.

The segment holds 10–12% share of the Outdoor Lighting Systems Market, especially for off-grid, rapid-deployment applications in events, emergencies, and mining. In the Power Backup and Auxiliary Equipment Market, it accounts for around 5–7%, functioning as integrated lighting and generator solutions. The market also makes up 14–16% of the Event and Emergency Lighting Solutions Market, with growing demand in disaster response, defense exercises, and large-scale gatherings.

Market expansion is driven by infrastructure development in remote zones, increased nighttime construction activity, and stricter safety standards. LED-based light towers with higher lumen output and lower energy use are replacing older metal halide systems. Solar-powered and hybrid models are gaining traction in regions with limited fuel access or emissions restrictions.

Manufacturers are integrating GPS tracking, automated mast deployment, and anti-theft systems to improve fleet management. Rental fleet operators and OEMs are targeting oil and gas, roadwork, and utilities as core revenue segments amid expanding civil works and maintenance operations.

The mobile light tower market is demonstrating steady growth supported by increasing demand across construction, mining, oil and gas, and emergency response sectors. Growing infrastructure activities, rising emphasis on worker safety during night operations, and the need for reliable off-grid lighting solutions are driving adoption.

The market is also benefitting from technological innovations in lighting efficiency and power optimization which are reducing operational costs and improving environmental compliance. Future growth is anticipated to be shaped by stricter emission norms, growing preference for energy-efficient lighting technologies, and integration of advanced control systems.

Investments in rental fleets and government initiatives for infrastructure modernization are further expected to create sustained opportunities while paving the way for more durable and user-friendly designs.

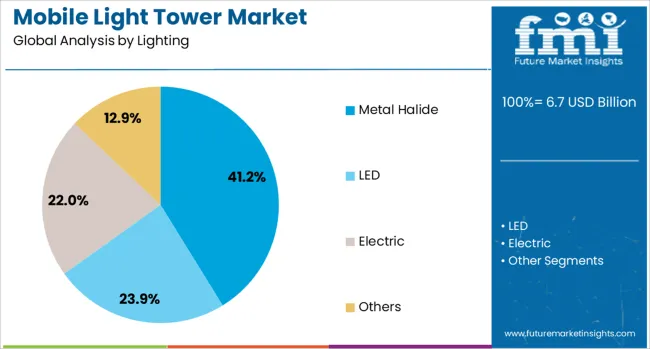

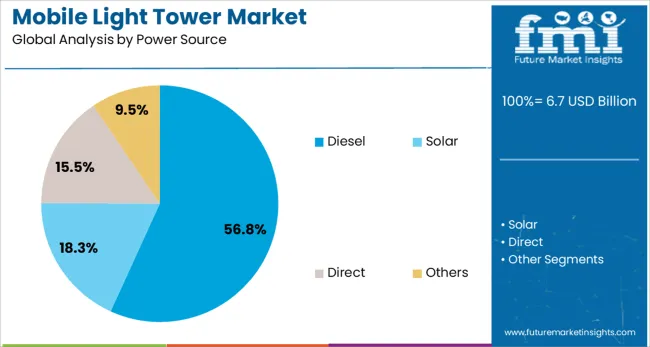

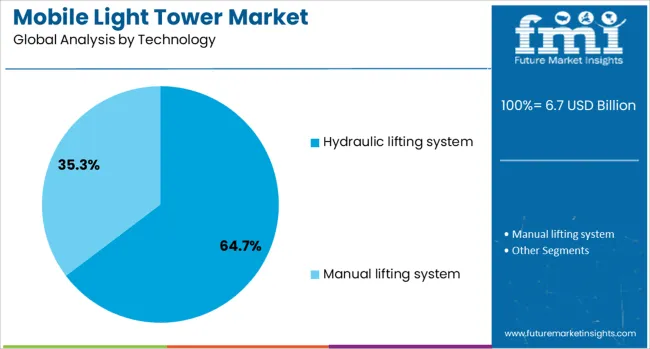

The mobile light tower market is segmented by lighting, power source, technology, application, and geographic regions. The mobile light tower market is divided into Metal Halide, LED, Electric, and Others. The power source of the mobile light tower market is classified into Diesel, Solar, Direct, and Others. The mobile light tower market is segmented based on technology into hydraulic and Manual lifting systems.

By application, the mobile light tower market is segmented into Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the mobile light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by lighting, the metal halide subsegment is projected to hold 41.20 % of the total market revenue in 2025, positioning itself as the leading lighting technology. This leadership is attributed to its proven capability to deliver high-intensity illumination over large areas, which is critical in heavy-duty outdoor applications.

Its dominance is also supported by relatively lower upfront cost compared to newer technologies, making it favorable for rental operators and budget-conscious buyers. The established supply chain and compatibility with existing tower designs have facilitated widespread adoption.

Furthermore, its ability to perform reliably in harsh conditions and meet the illumination standards required for industrial worksites has reinforced its continued preference despite emerging alternatives.

Segmented by power source, the diesel subsegment is expected to command 56.80 % of the mobile light tower market revenue in 2025, maintaining its top position. This has been supported by the unmatched energy density and reliability of diesel engines in remote or off-grid environments.

The robust performance of diesel-powered towers under variable loads and extreme weather has strengthened its foothold among end-users operating in mining, oilfields, and large-scale construction projects. Ease of refueling, widespread availability of diesel, and familiarity among operators have also contributed to its market share.

In addition, the relatively lower maintenance requirements and proven durability have made diesel the preferred choice where continuous and dependable operation is paramount.

When segmented by technology, the hydraulic lifting system is forecast to capture 64.70 % of the market revenue in 2025, securing its position as the dominant technological approach. This segment’s prominence is driven by the operational ease, safety, and efficiency that hydraulic systems offer compared to manual or mechanical alternatives.

Users have favored hydraulic mechanisms for their ability to enable quick deployment and retraction of the mast with minimal physical effort, which enhances productivity and reduces risk of injury. The ability to handle heavier loads and withstand demanding conditions has also supported their adoption in high-intensity environments.

Moreover, hydraulic systems have proven to lower downtime and improve fleet utilization rates, making them particularly attractive for rental and industrial applications where time and safety are critical.

Demand for mobile light towers is rising as construction, emergency response and outdoor event planning require portable high‑lux lighting solutions. Sales of LED, solar‑hybrid and diesel‑powered towers are increasing sharply. Growth is strongest in North America for safety compliance projects, while Asia‑Pacific leads in rental fleet and infrastructure deployment sectors.

Demand for LED hybrid mobile light towers was elevated in 2025 across construction and municipal segments in the United States and Canada. Units combining solar panels, lithium batteries and ergonomic mast systems enabled fuel use reduction of around 40% compared to diesel‑only models. Deployment often included telescopic masts supporting multi‑directional illumination, improving site coverage and reducing glare. Lighting uptime increased by over 20% through enhanced autonomy and plug‑and‑play on‑site charging. Vendors bundling preventive service programmes and remote monitoring dashboards secured repeat rental agreements with utility contractors and road maintenance crews.

High-intensity diesel mobile light towers saw uptake in Asia‑Pacific in 2025 for infrastructure maintenance and large‑scale outdoor events. Units delivering up to 260 lux at 10 meters and remote control operation capability enabled extended project running hours. Rapid deployment setups were valued in rural planning works and festival installations across India, Indonesia and Australia. Maintenance cycles were optimized by modular components, reducing downtime by approximately 18%. OEM partnerships with lighting rental firms offering turnkey delivery and on‑site service bolstered repeat bookings from engineering contractors and event management firms.

In 2025, solar-powered mobile light towers witnessed accelerated deployment across environmentally regulated zones and green-certified construction sites. Units featuring monocrystalline solar panels with MPPT charge controllers supported autonomous night operations without fuel dependency. In European urban centers and eco-zoned areas of California, these towers were selected for emissions compliance and silent operation mandates. Operating costs were reduced by nearly 60% due to minimal maintenance and zero fuel input. Equipment rental firms integrated app-based performance tracking, allowing clients to remotely monitor energy generation and lighting hours. As public infrastructure projects moved toward ESG-aligned execution, demand for off-grid solar lighting kits rose consistently among government contractors.

Demand for ruggedized mobile light towers intensified in 2025 from telecom maintenance and mining exploration zones. Units equipped with reinforced chassis, impact-resistant LED modules and vibration-tolerant masts were used in high-dust and high-altitude environments. South African mining fields and Middle Eastern telecom relay sites adopted these towers to ensure lighting resilience in extreme weather. Real-time diagnostics were built into control systems to pre-empt failures and minimize downtime. In telecom tower repair and emergency line restoration work, towers offering up to 8-meter mast height and 360-degree illumination coverage were prioritized. Providers offering modular payloads with quick disassembly features gained preference in tender contracts.

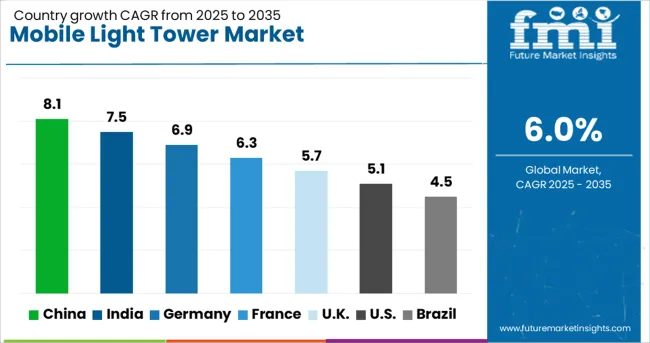

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global market is projected to expand at a CAGR of 6.0% from 2025 to 2035, fueled by growing infrastructure activities and emergency lighting needs across construction, mining, and energy sectors. China leads with an 8.1% CAGR, supported by large-scale infrastructure rollouts, smart city projects, and growing mining operations in western provinces. India follows at 7.5%, where robust investments in road and rail construction and rural electrification boost light tower adoption.

Germany is projected to grow at 6.9%, underpinned by renewable energy site deployments and industrial maintenance requirements. The UK, with a 5.7% CAGR, benefits from rising event-based demand and public utility upgrades. Meanwhile, the USA is set to grow at 5.1%, with steady replacement demand in oil & gas fields and power outage response operations. These nations significantly influence global supply chains, innovation, and rental-based service models for mobile lighting systems. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is anticipated to expand at a CAGR of 8.1% during the forecast period from 2025 to 2035 in the Mobile Light Tower Market. Between 2020 and 2024, sales were propelled by major roadwork and nighttime construction in Tier 1 cities. From 2025 onward, increased investments in rail maintenance, smart infrastructure upgrades, and greenfield construction zones will sustain demand for high-efficiency LED and hybrid mobile light towers. The rapid pace of highway expansion and mining projects across Xinjiang and Inner Mongolia will further augment deployment.

India is set to record a CAGR of 7.5% from 2025 to 2035 in the Mobile Light Tower Market. Between 2020 and 2024, deployments were driven by metro rail works and national highway corridor upgrades. In the coming years, government programs such as Bharatmala and Smart Cities Mission will accelerate the need for solar-powered and low-emission light towers. Demand for Mobile Light Tower Market solutions in India will also be supported by oilfield expansions in Gujarat and industrial hub upgrades in Tamil Nadu.

Germany is forecast to grow at a CAGR of 6.9% during 2025 to 2035 in the Mobile Light Tower Market. From 2020 to 2024, the demand was primarily focused on nighttime rail maintenance and urban utility repair services. Between 2025 and 2035, transition to zero-emission equipment will boost uptake of battery-powered LED towers and hybrid variants. Strong emphasis on occupational safety and carbon-neutral job sites will shape preferences across federal road and telecom infrastructure projects.

The United Kingdom is expected to post a CAGR of 5.7% between 2025 and 2035 in the Mobile Light Tower Market. Between 2020 and 2024, fleet upgrades by rental companies and increased use in motorway projects boosted adoption. The forecast period will witness rising use in offshore windfarm logistics, night rail repair, and large-scale events requiring temporary lighting infrastructure. Decarbonization targets and noise regulations will drive investment in hybrid and electric mobile towers.

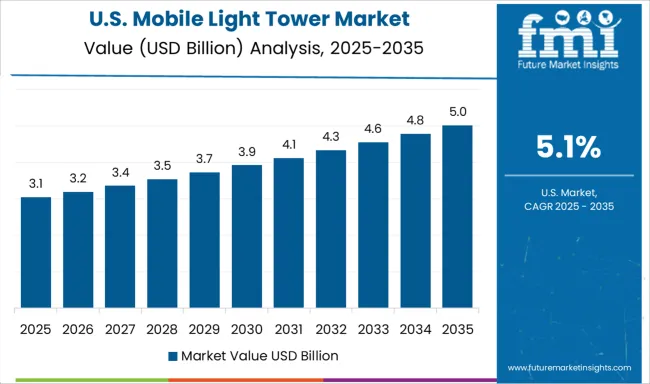

The United States is projected to achieve a CAGR of 5.1% from 2025 to 2035 in the Mobile Light Tower Market. Between 2020 and 2024, growth came largely from oil and gas sectors in Texas and New Mexico. From 2025 onward, widespread adoption is expected in highway maintenance, airport runway repair, and disaster response zones. Sales of Mobile Light Tower Market units will be reinforced by federal infrastructure funding and demand for rapid-deploy LED towers in remote construction zones.

Generac Power Systems leads the mobile light tower market through a diverse portfolio serving construction sites, mining zones, and emergency response operations. Its growing lineup of hybrid and solar-powered models aligns with increased demand for energy-efficient lighting technologies. Atlas Copco, Allmand Bros., and Caterpillar offer high-durability, fuel-optimized towers designed for remote and rugged conditions, making them widely adopted across large-scale infrastructure projects.

United Rentals supports strong market traction through its expansive leasing network, particularly in North America’s oil & gas and utility sectors. Progress Solar Solutions and Olikara Lighting Towers are advancing rapidly by focusing on renewable-powered mobile lighting systems. Additional players such as Larson Electronics, Light Boy, Aska Equipments, and The Will-Burt Company are developing niche-use towers for industrial operations and outdoor events, expanding their reach across specialized applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.7 Billion |

| Lighting | Metal Halide, LED, Electric, and Others |

| Power Source | Diesel, Solar, Direct, and Others |

| Technology | Hydraulic lifting system and Manual lifting system |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros., Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Larson Electronics, Light Boy, LTA Projects, Olikara Lighting Towers, Progress Solar Solutions, The Will-Burt Company, United Rentals, and Youngman Richardson |

| Additional Attributes | Dollar sales by power source (diesel vs solar/hybrid vs direct), lighting type (metal‑halide vs LED), and deployment mode (trailer vs skid-mounted), demand dynamics driven by construction, mining, oil & gas, and events, regional leadership in North America with rapid Asia‑Pacific growth, innovation in energy-efficient LED, remote monitoring, and hybrid-power systems, and environmental impact via reduced fuel use and emissions. |

The global mobile light tower market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the mobile light tower market is projected to reach USD 12.0 billion by 2035.

The mobile light tower market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in mobile light tower market are metal halide, led, electric and others.

In terms of power source, diesel segment to command 56.8% share in the mobile light tower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Portable Light Towers Market

Commercial Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA