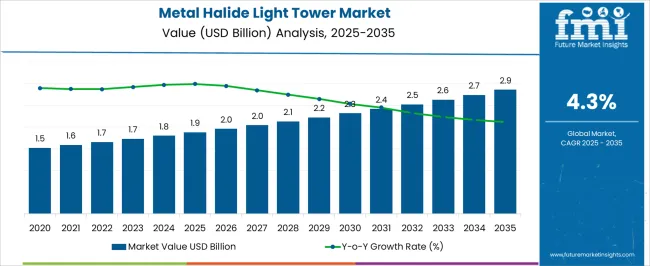

The metal halide light tower market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. During the early adoption phase from 2020 to 2024, demand was primarily driven by construction sites, mining operations, and event management projects experimenting with portable lighting solutions for night-time operations.

Manufacturers increase production capacity, strengthen distribution channels, and provide maintenance support, contributing to broader market penetration and steady revenue growth. Between 2030 and 2035, the market enters the consolidation phase, with revenues expected to reach 2.9 billion dollars by 2035 while maintaining a CAGR of 4.3%. Leading suppliers consolidate positions through fleet contracts, long-term service agreements, and regional expansions. Smaller players either focus on niche applications or exit the market. Adoption stabilizes as most potential users are equipped with standardized lighting solutions. Companies emphasize operational efficiency, durability, and after-sales support. By 2035, the market will demonstrate predictable growth, mature competition, and established operational standards, creating a structured and stable industry landscape.

| Metric | Value |

|---|---|

| Metal Halide Light Tower Market Estimated Value in (2025 E) | USD 1.9 billion |

| Metal Halide Light Tower Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The metal halide light tower market is supported by multiple end-use segments that drive demand and adoption. Construction and Infrastructure Projects dominate with approximately 35% of the market, using light towers for night-time operations, site safety, and project continuity. Mining and Quarrying Operations contribute 20%, where portable lighting is essential for underground and surface operations.

Events and Entertainment account for 12%, including outdoor concerts, festivals, and sports venues that rely on temporary lighting solutions. Oil & Gas Facilities represent 10%, deploying towers for maintenance, inspection, and emergency lighting. Transportation and Logistics Hubs hold 8%, supporting nighttime operations at ports, rail yards, and highways. Emergency Response and Disaster Relief contribute 7%, providing rapid deployment lighting during crises.

Telecom and Utility Maintenance accounts for 5%, with towers playing a key role in repair, inspection, and construction activities. Smaller segments, such as Agriculture and Military Engineering Units, account for the remaining 3%, using specialized or portable lighting solutions. Revenue growth reflects adoption trends, expanding from 1.5 billion dollars in 2020 to 1.9 billion in 2025 and projected to reach 2.9 billion by 2035, at a CAGR of 4.3%. Construction and mining remain the primary drivers, while events, emergency response, and utilities provide steady incremental growth, supporting the market’s long-term expansion and diversified application base.

The metal halide light tower market is experiencing consistent growth due to rising demand for reliable and high intensity lighting solutions in construction, mining, and large scale event applications. The ability of metal halide technology to deliver bright, wide area illumination with superior color rendering has maintained its relevance despite the emergence of LED alternatives.

Increased infrastructure development projects, expansion of night time operations in industrial sectors, and requirements for safety compliant lighting are driving market adoption. Durability, weather resistance, and cost effectiveness over large operational areas further strengthen the value proposition of metal halide light towers.

The market outlook remains positive as emerging economies invest heavily in infrastructure and resource extraction, creating steady demand for portable and stationary lighting solutions that can perform in challenging environments.

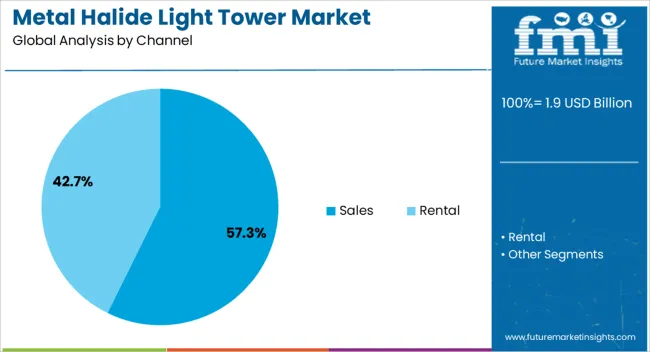

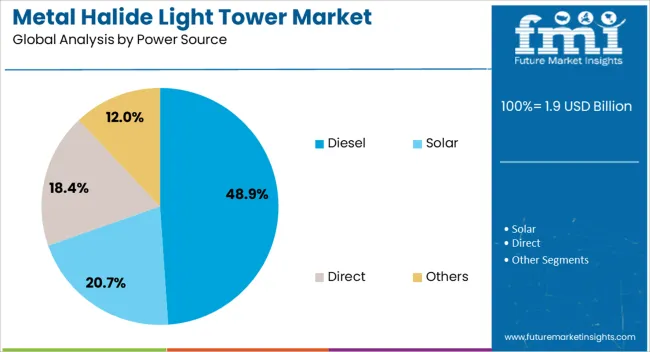

The metal halide light tower market is segmented by channel, product, power source, technology, application, and geographic regions. By channel, metal halide light tower market is divided into Sales and Rental. In terms of product, metal halide light tower market is classified into Stationary and Mobile. Based on power source, metal halide light tower market is segmented into Diesel, Solar, Direct, and Others.

By technology, metal halide light tower market is segmented into Manual lifting and Hydraulic lifting. By application, metal halide light tower market is segmented into Construction, Infrastructure & development, Oil & gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the metal halide light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sales channel segment is projected to account for 57.30% of total market revenue by 2025, making it the leading distribution method. Its dominance is driven by the preference for direct purchase among contractors and industrial operators seeking long term cost efficiency and control over maintenance.

Sales channels provide buyers with the ability to customize units, ensure availability, and integrate towers into existing equipment fleets. Additionally, ownership eliminates recurring rental costs, making it financially advantageous for companies with frequent lighting requirements.

This approach has cemented the position of sales as the primary channel in the metal halide light tower market.

The diesel power source segment is anticipated to hold 48.90% of total revenue by 2025, making it the dominant power choice in the market. Diesel-powered light towers are valued for their reliability, fuel efficiency, and ability to operate in remote areas without access to grid power.

They provide consistent illumination over long operational cycles and are easily refueled on site, ensuring minimal downtime.

Their proven performance in demanding outdoor environments has sustained high adoption levels, particularly in construction, mining, and emergency response applications.

The metal halide light tower market is growing due to increasing demand for high-intensity, portable illumination in construction, mining, and outdoor events. North America and Europe lead with towers featuring high lumen output, extended mast height, and reliable metal halide lamps. Asia-Pacific shows rapid growth driven by infrastructure projects, industrial expansion, and large-scale outdoor activities. Manufacturers differentiate through mobility, energy efficiency, and lamp durability. Regional variations in application requirements, environmental conditions, and operational safety strongly influence adoption, deployment, and competitive positioning globally.

Adoption of metal halide light towers is driven by the need for high-intensity illumination in construction sites, mining operations, and large outdoor events. North America and Europe prioritize towers with high-lumen metal halide lamps capable of providing uniform lighting over extensive areas, ensuring operational safety and efficiency. Asia-Pacific markets adopt cost-effective towers for infrastructure projects, temporary construction sites, and public events. Differences in light coverage, beam uniformity, and operational duration influence deployment planning, project timelines, and adoption. Leading suppliers offer towers with adjustable masts, energy-efficient lamps, and durable components, while regional manufacturers provide practical, robust solutions. Illumination requirement contrasts shape adoption, operational efficiency, and market competitiveness globally.

Lamp lifespan and maintenance requirements significantly impact adoption of metal halide light towers. North America and Europe favor towers with extended lamp life, low replacement frequency, and minimal maintenance interventions to reduce downtime and operational costs. Asia-Pacific markets adopt towers with standard metal halide lamps that balance cost with durability for high-volume usage in construction and industrial applications. Differences in lamp efficiency, thermal management, and ease of replacement affect lifecycle cost, operational continuity, and user satisfaction. Leading suppliers offer long-life, pre-tested lamps with easy maintenance, while regional manufacturers provide practical, easily replaceable solutions. Longevity and maintenance contrasts shape adoption, reliability, and competitiveness globally.

Mobility, compact design, and rapid deployment capabilities drive metal halide light tower adoption. North America and Europe emphasize mobile towers with hydraulic or manual mast adjustment, wheel-mounted bases, and towing capability for flexible deployment across sites. Asia-Pacific markets prioritize robust, easily transportable units for urban and remote construction projects. Differences in portability, setup time, and operational flexibility influence installation efficiency, workforce requirements, and adoption speed. Leading suppliers offer towers with hydraulic lifts, stabilizing outriggers, and ergonomic handling, while regional players focus on cost-effective, practical mobility solutions. Deployment flexibility contrasts shape adoption, operational convenience, and competitive positioning globally.

Compliance with safety standards, environmental regulations, and operational guidelines strongly affects adoption of metal halide light towers. North America and Europe enforce OSHA, CE, and local illumination safety standards to ensure tower stability, electrical safety, and proper illumination intensity. Asia-Pacific regulations vary, with developed regions adopting international norms and emerging markets following locally recognized codes. Differences in safety certification, electrical compliance, and operational requirements influence procurement, deployment speed, and end-user confidence. Leading suppliers provide certified, regulation-compliant towers with integrated safety features, while regional manufacturers focus on practical, regulation-aligned designs. Regulatory and safety contrasts shape adoption, market credibility, and competitiveness globally.

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

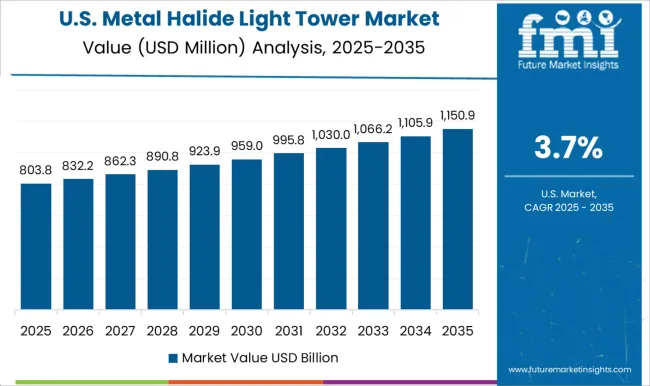

| USA | 3.7% |

| Brazil | 3.2% |

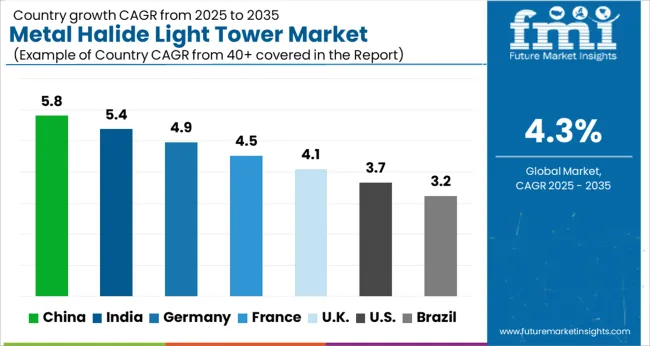

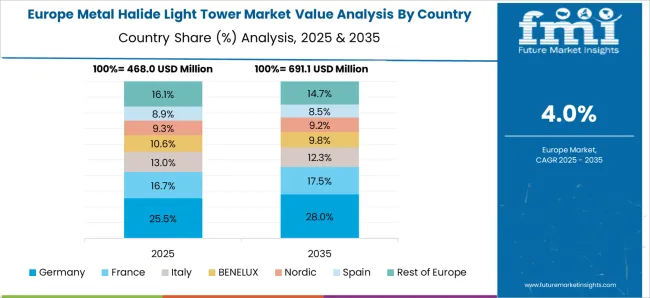

The global metal halide light tower market is projected to grow at a 4.3% CAGR through 2035, driven by applications in construction, mining, and event lighting. Among BRICS nations, China led with 5.8% growth as large-scale manufacturing and deployment across industrial and commercial projects were carried out, while India at 5.4% growth expanded utilization in infrastructure and temporary lighting setups. In the OECD region, Germany at 4.9% maintained steady adoption under safety and quality regulations, while the United Kingdom at 4.1% integrated these light towers across construction sites and public events. The USA, growing at 3.7%, advanced deployment in industrial, commercial, and municipal applications while complying with federal and state-level operational standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The metal halide light tower market in China is projected to grow at a CAGR of 5.8%, driven by increasing demand for temporary lighting in construction, mining, and outdoor events. Adoption is being encouraged by towers that provide bright illumination, durability, and ease of transport. Manufacturers are being urged to supply energy efficient, high intensity, and reliable light towers suitable for large scale operations. Distribution through rental services, construction contractors, and industrial suppliers is being strengthened. Research in lamp efficiency, mobility, and extended operational life is being conducted. Growing infrastructure projects, night time construction requirements, and industrial safety regulations are considered key factors supporting the metal halide light tower market in China.

The metal halide light tower market in India is expected to grow at a CAGR of 5.4%, driven by adoption in road construction, industrial operations, and large outdoor events. Adoption is being strengthened by towers that provide efficient illumination, portability, and long operational hours. Manufacturers are being encouraged to deliver cost effective, durable, and energy efficient light towers. Distribution through industrial equipment suppliers, rental companies, and construction contractors is being expanded. Awareness programs and technical demonstrations are being conducted to ensure proper use and safety. Expansion of infrastructure projects, demand for night time operations, and urban development are recognized as primary drivers of the metal halide light tower market in India.

Germany is witnessing steady growth in the metal halide light tower market at a CAGR of 4.9%, supported by demand for temporary lighting in construction sites, industrial plants, and emergency operations. Adoption is being encouraged by towers that offer high brightness, reliability, and energy efficiency. Manufacturers are being urged to supply advanced, durable, and compliant equipment. Distribution through construction firms, industrial suppliers, and rental service providers is being maintained. Research in lamp life extension, power consumption reduction, and portability is being pursued. Infrastructure renovation, increasing night shift operations, and safety regulations are driving the metal halide light tower market in Germany.

The metal halide light tower market in the United Kingdom is projected to grow at a CAGR of 4.1%, driven by demand for reliable lighting in construction, mining, and outdoor events. Adoption is being emphasized for towers that provide high intensity illumination, ease of transport, and long service life. Manufacturers are being encouraged to supply robust, energy efficient, and cost effective towers. Distribution through industrial suppliers, rental companies, and construction contractors is being strengthened. Training sessions and product demonstrations are being conducted to improve adoption and safety awareness. Expansion of infrastructure projects, temporary outdoor operations, and regulatory compliance are recognized as major contributors to the metal halide light tower market in the United Kingdom.

The metal halide light tower market in the United States is projected to grow at a CAGR of 3.7%, supported by adoption in construction, industrial sites, and emergency lighting applications. Adoption is being encouraged by towers that provide high intensity lighting, durability, and operational efficiency. Manufacturers are being urged to deliver reliable, energy efficient, and long lasting products. Distribution through construction contractors, industrial suppliers, and rental services is being maintained. Research in extended lamp life, power efficiency, and mobility is being pursued. Increasing night time construction projects, industrial lighting demand, and compliance with safety standards are considered key drivers of the metal halide light tower market in the United States.

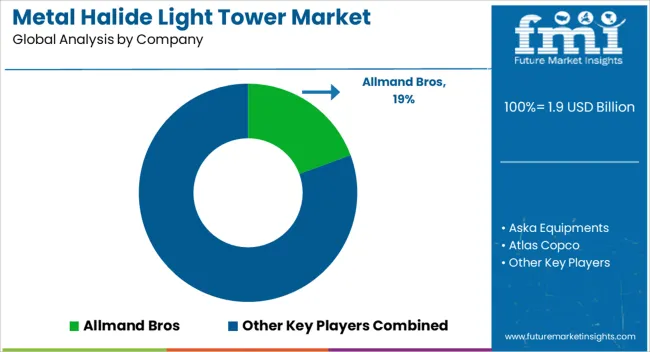

The metal halide light tower market is shaped by a combination of global lighting equipment manufacturers, regional suppliers, and specialized construction and industrial lighting solution providers. Leading players such as Generac Holdings, Atlas Copco, Terex Corporation, and Doosan Portable Power hold strong positions by offering a diversified portfolio of metal halide light towers designed for construction sites, mining operations, outdoor events, and emergency applications. Competitive differentiation is driven by lighting intensity, mast height, fuel efficiency, portability, and ease of operation. Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective solutions and localized technical support for industrial and temporary lighting applications.

Strategic collaborations with construction companies, rental service providers, and event management firms enhance market penetration and brand visibility. Innovation in high-efficiency metal halide lamps, durable mast designs, and low-maintenance fuel systems further strengthens competitive positioning. Companies focusing on regulatory compliance, safety standards, and robust after-sales support are well-positioned to capture significant market share. Overall, firms combining technological expertise, scalable production, and reliable service networks are expected to benefit from the growing demand for high-intensity portable lighting solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Channel | Sales and Rental |

| Product | Stationary and Mobile |

| Power Source | Diesel, Solar, Direct, and Others |

| Technology | Manual lifting and Hydraulic lifting |

| Application | Construction, Infrastructure & development, Oil & gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, Generac Power Systems, Himoinsa, Inmesol Gensets, JC Bamford Excavators, Larson Electronics, Light Boy, LTA Projects, Multiquip, Olikara Lighting Towers, Progress Solar Solutions, The Will Burt Company, Trime, United Rentals, Wacker Neuson, and Youngman Richardson |

| Additional Attributes | Dollar sales vary by product type, including diesel-powered and hybrid light towers; by application, such as construction sites, mining operations, emergency response, and outdoor events; by end-use, spanning construction companies, mining firms, government agencies, and event organizers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by demand for high-intensity, portable lighting and off-grid illumination solutions. |

The global metal halide light tower market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the metal halide light tower market is projected to reach USD 2.9 billion by 2035.

The metal halide light tower market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in metal halide light tower market are sales and rental.

In terms of product, stationary segment to command 64.2% share in the metal halide light tower market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA