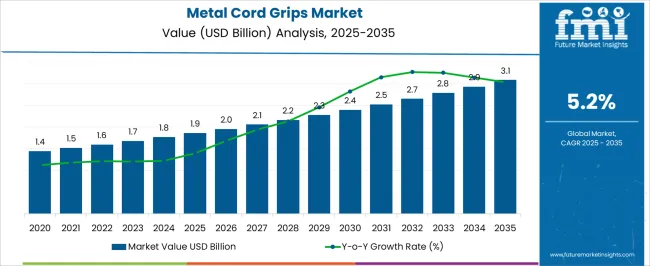

The metal cord grips market is anticipated to reach USD 1.8 billion in 2025 and USD 3.1 billion by 2035, growing at a CAGR of 5.2%. A rolling CAGR analysis highlights how the growth trajectory strengthens and moderates across phases, offering a clearer picture of the momentum. Between 2025 and 2027, the CAGR trend hovers around 5.0% as installations expand in construction and industrial cabling projects where secure connections are prioritized.

From 2027 to 2030, the rolling CAGR stabilizes near 5.1%, reflecting sustained demand from oil and gas, manufacturing plants, and renewable energy facilities where safety compliance continues to dictate procurement. By 2030 to 2032, the CAGR climbs closer to 5.3%, driven by the modernization of utility networks, the integration of advanced machinery, and investments in high-voltage equipment requiring durable cord grips. From 2032 to 2035, the CAGR remains steady at 5.2%, with adoption in data centers, telecom infrastructure, and smart grid projects strengthening the base.

The overall pattern suggests that while early years will see moderate but dependable expansion, later years will experience accelerated demand tied to new industrial hubs and large-scale retrofit projects. The rolling CAGR analysis underscores the role of regional infrastructure growth, regulatory-driven upgrades, and cross-industry reliance on robust metal cord grips for secure electrical connections.

| Metric | Value |

|---|---|

| Metal Cord Grips Market Estimated Value in (2025 E) | USD 1.9 billion |

| Metal Cord Grips Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The metal cord grips market is shaped by five interconnected parent markets, each influencing adoption and overall expansion. The electrical infrastructure market holds the largest share at 32%, as cord grips ensure safe cable entry, strain relief, and secure connections in power distribution and industrial wiring systems. The oil, gas, and petrochemical market contributes 25%, where hazardous environments require durable, explosion-proof cord grips that withstand extreme temperatures and chemical exposure.

The construction and building services segment accounts for 20%, driven by the need for secure electrical fittings in commercial complexes, residential projects, and utility installations. The manufacturing and industrial machinery market holds 13%, where cord grips are essential for equipment cabling, motor wiring, and assembly line operations. Finally, the telecommunications and data center market represents 10%, relying on cord grips to manage high-density cabling, fiber optics, and secure power supply lines in mission-critical environments.

Electrical infrastructure, oil and gas, and construction together account for 77% of total share, highlighting that heavy industrial usage, safety compliance, and infrastructure development are the main drivers, while machinery and telecom applications provide complementary growth avenues that strengthen long-term adoption globally.

The metal cord grips market is experiencing steady growth driven by increasing demand for secure cable management solutions across industrial and commercial applications. Rapid advancements in machinery automation, rising emphasis on workplace safety, and expansion in heavy duty electrical infrastructure have intensified the need for robust and durable cord grip components.

Metal cord grips are preferred for their resistance to extreme temperatures, chemicals, and mechanical stress, making them ideal for use in manufacturing, construction, and energy environments. Additionally, the shift toward custom enclosures and modular systems is creating new requirements for flexible yet secure cord entries.

As regulations around cable safety, grounding, and strain relief become more stringent, manufacturers are focusing on developing high performance metal cord grips that ensure long term reliability and compatibility with various cable sizes and geometries. The market outlook remains favorable with increasing investments in infrastructure upgrades and equipment safety compliance worldwide.

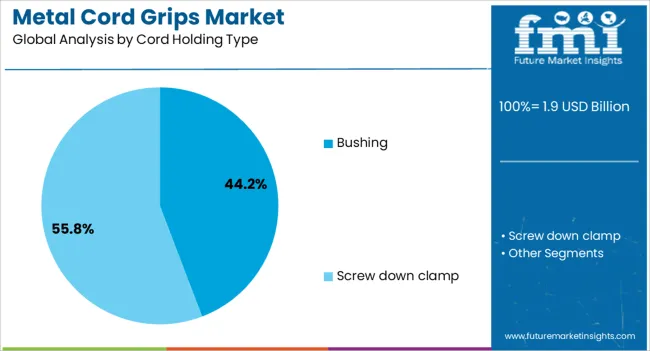

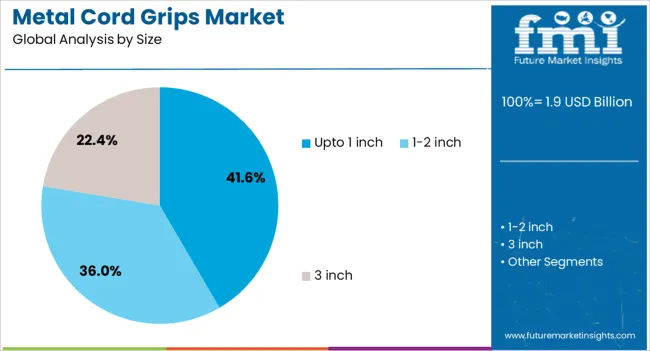

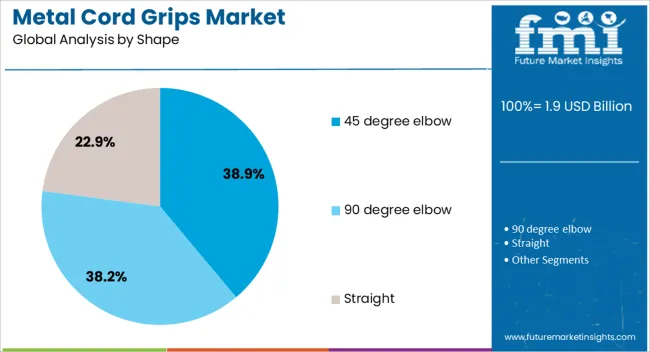

The metal cord grips market is segmented by material type, size, shape, cord holding type, end use, distribution channel, and geographic regions. By material type, metal cord grips market is divided into Brass, Stainless Steel, Aluminium, and Others. In terms of size, metal cord grips market is classified into Upto 1 inch, 1-2 inch, and 3 inch. Based on shape, metal cord grips market is segmented into 45 degree elbow, 90 degree elbow, and Straight. By cord holding type, metal cord grips market is segmented into Bushing and Screw down clamp.

By end use, metal cord grips market is segmented into General Manufacturing, Construction, Oil & Gas, Energy & Power, Transportation, Cleanroom Environments, Utilities, and Others. By distribution channel, metal cord grips market is segmented into Direct and Indirect. Regionally, the metal cord grips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The brass segment is projected to account for 47.50% of total market revenue by 2025 within the material type category, making it the leading material choice. Brass is favored due to its superior corrosion resistance, mechanical strength, and conductivity properties.

It offers optimal performance in both indoor and outdoor environments, particularly where exposure to moisture, vibration, or chemicals is common. Its compatibility with a wide range of cable types and ease of machining further enhance its applicability.

Moreover, brass cord grips meet electrical conductivity and safety requirements essential for hazardous and industrial environments. These advantages have established brass as the most reliable and widely adopted material type in the metal cord grips market.

The upto 1 inch size segment is expected to contribute 41.60% of total revenue in the size category by 2025, reflecting its dominance in the market. This segment is widely used in light to medium-duty applications where flexibility, compactness, and adaptability are required.

Industries such as automation, lighting, and panel assembly frequently utilize cord grips in this size range due to their compatibility with standard wiring systems and enclosures. Their availability in multiple thread types and sealing options has increased their demand across diverse industrial use cases.

As compact equipment and modular enclosures gain popularity, the upto 1 inch size segment continues to hold a significant position in the market.

The 45 degree elbow shape segment is anticipated to hold 38.90% of total revenue within the shape category by 2025, positioning it as a preferred design configuration. This shape provides a practical solution for managing cable direction in constrained or angled installations, improving cable routing and reducing strain at entry points.

Its use is particularly prominent in control panels, junction boxes, and equipment where right angle routing is not feasible but partial redirection is needed. The 45 degree elbow design enhances safety and performance by minimizing cable bending stress while maintaining a secure seal.

These functional benefits have elevated its adoption, making it one of the most relied upon shapes in modern cable management systems.

The metal cord grips market is influenced by industrial installations, oil and gas projects, construction activities, and regulatory compliance. Together, these dynamics highlight reliability and safety as the leading growth catalysts.

Metal cord grips are gaining wider application across electrical networks, industrial facilities, and utility projects due to their role in providing strain relief and preventing cable damage. These components ensure that cords remain secure under heavy mechanical stress, high temperatures, and corrosive environments. Industrial contractors and electrical engineers prefer metal cord grips for long-term durability compared to plastic alternatives. Growth is driven by ongoing upgrades in transmission infrastructure, renewable energy projects, and the expansion of commercial buildings requiring secure electrical fittings. Their adaptability across both small-scale wiring and heavy-duty industrial systems reinforces consistent adoption. This dynamic underscores the critical role of safety and performance in driving installation preferences worldwide.

The oil and gas industry remains one of the largest adopters of metal cord grips, primarily due to the stringent safety and performance requirements of hazardous environments. Refineries, offshore rigs, and petrochemical plants use cord grips to secure power and control cables against vibration, pressure, and harsh conditions. Explosion-proof and corrosion-resistant designs are especially sought after to meet compliance and reliability standards. Increasing energy demand and the development of new exploration sites create ongoing opportunities for specialized cord grip suppliers. This demand cycle is strengthened by government regulations on workplace safety, which mandate certified equipment for critical electrical connections in oil and gas facilities.

Construction projects across commercial, residential, and public infrastructure segments drive steady usage of metal cord grips. Electricians, contractors, and utility operators choose these products to provide secure connections and minimize risks of cable pullouts or electrical faults. Growth is influenced by rising installation of HVAC systems, elevators, and building wiring systems that depend on durable fittings. Metal cord grips also offer advantages in grounding, which is vital for ensuring compliance with electrical codes in high-density buildings. The availability of multiple sizes and material options allows their application in both large-scale urban projects and small housing developments, giving suppliers wide market reach.

The role of regulatory standards has grown increasingly significant, shaping procurement choices in the metal cord grips market. International certification, such as UL, IEC, and ATEX, is often mandated in oil, gas, and heavy industries, making compliance an important differentiator. Buyers are prioritizing suppliers that can deliver tested and documented safety features, ensuring fault tolerance and reduced downtime. Certification also provides confidence to electrical engineers and contractors who specify products for high-value projects.

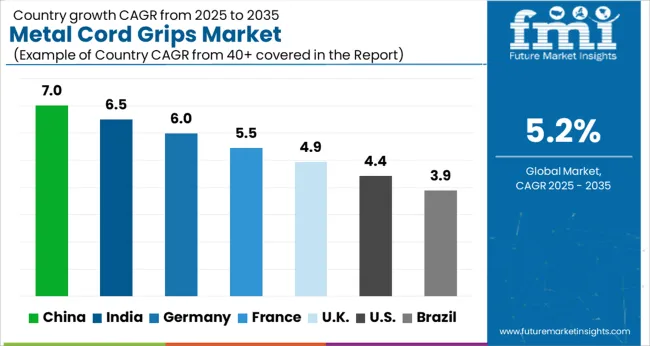

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

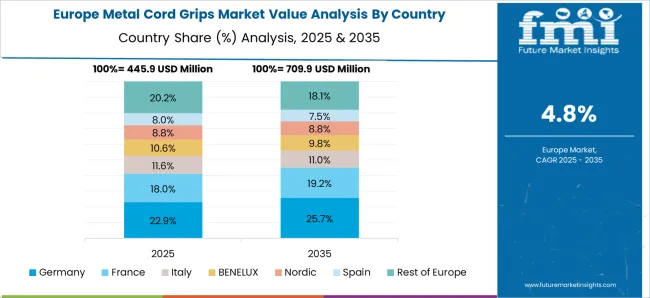

The global metal cord grips market is projected to grow at a CAGR of 5.2% from 2025 to 2035. China leads at 7.0%, followed by India at 6.5% and Germany at 6.0%, while France records 5.5%, the UK posts 4.9%, and the USA follows at 4.4%. Growth in Asia, particularly China and India, is driven by industrial expansion, rapid infrastructure upgrades, and high demand from oil, gas, and manufacturing projects. Germany and France emphasize regulatory standards, durable fittings, and advanced applications across construction and industrial automation. The UK and the USA demonstrate steady but slower growth due to reliance on established infrastructure and moderate replacement cycles. Collectively, Asia remains the strongest growth hub, while Europe and North America sustain demand through regulatory compliance and modernization programs. The analysis includes over 40+ countries, with the leading markets detailed below.

The metal cord grips market in China is projected to grow at 7.0% CAGR from 2025 to 2035. Expansion is being powered by large construction programs, metro rail projects, and utility upgrades that demand secure cable entry and strain relief across switchboards and distribution panels. Oil and gas complexes, chemical parks, and shipyards continue to specify metal bodies with high pullout resistance, ingress protection, and thread integrity. Distributors report steady movement in nickel plated brass and stainless grades as contractors target longer service life in coastal and corrosive zones. Product selection is being driven by certification, torque consistency, and gland seal performance under vibration. It is assessed that China will retain a leadership position as OEMs standardize metal cord grips across motors, drives, HVAC units, and outdoor enclosures through the period.

The metal cord grips market in India is projected to expand at 6.5% CAGR from 2025 to 2035. Growth is supported by power distribution upgrades, data center buildouts, and brownfield plant modernizations across steel, cement, and food processing. Installers favor metallic glands for thermal stability, thread accuracy, and reliable IP sealing in dusty and humid conditions. State corridor projects and renewable installations have encouraged stocking of metric and NPT variants to match mixed equipment bases. Procurement is influenced by documented short circuit performance, tensile load ratings, and availability of EMC shielding options for sensitive controls. In an opinionated view, India will deliver consistent volume as EPC contractors adopt standard kits that bundle locknuts, washers, and grommets for faster site execution during 2025 to 2035.

The metal cord grips market in France is expected to grow at 5.5% CAGR from 2025 to 2035. Demand is supported by code driven installations across building services, water treatment, and food and beverage packaging where ingress protection and hygiene are monitored closely. Stainless steel AISI grades are preferred in dairies, breweries, and marine settings, while nickel plated brass serves general purpose electrical rooms and rooftops. Specifiers emphasize documentation on IP66 to IP68 sealing, temperature ranges, and corrosion tests. Price discipline is important, yet buyers show willingness to pay for lifecycle reliability and traceable materials. It is judged that France will reward suppliers offering consistent threads, anti vibration claws, and low profile designs that clear tight panels and compact enclosures across the forecast window.

The metal cord grips market in the UK is anticipated to advance at 4.9% CAGR from 2025 to 2035. Steady activity in commercial refurbishments, onshore energy projects, and transport hubs sustains demand for metallic glands that resist pullout and moisture ingress. Consulting engineers place weight on ATEX and IECEx options for hazardous zones, while general sites specify IP68 and UV stable seals for rooftops and coastal weather. Stock availability and consistent lead times influence contractor loyalty. Documentation on thread tolerances, clamping ranges, and compression seal behavior at low temperatures is frequently requested. It is believed that measured growth will continue as maintenance programs replace aging fittings and as panel builders standardize a narrower set of SKUs to reduce complexity.

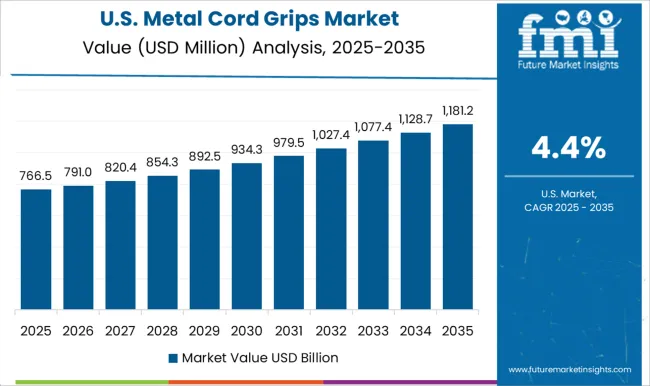

The metal cord grips market in the USA is projected to grow at 4.4% CAGR from 2025 to 2035. Activity is supported by warehouse automation, food plants, and municipal utilities that need durable strain relief for motors, conveyors, and pumps. NEC driven practices favor metallic bodies for grounding continuity and mechanical strength, with stainless options used in washdown areas. Buyers evaluate UL listings, NEMA compatibility, and pullout performance under vibration. Domestic stocking and responsive technical support remain decisive in bids. In this assessment, growth will be steady as retrofit projects replace aging plastic fittings and as data centers and parcel facilities demand tighter cable management and dependable sealing performance through the period.

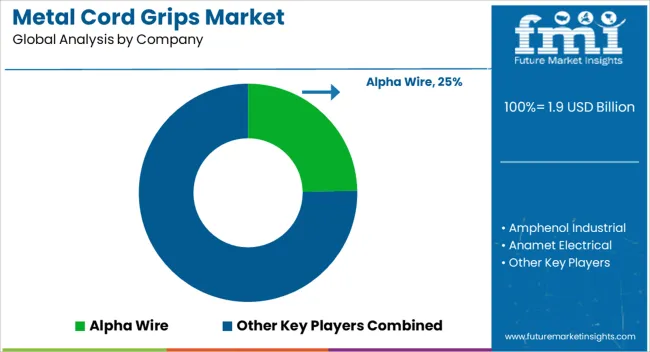

The metal cord grips market is shaped by global cable gland and connector manufacturers, regional metalworking firms, and specialized suppliers of industrial sealing solutions. Leading players such as Hummel, Lapp Group, HellermannTyton, Amphenol, and Hubbell are positioned strongly through wide product ranges that include nickel-plated brass, stainless steel, and EMC-shielding cord grips for industrial, marine, oil and gas, and hazardous-area applications. Competitive differentiation is driven by ingress protection ratings, material grade, thread standards, corrosion resistance, and certification compliance with ATEX, IECEx, and NEMA.

Regional manufacturers in Asia provide price-competitive alternatives and fast lead times for large-volume projects, while European and North American suppliers compete on documented quality, traceability, and engineering support. OEM partnerships and distribution channel strength influence procurement decisions for panel builders, switchgear makers, and electrical contractors. Product variants such as armor clamps, earthing options, and strain-relief designs are used to target niche end uses. Service offerings covering custom machining, plating, and inventory stocking add commercial value. Companies that combine certified product portfolios, broad distribution, and dependable technical support are expected to retain advantage as demand for durable, code-compliant cable entry solutions grows.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Material Type | Brass, Stainless Steel, Aluminium, and Others |

| Size | Upto 1 inch, 1-2 inch, and 3 inch |

| Shape | 45 degree elbow, 90 degree elbow, and Straight |

| Cord Holding Type | Bushing and Screw down clamp |

| End Use | General Manufacturing, Construction, Oil & Gas, Energy & Power, Transportation, Cleanroom Environments, Utilities, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpha Wire, Amphenol Industrial, Anamet Electrical, Cooper Crouse-Hinds (Eaton), Eaton, Heyco (Nexans), Hubbell Wiring Device-Kellems, Lapp Group, Leviton, Mencom Corporation, Panduit, R. Stahl, Remke Industries, Sealcon, and Thomas & Betts (ABB) |

| Additional Attributes | Dollar sales by material type, share by end-use sectors, competitive positioning, regional growth hotspots, certification trends, pricing benchmarks, and OEM partnership opportunities. |

The global metal cord grips market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the metal cord grips market is projected to reach USD 3.1 billion by 2035.

The metal cord grips market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in metal cord grips market are brass, stainless steel, aluminium and others.

In terms of size, upto 1 inch segment to command 41.6% share in the metal cord grips market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA