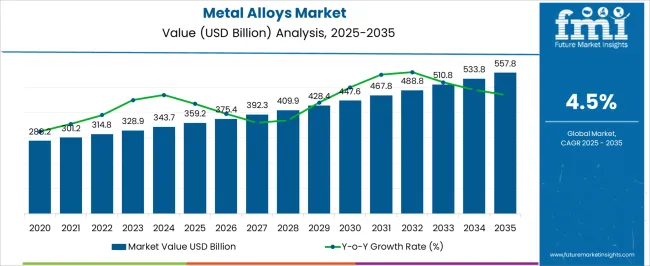

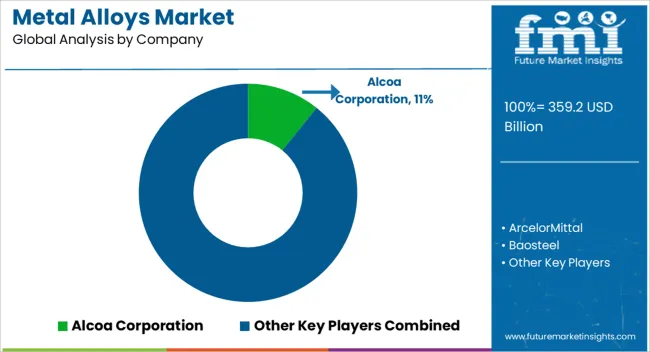

The metal alloys market stands at USD 359.2 billion in 2025 and is expected to reach USD 557.8 billion by 2035, growing at a CAGR of 4.5%, with a multiplying factor of about 1.55x. Peak-to-trough analysis highlights the cyclical nature of demand in the market, driven by fluctuations in end-use industries such as automotive, aerospace, construction, and machinery manufacturing.

The initial phase, from 2025 to 2028, represents a peak in demand supported by rising industrial production, infrastructure projects, and increasing adoption of high-performance alloys in aerospace and automotive applications. Raw material availability, stable pricing, and favorable trade conditions contribute to stronger market momentum during this period. Between 2028 and 2032, the market experiences a relative trough as growth moderates due to raw material price volatility, slower industrial output in mature regions, and competitive substitution with alternative materials in certain applications.

This trough period is characterized by reduced momentum rather than absolute decline, with steady demand maintained through replacement and maintenance cycles. From 2032 to 2035, another peak emerges, driven by technological innovations, expansion in emerging markets, and rising adoption of specialized alloys for renewable energy, defense, and high-tech manufacturing. Peak-to-trough cycles emphasize the importance of aligning production, supply chain management, and R&D investment with periods of accelerated demand and temporary moderation, ensuring sustained value creation in the metal alloys market.

| Metric | Value |

|---|---|

| Metal Alloys Market Estimated Value in (2025 E) | USD 359.2 billion |

| Metal Alloys Market Forecast Value in (2035 F) | USD 557.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The metal alloys market is influenced by multiple upstream sectors. Steel and alloy producers account for approximately 39%, supplying high-performance alloys for construction, automotive, and industrial applications. Aerospace and defense manufacturers contribute around 26%, using specialized alloys for structural components and high-temperature environments. Automotive OEMs represent roughly 16%, integrating alloys for engine, chassis, and body components. Industrial machinery and equipment producers hold close to 11%, applying alloys in tooling, mechanical systems, and heavy machinery. Research institutions and specialty material suppliers make up the remaining 8%, providing customized alloys and technical support for innovative applications. The market is evolving with increasing demand for lightweight, high-strength, and corrosion-resistant alloys. Aerospace and defense applications now account for over 32% of high-performance alloy consumption, driven by fuel efficiency and structural integrity requirements. Automotive adoption of aluminum, magnesium, and advanced steel alloys has grown by ~13% year-on-year, reducing vehicle weight while maintaining strength. Additive manufacturing using metal alloys is rising, enabling complex geometries and material efficiency improvements of 8–10%. Industrial applications are integrating wear-resistant and high-temperature alloys, extending component lifespan. Additionally, digital metallurgical simulations and alloy optimization are improving process efficiency and reducing material waste

Industry announcements and engineering material studies have emphasized the role of alloys in delivering superior strength, corrosion resistance, and durability across a wide range of applications. Rising demand from automotive, aerospace, construction, and energy sectors has reinforced the need for high-performance alloy materials that can meet stringent safety and operational standards.

Strategic investments in alloy research have led to improved metallurgical compositions, enhancing performance in extreme environmental conditions. Additionally, the transition towards lightweight materials for fuel efficiency and reduced emissions has accelerated the adoption of specialized alloys in transportation and industrial machinery.

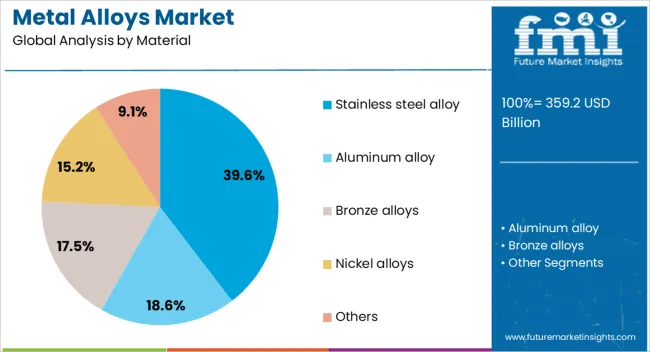

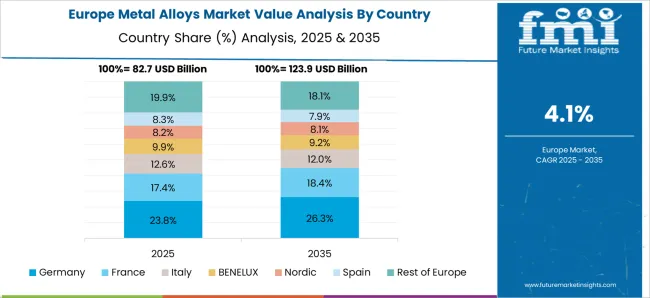

Regional market growth is being stimulated by both emerging economies expanding their industrial base and developed economies upgrading to advanced manufacturing techniques. Over the forecast period, stainless steel alloys, transportation-related applications, and casting processes are expected to remain key drivers, supported by their versatility, scalability, and established supply chain networks.

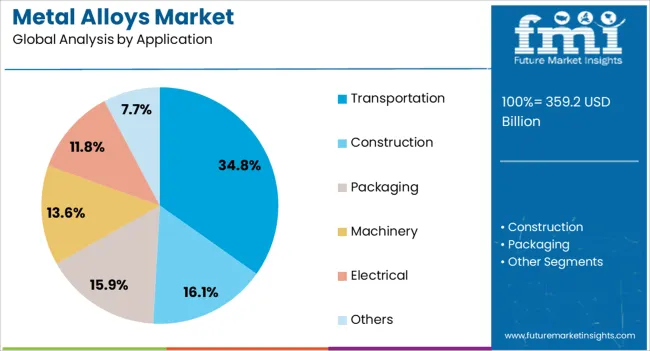

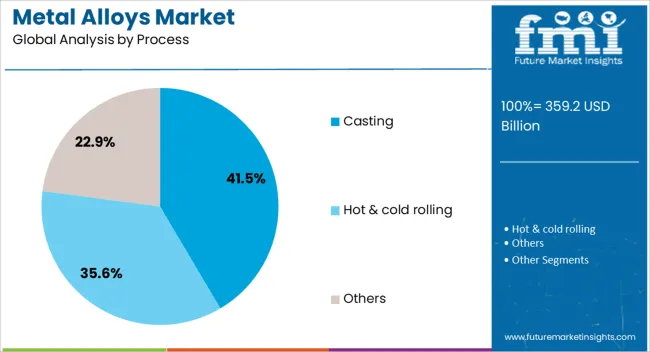

The metal alloys market is segmented by material, application, process, and geographic regions. By material, metal alloys market is divided into Stainless steel alloy, Aluminum alloy, Bronze alloys, Nickel alloys, and Others. In terms of application, metal alloys market is classified into Transportation, Construction, Packaging, Machinery, Electrical, and Others. Based on process, metal alloys market is segmented into Casting, Hot & cold rolling, and Others.

Regionally, the metal alloys industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stainless steel alloy segment is projected to hold 39.6% of the metal alloys market revenue in 2025, maintaining its leadership position due to its exceptional corrosion resistance, mechanical strength, and adaptability. Demand for stainless steel alloys has been reinforced by their use in industries where hygiene, longevity, and aesthetic appeal are critical, including transportation, construction, and consumer goods.

Manufacturing sector reports have highlighted the cost-effectiveness of stainless steel alloys in lifecycle terms, given their low maintenance requirements and recyclability. Additionally, advancements in alloy compositions, such as improved chromium and nickel balances, have enhanced their performance in high-stress environments.

The ability to customize stainless steel alloys for specific applications, coupled with their global availability, ensures sustained demand. This combination of performance characteristics and supply stability is expected to keep stainless steel alloys at the forefront of material selection across multiple industries.

The transportation segment is projected to contribute 34.8% of the metal alloys market revenue in 2025, retaining its dominant application share due to the sector’s ongoing push for materials that combine strength, weight reduction, and durability. Automotive, aerospace, and rail manufacturers have increasingly adopted advanced alloys to meet performance standards, safety regulations, and environmental targets.

Technical publications have noted that alloys offer superior resistance to fatigue, wear, and environmental degradation, making them ideal for critical components like engine parts, structural frames, and safety systems.

The rising demand for electric vehicles has further increased alloy consumption, particularly in battery casings, lightweight frames, and drivetrain components. With transportation industries globally committed to improving efficiency and reducing emissions, alloy materials are expected to maintain a central role in product innovation and manufacturing strategies.

The casting segment is projected to account for 41.5% of the metal alloys market revenue in 2025, holding its leading position due to its efficiency in producing complex, high-strength components at scale. Foundry industry data has highlighted casting’s ability to deliver precise shapes with minimal material wastage, making it cost-effective for both high-volume production and specialized parts.

Alloys processed through casting benefit from enhanced structural integrity and flexibility in design, allowing manufacturers to produce components tailored to specific operational demands.

The process supports a wide range of alloys, including stainless steel, aluminum, and titanium, which are integral to industries such as transportation, energy, and heavy machinery. Technological advancements in mold design, simulation software, and cooling techniques have improved quality control and reduced defect rates. As industries continue to demand complex geometries and high-performance materials, casting is expected to remain a preferred manufacturing process for alloy-based components.

The metal alloys market is expanding due to increasing demand from aerospace, automotive, construction, and industrial manufacturing sectors. Metal alloys, including aluminum, steel, nickel, and titanium-based compositions, offer enhanced strength, corrosion resistance, and lightweight properties. Asia Pacific leads consumption and production due to large-scale industrialization and infrastructure development, while North America and Europe focus on high-performance and specialty alloys for aerospace and defense.

The automotive and aerospace industries are driving significant demand for metal alloys. Automakers use lightweight aluminum and magnesium alloys to improve fuel efficiency and reduce emissions, while titanium and nickel-based alloys are critical for high-performance aerospace components. Alloy selection is guided by strength-to-weight ratio, thermal stability, and corrosion resistance. Increasing electric vehicle production and advanced aircraft manufacturing require high-performance alloys for structural and functional components. Adoption of alloys in critical components such as engine parts, chassis, and turbine systems ensures enhanced durability and performance, driving global market growth.

Growth Opportunity Advancements in Specialty and High-Performance Alloys

Specialty and high-performance alloys present growth opportunities by offering enhanced mechanical, thermal, and corrosion resistance properties. Nickel, cobalt, and titanium alloys are increasingly adopted in aerospace, defense, and energy sectors. Aluminum and magnesium alloys are widely used in automotive and lightweight industrial applications. Technological improvements in alloy production, powder metallurgy, and additive manufacturing enable customized compositions and improved performance. Companies focusing on sustainable, high-performance, and application-specific alloys are positioned to capitalize on increasing industrial and commercial demand. Rising adoption in electric vehicles, aircraft components, and energy infrastructure further supports market expansion globally.

Emerging Trend Integration with Additive Manufacturing and Coatings

Metal alloys are increasingly integrated with additive manufacturing and advanced coating technologies. Additive manufacturing allows precise, complex geometries while reducing material waste. Coatings enhance surface durability, corrosion resistance, and thermal performance. These trends are particularly relevant in aerospace, defense, and automotive applications, where high performance and lightweight structures are essential. Manufacturers are focusing on alloy customization, powder quality, and process optimization to meet specific requirements. The convergence of additive manufacturing and surface engineering is enabling the development of advanced components, supporting broader adoption of metal alloys in industrial, automotive, and high-tech applications.

Market Challenge Raw Material Price Volatility and Production Complexity

Fluctuations in raw material costs, including aluminum, nickel, and titanium, and complex alloying processes present challenges. High energy consumption, precise process control, and quality testing increase production costs. Standardizing alloy composition across different regions and applications adds complexity. Companies focusing on efficient production techniques, cost optimization, and supply chain management are better positioned to overcome these challenges. Ensuring consistent quality, durability, and cost-effectiveness is critical to sustaining adoption and competitiveness in the global metal alloys market.

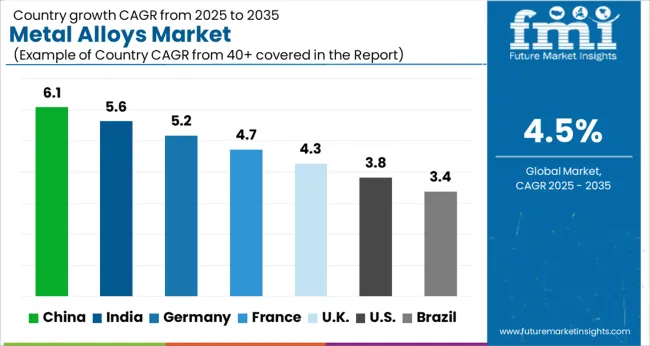

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| U.K. | 4.3% |

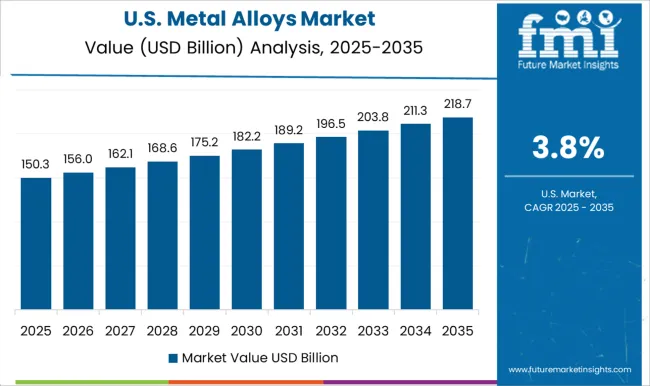

| U.S. | 3.8% |

| Brazil | 3.4% |

The metal alloys market is expanding at a global CAGR of 4.5% from 2025 to 2035, driven by increasing demand across automotive, aerospace, construction, and industrial applications. China leads with a CAGR of 6.1%, +36% above the global benchmark, supported by BRICS-driven industrial growth, large-scale manufacturing, and rising consumption in infrastructure and automotive sectors. India follows at 5.6%, +24% over the global average, reflecting strong domestic demand, industrialization, and investment in metal processing technologies. Germany records 5.2%, +16% above the global CAGR, shaped by OECD-supported precision engineering, high-performance alloys, and aerospace applications. The United Kingdom posts 4.3%, slightly below the global rate, influenced by moderate industrial adoption and selective specialty alloy usage. The United States stands at 3.8%, −15% under the global benchmark, reflecting mature industrial markets but steady demand for high-grade alloys in aerospace, automotive, and energy sectors. BRICS nations are driving volume, while OECD countries focus on technological refinement and application-specific innovations.

China is growing at a CAGR of 6.1%, 1.6% above the global CAGR of 4.5%, driven by demand from automotive, aerospace, and construction sectors. Manufacturers are investing in high-strength and lightweight alloys to improve performance, reduce weight, and enhance durability. Rapid industrial expansion, infrastructure projects, and increasing production of electric vehicles boost alloy consumption. Strategic partnerships with technology providers and research institutes facilitate innovation and quality improvement. Rising exports of high-performance alloys further reinforce China’s global market position. Adoption of advanced alloy manufacturing techniques, such as powder metallurgy and additive manufacturing, supports operational efficiency and product performance, positioning China as a leading contributor to global metal alloy growth.

India is expanding at a CAGR of 5.6%, 1.1% above the global CAGR, supported by rising demand from automotive, infrastructure, and industrial machinery sectors. Manufacturers are increasing production of corrosion-resistant and lightweight alloys. Government initiatives in infrastructure and industrial modernization accelerate adoption. Partnerships with global alloy suppliers enable technology transfer and enhanced manufacturing capabilities. Growth is further supported by electric vehicle production and industrial electrification. Rising demand for high-performance materials across transportation, construction, and energy sectors strengthens India’s position in the Asia-Pacific alloy market.

Germany is growing at a CAGR of 5.2%, 0.7% above the global CAGR, driven by automotive, aerospace, and precision engineering sectors. High-quality alloys are used to enhance vehicle performance, reduce weight, and improve durability. Strong R&D infrastructure and collaborations with European suppliers support innovation in material composition and processing. Export demand for automotive and aerospace components sustains steady growth. Germany’s focus on precision engineering, industrial automation, and lightweight materials ensures consistent adoption of advanced alloys.

The United Kingdom is expanding at a CAGR of 4.3%, slightly below the global CAGR of 4.5%, reflecting moderate adoption. Automotive, aerospace, and industrial manufacturing sectors drive demand. Imports of high-performance alloys supplement domestic production. Investments in R&D improve material properties, efficiency, and durability. Industrial modernization and infrastructure projects ensure steady growth. Adoption of corrosion-resistant and lightweight alloys supports performance requirements in automotive and energy applications. Growth remains gradual but consistent due to focused industrial demand and targeted import strategies.

The United States is growing at a CAGR of 3.8%, 0.7% below the global CAGR of 4.5%, reflecting slower expansion due to market maturity. Adoption is concentrated in automotive, aerospace, and industrial machinery sectors. High-performance alloys for lightweighting, durability, and corrosion resistance are widely used. Domestic production is complemented by imports from Europe and Asia. Growth is supported by industrial modernization, electric vehicle production, and aerospace demand, though expansion remains below global benchmarks. The US market maintains steady demand in high-value manufacturing applications, with R&D investments enhancing alloy performance and industrial adoption.

The metal alloys market is driven by companies providing high-performance materials for automotive, aerospace, construction, and industrial applications. Alcoa Corporation is assumed to be the leading player, offering a portfolio of lightweight and high-strength aluminum alloys, engineered for superior corrosion resistance, thermal stability, and manufacturing versatility. ArcelorMittal and Baosteel maintain competitive positions with stainless steel and specialty alloys designed for structural applications, emphasizing strength-to-weight ratios, durability, and adaptability to fabrication processes. Dynacast focuses on precision die-cast alloys suitable for automotive components and electronics, while Jindal Stainless and Kaiser Aluminum provide cost-effective solutions for large-scale industrial and infrastructure projects.

Kobe Steel, Nippon Steel Corporation, and Novelis contribute through tailored alloy compositions, surface treatments, and high-quality standards that support aerospace, transportation, and consumer product applications. POSCO, Rio Tinto, and RUSAL enhance the market with global production capacities, technical support, and alloy grades optimized for lightweighting, heat treatment, and mechanical performance. Product brochures emphasize alloy composition, tensile strength, corrosion resistance, thermal performance, and machinability. Features such as weldability, fatigue resistance, and adaptability to casting, forging, or rolling processes are highlighted. Technical specifications, handling instructions, and application guidelines enable manufacturers to select the right alloys for automotive chassis, aerospace structures, industrial machinery, and infrastructure components.

| Item | Value |

|---|---|

| Quantitative Units | USD 359.2 Billion |

| Material | Stainless steel alloy, Aluminum alloy, Bronze alloys, Nickel alloys, and Others |

| Application | Transportation, Construction, Packaging, Machinery, Electrical, and Others |

| Process | Casting, Hot & cold rolling, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alcoa Corporation, ArcelorMittal, Baosteel, Dynacast, Jindal Stainless, Kaiser Aluminum, Kobe Steel, Nippon Steel Corporation, Novelis, POSCO, Rio Tinto, and RUSAL |

| Additional Attributes | Dollar sales by alloy type and application industry, demand dynamics across aerospace, automotive, construction, and industrial machinery, regional trends across North America, Europe, and Asia-Pacific, innovation in high-strength, lightweight, and corrosion-resistant alloys, environmental impact of energy-intensive production and recyclability, and emerging use cases in electric vehicles, renewable energy, and advanced manufacturing components. |

The global metal alloys market is estimated to be valued at USD 359.2 billion in 2025.

The market size for the metal alloys market is projected to reach USD 557.8 billion by 2035.

The metal alloys market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in metal alloys market are stainless steel alloy, aluminum alloy, bronze alloys, nickel alloys and others.

In terms of application, transportation segment to command 34.8% share in the metal alloys market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA