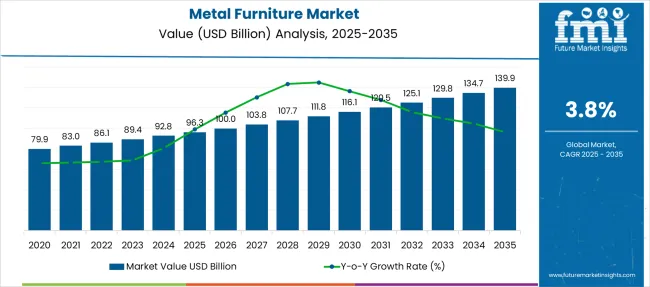

The Metal Furniture Market is estimated to be valued at USD 96.3 billion in 2025 and is projected to reach USD 139.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. A growth contribution index analysis reveals a moderately back-weighted growth pattern. The first half of the forecast period (2025 to 2030) shows an increase from USD 100.0 billion to 116.1 billion, contributing USD 16.1 billion, which represents approximately 40.3% of the total growth. This phase reflects steady adoption driven by commercial furniture demand in offices, hospitality, and institutional setups, alongside rising residential usage of modular metal furniture. Annual values during this phase include 103.8 billion in 2027 and 111.8 billion in 2029, indicating incremental but consistent gains.

The second half (2030 to 2035) dominates the growth curve, adding USD 23.8 billion, or 59.7% of cumulative growth, as the market expands from 116.1 billion to 139.9 billion. Key contributors include premium product demand, hybrid metal-wood designs, and increasing penetration of smart and ergonomic metal furniture in urban households and co-working spaces. This pattern highlights a progressive acceleration in later years as manufacturing technologies improve and supply chain efficiencies lower production costs. Vendors focusing on customization, design innovation, and cost optimization will capture a higher share of this back-weighted opportunity.

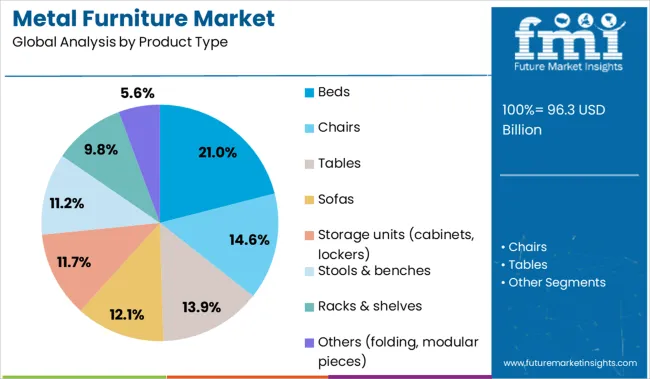

Demand is being influenced by rising interest in modern interior designs that incorporate sleek metallic finishes and the material’s long lifespan compared to alternatives. Beds represent the leading segment, accounting for the largest share due to their structural strength and suitability for both residential and hospitality environments. Increasing adoption of modular and multifunctional metal furniture for offices, educational spaces, and healthcare facilities has further accelerated uptake in commercial settings.

The growth pattern of the market is characterized by a smooth upward slope rather than an aggressive rise, suggesting stable and predictable progress. This trend aligns with replacement cycles in mature regions and expanding middle-class consumption in emerging economies. North America remains a dominant contributor, while Asia-Pacific is showing strong momentum with rising construction and lifestyle shifts. Product differentiation through ergonomic design, powder-coated finishes, and hybrid materials has become essential to attract consumers seeking aesthetic appeal with practicality. While traditional demand drivers remain intact, opportunities exist in customized offerings and integration with space-saving solutions, which will likely shape the market’s trajectory toward premium and flexible furniture concepts.

| Metric | Value |

|---|---|

| Metal Furniture Market Estimated Value in (2025 E) | USD 96.3 billion |

| Metal Furniture Market Forecast Value in (2035 F) | USD 139.9 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The metal furniture market is witnessing steady growth, supported by increasing demand for durable, minimal-maintenance, and space-efficient furniture across residential and commercial sectors. Evolving interior design trends that favor industrial and contemporary aesthetics have accelerated the adoption of metal-based furnishings.

The market is further benefiting from advancements in fabrication technology and surface finishing methods that enhance corrosion resistance, texture, and design versatility. Manufacturers are increasingly focusing on recyclable and sustainable material sourcing to meet evolving regulatory requirements and green building certifications.

With urban housing becoming more compact, the demand for modular, lightweight metal furniture is rising, particularly in the indoor furniture segment. Long-term market outlook remains positive, driven by consumer preference for longevity, material strength, and design adaptability, supported by growing investments in home improvement and real estate development.

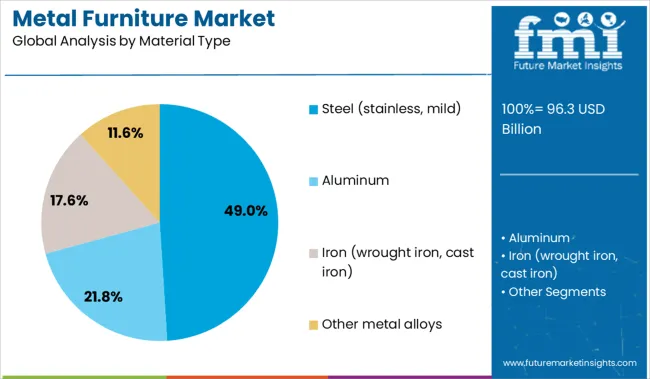

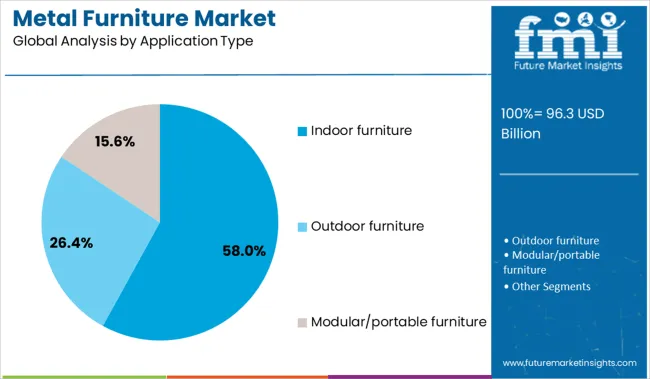

The metal furniture market is segmented by product type, material type, application type, end use, distribution channel, and region. By product type, it includes beds, chairs, tables, sofas, storage units such as cabinets and lockers, stools and benches, racks and shelves, and others, including folding and modular pieces. In terms of material type, the segmentation comprises steel (stainless and mild), aluminum, iron (wrought and cast), and other metal alloys. Based on application type, it covers indoor furniture, outdoor furniture, and modular or portable furniture solutions. By end use, the market includes residential, commercial, office, hotel and restaurant, educational institution, healthcare facility, industrial space, and government or military facilities. Distribution channels are divided into offline and online platforms. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Beds are projected to contribute 21.0% of the total revenue in the metal furniture market by 2025, establishing them as the leading product type segment. This leadership is attributed to the increasing preference for durable and stable bedding solutions, especially in residential, hospitality, and institutional environments.

Metal beds offer structural strength, resistance to termites and moisture, and ease of assembly, which are essential factors in both domestic and commercial settings. Their ability to accommodate under-bed storage and adapt to modern design trends has strengthened their market appeal.

Moreover, the availability of customizable designs with powder-coated finishes and decorative frameworks has contributed to broader consumer acceptance. As real estate developers and homeowners alike focus on maximizing utility and lifespan, the demand for metal-based bed frames is expected to remain strong.

Steel, including both stainless and mild variants, is anticipated to hold 49.0% of the revenue share in 2025, making it the most widely used material in the metal furniture market. Its dominance is being driven by its superior strength-to-weight ratio, corrosion resistance, and versatility in forming and welding processes. Stainless steel offers aesthetic appeal and hygiene benefits, making it ideal for high-traffic and moisture-prone environments.

Mild steel, on the other hand, is preferred for its cost-efficiency and adaptability in intricate furniture designs. Both variants support surface treatments such as powder coating and galvanization, which extend product life and reduce maintenance.

The recyclability of steel and its alignment with green building standards have further increased its adoption across both residential and commercial applications. As demand grows for materials that deliver both durability and sustainability, steel continues to be the material of choice for furniture manufacturers globally.

Indoor furniture is expected to dominate the metal furniture market with a 58.0% revenue share in 2025. This segment’s strength is being shaped by rising urbanization, shifting lifestyle patterns, and the need for long-lasting, modern furnishings in apartments, offices, and hospitality settings.

Metal indoor furniture, including beds, tables, chairs, and storage units, is gaining popularity due to its minimal upkeep requirements, durability, and compatibility with hybrid material combinations like wood or glass. Interior design trends favoring industrial aesthetics and modular layouts have further supported the use of metal furniture indoors.

Additionally, increased spending on home renovation and workspace customization has propelled demand for premium, space-saving furniture solutions. As consumers and developers prioritize functionality, aesthetics, and longevity, the indoor application of metal furniture is expected to remain the cornerstone of market growth.

Design and utility preferences are reshaping the metal furniture market, with modular, space-saving, and corrosion-resistant options gaining traction. Competitive growth is being fueled by e-commerce expansion, contract sales, and SKU diversification.

The metal furniture market is being redefined by the blending of minimalism, durability, and industrial-inspired aesthetics. It is widely observed that preferences have shifted toward sleek finishes, powder-coated frames, and modular structures, especially in compact living spaces. Stainless steel and aluminum are increasingly being favored for their corrosion resistance and visual neutrality. Rising demand for customizable furniture formats, including foldable or stackable units, has been cited as a strong influence across residential and commercial segments. A shift toward multipurpose layouts, like beds with storage or convertible tables, is being embraced, particularly by younger demographics and interior designers. The segment's growth is seen as being closely tied to changing spatial utilization patterns and evolving interior décor tastes.

A growing number of manufacturers are being driven toward online channels, with e-commerce platforms playing a pivotal role in expanding geographic reach and engaging price-sensitive buyers. White-labeling, private licensing, and institutional contracts, especially with hotels, offices, and educational facilities, are being recognized as major revenue streams. The brand loyalty factor in metal furniture remains fragmented, making price, design, and delivery speed key differentiators. Regional manufacturers are being noted for leveraging domestic sourcing advantages and localized marketing. Market competitiveness is being intensified by mass custom production, rapid shipping models, and D2C channel exploration. It’s increasingly believed that those embracing omni-channel retail models and differentiated SKUs will be positioned at the forefront of future dollar sales and share gains.

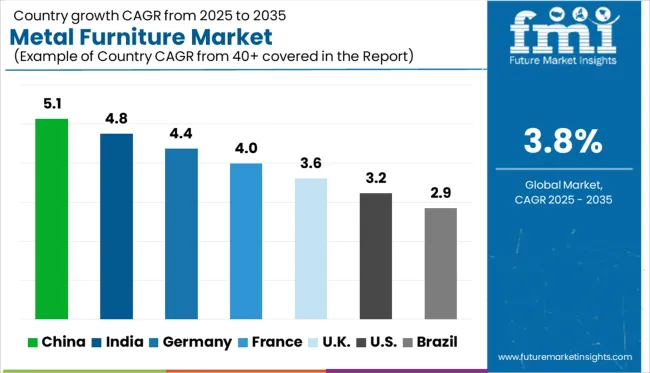

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The global metal furniture market is growing at a CAGR of 3.8% from 2025 to 2035, but several nations, especially in BRICS and OECD regions, are outperforming this average due to structural housing trends and contract furnishing demand. China leads with a CAGR of 5.1%, driven by rapid urbanization, evolving lifestyle preferences, and a booming e-commerce channel for home furnishings.

India follows at 4.8%, benefiting from rising middle-class spending and the government's push for domestic manufacturing under initiatives like “Make in India.” Germany, a key OECD country, is expanding at 4.4%, propelled by a strong institutional and hospitality sector that favors durable and modular furniture solutions.

The UK and USA lag the global average at 3.6% and 3.2%, respectively, due to market saturation and slower growth in the residential sector. ASEAN economies are gaining momentum in export-focused production, though not listed above. The report evaluates over 40+ countries, with the top five highlighted for reference.

The CAGR for the UK metal furniture market was estimated at 3.6% from 2020 to 2024. It is projected to rise to approximately % between 2025 and 2035, surpassing the global CAGR of 3.8%. The earlier period reflected cautious spending, subdued construction growth, and import dependence due to Brexit-related supply constraints. However, post-2024, retail recovery, a stronger housing cycle, and commercial refurbishments have contributed to improved momentum. Growth in office redevelopments and demand for modular metal workstations and storage solutions is being actively observed. Made-in-UK sourcing and regional distribution efficiency are being seen as levers for margin improvements. Consumer interest in minimalist and space-efficient products has driven demand, especially in London, Manchester, and Birmingham. E-commerce penetration, supported by domestic logistics and reduced EU shipping barriers following Brexit, is expected to fuel future sales volume and share.

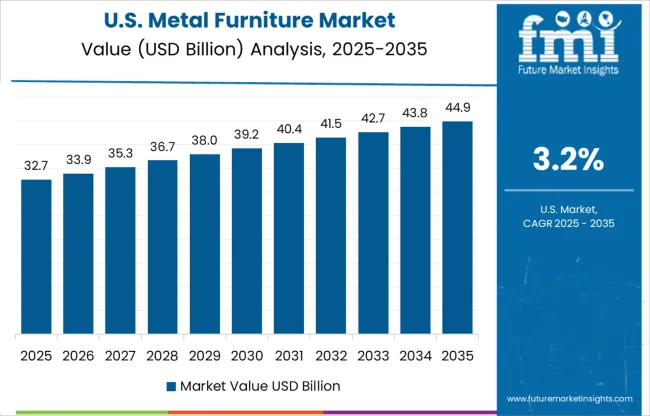

The US metal furniture market is expected to grow with a moderate rise of 3.2% from 2025 to 2035. The initial years were impacted by pandemic-related commercial real estate disruptions and global supply chain lags. However, gradual normalization and revived CAPEX in healthcare, education, and defense sectors have driven demand for metal-based institutional furniture.

Consumer affinity toward metal bunk beds, kitchen racks, and garden furniture has increased across suburbs and fast-growing towns. The US is also benefiting from nearshoring trends and the reshoring of production, allowing improved turnaround times. Dollar sales growth is increasingly being driven by digital-native D2C brands, leveraging augmented reality tools for furniture customization. Furniture-as-a-service models have also gained visibility in the corporate and co-living segments.

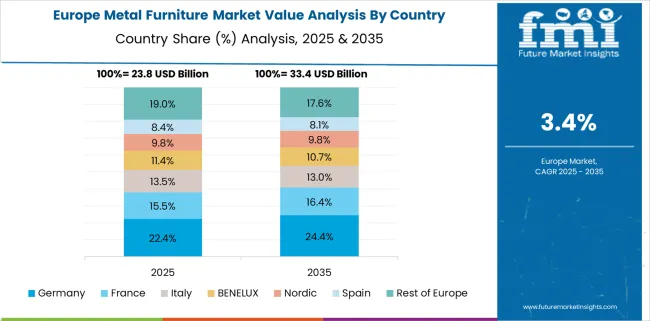

Germany posted a CAGR of 4.4% from 2020 to 2024, which is expected to grow slightly to 4.6% from 2025 to 2035, staying above the global average. Market resilience was maintained by consistent investment in modular housing and the institutional furnishing sector. Growth is being supported by the country’s demand for functional, high-end, and ergonomically designed metal furniture.

German manufacturers are increasingly emphasizing customizable formats aligned with Bauhaus aesthetics, which remains a key design influence. Exports to neighboring EU countries have also reinforced production volumes, while local preferences for durable, environmentally sound products keep metal a favored material. The growing adoption of hybrid workplace formats is leading to increased purchases of adjustable metal fixtures and collaborative workspace setups.

Demand in China is expected to grow at a CAGR of 5.1% from 2025 to 2035, making it one of the strongest performers globally. Industrial-scale production, government-backed export incentives, and urban housing projects have sustained high-volume demand. The rise of the younger urban workforce, coupled with new apartment sales, has led to increased adoption of minimalist, space-saving, metal-framed furniture.

Chinese e-commerce platforms such as Tmall and JD.com have driven product visibility, offering customization at scale. Growth is also being supported by expanded export agreements with Southeast Asia, Africa, and Europe. The integration of smart packaging, digital warranty models, and AI-driven inventory forecasting tools is being actively adopted by regional manufacturers.

The market growth in India shows a steady demand with a 4.8% CAGR during the forecast period. Increased consumer migration to urban apartments and co-living spaces is influencing the uptake of cost-effective and durable furniture solutions.

The domestic metal furniture industry is expanding due to infrastructure investment and the growth of the hospitality sector. Government procurement programs and institutional demand from schools and hospitals have further boosted local manufacturing clusters in Maharashtra, Tamil Nadu, and Gujarat.

Organized retail and furniture chains such as Urban Ladder and Pepperfry are partnering with metal furniture brands to cater to rising middle-income aspirations. Import substitution and Make in India initiatives are being credited with improving local value addition.

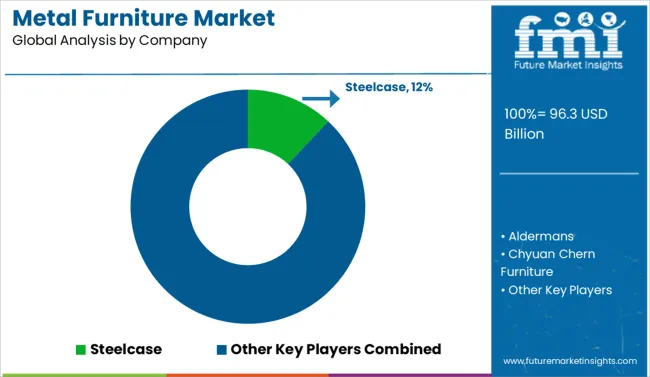

In the global metal furniture market, leading manufacturers are being recognized for their durable designs, modular formats, and space-efficient solutions catering to residential, institutional, and commercial needs. Major players such as Steelcase, Herman Miller, and Haworth are prioritizing ergonomic innovation and contract furniture excellence, particularly in office and education segments.

HNI, Knoll, and Okamura are expanding their portfolios with customizable workstations and hybrid workspace offerings. Asian manufacturers like Foshan Kinouwell Furniture, Chyuan Chern Furniture, and Weiling Steel Furniture are contributing significantly to export growth, backed by mass production capabilities.

Samsonite and Meco are maintaining relevance through multifunctional and foldable designs. Vitra International and KI are focusing on design-led approaches for institutional and public space seating. Xinyue Holding Group and Aldermans are gaining ground in regional markets via cost-effective, high-volume models with streamlined distribution.

Key Developments in the Metal Furniture Market

Key players in the metal furniture market are focusing on design innovation, material optimization, and cost efficiency to strengthen their competitive position. Strategies include introducing lightweight alloys and corrosion-resistant finishes, integrating smart features such as adjustable mechanisms, and adopting modular, space-saving designs for urban consumers. Companies are also investing in automated manufacturing, eco-friendly coatings, and regional supply chain networks to improve scalability and reduce lead times. Strategic partnerships with e-commerce platforms and expansion into emerging markets further support growth through enhanced distribution and increased customer accessibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 96.3 Billion |

| Product Type | Beds, Chairs, Tables, Sofas, Storage units (cabinets, lockers), Stools & benches, Racks & shelves, and Others (folding, modular pieces) |

| Material Type | Steel (stainless, mild), Aluminum, Iron (wrought iron, cast iron), and Other metal alloys |

| Application Type | Indoor furniture, Outdoor furniture, and Modular/portable furniture |

| End Use | Residential, Commercial, Offices, Hotels & restaurants, Educational institutions, Healthcare facilities, Industrial, and Government & military |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Steelcase, Aldermans, Chyuan Chern Furniture, Foshan Kinouwell Furniture, Haworth, Herman Miller, HNI, KI, Knoll, Meco, Okamura, Samsonite, Vitra International, Weiling Steel Furniture, and Xinyue Holding Group |

| Additional Attributes | Dollar sales, regional share, material trends, buyer preferences, e-commerce penetration, contract sales growth, pricing benchmarks, and competitive positioning by brand and geography. |

The global metal furniture market is estimated to be valued at USD 96.3 billion in 2025.

The market size for the metal furniture market is projected to reach USD 139.9 billion by 2035.

The metal furniture market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in metal furniture market are beds, chairs, tables, sofas, storage units (cabinets, lockers), stools & benches, racks & shelves and others (folding, modular pieces).

In terms of material type, steel (stainless, mild) segment to command 49.0% share in the metal furniture market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA