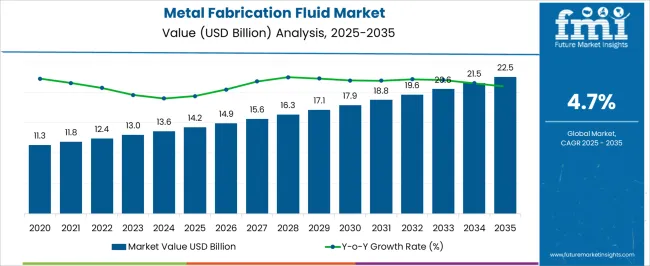

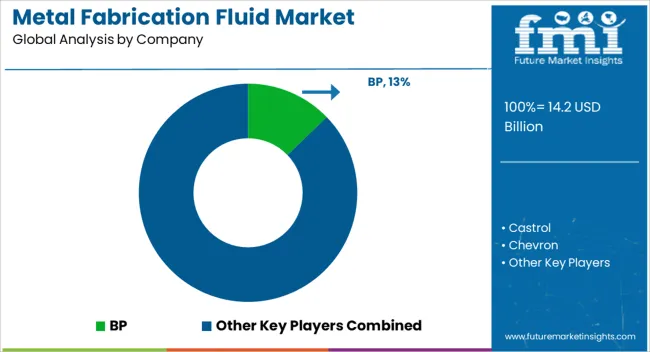

The metal fabrication fluid market is estimated to be valued at USD 14.2 billion in 2025 and is projected to reach USD 22.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The metal fabrication fluid market is projected to climb from USD 14.2 billion in 2025 to USD 22.5 billion by 2035, translating into a compound annual growth rate (CAGR) of 4.7%. The growth rate volatility index over this decade signals a consistent upward pattern, reflecting steady yet impactful demand for fluids used in machining, cutting, and shaping processes. Such demand is closely tied to manufacturing intensity across industries like automotive, construction, heavy machinery, and aerospace.

Despite cyclical fluctuations in raw material pricing and production costs, the market shows resilience, as fabrication fluids are essential for ensuring efficiency, reducing wear and tear, and improving operational throughput in industrial settings. This steady trajectory demonstrates that demand stability will outweigh volatility, which positions the market as one with reliable long-term opportunities. A closer review of the 2025 to 2035 data shows yearly increments that maintain balance without sharp disruptions, suggesting that volatility is modest and manageable. By 2030, the market is anticipated to cross USD 17.9 billion, with consistent growth blocks underpinning performance. Players in the industry are expected to benefit from gradual yet broad-based adoption of advanced metalworking processes that continue to require effective lubrication and cooling solutions.

While competition among suppliers may intensify, the need for process optimization will favor manufacturers who provide durable, cost-efficient, and high-performance fluids. The market’s progression is likely to be shaped more by incremental adoption trends than by abrupt shifts, making the growth rate volatility index lean toward stability rather than unpredictability, a favorable indicator for long-term stakeholders.

| Metric | Value |

|---|---|

| Metal Fabrication Fluid Market Estimated Value in (2025 E) | USD 14.2 billion |

| Metal Fabrication Fluid Market Forecast Value in (2035 F) | USD 22.5 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The metal fabrication fluid market has carved a critical role across its parent industries, as these fluids are indispensable in processes like cutting, grinding, stamping, and forming, ensuring efficiency and durability of both machines and end products. Within the industrial lubricants market, metal fabrication fluids contribute nearly 12–14% share, owing to their role in reducing wear and extending machinery life.

In the broader metalworking fluids market, the segment dominates with about 30–35% share, as fabrication processes rely heavily on cooling and lubrication solutions. Within the manufacturing chemicals market, fabrication fluids hold around 8–10% share, given their necessity in industrial-scale production lines. In the automotive components market, these fluids represent about 6–8% share, since their use in engine parts, chassis, and body fabrication supports consistent quality and performance. In the heavy machinery market, the contribution stands at approximately 10–12%, as such equipment demands specialized fluids for precision and prolonged operational life. Despite concerns regarding fluid disposal and regulatory compliance, the demand remains resilient because fabrication processes cannot be substituted without risking productivity and component quality.

From my perspective, the metal fabrication fluid market is not just another niche in industrial chemicals but a backbone of advanced manufacturing, as its absence would directly impact operational continuity, product accuracy, and competitiveness across automotive, aerospace, and machinery sectors, making it a non-negotiable element in modern industrial value chains.

The metal fabrication fluid market is experiencing robust growth driven by increasing demand from manufacturing, automotive, and heavy machinery industries. Advancements in precision engineering, coupled with rising production of complex metal components, are fueling the requirement for high-performance fabrication fluids.

Environmental regulations are pushing manufacturers toward more sustainable and efficient fluid formulations, leading to greater adoption of biodegradable and low-toxicity variants. Water-based technologies are gaining traction due to reduced environmental impact and improved worker safety.

Continuous innovation in fluid chemistry to enhance lubrication, cooling, and corrosion resistance is further supporting market expansion. The outlook remains positive as industries focus on operational efficiency, extended tool life, and sustainable manufacturing practices, creating consistent demand for advanced metal fabrication fluid solutions.

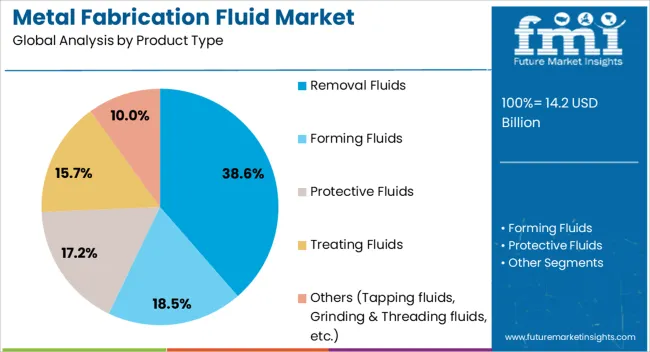

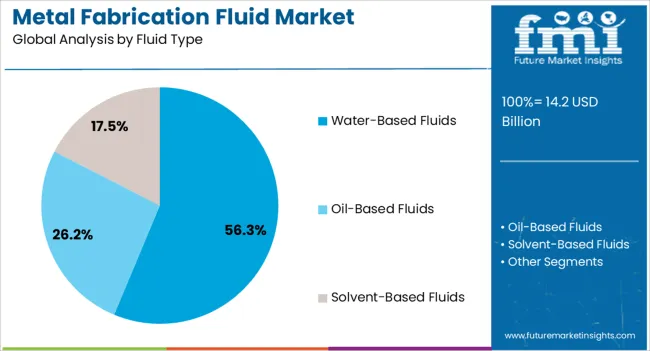

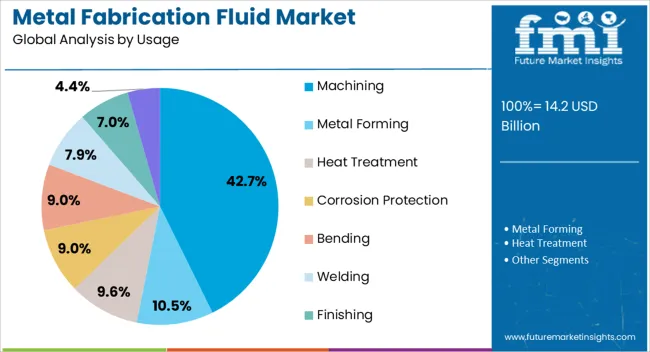

The metal fabrication fluid market is segmented by product type, fluid type, usage, end use industry, distribution channel, and geographic regions. By product type, metal fabrication fluid market is divided into removal fluids, forming fluids, protective fluids, treating fluids, and others (tapping fluids, grinding & threading fluids, etc.). In terms of fluid type, metal fabrication fluid market is classified into water-based fluids, oil-based fluids, and solvent-based fluids. Based on usage, metal fabrication fluid market is segmented into machining, metal forming, heat treatment, corrosion protection, bending, welding, finishing, and others (surface grinding, die casting, etc.). By end use industry, metal fabrication fluid market is segmented into automotive, aerospace, heavy machinery, metal fabrication, oil & gas, construction, and others (marine, agriculture, etc.). By distribution channel, metal fabrication fluid market is segmented into direct and indirect. Regionally, the metal fabrication fluid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The removal fluids segment is projected to hold 38.6% of total market revenue by 2025, making it the leading product type. This dominance is driven by its effectiveness in cleaning, degreasing, and removing contaminants from metal surfaces during fabrication processes.

Removal fluids ensure precision in subsequent operations such as welding, coating, and assembly, thereby improving overall product quality. Their widespread use in high-precision sectors such as aerospace, automotive, and industrial machinery manufacturing has further reinforced market leadership.

Enhanced formulations offering faster cleaning, reduced residue, and compatibility with automated systems have contributed to their strong adoption.

The water-based fluids segment is expected to account for 56.3% of total revenue by 2025 within the fluid type category, positioning it as the most prominent segment. This growth is being supported by stringent environmental regulations and the shift toward eco-friendly manufacturing practices.

Water-based fluids offer superior cooling properties, lower toxicity, and reduced fire hazards compared to oil-based alternatives. Their ability to extend tool life, reduce energy consumption, and improve workplace safety has driven their preference in modern machining and fabrication facilities.

Ongoing innovation to improve corrosion protection and lubrication efficiency has strengthened their position in the market.

The machining segment is projected to represent 42.7% of total market revenue by 2025 under the usage category, establishing it as the dominant segment. This is due to the critical role of fabrication fluids in reducing heat generation, improving surface finish, and extending tool longevity during machining operations.

The growth of advanced CNC machinery and high-speed metal cutting processes has increased the demand for high-performance fluids that can withstand extreme conditions.

The emphasis on precision engineering in sectors such as automotive, defense, and industrial equipment manufacturing has further fueled the adoption of specialized fluids for machining applications.

The metal fabrication fluid market is gaining demand through expanding industrial machining and metalworking applications. Opportunities lie in precision tooling, while trends highlight performance-focused and safer formulations. However, the market continues to be challenged by disposal regulations and raw material cost fluctuations. Despite these hurdles, the industry is expected to progress steadily, supported by its integral role in global manufacturing and metal processing activities.

The demand for metal fabrication fluids has been reinforced by rising industrial production, manufacturing, and automotive component development. These fluids are used to lubricate, cool, and protect tools and metals during machining, grinding, and cutting operations. As global industries continue to prioritize efficiency and productivity, the role of fabrication fluids becomes more indispensable. The expanding use of metals in construction, aerospace, and heavy machinery has fueled the need for reliable cooling and lubrication solutions. This momentum is projected to sustain market demand steadily.

Significant opportunities are being created in the precision machining and tooling sector where fabrication fluids enhance surface quality and extend equipment lifespan. Industries such as electronics, defense, and energy are requiring tighter tolerances and superior finishes, which is where specialized fluid formulations find high adoption. As manufacturers focus on high-performance operations, advanced fluid solutions are being integrated into processes. This shift offers opportunities for suppliers to tailor product lines toward niche applications, making precision-focused fluids an attractive segment for future growth.

A key trend in the metal fabrication fluid market lies in the transition toward high-performance formulations with enhanced stability and lower consumption rates. Blended products offering anti-rust properties and reduced foaming tendencies are being increasingly selected by end users. The industry is also witnessing a gradual preference toward fluids designed with fewer hazardous elements, addressing operator safety and operational efficiency. This dual shift toward performance improvement and safety-conscious products is redefining buyer expectations, giving suppliers room to innovate around long-lasting, less wasteful formulations.

The market continues to face challenges linked to disposal regulations and fluctuating raw material costs. Used fluids often fall under strict environmental guidelines, requiring proper treatment and disposal methods that raise operational costs for end users. Moreover, volatility in petroleum-based raw materials has been adding pressure on pricing structures, impacting both suppliers and buyers. Compliance with health and safety rules also increases formulation complexity. These regulatory and cost-related hurdles create barriers that participants must overcome to maintain competitiveness in a demanding marketplace.

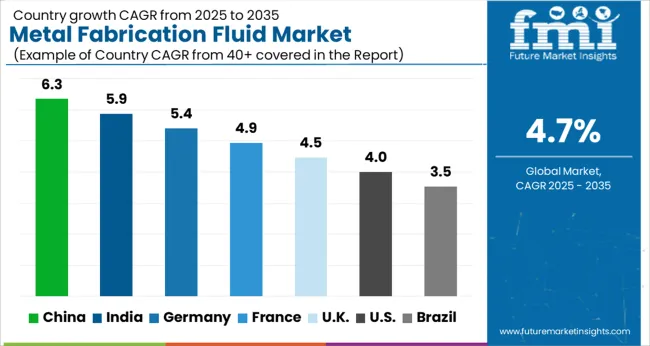

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global metal fabrication fluid market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads the growth with a rate of 6.3%, followed by India at 5.9% and Germany at 5.4%. The United Kingdom records a slower growth of 4.5%, while the United States shows the lowest expansion at 4%. Growth is supported by rising demand from automotive, aerospace, heavy machinery, and construction industries. Emerging markets like China and India are benefiting from rising industrial production and increasing metal processing needs, while developed markets such as Germany, the UK, and the USA are more focused on advanced machining processes, higher efficiency fluids, and sustainable manufacturing practices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The metal fabrication fluid market in China is expected to grow at a CAGR of 6.3%. China’s dominance in global manufacturing, particularly in automotive, construction, and heavy equipment, drives high consumption of metal fabrication fluids. With a strong industrial base and large-scale production facilities, the market is supported by rising investments in modern machining technologies. The government’s continued infrastructure development and export-driven industries are further pushing demand. Furthermore, increasing emphasis on fluid efficiency and better lubrication properties is shaping market dynamics in the country.

The metal fabrication fluid market in India is projected to grow at a CAGR of 5.9%. India’s rapid industrialization, coupled with the expansion of its automotive and infrastructure sectors, is creating strong opportunities for metal fabrication fluid demand. The country’s "Make in India" initiative and foreign investments in manufacturing are encouraging higher adoption of modern machining fluids. Rising demand for high-performance lubrication solutions in steel production and component manufacturing further strengthens market prospects. Additionally, the growing export potential of Indian engineering goods is fueling consumption.

The metal fabrication fluid market in Germany is expected to grow at a CAGR of 5.4%. Germany’s strong position in automotive, aerospace, and engineering industries fuels the adoption of high-quality fabrication fluids. The country emphasizes advanced manufacturing and precision engineering, which requires efficient metal cutting and forming fluids. Demand is further supported by investments in automation and Industry 4.0 practices, pushing for fluids with longer lifespans and enhanced performance. Germany’s export-driven economy and commitment to high production standards ensure steady market expansion.

The metal fabrication fluid market in the United Kingdom is projected to grow at a CAGR of 4.5%. The UK’s engineering and construction sectors are primary drivers for the demand for fabrication fluids. While the country has a smaller industrial base compared to China or India, its focus on advanced manufacturing and adoption of modern machining solutions enhances growth prospects. Increased investment in infrastructure projects and automotive engineering contributes to steady market expansion. Companies are also placing more emphasis on performance-driven fluids that extend machinery life and reduce maintenance costs.

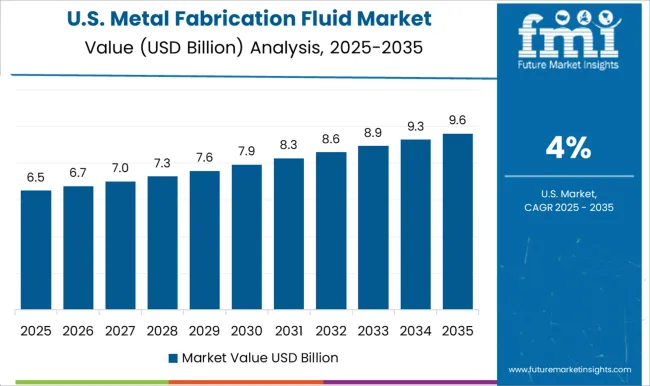

The metal fabrication fluid market in the United States is expected to grow at a CAGR of 4%. The USA market is characterized by advanced manufacturing processes in aerospace, defense, automotive, and heavy machinery industries. While growth is moderate compared to Asian countries, the market benefits from higher adoption of premium-grade fluids designed for efficiency and precision. Increasing investments in defense manufacturing and infrastructure upgrades further add to demand. Moreover, strong R&D focus by local manufacturers supports the development of innovative fluids to meet performance needs.

The metal fabrication fluid market is shaped by intense rivalry between global oil majors, chemical giants, and niche formulation specialists. BP, Castrol, Chevron, ExxonMobil, Shell, and TotalEnergies lead with their extensive distribution networks and comprehensive product lines serving cutting, forming, grinding, and surface protection. Their brochures often emphasize performance benefits such as longer tool life, reduced wear, and higher operational efficiency.

Clariant and Lubrizol highlight their strength in specialty additives, focusing on enhancing lubricity, corrosion protection, and thermal stability, which positions them as key partners for customized solutions that address complex industrial needs. Smaller yet influential companies such as Fuchs Lubricants, Houghton International, Quaker Houghton, and Master Fluid Solutions stress innovation in water-soluble coolants, synthetic blends, and advanced long-life fluids. Indian Oil and Petro-Canada Lubricants emphasize affordability, regional availability, and consistent quality to gain stronger domestic adoption. Meanwhile, Milacron markets the integration of fluids with machining equipment to optimize performance.

Competition revolves around cooling efficiency, corrosion control, compliance, and reduced downtime, with most brochures underscoring productivity gains, machine longevity, and operating cost reductions. These attributes make fabrication fluids indispensable to the global manufacturing and heavy engineering industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.2 billion |

| Product Type | Removal Fluids, Forming Fluids, Protective Fluids, Treating Fluids, and Others (Tapping fluids, Grinding & Threading fluids, etc.) |

| Fluid Type | Water-Based Fluids, Oil-Based Fluids, and Solvent-Based Fluids |

| Usage | Machining, Metal Forming, Heat Treatment, Corrosion Protection, Bending, Welding, Finishing, and Others (Surface Grinding, Die Casting, etc.) |

| End Use Industry | Automotive, Aerospace, Heavy Machinery, Metal Fabrication, Oil & Gas, Construction, and Others (Marine, Agriculture, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BP, Castrol, Chevron, Clariant, ExxonMobil, Fuchs Lubricants, Houghton International, Indian Oil, Lubrizol, Master Fluid Solutions, Milacron, Petro-Canada Lubricants, Quaker Houghton, Shell, and TotalEnergies |

| Additional Attributes | Dollar sales by fluid type (coolants, lubricants, cleaning fluids, protective fluids) and application (automotive, aerospace, machinery, construction) are key metrics. Trends include rising demand for high-performance fluids in precision machining, growth in metalworking industries, and increasing preference for environmentally compliant formulations. Regional adoption, technological advancements, and regulatory standards are driving market growth. |

The global metal fabrication fluid market is estimated to be valued at USD 14.2 billion in 2025.

The market size for the metal fabrication fluid market is projected to reach USD 22.5 billion by 2035.

The metal fabrication fluid market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in metal fabrication fluid market are removal fluids, forming fluids, protective fluids, treating fluids and others (tapping fluids, grinding & threading fluids, etc.).

In terms of fluid type, water-based fluids segment to command 56.3% share in the metal fabrication fluid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Metal Wheel Chock Market Size and Share Forecast Outlook 2025 to 2035

Metal Aerosol Can Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA