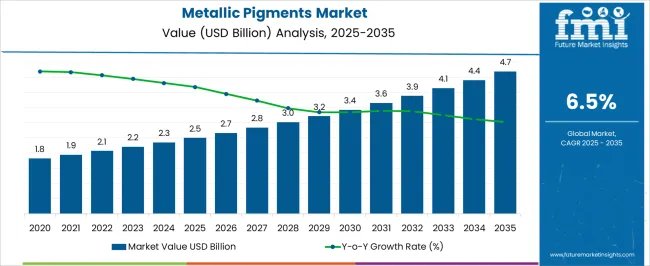

The Metallic Pigments Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. Supported by a CAGR of 6.5%, this growth is driven by increasing demand for high-performance coatings, automotive finishes, and decorative applications.

During the first five years (2025 to 2030), the market will expand from USD 2.5 billion to USD 3.4 billion, adding USD 0.9 billion, which accounts for 41.3% of the total incremental growth, fueled by the rise of premium paints and coatings in the automotive and consumer goods sectors. The second phase (2030 to 2035) contributes USD 1.3 billion, representing 58.7% of incremental growth, reflecting steady acceleration as innovations in sustainable pigments, eco-friendly coatings, and specialized applications in packaging and electronics gain traction.

Annual increments increase from USD 0.2 billion in early years to approximately USD 0.3 billion by 2035, indicating strong late-cycle growth. Manufacturers focusing on reducing heavy metal content, offering vibrant color solutions, and expanding their presence in emerging economies will capture the largest share of this USD 2.2 billion opportunity in the coming decade.

| Metric | Value |

|---|---|

| Metallic Pigments Market Estimated Value in (2025 E) | USD 2.5 billion |

| Metallic Pigments Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The metallic pigments market is gaining steady momentum, driven by increasing demand across automotive, consumer goods, packaging, and decorative coatings. The market's growth is supported by advancements in pigment dispersion technologies and rising consumer preference for premium finishes in paints, plastics, and printing applications.

Regulatory pressure to reduce solvent-based systems has accelerated the shift toward eco-friendly and high-performance metallic pigment solutions. Manufacturers are also investing in non-toxic, heavy-metal-free pigment variants that comply with global safety standards.

Additionally, the expansion of the packaging and cosmetics sectors, where metallic effects are used for branding and shelf appeal, is contributing to market expansion. As global industrial output recovers and demand for specialty coatings rises, metallic pigments are expected to play an increasingly vital role in both aesthetic enhancement and functional performance of end-use products.

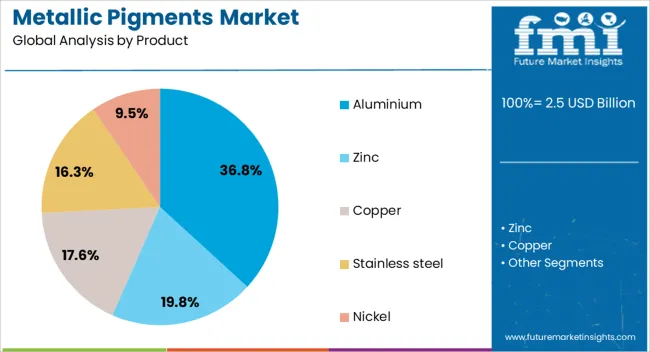

The metallic pigments market is segmented by product and geographic regions. The metallic pigments market is divided into Aluminium, Zinc, Copper, Stainless steel, and Nickel. Regionally, the metallic pigments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Aluminium pigments are projected to account for 36.8% of the overall revenue in the metallic pigments market by 2025, establishing them as the leading product segment. This leadership is attributed to their versatile application in automotive coatings, plastics, printing inks, and decorative paints.

Aluminium pigments offer superior brightness, reflectivity, and corrosion resistance, making them highly desirable for both functional and aesthetic purposes. The segment's growth has been supported by technological advancements in leafing and non-leafing aluminium pigments, allowing greater control over gloss, opacity, and orientation.

Demand has also been reinforced by their compatibility with both waterborne and solventborne systems, as industries increasingly adopt sustainable and low-VOC coating technologies. Lightweight characteristics and cost-effectiveness further enhance their commercial appeal, especially in price-sensitive markets where performance and visual impact are critical.

The metallic pigments market is expanding due to the growing demand in automotive, cosmetics, and construction industries. In 2024 and 2025, growth drivers include increasing demand for high-quality finishes and aesthetics in various applications. Opportunities lie in the development of eco-friendly, non-toxic pigments. Emerging trends include the shift toward high-performance pigments with enhanced durability and color consistency. However, market restraints include high production costs and limited availability of raw materials, which could hinder market growth in certain regions.

The major growth driver for the metallic pigments market is the increasing demand for aesthetic finishes in automotive and cosmetics. In 2024, the automotive industry sought advanced coatings that offered enhanced visual appeal, such as pearlescent and metallic effects. Similarly, cosmetic companies prioritized pigments that offered vibrant, long-lasting colors for high-end products. As the demand for visually appealing designs in various sectors rises, the market for metallic pigments is expected to continue growing.

Opportunities in the metallic pigments market are emerging with the development of eco-friendly, non-toxic pigments. In 2025, growing regulatory pressure for safer and more sustainable materials pushed manufacturers to innovate in eco-friendly pigment options. These new pigments not only meet environmental standards but also maintain high performance in various applications. As consumer awareness about the environmental impact of products increases, demand for these sustainable pigments is expected to rise, presenting a key opportunity for manufacturers.

Emerging trends in the market include a shift toward high-performance metallic pigments with enhanced durability. In 2024, industries such as automotive coatings began adopting pigments that offer greater resistance to weathering, fading, and wear. This trend is driven by the need for products that not only look good but also maintain their appearance under challenging conditions. As the demand for long-lasting, high-quality finishes increases, the adoption of durable metallic pigments is likely to rise, particularly in high-end automotive and industrial applications.

Key market restraints include high production costs and raw material shortages. In 2024 and 2025, the high cost of manufacturing metallic pigments, particularly those derived from precious metals or complex chemical processes, limited their widespread use. Additionally, the availability of raw materials like aluminum, titanium, and iron oxide has been constrained due to supply chain disruptions, impacting production schedules. These factors make it difficult for small-scale manufacturers to compete, especially in cost-sensitive industries.

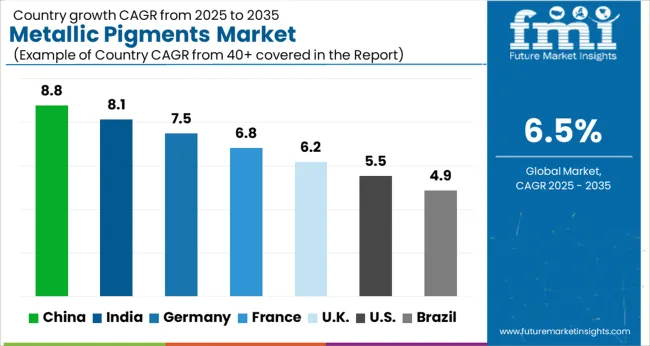

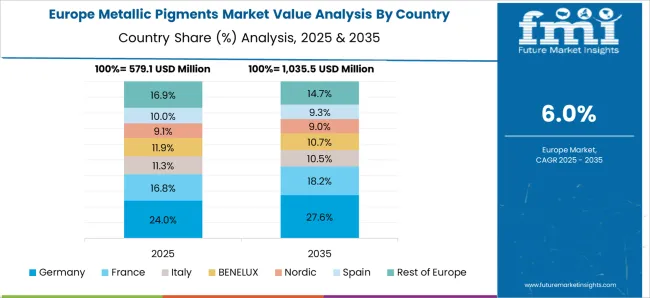

The global metallic pigments market is projected to grow at 6.5% CAGR from 2025 to 2035. China leads with 8.8% CAGR, driven by the rapid growth of the automotive, construction, and cosmetics industries, which are increasingly adopting metallic pigments for their aesthetic and functional properties. India follows at 8.1%, supported by the rise in consumer demand for decorative coatings, automotive finishes, and packaging applications.

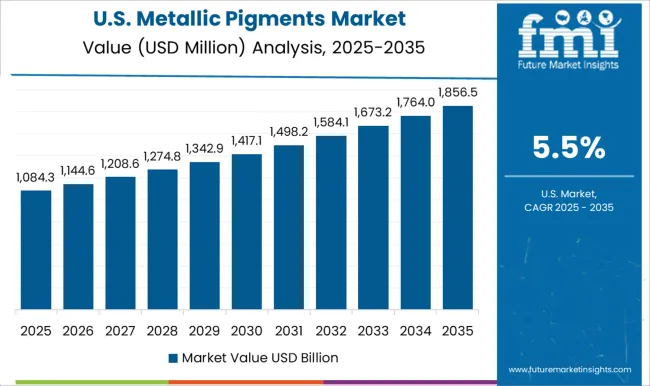

Germany records 7.5% CAGR, reflecting strong demand from the automotive and industrial coatings sectors, as well as the growing use of metallic pigments in high-end decorative products. The United Kingdom grows at 6.2%, while the United States posts 5.5%, reflecting steady demand in mature markets with a focus on advanced and eco-friendly pigment solutions. Asia-Pacific leads market growth, while Europe and North America focus on innovation and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The metallic pigments market in China is forecasted to grow at 8.8% CAGR, driven by the rapid industrial expansion, increasing demand for decorative coatings, and the country’s strong automotive and packaging industries. As China continues to dominate manufacturing and exports, the demand for high-performance metallic pigments for automotive coatings, packaging, and consumer goods rises. Additionally, the government’s focus on sustainability and green production practices accelerates the demand for eco-friendly metallic pigments.

The metallic pigments market in India is projected to grow at 8.1% CAGR, driven by rising consumer demand for decorative coatings, automotive finishes, and packaging applications. India’s expanding manufacturing base and increasing disposable income contribute to the rising adoption of metallic pigments in various industries. The growing interest in high-quality, visually appealing packaging, along with automotive sector growth, further accelerates demand for metallic pigments.

The metallic pigments market in Germany is expected to grow at 7.5% CAGR, supported by strong demand in automotive coatings, industrial paints, and high-end decorative products. Germany’s advanced automotive industry, coupled with its focus on sustainable and innovative pigment solutions, strengthens the market. As demand for eco-friendly and durable coatings increases, metallic pigments continue to play a key role in achieving aesthetic and functional properties in coatings and finishes.

The metallic pigments market in the United Kingdom is projected to grow at 6.2% CAGR, driven by the growing demand for advanced pigments in the automotive, packaging, and decorative sectors. The UK’s strong focus on sustainable materials and innovative pigment solutions in coatings and packaging contributes to market growth. As the country continues to invest in eco-friendly alternatives and high-performance coatings, the demand for metallic pigments remains strong.

The metallic pigments market in the United States is projected to grow at 5.5% CAGR, supported by steady demand in a mature market, particularly in automotive finishes, industrial coatings, and packaging applications. The increasing focus on sustainability, along with innovations in eco-friendly metallic pigments, contributes to market growth. Additionally, the growing demand for high-performance and visually appealing coatings in consumer goods further strengthens the market.

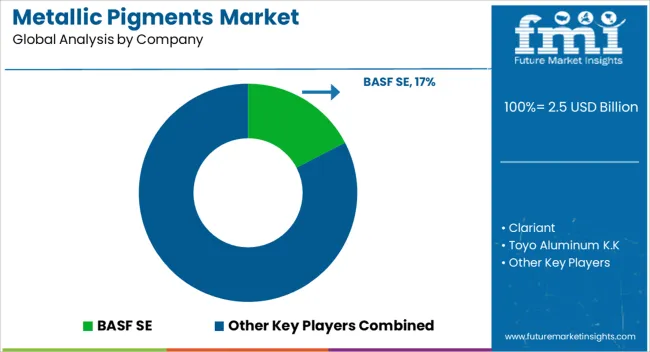

The metallic pigments market is dominated by BASF SE, a global leader in the production of high-quality pigments, including metallic pigments used in coatings, plastics, and cosmetics. BASF’s dominance is supported by its innovative product offerings, advanced production techniques, and strong global presence across various industries. Known for its extensive R&D capabilities, BASF continues to develop advanced metallic pigments that provide enhanced color, durability, and light reflectivity.

The company’s market share is substantial, driven by its diverse applications in automotive, industrial coatings, and decorative finishes, where high-quality pigmentation is essential for product aesthetics and performance. In addition to BASF, other significant players in the metallic pigments market include Clariant, Toyo Aluminum K.K., Sun Chemical Corporation, and Silberline Manufacturing. These companies are key contributors to market growth, offering a range of high-performance metallic pigments for automotive coatings, packaging, and other decorative applications.

Clariant and Toyo Aluminum K.K. focus on providing innovative pigment solutions, while Sun Chemical and Silberline are known for their global reach and expertise in producing metallic pigments with excellent consistency and color stability. The market is driven by increasing demand for visually appealing, durable finishes in consumer products and industrial applications, with ongoing innovations in sustainable pigment solutions and enhanced product characteristics.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Product | Aluminium, Zinc, Copper, Stainless steel, and Nickel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant, Toyo Aluminum K.K, Sun Chemical Corporation, Silberline Manufacturing, Carl Schlenk AG, and Altana |

| Additional Attributes | Dollar sales by pigment type and application, demand dynamics across automotive, coatings, and cosmetics sectors, regional trends in metallic pigment consumption, innovation in eco-friendly and high-performance pigments, impact of regulatory standards on product formulations, and emerging use cases in 3D printing and special effect coatings. |

The global metallic pigments market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the metallic pigments market is projected to reach USD 4.7 billion by 2035.

The metallic pigments market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in metallic pigments market are aluminium, zinc, copper, stainless steel and nickel.

In terms of , segment to command 0.0% share in the metallic pigments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metallic Glasses Market Size and Share Forecast Outlook 2025 to 2035

Metallic Rope Cords Market

Metallic Static Shielding Bags Market

Metallic Hot Stamping Foils Market

Bimetallic Thermometer Market

Nonmetallic Mineral Product Market Size and Share Forecast Outlook 2025 to 2035

Organometallics Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algal Pigments Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Pigments Manufacturers

Organic Pigments Market - Growth & Demand 2025 to 2035

Plastic Pigments Market

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Dyes and Pigments Market

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Ultramarine Pigments Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA