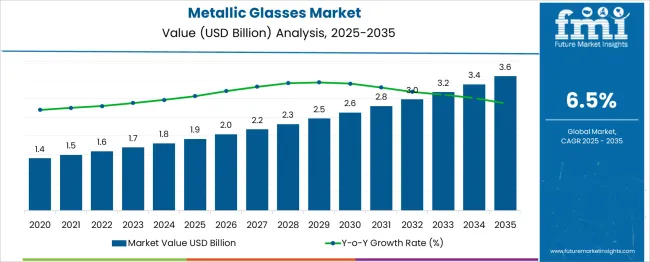

The Metallic Glasses Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. This reflects an absolute dollar opportunity of USD 1.7 billion, signaling steady market momentum. Between 2025 and 2030, the market is projected to grow from USD 1.9 billion to USD 2.5 billion, representing an incremental gain of USD 600 million.

The year-over-year (YoY) growth ranges from 5.3% to 6.0%, highlighting consistent performance supported by material innovation and growing demand across multiple sectors. From 2030 to 2035, the market is expected to continue expanding at a healthy rate, moving from USD 2.5 billion to USD 3.6 billion, driven by increasing adoption in electronics, medical devices, aerospace, and structural applications.

The unique properties of metallic glasses, such as high strength, corrosion resistance, and superior elasticity, are attracting industries looking for advanced materials with high performance-to-weight ratios. Moreover, miniaturization trends in electronics and the push for lightweight materials in automotive and aerospace are expected to strengthen the demand curve. The market's upward trajectory indicates a robust future, propelled by continued R&D investment and scaling of production technologies.

| Metric | Value |

|---|---|

| Metallic Glasses Market Estimated Value in (2025 E) | USD 1.9 billion |

| Metallic Glasses Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The metallic glasses market is witnessing consistent growth as industries prioritize materials that offer superior strength, elasticity, and corrosion resistance compared to traditional crystalline metals. Advancements in manufacturing techniques and increasing demand for high-performance materials in electronics, aerospace, and sporting goods are driving adoption.

The ability of metallic glasses to deliver improved magnetic properties and enhanced wear resistance has positioned them favorably in precision engineering applications. Future expansion is expected to be supported by ongoing innovations in alloy composition, cost-effective processing technologies, and the pursuit of lightweight yet durable alternatives in structural and functional components.

Rising emphasis on energy efficiency and miniaturization in end-use sectors is paving the way for greater utilization and wider market acceptance of metallic glasses across diverse industries.

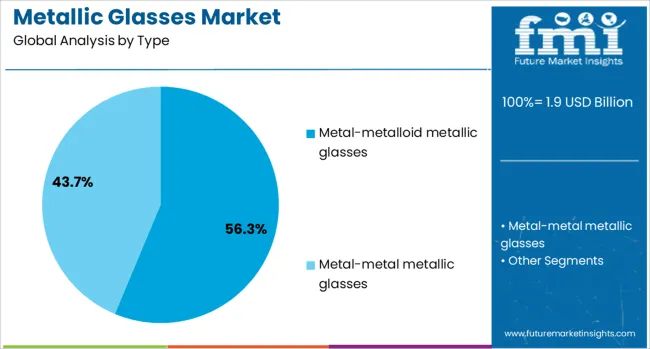

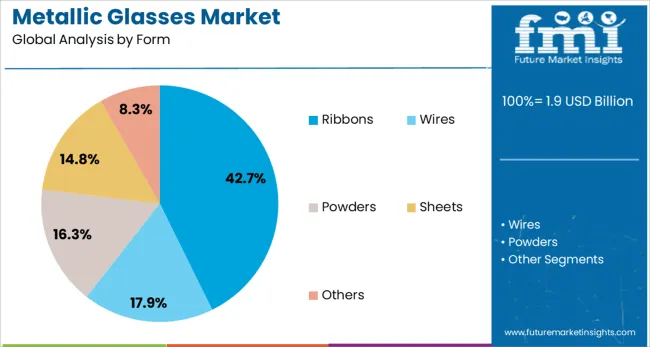

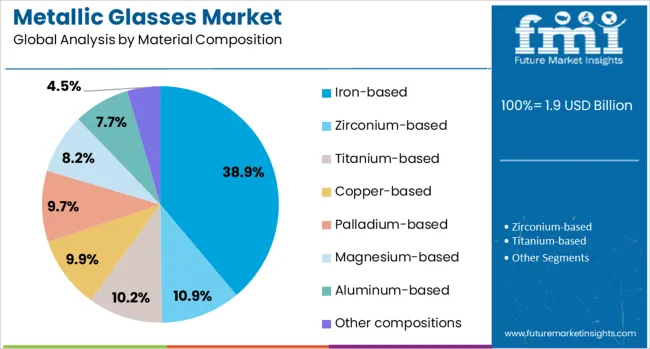

The metallic glasses market is segmented by type, form, material composition, manufacturing process, end-use industry, and geographic regions. The metallic glasses market is divided into Metal-metalloid metallic glasses and Metal-metal metallic glasses. In terms of form, the metallic glasses market is classified into Ribbons, Wires, Powders, Sheets, and others. The material composition of the metallic glasses market is segmented into Iron-based, Zirconium-based, Titanium-based, Copper-based, Palladium-based, Magnesium-based, Aluminum-based, and other compositions.

The manufacturing process of the metallic glasses market is segmented into extremely rapid cooling, Physical vapor deposition, Solid-state reaction, Ion irradiation, and others. By end-use industry, the metallic glasses market is segmented into Electronics and electrical, Automotive and transportation, Aerospace and defense, Medical and healthcare, Sports and leisure, Energy, Industrial equipment, and others. Regionally, the metallic glasses industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the metalloid metallic glasses segment is expected to hold 56.30% of the total market revenue in 2025, marking it as the leading type. This leadership has been attributed to the superior glass-forming ability and stable amorphous structure of these alloys, which enhance their mechanical and magnetic properties.

The combination of metal and metalloid elements has enabled higher thermal stability and improved corrosion resistance,e making them highly suitable for demanding industrial applications. Their ability to be processed into bulk forms while maintaining strength and toughness has accelerated adoption in electronics and energy storage sectors.

These advantages have reinforced their position as the preferred choice where performance reliability and manufacturability are critical.

When segmented by form, ribbons are projected to account for 42.7% of the market revenue in 2025, establishing themselves as the dominant form. This prominence has been driven by the ease of production through rapid solidification techniques, which result in uniform thin strips with desirable magnetic and structural characteristics.

Ribbons have been widely adopted due to their favorable surface area to volume ratio, which enhances functional performance in transformers, sensors, and magnetic shielding applications. Their cost-effectiveness and adaptability to high-speed automated manufacturing have further strengthened their appeal in high-volume industrial settings.

The ability to achieve consistent quality and predictable properties at scale has solidified ribbons as the preferred form within the metallic glasses market.

Segmented by material composition, iron-based metallic glasses are anticipated to command 38.9% of the market revenue in 2025, positioning them as the leading material category. Their excellent magnetic properties have reinforced this dominance, cost competitiveness, and abundant raw material availability.

Iron-based alloys have been particularly favored for soft magnetic applications in electrical and electronic devices due to their low coercivity and high permeability. Their suitability for large-scale production and alignment with the performance requirements of power distribution and conversion equipment have sustained their leadership.

The balance of affordability, mechanical strength, and functional efficiency has ensured their continued preference across multiple end-use industries, further strengthening their market share.

The metallic glasses market is gaining momentum due to the growing demand for materials that offer superior strength, high elasticity, and corrosion resistance across electronics, aerospace, biomedical, and defense sectors. These amorphous alloys, often called bulk metallic glasses (BMGs), exhibit unique properties like high hardness and excellent wear resistance, making them suitable for structural and functional components. The absence of crystalline structure enables precise molding and complex geometries. As industries pursue lightweight, high-performance materials, metallic glasses continue to present strong alternatives to conventional metals and ceramics.

The use of metallic glasses in electronic casings, precision sensors, and wearable device components is expanding. Their combination of high strength and aesthetic finish makes them ideal for smartphone frames, bezels, and housings. Unlike traditional metals, they offer superior durability while maintaining slim form factors. Their non-magnetic and corrosion-resistant nature is especially advantageous for miniaturized components and biomedical wearables. Manufacturers benefit from net-shape casting capabilities that reduce machining and post-processing steps, thereby improving production efficiency. As consumer electronics move toward more rugged, lightweight, and stylish designs, demand for metallic glasses in casing and connector applications continues to rise. With growing requirements for both form and function in wearables and mobile technology, metallic glasses enable design freedom without compromising durability or performance. This makes them an attractive material choice in next-generation electronics manufacturing, where material behavior under thermal, electrical, and mechanical stress is critical.

Metallic glasses are gaining traction in biomedical applications such as surgical tools, orthopedic implants, and dental devices. Their biocompatibility, resistance to corrosion in bodily fluids, and high mechanical strength offer clear benefits over conventional stainless steel or titanium. The amorphous structure reduces the risk of bacterial colonization and offers smoother surface finishes, enhancing hygiene and healing outcomes. These materials also allow for precision fabrication of small, complex shapes needed in minimally invasive instruments. As medical devices evolve toward personalized, minimally invasive solutions, manufacturers are looking for materials that support fine geometries and superior wear resistance. Although still limited by cost and availability, metallic glasses are increasingly considered for premium or critical-use components where reliability and patient safety are paramount. Ongoing clinical research and certification efforts are helping open new applications, enabling a slow but steady market penetration in specialized biomedical use cases.

Aerospace and defense sectors value metallic glasses for their exceptional strength-to-weight ratio, impact resistance, and structural stability under extreme conditions. These properties make them suitable for lightweight structural components, vibration-damping parts, and even protective armor systems. The absence of grain boundaries in metallic glasses reduces the chances of crack initiation and propagation, improving fatigue resistance over traditional alloys. Components made from metallic glasses are also less prone to failure due to thermal cycling, which is critical in aerospace systems exposed to fluctuating temperatures. Their ability to undergo precision casting without shrinkage or warping supports the manufacture of high-tolerance parts. While cost and production scale still limit widespread adoption, interest remains high in research and pilot programs for advanced air and space vehicle parts. Continued focus on lightweighting and extreme performance in aerospace missions supports the long-term integration of metallic glasses into these high-value applications.

Despite their performance advantages, metallic glasses face challenges in widespread industrial adoption due to production complexity and high material costs. Manufacturing requires precise thermal control and rapid cooling to prevent crystallization, which limits scalability and increases energy consumption. The availability of only a few commercial-grade metallic glass alloys restricts design flexibility, especially in applications needing specific mechanical or thermal properties. Compared to traditional metals, the tooling and processing equipment needed to mold or shape metallic glasses can be expensive and difficult to integrate into existing lines. Inconsistencies during casting or cooling can also lead to performance defects, making quality assurance more demanding. These limitations are particularly problematic for high-volume, cost-sensitive industries like automotive. Until scalable processing methods and alloy diversification improve, the use of metallic glasses will likely remain confined to high-performance, low-volume applications. Overcoming these constraints is essential for the material to gain broader industrial acceptance.

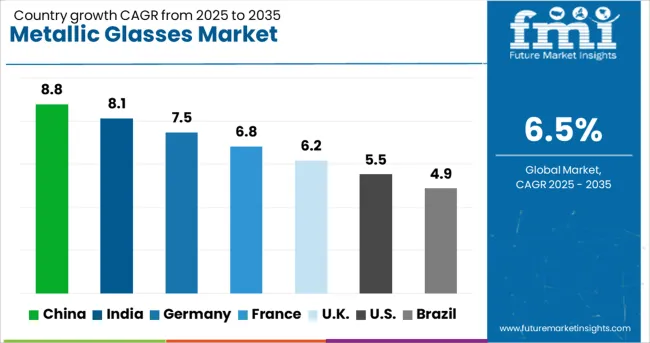

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global metallic glasses market is projected to grow at a CAGR of 6.5% through 2035, supported by increasing use in electronics, medical devices, and structural applications requiring high strength-to-weight ratios. Among BRICS nations, China leads with 8.8% growth, driven by advancements in alloy casting and integration into consumer electronics. India follows at 8.1%, where research initiatives and limited-scale manufacturing have expanded applications in precision tools and automotive components. In the OECD region, Germany reports 7.5% growth, supported by regulated production methods and high demand for high-performance materials. France, growing at 6.8%, has maintained adoption in instrumentation, aerospace, and micro-component industries. The United Kingdom, at 6.2%, reflects steady use in academic prototyping, wearable technologies, and defense-related materials. Metallurgical standards, processing constraints, and end-use qualification procedures have shaped market activity. This report includes insights on 40+ countries; the top markets are shown here for reference.

Robust deployment of metallic glasses across precision components and industrial tooling has pushed the China market to a CAGR of 8.8%. Strong interest has been observed from electronics firms manufacturing casings and cores requiring high strength-to-weight ratios. Manufacturing clusters have shifted alloy designs toward zirconium- and palladium-based types with improved amorphous structure retention. Usage in robotics and automation tool heads has contributed to specialized batch production. Defense sector suppliers have adopted high-density metallic glasses for shock-resistant parts. Foundries have operated with modified casting chambers to support handling of amorphous materials. Contract facilities have delivered strip forms and powder variants to magnetic and electronic component assemblers. Local demand has also grown for non-crystalline alloys in thermal barrier and wear-resistant coatings.

India’s metallic glasses market has advanced steadily, maintaining a CAGR of 8.1%, with usage evident in electronics packaging, magnetic shielding, and wear-resistant surfaces. Procurement has been driven by the expansion of domestic foundry operations supporting component hardening and casing applications. Demand from educational research units and metallurgical labs has ensured steady uptake of rod and ribbon forms. Tooling subcontractors have applied metallic glass inserts for dies and molds in low-volume production. Adoption of bulk metallic glasses has grown in the machining sector for precision fittings. Magnetism-sensitive parts have been developed using iron-based amorphous structures. Sheet forms have been distributed to aerospace and automotive R&D centers. Powdered variants have been blended into composites for pilot-scale mechanical testing.

Across Germany, a CAGR of 7.5% has been recorded in the metallic glasses market, with consistent activity in the automotive, optics, and tooling segments. Industrial suppliers have transitioned to amorphous structures for reduced mechanical loss and improved surface wear. High-precision component makers have favored metallic glasses in pump systems and laser mounts. Rod extrusion units have upgraded cooling techniques to retain amorphous consistency. Academic institutes have utilized metallic glass samples in microstructure studies and applied mechanics simulations. Injection mold makers have applied copper-based blends for improved surface performance. Industrial gear manufacturers have sourced metallic glass layers for vibration damping. Small-scale test runs have been carried out in additive manufacturing setups. Specialized casting machines have been installed in southern Germany.

France has exhibited CAGR growth of 6.8% in the metallic glasses sector, with adoption noted in biomedical, industrial machinery, and military components. Biocompatible metallic glasses have been incorporated into orthopedic fasteners and dental implants. Mechanical part fabricators have applied amorphous alloys in load-bearing and precision-critical fixtures. Small-batch producers have relied on copper- and iron-based ribbons for thermal sensors and magnetic couplings. Defense-grade use cases have included blade edges and casings that require fracture toughness. Metal injection molders have integrated metallic glass feedstock in micro-injection units. Research collaborations between public labs and foundries have led to increased alloy variety. Use in fast-response actuators and heat exchangers has shown upward momentum. Applications in customized wear-resistant layering have added niche demand.

Within the United Kingdom, the metallic glasses market has maintained a CAGR of 6.2%, with expanding usage across tooling inserts, electronics, and design prototypes. Rod and strip forms have been supplied to toolmakers for high-stress, low-volume press tools. Precision electronics firms have explored applications in compact magnetic enclosures and transformer cores. Composite researchers have investigated blends with thermoplastics and ceramics for lightweight structural layering. Manufacturers of aerospace fixtures have evaluated metallic glasses for bracketry and thermal isolation. Trial deployments have occurred in creative prototyping where fine surface finish and shape memory are prioritized. Sourcing has been diversified through regional distributors aligned with academic and technical buyers. Alloys with improved corrosion resistance have been favored in marine and lab-based setups.

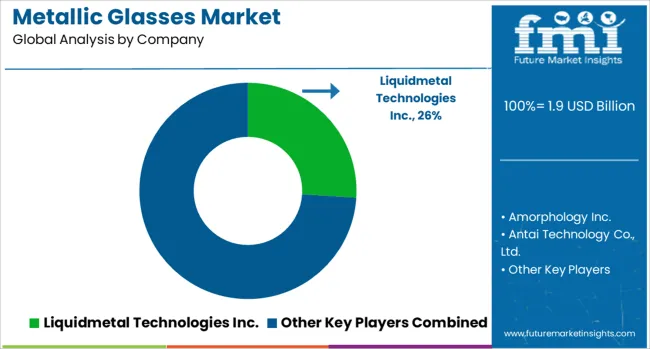

The metallic glasses market is supported by a specialized group of suppliers producing amorphous alloys known for their exceptional strength, elasticity, and corrosion resistance, widely used in electronics, aerospace, medical devices, and precision tools. Liquidmetal Technologies Inc. leads the market with proprietary bulk metallic glass (BMG) formulations used in high-performance components requiring near-net-shape molding and superior mechanical properties.

Amorphology Inc., a spin-off from NASA’s Jet Propulsion Laboratory, offers space-grade amorphous metal parts focused on precision gears and advanced industrial applications. Asian manufacturers such as Antai Technology Co., Ltd., EPSON ATMIX Corporation, and Qingdao Yunlu Advanced Materials Technology Co., Ltd. play a growing role in producing amorphous alloy powders and parts at scale, supplying local electronics and automotive sectors.

Hitachi Metals Ltd. and Usha Amorphous Metals Limited are significant regional contributors, focusing on magnetic metallic glasses for power distribution and transformer cores. European suppliers like Exmet AB, Glassimetal Technology, and PX Group SA provide customized BMG products for watches, surgical tools, and consumer electronics, where high strength and precision formability are essential.

Heraeus Holding and Materion Corporation bring material science expertise, offering tailored metallic glass solutions for medical implants, semiconductor packaging, and structural components. PrometalTech and RS Alloys contribute to niche market segments with application-specific amorphous alloys. As demand for lightweight, high-performance materials rises, these suppliers continue refining processing methods like injection molding and additive manufacturing to meet expanding needs in advanced manufacturing sectors.

On March 15, 2024, Liquidmetal Technologies Inc. officially executed an Amended License Agreement with Amorphology, Inc., expanding their prior collaboration. The agreement grants Amorphology a non‑exclusive, royalty-bearing license to utilize Liquidmetal's proprietary bulk metallic glass (BMG) technology to manufacture and sell amorphous metal parts and components

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Metal-metalloid metallic glasses and Metal-metal metallic glasses |

| Form | Ribbons, Wires, Powders, Sheets, and Others |

| Material Composition | Iron-based, Zirconium-based, Titanium-based, Copper-based, Palladium-based, Magnesium-based, Aluminum-based, and Other compositions |

| Manufacturing Process | Extremely rapid cooling, Physical vapor deposition, Solid-state reaction, Ion irradiation, and Others |

| End Use Industry | Electronics and electrical, Automotive and transportation, Aerospace and defense, Medical and healthcare, Sports and leisure, Energy, Industrial equipment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Liquidmetal Technologies Inc., Amorphology Inc., Antai Technology Co., Ltd., EPSON ATMIX Corporation, Exmet AB, Glassimetal Technology, Heraeus Holding, Hitachi Metals Ltd., Materion Corporation, PrometalTech, PX Group SA, Qingdao Yunlu Advanced Materials Technology Co., Ltd., RS Alloys, and Usha Amorphous Metals Limited |

| Additional Attributes | Dollar sales by staples polypropylene nonwoven type including spunbond, meltblown, and composite variants, by application in hygiene products, medical textiles, agriculture, industrial fabrics, and packaging, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by disposable hygiene product consumption, medical safety standards, and sustainable packaging trends; innovation in ultra-soft textures, antimicrobial finishes, and bio-based PP blends; costs influenced by polypropylene resin prices, energy use, and production technology; and emerging use cases in biodegradable hygiene substrates, filtration media, and smart agricultural covers. |

The global metallic glasses market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the metallic glasses market is projected to reach USD 3.6 billion by 2035.

The metallic glasses market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in metallic glasses market are metal-metalloid metallic glasses and metal-metal metallic glasses.

In terms of form, ribbons segment to command 42.7% share in the metallic glasses market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metallic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Metallic Rope Cords Market

Metallic Static Shielding Bags Market

Metallic Hot Stamping Foils Market

Bimetallic Thermometer Market

Nonmetallic Mineral Product Market Size and Share Forecast Outlook 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

Sunglasses Market Growth, Trends and Forecast from 2025 to 2035

Sunglasses Pouch Market

Organometallics Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Plano Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Chalcogenide Glasses Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Augmented Reality Glasses Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA