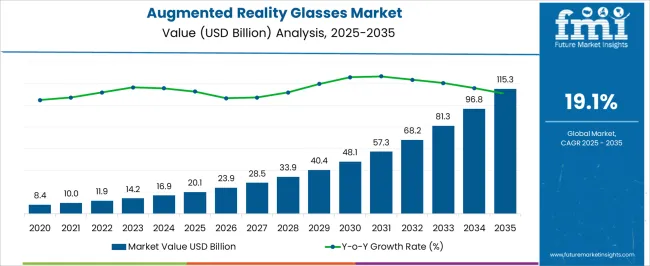

The Augmented Reality Glasses Market is estimated to be valued at USD 20.1 billion in 2025 and is projected to reach USD 115.3 billion by 2035, registering a compound annual growth rate (CAGR) of 19.1% over the forecast period.

| Metric | Value |

|---|---|

| Augmented Reality Glasses Market Estimated Value in (2025 E) | USD 20.1 billion |

| Augmented Reality Glasses Market Forecast Value in (2035 F) | USD 115.3 billion |

| Forecast CAGR (2025 to 2035) | 19.1% |

The Augmented Reality Glasses market is being driven by advancements in display technology, real-time data processing, and wearable computing solutions that enhance user interaction with digital environments. In the current market scenario, increasing investments in industrial automation, remote assistance, and training solutions are expanding the scope of augmented reality applications. The market’s future outlook is shaped by growing adoption across sectors such as manufacturing, healthcare, logistics, and construction, where efficiency, safety, and data visualization are critical.

Augmented reality glasses are being integrated with artificial intelligence, edge computing, and 5G connectivity to offer seamless, low-latency experiences that can operate in diverse environments. Rising focus on workplace safety, error reduction, and productivity improvement is encouraging enterprises to deploy augmented reality solutions at scale.

With further developments expected in user experience interfaces, voice commands, and ergonomic designs, the market is set to benefit from broader industrial deployment As the technology becomes more affordable and interoperable, new use cases are expected to emerge, fueling sustained demand and innovation across industrial sectors.

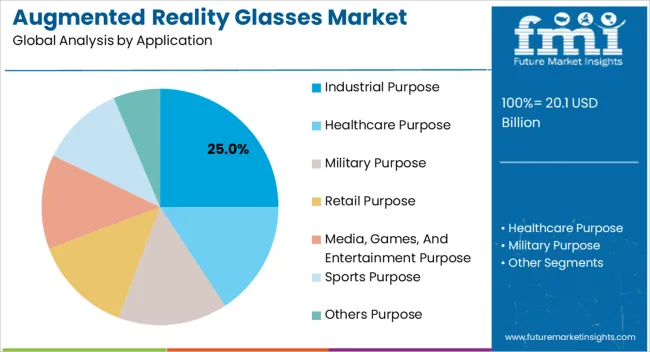

The Industrial Purpose segment is expected to hold 25.00% of the Augmented Reality Glasses market revenue in 2025, making it a leading application area. This segment’s growth is being attributed to its role in enhancing operational efficiency and safety in manufacturing, logistics, and field services. Augmented reality glasses are being utilized for tasks such as equipment maintenance, assembly line monitoring, and remote expert guidance, where real-time overlays of information improve accuracy and reduce downtime.

The ability to access data hands-free in complex industrial settings has driven adoption, as employees can perform tasks more efficiently while minimizing errors. Additionally, industrial enterprises are leveraging augmented reality to support workforce training and skill development, allowing workers to learn procedures in immersive environments without the risk of costly mistakes.

The segment’s expansion is further supported by increasing investments in digital transformation initiatives, as well as the need for enhanced visualization tools to support predictive maintenance and operational analytics As more industries prioritize safety, accuracy, and data-driven workflows, augmented reality glasses designed for industrial use are expected to see sustained growth.

AR technology has been the driving force with technology making a quantum leap ever since the COVID-19 outbreak. The head-mounted display & smart glass segment accounted for the highest revenue share of 69.5% in 2025. The segment is expected to continue dominating the augmented reality market in the forecast period as a result of the increasing demand for head-mounted displays and smart glasses in industrial & enterprise applications.

Advances in OLED technology and the growing use cases for AR technology in industrial & enterprise applications are expected to drive mass availability of lightweight head-mounted displays, thereby driving the growth of the segment.

AR-powered head-mounted displays and smart glasses can potentially find innovative use cases in the supply chain & logistics industry, and subsequently, transform the entire supply chain. Although AR-powered smart glasses consume high computation resources, their ability to visualize in real-time for viewers stokes market growth.

AR technology is a boon in day-to-day applications

AR glasses help Lenskart thrive in individual sales of spectacles and sunglasses with a well-informed buying decision

The augmented reality market can be described as a relatively untapped market, where several opportunities remain unexplored. Vendors are investing aggressively in research and development to develop innovative AR solutions for day-to-day applications as well as for enterprises to simplify their workflows and enhance their processes.

The ability to offer an immersive experience is particularly prompting technology and e-commerce companies to opt for new, innovative solutions based on AR technology.

For instance, Lenskart Solutions Pvt Ltd. is using AR technology in the mobile app to allow individuals to superimpose spectacles, sunglasses, and other products virtually on their faces before making a buying decision. Similarly, the AR feature implemented by LG Corporation on its electronics website allows users to witness how a particular television set is expected to look in their house on their mobile phones before they make a buying decision.

Smart glasses go much further than simply being head-mounted HUD; their primary function is as an augmented reality display. Augmented reality is when digital information is presented in real-time. It more than just displays static information and takes a shot at displaying visually real-time shots that look as if they are being played out in front of your eyes.

The high cost of AR glasses is a deterrent to market growth

The high cost of smart glass is one of the factors hindering the smart glass market growth. Customers in developing countries have lower disposable incomes and prefer to prioritize spending on necessities. Moreover, consumers in these countries prefer blinds and curtains instead of smart glass.

Meanwhile, customers in most countries in the Asia Pacific, Middle East, and Africa are price-sensitive and are expected to opt for glass that can serve basic requirements. Most users do not have enough knowledge about energy cost savings associated with the use of smart glass.

Although augmented reality glasses are still in the development stage, the main factor impeding the growth of the augmented reality glasses market is a lack of knowledge. Furthermore, despite price declines, the high cost of augmented reality glasses impedes its growth and adoption rate.

AR/VR smart glasses are a costly technology with mammoth maintenance costs. Smart glasses' hardware, software solutions, and maintenance are highly expensive. The software used to obtain information and records adds to the cost of AR/VR smart glasses because it is customizable according to the user's needs. This incurs additional costs, which raises the overall cost of the product and reduces its adoption rate.

Enterprise segment to take the lead in market growth

The major AR market growth came from the enterprise segment. AR apps are used by enterprises to check inventory, provide information on available stock, and save time and travel costs through remote assistance.

AR technology also helps enterprises in training, data visualization, marketing, collaboration, inspection, repairs, solving complex problems, and minimizing human errors. These advantages and the high level of customization offered by augmented reality are projected to boost its adoption for various applications in enterprises.

| Country | Market CAGR % (2025 to 2035) |

|---|---|

| North America Market Share % (2025) | 31.6% |

| The United States Market Share % (2025) | 21.2% |

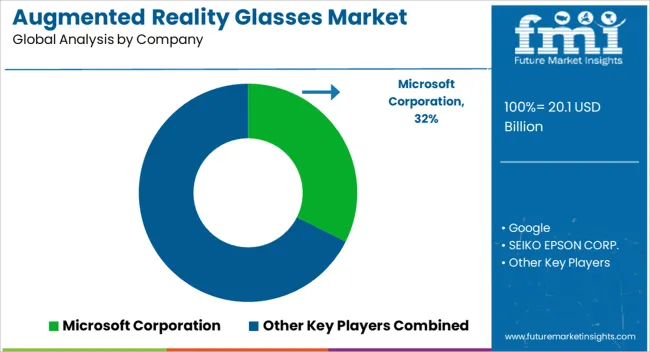

North America accounted for the largest revenue share of 31.6% in 2025 and is anticipated to account for a significant market share in the forecast period. The United States accounted for the largest North American regional market share. In 2025, the United States recorded a 21.2% stake in the global market. The United States is home to several leading technology companies, such as Google LLC, and Microsoft, among others.

The country is also considered an early adopter of new technologies. Europe is poised for significant growth as it has taken the lead in adopting AR technology for gaming & entertainment applications. Germany is particularly gaining recognition for implementing AR technology in the gaming industry.

| Country | Market CAGR % (2025 to 2035) |

|---|---|

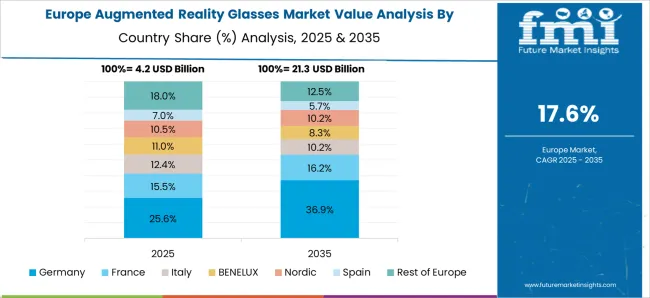

| Europe Market Share % (2025) | 22.8% |

| Germany Market Share % (2025) | 8.9% |

| The United Kingdom’s Market CAGR % (2025 to 2035) | 19.3% |

With increased internet penetration, more awareness, and higher usage of smartphones and tablets, Europe is predicted to develop at the greatest rate. In 2025, Europe held 22.8% of the worldwide market share.

In the anticipated period, the development of new technologies such as IoT and 5G is expected to increase demand for AR smart glasses in this region. Warehouse pickup solutions that use augmented reality to provide the correct position of things in a warehouse are being adopted by various companies in Europe. As a result, it minimizes the time required to complete the order, increasing warehouse worker productivity.

At the same time, enterprises in Europe deploy augmented reality applications to enable buyers to visualize the product in the actual world. This could include products from automotive, home, and beauty brands and thus are responsible for driving the demand in this market rapidly.

| Country | Market CAGR % (2025 to 2035) |

|---|---|

| China | 23.5% |

| India | 21.7% |

Asia Pacific is predicted to emerge as the fastest-growing regional market in the forecast period. Developed countries, such as Japan and Australia, are gradually paving their path as the leaders in the regional market leveraging a large customer base and advancing the implementation of internet-based platforms.

The continued rollout of high-speed, 5G networks in the Asia Pacific is also expected to trigger widespread adoption of AR technology and AR-based solutions across the region. India with its large population and rapidly growing internet penetration rate is emerging among the leading economies in the Asia Pacific utilizing AR technology in the manufacturing and healthcare industries, where more immersive and hands-on experience is of paramount importance.

Who are the Leading Players in the Augmented reality glasses Market?

Market players are striking strategic alliances and partnerships and engaging in mergers and acquisitions as part of their efforts to advance technology development amid the intensifying competition.

| Report Attribute | Details |

|---|---|

| Growth Rate | 19.1% CAGR from 2025 to 2035 |

| Market Value in 2025 | USD 13,922.2 million |

| Market Value in 2035 | USD 87,165.4 million |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Microsoft CorporationGoogleSEIKO EPSON CORP.Laster TechnologiesPennySony Mobile Communications Inc.Recon InstrumentsLUMUS |

| Customization Scope | Available upon Request |

The global augmented reality glasses market is estimated to be valued at USD 20.1 billion in 2025.

The market size for the augmented reality glasses market is projected to reach USD 115.3 billion by 2035.

The augmented reality glasses market is expected to grow at a 19.1% CAGR between 2025 and 2035.

The key product types in augmented reality glasses market are industrial purpose, healthcare purpose, military purpose, retail purpose, media, games, and entertainment purpose, sports purpose and others purpose.

In terms of , segment to command 0.0% share in the augmented reality glasses market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Augmented Analytics Market Size and Share Forecast Outlook 2025 to 2035

Augmented Learning Market

Augmented Reality (AR) Shopping Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality for Retail Market

AR & VR Market Trends – Growth & Forecast 2017-2025

Augmented and Virtual Reality in Education Market - Growth & Forecast 2025 to 2035

Mobile Augmented Reality Market Analysis by Solution, Application, and Region Through 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Extended Reality (XR) Market Trends – Growth & Forecast 2025 to 2035

Tourists Virtual Reality Headsets Market Insights - Growth & Forecast 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

Sunglasses Market Growth, Trends and Forecast from 2025 to 2035

Sunglasses Pouch Market

Plano Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Metallic Glasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Chalcogenide Glasses Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA