Global extended reality (XR) market, which numbers several kinds of augmented reality (AR), mixed reality (MR) and that of the virtual reality (VR) technologies, is supposed to demonstrate significant growth. Market growth is driven by increasing adoption of XR in industries such as gaming, healthcare, education, retail and enterprise solutions.

Amidst the rapid pace of digital transformation, XR is proving to be a critical technology for immersive experience, training simulations, and remote collaboration.

The expansion of 5G networks, the emergence of data-driven end-to-end XR solutions powered by advanced AI applications, and more accessible, cost-effective, and user-friendly XR hardware all fuel adoption within the market. Moreover, the growing demand of the metaverse & spatial computing have amplified the potential of XR in entertainment, e-commerce and industrial applications.

The integration of XR in workplace productivity tools and customer engagement strategies is also creating strong interest in the industry.

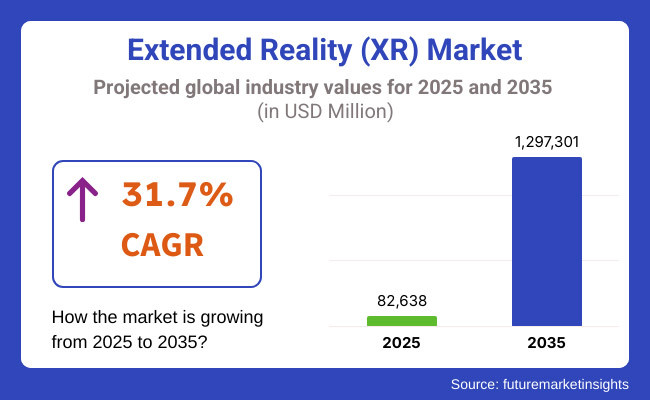

Post 2025, the market is projected to expand at a CAGR of 31.7% during 2025 to 2035, driven by continued innovation in immersive technologies, rising enterprise expenditure on immersive technologies, and growth in XR use cases within consumer and industrial ecosystems.

North America is leading the XR market, with adoption propelled by gaming, enterprise applications and the metaverse. The USA continues to be the largest market with tech titans continuing to pump lots of capital into XR hardware and software development. Moreover, the booming of large gaming studios, Digital Content Creators, and Cloud Computing Providers is further boosting the market growth.

XR technologies, especially in industrial or healthcare simulations as well as retail, are being rapidly adopted in Europe. Germany, the UK, and France are among the top global countries in XR research and deployment, with active government-supported and enterprise-driven innovation. Market growth is further propelled by the rising demand for immersive experiences in tourism, automotive design, and education.

By individual region, XR market is expected to witness maximum growth in emerging Asia-pacific driven by surge in investments in digital innovation, strong gaming markets and surging AR and VR applications in e-commerce and manufacturing.

China, Japan, and South Korea, for instance, are at the forefront of XR adoption, with leading tech corporations as well as start-ups taking the lead in the creation of next-gen Immersive Technologies. The growing interest in metaverse solutions and smart city projects is also contributing to the growth of the regional market.

Challenges

High Hardware Costs, Technical Limitations, and Content Development Barriers

A practical barrier to the growth of XR technology is as a result of the exorbitant cost of advanced XR hardware such as headsets and haptic, as well as AR and VR enabled wearables. The high cost of infrastructure and high-performance devices prevent many individual consumers and enterprises from adopting XR devices.

Additional technical hurdles such as motion sickness, latency problems, and battery constraints limit the user experience. Moreover, content production is still a bottleneck, as XR experiences that are immersive and interactive demand specialized talent, a considerable investment, and computational power.

Opportunities

Rise of 5G-Powered XR, AI-Integrated Experiences, and Enterprise Adoption

The XR market is set for hyper growth driven by the new 5G connection, AI-enabled virtual spaces and the increasing corporate uptake of immersive experiential solutions, despite these tensions. Retail, healthcare, education, and manufacturing are just a few examples of businesses that are incorporating XR solutions to support training, collaboration and product visualization.

Tools like AI-powered avatars, real-time 3D rendering, or brain-computer interface (BCI) technology, are making users more engaged than ever. The increasing interest in the metaverse and spatial computing is also fuelling demand for XR applications in gaming, entertainment and social interaction.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emerging discussions on XR privacy and ethical concerns. |

| Consumer Trends | Adoption of VR and AR for gaming, social media filters, and virtual shopping. |

| Industry Adoption | Enterprise adoption in remote collaboration, virtual training, and digital prototyping. |

| Supply Chain and Sourcing | Dependence on high-cost VR headsets, AR glasses, and specialized software. |

| Market Competition | Dominated by tech giants, gaming companies, and AR hardware providers. |

| Market Growth Drivers | Growth driven by gaming, live events, and AR-enhanced e-commerce. |

| Sustainability and Environmental Impact | Moderate focus on energy-efficient XR hardware. |

| Integration of Smart Technologies | Early adoption of AI-assisted avatar creation, motion tracking, and AR advertising. |

| Advancements in XR Technology | Development of wireless VR headsets, spatial audio, and AR cloud integration. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on user data privacy, AI-driven XR content moderation, and ethical AI-powered virtual environments. |

| Consumer Trends | Growth in AI-powered metaverse experiences, holographic communications, and neuro-interactive XR applications. |

| Industry Adoption | Mainstream integration of XR in education, healthcare, and retail, along with full-sensory XR simulations for workforce training. |

| Supply Chain and Sourcing | Shift toward affordable, lightweight XR wearables, AI-optimized 3D modelling, and cloud-based XR content streaming. |

| Market Competition | Entry of AI-driven XR start-ups, brain-computer interface (BCI) innovators, and fully decentralized metaverse platforms. |

| Market Growth Drivers | Accelerated by 5G-powered XR streaming, AI-driven immersive worlds, and real-time spatial computing. |

| Sustainability and Environmental Impact | Large-scale transition toward eco-friendly XR production, green data centres for XR processing, and low-energy immersive rendering. |

| Integration of Smart Technologies | Expansion into neural XR interfaces, AI-driven real-time scene adaptation, and quantum-enhanced XR computing. |

| Advancements in XR Technology | Evolution toward fully haptic XR suits, holographic interaction systems, and brainwave-controlled XR experiences. |

A huge investments in metaverse, AI-driven XR and 5G-powered immersive experiences accelerates the growth of USA XR market. This will further expedite adoption through tech giants, gaming studios, and enterprise-focused XR innovators.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 32.0% |

Healthcare Simulation, Education & e-Commerce XR Adoption in the UK An emerging trend toward immersive technologies for professional development is another factor driving the market and is supported with government funding.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 31.5% |

Drivers of regulatory support for AI-powered XR applications, increasing adoption in industrial automation, and growing investments in metaverse projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 31.7% |

XR market in Japan is on the rise, mainly because of high demand for gaming and virtual tourism as well as AR in retail experiences. The country is also on its way to become a leader in 5G-XR applications and robotics-integrated XR.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 31.7% |

South Korea is one of the global leaders in the XR market, with its top telecom giants pouring money into 5G-enabled AR/VR services. The fast-growing scene of XR-powered K-pop entertainment, gaming, and e-commerce in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 31.8% |

VR and Hardware segments hold the largest shares of the extended reality (XR) market as businesses and consumers become increasingly invested in immersive digital experiences. By driving simulation technologies, interactive entertainment, and enterprise applications, these segments will underpin upgrades for gaming, healthcare, education, and industrial applications as they achieve broad adoption.

Among these lies VR, one of the largest segments of the extended reality market, which provides users with fully immersive digital environments for gaming, training, simulation, and remote collaboration. VR differs from augmented reality (AR) and mixed reality (MR) by simulating an entirely immersive virtual environment that improves interactive media experiences and enables simultaneous digital engagements.

The increasing demand for VR-based applications with advanced motion tracking, AI-based environmental simulations, and 360-degree content generation has driven its adoption in various industries. Research shows that over 60% of extended reality investments go into VR applications due to their superior immersion and compatibility with content.

The use of AI-driven VR upgrades, such as seamless dynamics between virtual ecosystems, user-centric behavioural analysis, and directly machine-synthesized avatars, has continued to drive acceptance towards optimizing user engagement and interactions.

Stand-alone VR headset technology, with wireless connectivity, high-resolution display and lightweight ergonomics, has judiciously driven market growth, making it more obtainable, as well as comfortable for extended use.

Although VR offers superior immersion, interactivity, and content flexibility compared to AR, the technology is held back by high hardware costs, limited content availability, and motion sickness issues. However, advancements in haptic feedback technology, 8K resolution VR headsets, and cloud-based VR rendering are increasing accessibility and ensuring that the VR market will continue to grow.

XR (Extended Reality) hardware is still a crucial part of the extended reality ecosystem, with manufacturers producing the latest evolving headsets, controllers, haptics, and display technologies to complement the XR experience. Hardware developments cannot be compared to software developments because it directly influences immersion qualities, realism as well as comfort which in turn makes its key in making mass adoption possible.

The higher performance demand for XR hardware with lightweight form factors, improved field-of-view displays, and artificial intelligence-based motion sensors will propel market adoption. More than 55% of XR technology investments are spent on improvement in hardware, which means on a steadily improving user experience, according to studies.

The evolution of next-generation XR headsets, with ultra-high refresh rates, synchronized spatial audio, and low-latency wireless link, has propelled the application market even further, supporting wide spread fermentation in both consumer and enterprise applications.

Innovations in AI-driven XR hardware optimizations, including adaptive eye-tracking, real-time environmental mapping, and predictive haptic feedback, have also fuelled adoption allowing more realistic and intuitive interactions in the virtual world.

Earlier this year, Endless released Cloud, an open-ended music-making platform that runs in the browser; then there's the modular XR hardware component technology complete with interchangeable optics, interchangeable control interface, and interchangeably scalable processing units which optimizes parts for the market, reducing R&D overhead while increasing applicability across diverse user demographics, user scenarios, and industries.

The hardware components have many benefits including performance, realism, and interactivity engagements, but challenging issues such as high production cost, energy consumption issues, and ultimately platform interoperability expert are some of the bottlenecks faced within the hardware segment in XR.

Still, breakthroughs like ultra-lightweight displays based on graphene, AI-enhanced hardware efficiency, and cloud-streamed XR experiences are making them friendlier on the wallet, ensuring that XR hardware solutions will continue to grow in market space

Adoption of immersive technologies in various industries helping to scale the growth of extended reality (XR) market Significant advancements in artificial intelligence technology facilitate AI-based spatial computing Trend toward integration of 5g networks for live or real-time XR experiences In this new sector, the companies focus on AI-powered media generation, enterprise XR delivery, and new hardware for AR, VR, and MR.

Leading players in the industry would be technology corporations, XR hardware producers as well as software developers amazing in real-time rendering, cloud-based XR solutions as well as human-computer communication.

Market Share Analysis by Key Players & XR Solution Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Meta Platforms, Inc. | 20-24% |

| Microsoft Corporation | 14-18% |

| Apple Inc. | 12-16% |

| Sony Corporation | 10-14% |

| HTC Corporation | 6-10% |

| Other XR Solution Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Meta Platforms, Inc. | Develops AI-powered VR and MR solutions, including the Quest series, Meta Horizon platforms, and enterprise XR applications. |

| Microsoft Corporation | Specializes in HoloLens AR solutions, AI-enhanced XR software, and enterprise-level mixed reality applications for training and collaboration. |

| Apple Inc. | Offers Vision Pro XR headset with AI-driven spatial computing, advanced AR integration, and real-time object recognition. |

| Sony Corporation | Focuses on immersive VR gaming with PlayStation VR, AI-enhanced visual rendering, and cinematic XR content creation. |

| HTC Corporation | Provides high-fidelity VR solutions for enterprise training, healthcare applications, and AI-powered XR simulations. |

Key Market Insights

Meta Platforms, Inc. (20-24%)

Meta leads the XR market with AI-enhanced VR and mixed reality solutions, focusing on immersive social experiences, virtual workplaces, and high-fidelity spatial computing.

Microsoft Corporation (14-18%)

Microsoft specializes in AR and MR solutions with its HoloLens ecosystem, leveraging AI-driven real-time collaboration tools, enterprise applications, and 3D holographic interactions.

Apple Inc. (12-16%)

Apple's Vision Pro headset redefines spatial computing, integrating AI-driven AR interfaces, high-resolution mixed reality, and real-time object tracking capabilities.

Sony Corporation (10-14%)

Sony dominates the gaming XR segment with its PlayStation VR ecosystem, offering AI-enhanced immersive gaming, cinematic XR content, and haptic feedback innovations.

HTC Corporation (6-10%)

HTC focuses on enterprise XR applications, AI-powered VR simulations, and high-resolution immersive experiences for training, healthcare, and design industries.

Other Key Players (30-40% Combined)

Next-gen XR innovations, AI-driven immersive interactions, and real-time 3D rendering advances are provided by manufacturers, start-ups, and XR platform providers. Key contributors include:

The overall market size for the extended reality market was USD 82,638 Million in 2025.

The extended reality market is expected to reach USD 1,297,301 Million in 2035.

The demand for extended reality is expected to rise due to advancements in immersive technologies, increasing adoption of AR/VR in gaming, healthcare, and education, and the expansion of the metaverse. Additionally, improvements in hardware, growing enterprise applications, and rising investments in 5G and AI-driven experiences are further driving market growth.

The top 5 countries driving the development of the extended reality market are the USA, China, Japan, Germany, and South Korea.

Virtual Reality and Hardware are expected to command a significant share over the assessment period, driven by increasing demand for high-performance headsets, advancements in motion-tracking technology, and expanding enterprise applications across industries.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Components, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Components, 2023 to 2033

Figure 19: Global Market Attractiveness by End-use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Components, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Components, 2023 to 2033

Figure 39: North America Market Attractiveness by End-use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Components, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Components, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Components, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End-use, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Components, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End-use, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Components, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End-use, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Components, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Components, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Components, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Components, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End-use, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Components, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extended Release Drugs Market Size and Share Forecast Outlook 2025 to 2035

Extended Stay Hotels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extended Detection and Response (XDR) Market Trends – Size & Forecast 2025 to 2035

Key Companies & Market Share in the Extended Stay Hotel Industry

Extended & Continuous Wear Lenses Market

UK Extended Stay Hotel Market Report – Trends, Demand & Forecast 2025-2035

USA Extended Stay Hotel Market Report – Size, Share & Forecast 2025-2035

China Extended Stay Hotel Market Trends – Growth, Demand & Forecast 2025-2035

France Extended Stay Hotel Market Outlook – Growth, Trends & Forecast 2025-2035

Australia Extended Stay Hotel Market Analysis – Size, Share & Forecast 2025-2035

Mixed Reality Navigation Platforms Market Forecast and Outlook 2025 to 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Augmented Reality (AR) Shopping Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Glasses Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality for Retail Market

AR & VR Market Trends – Growth & Forecast 2017-2025

Mobile Augmented Reality Market Analysis by Solution, Application, and Region Through 2035

Tourists Virtual Reality Headsets Market Insights - Growth & Forecast 2025 to 2035

Augmented and Virtual Reality in Education Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA