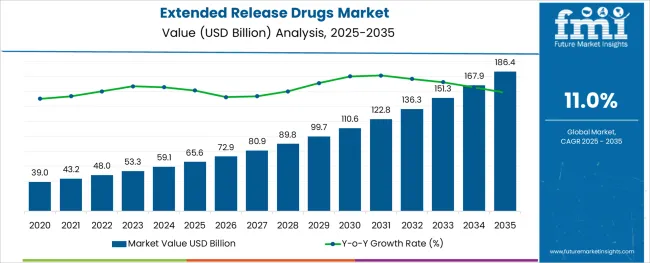

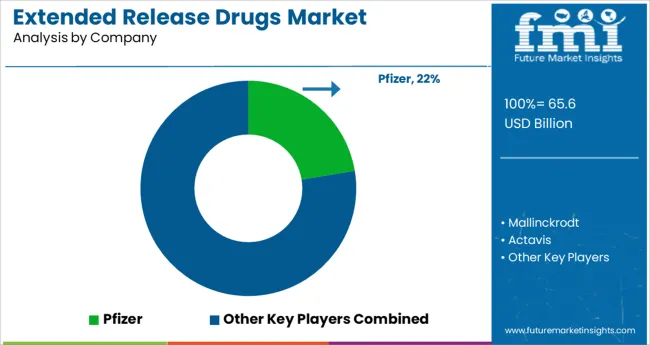

The Extended Release Drugs Market is estimated to be valued at USD 65.6 billion in 2025 and is projected to reach USD 186.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period.

The extended release drugs market is gaining momentum as healthcare providers focus on improving patient compliance and ensuring steady drug absorption over longer periods. Clinicians and pharmacologists have increasingly emphasized the importance of maintaining consistent therapeutic drug levels to minimize dosing frequency and reduce side effects. Industry updates have shown strong interest in extended release formulations across chronic disease management, where long-term treatment regimens require steady pharmacokinetic profiles.

Advances in drug delivery technologies and formulation science have enabled the development of dosage forms that offer sustained therapeutic effects without the need for frequent administration. Hospitals and specialty clinics have shown growing demand for these products to enhance patient convenience and therapeutic outcomes.

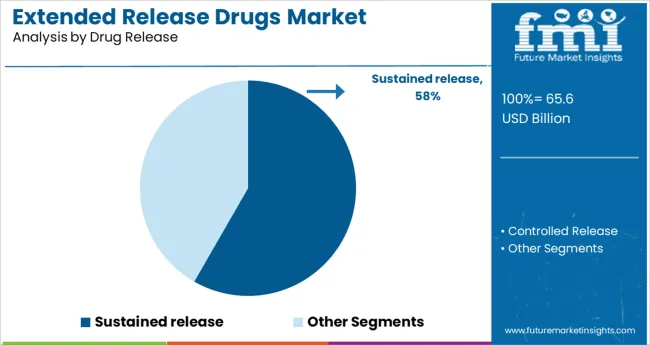

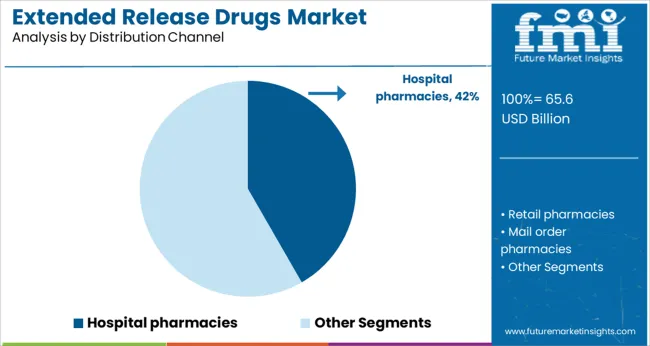

The market is expected to continue expanding as pharmaceutical companies invest in novel polymer-based drug delivery systems and as patient populations with chronic illnesses increase globally. Segmental growth is anticipated to be driven by Sustained Release formulations in drug release types and Hospital Pharmacies as the primary distribution channel.

The market is segmented by Drug Release and Distribution Channel and region. By Drug Release, the market is divided into Sustained release and Controlled Release. In terms of Distribution Channel, the market is classified into Hospital pharmacies, Retail pharmacies, Mail order pharmacies, and Drug Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Drug Release and Distribution Channel and region. By Drug Release, the market is divided into Sustained release and Controlled Release. In terms of Distribution Channel, the market is classified into Hospital pharmacies, Retail pharmacies, Mail order pharmacies, and Drug Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Sustained Release segment is projected to account for 58.3% of the extended release drugs market revenue in 2025, leading the drug release category. This growth has been fueled by the ability of sustained release formulations to provide prolonged drug action which helps reduce the number of doses required each day.

Patients and healthcare providers have increasingly preferred sustained release drugs to support adherence to treatment schedules particularly in chronic conditions such as hypertension and diabetes. Researchers have developed advanced drug matrices and coatings that allow active pharmaceutical ingredients to be released gradually over time.

This not only improves therapeutic consistency but also enhances patient comfort by avoiding sharp fluctuations in drug concentration. As the demand for improved medication adherence and steady treatment outcomes rises, the Sustained Release segment is expected to remain at the forefront of drug delivery solutions.

The Hospital Pharmacies segment is projected to hold 41.7% of the extended release drugs market revenue in 2025, maintaining its position as the key distribution channel. Growth in this segment has been supported by the wide-scale use of extended release drugs in inpatient settings where close monitoring of patient therapy is essential.

Hospitals have consistently stocked extended release formulations to manage acute and chronic conditions efficiently within controlled care environments. Healthcare administrators have favored hospital pharmacies for dispensing such drugs due to their role in managing medication regimens and ensuring timely administration.

Additionally, the treatment of complex cases often requires customized drug regimens that are more effectively managed in hospital pharmacy settings. As patient admissions for chronic diseases increase and therapeutic care protocols evolve, the Hospital Pharmacies segment is expected to continue driving the distribution of extended release drugs.

Compared to conventional oral drugs, extended-release drugs are well-planned administration of medication. Extended-release drugs control the time, area, and rate of the dosage, thereby increasing safety and efficacy. With the controlled release of the active ingredient, extended-release drugs also help to reduce the frequency of dosage, resulting in easier and better acceptance by patients as well as increased bioavailability.

Growing demand for pediatric and geriatric extended drug release formulations, widespread acceptance of extended drug release systems, and notable changes in the prescription pattern of doctors will drive the market.

Advancing research & development, ongoing clinical trials in the pharmaceutical sector, and a greater focus on the development of new and innovative therapeutics will further bolster the market for extended drug release.

The cost of extended drug release is a major roadblock for manufacturers. A single unit of extended-release drugs costs double or triple the conventional oral dosage. The price of Namenda's extended-release drug is around USD 494 for 7mg. This is expected to limit sales in the market.

Conventional drugs have an almost immediate impact whereas extended-release drugs take a comparatively long time to make an impact as they have a slower course of action.

Side effects such as dose dumping could seriously affect health, which might hamper the growth of the market.

Dose dumping is the quick release of extended-release drugs in the circulatory system and can lead to toxicity. Refusal of extended-release drugs due to bad taste or swallowing difficulties is another factor that may impede demand in the forthcoming years.

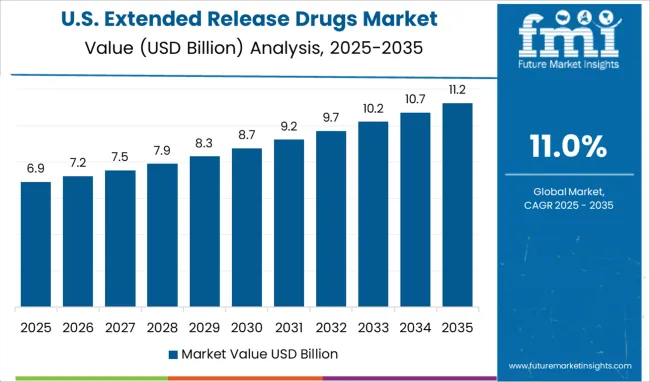

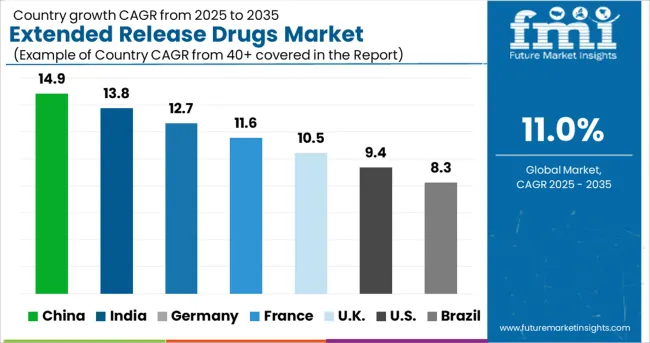

Owing to the introduction of new and innovative therapeutics and their widespread acceptance, North America holds a significant share of the global extended-release drugs market.

The presence of leading pharmaceutical and biopharmaceutical companies, along with increasing investments in research and development in the pharmaceutical sector will propel the growth in the North American extended-release drug market.

The growing burden of chronic diseases and the adoption of extended-release drugs in the treatment of hypertension will further underpin the demand for extended-release drugs.

Increasing adoption of extended-release drugs across countries such as Germany, the United Kingdom, Italy, and France is expected to boost the Europe extended-release market over the assessment period.

The rising incidence of chronic diseases such as COPD, diabetes, and cancer has led to quicker adoption of extended-release drugs. This is expected to create opportunities for extended-release drug manufacturers operating in Europe.

As per FMI, Asia Pacific is predicted to display the highest CAGR during the forecast period. The region has shown great potential in the extended-release drugs market due to the rapid growth of the pharmaceutical industry.

The ongoing expansion of the pharmaceutical and biopharmaceutical sectors across countries including China and India is anticipated to steer sales in the Asia Pacific extended-release drugs market.

Some of the key players in the global extended-release drugs market are Pfizer, Mallinckrodt, Actavis, Janssen Pharmaceuticals, Endo Pharmaceuticals, Purdue Pharma, Lavipharm Labs, Mylan Technologies, Noven, Aveva, Watson, Impax, Ranbaxy.

The global extended-release drug market is highly competitive with leading companies focusing on developing novel therapeutics. Mergers and acquisitions are the go-to strategies adopted by key players to expand their product portfolios.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR 11% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Drug Release, Distribution Channel, Region |

| Countries Covered | North America (USA, Canada); Latin America (Mexico, Brazil); Western Europe (Germany, Italy, France, United Kingdom, Spain, Nordic countries, Belgium, Netherlands, Luxembourg); Eastern Europe (Poland, Russia); Asia-Pacific Excluding Japan (China, India, ASEAN, Australia & New Zealand); Japan; The Middle East and Africa (GCC, S. Africa, N. Africa) |

| Key Companies Profiled | Pfizer; Mallinckrodt; Actavis; Janssen Pharmaceuticals; Endo Pharmaceuticals; Purdue Pharma; Lavipharm Labs; Mylan Technologies; Noven; Aveva; Watson; Impax; Ranbaxy |

| Customization | Available Upon Request |

The global extended release drugs market is estimated to be valued at USD 65.6 billion in 2025.

It is projected to reach USD 186.4 billion by 2035.

The market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types are sustained release and controlled release.

hospital pharmacies segment is expected to dominate with a 41.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extended Stay Hotels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extended Reality (XR) Market Trends – Growth & Forecast 2025 to 2035

Extended Detection and Response (XDR) Market Trends – Size & Forecast 2025 to 2035

Key Companies & Market Share in the Extended Stay Hotel Industry

Extended & Continuous Wear Lenses Market

UK Extended Stay Hotel Market Report – Trends, Demand & Forecast 2025-2035

USA Extended Stay Hotel Market Report – Size, Share & Forecast 2025-2035

China Extended Stay Hotel Market Trends – Growth, Demand & Forecast 2025-2035

France Extended Stay Hotel Market Outlook – Growth, Trends & Forecast 2025-2035

Australia Extended Stay Hotel Market Analysis – Size, Share & Forecast 2025-2035

Release Tapes Market Size and Share Forecast Outlook 2025 to 2035

Release Agent Market – Trends & Forecast 2025 to 2035

Release Liner Recycling Market

PET Release Liner Market

Heat Release Tester Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Smart-Release Moisture-Boosting Technology Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Wrinkle Release Spray Market Analysis - Trends, Growth & Forecast 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Silicone Release Liners Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA