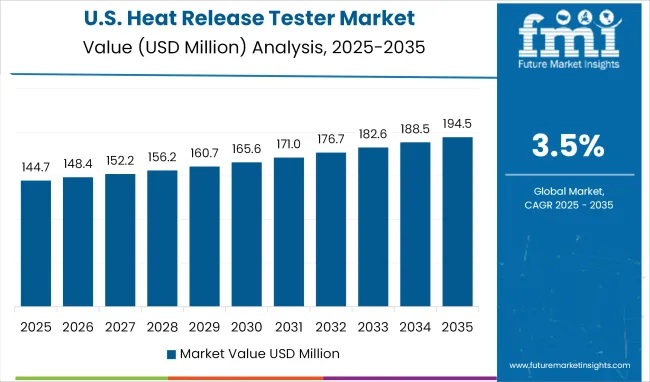

The heat release tester market is projected to rise from USD 413.2 million in 2025 to approximately USD 582.8 million by 2035, registering a CAGR of 3.5% during the forecast period. The market is becoming highly dynamic as industries ranging from building materials to automotive align thermal safety with regulatory mandates and performance benchmarks.

Leading equipment makers are sourcing advanced sensors and fast-response calorimeters from specialized Tier‑2 component suppliers to support real-time heat flux analysis in fire tests for aerospace composites and construction panels.

Calibration labs are responding by offering traceable ISO‑17025 services that validate new equipment within 48 hours, reducing downtime for R&D teams. Across Asia and Europe, OEMs are pairing shipment contracts with on-site training and maintenance packages, signaling a shift toward service‑based models. Raw material labs are optimizing sample preparation workflows using robotic cutting and moisture control systems that ensure consistent data across global testing sites.

As of 2025, the heat release tester market is regarded as a focused yet essential niche within broader safety and testing industries. Within the global fire testing equipment market, these testers represent approximately 6-8% of total value, as they are key to assessing material flammability. In the test and measurement instruments market, their share is about 2-3%, reflecting their specialized application.

In the building materials testing sector, they contribute roughly 4-5%, driven by regulatory demands for fire-safe construction components. Within the safety and compliance equipment market, a 3-4% share is held by heat release testers, due to increasing emphasis on certification and risk management. In the product certification services market, they account for 2-3%, supporting lab-based compliance across diverse industries.

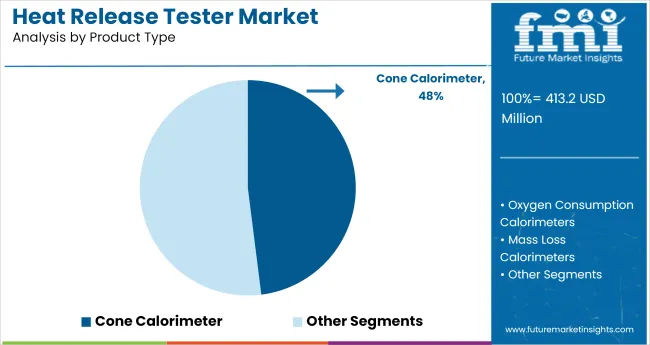

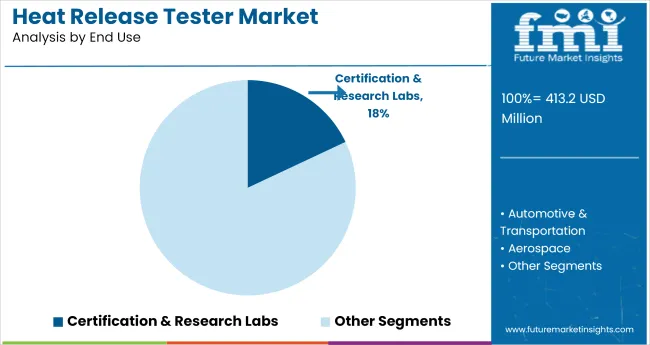

The market is advancing steadily across critical sectors, fueled by regulatory emphasis on fire safety, increasing product testing volumes, and the growing presence of third-party labs. Among the leading segments, cone calorimeters and certification & research labs show high investor potential due to their relevance in modern flame retardancy assessment.

Cone calorimeters are projected to account for 48% of the heat release tester market by 2025, making them the dominant product type. They offer precise measurements of heat release rates, smoke production, and ignition time under controlled conditions, essential for evaluating flammability performance in building materials, plastics, and textiles.

Certification and research labs are set to secure an 18% share of the global market by 2025. Their role in verifying material safety, issuing fire compliance reports, and assisting manufacturers with product approvals positions them as core consumers of heat release testers. Investment in this segment is supported by heightened testing demand across industries.

Demand for heat release testers is rising with stricter flammability regulations in aerospace, automotive, and construction sectors. In 2024, global installations grew by 7.2%, driven by increased emphasis on fire safety certification. Testing standards such as ISO 5660 and FAA FAR 25.853 are accelerating equipment upgrades worldwide.

Modern testers now include oxygen consumption calorimetry and integrated data loggers. In 2024, nearly 46% of new units featured real-time HRR visualization with software-based thermal profiling. Labs are replacing legacy units to align with automated reporting and international audit requirements.

China, Japan, and South Korea are investing heavily in material safety testing infrastructure. In 2024, APAC accounted for 31% of global heat release tester sales, up from 24% in 2020. Government-funded fire safety labs and private certification agencies are boosting demand.

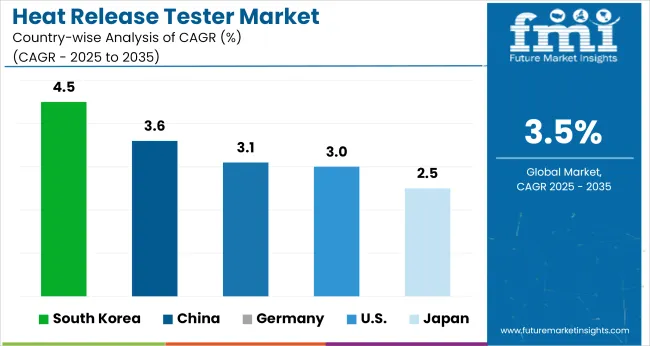

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

| Countries | CAGR (2025-2035) |

|---|---|

| South Korea | 4.5% |

| China | 3.6% |

| Germany | 3.1% |

| United States | 3.0% |

| Japan | 2.5% |

The global heat release tester market is expected to expand at a CAGR of 3.5% between 2025 and 2035. South Korea leads the group with a 4.5% CAGR, which is 29% higher than the global baseline. China also edges past the average with 3.6% growth, while Germany at 3.1% and the United States at 3.0% trail the global rate by 11% and 14%, respectively. Japan records the slowest pace at 2.5%, falling 29% short of the global average.

These country-level variations reflect differences in fire safety compliance, test lab modernization, and adoption of updated flammability standards. South Korea is seeing faster growth due to greater emphasis on building code revisions and investments in fire-resistant materials testing. OECD economies such as Japan, the USA, and Germany are experiencing slower turnover in safety infrastructure and stricter procurement cycles, which are limiting gains in the heat release tester segment.

South Korea is growing at a CAGR of 4.5% between 2025 and 2035, supported by stringent fire safety protocols in electronics and construction. The country’s strong electronics and automotive sectors are actively integrating advanced fire testing protocols during component development. The government has introduced updated fire codes that make heat release measurements mandatory for certain materials used in interiors. Growing R&D in universities and state labs has resulted in wider deployment of modern calorimetry devices. These trends are strengthening the demand for precise heat release testers across industries.

China’s market for heat release testers is expected to register a CAGR of 3.6% from 2025 to 2035, as national fire codes are revised to include stricter compliance requirements. Rapid infrastructure development and booming high-rise construction have increased the need for flammability testing of building materials. The aviation and railway sectors are also using these devices to validate fire-resistant composites. Chinese equipment manufacturers are entering the segment with cost-effective solutions, supporting accessibility for mid-sized laboratories. This trend is reshaping local procurement strategies.

Germany is projected to expand at a CAGR of 3.1% through 2035, driven by high industrial safety benchmarks across sectors such as aerospace, construction, and electricals. The country’s emphasis on precision testing and certification is reinforcing the role of heat release testers in research labs and production lines. Strict adherence to EU fire standards and material classification systems has necessitated wider use of calibrated calorimetry instruments. German laboratories also demand long-life, modular systems that comply with ISO 5660 and DIN standards.

The United States is anticipated to experience a CAGR of 3.0% in the heat release tester market from 2025 to 2035. Growing concern over fire hazards in public buildings and aircraft interiors is increasing demand for performance-based fire testing. Regulatory bodies such as NFPA and FAA have mandated specific heat release rate limits for critical applications, especially in mass transit and defense. Universities, third-party labs, and OEMs are enhancing capabilities with cone calorimeters and smoke density testers that meet ASTM standards.

Japan’s market is expected to expand at a CAGR of 2.5% between 2025 and 2035. National regulations require standardized flammability testing for a range of construction, automotive, and appliance materials. The country is investing in modernizing laboratory infrastructure, especially in fire research institutes and academic centers. Advanced testing equipment that offers dual-mode analysis and compliance with JIS and ISO fire test standards is gaining ground. Despite the mature market, evolving technology and focus on disaster resilience are supporting steady growth.

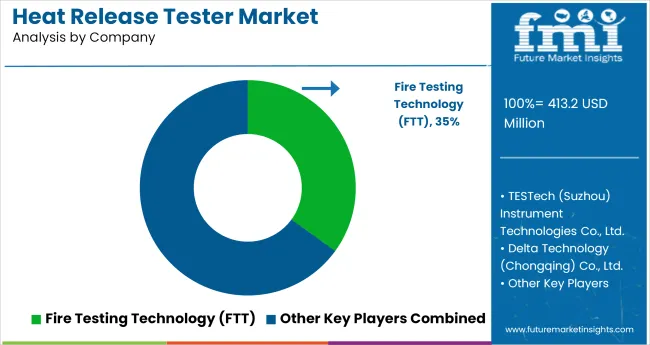

Fire Testing Technology (FTT), based in the UK, dominates the premium segment with an estimated 35% global market share, supplying advanced cone calorimeters compliant with ISO 5660 and ASTM E1354 standards. TESTech (Suzhou) follows with strong traction in Asia-Pacific, particularly in China and South Korea, due to its cost-effective lab-scale models, holding approximately 20% share. Delta Technology (Chongqing) Co. Ltd. has grown rapidly by integrating digital control systems and exporting to mid-tier European labs. Dongguan Daxian and Motis Fire Technology focus primarily on the domestic Chinese education and R&D sectors, supplying over 400 units annually. Emerging Indian players like Asian Test Equipments are gaining traction in South Asia, targeting material certification labs with budget-friendly systems.

Recent Heat Release Tester Industry News

In January 2025, Fire Testing Technology (FTT) launched a new U.S. subsidiary and designated Earth Products China as its exclusive agent for mainland China, Hong Kong, and Macau. These strategic moves enhance FTT’s global footprint, improving customer support and distribution for its advanced heat-release and smoke-density testers.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 413.2 million |

| Projected Market Size (2035) | USD 582.8 million |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Product Types Analyzed (Segment 1) | Cone Calorimeters, Oxygen Consumption Calorimeters, Mass Loss Calorimeters, Other Specialized Types |

| End Uses Analyzed (Segment 2) | Automotive & Transportation, Aerospace, Certification & Research Laboratories, Process Industries, Mining & Metallurgy, Other Industrial Sectors |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | TESTech (Suzhou) Instrument Technologies Co., Ltd., Dongguan Skyline Industrial Co., Ltd., Asian Test Equipments , Delta Technology (Chongqing) Co., Ltd., Fire Testing Technology (FTT), Dongguan Daxian Instrument Equipment Co., Ltd., Motis Fire Technology (China) Co., Ltd. |

| Additional Attributes | Dollar sales by product and end use, increasing demand for fire performance testing in transport and construction, evolving international safety standards, and rising investment in lab-based combustion analytics. |

The market is segmented into cone calorimeters, oxygen consumption calorimeters, mass loss calorimeters, and other specialized types used for fire behavior analysis across materials and systems.

End-use segments include automotive and transportation, aerospace, certification and research laboratories, process industries, mining and metallurgy, and other industrial sectors requiring fire performance testing.

Regional analysis covers North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa, highlighting global demand dynamics and regulatory variations.

The market is estimated to be worth USD 413.2 million in 2025.

The market is expected to reach USD 582.8 million by 2035.

The market is anticipated to grow at a CAGR of 3.5% during the forecast period.

Cone calorimeters lead the segment with a 48% share in 2025.

South Korea is the top growing country, expanding at a CAGR of 4.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Sealing Tester Market

Heat Deformation Tester Market

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heat Treating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA