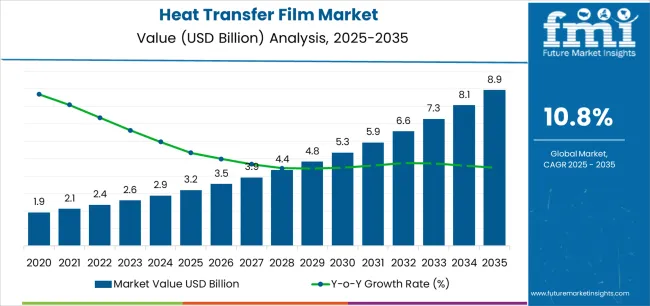

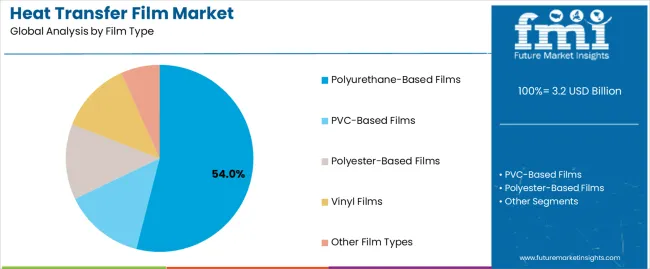

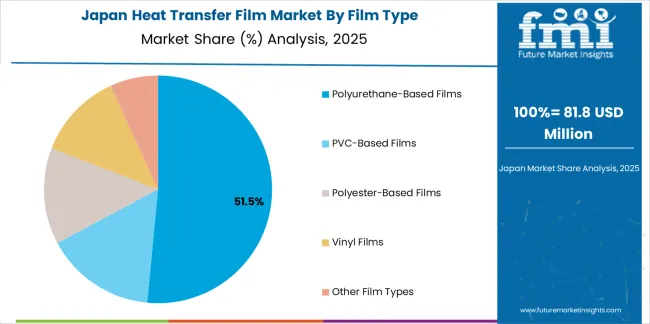

The global heat transfer film market is set to grow from USD 3.2 billion in 2025 to USD 8.9 billion by 2035, adding USD 5.7 billion in new revenue and advancing at a strong 10.8% CAGR. Growth is driven by the accelerating shift toward product personalization, rapid expansion of customized apparel decoration, and the rising use of durable graphic films in sportswear, footwear, consumer goods, and automotive interiors. Polyurethane-based films dominate with a 54% share in 2025, supported by their superior stretchability, wash resistance, and compatibility with diverse textile substrates. PVC-, polyester-, and vinyl-based films continue to scale but remain secondary as brands prioritize soft-hand feel, premium finishes, and performance durability associated with PU formulations.

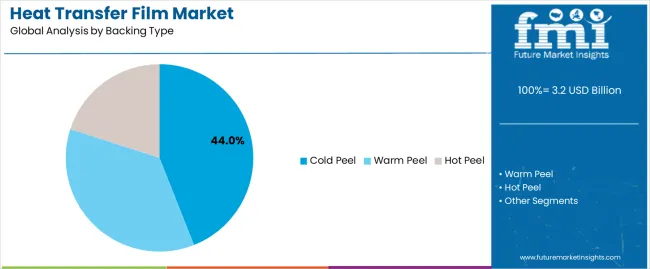

Cold-peel backing types lead the market with a 44% share, favored for delivering sharper detailing, smoother finishes, and superior graphic clarity demanded by premium apparel decorators and professional printing studios. Packaging applications account for the largest industry share, contributing 35–40% of demand as brands seek high-resolution labeling and decorative effects for consumer goods. Textiles and apparel follow with 25–30%, driven by booming customization trends and the global sportswear surge. Automotive interiors, electronics, and promotional products collectively generate additional lift as manufacturers embrace heat transfer films for branding, protection, and aesthetic enhancement.

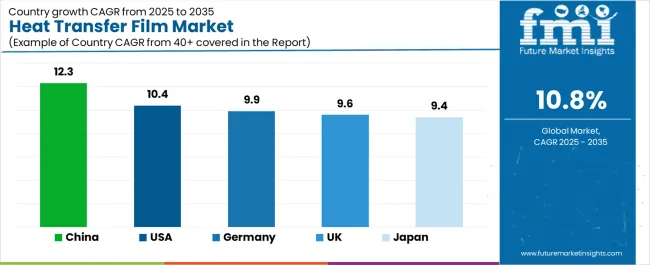

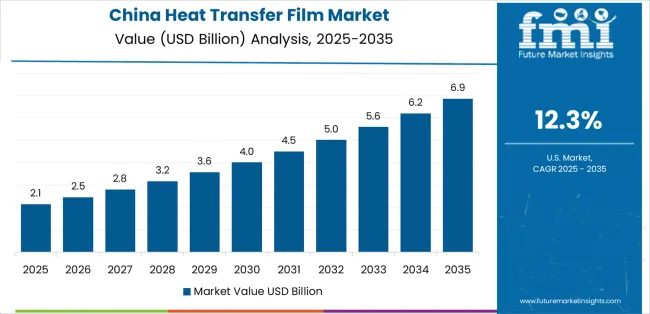

Asia Pacific anchors global expansion, with China growing at 12.3% CAGR as textile clusters scale output and manufacturers integrate advanced film technologies. The United States follows at 10.4%, led by strong personalization demand and a mature apparel decoration ecosystem. Germany, the UK, and Japan sustain high-quality adoption supported by precision manufacturing and fashion-driven demand. Competitive differentiation is shifting toward adhesive engineering, eco-friendly formulations, digital-print compatibility, and long-term durability rather than base material supply. Market leaders, Avery Dennison, Siser, Stahls’, Hexis, and Poli-Tape Group, are strengthening their position through advanced coating technologies, colorfastness optimization, and integrated decoration systems that streamline professional production workflows.

A major dynamic shaping demand is the surge in personalized and small-batch apparel production. Fashion brands, sportswear companies, and promotional product manufacturers increasingly rely on heat transfer films to accommodate rapid design changes, variable quantities, and short turnaround times. Unlike screen printing, which becomes inefficient at small volumes, heat transfer films allow brands to execute dozens or hundreds of SKUs with minimal setup time. This flexibility aligns directly with current fashion cycles where micro-collections, athlete-specific designs, fast merchandising, and influencer-driven capsule drops require immediate production capability. The expansion of digital heat transfer technologies, including printable polyurethane films, has further strengthened adoption by enabling high-resolution graphics and photo-quality imagery.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.2 billion |

| Forecast Value in (2035F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 10.80% |

The packaging market is the largest contributor, accounting for 35-40% of the demand. Heat transfer films are extensively used for packaging applications, particularly in labeling and decoration. Their ability to provide high-quality graphics, durability, and resistance to wear and tear makes them ideal for consumer goods packaging, including beverages, cosmetics, and food products. The textile industry adds about 25-30%, as heat transfer films are increasingly used for custom garment decoration and branding. With the rise in demand for personalized apparel and sportswear, heat transfer films provide an efficient and cost-effective solution for printing logos, designs, and graphics on fabrics.

The automotive market contributes approximately 15-18%, where heat transfer films are used for decorative finishes, branding, and protective coatings on automotive parts and components. These films help enhance the aesthetic appeal of vehicles while providing additional protection against UV rays and scratches. The electronics market accounts for around 12-15%, as heat transfer films are utilized in the decoration and protection of electronic products, including smartphones, laptops, and other consumer electronics. Their scratch resistance and ability to maintain print quality under heavy use are key drivers of adoption. The consumer goods market represents approximately 8-10%, where heat transfer films are used for decorating home appliances, toys, and other products requiring branding or aesthetic customization.

Market expansion is being supported by the increasing global demand for customization solutions and the corresponding shift toward professional-grade decoration technologies that can provide superior graphic outcomes while meeting user requirements for durability assurance and reliable application processes. Modern designers and manufacturers are increasingly focused on incorporating decoration solutions that can enhance product differentiation while satisfying demands for durable, consistently performing graphics and optimized production practices. Heat transfer films' proven ability to deliver decoration benefits, design flexibility, and diverse application possibilities makes them essential products for fashion-forward brands and quality-conscious manufacturers.

The growing emphasis on product personalization and brand differentiation is driving demand for high-quality heat transfer films that can support distinctive decoration outcomes and comprehensive design positioning across apparel decoration, footwear customization, and promotional product categories. User preference for products that combine graphic excellence with durability characteristics is creating opportunities for innovative implementations in both traditional and emerging decoration applications. The rising influence of fashion trends and customization initiatives is also contributing to increased adoption of heat transfer films that can provide authentic design benefits and performance characteristics.

The market is segmented by film type, backing type, end-use industry, and region. By film type, the market is divided into polyurethane-based films, PVC-based films, polyester-based films, vinyl films, and other film types. Based on backing type, the market is categorized into hot peel, cold peel, and warm peel. By end-use industry, the market includes textile & apparel, footwear, automotive interiors, promotional products, sports equipment, and other industries. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and other regions.

The polyurethane-based films segment is projected to account for 54% of the heat transfer film market in 2025, reaffirming its position as the leading product category. Designers and manufacturers increasingly utilize polyurethane-based films for their superior stretchability characteristics, established durability performance, and essential functionality in apparel decoration applications across diverse textile categories. Polyurethane-based films' standardized flexibility characteristics and proven graphic effectiveness directly address user requirements for reliable design execution and optimal decoration value in professional applications.

This product segment forms the foundation of modern textile decoration patterns, as it represents the format with the greatest professional acceptance potential and established compatibility across multiple fabric systems. Professional investments in decoration process optimization and quality standardization continue to strengthen adoption among quality-conscious manufacturers. With users prioritizing design flexibility and graphic durability, polyurethane-based films align with both aesthetic objectives and performance requirements, making them the central component of comprehensive textile decoration strategies.

Cold peel films are projected to represent 44% of the heat transfer film market growth through 2035, underscoring their critical role as the primary choice for quality-focused manufacturers seeking superior graphic benefits and enhanced clarity credentials. Professional users and premium apparel producers prefer cold peel films for their enhanced detail standards, proven finish superiority, and ability to maintain exceptional graphic profiles while supporting long-term durability during high-quality decoration experiences. Positioned as essential products for discerning manufacturers, cold peel offerings provide both graphic excellence and application advantages.

The segment is supported by continuous improvement in adhesive formulation technology and the widespread availability of established manufacturing infrastructure that enables quality assurance and premium positioning at the professional level. Film manufacturers are optimizing cold peel processing methods to support market differentiation and accessible premium pricing. As adhesive technology continues to advance and users seek superior decoration solutions, cold peel films will continue to drive market growth while supporting design precision and professional application strategies.

The heat transfer film market is advancing rapidly due to increasing customization consciousness and growing need for professional-grade decoration choices that emphasize superior graphic outcomes across fashion segments and promotional applications. The market faces challenges, including higher raw material costs, temperature sensitivity in application processes, and supply chain complexities affecting pricing stability. Innovation in adhesive formulations and specialized product development continues to influence market development and expansion patterns.

The growing adoption of heat transfer films in specialized fashion programs and design-intensive applications is enabling users to develop decoration patterns that provide distinctive graphic benefits while commanding premium positioning and enhanced differentiation characteristics. Fashion applications provide superior design density while allowing more sophisticated customization approaches across various apparel categories. Users are increasingly recognizing the competitive advantages of heat transfer film positioning for premium product decoration and design-conscious brand integration.

Modern heat transfer film manufacturers are incorporating advanced printing systems, digital design technologies, and quality management protocols to enhance graphic capabilities, improve user outcomes, and meet professional demands for design-specific decoration solutions. These systems improve film effectiveness while enabling new applications, including integrated color-matching and specialized finish programs. Advanced technology integration also allows manufacturers to support premium market positioning and decoration leadership beyond traditional graphic operations.

| Country | CAGR (2025-2035) |

|---|---|

| USA | 10.4% |

| Germany | 9.9% |

| UK | 9.6% |

| China | 12.3% |

| Japan | 9.4% |

The heat transfer film market is experiencing robust growth globally, with China leading at a 12.3% CAGR through 2035, driven by the expanding textile manufacturing sector, growing fashion sophistication, and increasing adoption of professional decoration technologies. The USA follows at 10.4%, supported by rising customization trends, expanding apparel market, and growing acceptance of personalized decoration solutions. Germany shows growth at 9.9%, emphasizing established fashion markets and comprehensive manufacturing development. The UK records 9.6%, focusing on premium decoration products and fashion innovation expansion. Japan demonstrates 9.4% growth, prioritizing quality graphic solutions and technological advancement.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from heat transfer film consumption and sales in the USA is projected to exhibit exceptional growth with a CAGR of 10.4% through 2035, driven by the country's rapidly expanding customization sector, favorable consumer attitudes toward personalized products, and initiatives promoting design innovation across major fashion regions. The USA's position as a leading fashion market and increasing focus on customization development are creating substantial demand for high-quality heat transfer films in both commercial and retail markets. Major apparel manufacturers and specialty decoration providers are establishing comprehensive distribution capabilities to serve growing customization demand and emerging design opportunities.

Demand for heat transfer film products in Germany is expanding at a CAGR of 9.9%, supported by rising fashion sophistication, growing textile precision, and expanding decoration infrastructure. The country's developing manufacturing capabilities and increasing professional investment in quality apparel are driving demand for heat transfer films across both imported and domestically produced applications. International decoration companies and domestic manufacturers are establishing comprehensive distribution networks to address growing market demand for quality heat transfer films and graphic solutions.

Revenue from heat transfer film products in the UK is projected to grow at a CAGR of 9.6% through 2035, supported by the country's mature fashion market, established design culture, and leadership in quality standards. Britain's sophisticated textile infrastructure and strong support for customization are creating steady demand for both traditional and innovative heat transfer film varieties. Leading apparel manufacturers and specialty decoration providers are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Demand for heat transfer film products in China is projected to expand at a CAGR of 12.3% through 2035, driven by the country's emphasis on textile expansion, manufacturing leadership, and sophisticated production capabilities for apparel requiring specialized decoration varieties. Chinese manufacturers and distributors consistently seek professional-grade products that enhance design flexibility and support textile operations for both traditional and innovative fashion applications. The country's position as an Asian manufacturing leader continues to drive innovation in specialty heat transfer film applications and professional product standards.

Revenue from heat transfer film products in Japan is anticipated to grow at a CAGR of 9.4% through 2035, supported by the country's emphasis on quality manufacturing, design excellence standards, and advanced technology integration requiring efficient decoration solutions. Japanese designers and apparel manufacturers prioritize quality performance and precision graphics, making heat transfer films essential components for both traditional and modern fashion applications. The country's comprehensive manufacturing excellence and advancing textile patterns support continued market expansion.

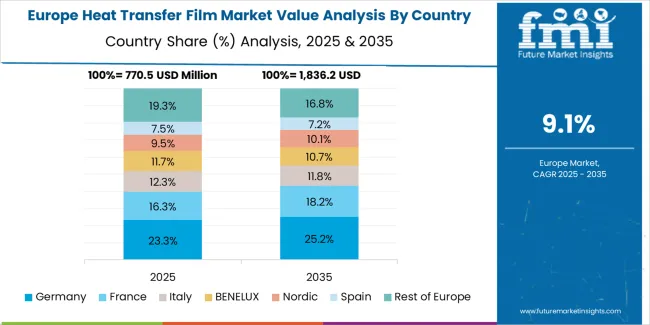

The Europe heat transfer film market is projected to grow from USD 1.1 billion in 2025 to USD 2.7 billion by 2035, recording a CAGR of 9.4% over the forecast period. Germany leads the region with a 33.0% share in 2025, moderating slightly to 32.5% by 2035, supported by its strong textile manufacturing culture and demand for premium, professionally engineered heat transfer films. The United Kingdom follows with 22.0% in 2025, easing to 21.5% by 2035, driven by a sophisticated fashion market and emphasis on quality and design standards. France accounts for 19.5% in 2025, rising to 20.0% by 2035, reflecting steady adoption of decoration solutions and fashion consciousness.

Italy holds 13.0% in 2025, expanding to 13.8% by 2035 as fashion innovation and specialty apparel applications grow. Spain contributes 6.5% in 2025, growing to 7.0% by 2035, supported by expanding textile manufacturing and professional decoration handling. The Nordic countries rise from 4.0% in 2025 to 4.5% by 2035 on the back of strong quality adoption and advanced design integration. BENELUX remains at 2.0% share across both 2025 and 2035, reflecting mature, premium-focused markets.

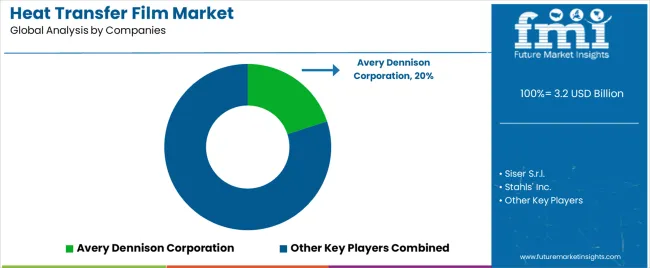

The heat transfer film market features 10–15 players with moderate concentration, where the top three companies collectively hold around 42–48% of global market share. Growth is driven by the expansion of apparel customization, rising demand from sportswear and athleisure brands, and increasing adoption of digital garment decoration technologies. The leading company, Avery Dennison Corporation, commands 20% market share, supported by its extensive range of high-performance heat transfer films, global production footprint, and strong partnerships with apparel manufacturers, fashion brands, and sportswear companies. Competition centers on film durability, wash resistance, color vibrancy, stretchability, and compatibility with modern heat-press and digital printing systems rather than price alone.

Market leaders such as Avery Dennison, Siser S.r.l., and Stahls’ Inc. maintain dominant positions by offering premium polyurethane and specialty heat transfer materials designed for cotton, polyester, blends, and performance fabrics. Their competitive strengths include innovative finishes, faster application technologies, and strong brand recognition in both commercial and craft markets.

Challenger companies including Hexis S.A., Poli-Tape Group, and Chemica S.A. compete by providing cost-effective, design-flexible films for small businesses, print shops, and textile decorators.

Additional competitive pressure comes from Specialty Materials LLC, SEF Textile, Neenah Inc. (Mativ), and Hanse Corporation, which strengthen their market presence through niche film offerings, regional distribution networks, and tailored solutions for fashion, promotional products, and customized apparel.

The success of heat transfer films in meeting professional decoration demands, design-driven customization requirements, and quality assurance integration will not only enhance graphic outcomes but also strengthen global textile capabilities. It will consolidate emerging regions' positions as hubs for efficient film manufacturing and align advanced economies with professional apparel decoration systems. This calls for a concerted effort by all stakeholders -- governments, industry bodies, suppliers, distributors, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How Distributors and Apparel Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.2 billion |

| Film Type | Polyurethane-Based Films, PVC-Based Films, Polyester-Based Films, Vinyl Films, Other Film Types |

| Backing Type | Hot Peel, Cold Peel, Warm Peel |

| End-Use Industry | Textile & Apparel, Footwear, Automotive Interiors, Promotional Products, Sports Equipment, Other Industries |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Other Regions |

| Countries Covered | United States, Germany, United Kingdom, China, Japan, and 40+ countries |

| Key Companies Profiled | Avery Dennison Corporation, Siser S.r.l., Stahls' Inc., Hexis S.A., Poli-Tape Group, Chemica S.A., Specialty Materials LLC (ThermoFlex Plus), SEF Textile, Neenah Inc. (Mativ), and Hanse Corporation |

| Additional Attributes | Dollar sales by film type, backing type, end-use industry, and region; regional demand trends, competitive landscape, technological advancements in adhesive engineering, graphic design integration initiatives, quality enhancement programs, and premium product development strategies |

The global heat transfer film market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the heat transfer film market is projected to reach USD 8.9 billion by 2035.

The heat transfer film market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in heat transfer film market are polyurethane-based films, pvc-based films, polyester-based films, vinyl films and other film types.

In terms of backing type, cold peel segment to command 44.0% share in the heat transfer film market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Heat Transfer Film Manufacturers

Heat Transfer Paper Market Analysis - Growth & Demand 2024 to 2034

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Film Market Trends & Industry Forecast 2024-2034

POF Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Non Heat Sealable Film Market

Vacuum Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Holographic Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vacuum Heat Shrink Film in UK Size and Share Forecast Outlook 2025 to 2035

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA