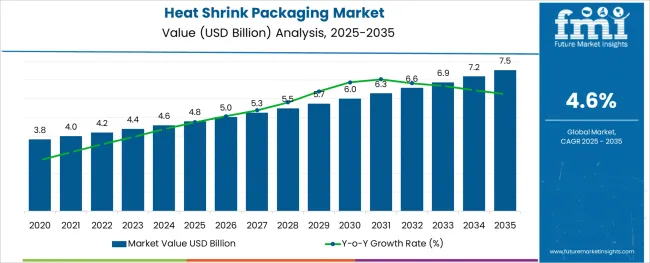

The Heat Shrink Packaging Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The heat shrink packaging market is experiencing sustained demand owing to the increasing need for protective, tamper evident, and cost efficient packaging solutions across industrial and consumer applications. Growing emphasis on product shelf life, contamination prevention, and visual appeal is driving the adoption of shrink films in sectors such as food and beverage, pharmaceuticals, and personal care.

Advancements in shrink film formulations, including improved clarity, durability, and environmental performance, are aligning with evolving regulatory and brand sustainability targets. Automated shrink wrapping systems are gaining traction for their efficiency in high speed packaging lines, further accelerating adoption.

As supply chains continue to prioritize secure transport and space efficient packaging formats, the market outlook remains strong with innovation and sustainability at the forefront of material and machinery development.

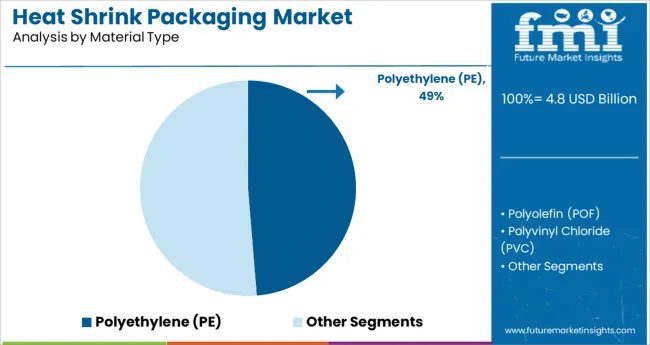

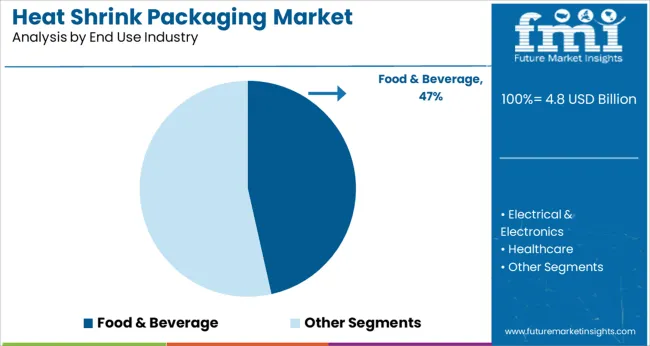

The market is segmented by Material Type and End Use Industry and region. By Material Type, the market is divided into Polyethylene (PE), Polyolefin (POF), Polyvinyl Chloride (PVC), and Polypropylene (PP). In terms of End Use Industry, the market is classified into Food & Beverage, Electrical & Electronics, Healthcare, Automotive, Consumer Goods, and Others (Personal Care & Cosmetics, Homecare). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment is projected to account for 48.70% of total revenue by 2025 within the material type category, making it the most dominant material in the market. This leadership is driven by polyethylene’s excellent shrinkability, durability, and cost effectiveness which make it suitable for a wide range of packaging formats.

Its flexibility, high impact resistance, and compatibility with various sealing technologies have enhanced its utility across multiple industries. Additionally, ongoing innovations in recyclable and bio based polyethylene blends are aligning with global sustainability goals, reinforcing its position in environmentally conscious packaging strategies.

The combination of performance efficiency and adaptability continues to make polyethylene the preferred choice for manufacturers and converters across global markets.

The food and beverage industry is expected to represent 46.50% of the total market revenue by 2025 within the end use industry category, emerging as the leading segment. This growth is driven by the rising need for hygienic, tamper evident, and visually appealing packaging in retail and logistics environments.

Heat shrink films offer enhanced protection against moisture, contaminants, and spoilage, supporting extended shelf life and freshness. Moreover, the ability to form fit packages and improve product display aesthetics has increased their appeal for beverages, frozen foods, and ready to eat products.

Regulatory standards for food safety and waste reduction are further encouraging the adoption of reliable and secure shrink packaging. As consumer demand for clean, transparent, and sustainable packaging continues to grow, the food and beverage sector remains at the forefront of driving innovation and volume in the heat shrink packaging market.

The heat shrink packaging market created an incremental opportunity of USD 3.8 Million during the historic years 2020 to 2024 and held the market value of USD 3.5 Billion in 2020 and reaching around USD 4.6 Billion by the end of 2024. Thus, the market for heat shrink packaging is expanding at a remarkable rate over the last few years.

The rapidly growing demand for packaged food and beverages, electronics, healthcare, etc. is driving the heat shrink packaging market. Due to high demand in these industries manufacturing units have started increasing their capacity to cope with the demand and satisfy their consumers. Heat Shrink packaging is generally used to increase its durability by combining multiple products into one package unit. This works best in packaging small products together in one combined package unit as it allows seamless and smooth transportation. It helps in lowering cost-effective methods and increases the shelf life of these products.

Also due to increasing economic growth all around the globe, there is a rise in demand for packaged foods. And this in turn is increasing the demand for the heat shrink packaging market.

Considering all the above-mentioned factors, the heat shrink packaging market is expected to increase at a CAGR of 4.6% with an incremental opportunity of USD 2.5 Billion. Over the next decade. Thus, the heat shrink packaging market is growing at a remarkable rate with a surprising increase in the food, healthcare sector, etc.

The heat shrink packaging market has increased widely in recent years. The food & beverage sector and healthcare sector have majorly been a part of the huge profit in the market. Heat shrink packaging is used for the packaging of various products. Heat shrink packaging is made of recyclable material such as polyolefin, polyethene (PE) polyvinyl chloride (PVC), etc. which can be further reused. With the recyclable feature, these heat shrink packaging bags are in huge demand.

Heat plays a vital role in the shrink packaging market. Heat machines are used to shrink-wrap the products to combine into one unit. So protection is the second major factor driving the heat shrink packaging market. When heat is generated to wrap the shrink bags to products, it makes a tight seal and combines the small products into one. Once this is done it gets very easy for transportation, as well as the product packaged, stays safe for a longer time. This helps the product to stay safe from moisture or dust from the environment. Also, heat shrink packaging bags are very affordable and it saves the space of bulky packages like boxes saving money and space for the manufacturers.

Therefore, these are the major factors which are driving the demand for the heat shrink packaging market. The most convenient reason is this process needs only two things that are heat and shrink packaging bags. This makes it very handy for the manufacturers.

The packaging industry has changed drastically in recent years. It has made many positive changes and has flourished enormously. The same is with the heat shrink packaging market. With increasing lifestyle changes, sustainability is the most important change everyone is trying to adopt. Manufacturers in this market are also looking for sustainable packaging solutions by eliminating toxic substances from the shrink packaging materials. This in turn recycles the product and helps to maintain the product performance.

When the products are shrink-packed and sealed, it is easy to identify if any tampering is done after the packaging as it holds its shape tight without loosening. Due to this many food and health care companies shrink their products now for the safety of their products to rectify the tampering if done in future. Thus these are the latest market trends driving the heat shrink packaging market.

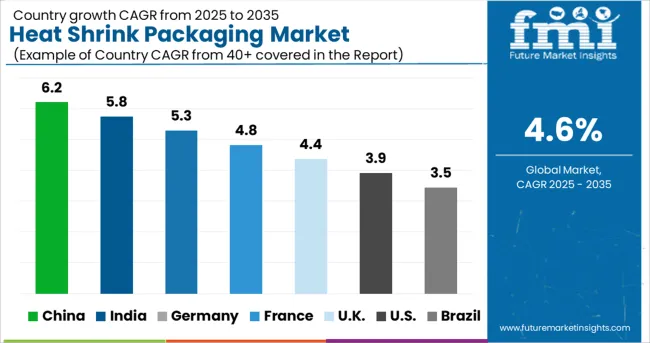

The China market in the heat shrink packaging market is expected to observe a rise at a CAGR of 5.0% by 2035 according to FMI forecast. According to the Ministry of Industry and Information Technology, a state agency of people’s republic of china published that major beverage producers in China registered double-digit growth in output last year. This results in increasing growth for heat shrink packaging market. As China has the largest population the demand for packaged food, healthcare, etc. is increasing day by day due to rising disposable income.

Thus, the market value of China in heat shrink packaging market is anticipated to reach at USD 7.5 Billion by the year 2035.

The Indian heat shrink packaging market is projected to create an incremental opportunity of USD 268 Million during the forecast period. The reason behind the same is the growing healthcare and food and beverage sector in the end use industry.

According to the India Brand Equity foundation, Government of India, the packaging market in India has grown rapidly over the past few years, which is expected to continue over the forecasted period. India's exposure to technology has made a significant impact on its growth. Thus, the rise in the packaging of food products in turn is giving an increase in the heat shrink packaging market.

During the forecast period, the polyethylene (PE) material is projected to hold the majority of the market share which is anticipated to account for a CAGR of 3.8% by the end of 2035. This material is majorly used for heat shrink packaging as it has strong heat sealing power. It has variations like low density, linear low density and high-density temperature shrink. Another benefit of Polyethylene material is that it is available at the lowest cost to manufacturers.

There is a rising demand for the usage of recycled low-density polyethylene (LDPE) in heat shrink packaging production which is driving the market growth. Thus, this is giving a huge growth opportunity to the heat shrink packaging market. As per FMI analysis Polyethylene material is anticipated to total revenue of USD 7.5 Billion by 2035.

Food & beverage is the largest end-use in the heat shrink packaging market by having the highest market share, accounting for 49% of the total market. The expansion of the retail network is expected to impact the demand for packaged foods resulting in heat shrink packaging market growth.

Due to changing lifestyles toward convenient consumption of food and beverages, the demand in this end-use industry has boosted positively. The FMI analysis anticipates that during the forecast period, the food and beverage end-use segment for the heat shrink packaging market is expected to make an incremental opportunity of USD 1.0 Billion by the year 2035.

The above images present the BPS analysis, which analyses the variation in market shares between 2025 and 2035.

As shown in the above image Polyolefin (POF) shows a huge growth as it has witnessed a maximum gain of 350 basis points in market shares during the 10 years between 2025 and 2035. Polyolefin (POF) has flexible and strong packing which ensures tight sealing and consistency.

The healthcare segment is estimated to see a decent growth of 250 basis points, with increasing usage of healthcare products across the globe the end-use segment is expected to reflect lucrative growth in the heat shrink packaging market.

The heat shrink packaging market is differentiated due to the presence of many market players around the world. With the presence of different regional and local competitors in the market, the heat shrink packaging market is highly competitive. Key players are focusing on various different strategies to increase their revenue and market share in the global market such as capacity expansion, mergers & acquisitions, expansions, collaborations, and partnerships.

Some of the recent developments in the market are as follows -

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segment Covered | Material type, End Use Industry, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Russia, China, Japan, India, GCC Countries, Australia |

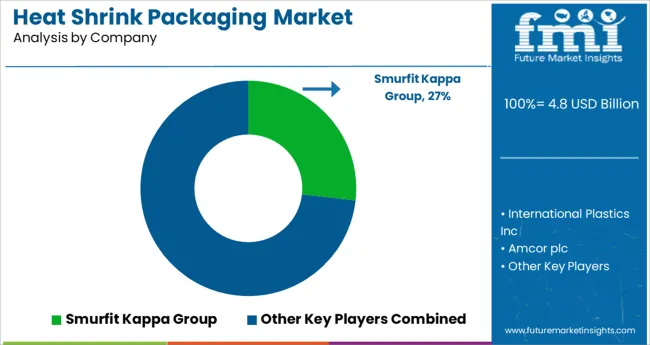

| Key Companies Profile | Smurfit Kappa Group; International Plastics Inc; Amcor plc; Berry Global Inc; Dow Chemical Company; Traco Manufacturing Inc; LyondellBasell Industries N.V; Bonset America Corporation; Allen Plastic Industries Co., Ltd.; FlexiPack Group; Bagla Group; Huayu Packing Machinery; HUBEI HYF PACKAGING CO., LTD.; KOHJIN Film & Chemicals Co. Ltd.; Unik Polypack; RETAL Industries LTD.; Intertape Polymer Group Inc; Vintech Polymers Pvt. Ltd.; J K POLYFILM; Shenzhou Packing Machine Co., Ltd. |

| Customization | Available Upon Request |

The global heat shrink packaging market is estimated to be valued at USD 4.8 billion in 2025.

It is projected to reach USD 7.5 billion by 2035.

The market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types are polyethylene (pe), polyolefin (pof), polyvinyl chloride (pvc) and polypropylene (pp).

food & beverage segment is expected to dominate with a 46.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heat Treating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA