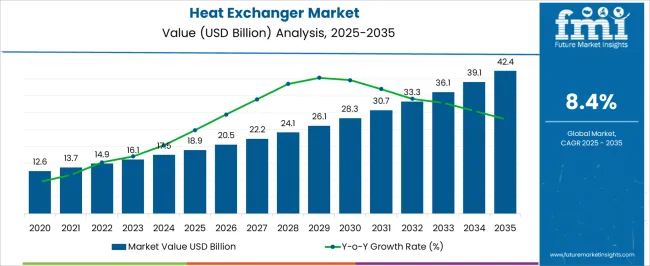

The heat exchanger market, valued at USD 18.9 billion in 2025 and projected to reach USD 42.4 billion by 2035 at a CAGR of 8.4%, shows strong dependence on technological contribution patterns. The growth curve reveals steady expansion across applications, driven by demand in power generation, oil and gas, HVAC, and chemical processing.

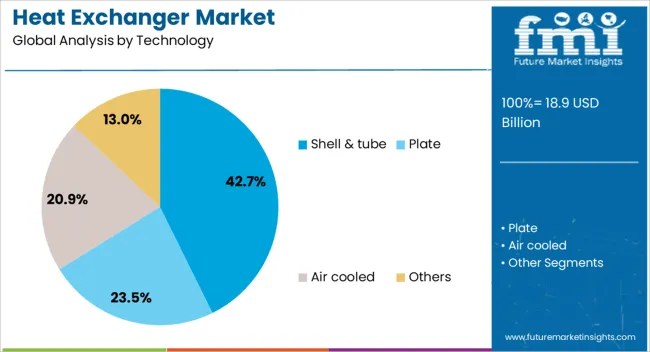

The contribution of technology types can be observed in varying scales, with shell and tube exchangers expected to hold a consistent share due to their reliability in heavy-duty operations. Their presence in refineries and chemical industries ensures stable demand despite competition from compact systems. Plate heat exchangers are projected to contribute significantly, owing to their efficiency in space optimization and energy recovery. Their modular design and ability to handle varying thermal loads make them critical in HVAC and food processing. Air-cooled exchangers, on the other hand, are contributing increasingly as industries move toward water conservation and environmental compliance. These systems reduce dependency on water resources while ensuring performance in power and petrochemical applications.

The contribution by technology reflects a transition from traditional large-scale units toward more compact, efficient, and environmentally compliant solutions. Market data suggests that hybrid and advanced designs integrating corrosion resistance and high thermal efficiency will account for rising adoption, ultimately shaping the technology-driven trajectory of this industry.

The heat exchanger market is recognized as a vital part of process industries and energy infrastructure. It is estimated to hold 7.8% of the global HVAC equipment market, due to its widespread use in heating and cooling systems. In industrial process equipment, a 5.6% share is assessed, as heat transfer devices are crucial for maintaining process efficiency.

Within power generation equipment, the market accounts for 6.9%, supporting turbines, condensers, and nuclear systems. In the chemical processing equipment market, a 4.3% contribution is observed, since heat exchangers are essential for temperature control and reaction optimization. Oil and gas equipment represents 5.1%, as heat exchangers play a central role in refining and LNG operations.

Recent industry trends highlight the shift toward compact and high-efficiency designs such as plate and microchannel exchangers. Groundbreaking developments include the use of additive manufacturing for custom geometries and corrosion-resistant alloys for harsh environments.

Key players are advancing strategies through modular heat exchanger solutions that reduce downtime and improve system scalability. Digital monitoring systems and IoT integration are being adopted for predictive maintenance and energy efficiency optimization. Companies are also investing in eco-friendly refrigerants and heat recovery technologies to support carbon reduction targets. Expansion in renewable energy projects, particularly in geothermal and solar thermal applications, has further expanded growth prospects.

| Metric | Value |

|---|---|

| Heat Exchanger Market Estimated Value in (2025 E) | USD 18.9 billion |

| Heat Exchanger Market Forecast Value in (2035 F) | USD 42.4 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The heat exchanger market is experiencing steady expansion, supported by the growing demand for efficient thermal management solutions across industrial, commercial, and energy sectors. Market performance is being shaped by rising energy efficiency standards, the need for optimized process performance, and increasing investment in industrial infrastructure.

Technological advancements in design, materials, and manufacturing have improved operational reliability, corrosion resistance, and maintenance cycles, enhancing adoption across diverse applications. Global market growth is also being driven by the expansion of power generation facilities, the modernization of chemical processing plants, and heightened activity in the oil and gas sector.

Additionally, stricter environmental regulations are encouraging the replacement of outdated equipment with more sustainable and high-efficiency systems. Over the forecast period, increasing integration of advanced monitoring systems, coupled with the development of compact and customized solutions, is expected to support continued market penetration and revenue growth worldwide.

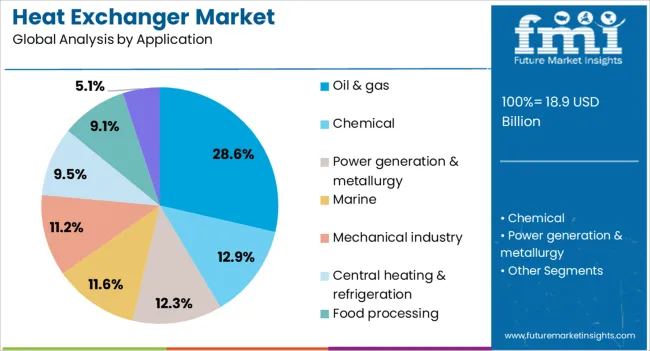

The heat exchanger market is segmented by technology, application, and geographic regions. By technology, heat exchanger market is divided into Shell & tube, Plate, Air cooled, and Others. In terms of application, heat exchanger market is classified into Oil & gas, Chemical, Power generation & metallurgy, Marine, Mechanical industry, Central heating & refrigeration, Food processing, and Others. Regionally, the heat exchanger industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shell & tube segment, holding 42.70% of the technology category, leads the market due to its proven durability, high thermal efficiency, and ability to operate under extreme pressure and temperature conditions. Its adaptability to a wide range of fluids and compatibility with multiple industrial processes has reinforced its widespread use in petrochemical plants, refineries, and power stations.

The segment benefits from design flexibility, allowing for customization based on specific operational requirements, while ease of maintenance and long service life further support its dominance. Continuous improvements in tube materials, baffle configurations, and sealing techniques have enhanced performance and reduced downtime. Additionally, the shell & tube design remains the preferred choice in large-scale industrial operations where reliability and cost-effectiveness are paramount, ensuring its sustained market leadership.

The oil & gas segment, accounting for 28.60% of the application category, dominates due to the sector’s heavy reliance on heat exchangers for critical processes such as gas cooling, crude oil heating, and waste heat recovery. Its leadership is supported by the global expansion of refining capacity, increased offshore and onshore exploration activities, and the modernization of existing facilities to meet stricter efficiency and emission standards.

Heat exchangers in this segment are required to withstand harsh operating environments, including high pressures, corrosive fluids, and extreme temperatures, making performance reliability a key adoption driver. Technological enhancements, such as advanced anti-fouling coatings and compact designs, are enabling improved energy recovery and operational efficiency.

As global energy demand persists and investments in liquefied natural gas (LNG) and petrochemical projects increase, the oil & gas application is expected to remain a core growth driver for the market.

The market has emerged as a fundamental segment within the global industrial equipment sector, serving applications across power generation, petrochemicals, oil and gas, HVAC, food processing, and automotive industries. These devices are vital for efficient thermal management, energy conservation, and process optimization.

Rising energy efficiency requirements, stricter emission regulations, technological innovations, and the expansion of industrial infrastructure worldwide have influenced demand growth. Price competitiveness, material advancements, lifecycle performance expectations, and sustainability commitments have also shaped the market. Companies that can balance reliability with innovation are increasingly gaining strategic importance in the global value chain.

The expansion of heavy industries, oil refining, power generation, and chemical processing has significantly increased reliance on heat exchangers. Their role in energy recovery and efficient heat transfer processes has become indispensable for maintaining operational productivity. With global industrial output rising and energy consumption intensifying, the deployment of heat exchangers in both new facilities and retrofitting projects has been reinforced. The integration of compact designs for limited space applications and enhanced surface technologies for improved thermal conductivity has further supported adoption. Industrialization across emerging markets has provided consistent demand streams, strengthening the overall resilience of the sector.

Stricter government regulations on emission reduction and energy efficiency have compelled manufacturers to design advanced heat exchanger systems. Environmental frameworks have reinforced the transition toward more efficient thermal equipment that minimizes energy wastage. Standards set by agencies in Europe, North America, and Asia have encouraged the replacement of outdated equipment with modern systems. Manufacturers have responded by incorporating enhanced flow dynamics, reduced fouling tendencies, and higher durability materials into their product lines. The regulatory environment has therefore served as both a challenge and an opportunity, driving innovation while compelling industries to upgrade.

Material advancements have played a crucial role in the evolution of heat exchanger technology. The use of stainless steel, nickel alloys, titanium, and corrosion resistant composites has enhanced durability under high pressure and high temperature conditions. These materials have enabled performance improvements in sectors such as oil and gas, marine, and chemical processing, where operating conditions are particularly demanding. Lightweight designs using aluminum have gained attention in automotive and aerospace industries for fuel efficiency. By optimizing material selection, manufacturers have been able to extend lifecycle performance, reduce maintenance requirements, and increase operational safety, positioning materials as a key competitive factor.

The growth of renewable energy sources has widened the application scope for heat exchangers, particularly in concentrated solar power, geothermal energy, biomass plants, and wind turbine cooling systems. Their role in efficient heat transfer and energy recovery has been recognized as critical for optimizing renewable generation processes. The push toward clean energy has amplified the focus on sustainable heat exchanger technologies capable of operating with minimal environmental footprint. Hybrid systems integrating waste heat recovery and renewable energy storage solutions have also benefited from heat exchanger deployment. This trend has provided a future-oriented growth avenue that extends beyond traditional industrial sectors.

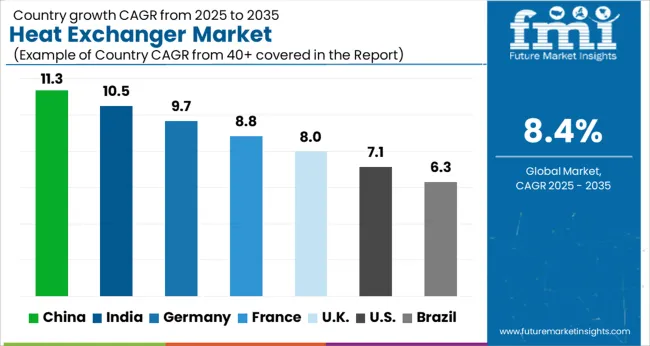

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

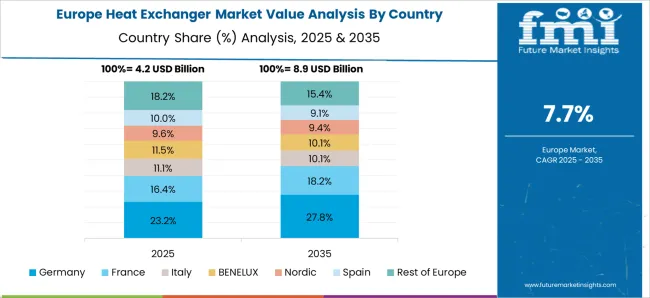

China led the heat exchanger market with a forecast CAGR of 11.3%, supported by large scale industrialization and rising demand across power generation and chemical processing. India followed with 10.5%, driven by rapid expansion of energy infrastructure and growth in oil and gas operations. Germany recorded 9.7%, where strong engineering expertise and emphasis on efficiency in industrial equipment contributed to steady adoption. The United Kingdom registered 8.0%, supported by investments in renewable energy projects and upgrading of thermal systems. The United States accounted for 7.1%, influenced by requirements in HVAC systems, petrochemical industries, and food processing facilities. Collectively, these nations represent the backbone of global demand and technological advancements shaping the heat exchanger market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 11.3% in the market, influenced by increasing industrial output, rising energy efficiency needs, and growing chemical processing activities. Investments in power generation facilities and oil refining units are creating strong demand for advanced heat transfer solutions. Manufacturers are adopting high-performance materials and compact designs to improve thermal efficiency while reducing operational costs. With rapid development in renewable energy projects, demand for heat exchangers in solar and wind power applications is also increasing. The Chinese market outlook remains optimistic, driven by continuous industrial expansion and government initiatives to modernize energy infrastructure.

India is expected to register a CAGR of 10.5% in the heat exchanger market, supported by expanding chemical, petrochemical, and power generation sectors. Growing investments in energy infrastructure, coupled with industrialization, are creating strong opportunities for heat exchanger deployment. The food and beverage sector is also witnessing increased use of these systems for processing and storage requirements. Adoption of compact and cost-effective designs is becoming more prominent as companies focus on improving efficiency. With emphasis on renewable power, demand for specialized heat exchangers in solar thermal and biomass plants is gaining traction, indicating sustained growth potential.

Germany is forecasted to grow at a CAGR of 9.7% in the market, fueled by strong demand from the automotive, chemical, and manufacturing sectors. The transition toward energy-efficient solutions is encouraging adoption of advanced materials and optimized designs. Power plants and industrial facilities are integrating high-performance exchangers to reduce emissions and improve operational reliability. With Germany being a leader in renewable energy integration, the role of heat exchangers in wind, solar, and biomass applications is gaining importance. The market outlook is supported by technology innovation, regulatory frameworks, and rising industrial investments.

The United Kingdom is estimated to achieve a CAGR of 8.0% in the market, led by growth in energy infrastructure modernization and industrial processing. Expanding requirements in power plants, oil refining, and food processing facilities are supporting consistent adoption. The shift toward low-carbon technologies is also creating opportunities for heat exchangers in renewable and district heating systems. Market participants are focusing on compact, durable, and corrosion-resistant designs to improve lifecycle efficiency. As industries pursue sustainable operations, the UK market is expected to advance steadily with emphasis on innovation and energy transition.

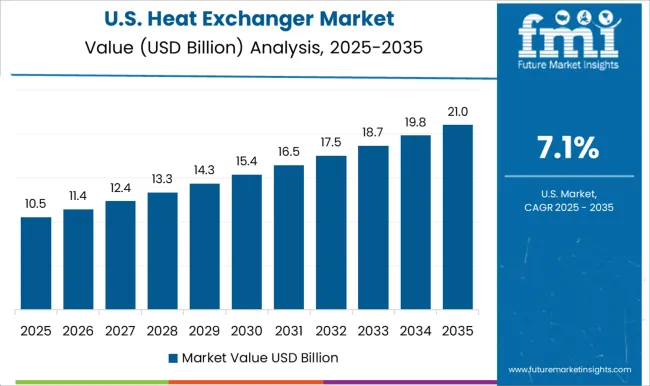

The United States is anticipated to witness a CAGR of 7.1% in the market, influenced by steady demand from power generation, HVAC, and chemical industries. Increased focus on improving energy efficiency and regulatory pressure for emission control are accelerating adoption. The oil and gas sector continues to remain a key contributor, with investments in refining and petrochemical capacity supporting consistent demand. Technological advances in compact plate and air-cooled exchangers are gaining traction due to their efficiency and cost benefits. The US market outlook remains positive, driven by industrial diversification and modernization of energy systems.

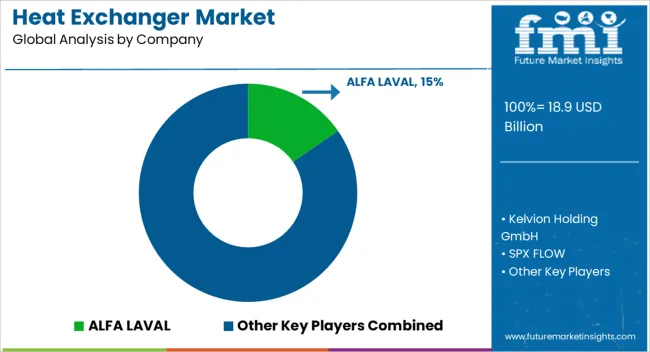

The market is defined by its critical role in industries such as power generation, oil and gas, chemicals, food and beverages, HVAC, and water treatment. ALFA LAVAL remains a global leader with a diverse portfolio of advanced thermal solutions serving energy and processing industries. Kelvion Holding GmbH has developed a strong presence through its wide range of plate and finned tube exchangers that support heavy industrial applications. SPX FLOW continues to expand its influence by providing highly engineered thermal transfer systems tailored to process industries and infrastructure sectors.

IHI Corporation and Xylem are prominent contributors with specialized designs that optimize energy efficiency in large-scale installations. Danfoss and API Heat Transfer strengthen the market with compact and customizable solutions for HVAC and industrial operations. FUNKE Wärmeaustauscher, Thermowave, and HISAKA WORKS further enhance competition with their specialized engineering focus. SWEP International AB, Accessen Group, and Doosan Power Systems provide modular and high-performance systems for demanding energy markets. Larsen & Toubro, Koch Heat Transfer, HRS Heat Exchangers, Thermofin, Enerquip Thermal Solutions, Mason Manufacturing, and Wessels Company complete the competitive landscape with innovations that target regional and global demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.9 Billion |

| Technology | Shell & tube, Plate, Air cooled, and Others |

| Application | Oil & gas, Chemical, Power generation & metallurgy, Marine, Mechanical industry, Central heating & refrigeration, Food processing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ALFA LAVAL, Kelvion Holding GmbH, SPX FLOW, IHI Corporation, Xylem, Danfoss, API Heat Transfer, FUNKE Wärmeaustauscher Apparatebau GmbH, Thermowave GmbH, HISAKA WORKS LTD., SWEP International AB, Accessen Group Co., Ltd., Doosan Power Systems, LARSEN & TOUBRO LIMITED, Koch Heat Transfer Company, HRS Heat Exchangers, Thermofin, Enerquip Thermal Solutions, Mason Manufacturing LLC, and Wessels Company |

| Additional Attributes | Dollar sales by exchanger type and application, demand dynamics across HVAC, chemical, and power generation sectors, regional trends in industrial equipment adoption, innovation in thermal efficiency, compact design, and corrosion resistance, environmental impact of energy consumption and material usage, and emerging use cases in renewable energy systems and advanced cooling technologies. |

The global heat exchanger market is estimated to be valued at USD 18.9 billion in 2025.

The market size for the heat exchanger market is projected to reach USD 42.4 billion by 2035.

The heat exchanger market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in heat exchanger market are shell & tube, plate, air cooled and others.

In terms of application, oil & gas segment to command 28.6% share in the heat exchanger market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Moisture Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Plate Heat Exchanger Market Growth - Trends & Forecast 2025 to 2035

Brewery Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Automotive Heat Exchanger Market

Brazed Plate Heat Exchangers Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

High Pressure Heat Exchanger Market

Plate and Frame Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

CDU Heat Exchanger Anti-foulant Market 2025-2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heat Treating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA