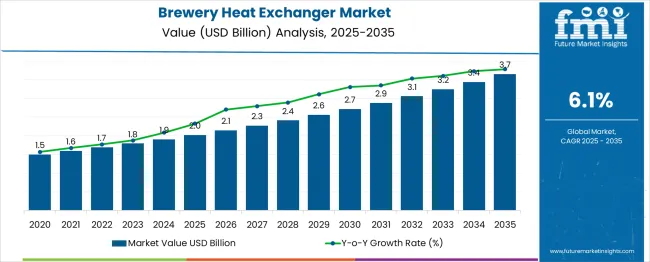

The Brewery Heat Exchanger Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The brewery heat exchanger market is observing steady growth as breweries increasingly prioritize process efficiency, product quality, and energy conservation. Rising production volumes in craft and commercial breweries have accelerated the demand for efficient thermal management systems that can handle high loads while maintaining hygiene standards.

Stringent regulatory norms for sanitation and sustainability are further motivating adoption of advanced heat exchangers that minimize water and energy consumption. Innovations in design and materials aimed at reducing fouling and enhancing heat transfer efficiency are paving the way for broader deployment.

Future market expansion is anticipated to be supported by investments in modernization of brewing facilities, growing preference for automated and modular systems, and the need to align with environmental and operational benchmarks set by leading breweries. Strong emphasis on reducing operational costs while maintaining consistent product quality continues to shape the trajectory of this market.

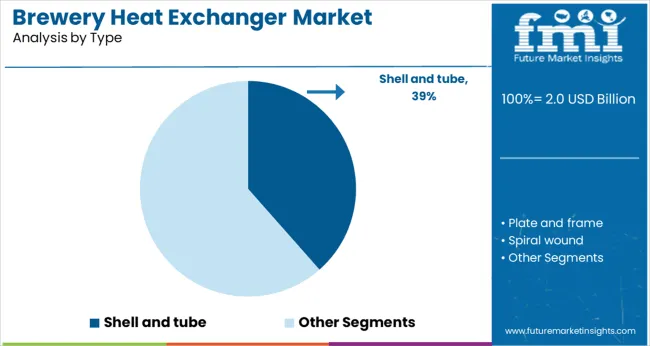

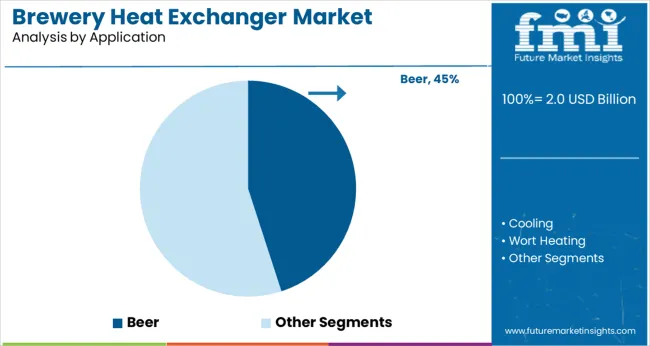

The market is segmented by Type, Application, and Distribution Channel and region. By Type, the market is divided into Shell and tube, Plate and frame, Spiral wound, and Immersion coil. In terms of Application, the market is classified into Beer, Cooling, and Wort Heating.

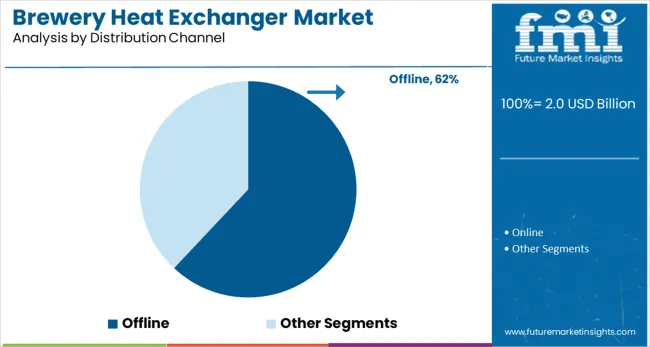

Based on Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the shell and tube segment is expected to hold 38.5% of the total market revenue in 2025, establishing itself as the leading type. This dominance is attributed to its proven reliability in handling large-scale heat transfer operations and its ability to manage varying flow rates and pressures without compromising performance.

The robust construction and ease of maintenance have allowed shell and tube heat exchangers to remain the preferred choice in breweries where durability and continuous operation are critical. The flexibility to handle different media and withstand rigorous cleaning protocols without significant wear has reinforced their widespread deployment

Additionally, their modular design and availability in diverse configurations have facilitated customization to specific brewing processes, ensuring optimal energy utilization and operational efficiency. These advantages have collectively sustained the shell and tube segment’s leadership in the market.

In terms of application, the beer segment is projected to account for 45.0% of the market revenue share in 2025, positioning it as the top application area. This leadership has been driven by the substantial production volumes of beer globally and the necessity for precise temperature control during brewing stages such as wort cooling and fermentation.

The demand for consistent flavor, clarity, and microbiological stability in beer has necessitated the integration of advanced heat exchanger systems in the brewing process. Efficiency in managing high thermal loads while maintaining hygienic conditions has been crucial in supporting the beer segment’s dominance.

The scalability of heat exchanger solutions to meet both craft and industrial brewery demands has further entrenched their application in beer production. This alignment with operational needs and quality standards has ensured the continued prominence of the beer application segment in the market.

When segmented by distribution channel, the offline segment is forecast to capture 62.0% of the market revenue in 2025, reinforcing its position as the leading channel. This dominance is supported by the technical complexity and high-value nature of brewery heat exchangers, which has favored in-person consultation and direct sales over digital alternatives.

Buyers have preferred offline channels to benefit from personalized service, site assessments, and after-sales support, all of which are critical in ensuring correct specification and installation.

The offline presence of specialized distributors and manufacturers has facilitated stronger relationships with breweries, allowing for tailored solutions and maintenance contracts. Additionally, the ability to physically inspect equipment and engage with experts during procurement has bolstered trust and confidence among buyers, sustaining the offline segment’s leading share in the market.

Unique designs are used by brewery heat exchanger manufacturers to increase efficiency and suit the processing demands of varied commodities with different viscosities. For instance, plate heat exchanger technology is essential in applications for dairy, beverages, and processed foods. Thus, the demand for brewery heat exchangers is anticipated to rise over the forecast period. A significant market potential for plate & frame exchangers is being created by the rising need for energy-efficient heat exchange systems.

The global brewery heat exchanger market has undergone significant transformation in recent years. The most common and widely used heat recovery equipment is brewery heat exchangers. To meet long-term sustainability goals, regulatory agencies are working to minimize energy consumption, which is driving the global market for brewery heat exchangers. In many countries, the usage of brewery heat exchangers has significantly expanded in recent years.

The brewery heat exchanger market is expected to grow significantly in the coming years. This is due to the increasing demand for beer and other alcoholic beverages. The heat exchanger is an essential piece of equipment in a brewery, as it helps to keep the beer at a consistent temperature. There are a variety of different types of brewery heat exchangers available on the market, and each has its advantages and disadvantages. It is important to choose the right type of heat exchanger for your brewery, as this will affect the quality of your beer.

| Attribute | Details |

|---|---|

| Brewery Heat Exchanger Market Estimated Size (2025) | USD 1,794.3 million |

| Brewery Heat Exchanger Market Forecast Size (2035) | USD 3,305.4 million |

| Brewery Heat Exchanger Market (CAGR) | 6.1% |

| Share of Germany in Brewery Heat Exchanger Market | 23.8% |

According to Future Market Insights, the brewery heat exchanger market was growing at a CAGR of 4.2% to reach USD 1,379.8 million in 2025 from USD 1,170.4 million in 2020.

The market is driven by various factors such as the increasing demand for beer and other alcoholic beverages and the need for efficient cooling solutions in breweries. The rising popularity of craft beer and the increasing number of microbreweries are also driving the growth of the brewery heat exchanger market. However, the high cost of installation and maintenance is restraining the growth of this market.

The food and beverage industry is one of the major industries propelling the sales of the brewery heat exchanger. Heat exchangers are used to transfer heat from one fluid to another, and are an essential component in many food and beverage processing applications. The use of heat exchangers can help breweries save energy and improve product quality. The food and beverage industry is a major user of heat exchangers. The brewing process itself relies on heat exchangers to transfer heat from the hot wort to the cooling water. Heat exchangers are also used in other parts of the brewing process, such as during fermentation and pasteurization.

To maintain high levels of productivity, breweries need to have reliable heat exchangers. The beer and wort applications are expected to see the greatest growth in the brewery heat exchangers market. This is due to the increasing demand for craft beer and the need for efficient brewing processes.

The beer and wort applications are expected to see the greatest growth in the brewery heat exchangers market. This is due to the increasing demand for craft beer and the need for efficient brewing processes. The use of heat exchangers helps breweries save time and energy by efficiently heating or cooling liquids.

There are a variety of different types of heat exchangers available on the market, each with its benefits. Plate heat exchangers are often used in breweries because they provide a high level of thermal efficiency.

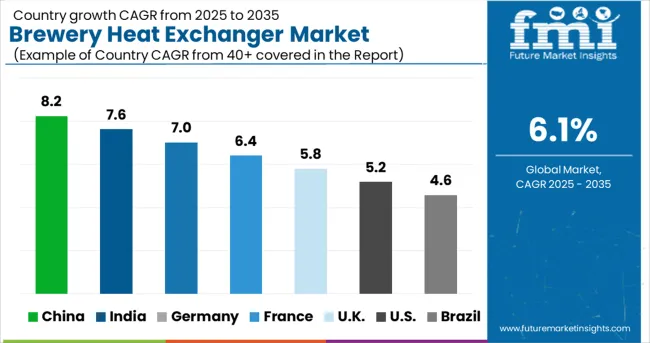

China is expected to be the fastest-growing market for brewery heat exchangers during the forecast period. The demand for beer in the China and India is growing at a rapid pace, owing to the changing lifestyles of people and the increasing disposable incomes. In addition, the rising number of bars and pubs in the region is also driving the growth of the brewery heat exchangers market. Moreover, the presence of a large number of small and medium-sized breweries in the region is providing a boost to market growth.

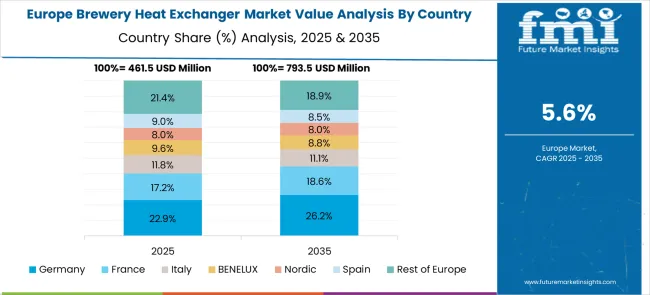

Germany currently maintains the greatest share of the European brewery heat exchangers market, owing to the region's export-based nature and substantial installed brewery heat exchanger plant capacity. Furthermore, it is home to the majority of the market's major companies.

The European market is a very attractive market for brewery heat exchangers due to its large size and potential for growth. The market is also appealing due to its regulatory environment, which is much more favorable to the brewing industry than other markets such as the United States. Finally, Europe has a long history of brewing and a strong culture of beer consumption, making it an ideal place to sell brewery heat exchangers.

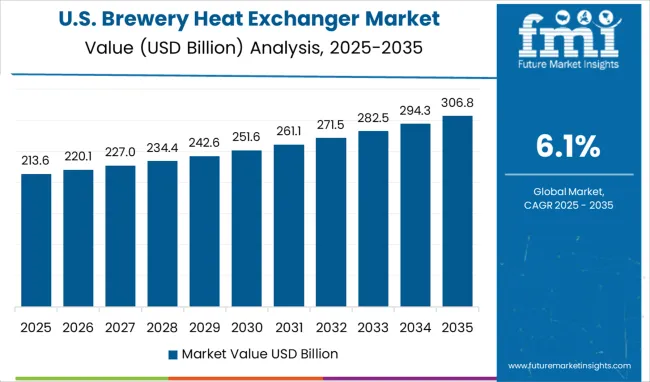

United States' dominance in the market is due to several factors. First, there is a large and well-established brewing industry in North America. This provides a ready market for heat exchangers and other brewing equipment. Second, brewery heat exchanger manufacturers have been able to capitalize on this demand by developing innovative and efficient heat exchangers. This has allowed them to gain a significant share of the global market. Finally, North American brewers have also been able to benefit from economies of scale, which have helped to lower costs and improve competitiveness.

The number of players in the market has increased significantly, and the level of competition has also intensified. In addition, the players are also investing heavily in research and development to gain a competitive edge over their rivals.

The major approach used by market participants to improve their market position was new product releases. Expansions, mergers and acquisitions, and contracts, agreements, and partnerships are some of the other tactics employed by manufacturers to capture a larger share of the market.

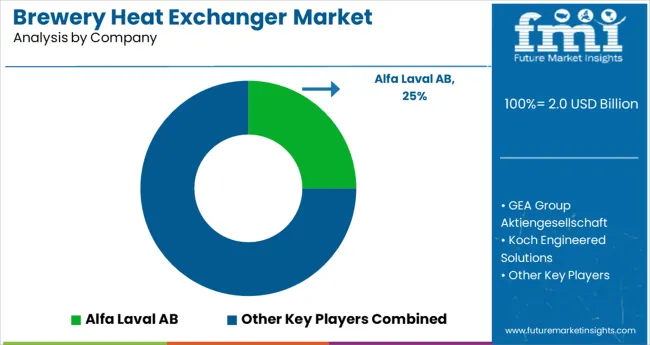

Alfa Laval, a Swedish firm, to Lead in Terms of Manufacturing Brewery Heat Exchanger Equipment

Over the next several years, the firm will primarily focus on Research and Development (R&D) to create new goods and services, as well as build highly efficient heat exchangers. It also produces high-quality items, which contributes to the company's excellent brand image in this industry. Alfa Laval introduced a new product for cooling data centers, which is another area that is predicted to develop rapidly shortly.

Alfa Laval AB is committed to optimizing processes, supporting sustainable growth and development, and moving ahead - always going above and beyond to help clients accomplish their business goals and sustainability goals. Alfa Laval has a workforce of 17,500 individuals. In 2020, revenues amounted to SEK 46.5 million (about EUR 4.4 million). The stock is listed on the Nasdaq OMX platform.

The Company's product portfolio of plate & frame heat exchangers includes the following:

Some of the Major Players in the Market for Brewery Heat Exchangers

| Attribute | Details |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2024 |

| Market analysis | million in value |

| Key regions covered | North America; Eastern Europe; Western Europe; Japan; South America; Asian Pacific; Middle east and Africa |

| Key countries covered | The USA, Germany, France, Italy, Canada, The United Kingdom, Spain, China, India, Australia |

| Key segments covered | Type, Application, Distribution channel, Region |

| Key companies profiled | GEA Group; Aktiengesellschaft; Alfa Laval AB; Koch Engineered Solutions; Swenson Technology; Praj Industries Ltd.; PWT Holdings Ltd.; Zenith Brewing Co.; HRS Process Systems |

| Report Coverage | Market Forecast, Company Share Analysis, DROT Analysis, Market Dynamics, Competitive Landscape, Challenges, Strategic Growth Initiatives |

| Customization and Pricing |

Available upon request |

The global brewery heat exchanger market is estimated to be valued at USD 2.0 billion in 2025.

It is projected to reach USD 3.7 billion by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are shell and tube, plate and frame, spiral wound and immersion coil.

beer segment is expected to dominate with a 45.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Moisture Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Plate Heat Exchanger Market Growth - Trends & Forecast 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Automotive Heat Exchanger Market

Brazed Plate Heat Exchangers Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

High Pressure Heat Exchanger Market

Plate and Frame Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

CDU Heat Exchanger Anti-foulant Market 2025-2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA