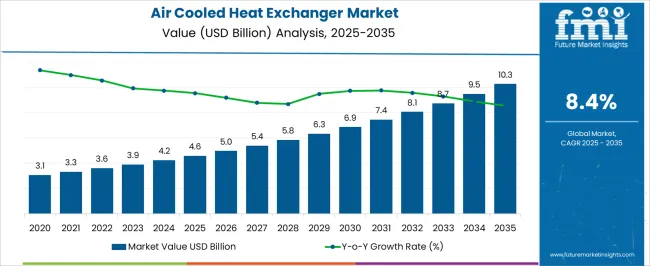

The air cooled heat exchanger market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 10.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

This climb is a reflection of how cooling technologies are being prioritized in energy-intensive industries that demand efficiency, reliability, and reduced operational risks. Year-on-year expansion from USD 4.6 billion to USD 6.3 billion by 2029 and further to USD 10.3 billion by 2035 reveals that end-users are steadily shifting toward air-cooled systems in place of water-based solutions, given constraints on water usage and the requirement for equipment longevity. This growth is not simply a replacement trend but a deliberate choice by industries to align performance, cost efficiency, and long-term resilience in their infrastructure. By 2035, the air cooled heat exchanger market nearly doubles its value, a clear demonstration of its expanding role in industrial plants, power generation facilities, and heavy processing sectors.

What stands out in this comparison is the steady yet strong rise from USD 4.6 billion in 2025 to USD 9.5 billion by 2034, before reaching USD 10.3 billion the following year, showing a disciplined growth curve. It is my opinion that such a consistent trajectory points to air-cooled exchangers being treated not just as equipment but as critical assets that minimize dependency on external water resources while offering operational stability. The market’s expansion emphasizes how equipment choices are being driven by reliability and long-term economic logic rather than short-term fixes.

| Metric | Value |

|---|---|

| Air Cooled Heat Exchanger Market Estimated Value in (2025 E) | USD 4.6 billion |

| Air Cooled Heat Exchanger Market Forecast Value in (2035 F) | USD 10.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The air cooled heat exchanger market has secured a substantial position across multiple parent sectors, with its relevance most visible in industries seeking efficient cooling without dependence on water-based systems. Within the industrial heat exchangers market, air cooled models account for nearly 20–22%, as manufacturers increasingly deploy them for simplified maintenance and cost efficiency. In the power generation equipment market, they hold around 15–17% share, given their crucial role in cooling turbines and engines in areas where water resources are scarce. The oil and gas processing equipment market reflects a higher dependency, with close to 25–28% of share, since upstream and midstream operations demand durable and reliable cooling solutions. In chemical processing equipment, the segment contributes nearly 18–20%, largely because plants rely on robust air-cooled units to handle corrosive fluids and high-temperature operations.

The HVAC and refrigeration systems market also records about 12–14% share, where air cooled exchangers are adopted for commercial and industrial climate control solutions. While detractors may argue that air cooled systems are less efficient than water-cooled alternatives in certain climates, the balance of lower water usage, reduced operating costs, and long-term reliability makes them highly competitive. In my opinion, their increasing integration into diverse applications signals a structural shift, with air cooled exchangers gradually emerging as a preferred standard in industries where operational dependability outweighs peak efficiency benchmarks.

The air cooled heat exchanger market is expanding steadily, supported by rising energy efficiency requirements, stricter environmental regulations, and increased industrial adoption in sectors where water scarcity makes air cooling more viable than liquid-based alternatives. Technological innovations in fan design, heat transfer surfaces, and modular construction have enhanced performance while reducing maintenance costs.

Growing demand for cost-effective cooling solutions in power generation, petrochemicals, and heavy manufacturing has reinforced market growth. Additionally, the adoption of renewable energy infrastructure and expansion of oil & gas operations in remote areas have increased reliance on air cooled systems due to their minimal water requirements.

Looking ahead, the market is expected to benefit from upgrades in existing industrial facilities, integration of smart monitoring systems for predictive maintenance, and expanding use in combined-cycle and cogeneration plants.

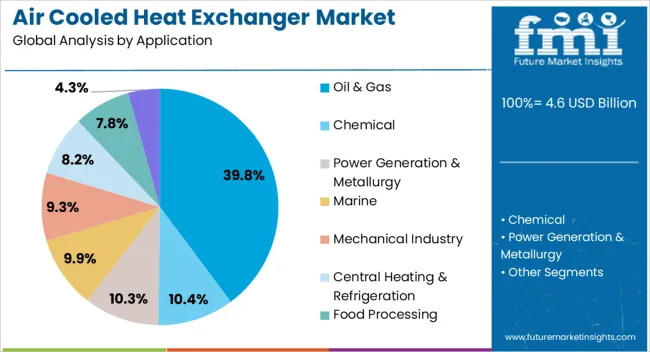

The air cooled heat exchanger market is segmented by application, and geographic regions. By application, air cooled heat exchanger market is divided into oil & gas, chemical, power generation & metallurgy, marine, mechanical industry, central heating & refrigeration, food processing, and others. Regionally, the air cooled heat exchanger industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil & gas segment is projected to account for 39.8% of the air cooled heat exchanger market revenue in 2025, maintaining its status as the leading application area. This dominance is linked to the extensive use of air cooled heat exchangers in upstream, midstream, and downstream operations for cooling process fluids, compressors, and other critical equipment.

The oil & gas industry’s preference for air cooled units stems from their ability to operate efficiently in remote, arid regions where water-based cooling systems are impractical. The segment has also benefitted from continuous investment in refining capacity upgrades, pipeline expansions, and LNG projects, which require robust and low-maintenance cooling solutions.

Furthermore, safety standards and operational reliability in oil & gas processing have driven demand for equipment capable of handling high-pressure and high-temperature applications. As global energy demand continues to grow and operators prioritize sustainable water usage, the Oil & Gas segment is expected to remain the primary driver of air cooled heat exchanger adoption.

The air cooled heat exchanger market is expanding as industries prioritize water-efficient and reliable cooling solutions. Opportunities are fueled by large-scale energy and infrastructure projects, while modular and IoT-integrated designs are becoming notable trends. However, high upfront costs, maintenance needs, and climate-related efficiency issues pose hurdles. Overall, the market outlook remains optimistic, as global industries steadily shift toward innovative, flexible, and sustainable thermal management systems tailored to modern industrial requirements.

The air cooled heat exchanger market is experiencing strong demand due to industries seeking energy-efficient and water-saving cooling alternatives. Traditional water-based systems are increasingly viewed as unsustainable in regions facing water scarcity, making air-cooled systems a preferred choice. Their application in oil and gas, power generation, petrochemicals, and manufacturing drives significant adoption. The ability to deliver effective cooling without extensive water infrastructure enhances their appeal in industrial facilities. Demand is also driven by stricter emission regulations and the push for reliable thermal management solutions across energy-intensive operations.

Massive opportunities are arising from large-scale infrastructure and energy development projects globally. As power plants, refineries, and chemical facilities continue to expand, the need for robust cooling systems grows in parallel. Air cooled heat exchangers offer scalable designs suited for diverse industrial settings, opening opportunities for suppliers to deliver customized solutions. Emerging markets in Asia-Pacific, the Middle East, and Africa are investing heavily in energy and industrial projects, where air-cooled units are increasingly favored. Strategic partnerships with engineering contractors and EPC firms offer suppliers competitive positioning in upcoming projects.

A strong trend toward modular, lightweight, and compact air-cooled heat exchangers is reshaping the market landscape. Industries prefer designs that reduce installation footprint, minimize operating costs, and allow easy scalability. IoT-enabled monitoring systems and predictive maintenance features are also being integrated to improve operational reliability and reduce downtime. Many end-users are prioritizing exchangers with enhanced materials that offer higher durability in harsh environments. The market trend highlights a shift toward innovation, with suppliers focusing on cost-effective, technologically advanced systems that meet performance requirements with greater operational flexibility.

Despite strong growth potential, the market faces challenges from higher upfront costs and ongoing maintenance requirements. Air cooled heat exchangers often require significant capital investment compared to traditional cooling systems, which can limit adoption in cost-sensitive industries. Their performance is also influenced by ambient temperature, posing difficulties in hot climates where cooling efficiency may decline. Maintenance complexity, such as cleaning air passages and managing fan systems, also adds to operational expenses. Overcoming these challenges requires suppliers to emphasize lifecycle cost benefits, robust design improvements, and after-sales support services.

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

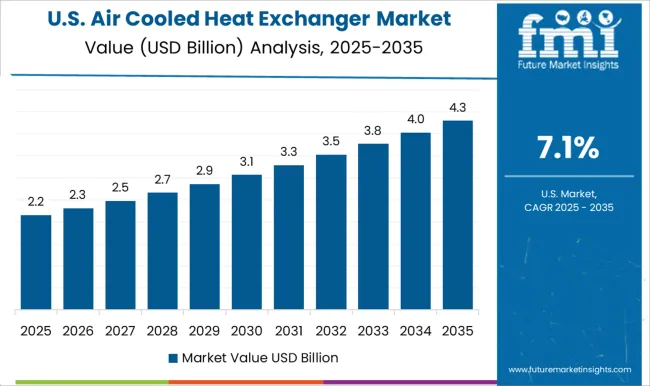

| USA | 7.1% |

| Brazil | 6.3% |

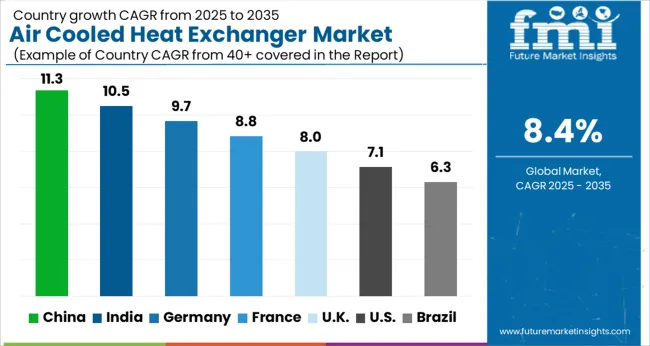

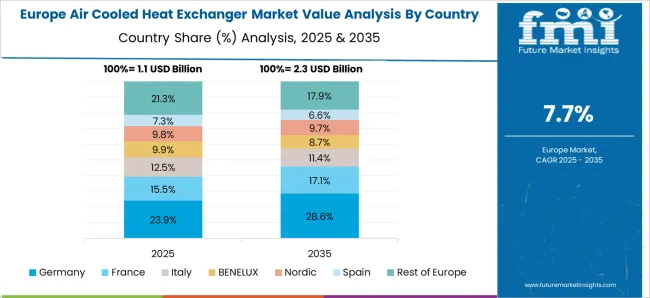

The global air cooled heat exchanger market is projected to grow at a CAGR of 8.4% between 2025 and 2035. China leads growth with 11.3%, followed by India at 10.5% and Germany at 9.7%. The United Kingdom and United States record comparatively moderate growth at 8% and 7.1%, respectively. Expansion is driven by rising demand for energy-efficient cooling systems across power generation, petrochemicals, and manufacturing industries.

Emerging markets such as China and India are experiencing rapid adoption due to industrial expansion and infrastructure projects, while mature markets like Germany, the UK, and the USA emphasize emission reduction, advanced thermal technologies, and system optimization. With industries shifting toward cost-efficient and environmentally compliant cooling solutions, the market outlook remains strong globally. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The air cooled heat exchanger market in China is projected to expand at a CAGR of 11.3%. Industrial expansion in petrochemicals, oil and gas, and power generation continues to drive adoption. Rising energy consumption and stricter regulations on water conservation support the use of air cooled systems as alternatives to water-intensive cooling methods.

With the government encouraging sustainable practices, industries are turning to energy-efficient heat exchangers. Demand is also boosted by investments in renewable energy projects, where cooling reliability is critical. China’s large manufacturing base and ongoing refinery expansions further fuel the deployment of advanced heat exchangers across industrial facilities.

The air cooled heat exchanger market in India is forecasted to grow at a CAGR of 10.5%. Industrial growth in oil and gas, power generation, and petrochemicals remains a primary driver. Rising water scarcity challenges across industrial hubs have made air cooled systems a preferred choice for long-term sustainability.

Increasing investment in renewable energy and large-scale infrastructure development is contributing to growth. Companies are adopting advanced thermal management technologies to improve efficiency and meet stricter environmental norms. Expanding refinery operations, coupled with the push for energy security, ensures steady adoption across critical industrial sectors in India.

The air cooled heat exchanger market in Germany is expected to grow at a CAGR of 9.7%. The country’s strong industrial base, especially in chemicals, petrochemicals, and power generation, drives consistent demand. Germany’s energy transition policies emphasize emission reduction and water conservation, creating favorable conditions for air cooled solutions.

Adoption is supported by the focus on advanced engineering and integration of digital monitoring systems to enhance thermal efficiency. Strong investments in renewable energy infrastructure also contribute to demand. German manufacturers continue to lead with innovation, making the country both a strong consumer and a global supplier of advanced cooling technologies.

The air cooled heat exchanger market in the United Kingdom is projected to grow at a CAGR of 8%. Growth is influenced by the country’s commitment to emission reduction and adoption of energy-efficient cooling technologies. Key demand comes from the oil and gas sector, power generation, and industrial manufacturing.

Aging infrastructure in energy and utilities is being modernized with advanced cooling systems. The push toward sustainable practices and regulatory requirements encourages wider adoption of air cooled solutions. With a focus on operational reliability and efficiency, the UK market demonstrates steady adoption across both legacy and new installations.

The air cooled heat exchanger market in the United States is forecasted to grow at a CAGR of 7.1%. The USA market is shaped by demand from petrochemicals, refineries, and power plants, where reliability and efficiency are critical. Environmental regulations targeting water usage push industries toward air cooled systems.

Rising demand for cleaner and cost-effective technologies also accelerates adoption. Growth in shale gas production and refining activities continues to create opportunities for deployment. Increasing investment in modernizing energy infrastructure and industrial facilities ensures steady demand. Although slower compared to emerging economies, the USA market remains significant due to its scale and advanced technological adoption.

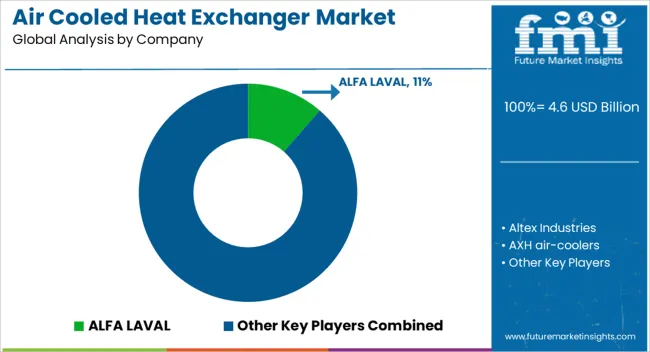

The air cooled heat exchanger market is steered by leading firms such as ALFA LAVAL, SPG Dry Cooling, and SPX Cooling Tech, who compete by promoting advanced thermal efficiency, long lifecycle value, and broad application reach. Their brochures emphasize modular designs, reduced water dependency, and high-performance airflow systems, appealing to industries such as oil & gas, power generation, and chemicals. AXH air-coolers, Exchanger Industries, and Graham Hart (Process Technology) highlight custom-built solutions tailored for harsh operating environments, with brochures stressing reliability under fluctuating load conditions.

Mid-sized firms like Dry Coolers and EMMEGI Heat Exchangers position themselves with compact, cost-effective offerings, gaining traction among secondary buyers in industrial and manufacturing sectors. Competition relies heavily on brochure narratives that stress efficiency gains and minimized maintenance demands. Premium suppliers including Kawasaki Heavy Industries, Thermax, and Thermofin emphasize engineering excellence and global supply reach in their brochures, attracting large-scale infrastructure projects.

Marmon Industrial Water, Boldrocchi, and Positron differentiate with hybrid systems and specialized cooling configurations, reflecting adaptability to evolving energy markets. Niche players such as Perry Hayden and Spiro-Gills Thermal Products promote durability and bespoke designs in their marketing content, targeting buyers with specific operational requirements.

Across the industry, brochures act as competitive instruments, showcasing airflow optimization, advanced fin technology, and compliance with environmental norms. The competitive landscape is defined by a balance of global scale and specialized expertise, where suppliers aim to secure contracts through brochures that communicate dependability, adaptability, and strong return on investment.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 billion |

| Application | Oil & Gas, Chemical, Power Generation & Metallurgy, Marine, Mechanical Industry, Central Heating & Refrigeration, Food Processing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ALFA LAVAL, Altex Industries, AXH air-coolers, Boldrocchi, Chart Industries, Dry Coolers, EMMEGI Heat Exchangers, Exchanger Industries, Graham Hart (Process Technology), Industrial Heat Transfer, Kawasaki Heavy Industries, Marmon Industrial Water, Perry Hayden, Positron, SPG Dry Cooling, SPX Cooling Tech, Spiro-Gills Thermal Products, Thermax, and Thermofin |

| Additional Attributes | Dollar sales by design type (forced draft, induced draft) and application (oil & gas, power generation, chemical, HVAC) are key metrics. Trends include rising demand for efficient cooling systems, replacement of water-based exchangers, and adoption in energy-intensive industries. Regional adoption, technological improvements, and regulatory compliance are driving market growth. |

The global air cooled heat exchanger market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the air cooled heat exchanger market is projected to reach USD 10.3 billion by 2035.

The air cooled heat exchanger market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in air cooled heat exchanger market are oil & gas, chemical, power generation & metallurgy, marine, mechanical industry, central heating & refrigeration, food processing and others.

In terms of application, the oil & gas segment is projected to account for 39.8% share in the air cooled heat exchanger market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA