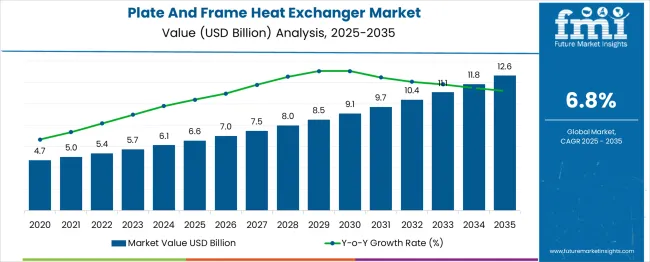

The plate and frame heat exchanger market is expected to increase from USD 6.6 billion in 2025 to USD 12.6 billion in 2035, achieving a compound annual growth rate (CAGR) of 7%. Recurring trends can be observed approximately every 3–4 years, with incremental growth of USD 0.4–0.6 billion during each cycle. For instance, values rise from USD 6.6 billion in 2025 to USD 7.5 billion by 2028, and from USD 8.5 billion in 2030 to USD 9.7 billion in 2033, indicating steady cyclical expansion. This pattern reflects continuous adoption in industrial and commercial applications, driven by rising demand for efficient thermal management, energy savings, and process optimization across multiple sectors.

Quick Stats for Plate and Frame Heat Exchanger Market

| Metric | Value |

| Estimated Value in (2025E) | USD 6.6 billion |

| Forecast Value in (2035F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 7% |

The plate and frame heat exchanger market exhibits predictable seasonal fluctuations, influenced by industrial production cycles, energy demand patterns, and maintenance schedules. Between 2020 and 2035, the market rises from USD 4.7 billion to USD 12.6 billion, but annual values reveal periods of relatively slower and faster growth. For example, modest annual increases are observed in 2021–2023 and 2026–2028, coinciding with planned plant shutdowns, equipment upgrades, or reduced industrial output. These periods represent temporary dips or plateaus in growth, which do not affect the long-term expansion trajectory but indicate cyclical trends that can be anticipated by manufacturers and end-users.

Predictable peaks occur approximately every 3–4 years, aligned with capacity expansions, increased demand for cooling and heating efficiency, and implementation of new industrial projects. For instance, notable growth is seen in 2025–2026, 2030–2031, and 2034–2035, reflecting heightened procurement activity and adoption across chemical, HVAC, and power sectors. Awareness of these recurring peaks and dips enables suppliers to optimize inventory, plan maintenance schedules, and align production with demand cycles, ensuring stable operations and cost efficiency throughout the forecast period.

Market expansion is being supported by the increasing industrial production and corresponding demand for efficient heat transfer solutions across various manufacturing processes. Modern industries are increasingly focused on energy optimization measures that can reduce operational costs, improve process efficiency, and minimize environmental impact. Plate and frame heat exchangers' proven effectiveness in providing superior heat transfer rates while maintaining compact footprints makes them preferred equipment in industrial applications.

The growing emphasis on eco-efficient manufacturing and energy conservation is driving demand for heat exchangers that offer high thermal efficiency and reduced energy consumption. Industrial preference for modular systems that combine flexibility with performance is creating opportunities for innovative designs and configurations. The rising influence of automation technologies and smart manufacturing processes is also contributing to increased adoption of advanced heat exchanger systems across different industrial sectors and applications.

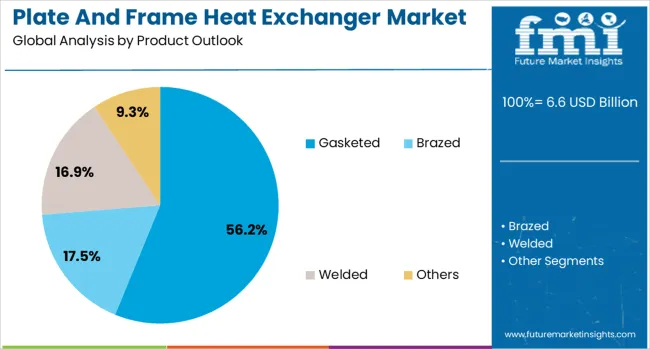

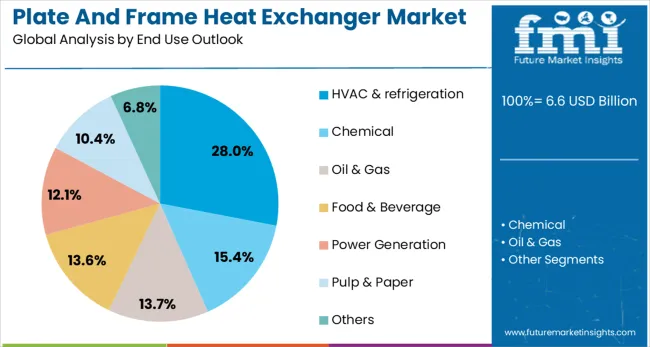

The market is segmented by product type, end-use, and region. By product type, the market is divided into gasketed, brazed, welded, welded plate & block, and welded spiral. Based on end-use, the market is categorized into HVAC & refrigeration, chemical, oil & gas, food & beverage, power generation, pulp & paper, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Gasketed plate and frame heat exchangers are projected to account for 56% of the market in 2025, maintaining their position as the dominant product type. Industries increasingly adopt gasketed systems for their ease of maintenance, adaptability to changing capacity requirements, and capability to handle fluctuating operating conditions. These exchangers provide reliable heat transfer while offering cost-effective solutions for routine cleaning and inspection. Gasketed designs continue to form the backbone of industrial installations, supported by engineering validations and proven operational performance. With operations demanding flexible and efficient thermal management solutions, gasketed systems remain central to heat exchanger market growth and industrial adoption.

HVAC and refrigeration applications are projected to account for 28% of plate and frame heat exchanger demand in 2025, highlighting their importance in thermal management. Industries favor these heat exchangers for compact designs, high thermal efficiency, and the ability to handle variable load conditions, ensuring optimal performance in climate control systems. These exchangers provide energy savings, reliable temperature regulation, and consistent operational performance, meeting both environmental and regulatory expectations. The segment benefits from increasing adoption of energy-efficient buildings and advanced system designs that improve heat transfer while minimizing footprint. HVAC and refrigeration applications continue to drive market expansion, supporting broader industrial energy optimization strategies.

Plate and frame exchangers offer a smaller footprint compared to traditional shell-and-tube systems, making them attractive for industries with limited installation areas. Their modular design also allows for easy capacity expansion without requiring major infrastructure changes. This feature has gained popularity in industries such as pharmaceuticals, marine, and HVAC, where space efficiency is critical. The rising need for compact, high-performance equipment has positioned plate and frame heat exchangers as a preferred choice in many modern facilities.

The market is not only growing through new installations but also through after-sales services and maintenance opportunities. Plate and frame heat exchangers require periodic cleaning and gasket replacement to maintain optimal performance. As the installed base of these systems increases, service providers are generating significant revenue from maintenance contracts, refurbishment, and spare parts supply. End users are also demanding faster turnaround times and cost-efficient maintenance solutions, which has led to the growth of third-party service companies. This dynamic demonstrates how the market is expanding beyond product sales into lifecycle management, creating new business opportunities for manufacturers and service specialists alike.

District heating and cooling networks are creating new opportunities for plate and frame heat exchangers. These systems require reliable and efficient heat transfer equipment to distribute thermal energy to residential, commercial, and industrial buildings. Plate and frame exchangers are ideal due to their high efficiency, flexibility in handling varying loads, and ease of installation. Growing investments in urban infrastructure projects across Europe, Asia, and North America are accelerating adoption. In addition, rising demand for energy-efficient building systems has increased reliance on centralized heating and cooling solutions. This trend highlights the expanding role of plate and frame heat exchangers in large-scale infrastructure and utility projects worldwide.

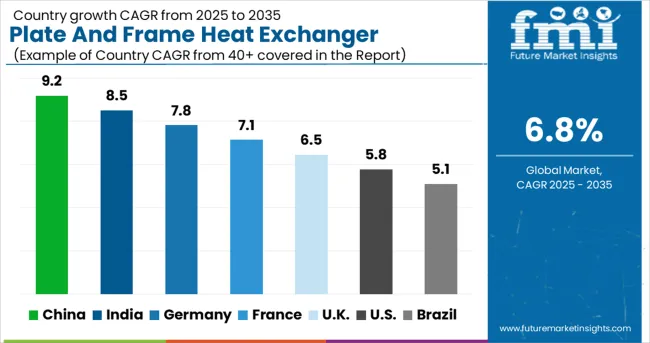

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| U.K. | 6.5% |

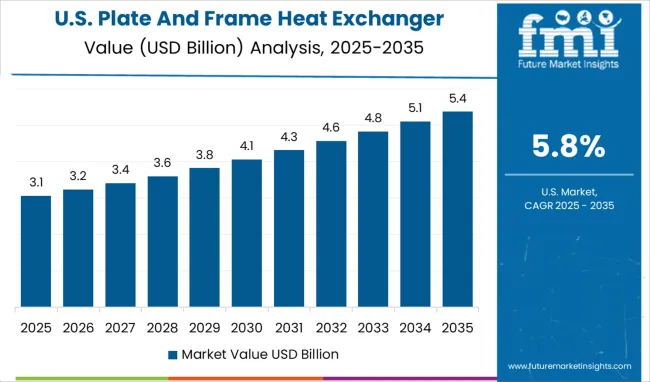

| U.S. | 5.8% |

The plate and frame heat exchanger market is experiencing robust growth globally, with China leading at a 9.2% CAGR through 2035, driven by rapid industrialization, expanding manufacturing sector, and increasing adoption of energy-efficient technologies. India follows closely at 8.5%, supported by growing industrial production, infrastructure development, and rising demand for thermal management solutions. Germany shows steady growth at 7.8%, emphasizing advanced manufacturing technologies and energy optimization systems. France records 7.1%, focusing on eco-efficient manufacturing practices and industrial modernization. The UK shows 6.5% growth, prioritizing energy efficiency and advanced thermal management systems.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Plate and frame heat exchangers in China are expected to achieve significant growth at a CAGR of 9.2% through 2035, fueled by rapid industrial expansion and rising adoption of energy-efficient manufacturing processes. Domestic and international manufacturers are establishing large-scale production facilities to cater to a growing industrial consumer base in tier-1 and tier-2 cities. Adoption is outpacing India and the UK due to government-backed industrial initiatives and infrastructure growth. Demand is driven by process optimization, operational efficiency, and advanced thermal management requirements across automotive, chemical, and heavy manufacturing industries.

Plate and frame heat exchangers in India are projected to expand at a CAGR of 8.5% through 2035, driven by increasing industrial production, growing manufacturing investments, and adoption of advanced thermal technologies. International and domestic equipment suppliers are expanding distribution networks to serve industrial clients across manufacturing, chemical, and food processing sectors. Adoption is slightly behind China but benefits from rising energy efficiency awareness and automation trends. Demand is shaped by operational optimization, cost-effective energy management, and industrial modernization initiatives, positioning heat exchangers as critical solutions for process-intensive industries.

Plate and frame heat exchangers in the U.S. are expected to grow at a CAGR of 5.8% through 2035, supported by industrial emphasis on energy efficiency, operational optimization, and advanced manufacturing processes. Adoption is characterized by demand for durable, high-performance thermal management systems that enhance process reliability and industrial output. Domestic industries increasingly integrate heat exchangers in chemical, food processing, and heavy manufacturing operations to reduce energy consumption while improving production efficiency. The U.S. market prioritizes eco-efficient systems that combine sustainability with industrial reliability and advanced process monitoring capabilities, maintaining a moderate growth pace relative to Asian counterparts.

Plate and frame heat exchangers in Germany are anticipated to expand at a CAGR of 7.8% through 2035, driven by a strong industrial base, advanced manufacturing technologies, and demand for energy-efficient systems. Domestic manufacturers and international suppliers provide high-quality solutions for automotive, chemical, and industrial process applications. Adoption emphasizes reliability, precision, and operational efficiency, surpassing U.S. levels while slightly trailing China. Investments in next-generation thermal systems, real-time monitoring, and automation integration are shaping market growth. German industries increasingly rely on advanced heat exchangers to optimize energy consumption, maintain consistent process quality, and support industrial modernization strategies.

Plate and frame heat exchangers in the UK are projected to grow at a CAGR of 6.5% through 2035, fueled by industrial modernization, operational efficiency goals, and focus on energy-efficient manufacturing systems. Equipment adoption emphasizes reliability, performance, and compliance with industrial standards across manufacturing, food processing, and chemical sectors. Adoption is behind China and Germany but supported by automation integration and process optimization initiatives. British industries increasingly rely on high-efficiency thermal systems to reduce energy usage, enhance production outcomes, and maintain competitive performance standards in both domestic and export-oriented facilities.

Plate and frame heat exchangers in France are expected to expand at a CAGR of 7.1% through 2035, supported by a focus on industrial innovation, operational efficiency, and equipment reliability. Domestic manufacturers and international suppliers are targeting automotive, chemical, and manufacturing sectors with high-performance thermal solutions. Adoption is influenced by stringent industrial standards and demand for advanced, reliable systems, slightly behind Germany and China. Investments in industrial process optimization, integration of monitoring technologies, and energy-efficient operations are driving market growth. French industries increasingly rely on advanced heat exchangers to maintain performance, comply with regulations, and optimize thermal management across production facilities.

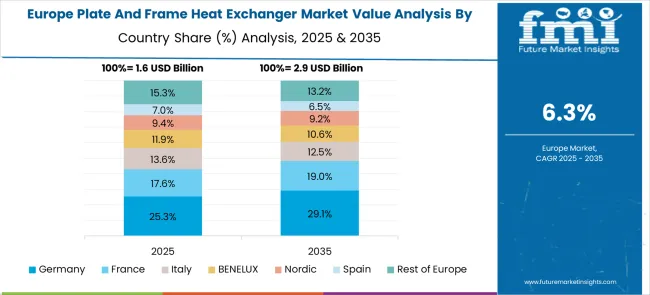

The plate and frame heat exchanger market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced manufacturing sector and emphasis on energy-efficient industrial systems, supported by companies leveraging engineering expertise to develop high-performance heat exchangers that optimize thermal management and reduce energy consumption across various industrial applications.

France represents a significant market driven by its diverse industrial base and focus on eco-efficient manufacturing practices, with companies pioneering advanced heat exchanger technologies that combine French engineering excellence with innovative thermal management solutions for enhanced process efficiency and environmental compliance.

The UK exhibits considerable growth through its emphasis on industrial modernization and energy optimization, with manufacturers leading the adoption of efficient heat transfer systems and comprehensive integration of advanced thermal management technologies. Germany and France show expanding interest in high-efficiency heat exchange solutions, particularly in specialized applications targeting industrial process optimization and energy conservation. Other European countries contribute through their focus on manufacturing excellence and eco-efficient industrial practices, while Eastern Europe displays growing potential driven by increasing industrialization and expanding access to advanced thermal management equipment across diverse manufacturing sectors.

The plate and frame heat exchanger market is defined by competition among long-established industrial equipment manufacturers, specialized thermal technology providers, and emerging system integration companies. Significant investments are being made in advanced materials, innovative design methodologies, and comprehensive service capabilities. Global distribution networks are being strengthened to ensure timely delivery and accessibility of solutions. Product development, process optimization, and strategic market expansion are being pursued to broaden equipment portfolios, enhance reliability, and reinforce competitive positioning across industrial segments.

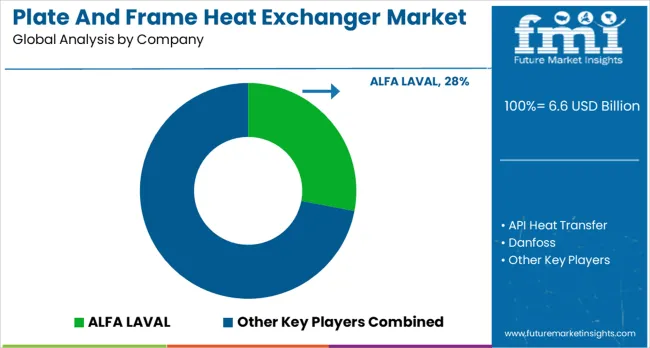

ALFA LAVAL maintains a leading position in the market, capturing an estimated 28% of global value. Extensive heat exchanger solutions are provided with emphasis on thermal efficiency, operational reliability, and adaptability across diverse industrial applications. API Heat Transfer delivers specialized thermal management systems designed for custom engineering requirements and application-specific configurations. Danfoss focuses on advanced heat transfer technologies that prioritize energy efficiency and seamless integration into complex systems. Kelvion Holding GmbH applies innovative design approaches and durable materials to provide high-performance solutions for demanding industrial environments.

Global players such as Nexson Group and Barriquand Group offer broad portfolios of plate and frame heat exchanger systems, serving multiple industrial sectors and application areas. SPX Flow leverages advanced manufacturing techniques and engineering expertise to position premium solutions within the market. HISAKA WORKS LTD delivers equipment optimized for high-performance applications, emphasizing advanced material usage and operational precision. Tranter Inc. and WCR Inc. provide targeted thermal management solutions tailored to specific industrial requirements, integrating custom engineering approaches to enhance efficiency. Product brochures highlight design innovations, material selection, thermal performance, and service offerings, illustrating each company’s competitive strengths. Collectively, these market leaders shape the evolution of the plate and frame heat exchanger industry, emphasizing efficiency, reliability, and industrial versatility.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 6.6 billion |

| Product Type | Gasketed, Brazed, Welded, Welded Plate & Block, Welded Spiral |

| End-Use | HVAC & refrigeration, Chemical, Oil & Gas, Food & Beverage, Power Generation, Pulp & Paper, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ALFA LAVAL, API Heat Transfer, Danfoss, Kelvion Holding GmbH, Nexson Group, Barriquand Group, SPX Flow, HISAKA WORKS LTD, Tranter Inc., and WCR Inc. |

| Additional Attributes | Dollar sales by heat exchanger type and capacity level, regional demand trends, competitive landscape, industrial preferences for material specifications, integration with process optimization systems, innovations in thermal efficiency, advanced materials, and eco-efficient manufacturing practices |

The global plate and frame heat exchanger market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the plate and frame heat exchanger market is projected to reach USD 12.6 billion by 2035.

The plate and frame heat exchanger market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in plate and frame heat exchanger market are gasketed, brazed, welded, _welded he, _welded plate & block, _welded spiral, _welded shell & plate and others.

In terms of end use outlook, hvac & refrigeration segment to command 28.0% share in the plate and frame heat exchanger market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plate Chain Elevator Market Size and Share Forecast Outlook 2025 to 2035

Platelet Shaker Market Size and Share Forecast Outlook 2025 to 2035

Platelet Concentration Systems Market Size and Share Forecast Outlook 2025 to 2035

Platelet Rich Plasma Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plate Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Platelet Function Test Market Report - Growth & Forecast 2025 to 2035

Plates Market

Plate Heat Exchanger Market Growth - Trends & Forecast 2025 to 2035

Tinplate Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Template Preparation Kits Market

Drawplate Market Size and Share Forecast Outlook 2025 to 2035

PCR Plate Sealer Market Size and Share Forecast Outlook 2025 to 2035

Gold-plated Palladium Bonding Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Core Plate Varnishes Market Size and Share Forecast Outlook 2025 to 2035

Ship Plate Market Size and Share Forecast Outlook 2025 to 2035

Microplate Washer Market Size and Share Forecast Outlook 2025 to 2035

Microplate Luminometer Market Analysis – Trends & Industry Insights 2024-2034

Wear Plates Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA