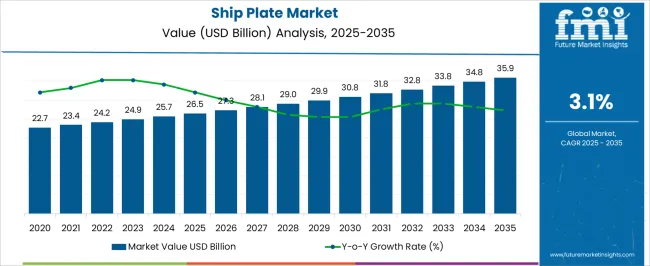

The ship plate market is anticipated to reach 26.5 USD billion in 2025, projected to reach 35.9 USD billion by 2035, recording a CAGR of 3.1 percent across the period. Growth is not evenly paced, as the trajectory shows an acceleration phase until the early 2030s, followed by a softer deceleration pattern toward the latter part of the forecast window.

Between 2025 and 2029, yearly increments remain modest, adding roughly 0.7 to 0.8 USD billion annually, which implies a steady but not aggressive climb. The early rise can be associated with naval modernization programs, shipbuilding investments, and regional trade expansion. As the market moves into the 2030–2032 bracket, the pace is expected to accelerate further, with gains averaging nearly 0.9 to 1.0 USD billion per year, indicating stronger momentum.

This acceleration is likely supported by large-scale fleet renewals and higher demand for corrosion-resistant and high-strength steel plates, especially in Asia-Pacific shipyards. Yet the curve begins to flatten after 2033, with increments narrowing again to 0.9 to 1.1 USD billion, suggesting a gradual deceleration. The tapering growth may be driven by supply chain adjustments, mature replacement cycles, and stabilized naval procurement budgets.

While expansion remains intact, the industry will face growing pressure from alternative materials, green shipbuilding standards, and cost optimization trends, making the second half of the forecast period more challenging for plate producers.

| Metric | Value |

|---|---|

| Ship Plate Market Estimated Value in (2025 E) | USD 26.5 billion |

| Ship Plate Market Forecast Value in (2035 F) | USD 35.9 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The ship plate market sources its demand from five primary parent markets, each shaping the overall industry share through distinct consumption patterns. The commercial shipbuilding segment holds the largest share at 32%, as bulk carriers, container ships, and cargo vessels consume significant volumes of plates to meet the growing demands of international trade and marine logistics.

The naval and defense sector follows with a 25% share, supported by fleet modernization programs, rising defense budgets, and the development of technologically advanced warships that require specialized, high-strength plates. Offshore oil and gas exploration accounts for 18%, where rigs, platforms, and related marine infrastructure demand corrosion-resistant and heavy-duty plates to withstand harsh environments, making this segment vital for stability in energy supply chains. The passenger and cruise ship segment represents 15%, as investments in luxury liners, ferries, and tourism-oriented vessels rise steadily, particularly in the Asia-Pacific and European markets. The remaining 10% is attributed to repair, maintenance, and retrofitting services, where shipyards and dockyards utilize plates for vessel upgrades and life extension programs. In my opinion, the dominance of commercial shipbuilding and naval defense, which together account for over half of total demand, confirms that trade expansion and maritime security remain the strongest growth pillars, while offshore and passenger segments create diversification opportunities.

The ship plate market is experiencing steady expansion, supported by the growth of global maritime trade, the modernization of fleets, and rising investments in shipbuilding infrastructure. Industry announcements and shipyard project reports have highlighted sustained demand for high-strength, corrosion-resistant plates to meet the structural and safety requirements of various vessel types. Technological advancements in steel manufacturing and plate rolling processes have improved durability and weldability, enabling efficient construction and maintenance.

Environmental regulations promoting fuel-efficient ship designs have also influenced the choice of materials and production standards for ship plates. Additionally, the increase in offshore exploration, naval projects, and intercontinental shipping routes has boosted the need for specialized ship plates that can withstand harsh marine environments.

Future market momentum is expected to be driven by steel’s continued dominance as the primary material, the critical role of hull construction in vessel integrity, and the expanding scale of commercial shipbuilding to meet global shipping demand.

The ship plate market is segmented by material, application, end use, distribution channel, and geographic regions. By material, ship plate market is divided into Steel, Aluminum, Composite materials, and Others (titanium, magnesium alloy). In terms of application, ship plate market is classified into Hull construction, Decking, Interior structures, and Others (ice-class vessels, offshore wind farm support structures, and naval architecture).

Based on end use, ship plate market is segmented into Commercial shipbuilding, Military shipbuilding, and Repair & maintenance. By distribution channel, ship plate market is segmented into Direct and Indirect. Regionally, the ship plate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steel segment is projected to account for 64.8% of the ship plate market revenue in 2025, maintaining its position as the primary material choice. This dominance is supported by steel’s exceptional tensile strength, cost-effectiveness, and adaptability to various shipbuilding requirements.

Shipyards have continued to prefer steel plates due to their ability to withstand extreme marine conditions, including saltwater corrosion and high mechanical stress. Advancements in marine-grade steel production have further enhanced resistance to fatigue and improved weldability, making it suitable for large-scale hull fabrication.

Additionally, the well-established global supply chain for steel ensures steady availability, reducing procurement challenges for shipbuilders. Regulatory standards for maritime safety and performance have consistently aligned with steel’s capabilities, reinforcing its role as the default material in ship plate manufacturing.

The hull construction segment is expected to contribute 52.4% of the ship plate market revenue in 2025, solidifying its leading application role. The hull serves as the primary structural framework of a vessel, making material integrity and precision engineering critical for safety and performance.

Shipbuilding projects have prioritized high-quality hull plates that can endure hydrodynamic forces, impact loads, and harsh weather conditions over long operational lifespans. Technological improvements in plate forming, cutting, and welding have increased efficiency in hull assembly, enabling faster project completion.

Industry standards for seaworthiness and vessel classification have further driven demand for specialized hull plates, particularly in commercial and naval fleets. As the global fleet expands and older vessels are replaced, hull construction is expected to remain the most significant application segment in the ship plate market.

The commercial shipbuilding segment is projected to hold 58.9% of the ship plate market revenue in 2025, retaining its dominance in end-use demand. The expansion of global cargo transport, container shipping, and passenger cruise operations has driven growth in this segment.

Commercial shipyards have increasingly invested in advanced plate processing technologies to meet the needs of large-scale vessels, from bulk carriers to LNG tankers. Rising trade volumes, particularly in Asia-Pacific and Europe, have fueled demand for new ship construction and fleet modernization.

Additionally, international regulations aimed at improving energy efficiency and reducing emissions have encouraged the design and construction of next-generation commercial ships, further boosting ship plate requirements. With sustained investments in maritime logistics and global shipping networks, commercial shipbuilding is expected to remain the largest consumer of ship plates.

The ship plate market is shaped by global trade growth, defense programs, offshore energy projects, and passenger vessel expansion. Commercial and defense segments remain dominant, while energy and tourism provide diversification opportunities

The ship plate market is anticipated to expand steadily as global maritime trade continues to dominate the transportation of raw materials and finished goods. Ship plates remain indispensable in building bulk carriers, oil tankers, and container vessels, which account for the majority of global cargo movement. The sector has been influenced by an uptick in regional exports, supply chain diversification, and cross-border trade agreements that encourage large vessel construction. Demand from Asia-Pacific countries, particularly China, Japan, and South Korea, has shaped procurement patterns. This trade-driven requirement has strengthened steel consumption for marine applications, even when facing cost fluctuations.

National security priorities and naval modernization programs have significantly contributed to ship plate demand. Governments in regions such as the US, Europe, and Asia are investing heavily in naval fleets to enhance maritime defense capabilities. Warships, aircraft carriers, and submarines require specialized steel plates with advanced mechanical properties, ensuring durability under extreme conditions. The defense-driven need has generated consistent orders for shipyards, creating long-term opportunities for steel suppliers. Procurement linked to rising defense budgets has further secured stable demand, offsetting occasional slowdowns in the commercial shipping sector.

The offshore oil and gas industry has sustained ship plate consumption through requirements for drilling platforms, floating production units, and subsea infrastructure. With offshore exploration moving deeper, stronger and corrosion-resistant plates are being prioritized. Steelmakers supplying to energy projects face specifications around weldability, thickness, and safety compliance. Offshore wind energy installations have also expanded this segment, with marine construction requiring heavy plates to withstand environmental stress. The long-term transition toward offshore renewables and continued hydrocarbon exploration will secure demand stability. This infrastructure-driven usage proves that energy investments hold a pivotal role in keeping ship plate orders resilient against broader economic shifts.

The growth of passenger traffic and the global cruise tourism industry has opened another pathway for ship plate consumption. Luxury liners, ferries, and inter-island transport vessels demand high-quality plates for structural reliability and passenger safety. Asia and Europe have led this demand surge as governments and private operators promote marine tourism. Even though this segment is smaller in volume compared to commercial shipbuilding, the design complexity and safety requirements elevate the quality standards of supplied plates. Cruise ship construction provides lucrative opportunities, as the market places emphasis on innovation in comfort, efficiency, and vessel aesthetics, ensuring sustained high-value demand for plate manufacturers.

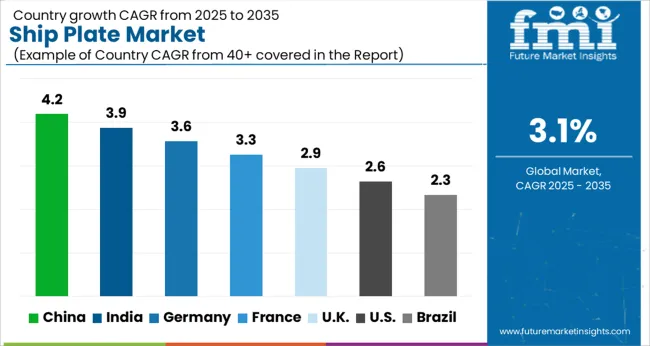

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| U.K. | 2.9% |

| U.S. | 2.6% |

| Brazil | 2.3% |

The global ship plate market is projected to grow at a CAGR of 3.1% from 2025 to 2035. China leads with 4.2%, followed by India at 3.9%, Germany at 3.6%, France at 3.3%, the U.K. at 2.9%, and the U.S. at 2.6%. Growth is supported by strong demand in commercial shipbuilding, naval defense programs, and offshore energy infrastructure. China remains the dominant hub, driven by its massive shipyard capacity and government-backed investments, while India is rapidly scaling due to port development and increasing maritime trade. Germany and France emphasize technologically advanced ship designs, reflecting Europe’s role in high-specification vessels. The U.K. and the U.S. focus more on defense-related shipbuilding, ensuring steady demand despite slower commercial expansion. The analysis includes more than 40 countries, with the leading markets highlighted below.

The ship plate market in China is projected to grow at a CAGR of 4.2% from 2025 to 2035, supported by the nation’s dominance in global shipbuilding and government-backed investments in port and naval infrastructure. China’s massive shipyards in regions such as Shanghai, Jiangsu, and Dalian account for a substantial share of global vessel construction, including bulk carriers, container ships, and oil tankers. Strong domestic steel production ensures a steady supply of ship plates, while demand is enhanced by both commercial and defense programs. Offshore oil exploration and renewable energy platforms add further requirements. Chinese manufacturers are prioritizing high-strength, corrosion-resistant grades to comply with international safety and environmental standards, ensuring competitiveness in exports. China will continue to set the pace for global supply, making it the undisputed leader in this segment.

The ship plate market in India is forecasted to grow at a CAGR of 3.9% from 2025 to 2035, driven by expansion in maritime trade, port modernization, and government initiatives such as Sagarmala. Indian shipyards are witnessing increased orders for cargo vessels, fishing trawlers, and coastal transport ships. Demand for ship plates is also supported by naval projects and the country’s ambition to enhance defense capabilities across the Indian Ocean. Steel producers are adapting production lines to meet shipbuilding specifications, while private shipyards are collaborating with global players for technology transfer. India is steadily emerging as a competitive hub for both domestic and export-oriented shipbuilding, though infrastructure gaps remain a constraint.

The ship plate market in Germany is anticipated to expand at a CAGR of 3.6% from 2025 to 2035, supported by its expertise in high-specification vessels, cruise liners, and advanced marine engineering. German shipyards such as Meyer Werft focus on constructing passenger vessels and technologically sophisticated ships, demanding premium-quality plates. Emphasis on environmental compliance, lightweight materials, and precision engineering drives higher consumption of specialty steel grades. Offshore wind projects in the North Sea further sustain demand, as marine structures rely on durable and corrosion-resistant plates. Germany’s strength lies not in volume but in premium-grade shipbuilding, making it a critical market for high-value ship plate applications.

The ship plate market in the U.K. is expected to grow at a CAGR of 2.9% from 2025 to 2035, largely influenced by naval and defense shipbuilding rather than commercial vessel construction. The Royal Navy modernization programs and investment in aircraft carriers, submarines, and patrol vessels drive significant demand for specialized ship plates. Commercial shipbuilding has been comparatively limited, though offshore oil, gas, and wind projects provide incremental opportunities. British steel suppliers are focusing on defense contracts and ensuring compliance with high safety standards. While growth is moderate, the U.K. remains strategically important due to its defense-driven demand and growing offshore renewable sector.

The ship plate market in the U.S. is projected to grow at a CAGR of 2.6% from 2025 to 2035, with naval defense as the dominant contributor. The U.S. Navy’s large-scale fleet renewal programs, including destroyers, submarines, and carriers, demand substantial volumes of heavy-duty plates. Commercial shipbuilding has been relatively limited compared to Asia, though offshore energy exploration and marine infrastructure projects create consistent demand. U.S. steelmakers emphasize advanced grades, weldability, and corrosion resistance to comply with stringent defense and marine requirements. Although growth lags behind Asian countries, the U.S. market maintains long-term stability through defense investments and energy-related projects.

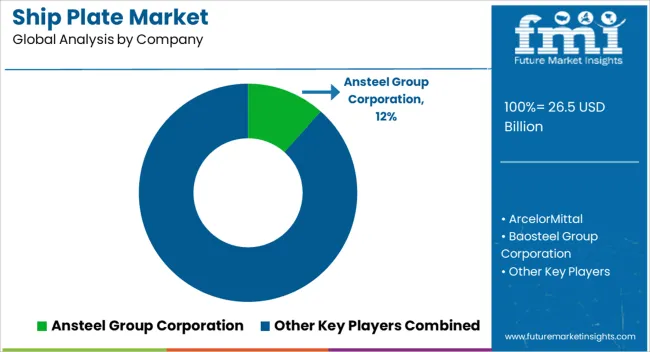

Competition in the ship plate market is dominated by large integrated steelmakers and specialized suppliers that offer scale, technical grades, and global logistics. Market leadership is held by Ansteel Group Corporation, ArcelorMittal, Baosteel Group, China Steel Corporation, and POSCO, whose production capacity and distribution networks are being leveraged to meet large orders from shipyards. Japanese and Korean producers such as JFE Steel Corporation, Nippon Steel Corporation, and Hyundai Steel Company are being relied upon for premium, high-strength grades that meet strict weldability and toughness specifications. European players, including Thyssenkrupp AG and ArcelorMittal, are being positioned to serve high-specification cruise, offshore, and naval segments. Indian and Russian suppliers like JSW Steel Limited, Tata Steel Limited, and Novolipetsk Steel (NLMK) are being tapped for cost-competitive volumes and regional projects. Product differentiation is being driven by grade performance, plate thickness ranges, and certification for marine and defense standards.

Value is being offered through services such as just-in-time delivery, plate cutting and profiling, and supply-chain traceability. Strategic partnerships between steel mills and shipyards are being struck to secure long-term contracts, while raw material cost management is being emphasized across the supply chain. Scale advantages will continue to favor Asian integrated mills for commercial shipbuilding, while Western suppliers will retain niche strength in defense and high-spec vessels. Innovation in alloy composition and surface treatment is being adopted to extend service life in corrosive marine environments. Pricing pressure is being offset by quality premiums in specialty segments, and market share shifts are likely to be influenced by regional shipbuilding cycles and government procurement policies.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.5 Billion |

| Material | Steel, Aluminum, Composite materials, and Others (titanium, magnesium alloy) |

| Application | Hull construction, Decking, Interior structures, and Others (ice-class vessels, offshore wind farm support structures, and naval architecture) |

| End Use | Commercial shipbuilding, Military shipbuilding, and Repair & maintenance |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ansteel Group Corporation, ArcelorMittal, Baosteel Group Corporation, China Steel Corporation, Chongqing Iron & Steel Group, Hyundai Steel Company, JFE Steel Corporation, Jiangsu Shagang Group, JSW Steel Limited, Nippon Steel Corporation, Novolipetsk Steel (NLMK), POSCO, POSCO Daewoo Corporation, Tata Steel Limited, and Thyssenkrupp AG |

| Additional Attributes | Dollar sales, market share by grade and thickness, demand from commercial and naval shipbuilding, pricing trends, key competitors, and growth drivers in offshore and passenger vessel segments. |

The global ship plate market is estimated to be valued at USD 26.5 billion in 2025.

The market size for the ship plate market is projected to reach USD 35.9 billion by 2035.

The ship plate market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in ship plate market are steel, aluminum, composite materials and others (titanium, magnesium alloy).

In terms of application, hull construction segment to command 52.4% share in the ship plate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ship Anchor Market Size and Share Forecast Outlook 2025 to 2035

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Ship Pod Drives Market Size and Share Forecast Outlook 2025 to 2035

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Competitive Breakdown of Shipping Mailers Manufacturers

Leading Providers & Market Share in Shipping Tapes

Ship Rudders Market

Ship Bridge Simulator Market

PUR Shippers Market Size and Share Forecast Outlook 2025 to 2035

EPS Shippers Market Size and Share Forecast Outlook 2025 to 2035

Jug Shipper Market

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA