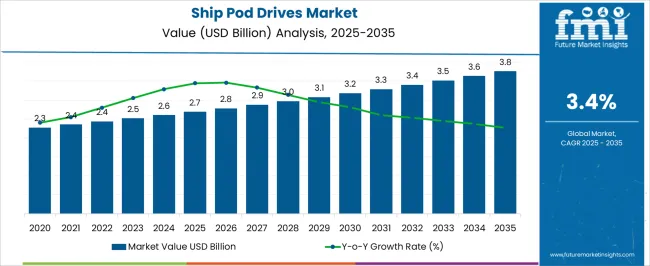

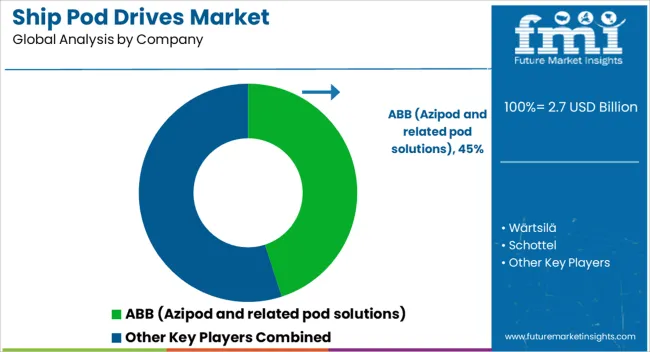

The ship pod drives market is valued at USD 2.7 billion in 2025 and expands to USD 3.8 billion by 2035, with a CAGR of 3.4%. Assessing the growth rate volatility index highlights how year-to-year changes remain relatively stable, though not entirely uniform, reflecting a mature market influenced by vessel retrofits and steady shipbuilding activity. From 2021 to 2025, the market moves from USD 2.3 billion to USD 2.7 billion. Annual increments are modest, varying between 3% and 4%. This low dispersion suggests a stable early growth pattern, with limited volatility, supported by retrofits in cruise ships and offshore support vessels seeking fuel efficiency and maneuverability. Between 2026 and 2030, values rise from USD 2.8 billion to USD 3.2 billion. Growth rates average near 2.7%, slightly lower than the earlier block. The volatility index here is more pronounced, as demand is influenced by fluctuating capital investments and regulatory-driven adoption of efficient propulsion systems. While stable overall, minor variability emerges due to uneven order books in the shipbuilding sector. From 2031 to 2035, the market increases from USD 3.3 billion to USD 3.8 billion, with annual growth clustering around 2.9%. Volatility during this period remains minimal, reflecting gradual replacement demand and integration with hybrid-electric propulsion technologies.

| Metric | Value |

|---|---|

| Ship Pod Drives Market Estimated Value in (2025 E) | USD 2.7 billion |

| Ship Pod Drives Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The ship pod drives market occupies a specialized role across several parent sectors, with shares reflecting both its growing adoption and limited presence compared to conventional propulsion. In the marine propulsion systems market, pod drives contribute nearly 6 to 7%, competing with shaft lines and waterjets while offering advantages in maneuverability and efficiency. Within the shipbuilding equipment market, their share stands at about 3 to 4%, as they are integrated selectively into cruise ships, ferries, and offshore vessels rather than mass-deployed across all builds. In the marine engineering and systems integration market, pod drives account for close to 5 to 6%, valued for their ability to combine propulsion with steering functions, reducing auxiliary components and enhancing fuel performance. The commercial shipping market shows stronger traction, where pod drives hold roughly 7 to 8%, largely in passenger and cruise segments prioritizing noise reduction, operational efficiency, and docking precision. Meanwhile, in the naval and defense marine market, their presence remains modest at 2 to 3%, limited to specialized patrol and research vessels requiring stealth or agility in confined waters. These shares demonstrate a clear pattern: while pod drives do not dominate propulsion volumes, they influence premium vessel categories where efficiency, acoustic performance, and integration benefits are decisive. Their importance is not measured by scale alone but by their ability to transform operational economics and vessel handling, positioning them as a key innovation in selective but high-value segments of the maritime industry.

The Ship Pod Drives market is experiencing significant growth, driven by the maritime sector’s increasing focus on fuel efficiency, operational flexibility, and environmental compliance. Ship operators are increasingly adopting pod drive systems due to their ability to enhance maneuverability, reduce noise, and lower emissions compared to conventional propulsion methods.

The transition towards cleaner marine technologies has been reinforced by stringent international regulations on greenhouse gas emissions, which are encouraging the adoption of energy-efficient propulsion solutions. Technological advancements in electric propulsion, integration with smart ship systems, and the rising demand for luxury cruise and passenger vessels are further boosting market adoption.

Additionally, the ability of ship pod drives to integrate propulsion and steering functions into a single unit is providing operators with improved space utilization and reduced maintenance needs Growing investment in ship modernization programs and the expansion of cruise tourism are expected to sustain market momentum, with innovative propulsion technologies paving the way for long-term growth opportunities.

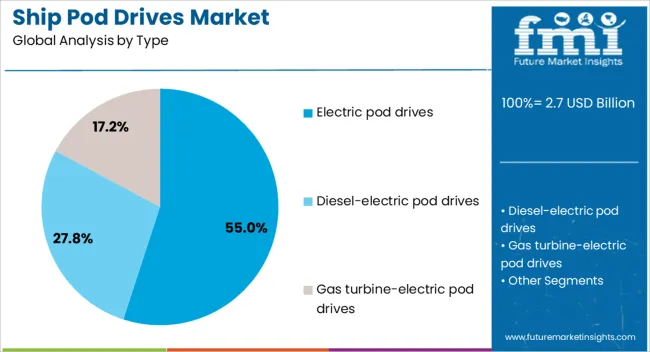

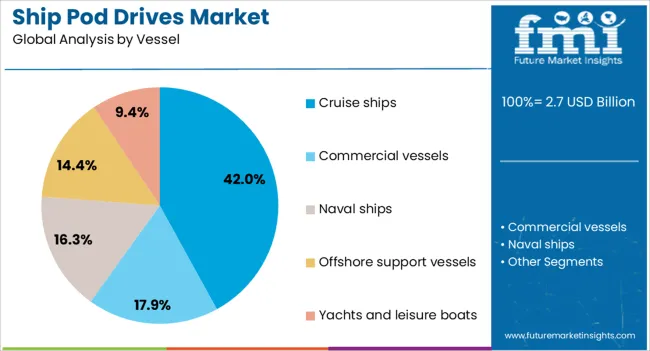

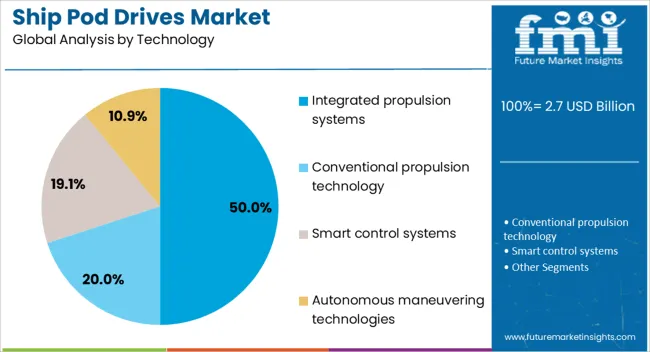

The ship pod drives market is segmented by type, vessel, technology, power rating, end use, and geographic regions. By type, ship pod drives market is divided into Electric pod drives, Diesel-electric pod drives, and Gas turbine-electric pod drives. In terms of vessel, ship pod drives market is classified into Cruise ships, Commercial vessels, Naval ships, Offshore support vessels, and Yachts and leisure boats. Based on technology, ship pod drives market is segmented into Integrated propulsion systems, Conventional propulsion technology, Smart control systems, and Autonomous maneuvering technologies. By power rating, ship pod drives market is segmented into 1 MW to 5 MW, Up to 1 MW, and Above 5 MW. By end use, ship pod drives market is segmented into Shipbuilders and Shipping companies. Regionally, the ship pod drives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric pod drives segment is projected to hold 55% of the Ship Pod Drives market revenue share in 2025, making it the dominant type. The segment’s growth has been supported by the increasing preference for energy-efficient propulsion systems that comply with strict environmental regulations. Electric pod drives have been recognized for their ability to significantly reduce emissions and improve vessel maneuverability, which is particularly valuable in congested ports and environmentally sensitive waters.

Their integration with onboard energy management systems allows for optimized fuel consumption and lower operational costs. Reduced vibration and noise levels have also enhanced passenger comfort, making them highly suitable for luxury vessels.

The adaptability of electric pod drives to hybrid and fully electric vessel configurations has further expanded their adoption across both new builds and retrofits With the maritime industry shifting towards sustainable propulsion solutions, electric pod drives are expected to maintain a strong competitive advantage in the coming years.

The cruise ships segment is anticipated to account for 42% of the Ship Pod Drives market revenue share in 2025, making it the leading vessel category. This dominance has been driven by the increasing demand for highly maneuverable, fuel-efficient propulsion systems in the cruise industry. Cruise ships require propulsion solutions that can operate quietly and efficiently while ensuring precise navigation in ports and sensitive marine areas.

Pod drives meet these requirements by integrating propulsion and steering into a single system, improving energy efficiency and passenger comfort. The growth of the cruise tourism industry, particularly in emerging destinations, has led to the deployment of larger and more technologically advanced vessels, further supporting adoption.

In addition, the ability of pod drives to reduce maintenance downtime and optimize space utilization onboard has contributed to their popularity among cruise operators As luxury travel demand continues to expand, the reliance on pod drive technology within the cruise sector is expected to strengthen.

The integrated propulsion systems segment is expected to hold 50% of the Ship Pod Drives market revenue share in 2025, positioning it as the leading technology. The segment’s growth has been influenced by the advantages of combining propulsion and steering systems into a compact, efficient unit. This integration has allowed for improved vessel maneuverability, reduced fuel consumption, and lower operational costs.

Maritime operators have increasingly adopted integrated systems to maximize cargo and passenger space while minimizing maintenance requirements. The seamless integration with onboard digital control systems enables real-time monitoring and performance optimization, further enhancing operational efficiency.

These systems are particularly valuable for vessels operating in challenging navigation environments, where precision and reliability are critical The trend towards smart shipping and digitalized maritime operations has further reinforced demand for integrated propulsion solutions, ensuring their continued dominance in the ship pod drives market.

The ship pod drives market is supported by demand for precise handling, compact machinery layouts, and reliable thrust across varied missions. Adoption is tempered by high capital cost, complex integration, and service logistics that require skilled support and protected dock time. Clear upside appears in offshore work, cruise vessels, tugs, ferries, and research ships where maneuvering and comfort matter. Programs increasingly pair pods with electric power management, condition monitoring, and regional service hubs. Vendors that guarantee availability and simplify lifecycle economics are well placed to convert newbuilds and retrofits globally.

Demand for ship pod drives is being propelled by the need for precise maneuverability, compact machinery layouts, and efficient thrust across varied operating profiles. Podded units combine propulsion and steering in a single underwater module, enabling vessels to rotate on the spot and dock confidently in restricted harbors. Dynamic positioning performance is improved because thrust vectors are directed instantly without rudders or long shaft lines. Naval architects gain flexibility in hull arrangements, freeing internal volume for payload, cabins, or mission equipment. Lower vibration and improved acoustics are valued on cruise, research, and passenger ferries where comfort matters. Tugs and offshore vessels benefit from rapid bollard response and fine station keeping around platforms and wind construction sites. Ports with tight turning basins encourage adoption as captains seek predictable handling in variable weather. As fleets prioritize precise movement and reliable uptime, podded propulsion is being treated as a strategic upgrade path.

Pods demand careful hull hydrodynamics, strengthened foundations, and electrical architectures sized for high torque duty, which raises engineering hours and approval touchpoints. Drydock access and heavy lift coordination are needed for major service, so schedule windows must be protected long in advance. Skilled technicians, specialized seals, and proprietary electronics increase lifecycle cost if regional support is thin. Ice class and debris exposure introduce strike risks that must be mitigated through guards and operating procedures. Owners also face multi party interfaces among shipyard, pod supplier, class society, and automation vendor, which complicates warranty accountability. Spare unit availability and long lead components can extend off hire periods after casualties. These realities keep procurement conservative, and they push many operators to trial pods on select vessels before broader fleet adoption.

Clear opportunities are emerging where maneuvering precision, hotel load integration, and space efficiency deliver measurable value. Offshore construction and service vessels gain from rapid thrust vectoring that supports dynamic positioning and walk to work operations with fewer thruster transitions. Cruise and expedition ships value quiet operation, tight turning, and shorter machinery rooms that free deck area for revenue spaces. Harbor tugs and escort tugs benefit from high bollard pull in any direction, allowing safer indirect towing and faster turnarounds. Inland ferries and research ships appreciate shallow draft configurations and fine control at low speed. Hybrid arrangements that pair pods with energy storage or auxiliary gensets allow engines to be run closer to optimal loading, while reducing engine starts during brief movements. Retrofit programs on mid life hulls are viable when shaft line renewals are due, creating windows where pod packages can be justified by lifecycle gains.

Industry trends indicate deeper integration with electric powertrains, data rich monitoring, and localized service ecosystems. Pods are being paired with medium voltage distribution, frequency converters, and energy management software that coordinates engines, batteries, and hotel loads for smoother transients and lower noise. Condition monitoring using vibration signatures, oil analysis, and bearing temperature data is being used to plan dockings and shorten troubleshooting. Remote assistance and fleet dashboards help operators compare efficiency across sister ships and maintain consistent handling practices. Ice capable pods and reinforced skegs are entering catalogs for polar routes, while compact units target fast ferries and yachts. Regional parts hubs and field schools are expanding to reduce downtime and improve first time fix rates. Long term service agreements with clear performance guarantees are gaining favor as owners look for predictable lifetime cost and documented availability across multi year operational cycles.

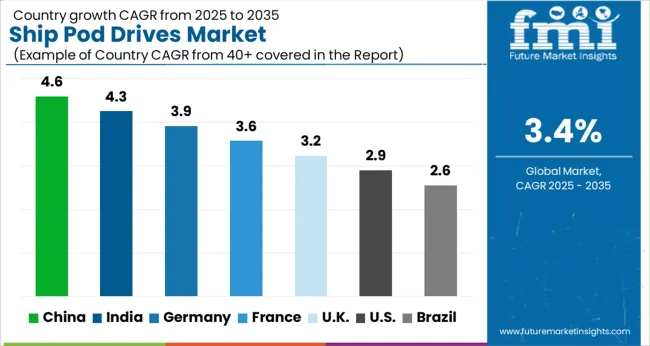

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The ship pod drives market is expected to grow globally at a CAGR of 3.4% from 2025 to 2035. China leads with 4.6%, followed by India at 4.3% and France at 3.6%, while the UK posts 3.2% and the USA trails at 2.9%. China secures the highest growth premium of +1.2% above the global baseline, supported by rapid shipbuilding expansion and maritime modernization. India follows at +0.9%, with ferry transport and naval projects creating strong opportunities. France anchors Europe with luxury yacht and cruise ship demand, while the UK focuses on offshore vessels. The USA, despite slower growth, maintains steady demand from cruise and naval applications. The analysis includes over 40+ countries, with the leading markets detailed below.

The ship pod drives market in China is projected to grow at a CAGR of 4.6% from 2025 to 2035, the fastest among the profiled countries. Growth is being driven by China’s expanding shipbuilding industry, particularly in passenger vessels, ferries, and offshore service vessels where pod propulsion enhances maneuverability and fuel efficiency. Domestic shipyards are increasingly adopting pod drives for both coastal and inland waterway vessels, while international suppliers are collaborating with Chinese firms to localize production. Government initiatives supporting modernization of the maritime sector and improved vessel efficiency standards are further fueling adoption. With strong demand in both commercial and specialized vessels, China is expected to remain a leading hub for ship pod drive deployment.

The ship pod drives market in India is expected to grow at a CAGR of 4.3% between 2025 and 2035. The shipbuilding and port modernization programs are creating steady demand for advanced propulsion systems. Pod drives are being increasingly adopted in ferries, coastal vessels, and offshore support vessels to improve maneuverability and reduce operating costs. The country’s growing focus on passenger ferry services, especially in coastal and riverine transport, supports market expansion. Imports dominate supply, but domestic firms are gradually exploring partnerships with global pod drive manufacturers. Rising investment in naval modernization also adds to potential adoption in specialized military and research vessels. India’s emphasis on marine logistics efficiency will continue to support gradual market growth.

The ship pod drives market in France is forecast to expand at a CAGR of 3.6% through 2035. France’s strong presence in luxury yachts, cruise ships, and naval vessels ensures steady adoption of pod propulsion technology. Pod drives are preferred for their high maneuverability, efficiency, and ability to reduce vibration in premium and passenger-oriented vessels. French shipyards and European marine engineering firms are advancing pod drive technologies to meet IMO regulations on efficiency and emissions. The growing demand for luxury yachts and ferries in Europe adds further momentum. France also benefits from collaborative research initiatives with EU partners to improve design and operational efficiency of pod drives.

The ship pod drives market in the United Kingdom is expected to grow at a CAGR of 3.2% between 2025 and 2035. The UK has a strong maritime sector with a focus on offshore energy vessels, passenger ferries, and naval platforms where pod propulsion systems provide advantages in fuel efficiency and maneuverability. Pod drives are being increasingly considered for vessels operating in congested ports and coastal waters. Domestic suppliers are active in integration and maintenance, while most pod drive systems are sourced from global manufacturers. Offshore energy developments in the North Sea are also contributing to demand for efficient propulsion systems. Despite moderate growth compared to Asia, the UK remains a strategic European market.

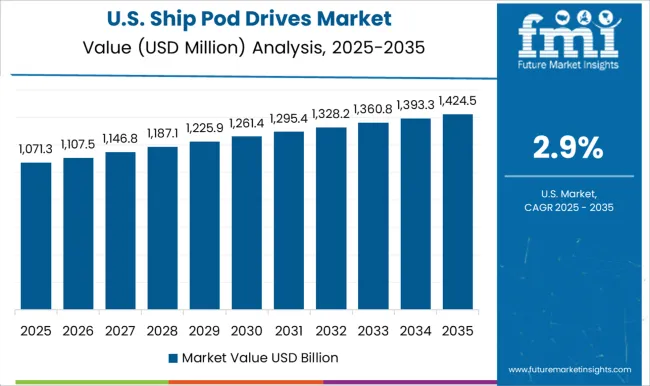

The ship pod drives market in the United States is projected to expand at a CAGR of 2.9%, the slowest among the profiled regions but still significant in terms of absolute demand. The USA shipbuilding sector, particularly in cruise ships, naval vessels, and offshore service vessels, remains a strong adopter of pod propulsion systems. Pod drives are valued for their ability to reduce vibration and improve passenger comfort, making them suitable for the cruise industry. Naval modernization programs are also creating niche demand. USA suppliers work closely with European manufacturers to integrate advanced pod drives in new builds and retrofits. While growth is modest, the USA market’s large-scale projects ensure consistent opportunities.

In the ship pod drives market, incumbents like ABB, Wärtsilä, and Kongsberg Maritime don’t dominate because they build slightly more efficient pods; they dominate because they lock in early at the vessel design stage, own the certification and safety cases, and wrap customers into decades-long service and software contracts. That means the barrier to entry isn’t hydrodynamics it’s trust, uptime guarantees, and system integration credibility. Any challenger selling “better pods” without an ecosystem is simply competing for scraps. This distinction between the visible product and the invisible moat is what shapes margins, procurement cycles, and market structure.

Equally, growth narratives often miss the operational red lines that buyers live by. Cruise operators care less about a half-percent efficiency gain than about avoiding the reputational risk of a propulsion failure mid-season. Offshore operators prioritize ice-class certification and resilience under harsh conditions, not brochure-level ROI.

The true game is lifecycle economics, integration with digital vessel management, and risk minimization. That is why incumbents price hardware thin but extract value through service, remote diagnostics, and proprietary software layers. The firms that win in this market are those that influence shipyard decisions upstream and guarantee predictable cost of ownership downstream.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Electric pod drives, Diesel-electric pod drives, and Gas turbine-electric pod drives |

| Vessel | Cruise ships, Commercial vessels, Naval ships, Offshore support vessels, and Yachts and leisure boats |

| Technology | Integrated propulsion systems, Conventional propulsion technology, Smart control systems, and Autonomous maneuvering technologies |

| Power rating | 1 MW to 5 MW, Up to 1 MW, and Above 5 MW |

| End Use | Shipbuilders and Shipping companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB (Azipod and related pod solutions), Wärtsilä, Schottel, Kongsberg, Rolls-Royce (marine assets / legacy), and Others |

| Additional Attributes | Dollar sales by product type (optical glass, crystals, ceramics, coatings), wavelength range (UV, visible, IR), and application (telecommunications, defense, medical devices, consumer electronics). Demand is fueled by high-performance imaging, laser systems, and precision sensing. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by industrial automation, advanced research, and adoption of precision optics in commercial and defense sectors. |

The global ship pod drives market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the ship pod drives market is projected to reach USD 3.8 billion by 2035.

The ship pod drives market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in ship pod drives market are electric pod drives, diesel-electric pod drives and gas turbine-electric pod drives.

In terms of vessel, cruise ships segment to command 42.0% share in the ship pod drives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ship Anchor Market Size and Share Forecast Outlook 2025 to 2035

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Ship Plate Market Size and Share Forecast Outlook 2025 to 2035

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Competitive Breakdown of Shipping Mailers Manufacturers

Leading Providers & Market Share in Shipping Tapes

Ship Rudders Market

Ship Bridge Simulator Market

PUR Shippers Market Size and Share Forecast Outlook 2025 to 2035

EPS Shippers Market Size and Share Forecast Outlook 2025 to 2035

Jug Shipper Market

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA