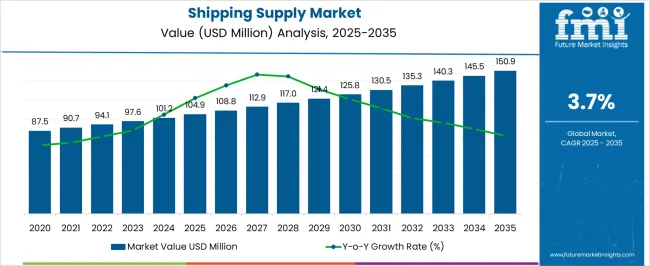

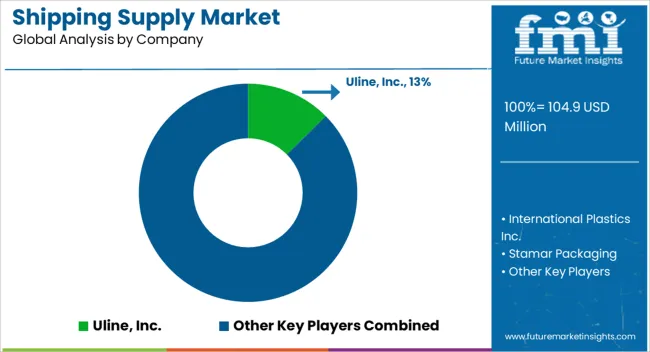

The Shipping Supply Market is estimated to be valued at USD 104.9 million in 2025 and is projected to reach USD 150.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Shipping Supply Market Estimated Value in (2025 E) | USD 104.9 million |

| Shipping Supply Market Forecast Value in (2035 F) | USD 150.9 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The shipping supply market is advancing steadily, driven by the expansion of global e-commerce, the rising need for secure packaging, and the growing emphasis on sustainable material innovation. Increased demand from logistics service providers, retail distributors, and courier companies has amplified reliance on packaging solutions that combine durability with cost efficiency.

The market is currently characterized by high usage of plastics and corrugated formats, supported by their lightweight properties and compatibility with diverse shipping requirements. Growing cross-border trade and the proliferation of small parcel deliveries have reinforced demand for standardized shipping supplies across industries.

The future outlook is shaped by a strong push toward recyclable and eco-friendly materials, with manufacturers focusing on innovation to balance strength, weight, and sustainability. With digital commerce penetration continuing to rise globally, the shipping supply market is expected to maintain consistent growth, anchored by continuous supply chain expansion and logistics modernization.

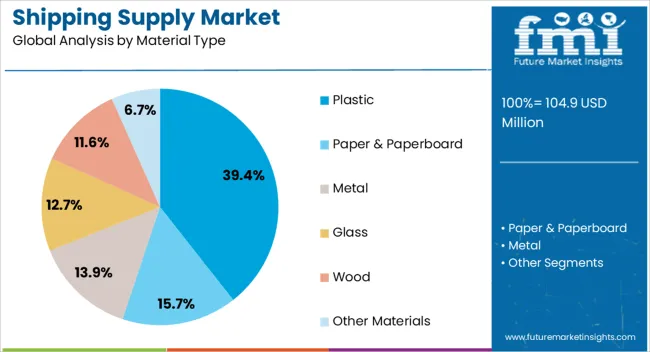

The plastic segment leads the material type category, accounting for approximately 39.4% share in the shipping supply market. Its leadership is attributed to its durability, lightweight nature, and adaptability across multiple packaging formats, from protective wraps to envelopes.

Plastic’s cost efficiency and resilience against moisture and external damage have strengthened its role in ensuring safe transit of goods across long distances. The segment has benefited from large-scale adoption in e-commerce and courier sectors, where high-volume shipments demand consistent performance.

Although sustainability concerns have triggered regulatory restrictions in some regions, ongoing innovation in recyclable and biodegradable plastics is supporting its continued use. With the dual advantage of functionality and cost-effectiveness, plastic remains the most widely utilized material in global shipping supplies.

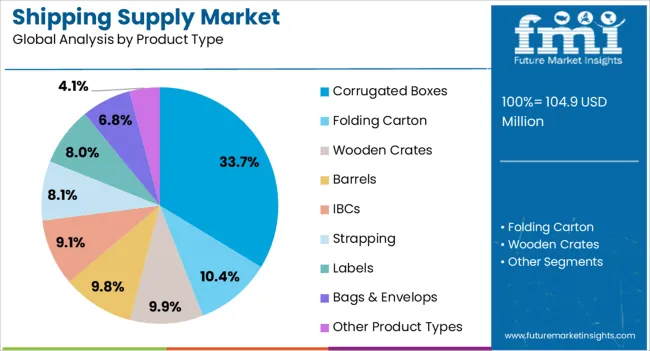

The corrugated boxes segment dominates the product type category, holding approximately 33.7% share. This leadership stems from corrugated packaging’s strength-to-weight ratio, stacking efficiency, and compatibility with branding requirements.

Corrugated boxes are extensively adopted in the shipping and logistics industry for their versatility in accommodating diverse product categories. The segment benefits from advancements in lightweight board designs that reduce material use while retaining structural integrity.

Additionally, recyclability and eco-friendly perception have reinforced corrugated boxes as a preferred choice among businesses striving to meet sustainability targets. Their ability to provide cushioning protection during long-distance transit and their widespread acceptance across industries ensure a stable growth trajectory.

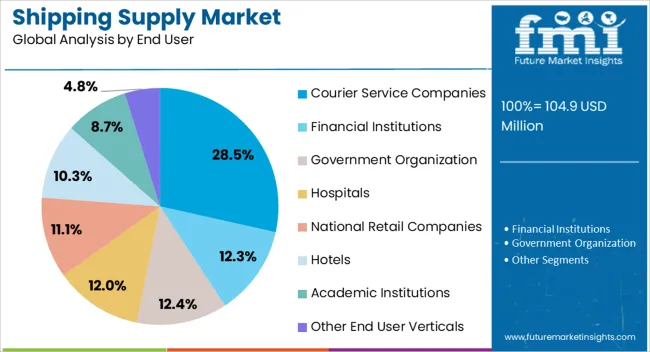

The courier service companies segment leads the end-user category, representing approximately 28.5% share. This dominance is driven by the increasing reliance of courier networks on standardized and reliable shipping supplies to manage large-scale parcel volumes.

Rapid growth in e-commerce and cross-border trade has heightened demand for consistent, cost-efficient, and protective packaging materials. Courier operators prioritize supplies that reduce handling damage and enhance logistical efficiency.

The segment also benefits from branding opportunities, as packaging solutions are customized to improve customer experience. With courier services expanding to meet last-mile delivery requirements, the demand for durable and lightweight shipping supplies is expected to remain high, sustaining this segment’s leadership in the forecast period.

The global shipping supply market was valued at USD 87.5 billion in 2020. It expanded at a CAGR of 2.1% from 2020 to 2025. The market reached USD 104.9 billion by 2025.

| Attributes | Details |

|---|---|

| Historical Market Size (2020) | USD 87.5 billion |

| Market Size (2025) | USD 104.9 billion |

| HCAGR (2020 to 2025) | 2.1% |

As more consumers opted for online shopping during 2024 and 2024, there was a significant increase in parcel packaging and mailing supplies. This fateful behavioral change in the consumer side led to the strengthening of logistics packaging trends that are expected to drive the market in the future as well.

Currently, packaging materials like corrugated boxes and cardboard boxes that are recyclable, biodegradable, and reusable are in a position to carve out a market niche. So, shipping and packing products suppliers are reorienting their supply chains to take advantage of sustainable packaging trends by using environmentally friendly packaging materials.

To improve customer experience and brand awareness, shipping service providers are looking for custom-made packaging solutions that are branded or easily printable. The sheer complexity of present-day supply chains due to globalization also necessitates greater marking and branding of cargo packaging solutions for easy sorting.

Market players that provided shipping supplies for pharmaceutical industries became essential during the pandemic years and reshaped the packaging materials industry outlook. Many shipping supply businesses that catered to different commercial sectors started concentrating on medicine and vaccine supplies only.

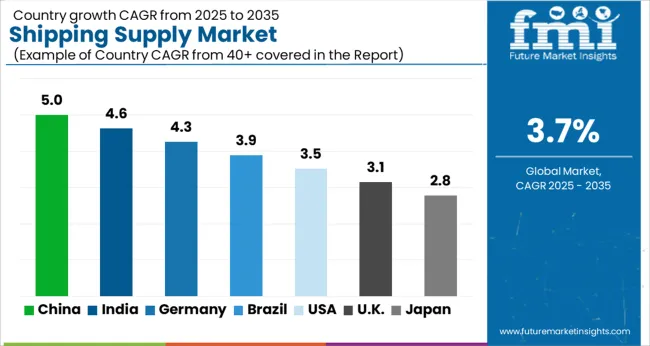

The list below presents a brief overview of how shipping supply industries in different geographical locations are going to perform in the coming days. The overall market size in developed economies like the United States and the United Kingdom is poised to remain higher. Meanwhile, emerging markets like India and China are anticipated to present more lucrative growth opportunities in the region.

The United States shipping supply market is projected to rise at a CAGR of 2.5% from 2025 to 2035.

The use of modern and effective transportation methods, such as logistics vehicles with GPS trackers, has also transformed the market in the United States. So, a greater share of the shipping supply business has been concentrated in the hands of a few market players with higher capital.

The demand for shipping supplies in the United Kingdom is poised to advance at a 3.8% CAGR during the forecast period.

Logistics companies in the United Kingdom are always more concerned regarding the safe delivery of cargo making packaging and shipping crucial for the industrial economy. There is a great demand for packaging solutions in the country that are safe, robust, and adhere to international shipping regulations.

Demand for shipping supplies is higher in China than in other Asian countries, and the market is expected to progress at a 5.7% CAGR through 2035.

The logistics and shipping industry has seen tremendous growth in China due to the weakening of laws to encourage import, export, and trade across the country. Furthermore, as cross-border eCommerce is growing fast in China, shipping supply companies have more opportunities to meet the special packing and shipping requirements of export companies.

The demand for shipping supplies in India is estimated to rise at a CAGR of 6.4% over the next ten years.

As direct-to-consumer services have grown in popularity, more small and medium-sized companies have joined the market in India in recent years. In addition, the development of small-scale industries in several tier II and tier III cities has indirectly increased the demand for shipping supplies for the packaging of merchandise.

The paper segment is estimated to constitute 43.6% of the market by material in 2025.

| Attributes | Details |

|---|---|

| Top Material Type | Paper |

| Market Share in 2025 | 43.6% |

Most companies prefer shipping products that are both affordable and dependable, resulting in higher use of paper materials by shipping supply service providers. Moreover, corrugated paper boxes and cardboard boxes made of paper are in line with the global shift toward a sustainable shipping and logistics sector.

The demand for packaging bags is expected to hold a total market share of 21.3% in 2025.

| Attributes | Details |

|---|---|

| Top Packaging Format Type | Bags |

| Market Share in 2025 | 21.3% |

As last-mile delivery services have grown, logistics companies are preferring lightweight and compact packing solutions like shipping bags and mailers. Durability, custom compliance, and protection during long-distance transit are highly desirable in the present-day shipping supply market. This is contributing to the segment’s growth.

Many big and small shipping supply service providers are present in the global landscape, and the intense competition is orchestrating cargo packaging market developments further. The responsibility of market players has stretched out to designing shipping equipment as per traveling conditions and protecting the cargo while they are in transit. Leading market players have also improved their brand visibility and control by focusing on innovations like temperature-controlled packaging, smart packaging, and track-and-trace technology.

Recent Developments in the Global Shipping Supply Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 101.2 billion |

| Projected Market Size (2035) | USD 145.5 billion |

| CAGR (2025 to 2035) | 3.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Material Type, By End User Verticals and By Region |

| Key Companies Profiled | Uline, Inc.; International Plastics Inc.; Stamar Packaging; UWAY Packaging Supplies.; Ferguson Box Company; Volk Packaging Corporation; Western Container Corporation; Great Little Box Company Ltd.; Liaoning Hengyue Printing and Packaging Co., Ltd.; Dahua Brother Enterprise Co., Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global shipping supply market is estimated to be valued at USD 104.9 million in 2025.

The market size for the shipping supply market is projected to reach USD 150.9 million by 2035.

The shipping supply market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in shipping supply market are plastic, _polyethylene (pe), _polypropylene (pp), _polyethylene terephthalate (pet), _polyvinyl chloride (pvc), _other types of plastic, paper & paperboard, metal, glass, wood and other materials.

In terms of product type, corrugated boxes segment to command 33.7% share in the shipping supply market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Competitive Breakdown of Shipping Mailers Manufacturers

Leading Providers & Market Share in Shipping Tapes

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Supply Chain Management Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Management BPO Market Analysis 2025 to 2035 by Outsourcing Model, Application, Service Type, Enterprise Size & Region

Supply Chain Analytics – AI-Powered Logistics & Insights

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Office Supply Market Forecast and Outlook 2025 to 2035

IoT in Supply Chain Market Insights – Trends, Growth & Forecast 2023-2033

DC Power Supply Module Market – Powering IoT & Electronics

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA