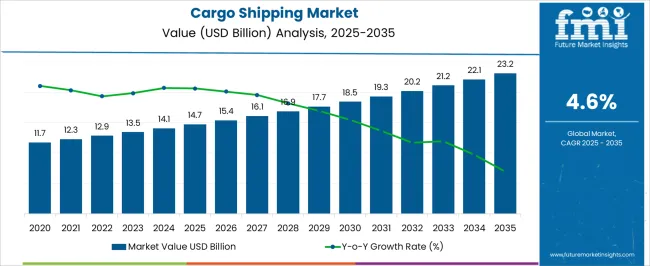

The Cargo Shipping Market is estimated to be valued at USD 14.7 billion in 2025 and is projected to reach USD 23.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Cargo Shipping Market Estimated Value in (2025 E) | USD 14.7 billion |

| Cargo Shipping Market Forecast Value in (2035 F) | USD 23.2 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The Cargo Shipping market is experiencing steady growth, driven by the increasing global demand for the efficient movement of goods across international and domestic supply chains. Rising trade volumes, expansion of e-commerce, and globalization of manufacturing operations are contributing to greater reliance on cargo shipping services. Technological advancements in vessel design, cargo handling systems, and tracking solutions are improving operational efficiency, reducing transit times, and enhancing safety in shipping operations.

The market is further supported by investments in port infrastructure, intermodal logistics, and environmentally sustainable shipping solutions aimed at reducing emissions and fuel consumption. Strong demand from sectors such as food, pharmaceuticals, and industrial manufacturing is shaping the market landscape, as these industries require reliable and timely delivery solutions.

Increasing regulatory oversight, adherence to safety standards, and integration of digital monitoring systems are further enhancing market confidence As global trade and supply chain complexity continue to grow, the Cargo Shipping market is expected to sustain expansion, supported by technological innovation and increasing demand for high-capacity, efficient transportation services.

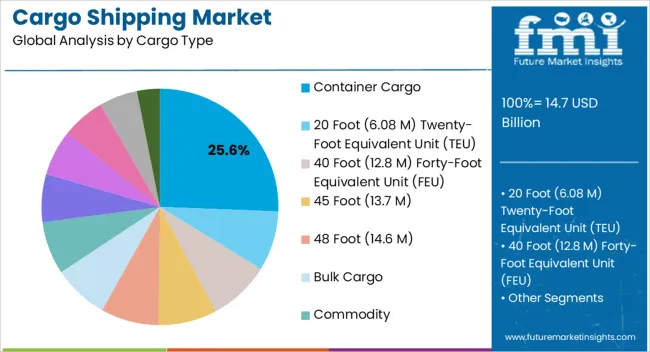

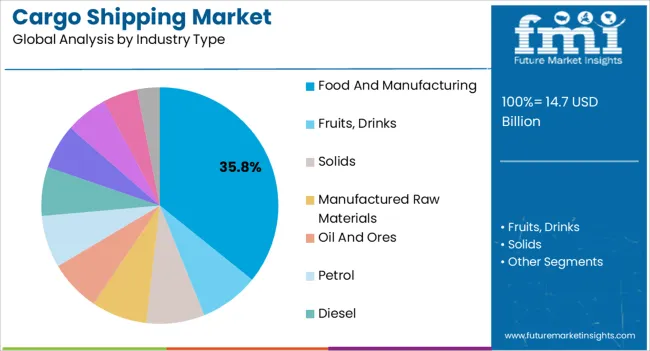

The cargo shipping market is segmented by cargo type, industry type, and geographic regions. By cargo type, cargo shipping market is divided into Container Cargo, 20 Foot (6.08 M) Twenty-Foot Equivalent Unit (TEU), 40 Foot (12.8 M) Forty-Foot Equivalent Unit (FEU), 45 Foot (13.7 M), 48 Foot (14.6 M), Bulk Cargo, Commodity, Materials, Oil, General Cargo, Solids, and Raw Materials. In terms of industry type, cargo shipping market is classified into Food And Manufacturing, Fruits, Drinks, Solids, Manufactured Raw Materials, Oil And Ores, Petrol, Diesel, Iron Ore, Electrical And Electronics, Electrical Equipment’s, and Electronic Equipment’s. Regionally, the cargo shipping industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The container cargo segment is projected to hold 25.6% of the market revenue in 2025, establishing it as the leading cargo type. Its dominance is being driven by the versatility and efficiency offered by standardized containers for transporting diverse goods across long distances. Containerization allows for improved cargo security, streamlined handling, and reduced damage or loss during transit.

Integration with intermodal transportation systems, including rail, road, and ports, further enhances operational efficiency and cost-effectiveness. The adoption of digital tracking systems, automation in port handling, and optimization of loading and unloading processes have strengthened the reliability of container cargo operations. Increasing global trade, particularly in high-value and perishable goods, has further reinforced demand.

Container cargo provides a scalable and flexible solution that supports both small-scale shipments and bulk transportation requirements As supply chains continue to evolve and trade volumes increase, container cargo is expected to maintain its leading position, driven by operational efficiency, cost-effectiveness, and adaptability to diverse industry needs.

The food and manufacturing industry segment is anticipated to account for 35.8% of the market revenue in 2025, making it the largest end-use industry. Growth in this segment is being driven by the increasing need to transport raw materials, semi-finished products, and finished goods efficiently across regional and global supply chains. The perishability of food products, coupled with stringent quality and safety standards, requires reliable cargo shipping solutions with temperature control, monitoring, and timely delivery capabilities.

Manufacturing industries depend on cargo shipping for the movement of heavy machinery, components, and industrial materials to maintain production schedules and reduce downtime. Adoption of containerized cargo, automation, and digital tracking systems ensures operational efficiency and minimizes losses.

The sector’s demand is further reinforced by expanding industrial production, globalization of supply chains, and the need for efficient distribution networks As food and manufacturing operations continue to grow and integrate into global markets, this industry segment is expected to remain the primary driver of cargo shipping demand, supported by reliability, scalability, and advanced logistics capabilities.

Trade liberalization and global economic growth boost the cargo shipping market. In the past decade cargo shipping market has fared quite successfully. With economic growth and development there is a direct increase in commodity consumption, which drives the cargo shipping market. Depending on the cargo and the type of storage, loading, unloading and securing it would require various types of ships for transportation.

Investments in port infrastructure and the global supply-demand cycle will have a positive impact on the shipping market. Growth in countries forging free trade agreements like AFTA (ASEAN Free Trade Area), TPSEP (Trans-Pacific Strategic Economic Partnership), and NAFTA (North American Free Trade Agreement) will drive the cargo shipping market.

Transport is an essential link for trading, and the aim is to obtain raw materials for manufacturing industries, or trade manufactured goods in good condition, as and when they are required. Demand and supply for sea transportation has increased and five key things to be considered in the cargo shipping market are: economy, average haul, seaborne commodity, random shocks and transport cost.

The cargo shipping industry is segmented on the basis of cargo and industry type. Infrastructure initiatives such as development of new ports and extension of existing ports leads to growth of the cargo shipping market. Container cargos load food, manufacturing industry’s raw materials and electrical & electronic goods.

Liquid bulk cargos are loaded with oil from the oilfields at sea – to do this they moor bow type tankers, known as shuttle tankers. Developing economies in Asia-Pacific account for the significant market share; especially China, since it is a major exporter.

Growth rate in Europe is presently steady and is expected to grow in the near future; owing to various initiatives by the European Union. Middle East and African regions have the highest potential in the coming years due to availability of oilfields; this is estimated despite the fall in oil prices internationally.

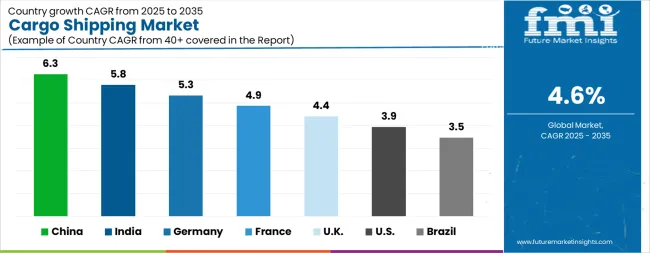

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.9% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The Cargo Shipping Market is expected to register a CAGR of 4.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.3%, followed by India at 5.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.5%, yet still underscores a broadly positive trajectory for the global Cargo Shipping Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.3%. The USA Cargo Shipping Market is estimated to be valued at USD 5.1 billion in 2025 and is anticipated to reach a valuation of USD 7.6 billion by 2035. Sales are projected to rise at a CAGR of 3.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 778.8 million and USD 465.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.7 Billion |

| Cargo Type | Container Cargo, 20 Foot (6.08 M) Twenty-Foot Equivalent Unit (TEU), 40 Foot (12.8 M) Forty-Foot Equivalent Unit (FEU), 45 Foot (13.7 M), 48 Foot (14.6 M), Bulk Cargo, Commodity, Materials, Oil, General Cargo, Solids, and Raw Materials |

| Industry Type | Food And Manufacturing, Fruits, Drinks, Solids, Manufactured Raw Materials, Oil And Ores, Petrol, Diesel, Iron Ore, Electrical And Electronics, Electrical Equipment’s, and Electronic Equipment’s |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

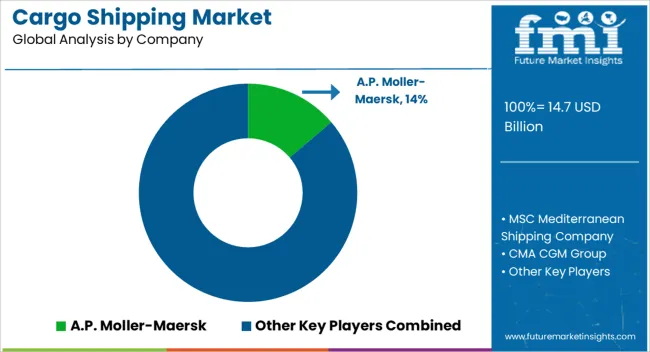

| Key Companies Profiled | A.P. Moller-Maersk, MSC Mediterranean Shipping Company, CMA CGM Group, COSCO Shipping Holdings, Hapag-Lloyd, Ocean Network Express (ONE), Evergreen Marine Corp., Yang Ming Marine Transport, Pacific International Lines (PIL), Wan Hai Lines, ZIM Integrated Shipping, SITC International, Zhonggu Logistics, Antong Holdings (QASC), X-Press Feeders, and Matson Navigation |

The global cargo shipping market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the cargo shipping market is projected to reach USD 23.2 billion by 2035.

The cargo shipping market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in cargo shipping market are container cargo, 20 foot (6.08 m) twenty-foot equivalent unit (teu), 40 foot (12.8 m) forty-foot equivalent unit (feu), 45 foot (13.7 m), 48 foot (14.6 m), bulk cargo, commodity, materials, oil, general cargo, solids and raw materials.

In terms of industry type, food and manufacturing segment to command 35.8% share in the cargo shipping market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Cargo Vans Market Size and Share Forecast Outlook 2025 to 2035

Cargo Inspection Market Size and Share Forecast Outlook 2025 to 2035

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Competitive Breakdown of Shipping Mailers Manufacturers

Leading Providers & Market Share in Shipping Tapes

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Air Cargo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Containers Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Handling Equipment Market

Aircraft Cargo Winches Market

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Electric 3-wheeler Cargo Bikes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA