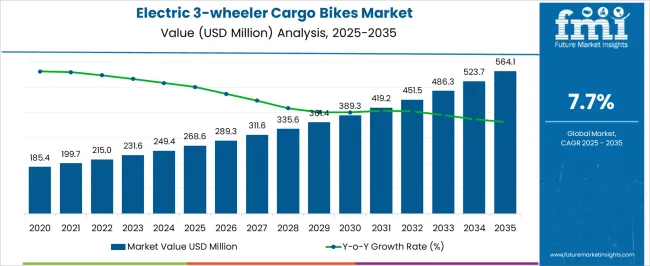

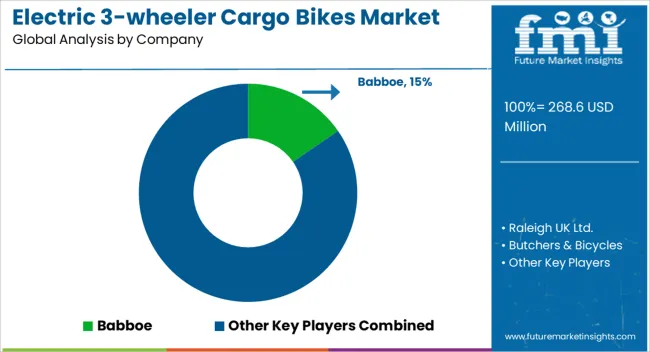

The electric 3-wheeler cargo bikes market is estimated to be valued at USD 268.6 million in 2025 and is projected to reach USD 564.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

In the early phase from 2021 to 2025, values rise from USD 185.4 million to 268.6 million, progressing steadily through USD 199.7 million, 215.0 million, 231.6 million, and 249.4 million. This period highlights initial adoption supported by urban logistics solutions, last-mile delivery demand, and favorable government incentives promoting electric mobility. The CAGR gains momentum in the subsequent half-decade, with market size expanding from USD 268.6 million in 2025 to USD 389.3 million in 2030, passing through USD 289.3 million, 311.6 million, 335.6 million, and 361.4 million. Rising fuel costs, stricter emission norms, and the growing penetration of e-commerce platforms drive wider acceptance among logistics providers, while improvements in battery technology enhance range and efficiency.

From 2031 to 2035, the market accelerates further, scaling from USD 419.2 million to 564.1 million, with intermediate values of USD 451.5 million, 486.3 million, and 523.7 million. This stage emphasizes large-scale deployment in urban freight networks, fleet electrification, and strong uptake across emerging economies. CAGR-led growth underscores consistent annual expansion, reflecting a balance between rising demand, cost competitiveness, and technological innovation that strengthens the long-term trajectory of the electric 3-wheeler cargo bikes market.

| Metric | Value |

|---|---|

| Electric 3-wheeler Cargo Bikes Market Estimated Value in (2025 E) | USD 268.6 million |

| Electric 3-wheeler Cargo Bikes Market Forecast Value in (2035 F) | USD 564.1 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The electric vehicle market contributes the largest share, about 28-32%, as the transition to clean mobility drives demand for compact, battery-powered cargo solutions. The urban logistics and last-mile delivery market adds around 22-25%, since e-commerce growth and on-demand services require cost-efficient, emission-free vehicles for parcel and food distribution in congested cities. The light commercial vehicle (LCV) market contributes roughly 15-18%, with electric 3-wheeler cargo bikes increasingly seen as substitutes for small vans in short-distance freight, offering lower operating costs and easier maneuverability. The micromobility solutions market accounts for 10-12%, where electric cargo bikes align with shared mobility and fleet operations, enhancing accessibility and sustainability in urban ecosystems.

Lastly, the renewable energy storage and battery systems market represents about 8-10%, as advancements in lithium-ion, solid-state, and swappable batteries directly improve the range, efficiency, and cost structure of these vehicles. Together, these parent markets highlight the growing role of electric 3-wheeler cargo bikes in reshaping urban freight, supporting greener supply chains, and meeting regulatory pressures on emissions and congestion while offering logistics operators scalable, affordable, and future-ready solutions.

The electric 3-wheeler cargo bikes market is experiencing steady momentum, supported by the expansion of last-mile delivery networks, stricter emission regulations, and rising fuel cost pressures. Industry reports, product launch updates, and logistics sector announcements have highlighted how businesses are increasingly turning to electric cargo vehicles to reduce operational costs while meeting sustainability targets.

Technological advancements, particularly in battery efficiency and motor performance, have enhanced the payload capacity and range of these vehicles, making them more competitive against conventional cargo solutions. Urban freight policies and government incentives have also played a critical role in promoting adoption, especially in densely populated cities where low-emission transport is encouraged.

With e-commerce and hyperlocal delivery models expanding, manufacturers are focusing on higher efficiency drivetrains, modular cargo designs, and better ergonomics for riders. Growth over the next few years is expected to be led by lighter payload variants for high-frequency deliveries, lithium-ion battery systems for extended range, and mid-tier power outputs that balance performance and efficiency.

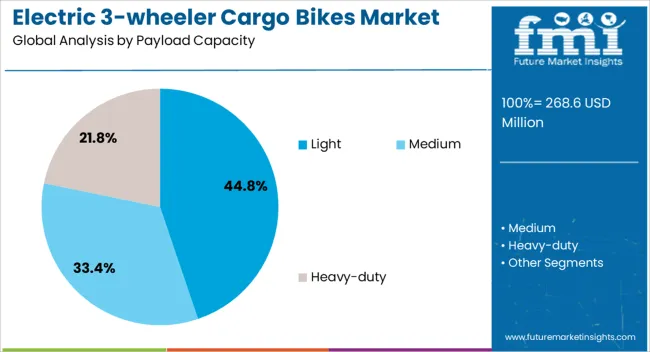

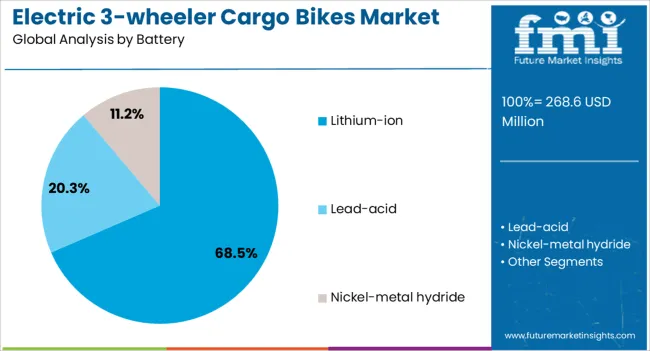

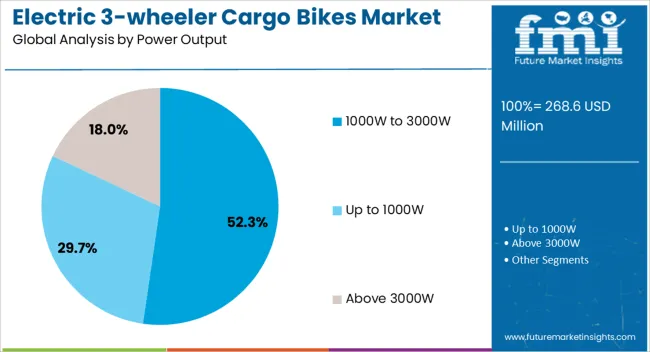

The electric 3-wheeler cargo bikes market is segmented by payload capacity, battery, power output, end-use, and geographic regions. By payload capacity, electric 3-wheeler cargo bikes market is divided into light, medium, and heavy-duty. In terms of battery, electric 3-wheeler cargo bikes market is classified into lithium-ion, lead-acid, and nickel-metal hydride. Based on power output, electric 3-wheeler cargo bikes market is segmented into 1000W to 3000W, up to 1000W, and above 3000W. By end-use, electric 3-wheeler cargo bikes market is segmented into logistics & delivery, retail & wholesale, construction and agriculture, and others. Regionally, the electric 3-wheeler cargo bikes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Light payload capacity segment is projected to account for 44.8% of the electric 3-wheeler cargo bikes market revenue in 2025, maintaining its lead due to its suitability for urban logistics and short-haul transport. This category’s growth has been driven by its maneuverability in congested traffic and the lower energy requirements compared to heavier payload models. Businesses engaged in courier services, grocery delivery, and small-scale goods transport have favored lighter payload vehicles for their operational agility and cost-effectiveness. Manufacturing innovations have improved structural strength without adding significant weight, allowing these models to maintain a balance between load-bearing capability and battery efficiency. The lower upfront and operating costs of light payload capacity vehicles have also made them attractive for small and medium-sized enterprises. With urban delivery volumes continuing to increase, the Light payload capacity segment is expected to remain a key driver in market growth.

The lithium-ion battery segment is expected to contribute 68.5% of the market revenue in 2025, cementing its position as the preferred energy storage technology for electric 3-wheeler cargo bikes. Its dominance is underpinned by superior energy density, faster charging capabilities, and longer lifecycle compared to lead-acid alternatives. Fleet operators have increasingly adopted lithium-ion batteries to extend vehicle range and reduce downtime, directly enhancing delivery efficiency. Advances in thermal management and battery management systems have further improved safety and performance, encouraging broader market acceptance. Additionally, the declining cost of lithium-ion technology has made it more accessible for both large-scale logistics companies and independent operators. As battery recycling infrastructure improves and raw material sourcing becomes more sustainable, the Lithium-ion segment is projected to strengthen its hold on the market.

The 1000W to 3000W power output segment is projected to capture 52.3% of the electric 3-wheeler cargo bikes market revenue in 2025, establishing itself as the dominant category. This power range has been preferred for its ability to provide a balance between adequate load-carrying performance and energy efficiency. Vehicles in this range can handle typical urban delivery demands while offering longer operational hours on a single charge. Logistics operators have favored these models for their versatility across diverse delivery routes and payload requirements. Technological improvements in motor efficiency have enhanced acceleration and climbing capability without significantly impacting battery consumption. The adaptability of 1000W to 3000W systems to both flat and moderately inclined terrains has widened their use case across urban and peri-urban areas. With e-commerce and delivery service volumes continuing to expand, this power output category is expected to maintain its market leadership.

Logistics, postal, and retail companies are adopting these vehicles to reduce fuel dependence and comply with strict emission norms. Government subsidies, tax benefits, and policy frameworks promoting electric mobility are further boosting adoption across Asia-Pacific, Europe, and North America. Despite growing interest, challenges persist, including high capital investment, limited charging infrastructure, and battery reliability issues. Manufacturers face the need to balance payload capacity with range performance while keeping costs competitive. However, significant opportunities are emerging with battery swapping networks, lightweight frame materials, and telematics-based fleet management. Trends point to rapid fleet electrification, data-driven logistics optimization, and cross-industry collaborations to create urban-ready transport solutions.

E-commerce and food delivery platforms are driving adoption of electric 3-wheeler cargo bikes for their operational efficiency and zero-emission performance. Companies such as Amazon, Flipkart, Swiggy, and DHL are introducing these vehicles into fleets to navigate congested urban areas more effectively than conventional vans. Electric cargo bikes offer lower maintenance costs, no fuel dependency, and better maneuverability, making them attractive for city logistics. In Asia-Pacific, especially India and China, government schemes and regulatory frameworks encourage large-scale deployment. European countries like Germany, France, and the Netherlands are integrating cargo bikes into urban mobility plans. Range reliability, payload capacity, and fast charging are critical evaluation factors for operators. With rising fuel costs and stricter emission standards, electric 3-wheelers are becoming vital solutions for e-commerce, postal, and food delivery businesses worldwide.

High upfront prices limit access for small enterprises, while financing options remain scarce in several markets. Charging infrastructure is still inadequate in many regions, reducing convenience for fleet operators that depend on consistent vehicle uptime. Technical challenges such as battery degradation, limited driving range under heavy load, and stability issues when carrying bulky cargo restrict full potential. Compliance with safety regulations, vehicle certification standards, and emission rules further complicates production. Buyers increasingly expect warranty-backed batteries, reliable service support, and long-term spare part availability. To capture demand, manufacturers must focus on lowering costs while delivering dependable, regulation-compliant vehicles. Meeting performance expectations, ensuring safety, and offering service reliability are key to winning contracts from logistics, postal, and delivery operators worldwide.

Battery swapping, particularly in India and China, is improving fleet utilization by reducing downtime and eliminating charging delays. Lightweight materials such as aluminum alloys and composites enhance load efficiency and reduce energy use per trip. IoT-based telematics systems enable fleet operators to monitor vehicles in real time, optimize delivery routes, and plan predictive maintenance, reducing overall costs. Rapid urbanization, growing e-commerce penetration, and city-level clean transport policies in Asia-Pacific and Europe are accelerating adoption. Manufacturers offering customizable designs, modular battery solutions, and advanced connectivity features are positioned to capture market share. Partnerships with logistics companies, mobility service providers, and infrastructure developers strengthen ecosystem readiness, ensuring electric 3-wheeler cargo bikes become integral to modern city logistics networks.

Large e-commerce players such as Amazon and Flipkart have pledged to electrify delivery fleets, while global logistics firms including DHL and UPS are deploying electric cargo bikes in urban centers across Europe and North America. Manufacturers are partnering with fleet operators and charging providers to expand adoption and build infrastructure ecosystems. The integration of telematics enables route optimization, predictive battery management, and real-time fleet monitoring. Modular vehicle platforms that adapt to different cargo needs are gaining popularity among operators managing diverse deliveries. Suppliers offering emission-free, digitally integrated, and regulation-compliant vehicles are well positioned to lead this shift. As urban freight networks expand, electric 3-wheeler cargo bikes are set to redefine the efficiency and reliability of last-mile transport.

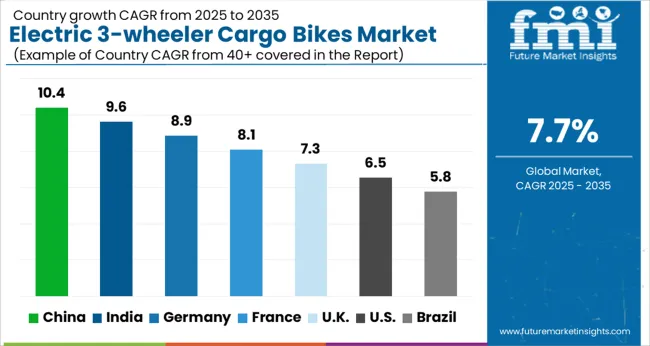

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The global electric 3-wheeler cargo bikes market is forecast to grow at a CAGR of 7.7% from 2025–2035. China leads at 10.4% and India at 9.6%, driven by dense urban logistics, fleet financing models, and local manufacturing scale. France (8.1%) and the UK (7.3%) show strong urban delivery adoption, micro-depot rollouts, and municipal procurement. The USA trails at 6.5%, with focused growth in campus, tourist, and dense downtown pilots. Key global trends include battery-swap/depot strategies, fleet-as-a-service offerings, modular cargo bodies, and integrated telematics—each lowering operational cost and improving utilization for commercial fleets. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the electric 3-wheeler cargo bikes market with a robust CAGR of 10.4% from 2025 to 2035. Urban logistics, last-mile deliveries, and dense city centers are driving the adoption of compact electric cargo solutions for couriers, grocery delivery, and micrologistics. Manufacturers are offering battery-swappable platforms, higher-payload frames, and weatherproof cargo boxes tailored to e-commerce fleets. Local OEMs benefit from integrated supply chains, which encompass battery cells, controllers, and motor assemblies, enabling cost-competitive models and rapid iterations. Municipal pilot programs and designated low-emission delivery zones are encouraging fleet trials among major retailers and logistics providers. Financing models, including lease-to-own and fleet-as-a-service, are lowering entry barriers for SMEs and neighborhood delivery operators. Charging network expansion and battery-leasing partnerships are expanding operational range and uptime for commercial fleets. Strategic partnerships between OEMs and logistics firms are accelerating large-scale fleet rollouts across megacities.

The electric 3-wheeler cargo bikes market in China is forecast to grow at a CAGR of 9.6% between 2025 and 2035. Rapid expansion of e-commerce, compact urban footprints, and last-mile delivery needs are catalyzing demand for affordable, high-payload three-wheelers. Manufacturers are tailoring vehicles for high payloads, reinforced chassis, and robust suspensions suited to mixed road conditions. Battery chemistry choices emphasize cost-effective lead-acid alternatives in lower tiers and lithium-ion packs for premium fleet customers. State incentives, cluster-level EV policies, and urban freight pilots are supporting fleet adoption in metros and tier-2 cities. Local assembly hubs and component suppliers reduce lead times, while rental and subscription offerings are making fleets accessible to kirana stores and regional logistics players. Aftermarket workshops and mobile service vans are important for uptime across distributed geographies. Partnerships between local OEMs and fintech firms enable innovative leasing and pay-per-use models for small businesses.

France is projected to grow at a CAGR of 8.1% from 2025 to 2035 in the electric 3-wheeler cargo bikes market. Demand is driven by urban deliveries in historic city centers, last-mile logistics for grocery and parcel distribution, and municipal low-emission zones. Lightweight, narrow-track cargo trikes are favored for maneuverability in pedestrianized streets and tight alleys. Fleet operators emphasize modular cargo bodies, refrigerated compartments for food delivery, and electric-assist powertrains to meet range and payload requirements. Manufacturers and upfitters collaborate with local couriers, retailers, and municipal agencies to pilot shared fleets and micro-depots. Charging infrastructure and centralized micro-hubs in dense neighborhoods improve operational cycles, while lease and fleet-management services reduce capital strain for operators. Regulatory support for low-emission, low-noise delivery vehicles in city centers is expanding procurement programs. Tourism peaks and seasonal food delivery demand further support rental fleets during high-volume months.

The United Kingdom’s electric 3-wheeler cargo bikes market is expected to record a CAGR of 7.3% from 2025 to 2035. Urban last-mile delivery, congestion-charging zones, and inner-city logistics are driving replacement of vans with compact electric cargo trikes. Operators value nimble machines that reduce curb search time and access restricted zones where larger vehicles are barred. Commercial models emphasize integrated telematics, route-optimization software, and standardized cargo modules for multi-type loads, including parcels and chilled goods. Local fleets are adopting contract hire and subscription models to scale without heavy upfront investment. Public procurement for municipal services waste collection in narrow streets, library and lab deliveries is boosting demand. Aftermarket support networks and certified service partners improve uptime, while partnerships with micro-depot operators extend range and turnaround.

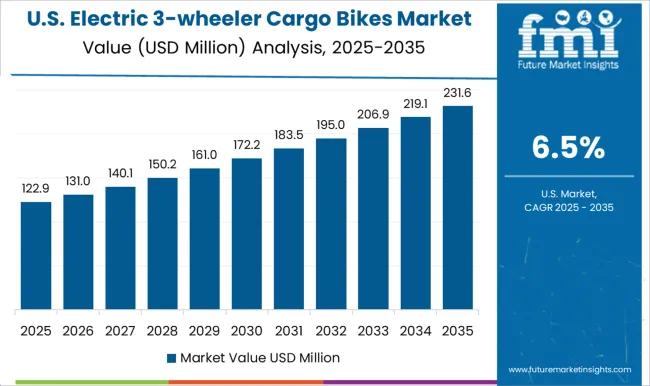

The United States is forecast to grow at a CAGR of 6.5% from 2025 to 2035 in the electric 3-wheeler cargo bikes market. Adoption is concentrated in dense urban cores, campus environments, and tourist districts where narrow, low-speed cargo trikes offer cost-effective delivery. Fleet pilots by last-mile providers, food-delivery platforms, and municipal services are validating operational models in congested downtowns. American buyers favor durable chassis, higher payload tolerances, and weatherproofing for year-round operation. Battery range and charging logistics are addressed through depot charging and rapid swap programs for commercial fleets. Local manufacturing and import partnerships provide a mix of premium and value models, while incentive programs at city and state levels help offset purchase costs. Challenges include regulatory harmonization across states and competition from light electric vehicles and cargo e-bikes.

Competition in the electric 3-wheeler cargo bikes market is shaped by stability, payload capacity, and urban mobility solutions. Babboe competes with family-focused trikes designed for safe child transport and urban logistics, highlighting robust frames and integrated e-assist systems. Raleigh UK Ltd. leverages strong distribution networks and established cycling brand value, offering versatile cargo models that blend traditional bike ergonomics with electric drivetrains. Winora Group targets European markets with commuter-oriented e-cargo trikes, focusing on reliability and accessible designs for daily riders.

Xuzhou Beiji Vehicle Co., Ltd. strengthens competition from Asia by offering cost-competitive electric cargo trikes with customization options, targeting small enterprises and bulk buyers. Strategies focus on expanding into last-mile delivery, family transport, and commercial logistics.

European brands emphasize design innovation and regulatory compliance for urban mobility, while USA and Asian manufacturers highlight affordability and heavy-duty performance. Product brochures typically feature cargo capacities from 100 to 300 kilograms, mid-drive or hub motor options with ranges up to 60 kilometers, modular box or flatbed platforms, hydraulic braking systems, weather protection canopies, and digital displays. Together these offerings underline a market balancing lifestyle appeal, commercial efficiency, and sustainable transport for dense urban environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 268.6 million |

| Payload Capacity | Light, Medium, and Heavy-duty |

| Battery | Lithium-ion, Lead-acid, and Nickel-metal hydride |

| Power Output | 1000W to 3000W, Up to 1000W, and Above 3000W |

| End-Use | Logistics & delivery, Retail & wholesale, Construction and agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Babboe, Raleigh UK Ltd., Winora Group, and Xuzhou Beiji Vehicle Co., Ltd. |

| Additional Attributes | Dollar sales by product type (family cargo, commercial cargo, industrial utility), battery capacity (low, medium, high range), and application (last-mile delivery, family transport, industrial use). Demand dynamics are fueled by government incentives for e-mobility, urban congestion challenges, and rising sustainability awareness. Regional trends show strong growth in Europe, North America, and Asia-Pacific, supported by cycling infrastructure investments and clean mobility regulations. |

The global electric 3-wheeler cargo bikes market is estimated to be valued at USD 268.6 million in 2025.

The market size for the electric 3-wheeler cargo bikes market is projected to reach USD 564.1 million by 2035.

The electric 3-wheeler cargo bikes market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in electric 3-wheeler cargo bikes market are light, medium and heavy-duty.

In terms of battery, lithium-ion segment to command 68.5% share in the electric 3-wheeler cargo bikes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA