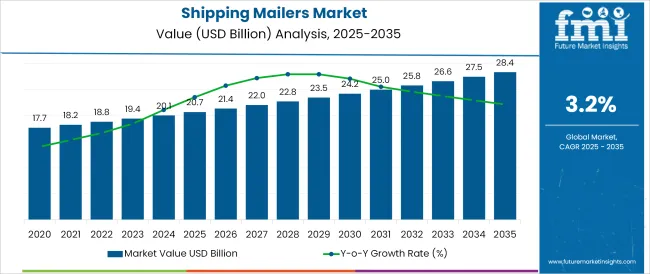

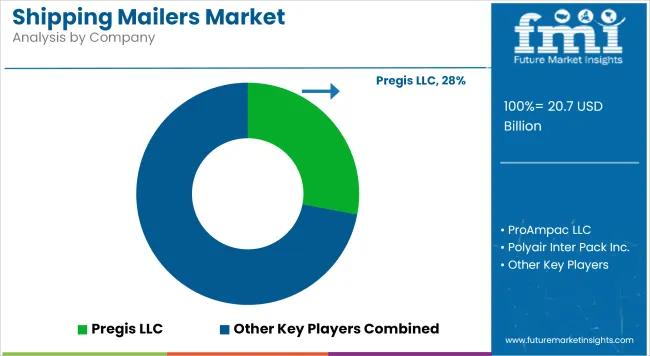

The shipping mailers market is projected to grow from USD 20.7 billion in 2025 to USD 28.4 billion by 2035, registering a CAGR of 3.2% during the forecast period. Sales in 2024 reached USD 20.1 billion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 20.7 billion |

| Industry Value (2035F) | USD 28.4 billion |

| CAGR (2025 to 2035) | 3.2% |

This growth has been supported by the rapid rise of direct-to-consumer commerce and demand for cost-effective last-mile delivery packaging.

Shipping mailers have been increasingly preferred for being lightweight, protective, and scalable in e-commerce supply chains. Growing urban deliveries and subscription box formats have continued to favor flexible mailer packaging solutions. Customization options and printability have been leveraged by brands to enhance packaging as a touchpoint for consumer engagement. These trends are expected to steadily elevate adoption in logistics and third-party fulfillment ecosystems.

In May 2025, Mondi, a global leader in sustainable packaging and paper, has expanded its re/cycle MailerBAG production capacity to serve the growing need for sustainable e-commerce packaging solutions. Alongside Mondi’s wide range of paper-based e-commerce products, which include corrugated and fill form seal solutions, the MailerBAG portfolio now features four distinct formats, making it one of the most comprehensive and versatile e-commerce packaging offerings available.

“Mondi is committed to leading the way in sustainable packaging for e-commerce. By expanding our e-commerce portfolio and increasing production capacity, we’re ensuring that we can continue to deliver innovative, sustainable solutions to meet the evolving needs of our customers, whether it be a box, paper bag or paper fill form seal solution, all while contributing to a better world” says Sebastian Frank, International Key Account Manager, e-commerce at Mondi.

Green practices and personalized designs are driving fresh changes in the mailers industry. Compostable mailers and curbside-recyclable padded options are being adopted by brands aligning with eco-regulatory standards. Additionally, on-demand printing and batch customization are being implemented to reduce wastage and elevate customer experience.

Digital workflows are also being leveraged to simplify artwork updates and streamline small-order production. Mono-material formats are being prioritized to support recyclability while ensuring adequate performance in moisture and tear resistance.

Continued expansion is expected alongside the growth of global e-commerce and fulfillment centers, particularly across North America and Europe. Investments in automation and process optimization are projected to lower production costs and increase packaging throughput. Regulatory frameworks are anticipated to promote greater use of recyclable and renewable substrates.

Companies are focusing on innovations that combine structural efficiency with branding functionality. Retailers and third-party logistics providers are projected to adopt integrated packaging platforms to synchronize inventory and optimize shipping volume

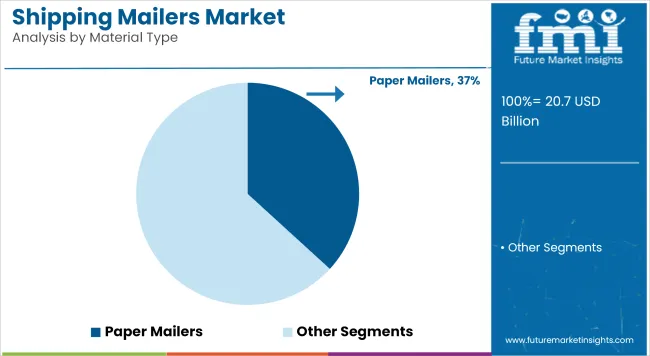

The market is segmented by material type, packaging type, closure type, end-use industry, and region. Material types include paper mailers, poly mailers, bubble mailers, kraft mailers, compostable/biodegradable mailers, and rigid mailers each offering varying levels of durability, eco friendliness, and cost-efficiency for shipping needs.

Packaging types are categorized into cushioned and non-cushioned mailers, addressing the need for product protection during transit. Closure types include peel & seal, self-adhesive, heat seal, zip lock, and button & string providing options for tamper evidence and reseal ability.

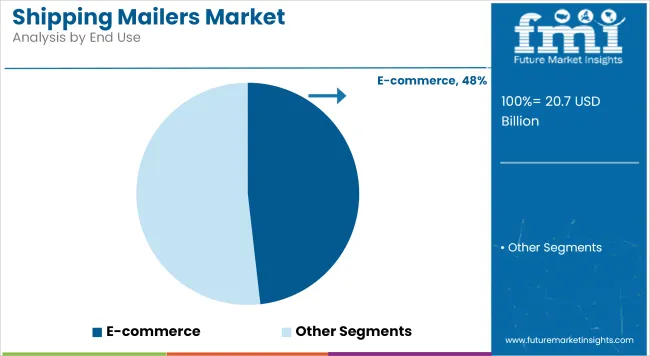

End-use industries span e-commerce & retail, fashion & apparel, electronics, books & media, healthcare & pharmaceuticals, and office supplies. The regional scope covers North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Paper mailers are projected to capture 36.8% of the shipping mailers market by 2025 due to growing demand for recyclable, plastic-free packaging. These mailers have been favored for their lightweight structure, ease of customization, and compatibility with various printing techniques. Retailers have increasingly chosen paper options to align with circular economy initiatives.

Eco-conscious consumers have reinforced the shift toward compostable and FSC-certified paper formats. Corrugated and kraft paper variants have been engineered for strength and puncture resistance. Double-layered liners and peel-and-seal closures have improved protection during transit. Branding through direct print and matte finishes has been widely adopted for premium unboxing experiences. Reduced carbon footprint and ease of disposal have driven large-scale retail and small business adoption.

Tamper-evident features and water-resistant coatings have enhanced the appeal of paper mailers in high-volume logistics. These solutions have gained traction across books, apparel, and accessory shipments. Integrated tear strips and gusseted bases have improved performance in multi-item orders.

Vendors have invested in automated packing lines optimized for paper mailer formats. E-commerce brands have shifted to branded paper mailers to boost consumer perception and support environmental KPIs. Versatility across courier services and packaging automation has solidified paper's role in distribution hubs. The balance between product safety and sustainability has proven critical in this segment. Further growth is expected as regulatory pressures and ESG goals evolve globally.

E-commerce segment is forecasted to lead the end-use segment in 2025 with an estimated market share of 48.2%. Rapid order fulfillment and the need for cost-effective packaging have accelerated adoption of lightweight and durable mailers. Packaging speed, scalability, and last-mile compatibility have guided material and format preferences.

Online marketplaces have standardized sizes and optimized packaging to reduce dimensional shipping costs. Custom-printed mailers have enhanced brand visibility and improved consumer engagement during delivery. High returns volume has prompted the use of resalable and tamper-evident formats. Retailers have deployed mailers compatible with automated packing lines to enhance throughput. Speed-to-market and consistent supply chain performance have remained central to procurement strategies.

Subscription boxes and D2C brands have adopted mailers for lower storage costs and versatile product protection. Retail fulfillment centers have favored flat mailers to optimize warehouse space. Consolidated multi-product orders have driven demand for expandable and reinforced mailer designs. Innovations like QR codes and RFID labels have supported inventory tracking and delivery verification.

Apparel, books, cosmetics, and accessories have emerged as key categories using mailers. E-commerce logistics partners have aligned with mailer designs to meet growing same-day and next-day delivery expectations. Sustainability certifications have added competitive edge in consumer-facing marketing. Overall, e-commerce’s scale and service standards will continue to steer future mailer preferences.

In a fast-paced environment, trends in shipping are changing rapidly. The exceptional packaging, such as minimalist mailers are being preferred by end-users. These are aesthetically appealing and clutter-free.

As newer technologies are available for manufacturing, there is growing inclination towards recyclable mailers. Mailers made from sustainable materials are important to reduce the carbon footprint across the globe, in the wake of growing eco-friendly products. Size reduction, integrating QR codes for engagement and customer interaction are few more trends to look out for.

Similarly, the patterns in international supply chains and accelerating development in technology, are expanding. The number of uses have expanded in multifold industries. As a result, newer and more complex versions of these products are being introduced to the market.

Among the many breakthroughs in product shipping and delivery due to a large spike in e-commerce shopping has driven customers to shift to online shopping. Some have developed to speed up the process, while others have emerged to make it easier.

Since the pandemic took charge of global supply chains, e-commerce has sky-rocketed and suppliers are now focusing to fulfill orders in stipulated time. Since a lot of trends are influencing the mailer designs, it has become important that online presence will be beneficial for serving customer demands effectively.

Last mile tracking, omni channel fulfillment, 3rd party delivery systems and internal logistics are some of the positive factors which are expected to positively shape the market demand for shipping mailers.

E-commerce companies, as well as mail and postal service companies, are always on the lookout for packaging solutions that might reduce overall packing costs, which are factored into last-mile delivery rates. The demand is being driven by the increasing penetration of e-Commerce into semi-urban and rural geographies in emerging markets.

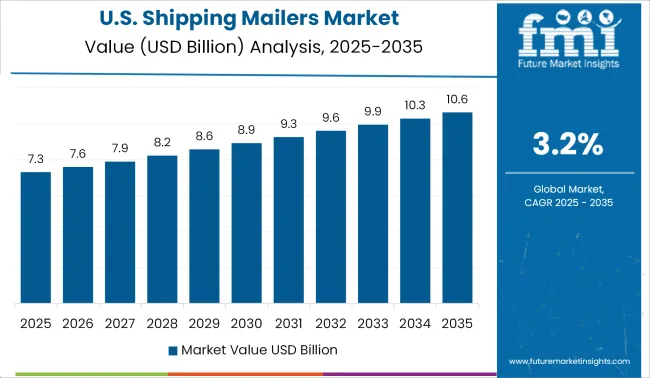

In the country of USA, the responding shifts of consumer behavior, is enabling suppliers to shift from offline channels to Omni channel fulfillment. Logistics companies have made noteworthy investments in data infrastructure and technology which is acting as a prime advantage for suppliers in the shipping mailers market.

Inventory management and integrated transportation management is adding better business capabilities. Due to these factors, USA is expected to lead the global shipping mailers market with substantial share during the forecast period.

The market for Shipping Mailers in Asia-Pacific is expected to pick up swiftly due to aggressive expansion of e-commerce in this region. In developing countries, due to urbanization, the demand for mailers has increased than ever before. China, Australia & New Zealand, India, and South Korea are the major drivers of the Asia-Pacific market. China has the largest share of global e-Commerce sales by country.

India, Indonesia, and Thailand are the Asia-Pacific's emerging e-Commerce markets. Overall the consumer preference for mailer paper boxes is increasing globally. The innovations in packaging industry focus on value creation and driving profitable growth. This is creating numerous opportunities for shipping mailer suppliers in Asia-Pacific market.

It is acting as an advantage to serve the various industries in the region such as manufacturing & warehousing, pharmaceutical, food & beverages and shipping & logistics.

Some of the leading manufacturers and suppliers include

Suppliers focus is to meet the varied customer requirements by incorporating usage of different mailer materials while also balancing cost and quality. There is a very high competition between established branded players and local domestic players, which is giving rise to fierce price battles between market participants.

The suppliers have adapted to gain a notable increasing digital presence which has led to higher sales from online channels compared to offline sales. As there is growing concern towards reducing environmental pollution, suppliers are providing paper mailers, which are also gaining prominence and rising in demand.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global shipping mailers market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the shipping mailers market is projected to reach USD 28.4 billion by 2035.

The shipping mailers market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in shipping mailers market are cushioned mailers and non-cushioned mailers.

In terms of material type, paper mailers segment to command 37.0% share in the shipping mailers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Shipping Mailers Manufacturers

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Leading Providers & Market Share in Shipping Tapes

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Mailers Market Trends - Growth & Forecast 2024 to 2034

Lab Mailers Market Size and Share Forecast Outlook 2025 to 2035

Padded Mailers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Padded Mailers Providers

Polybag Mailers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Thermal Insulated Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA