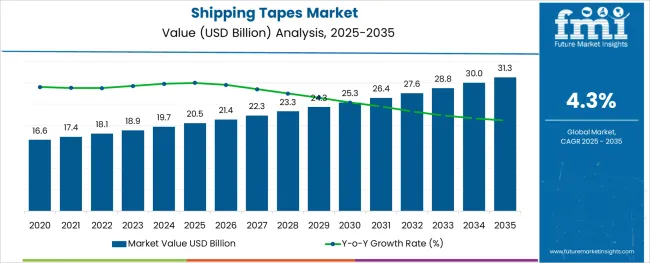

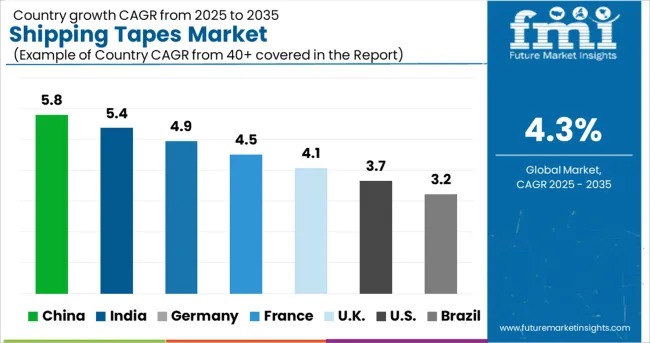

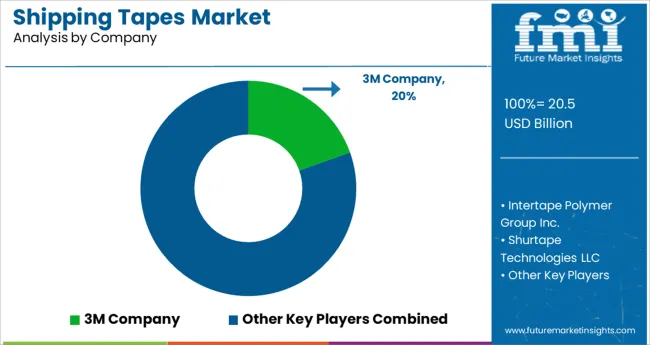

The Shipping Tapes Market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 31.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The shipping tapes market is expanding steadily, driven by the increasing volume of global trade and the growing need for secure packaging solutions in logistics. Industry reports have noted the rising preference for high-performance tapes that ensure reliable sealing and protection during transport. The surge in e-commerce and the expansion of supply chains have significantly contributed to demand growth.

Advances in adhesive technology and backing materials have enhanced tape durability, adhesion strength, and resistance to environmental factors such as moisture and temperature variations. Packaging companies and logistics providers are adopting tapes that improve operational efficiency and reduce product damage during handling.

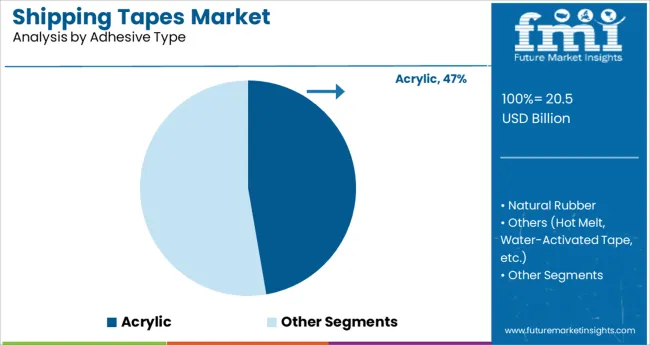

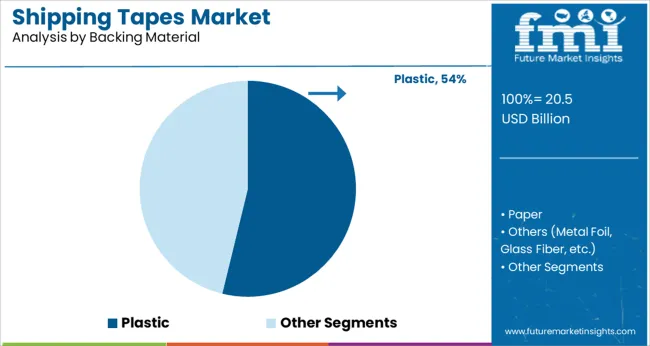

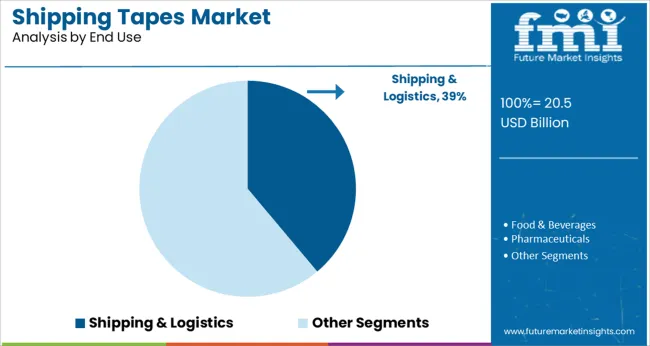

Sustainability initiatives are encouraging the development of recyclable and eco-friendly tape materials, which are gaining traction among environmentally conscious buyers. Future market growth is expected to be supported by innovations in adhesive formulations and the rising need for customized packaging solutions. The market is expected to be led by the Acrylic adhesive type, Plastic backing material, and the Shipping & Logistics end-use segment.

The market is segmented by Adhesive Type, Backing Material, and End Use and region. By Adhesive Type, the market is divided into Acrylic, Natural Rubber, and Others (Hot Melt, Water-Activated Tape, etc.). In terms of Backing Material, the market is classified into Plastic, Paper, and Others (Metal Foil, Glass Fiber, etc.). Based on End Use, the market is segmented into Shipping & Logistics, Food & Beverages, Pharmaceuticals, Building & Construction, E-Commerce, Cosmetics & Personal Care, Electrical & Electronics, and Others (Textile, Agriculture, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Acrylic adhesive segment is projected to hold 47.3% of the shipping tapes market revenue in 2025, retaining its position as the leading adhesive type. Acrylic adhesives are favored due to their strong bonding capabilities, durability, and resistance to UV radiation and aging. This makes them suitable for a wide range of packaging applications including those exposed to harsh environmental conditions.

The balance between strong adhesion and ease of tape removal has made acrylic the adhesive of choice for shipping and logistics companies aiming to minimize product damage and packaging waste. Increasing awareness of the need for reliable sealing solutions in long-distance shipments has further accelerated the adoption of acrylic-based tapes.

As supply chain complexities increase, acrylic adhesives are expected to continue dominating due to their performance reliability.

The Plastic backing material segment is forecasted to account for 53.8% of the market revenue in 2025, maintaining its lead as the preferred backing material. Plastic backing offers flexibility, tear resistance, and moisture protection, which are critical features for tapes used in shipping applications.

The ability of plastic-backed tapes to withstand rough handling and exposure to varying climatic conditions has made them ideal for securing packages in transit. Additionally, manufacturing advances have led to thinner yet stronger plastic films that reduce material usage while maintaining performance.

Plastic backing is widely compatible with different adhesive types, providing versatility to manufacturers. Growing demands for durable and cost-effective packaging solutions have solidified the position of plastic backing in the shipping tape market.

The Shipping & Logistics end-use segment is expected to represent 38.9% of the shipping tapes market revenue in 2025, solidifying its role as the dominant application sector. This segment’s growth is fueled by the expansion of global trade activities, increased parcel shipments, and the need for efficient packaging materials that ensure shipment integrity.

Logistics providers have prioritized the use of high-quality tapes to prevent package tampering, damage, and moisture ingress during transport. The rise of e-commerce has accelerated demand for reliable sealing products that support faster handling and automated packaging processes.

Industry focus on reducing shipping damages and returns has further encouraged the adoption of advanced tapes in this segment. As logistics networks become more complex and consumer expectations rise, the Shipping & Logistics segment is expected to maintain its market leadership.

Packing tape is one of the indispensable packaging materials used for both residential and commercial applications. Some packing tapes not only seal containers, but also help to load and unload them safely and efficiently.

Shipping tape offers excellent safety advantages, significant strength, high flexibility and durability, as well as outstanding endurance. It is also capable of keeping an individual’s package safe and sealed for a longer duration when it is used for shipping and storage purposes. Besides, it is resistant to temperature punctures and tears and thus can prevent package tampering.

Growing application of packaging tapes in various industries such as food, pharmaceuticals, and cosmetics is projected to elevate the global shipping tapes market. Continuous innovation, customization, new product development, and unique product processing activities are likely to create more promising opportunities in industries such as e-commerce.

Spurred by the aforementioned factors, the global shipping tapes market is anticipated to expand at a 4.3% CAGR during the forecast period.

Rapid expansion of the e-commerce sector and increasing online shopping activities across the globe are likely to drive the popularity of clear tapes. The e-commerce sector is set to propel the demand for secure packaging as robust mail packages help in protecting goods throughout the entire supply chain, as well as during transportation.

Growing importance of package security is another vital factor that would drive the market. Shipping tapes help in increasing the level of security in the e-commerce sector. These can also secure packages of any size while they are being shipped across the globe. These tapes are considered to be ideal for packaging lightweight products as they have very strong adhesives, which would prevent wear and tear before delivery. Manufacturers are using shipping tapes to restrict the entry of unwanted air and moisture into the product to prevent spoilage.

Emergence of unique branded shipping tapes is projected to excite buyers to open the product. Surging penetration of the internet is another vital factor that would push sales of products through e-commerce channels in developing countries. Thus, increasing demand for shipping tapes in the e-commerce industry is set to boost the global market.

Customization is considered to be significant for improving brand exposure and package deliverability. Customized shipping tapes not only help in building brand recognition but also show the customer that the company pays attention to small details. Customized tape further conveys important information such as safety warnings and handling instructions.

It also encourages customer interaction by printing phone numbers, email, physical addresses, website, and other contact information. The development of several advanced designs and materials in the global shipping tapes market has increased their usage in some end-use industries. Custom shipping tapes provide a superior unboxing experience and help in connecting customers emotionally with the brand. Thus, rising popularity of the customization trend worldwide is expected to drive the shipping tapes market in the upcoming decade.

Trend of Online Shopping to Augment the Demand for Printed Tapes in China

According to the International Trade Administration, China is the largest e-commerce market globally and it generated around 50% of the world’s e-commerce transactions. In 2024, China’s online retail sector transactions reached USD 2.29 trillion. In 2024, the country’s e-commerce sales were 52% of the total retail sales, which made it the first country in the world to have more sales online, as compared to traditional retail sales.

Frequent shipping and transportation of products through e-commerce channels are boosting the demand for transportation tapes in China. The China shipping tapes market is thus expected to showcase a significant CAGR of 5.3% during the forecast period.

Increasing Exports of Pharmaceutical Products in India to Spur Sales of Sealing Tapes

India is estimated to register a CAGR of 6.7% in the shipping tapes market during 2025 to 2035. As per the facts published by Invest India, the Indian pharmaceutical industry plays an important role in the global pharmaceutical sector. By value, India ranks 14th and by volume, it ranks 3rd in terms of the production of medicines globally.

India is considered to be the largest generic medicines provider worldwide, with a 20% share in the global supply of medicines by volume. Also, it is the top vaccine manufacturer across the globe. The country is the largest exporter of pharmaceuticals with more than 200 countries aided by Indian pharma exports. Thus, rising import and export activities in the pharmaceutical industry are anticipated to foster the demand for laminated tapes in India.

E-commerce Sector to Extensively Use Carton Sealing Tapes through 2025 & Beyond

According to FMI, the e-commerce end-use segment is expected to grow at a CAGR of 5.0% in the forecast period. These days, e-commerce sales are proliferated with the benefit of doorstep delivery. Strapping tapes are best in this regard as these allow manufacturers to ship their products without the fear of damages, thereby delivering a positive push to the e-commerce segment in the global shipping tapes market.

Acrylic Adhesion to Remain Highly Sought-After for Barcode Tapes

The acrylic adhesive type segment is expected to generate the largest shipping tapes market share of 47.1% in 2035. Acrylic carton sealing tapes can instantly bond to the packages such as corrugated boxes and can withstand a wide temperature range, as well as harsh environments. Their long-lasting surface adhesion is likely to spur demand in the promotional tapes industry.

Key players operating in the global shipping tapes market are adopting a variety of marketing strategies, including acquisitions, expansions, and partnerships to gain a competitive edge. Some of the key manufacturers are also focusing on new product development to expand their market presence among customers. A few recent developments in the global market are as follows:

| Attributes | Details |

|---|---|

| Market Value in 2025 | USD 20.5 Billion |

| Market CAGR 2025 to 2035 | USD 31.3 billion |

| Share of Top 3 Countries | 4.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (In billion) and Volume (Billion Sq M) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, and Australia |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; the Middle East & Africa; and Oceania |

| Key Segments Covered | Adhesive Type, Backing Material, End Use, and Region |

| Key Companies Profiled | 3M Company; Intertape Polymer Group Inc.; Shurtape Technologies LLC; tesa SE Group; Nitto Denko Corp; Papertec, Inc.; Holland Manufacturing Co. Inc.; Berry Global, Inc.; Scapa Group plc.; Bolex (Shenzhen) Adhesive Products Co. Ltd.; Vibac Group S.p.a.; Ultratape Industries Inc.; Shanghai Yongguan Adhesive Productions Corp., Ltd.; Pro Tapes & Specialties, Inc.; Maxfel S.R.l; NEUBRONNER GmbH & Co.KG; Loytape Industries SDN.BHD.; Windmill Tapes & Labels Ltd.; Avery Dennison Corporation; American Biltrite Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global shipping tapes market is estimated to be valued at USD 20.5 billion in 2025.

It is projected to reach USD 31.3 billion by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are acrylic, natural rubber and others (hot melt, water-activated tape, etc.).

plastic segment is expected to dominate with a 53.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Shipping Tapes

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Container Market Size, Share & Forecast 2025 to 2035

Competitive Breakdown of Shipping Mailers Manufacturers

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

Foil Tapes Market

Nano Tapes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA