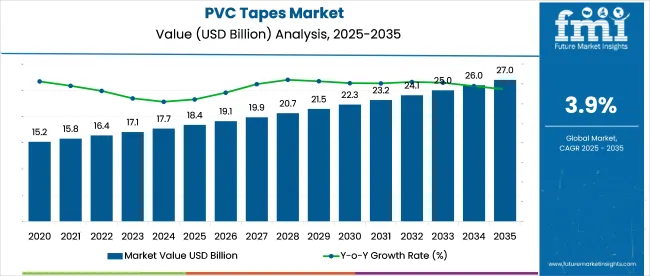

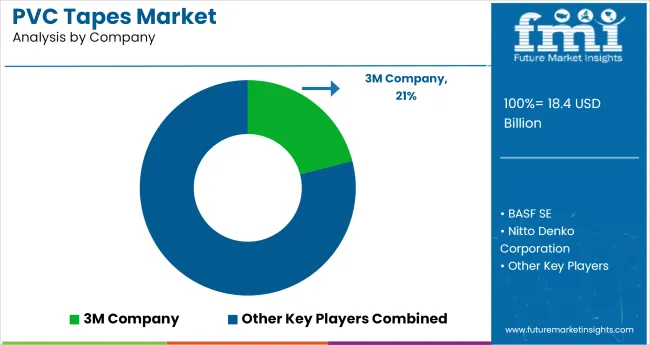

The PVC Tapes Market is estimated to be valued at USD 18.4 billion in 2025 and is projected to reach USD 27.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The PVC tapes market is experiencing steady expansion, supported by growth in construction, automotive, and electronics sectors where efficient sealing, insulation, and color coding are critical. PVC tapes are favored for their flame retardant properties, dielectric strength, and resistance to moisture, abrasion, and varying temperatures.

The rising need for electrical insulation in compact and high-voltage systems has accelerated the adoption of high-performance PVC tapes, particularly in wiring and component protection. Advancements in adhesive formulations and manufacturing efficiency are enabling improved bonding on diverse surfaces such as metal, plastic, and rubber. Additionally, the market is benefiting from increased demand in maintenance, repair, and overhaul (MRO) operations across industrial facilities.

The shift toward environment-friendly and low-VOC adhesive solutions is driving innovation and compliance across global markets. As industries focus on reliability, safety, and longevity in operational infrastructure, PVC tapes are poised to gain traction as essential consumables in professional and consumer-grade applications.

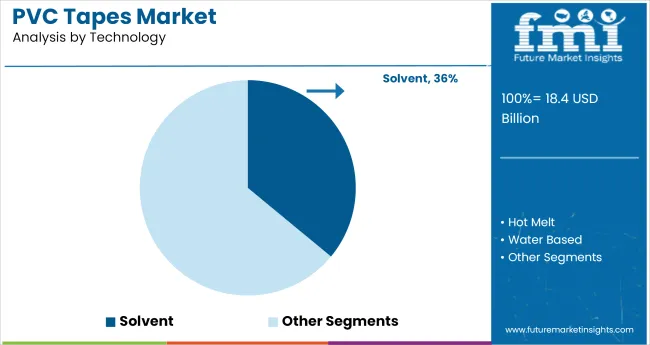

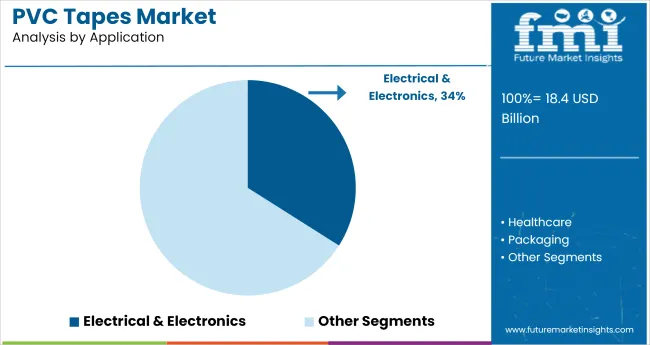

The market is segmented by Technology and Application and region. By Technology, the market is divided into Solvent, Hot Melt, and Water Based. In terms of Application, the market is classified into Electrical & Electronics, Healthcare, Packaging, Automotive, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Solvent-based technology is projected to account for 36.0% of the total revenue share in the PVC tapes market in 2025, making it the leading segment. This dominance is being attributed to the superior bonding strength and durability provided by solvent adhesives, particularly in demanding environments.

Solvent-based PVC tapes exhibit excellent performance under high temperature, moisture, and chemically aggressive conditions, which makes them indispensable in heavy-duty applications.

The technology ensures fast setting and long-lasting adhesion, which is critical in industrial, automotive, and electrical insulation tasks. Manufacturers continue to prefer solvent systems for their proven stability and performance in both indoor and outdoor applications. Additionally, ongoing improvements in solvent formulations have helped reduce VOC emissions, aligning the technology with evolving environmental standards.

The robust performance characteristics of solvent-based tapes are maintaining their relevance across critical end-use sectors, reinforcing their position as a preferred adhesive technology in high-reliability settings.

The electrical & electronics segment is expected to hold 34.0% of the PVC tapes market revenue in 2025, positioning it as the leading application area. This growth is being fueled by rising demand for insulation, bundling, and color coding in wiring systems, circuit protection, and component packaging.

PVC tapes are extensively used in electrical assembly and repair due to their flame retardance, flexibility, and dielectric strength. The proliferation of compact, high-density electronic devices has increased the need for precision insulation and mechanical protection during both manufacturing and maintenance.

The segment’s dominance is further supported by the expansion of the consumer electronics industry, smart home installations, and the electrification of transportation systems. PVC tapes provide a cost-effective and reliable solution for ensuring electrical safety and functionality in low and medium voltage applications.

As regulatory emphasis on electrical safety and sustainability intensifies, PVC tapes will remain integral to wiring infrastructure, board assembly, and electronics packaging.

Globally, PVC tape is also known as electrical tape due to its application in the electrical sector for insulation and protection from outdoor hazards. Also, it offers significant properties such as its dielectric strength and heat resistance owing to which the product is estimated to consolidate its position in the market over other tapes.

Increasing electrical infrastructure across the world and modernization of the electrical components have increased the importance of PVC tapes since the last couple of years and this trend is expected to continue in the near future.

Moreover, demand for environment-friendly, sustainable, and pressure sensitive PVC tapes has increased in the past few years.

PVC tapes are the most commonly used tapes in electrical insulation applications due to their economic price and availability as compared to other material types. Moreover, these tapes are abrasion and resistant to corrosion due to which is prefers for outdoor applications.

The packaging sector is another key end user of this product, with the tapes being used to seal and pack bags, cartons & boxes containing everything from food to clothes and various other products.

Also, the spurt in e-commerce and online ordering behavior during the pandemic has increased demand for these tapes for product packaging of home delivered items.

Based on application, the electrical and electronics segment accounts for more than half of the PVC tapes market share in terms of value and volume, and the trend is expected to continue its dominance soon owing to its increasing demand for smart cities where regional government is integrating powder grid with IoT (Internet of Things) technologies which will expected to fuel the market growth in the coming assessment period.

The increasing urban landscape, building & construction spending and growing demand for electrical insulation & wiring would further drive the market during the forecast period.

Based on quantitative analysis, electrical & electronics sector in China are expected to hold around one-third of the market volume share and are anticipated to grow at a CAGR of 3-5% during the forecast period followed by the automotive and healthcare segments.

Key players are vying to capitalize on country’s potential by investing in facilities & infrastructure to serve the domestic market in the country.

The market in China is expected to account for nearly 45% of the overall market in Asia Pacific region.

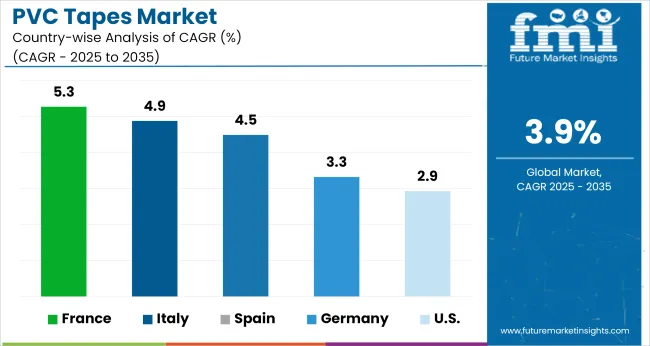

Market in Europe region is experiencing moderate growth during the forecast period. In addition, urbanization and industrialization in the Europe region have significantly increased the demand for PVC tapes for electrical insulation and packaging needs.

Among the European Union countries, Germany market is anticipated to experience lucrative growth driven by the construction and automotive sectors. The UK and France are also key demand centers for this product and are projected to maintain current growth rates over the long term.

Some of the leading manufacturers of PVC Tapes market includes

Globally, key players has been embracing R&D strategies and collaborate with governing bodies, where new environmental policies and emergence of technologies can gives rises to disruptive innovation among key players. Also, key players are expanding scale of business operation in the intensely competitive industry, where old production assets may impact the business profitability.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global PVC tapes market is estimated to be valued at USD 18.4 billion in 2025.

The market size for the PVC tapes market is projected to reach USD 27.0 billion by 2035.

The PVC tapes market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in PVC tapes market are solvent, hot melt and water based.

In terms of application, electrical & electronics segment to command 34.0% share in the PVC tapes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in PVC Tapes Industry

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

PVC-free Cap Liners Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

Alu-PVC Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Non PVC Plasticizers Market Growth & Outlook 2022 to 2032

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA